Black Quinoa Market Synopsis:

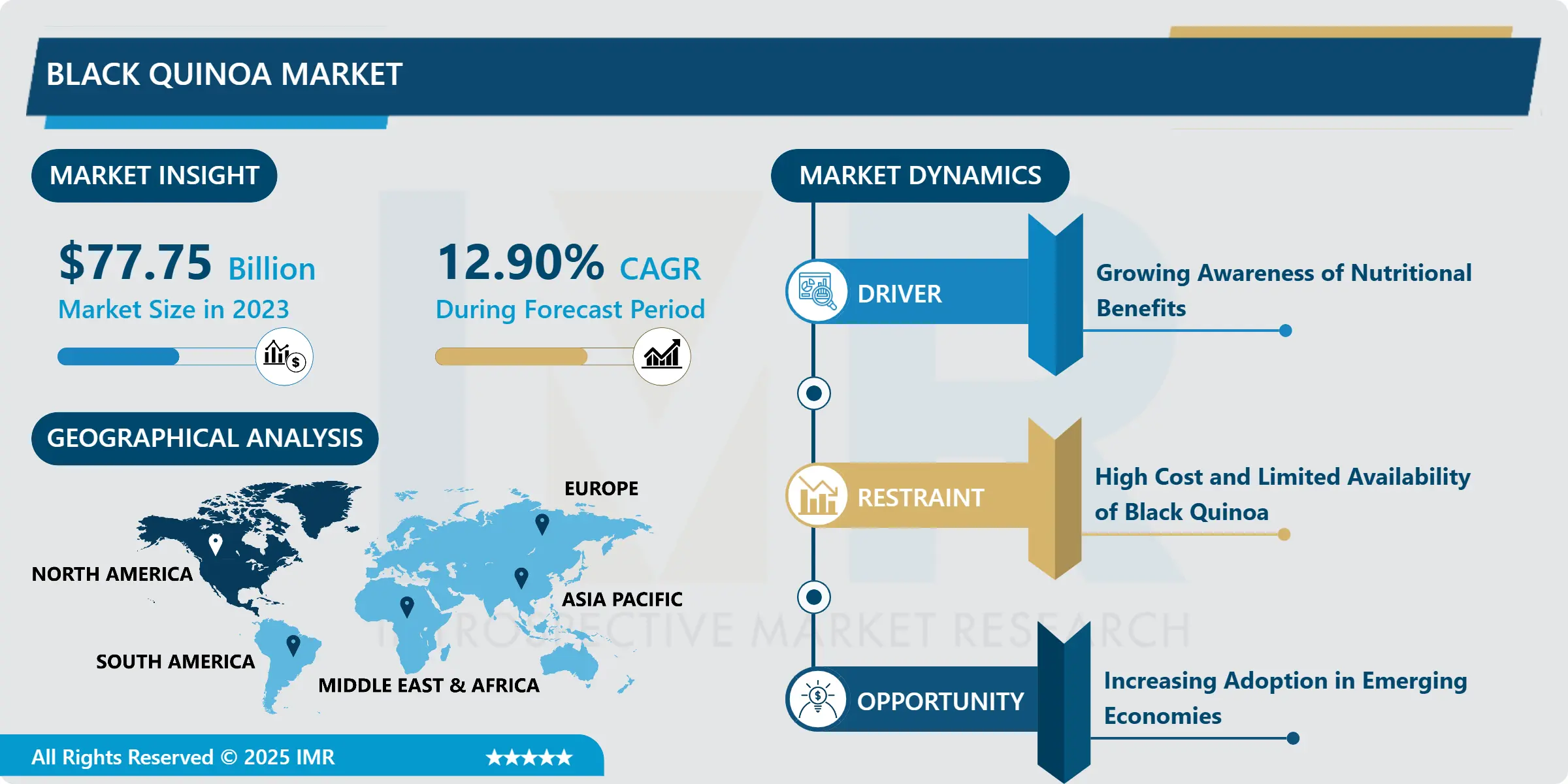

Black Quinoa Market Size Was Valued at USD 77.75 Billion in 2023, and is Projected to Reach USD 231.71 Billion by 2032, Growing at a CAGR of 12.90% From 2024-2032.

