Bronze Market Synopsis

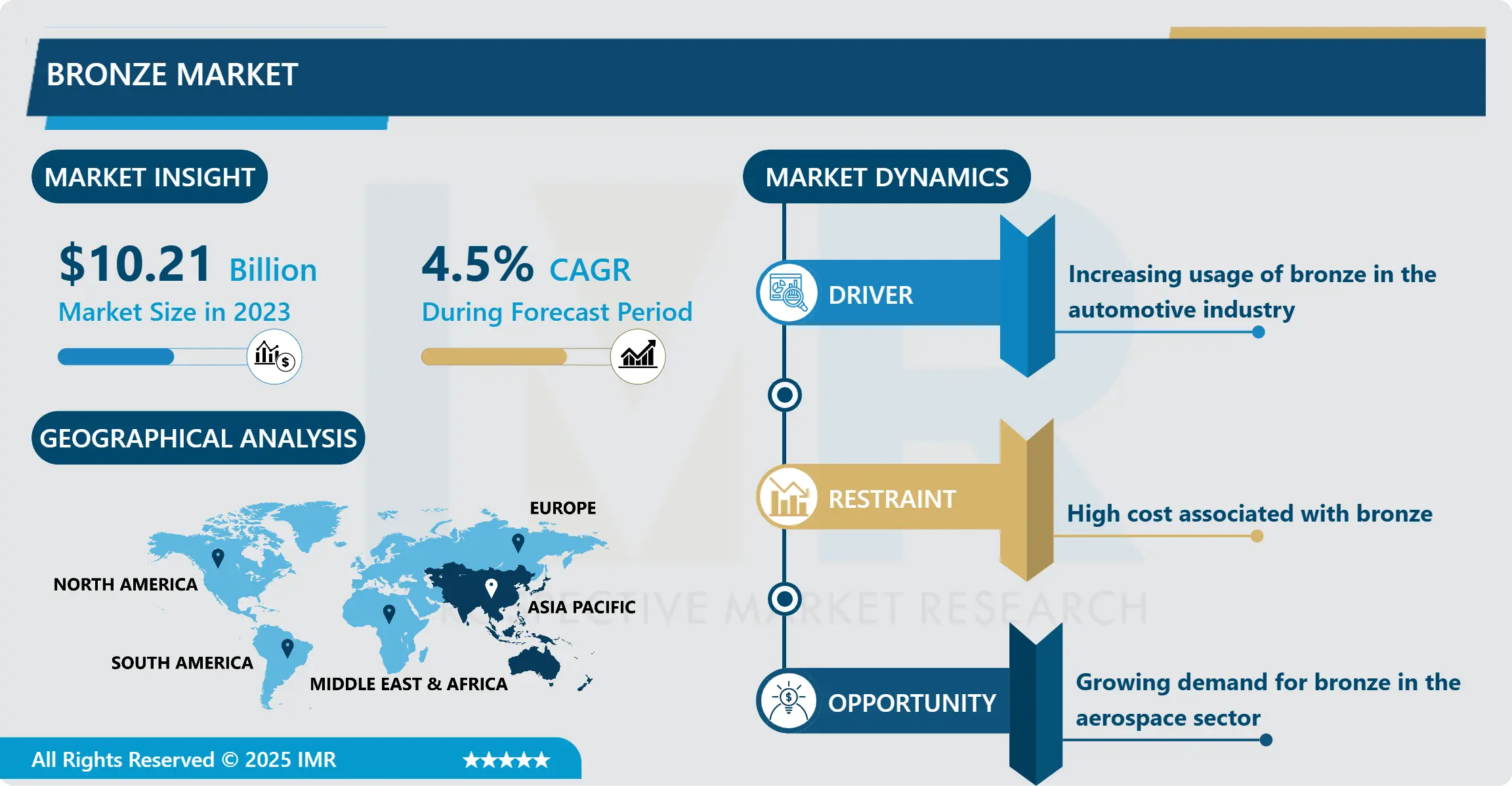

Bronze Market Size Was Valued at USD 10.21 Billion in 2023 and is Projected to Reach USD 15.17 Billion by 2032, Growing at a CAGR of 4.50% From 2024-2032.

