Bupivacaine HCl Market Synopsis

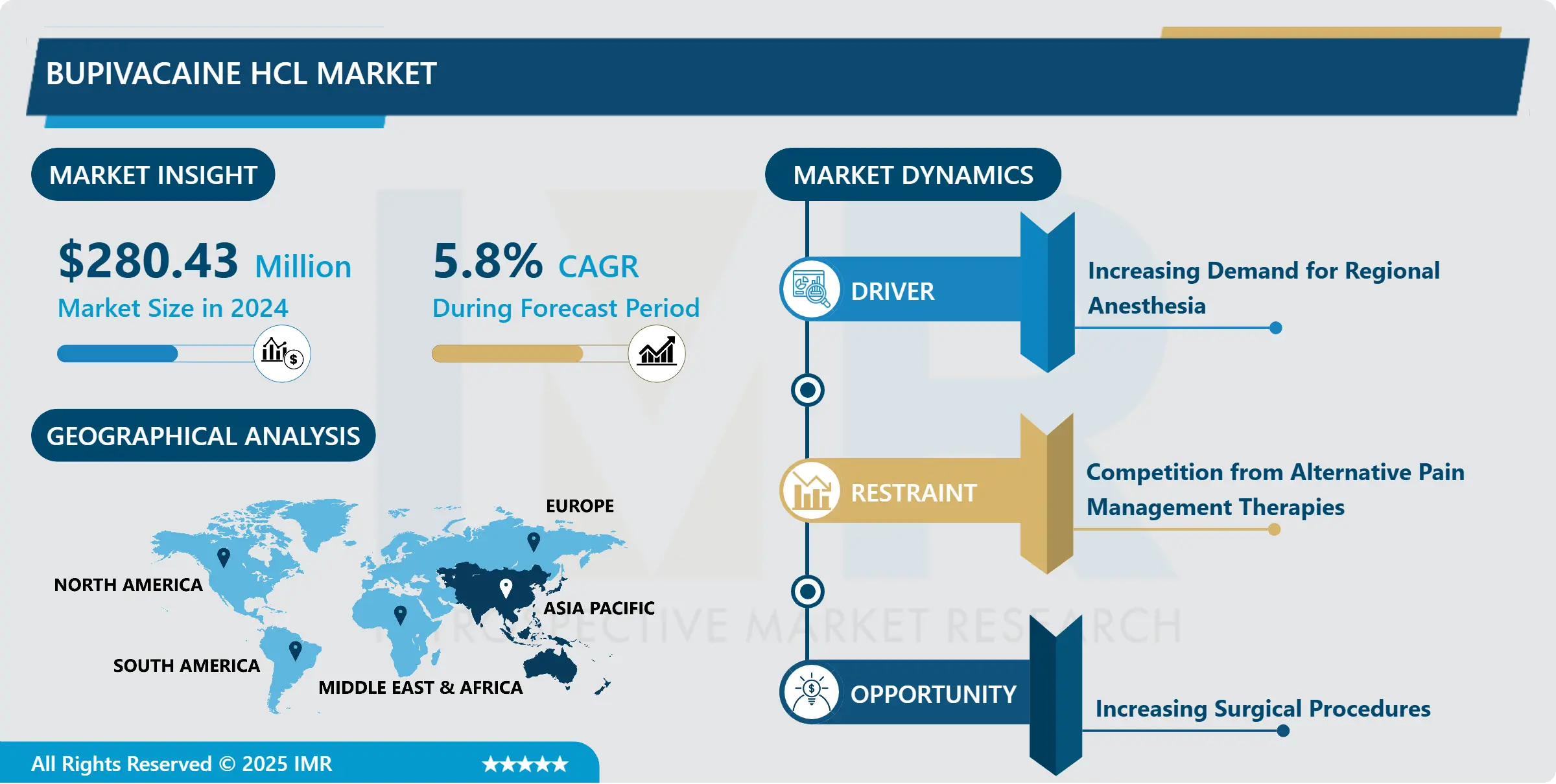

Bupivacaine HCl Market Size Was Valued at USD 280.43 Million in 2024 and is Projected to Reach USD 521.39 Million by 2035, Growing at a CAGR of 5.8 % From 2025-2035.

