Bio-based Propylene Glycol Market Synopsis

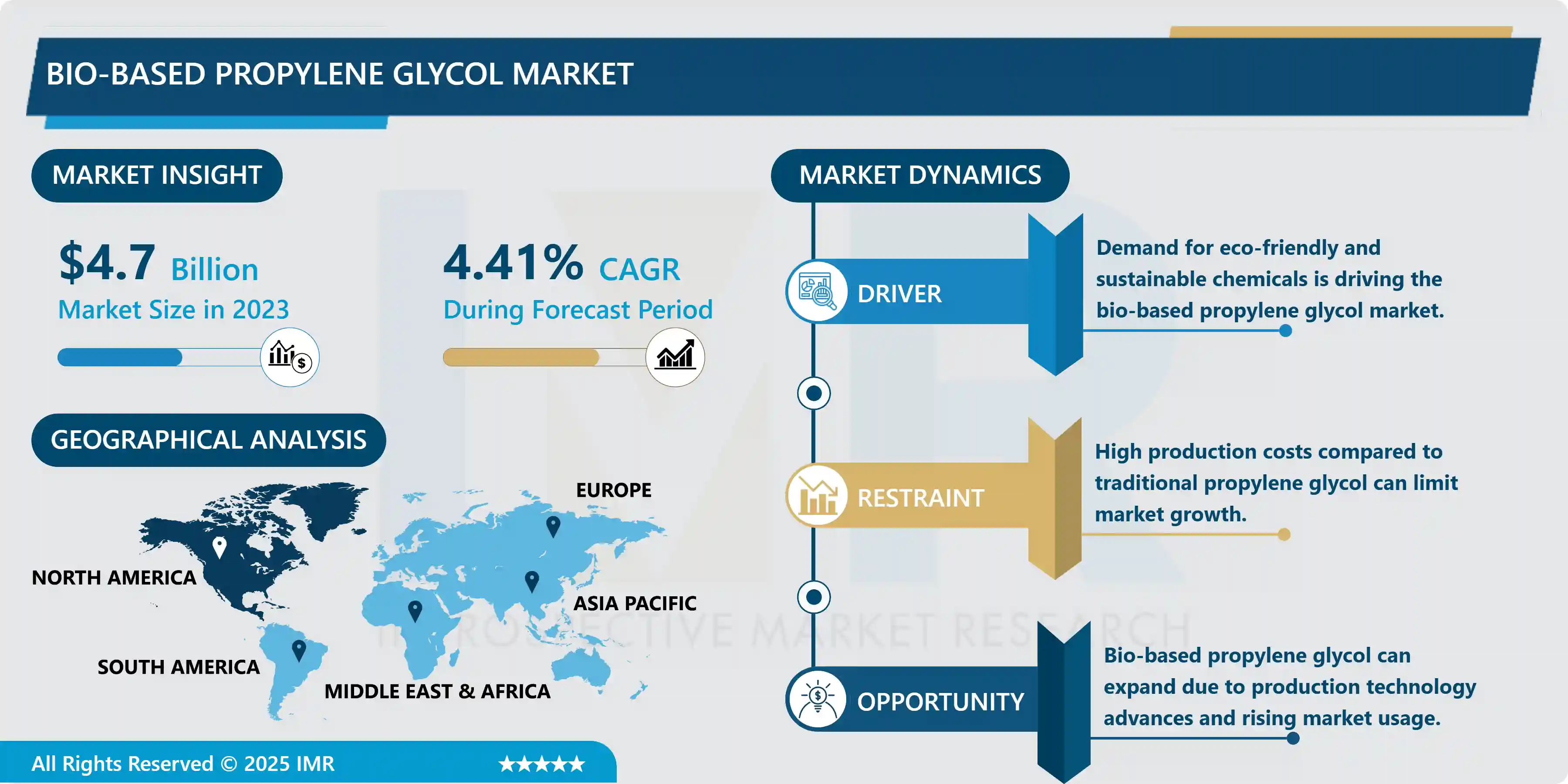

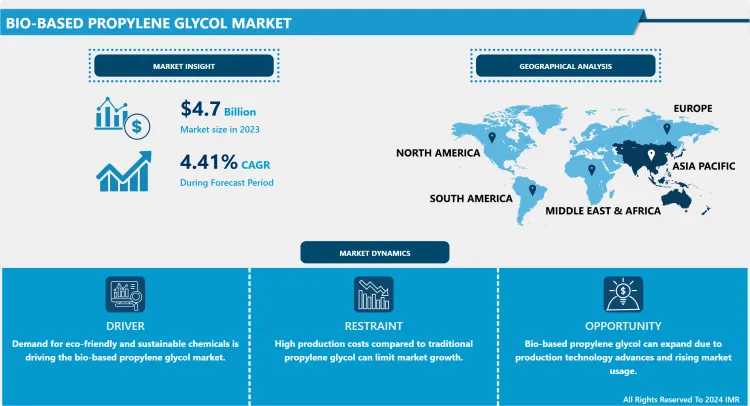

Bio-based Propylene Glycol Market Size is Valued at USD 4.70 Billion in 2023, and is Projected to Reach USD 6.65 Billion by 2032, Growing at a CAGR of 4.41% From 2024-2032.

The global market of Bio-based propylene glycol is on the rise due to increased concerns towards obeying natural products. Petroleum used to be the traditional source of propylene glycol. But currently, renewable materials such as maize, soybeans and other biomass are now sourcing it. Bio based substitutes are now widely demanded especially in automobile, food and beverages, medicine and cosmetics and many other sectors owing to its high biodegradability and low CO2 emissions. This emerging need is due to consumers’ growing knowledge of the earth’s adverse effects on synthetic compounds.

This drive is occasioned by concerns like the strict laws regulating petrochemical-derived outputs, coupled with the discovery of the sustainability agenda. In a bid to lessen the world’s reliance on fossil fuel, governments of various countries especially from the developed world of North America and Europe are calling for the use of bio-based materials. Also, technology continues to advance enabling synthesis of bio-based propylene glycol at affordable prices to allow for use in sectors that require low cost materials. The automotive industry which uses propylene glycol in its antifreeze and coolants and construction which utilizes propylene glycol in production of resins are incorporating bio-based aspects in its supply chain at a fast pace.

The key market issue involving the bio-based propylene glycol is its high production cost compared to the petroleum-derived product. However, the split of this type of passive optical network into two entirely different types, on the basis of the price range, may be a problem in particular where areas with many cost-sensitive industries are located. Secondly, feedstock (biomass) supply is dependent on other agricultural factors such as weather and crop yields, another factor that hampers the production with a view to meeting global demand. To overcome such challenges, there is increased focus on efficiency andcosts of production among the various organizations.

Bio-based Propylene Glycol Market Trend Analysis

Due to the demand for natural and eco-friendly components in cosmetics and skincare, the bio-based propylene glycol market is growing.

