Bottle Cap Market Synopsis

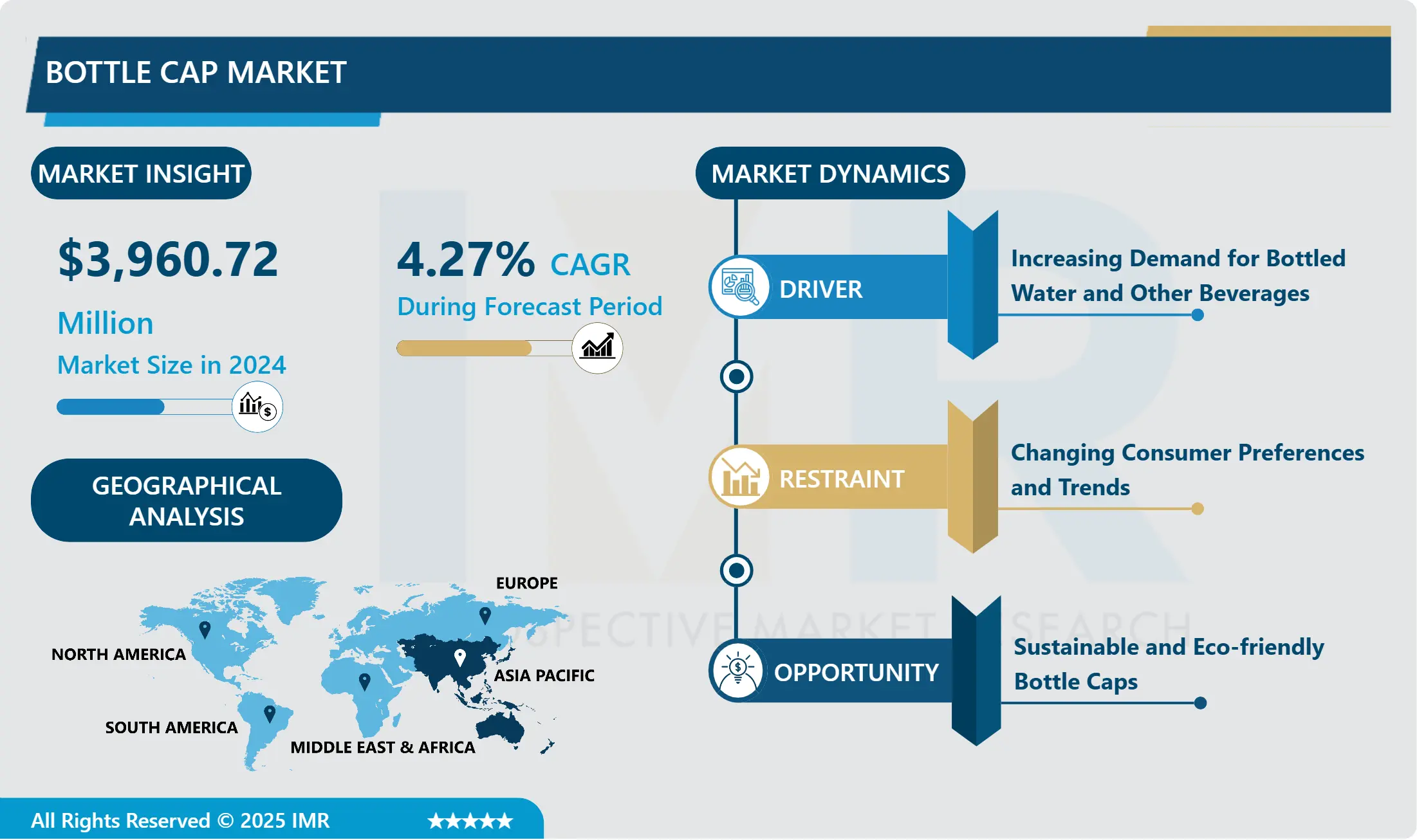

Bottle Cap Market Size Was Valued at USD 3,960.72 Million in 2024, and is Projected to Reach USD 5,534.13 Million by 2032, Growing at a CAGR of 4.27% From 2025-2032.

A bottle cap is a type of closure used to seal bottles. It comes in various shapes, sizes, and colors depending on the type of bottle. Bottle caps play an essential role in preserving and maintaining the quality of beverages.

In food and beverages industries, Bottle caps are commonly used to securely seal bottles of liquid products, ensuring freshness and preventing contamination.