Bronze is a metal used to create powerful alloys that are primarily copper with a secondary ingredient normally tin. Together these elements contribute to the hardness, stiffness, and strength of copper-tin alloy or bronze enabling major use in tools and weapons in ancient times and the modern industrial applications. Bronze which has a reddish-brown characteristic hue with good corrosion resistance has occupied a crucial place in human civilization, This is due both to the innovation of bronze metallurgy and to the progress of civilizations.

The market and demand or trade of bronze which is a very significant category of the alloy has also witnessed some changes based on certain factors including economic factors, technology, and even Geopolitical factors. In the field of metallurgy, Bronze, a material that is mainly produced from copper and tin is greatly valued for its benefits like the ability to resist corrosion, averagely high tensile strength, and high conductivity among others. These qualities make it versatile in the production of components necessary in sectors such as automobile, construction, marine, and electronic industries. It is evident that the demand fluctuations in the overall market, more specifically in the case of bronze, are heavily influenced by the levels of performance and future opportunities of these industries. For instance, the auto industry transforming from fuel-based transportation systems to electric cars has increased the demand for bronze which is efficient when used in electrical equipment. Likewise, the growth of the construction industry in emerging economies, particularly in the recovery of the construction market, is the main factor that influences the increase in demand for bronze for architectural and infrastructural purposes.

From a supply perspective, a major factor influencing the availability of bronze includes the costs of the chief elements in the metal found in copper and tin. Copper is the most dominant raw material being used in producing bronze, and that is why copper prices have a direct effect on the cost model and pricing policies within the bronze market. Tin, while being a secondary or minor constituent in the alloy, is imperative to the development of the same properties and its source has its drawbacks. Additional complexities on the supply side are geopolitical struggles, specific rules regarding mining in different countries especially in Peru, and Indonesia, and gradual but persistent change in the environmental policies of China. Further, the changes towards ecofriendly and green production processes are also deforming the bronze market. There is a growing trend by firms to ensure that they seek to embrace environmentally friendly ways and means of production to reduce their ecological impact consistent with global standards. This shift is not only on the factor production but also on the strategic positioning and the nature of competition by the key players.

Innovative deployment of technology in the deposition of a particular metal and the market place also, therefore, comes as a force to be reckoned with in the sales of bronze. New bronze alloys are created to allow for better utilization of the base metal due to improved properties when used in certain applications; this reveals new uses for the material and fuels market expansion. For instance, the creation of high-performance bronzes for aerospace and defense industries are remarkable products that signify how this market adjusts to changes in technological needs. In addition, the use of digital technologies in production and supply chain management also has positive effects in making productivity higher and costs lower; this makes market players enjoy a competitive advantage.

All in all, the above analysis gives the impression that the bronze market is highly volatile and sensitive to a variety of factors comprising, raw materials, industrial use, technological innovations, and more, especially in the environmentally responsible direction. The conglomerate of these factors forms a very dynamic environment where players within the markets face various challenges and risks that have to be overcome to achieve success. When one looks at newer, special and niche uses for bronze, it is apparent that the utilization of this material will only continue to grow and change, further cementing bronze as a valuable material with high application in markets today and in the future.

Bronze Market Trend Analysis

Rising Demand in the Renewable Energy Sector

- The aspect of renewable energy is affecting the bronze market since more resources are required for efficient use and in different applications in renewable energy. Copper-bearing bronze, due to its good electrical conductivity or electrical conductivity, corrosion resistance, and strength is gradually becoming popular in the manufacturing of wind turbines, photovoltaic solar panels, and other renewable energy devices. Wind turbines—for example—utilize bearings and gears where high-strength bronze is used because of properties such as Reusability, hardness, strength, durability, conductivity, corrosion resistance, and lubricity. Like in solar energy systems, copper components are utilized in connectors and other vital sections, as it is reliable and conductive.

- Since governments are increasingly encouraging suppliers and consumers to adopt cleaner energy sources, and firms are continuously establishing more eco-friendly structures, there is anticipated to be an increased need for such qualities as bronze, which could subsequently cause both intake and charges to rise in the bronze market. It is also connected with the ongoing technological progress in improving the effectiveness and versatility of bronze, as well as its already-established significance in the development of the growing renewable energy industry.