- There proppy glycol market is bio-based is experiencing huge growth mainly because of the increasing popularity of natural and environmentally friendly materials in many sectors. There is a growing trend toward using bio-based replacements, like propylene glycol in order to meet the goal of customers and the green ingredients in cosmetics and other hygienic products. Because of its functions of moisturizing and stabilizing a range of personal care products is beginning to incorporate bio-based propylene glycol, which will expand the market for it even further.

- Bio-based propylene glycol use in industries as well as personal care products is also increasing besides the automotive industry. Companies are moving towards bio- based propylene glycol in applications such as antifreeze, lubricants and resins because they prefer an environmentally friendly solution. The global market for green chemistry is experiencing growth due to the move towards green products and supportive legislation as well as the demands for a decrease in carbon emissions across North America, Europe and the Asia-Pacific.

Industrial applications of bio-based propylene glycol are another trend as organizations reduce their carbon footprint by using renewable resources.

- The aforementioned Bio-based propylene glycol market is emerging as more and more industries begin changing from petrochemical based products to renewed products. Bio based propylene glycol, which utilized for antifreeze, coolants and the resins is remarking commonplace in the automotive, construction and manufacturing industries. This substance comes from natural products such as maize and soy beans. Global sustainability objectives influence such change since they raise perception of climate change impacts and the need to cut on global value chains.

- The expanding application of bio-based propylene glycol in the industrial processes is another significant factor that have pushed the growth of this market. A change in components used in products is influenced by environmental concerns as organizations shift from fossil fuel based products. This action not only helps to advance corporate sustainability tasks but also aids and contributes to meeting strict environmental standards in core markets such as North America and Europe which subsequently grow the demand for bio-based propylene glycol in industrial segments.