Bupivacaine HCl is a local anesthetic used to numb specific areas of the body during medical procedures or to manage pain. It belongs to the amide class of local anesthetics, functioning by blocking nerve impulses. Commonly administered via injection, it provides long-lasting pain relief, making it valuable in surgeries, childbirth, and chronic pain management. While effective, caution is advised due to potential side effects such as dizziness, drowsiness, and cardiac toxicity if used improperly or in excessive doses.

Bupivacaine HCl is a widely used local anesthetic medication primarily administered via injection for pain management during surgical procedures, childbirth, and postoperative pain relief. It belongs to the class of amide-type local anesthetics and is known for its long-lasting analgesic effects.

The global market for Bupivacaine HCl is influenced by several factors, including the rise in surgical procedures, the increasing prevalence of chronic pain conditions, and the expanding geriatric population. Technological advancements in drug delivery systems have also contributed to market growth by improving the efficacy and safety of Bupivacaine HCl administration.

North America dominates the Bupivacaine HCl market due to high healthcare expenditure, advanced healthcare infrastructure, and a growing number of surgeries performed in the region. Europe follows closely, driven by increasing awareness of pain management and supportive government initiatives.

The Asia Pacific region is witnessing significant growth attributed to rising healthcare investments, improving healthcare infrastructure, and increasing adoption of advanced pain management techniques. Emerging economies like China and India offer lucrative opportunities for market expansion due to their large population base and improved healthcare access.

Overall, the Bupivacaine HCl market is expected to witness steady growth in the coming years, driven by the increasing demand for effective pain management solutions and advancements in drug delivery technologies.

Bupivacaine HCl Market Trend Analysis

Increasing Demand for Regional Anesthesia

- Regional anesthesia, including techniques like nerve blocks and epidurals, has gained traction due to its efficacy in providing targeted pain relief while minimizing systemic side effects.

- The rise in demand for regional anesthesia is driven by several factors. The patients are increasingly opting for minimally invasive procedures that require less post-operative pain management, thereby boosting the utilization of regional anesthesia techniques. Additionally, the growing preference for outpatient surgeries, coupled with advancements in ultrasound-guided techniques, has expanded the scope of regional anesthesia applications.

- Moreover, healthcare providers are recognizing the benefits of regional anesthesia in enhancing patient outcomes, reducing hospital stays, and improving patient satisfaction. As a result, there is a surge in the adoption of regional anesthesia across various medical specialties, fueling the demand for Bupivacaine HCl.

- Overall, the increasing demand for regional anesthesia emerges as a major driving force behind the growth of the Bupivacaine HCl market, with prospects of continued expansion in the foreseeable future.

Increasing Surgical Procedures

- As medical technology advances and populations age, there has been a notable rise in surgical interventions across various medical specialties including orthopedics, gynecology, dentistry, and general surgery. Bupivacaine HCl, a widely used local anesthetic agent, plays a crucial role in managing post-operative pain effectively.

- With the expansion of healthcare infrastructure in both developed and emerging economies, access to surgical procedures has become more widespread. Additionally, the growing prevalence of chronic diseases necessitating surgical interventions further propels the demand for Bupivacaine HCl. Its effectiveness in providing prolonged pain relief makes it indispensable in perioperative care, contributing significantly to patient satisfaction and recovery outcomes.

- Moreover, advancements in drug delivery systems and formulations enhance the efficacy and safety profile of Bupivacaine HCl, fostering its adoption in surgical settings. This increasing utilization of Bupivacaine HCl in tandem with the rising number of surgical procedures presents a lucrative opportunity for market players to expand their product offerings and strengthen their presence in the global healthcare landscape.

Bupivacaine HCl Market Segment Analysis:

Bupivacaine HCl Market Segmented based on type, Packaging, end-users, Distribution Channel and Region

By Type, Injectable segment is expected to dominate the market during the forecast period

- The injectable formulations offer a convenient and efficient means of administration, allowing healthcare professionals precise control over dosage and onset of action. This makes them particularly suitable for surgical procedures, post-operative pain management, and regional anesthesia. Secondly, injectable formulations of Bupivacaine HCl often exhibit superior pharmacokinetic properties compared to other dosage forms, such as oral or topical formulations, ensuring rapid onset of action and prolonged duration of pain relief.

- The injectable formulations are preferred in emergencies where immediate pain relief is required. Furthermore, the Injectable segment benefits from a wide range of applications across various medical specialties, including anesthesiology, orthopedics, and obstetrics, contributing to its dominance in the market.