The Black Quinoa Market in this context relates to a global marketing and eating of the so-called black quinoa, which is a pseudo cereal, containing high nutritive value and free from gluten, and rich in proteins and valuable nutrients. Being a few shades darker than the standard commercial yellow variety, black quinoa gives a richer earthy flavour and a crisper bite than the traditional variety making a popular product among customers willing to lose weight, consumers of special diets, and chefs who experiment with new recipes.

The black quinoa market has shown considerable increase in the recent years attributed to continuously increasing global consumption of organic and healthy food. The reason black quinoa is regarded as a premium product is discussed in relation to its content of antioxidants, fiber and essential amino-acids. This demand increase is due to consumers changing preference towards eco-friendly and vegan diets. The product versatility in vegan or gluten-free dishes, moreover, its appropriateness to a variety of cuisines has expanded customers’ reach among the urban-consumers internationally.

Besides, black quinoa is widely used in processed and packed products owing to improved food processing systems. Black quinoa is now included in the catalogues of many large retail chains and on-line stores. Manufacturers are focusing on the use of organic production techniques and green supply chain to fulfil the needs of an increasing number of green consumers. In addition, the market growth is supported by governmental measures such as subsidies and support of quinoa production, which comes from South America, where this plant originates

Black Quinoa Market Trend Analysis:

Rising Popularity of Organic and Non-GMO Products

- One of the striking features of the black quinoa market is the increase in organic and non-genetically modified foods certified as safe for consumption throughout the world. While risks associated with pesticide residues as well as genetically modified crops dominate the market, consumers are focusing on organic and Pesticide Residue-Free Quinoa that are safe for their health and are perceived to be ethically sourced. Organic black quinoa is another product, which has found application in this segment, because of its presence in certified organic varieties and improved nutritional quality. This variety is useful for especially health conscious populations including vegetarian and gluten free consumers. The increased prices of products that bear organic certification has not put customers off due to perceived quality and general health risks associated with the normally priced products.

- This trend is most conspicuous in the North America and Europe region given the popularity of the organic black quinoa type. Thanks to numerous campaigns organized to increase public awareness concerning the importance of using organic foods for healthy living and also the availability of special organic food sections in supermarkets, the sales of these foods have received a boost. In turn, using nutritional benefits that organic products provide, retailers and brands continue to introduce a wider choice of organic products to the market, this by using quality certifications as major selling points among shoppers who care about what they consume. This trend is expected to occur as more consumers begin demanding organic products; thus, it is anticipated to feature in the positioning of leading actors in the black quinoa marketplace.

Expansion in Emerging Markets

- Another trend, the black quinoa, has been observed to expanding its growth bases in the emerging economies of the Asia-Pacific and Africa. The third and the fourth aspects of the regional life are characterized by growing disposable money for food consumption that leads to a change in foods’ consumption pattern in certain regions with priority on urban households, and the general tendencies of which are oriented at health-improving. Developing nations such as the India and China will inevitably continue to see an increased market for this healthy ancient grain due to its nutritional advantages. This health food product known as black quinoa is also gradually occupying a place in the local recipes as well as the trendy new recipes. This demand continues rising following constant health awareness campaigns and improvements in focusing on quality and nutritious diets.

- Market accessibility in these regions is therefore rising through the expansions of e-commerce platforms. In conventional markets consumers were able to buy black quinoa and other premium quinoa products through online retail channels the access became easier. To counter the increasing demand, local talents are beginning to look into opportunities for local production of this crop of quinoa to reduce import dependency, and also meet the new demands of their consumers. Such endeavours do not only open up economic development possibilities, but they also contribute towards the development of a more sustainable supply chain therefore making these regions potential markets for black quinoa in the future.