In the pharmaceutical industry, it is used for sealing medicine bottles to ensure the integrity and safety of the contents. Bottle caps help to ensure the safe transportation, storage, and handling of hazardous substances in the chemical industry. Bottle caps also provide convenience, prevent accidental spills, maintain product potency, provide easy dispensing, ensure hygiene, and prevent leakage.

Currently millions of tons of waste bottle caps are produced in the world resulting to the cause pollution and harmful to the ecosystem. These waste bottle caps can be utilized in concrete production for disposing of waste. This helps to produce lighter-weight polymer concrete for its multidimensional use. Some of the plastic bottle caps can be turned into new plastic products, reducing plastic waste and promoting the recycling process.

Bottle Cap Market Trend Analysis

Bottle Cap Market Growth Driver- Increasing Demand for Bottled Water and Other Beverages

- With a busy lifestyle, people often rely on bottled drinks. As a result, there is a higher demand for effective packaging solutions like bottle caps which mainly help in easy handling and spill-proof solutions. Bottle caps help to prevent matter from external contamination keeping it fresh and safe. The bottle caps are also used as a marketing tool for the brand by designing unique caps or printing logos on caps.

- In the beverage industry, there is immense innovation and diversification. This leads to a corresponding rise in demand for specialized bottle caps to cater to these different product categories. There are various materials, and designs are available in the market to satisfy product & consumer needs such as flip-top caps, sports caps, and cork. The expansion of retail infrastructure has made bottled beverages easily accessible to consumers worldwide resulting in raised demand for bottle caps in the market.

Bottle Cap Market Opportunity- Sustainable and Eco-friendly Bottle Caps

- There is a global concern about the environment and sustainability which insists consumers seek eco-friendly options like bio-degradable caps and recyclable caps. By introducing eco-friendly options in bottle caps, companies can enhance their brand reputation and customer satisfaction. Sustainable bottle caps offer opportunities for manufacturers to differentiate their products within the beverage packaging industry.

- Companies can actively address the plastic pollution problem and demonstrate their commitment to sustainability by introducing plant-based material caps helping to environment-conscious consumers. These environment-friendly options can also help with manufacturing cost reduction. Governments and regulatory bodies are increasingly offering incentives and support to businesses that adopt sustainable practices which can lead to benefits like Tax benefits, and subsidies.

Bottle Cap Market Segment Analysis:

Bottle Cap Market Segmented on the basis of Type, Material, Application, Distribution channel, End-users, and Region.

By Type, Plastic Caps Segment Is Expected to Dominate the Market During the Forecast Period

- Plastic caps are flexible and versatile and easily mouldable into different designs and closures making them suitable for use across different industries. Plastic caps are durable and resistant to breakage as compared to other materials. This makes them a suitable option for juices, chemicals, etc.

- The plastic caps are cost-effective, lightweight, and easy to manufacture which makes them the convenient, portable option. The caps can also be recyclable, reusable, and also resealable. Plastic caps are resistant to corrosion and are not affected by moisture or chemicals. The plastic bottle cap supply, and raw material supply are steady along with a strong and developed supply chain which leads to accessibility and availability in the market.

By Application, The Beverages Segment Held the Largest Share in 2024

- The beverages industry has a significant consumer base and experiences high consumption rates globally including both alcoholic and non-alcoholic drinks. This leads to a higher demand for packaging solutions like bottle caps. There are different types of beverages available like carbonated drinks, bottled water, and milk beverages which require a variety of designs to fulfill their packaging need. The caps can maintain the taste, quality, and shelf life of beverages by providing a tight seal and preventing leakage, contamination, and exposure to the air.

- Bottle caps are reusable, resealable, and convenient options allowing on-the-go consumption and prevention. Consumer preference for certain cap designs for particular types of beverages contributes to the demand for caps in the beverages segment. The beverages industry, particularly in segments such as alcoholic beverages, experiences significant international trade and export activities leading to generate high demand for bottle caps.

- In 2023, packed water consumption exceeded 500 billion liters, making it the most consumed packed beverage type in the world. Packed alcoholic beverages and milk and dairy ranked second and third, respectively.

Bottle Cap Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is witnessing significant growth in the beverage industry due to population growth, rising disposable incomes, changing lifestyles, urbanization, and increased consumer awareness. The shift toward packaged beverages has led to a surge in demand for caps as a packaging material. Asia Pacific serves as a major manufacturing hub for bottle caps and packaging materials and exports bottle caps to global markets.