Bupivacaine HCl Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region encompasses a significant portion of the global population, with countries like China, India, and Japan being major contributors. This large population base creates a substantial demand for pharmaceutical products, including Bupivacaine HCl, which is commonly used as a local anesthetic in various medical procedures.

- The healthcare infrastructure in many Asia Pacific countries has been rapidly expanding and improving. This growth is driven by increasing investments in healthcare facilities, advancements in medical technology, and rising healthcare expenditure. As a result, there is a growing demand for pharmaceuticals, including Bupivacaine HCl, to support various medical procedures and treatments.

- Furthermore, the Asia Pacific region is witnessing a surge in surgical procedures, including orthopedic surgeries, dental procedures, and obstetrics, among others. Bupivacaine HCl is commonly used in these procedures to provide effective pain relief, driving its demand in the region.

- The pharmaceutical industry in the Asia Pacific region is experiencing significant growth and innovation. Local pharmaceutical companies are increasingly focusing on research and development activities to develop novel formulations and drug delivery systems, including Bupivacaine HCl formulations with improved efficacy and safety profiles.

- The combination of a large population base, expanding healthcare infrastructure, increasing surgical procedures, and a growing pharmaceutical industry positions the Asia Pacific region to dominate the Bupivacaine HCl market in the coming years.

Bupivacaine HCl Market Top Key Players:

- Hospira, Inc. (United States)

- Baxter International Inc. (United States)

- Merck & Co., Inc. (United States)

- Mylan N.V. (United States)

- Pfizer Inc. (United States)

- GlaxoSmithKline plc (United Kingdom)

- AstraZeneca plc (United Kingdom)

- Novartis International AG (Switzerland)

- Fresenius Kabi (Germany)

- Hikma Pharmaceuticals PLC (Jordan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sandoz International GmbH (Germany)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla Limited (India)

- Aspen Pharmacare Holdings Limited (South Africa)

- Other Active Players.

Key Industry Developments in the Bupivacaine HCl Market:

- In November 2023, Pacira BioSciences, Inc. announced that the FDA has approved an sNDA for EXPAREL® to be used as an adductor canal block and a sciatic nerve block in the popliteal fossa for adults. This expansion enhances non-opioid options for anesthesia and analgesia during surgeries of the knee, medial lower leg, foot, and ankle. This approval marks a significant step in advancing Pacira’s commitment to non-opioid pain management and broadens the applications of EXPAREL® (bupivacaine liposome injectable suspension) in surgical settings.

- In December 2021, Baxter International Inc. finalized its acquisition of Hillrom, a prominent player in the medical technology sector. Each outstanding share of Hillrom common stock was acquired for $156.00 in cash, totaling a purchase price of $10.5 Million . With the inclusion of Hillrom's debt obligations, the enterprise value of the deal stands at approximately $12.5 Million . This merger is poised to usher in a new era of advancements benefiting patients, clinicians, employees, shareholders, and global communities.

|

Global Bupivacaine HCl Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 280.43 Mn. |

|

Forecast Period 2025-35 CAGR: |

5.8 % |

Market Size in 2032: |

USD 521.39 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging |

|

||

|

By End User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bupivacaine HCl Market by Type (2018-2032)

4.1 Bupivacaine HCl Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Injectable

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Topical

Chapter 5: Bupivacaine HCl Market by Packaging (2018-2032)

5.1 Bupivacaine HCl Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Vials

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Ampoules

5.5 Pre-filled Syringes

Chapter 6: Bupivacaine HCl Market by End User (2018-2032)

6.1 Bupivacaine HCl Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers

6.5 Clinics

Chapter 7: Bupivacaine HCl Market by Distribution Channel (2018-2032)

7.1 Bupivacaine HCl Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospital Pharmacies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Retail Pharmacies

7.5 Online Pharmacies

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Bupivacaine HCl Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AMAZON WEB SERVICES (AWS) (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MICROSOFT AZURE (US)