Growing demand for bronze in the aerospace sector

- several factors are enriching the bronzed industry today, but a major one is the increase in demand for bronzed by the aerospace industry for manufacturing alloys. This demand is mostly in aspects including high tensile strength, high resistance to corrosion, and good abrasion resistance that makes the bronze ideal for different usage in aerospace parts like bushes, bearings, and gears. Moreover, in light of technological improvements in today’s aeronautics, materials that can endure high temperatures and stress, to which the properties of bronze respond well, are needed. The emerging trend toward lightweight and high-strength materials in aircraft construction has added still further to the demand for bronze, trends which are also fully serving to promote the market.

- Further, the trend of making aircraft and aircraft parts from more sustainable and recyclable metals is well aligned with the key attribute of this metal; that is, it can be recycled. Therefore, power formers are enhancing manufacturing capacity and university research and development efforts to design new batches of bronze products for aerospace industries, thus enhancing the sustainable demand for bronze in this technology-oriented industry.

Bronze Market Segment Analysis:

Bronze Market Segmented based on Type and Application.

By Alloy Type, Aluminum segment is expected to dominate the market during the forecast period

- The market segmentation of Bronze according to its component makes it easier to point out the features of the Aluminum Bronze variant, the Phosphor Bronze variant, as well as the Silicon Bronze variant based on every segmentation that is founded on alloy type. Aluminum bronze, which has higher strength, corrosion, and wear resistance and greater toughness is mainly used in marine, aerospace, and oil and gas industries where these properties are more valuable.

- Tin phosphor bronze which has tin and phosphorous is noted for its excellent wear resistance, and fatigue resistance besides its finer grain structure that makes it applicable in applications such as electrical connectors, springs, and bearings. Silicon bronze is another category of bronze that contains high levels of silicon that gives it good strength and resistance to corrosion; it is mainly used in boat fixtures, pumps, valves, hardware, and architectural hardware. The market trends for each of these types are determined by their characteristics, encouraging their use in industries that demand certain features and qualities. A rising degree of industrialization, the enhancement in manufacturing technologies, and the demand for better-performing materials in demanding environments continue to fuel the growth of the bronze market across these alloys.

By Application, Architectural Parts segment held the largest share in 2023

- Building construction using bronze is common since it is a durable and versatile metal also widely used in many other applications. Architectural element: since bronze is resistant to corrosion and is very tough, it is used in making architectural parts such as the doorknob and ornamental figures and gates which have not only to be efficient in serving their respective functions but also have to blend with the theme or concept of the building or establishment. That is why musical instruments, especially brass musical instruments – trumpets, saxophones, and bronze alloys are used to create the required characteristics of the played sound and necessary for compliance with the individual subtleties of the formed brass instrument.

- In transport the use of bronze bearings and bushing offer high strength thus eliminating friction and wear on the engines, greatears, and bearings since they auto lubricate thus improving the efficiency in operations. In an industrial context, bronze alloys help in manufacturing processes since it is a good conductor of heat and electricity, used in electrical connectors, heat exchangers, and various pieces of machine in which these properties are useful. Thus the bronze market remains active owing to its versatility in properties and its ability to satisfy needs in a wide range of applications that include the above-mentioned ones.

Bronze Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The same is expected over the forecast period and some of the factors include, The Asia-Pacific region will be the most dominating over the forecast period. Initially, the latest level of industrialization and urbanization in countries like China, India, and several countries in southeast Asia is increasing the demand for bronze in areas of construction and infrastructural development, and manufacturing industries. Steady economic development in this region translates to active participation in the construction of housing and business premises, which requires bronze alloy for its tough surface that is resistant to corrosion and esthetic value. However, the automobile manufacturing industry in the Asia Pacific region is growing and therefore the application of bronze in vehicle production will further be demanded.

- Furthermore, these are the electronics and electrical industries that use most of this bronze for manufacturing electronic connectors and electrical terminals amongst other uses owing to its high electrical conductivity. Other factors that are driving this market include government plans for the development and construction of infrastructure and capabilities of manufacturing industries. Additionally, focused research in improving the properties of bronze alloys, and use in aerospace, marine, and renewable energy industries are expected to bolster the authority of the region in the global market for bronze.

Active Key Players in the Bronze Market

- Wieland Group (U.S.)

- KME GERMANY GMBH (Germany)

- ONCAST METAL PRODUCTS CO. (U.S.)

- National Bronze Manufacturing Co. (U.S.)