- The growth of the supply chain, and distribution channels like retail stores, convenience stores, and online stores ensures the availability of beverages or bottled products which leads to a rise in demand for bottle caps. The region has witnessed increased investments in packaging technologies and innovations to improve product quality, safety, and convenience. The continuous innovation in bottle cap manufacturing processes, materials, and designs helps manufacturers to dominate the market.

Active Players in the Bottle Cap Market

- Crown Holdings Inc. (United States)

- Amcor plc (Australia)

- AptarGroup Inc. (United States)

- Silgan Holdings Inc. (United States)

- Berry Global Inc. (United States)

- Reynold Group Holdings Ltd (New Zealand)

- Closure Systems International (United States)

- Tech Closures (Italy)

- United Caps (Luxembourg)

- Hicap Closures Co., Ltd. (China)

- Guala Closures Group (Italy)

- ALPLA Werke Alwin Lehner GmbH & Co KG (Austria)

- Pelliconi & C. Spa (Italy)

- Global Closure Systems (United Kingdom)

- Tapi Group (United Kingdom)

- O.Berk Company (United States)

- UAB "Amber Glass Factory" (Lithuania)

- Interpack Group (Switzerland)

- Satyaprabha Glass Agency (India)

- Plastek Industries, Inc. (United States)

- Ganesh Bottle Agency (India)

- Magenta LLC (United States)

- Reliance Industries Limited (India)

- BERICAP Holdings GmbH (Germany)

- Caps & Closures Pvt. Ltd. (India)

- Other Active Players

|

Global Bottle Cap Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3,960.72 Mn. |

|

Forecast Period 2025-32 CAGR: |

4.27 % |

Market Size in 2032: |

USD 5534.13 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Crown Holdings Inc. (United States), Amcor plc (Australia), AptarGroup Inc. (United States), Silgan Holdings Inc. (United States), Berry Global Inc. (United States) and Other Active Players. |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bottle Cap Market by Type (2018-2032)

4.1 Bottle Cap Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Screw Cap

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Snap-on Cap

4.5 Flip-top Cap

4.6 Crown cap

4.7 Dispensing Cap

4.8 Tamper-evident Cap

Chapter 5: Bottle Cap Market by Material (2018-2032)

5.1 Bottle Cap Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Metal

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cork

5.5 Plastic

5.6 Rubber

5.7 Glass

Chapter 6: Bottle Cap Market by Application (2018-2032)

6.1 Bottle Cap Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Beverages

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pharmaceutical Products

6.5 Personal Care and Cosmetics

6.6 Food and Condiments

6.7 Chemicals and Industrial Products

Chapter 7: Bottle Cap Market by Distribution Channel (2018-2032)

7.1 Bottle Cap Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Retail Stores

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Online Retail

7.5 Wholesale Distributors

7.6 Packaging Suppliers

7.7 Contract Manufacturers

Chapter 8: Bottle Cap Market by End-user (2018-2032)

8.1 Bottle Cap Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Bottled Water Industry

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Beverage Industry

8.5 Pharmaceutical Industry

8.6 Cosmetics Industry

8.7 Food Industry

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Bottle Cap Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 CROWN HOLDINGS INC. (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 AMCOR PLC (AUSTRALIA)