Bio-based Propylene Glycol Market Segment Analysis:

Bio-based Propylene Glycol Market Segmented on the basis of By Application, and End-use Industry

By Application, Unsaturated Polyester Resin segment is expected to dominate the market during the forecast period

- There is a process of diversification in the existing bio-based propylene glycol market that roughly holds a variety of uses in different fields. A major application area of polyester resin is in the unsaturated polyester resin where bio-based propylene glycol is an essential component because of its friendly environmental characteristic. Several industries use it in the automotive industry and construction sectors for achieving optimal and durable composite solutions. Furthermore, in its chemical intermediates, segment, a key component –propylene glycol is bio-based making it easy to incorporate this company into the green chemistry.

- Propylene glycol derived from bio sources is a less toxic material as compared with petrochemical based glycols being used in antifreeze and coolants that is another usage. The solvent segment uses it in preparing environmentally friendly cleanser and coatings agents. It has been observed that people are demanding sustainable industrial solutions, and personal care products and pharmaceuticals are also using them.

End-use Industry, Automotive segment held the largest share in 2024

- The BiO based propylene glycol market is growing in different end user sectors as it is bio based, non toxic and has a wide range of application. In automotive applications, it applies to coolants and antifreeze, thus becoming environmentally friendly to the existing product type. Bio-based propylene glycol also applies to the food processing industry to get preference since this material complies with the standard requirements of the food Industry. Furthermore, the-growing application in cosmetics and pharmaceutical industries for safe and environmental friendly formulation.

- Bio based propylene glycol is used in the construction sector’s adhesives, coatings and sealants, thus enhancing sustainability in constructions.. The marine and transportation industry uses it for it has little or no effect on the environment because it improves the quality and efficiency of various fluids and products. In conclusion, bio based propylene glycol used in various industries demonstrates that this chemical makes a significant contribution towards sustainability and decreased use of fossil fuel.

Bio-based Propylene Glycol Market Regional Insights:

Asia-Pacific Bio-based propylene glycol (PG) Market is expected to Grow.

- The demand for bio-based PG in in the Asia-Pacific region may grow dramatically over time due to factors such as the growth in consciousness of environmentalism and a rising focus on the use of renewable feedstocks in the production process among various industries. This growth is due to the increasing use of PBT in applications like unsaturated polyester resins, antifreeze & coolants, and chemical intermediates due to a growing need for green solutions. When industries in countries such as China and India look for ecofriendly solutions, then bio based propylene glycol is indeed a perfect solution in terms of reducing carbon footprint and meeting regulatory requirements.

- Moreover, the automotive and construction markets are soon growing rapidly thus increasing the market in that region. Bio-based propylene glycol’s application in synthesizing high-performance materials and safer chemicals is in conjunction with the region’s environmental responsibility push. This has been backed up by advancement in production technologies and the rising tengreen chemical solutions in propylene glycol, Asia-Pacific region outcompeting the rest in the global bio-based propylene glycol market.

Active Key Players in the Bio-based Propylene Glycol Market

- Archer Daniels Midland Company (U.S.)

- BASF SE (Germany)

- The Dow Chemical Company (U.S.)

- DuPont Tate & Lyle Bio Products Company, LLC (UK)

- Huntsman International LLC. (U.S.)

- Cargill (U.S.)

- Oleon (Belgium)

- Ashland. (U.S) and Others Major Players

|

Global Bio-based Propylene Glycol Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.70 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.41% |

Market Size in 2032: |

USD 6.65 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By End-use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bio-based Propylene Glycol Market by Application (2018-2032)

4.1 Bio-based Propylene Glycol Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Unsaturated Polyester Resin

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Antifreeze & Coolant

4.5 Chemical Intermediates

4.6 Solvent

4.7 Others

Chapter 5: Bio-based Propylene Glycol Market by End-use Industry (2018-2032)

5.1 Bio-based Propylene Glycol Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Automotive

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Food Processing

5.5 Cosmetics

5.6 Pharmaceuticals

5.7 Construction

5.8 Marine

5.9 Transportation

5.10 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Bio-based Propylene Glycol Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ARCHER DANIELS MIDLAND COMPANY (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BASF SE (GERMANY)