- Mitsui Mining & Smelting Co. Ltd. (Japan)

- JX Nippon Mining & Metals Corporation (Japan)

- Aviva Metals (U.S.)

- Lebronze Alloys (France)

- Diehl Metall Stiftung & Co. KG (Germany)

- PMX Industries, Inc. (U.S.)

- Morgan Bronze Products, Inc. (U.S.)

- Govind Metal Co. (India)

- Beckett Bronze Co., Inc. (U.S.), and Other Key Players

Key Industry Developments in the Bronze Market

- In April 2023, Wieland Group acquired Heyco Metals and National Bronze Manufacturing. This acquisition led to the addition of a manufacturing site for bronze bushings and industrial components in the U.S.

- In August 2023, Wieland Group acquired Farmers Copper Ltd., a leading bronze alloys supplier in North America. This acquisition further expands Wieland’s footprint in North America and will increase penetration in end-use industries such as marine, aerospace, and defense.

- In August 2022, Chicago-based Temple Hall Group purchased Minnesota-based Reliable Bronze and Manufacturing Inc. (RBMI). The latter is a manufacturer of quality bearings and bar stock products. The former aims at carrying forward RBMI’s legacy and success.

|

Bronze Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.21 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.50% |

Market Size in 2032: |

USD 15.17 Bn. |

|

Segments Covered: |

By Alloy Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bronze Market by Alloy Type (2018-2032)

4.1 Bronze Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Aluminum

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Phosphor

4.5 Silicon

Chapter 5: Bronze Market by Application (2018-2032)

5.1 Bronze Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Architectural Parts

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Musical Instruments

5.5 Transportation

5.6 Industrial

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Bronze Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 WIELAND GROUP (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 KME GERMANY GMBH (GERMANY)

6.4 ONCAST METAL PRODUCTS CO. (U.S.)

6.5 NATIONAL BRONZE MANUFACTURING CO. (U.S.)

6.6 MITSUI MINING & SMELTING CO. LTD. (JAPAN)

6.7 JX NIPPON MINING & METALS CORPORATION (JAPAN)

6.8 AVIVA METALS (U.S.)

6.9 LEBRONZE ALLOYS (FRANCE)

6.10 DIEHL METALL STIFTUNG & CO. KG (GERMANY)

6.11 PMX INDUSTRIES INC. (U.S.)

6.12 MORGAN BRONZE PRODUCTS INC. (U.S.)

6.13 GOVIND METAL CO. (INDIA)

6.14 BECKETT BRONZE COINC. (U.S.)

6.15 AND OTHER KEY PLAYERS

Chapter 7: Global Bronze Market By Region

7.1 Overview

7.2. North America Bronze Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Alloy Type

7.2.4.1 Aluminum

7.2.4.2 Phosphor

7.2.4.3 Silicon

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Architectural Parts

7.2.5.2 Musical Instruments

7.2.5.3 Transportation

7.2.5.4 Industrial

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Bronze Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Alloy Type

7.3.4.1 Aluminum

7.3.4.2 Phosphor

7.3.4.3 Silicon

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Architectural Parts

7.3.5.2 Musical Instruments

7.3.5.3 Transportation

7.3.5.4 Industrial

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Bronze Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Alloy Type

7.4.4.1 Aluminum

7.4.4.2 Phosphor

7.4.4.3 Silicon

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Architectural Parts

7.4.5.2 Musical Instruments

7.4.5.3 Transportation

7.4.5.4 Industrial

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Bronze Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Alloy Type

7.5.4.1 Aluminum

7.5.4.2 Phosphor

7.5.4.3 Silicon

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Architectural Parts

7.5.5.2 Musical Instruments

7.5.5.3 Transportation

7.5.5.4 Industrial

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Bronze Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Alloy Type

7.6.4.1 Aluminum

7.6.4.2 Phosphor

7.6.4.3 Silicon

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Architectural Parts

7.6.5.2 Musical Instruments

7.6.5.3 Transportation

7.6.5.4 Industrial

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Bronze Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Alloy Type

7.7.4.1 Aluminum

7.7.4.2 Phosphor

7.7.4.3 Silicon

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Architectural Parts

7.7.5.2 Musical Instruments

7.7.5.3 Transportation

7.7.5.4 Industrial

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Bronze Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.21 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.50% |

Market Size in 2032: |

USD 15.17 Bn. |

|

Segments Covered: |

By Alloy Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||