9.4 APTARGROUP INC. (UNITED STATES)

9.5 SILGAN HOLDINGS INC. (UNITED STATES)

9.6 BERRY GLOBAL INC. (UNITED STATES)

9.7 REYNOLD GROUP HOLDINGS LTD (NEW ZEALAND)

9.8 CLOSURE SYSTEMS INTERNATIONAL (UNITED STATES)

9.9 TECH CLOSURES (ITALY)

9.10 UNITED CAPS (LUXEMBOURG)

9.11 HICAP CLOSURES COLTD. (CHINA)

9.12 GUALA CLOSURES GROUP (ITALY)

9.13 ALPLA WERKE ALWIN LEHNER GMBH & CO KG (AUSTRIA)

9.14 PELLICONI & C. SPA (ITALY)

9.15 GLOBAL CLOSURE SYSTEMS (UNITED KINGDOM)

9.16 TAPI GROUP (UNITED KINGDOM)

9.17 O.BERK COMPANY (UNITED STATES)

9.18 UAB AMBER GLASS FACTORY" (LITHUANIA)

9.19 INTERPACK GROUP (SWITZERLAND)

9.20 SATYAPRABHA GLASS AGENCY (INDIA)

9.21 PLASTEK INDUSTRIES INC. (UNITED STATES)

9.22 GANESH BOTTLE AGENCY (INDIA)

9.23 MAGENTA LLC (UNITED STATES)

9.24 RELIANCE INDUSTRIES LIMITED (INDIA)

9.25 BERICAP HOLDINGS GMBH (GERMANY)

9.26 CAPS & CLOSURES PVT. LTD. (INDIA)

9.27 AND

Chapter 10: Global Bottle Cap Market By Region

10.1 Overview

10.2. North America Bottle Cap Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Screw Cap

10.2.4.2 Snap-on Cap

10.2.4.3 Flip-top Cap

10.2.4.4 Crown cap

10.2.4.5 Dispensing Cap

10.2.4.6 Tamper-evident Cap

10.2.5 Historic and Forecasted Market Size by Material

10.2.5.1 Metal

10.2.5.2 Cork

10.2.5.3 Plastic

10.2.5.4 Rubber

10.2.5.5 Glass

10.2.6 Historic and Forecasted Market Size by Application

10.2.6.1 Beverages

10.2.6.2 Pharmaceutical Products

10.2.6.3 Personal Care and Cosmetics

10.2.6.4 Food and Condiments

10.2.6.5 Chemicals and Industrial Products

10.2.7 Historic and Forecasted Market Size by Distribution Channel

10.2.7.1 Retail Stores

10.2.7.2 Online Retail

10.2.7.3 Wholesale Distributors

10.2.7.4 Packaging Suppliers

10.2.7.5 Contract Manufacturers

10.2.8 Historic and Forecasted Market Size by End-user

10.2.8.1 Bottled Water Industry

10.2.8.2 Beverage Industry

10.2.8.3 Pharmaceutical Industry

10.2.8.4 Cosmetics Industry

10.2.8.5 Food Industry

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Bottle Cap Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Screw Cap

10.3.4.2 Snap-on Cap

10.3.4.3 Flip-top Cap

10.3.4.4 Crown cap

10.3.4.5 Dispensing Cap

10.3.4.6 Tamper-evident Cap

10.3.5 Historic and Forecasted Market Size by Material

10.3.5.1 Metal

10.3.5.2 Cork

10.3.5.3 Plastic

10.3.5.4 Rubber

10.3.5.5 Glass

10.3.6 Historic and Forecasted Market Size by Application

10.3.6.1 Beverages

10.3.6.2 Pharmaceutical Products

10.3.6.3 Personal Care and Cosmetics

10.3.6.4 Food and Condiments

10.3.6.5 Chemicals and Industrial Products

10.3.7 Historic and Forecasted Market Size by Distribution Channel

10.3.7.1 Retail Stores

10.3.7.2 Online Retail

10.3.7.3 Wholesale Distributors

10.3.7.4 Packaging Suppliers

10.3.7.5 Contract Manufacturers

10.3.8 Historic and Forecasted Market Size by End-user

10.3.8.1 Bottled Water Industry

10.3.8.2 Beverage Industry

10.3.8.3 Pharmaceutical Industry

10.3.8.4 Cosmetics Industry

10.3.8.5 Food Industry

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Bottle Cap Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Screw Cap

10.4.4.2 Snap-on Cap

10.4.4.3 Flip-top Cap

10.4.4.4 Crown cap

10.4.4.5 Dispensing Cap

10.4.4.6 Tamper-evident Cap

10.4.5 Historic and Forecasted Market Size by Material

10.4.5.1 Metal

10.4.5.2 Cork

10.4.5.3 Plastic

10.4.5.4 Rubber

10.4.5.5 Glass

10.4.6 Historic and Forecasted Market Size by Application

10.4.6.1 Beverages

10.4.6.2 Pharmaceutical Products

10.4.6.3 Personal Care and Cosmetics

10.4.6.4 Food and Condiments

10.4.6.5 Chemicals and Industrial Products

10.4.7 Historic and Forecasted Market Size by Distribution Channel

10.4.7.1 Retail Stores

10.4.7.2 Online Retail

10.4.7.3 Wholesale Distributors

10.4.7.4 Packaging Suppliers

10.4.7.5 Contract Manufacturers

10.4.8 Historic and Forecasted Market Size by End-user

10.4.8.1 Bottled Water Industry

10.4.8.2 Beverage Industry

10.4.8.3 Pharmaceutical Industry

10.4.8.4 Cosmetics Industry

10.4.8.5 Food Industry

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Bottle Cap Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Screw Cap