Black Quinoa Market Segment Analysis:

Black Quinoa Market is Segmented on the basis of type, application, end user, and region

By Type, Organic Black Quinoa segment is expected to dominate the market during the forecast period

- The specific segment of Organic Black Quinoa is fast-growing due to the awareness of health-conscious, environmental, and socially responsible, and clean label food products. Organic black quinoa is obtained from plants that have not been exposed to synthetic fertilizers, chemical pesticides or GMO food products hence favoured by those with sensitive stomachs or clients who prefer green foods. This variety is especially lucrative in area such as North America and Europe where consumers’ consciousness regarding organic foods and non-GMO certifications is high. The high cost of the organic black quinoa is further justified by its quality and safety which are seen to improve with usage of the grain hence the ever-growing segment of the market.

- The Conventional Black Quinoa segment continues to be of significant importance for the Global market, thus serving consumers who prefer products of a comparatively low-price level and owners of large businesses. Black Ricardo or conventional black quinoa is the more expensive product, not as easily found in stores as conventional black quinoa. It is normally incorporated in food manufactured in large quantities for example, processed foods, confectionery and fast foods. Although it does not have the organic label, it has other nutritional benefits that customers with the disease can afford in developing countries for quantity use. In any case, both segments combined are guaranteed to provide equal market representation with regard to the wide variety of customers’ requirements.

By Application, Food & Beverages segment expected to held the largest share

- The Food & Beverages segment accounts for the largest consumption of black quinoa, this is primarily because black quinoa is used in banquet preparations as well as processed foods. Black quinoa is the most common type used in salads, soups, breakfast cereals, snack products and bakery items because of the high protein content, the rich colour and taste, and appealing texture. Remarkably, due to its gluten-free property, it is suitable for people with special dietary needs, although the addition of the product to vegan and plant-based diets brought more buyers.

- In addition to food use, black quinoa has numerous uses in the manufacture of Health & Nutritional Products, Pharmaceuticals and Cosmetics. Black quinoa is a popular grain which is an essential component in manufacture of supplements and fortified foods in the health and nutritional segment due to rich content of antioxidants, fiber and essential amino acids. The pharmaceutical industry investigates its bioactive compounds of its potential for the treatment, for instance, inflammation and gut health.

Black Quinoa Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The South America became the dominant market for black quinoa This dominance is as a result of the fact that the Andean region is the biggest exporter and producer of quinoa primarily by Peru and Bolivia. These countries avail themselves of excellent climatic conditions with a long history of agricultural cultivation and, therefore, can grow black quinoa of even higher quality and superior nutritional value. Other attributes that make it easier for it to satisfy the growing global demand include a sound, well developed suppliers and farm framework. However, governmental actions, including subsidies and export promotion schemes, have been crucial to the development of quinoa crop as well as consolidating the region in an international level.

- This region has massive importance on export because South America has close relations with North America and Europe Region where the demand is constantly increasing in relation to superfoods and plant-based diets which includes the consumption of quinoa. The assured quality of the quinoa produced in the region has ensured that buyers ranging from food processors, retailers and health food brands and marketers can depend on sourcing quinoa as a staple from this region. The export report of black quinoa strengthens its relation as the black quinoa market grows and as the market demands, the key region South America is forecasted to retain its market supremacy for many more subsequent years

Active Key Players in the Black Quinoa Market

- Andean Naturals (USA)

- Andean Valley Corporation (Bolivia)

- Ancient Harvest (USA)

- Arrowhead Mills (USA)

- Big Oz Industries Ltd. (UK)

- Bob's Red Mill Natural Foods (USA)

- Comrural XXI (Bolivia)

- Eden Foods Inc. (USA)

- Great River Organic Milling (USA)

- Keen One Quinoa (USA)

- La Granja Organic (Peru)

- Lundberg Family Farms (USA)

- Quinoa Corporation (USA)

- Quinoa Foods Company (Peru)

- The British Quinoa Company (UK)

- Other Active Players

|

Black Quinoa Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 77.75 Billion |

|

Forecast Period 2024-32 CAGR: |

12.90% |

Market Size in 2032: |

USD 231.71 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Black Quinoa Market by Type