6.4 THE DOW CHEMICAL COMPANY (U.S.)

6.5 DUPONT TATE & LYLE BIO PRODUCTS COMPANY

6.6 LLC (UK)

6.7 HUNTSMAN INTERNATIONAL LLC. (U.S.)

6.8 CARGILL (U.S.)

6.9 OLEON (BELGIUM)

6.10 ASHLAND. (U.S) OTHERS MAJOR PLAYERS

6.11

Chapter 7: Global Bio-based Propylene Glycol Market By Region

7.1 Overview

7.2. North America Bio-based Propylene Glycol Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Application

7.2.4.1 Unsaturated Polyester Resin

7.2.4.2 Antifreeze & Coolant

7.2.4.3 Chemical Intermediates

7.2.4.4 Solvent

7.2.4.5 Others

7.2.5 Historic and Forecasted Market Size by End-use Industry

7.2.5.1 Automotive

7.2.5.2 Food Processing

7.2.5.3 Cosmetics

7.2.5.4 Pharmaceuticals

7.2.5.5 Construction

7.2.5.6 Marine

7.2.5.7 Transportation

7.2.5.8 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Bio-based Propylene Glycol Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Application

7.3.4.1 Unsaturated Polyester Resin

7.3.4.2 Antifreeze & Coolant

7.3.4.3 Chemical Intermediates

7.3.4.4 Solvent

7.3.4.5 Others

7.3.5 Historic and Forecasted Market Size by End-use Industry

7.3.5.1 Automotive

7.3.5.2 Food Processing

7.3.5.3 Cosmetics

7.3.5.4 Pharmaceuticals

7.3.5.5 Construction

7.3.5.6 Marine

7.3.5.7 Transportation

7.3.5.8 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Bio-based Propylene Glycol Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Application

7.4.4.1 Unsaturated Polyester Resin

7.4.4.2 Antifreeze & Coolant

7.4.4.3 Chemical Intermediates

7.4.4.4 Solvent

7.4.4.5 Others

7.4.5 Historic and Forecasted Market Size by End-use Industry

7.4.5.1 Automotive

7.4.5.2 Food Processing

7.4.5.3 Cosmetics

7.4.5.4 Pharmaceuticals

7.4.5.5 Construction

7.4.5.6 Marine

7.4.5.7 Transportation

7.4.5.8 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Bio-based Propylene Glycol Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Application

7.5.4.1 Unsaturated Polyester Resin

7.5.4.2 Antifreeze & Coolant

7.5.4.3 Chemical Intermediates

7.5.4.4 Solvent

7.5.4.5 Others

7.5.5 Historic and Forecasted Market Size by End-use Industry

7.5.5.1 Automotive

7.5.5.2 Food Processing

7.5.5.3 Cosmetics

7.5.5.4 Pharmaceuticals

7.5.5.5 Construction

7.5.5.6 Marine

7.5.5.7 Transportation

7.5.5.8 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Bio-based Propylene Glycol Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Application

7.6.4.1 Unsaturated Polyester Resin

7.6.4.2 Antifreeze & Coolant

7.6.4.3 Chemical Intermediates

7.6.4.4 Solvent

7.6.4.5 Others

7.6.5 Historic and Forecasted Market Size by End-use Industry

7.6.5.1 Automotive

7.6.5.2 Food Processing

7.6.5.3 Cosmetics

7.6.5.4 Pharmaceuticals

7.6.5.5 Construction

7.6.5.6 Marine

7.6.5.7 Transportation

7.6.5.8 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Bio-based Propylene Glycol Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Application

7.7.4.1 Unsaturated Polyester Resin

7.7.4.2 Antifreeze & Coolant

7.7.4.3 Chemical Intermediates

7.7.4.4 Solvent

7.7.4.5 Others

7.7.5 Historic and Forecasted Market Size by End-use Industry

7.7.5.1 Automotive

7.7.5.2 Food Processing

7.7.5.3 Cosmetics

7.7.5.4 Pharmaceuticals

7.7.5.5 Construction

7.7.5.6 Marine

7.7.5.7 Transportation

7.7.5.8 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Bio-based Propylene Glycol Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.70 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.41% |

Market Size in 2032: |

USD 6.65 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By End-use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||