10.5.4.2 Snap-on Cap

10.5.4.3 Flip-top Cap

10.5.4.4 Crown cap

10.5.4.5 Dispensing Cap

10.5.4.6 Tamper-evident Cap

10.5.5 Historic and Forecasted Market Size by Material

10.5.5.1 Metal

10.5.5.2 Cork

10.5.5.3 Plastic

10.5.5.4 Rubber

10.5.5.5 Glass

10.5.6 Historic and Forecasted Market Size by Application

10.5.6.1 Beverages

10.5.6.2 Pharmaceutical Products

10.5.6.3 Personal Care and Cosmetics

10.5.6.4 Food and Condiments

10.5.6.5 Chemicals and Industrial Products

10.5.7 Historic and Forecasted Market Size by Distribution Channel

10.5.7.1 Retail Stores

10.5.7.2 Online Retail

10.5.7.3 Wholesale Distributors

10.5.7.4 Packaging Suppliers

10.5.7.5 Contract Manufacturers

10.5.8 Historic and Forecasted Market Size by End-user

10.5.8.1 Bottled Water Industry

10.5.8.2 Beverage Industry

10.5.8.3 Pharmaceutical Industry

10.5.8.4 Cosmetics Industry

10.5.8.5 Food Industry

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Bottle Cap Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Screw Cap

10.6.4.2 Snap-on Cap

10.6.4.3 Flip-top Cap

10.6.4.4 Crown cap

10.6.4.5 Dispensing Cap

10.6.4.6 Tamper-evident Cap

10.6.5 Historic and Forecasted Market Size by Material

10.6.5.1 Metal

10.6.5.2 Cork

10.6.5.3 Plastic

10.6.5.4 Rubber

10.6.5.5 Glass

10.6.6 Historic and Forecasted Market Size by Application

10.6.6.1 Beverages

10.6.6.2 Pharmaceutical Products

10.6.6.3 Personal Care and Cosmetics

10.6.6.4 Food and Condiments

10.6.6.5 Chemicals and Industrial Products

10.6.7 Historic and Forecasted Market Size by Distribution Channel

10.6.7.1 Retail Stores

10.6.7.2 Online Retail

10.6.7.3 Wholesale Distributors

10.6.7.4 Packaging Suppliers

10.6.7.5 Contract Manufacturers

10.6.8 Historic and Forecasted Market Size by End-user

10.6.8.1 Bottled Water Industry

10.6.8.2 Beverage Industry

10.6.8.3 Pharmaceutical Industry

10.6.8.4 Cosmetics Industry

10.6.8.5 Food Industry

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Bottle Cap Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Screw Cap

10.7.4.2 Snap-on Cap

10.7.4.3 Flip-top Cap

10.7.4.4 Crown cap

10.7.4.5 Dispensing Cap

10.7.4.6 Tamper-evident Cap

10.7.5 Historic and Forecasted Market Size by Material

10.7.5.1 Metal

10.7.5.2 Cork

10.7.5.3 Plastic

10.7.5.4 Rubber

10.7.5.5 Glass

10.7.6 Historic and Forecasted Market Size by Application

10.7.6.1 Beverages

10.7.6.2 Pharmaceutical Products

10.7.6.3 Personal Care and Cosmetics

10.7.6.4 Food and Condiments

10.7.6.5 Chemicals and Industrial Products

10.7.7 Historic and Forecasted Market Size by Distribution Channel

10.7.7.1 Retail Stores

10.7.7.2 Online Retail

10.7.7.3 Wholesale Distributors

10.7.7.4 Packaging Suppliers

10.7.7.5 Contract Manufacturers

10.7.8 Historic and Forecasted Market Size by End-user

10.7.8.1 Bottled Water Industry

10.7.8.2 Beverage Industry

10.7.8.3 Pharmaceutical Industry

10.7.8.4 Cosmetics Industry

10.7.8.5 Food Industry

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

"

|

Global Bottle Cap Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 3,960.72 Mn. |

|

Forecast Period 2025-32 CAGR: |

4.27 % |

Market Size in 2032: |

USD 5534.13 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Crown Holdings Inc. (United States), Amcor plc (Australia), AptarGroup Inc. (United States), Silgan Holdings Inc. (United States), Berry Global Inc. (United States) and Other Active Players. |

||