4.1 Black Quinoa Market Snapshot and Growth Engine

4.2 Black Quinoa Market Overview

4.3 Organic Black Quinoa

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Organic Black Quinoa: Geographic Segmentation Analysis

4.4 Conventional Black Quinoa

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Conventional Black Quinoa: Geographic Segmentation Analysis

Chapter 5: Black Quinoa Market by Application

5.1 Black Quinoa Market Snapshot and Growth Engine

5.2 Black Quinoa Market Overview

5.3 Food & Beverages

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Food & Beverages: Geographic Segmentation Analysis

5.4 Health & Nutritional Products

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Health & Nutritional Products: Geographic Segmentation Analysis

5.5 Pharmaceuticals

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Pharmaceuticals: Geographic Segmentation Analysis

5.6 Cosmetics

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Cosmetics: Geographic Segmentation Analysis

Chapter 6: Black Quinoa Market by End User

6.1 Black Quinoa Market Snapshot and Growth Engine

6.2 Black Quinoa Market Overview

6.3 Household

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Household: Geographic Segmentation Analysis

6.4 Food Service Industry

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Food Service Industry: Geographic Segmentation Analysis

6.5 Industrial

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Industrial: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Black Quinoa Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ANCIENT HARVEST

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BOB'S RED MILL NATURAL FOODS

7.4 EDEN FOODS INC.

7.5 LUNDBERG FAMILY FARMS

7.6 QUINOA CORPORATION

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global Black Quinoa Market By Region

8.1 Overview

8.2. North America Black Quinoa Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Organic Black Quinoa

8.2.4.2 Conventional Black Quinoa

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Food & Beverages

8.2.5.2 Health & Nutritional Products

8.2.5.3 Pharmaceuticals

8.2.5.4 Cosmetics

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Household

8.2.6.2 Food Service Industry

8.2.6.3 Industrial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Black Quinoa Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Organic Black Quinoa

8.3.4.2 Conventional Black Quinoa

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Food & Beverages

8.3.5.2 Health & Nutritional Products

8.3.5.3 Pharmaceuticals

8.3.5.4 Cosmetics

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Household

8.3.6.2 Food Service Industry

8.3.6.3 Industrial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Bulgaria

8.3.7.2 The Czech Republic

8.3.7.3 Hungary

8.3.7.4 Poland

8.3.7.5 Romania

8.3.7.6 Rest of Eastern Europe

8.4. Western Europe Black Quinoa Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Organic Black Quinoa

8.4.4.2 Conventional Black Quinoa

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Food & Beverages

8.4.5.2 Health & Nutritional Products

8.4.5.3 Pharmaceuticals

8.4.5.4 Cosmetics

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Household

8.4.6.2 Food Service Industry

8.4.6.3 Industrial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 Netherlands

8.4.7.5 Italy

8.4.7.6 Russia

8.4.7.7 Spain

8.4.7.8 Rest of Western Europe

8.5. Asia Pacific Black Quinoa Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Organic Black Quinoa

8.5.4.2 Conventional Black Quinoa

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Food & Beverages

8.5.5.2 Health & Nutritional Products

8.5.5.3 Pharmaceuticals

8.5.5.4 Cosmetics

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Household

8.5.6.2 Food Service Industry

8.5.6.3 Industrial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Black Quinoa Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Organic Black Quinoa

8.6.4.2 Conventional Black Quinoa

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Food & Beverages

8.6.5.2 Health & Nutritional Products

8.6.5.3 Pharmaceuticals

8.6.5.4 Cosmetics

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Household

8.6.6.2 Food Service Industry

8.6.6.3 Industrial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkey

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Black Quinoa Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Organic Black Quinoa

8.7.4.2 Conventional Black Quinoa

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Food & Beverages

8.7.5.2 Health & Nutritional Products

8.7.5.3 Pharmaceuticals

8.7.5.4 Cosmetics

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Household

8.7.6.2 Food Service Industry

8.7.6.3 Industrial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Black Quinoa Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 77.75 Billion |

|

Forecast Period 2024-32 CAGR: |

12.90% |

Market Size in 2032: |

USD 231.71 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||