8.4 GOOGLE CLOUD PLATFORM (GCP) (US)

8.5 IBM CLOUD (US)

8.6 VMWARE CLOUD (US)

8.7 RACKSPACE TECHNOLOGY (US)

8.8 DIGITALOCEAN (US)

8.9 EQUINIX (US)

8.10 RED HAT OPENSHIFT (US)

8.11 CISCO CLOUD (US)

8.12 ORACLE CLOUD (US)

8.13 NVIDIA CLOUD (US)

8.14 ADOBE EXPERIENCE CLOUD (US)

8.15 SERVICENOW (US)

8.16 DROPBOX (US)

8.17 SALESFORCE (US)

8.18 SAP CLOUD PLATFORM (GERMANY)

8.19 ACCENTURE CLOUD (IRELAND)

8.20 KPMG CLOUD (NETHERLANDS)

8.21 TENCENT CLOUD (CHINA)

8.22 ALIBABA CLOUD (CHINA)

8.23 HUAWEI CLOUD (CHINA)

8.24 LENOVO CLOUD (CHINA)

8.25 FUJITSU CLOUD (JAPAN)

8.26 NTT CLOUD (JAPAN)

8.27

Chapter 9: Global Bupivacaine HCl Market By Region

9.1 Overview

9.2. North America Bupivacaine HCl Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Injectable

9.2.4.2 Topical

9.2.5 Historic and Forecasted Market Size by Packaging

9.2.5.1 Vials

9.2.5.2 Ampoules

9.2.5.3 Pre-filled Syringes

9.2.6 Historic and Forecasted Market Size by End User

9.2.6.1 Hospitals

9.2.6.2 Ambulatory Surgical Centers

9.2.6.3 Clinics

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Hospital Pharmacies

9.2.7.2 Retail Pharmacies

9.2.7.3 Online Pharmacies

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Bupivacaine HCl Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Injectable

9.3.4.2 Topical

9.3.5 Historic and Forecasted Market Size by Packaging

9.3.5.1 Vials

9.3.5.2 Ampoules

9.3.5.3 Pre-filled Syringes

9.3.6 Historic and Forecasted Market Size by End User

9.3.6.1 Hospitals

9.3.6.2 Ambulatory Surgical Centers

9.3.6.3 Clinics

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Hospital Pharmacies

9.3.7.2 Retail Pharmacies

9.3.7.3 Online Pharmacies

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Bupivacaine HCl Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Injectable

9.4.4.2 Topical

9.4.5 Historic and Forecasted Market Size by Packaging

9.4.5.1 Vials

9.4.5.2 Ampoules

9.4.5.3 Pre-filled Syringes

9.4.6 Historic and Forecasted Market Size by End User

9.4.6.1 Hospitals

9.4.6.2 Ambulatory Surgical Centers

9.4.6.3 Clinics

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Hospital Pharmacies

9.4.7.2 Retail Pharmacies

9.4.7.3 Online Pharmacies

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Bupivacaine HCl Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Injectable

9.5.4.2 Topical

9.5.5 Historic and Forecasted Market Size by Packaging

9.5.5.1 Vials

9.5.5.2 Ampoules

9.5.5.3 Pre-filled Syringes

9.5.6 Historic and Forecasted Market Size by End User

9.5.6.1 Hospitals

9.5.6.2 Ambulatory Surgical Centers

9.5.6.3 Clinics

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Hospital Pharmacies

9.5.7.2 Retail Pharmacies

9.5.7.3 Online Pharmacies

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Bupivacaine HCl Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Injectable

9.6.4.2 Topical

9.6.5 Historic and Forecasted Market Size by Packaging

9.6.5.1 Vials

9.6.5.2 Ampoules

9.6.5.3 Pre-filled Syringes

9.6.6 Historic and Forecasted Market Size by End User

9.6.6.1 Hospitals

9.6.6.2 Ambulatory Surgical Centers

9.6.6.3 Clinics

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Hospital Pharmacies

9.6.7.2 Retail Pharmacies

9.6.7.3 Online Pharmacies

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Bupivacaine HCl Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Injectable

9.7.4.2 Topical

9.7.5 Historic and Forecasted Market Size by Packaging

9.7.5.1 Vials

9.7.5.2 Ampoules

9.7.5.3 Pre-filled Syringes

9.7.6 Historic and Forecasted Market Size by End User

9.7.6.1 Hospitals

9.7.6.2 Ambulatory Surgical Centers

9.7.6.3 Clinics

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Hospital Pharmacies

9.7.7.2 Retail Pharmacies

9.7.7.3 Online Pharmacies

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Bupivacaine HCl Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 280.43 Mn. |

|

Forecast Period 2025-35 CAGR: |

5.8 % |

Market Size in 2032: |

USD 521.39 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging |

|

||

|

By End User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||