Asset Finance and Leasing Software Market Synopsis

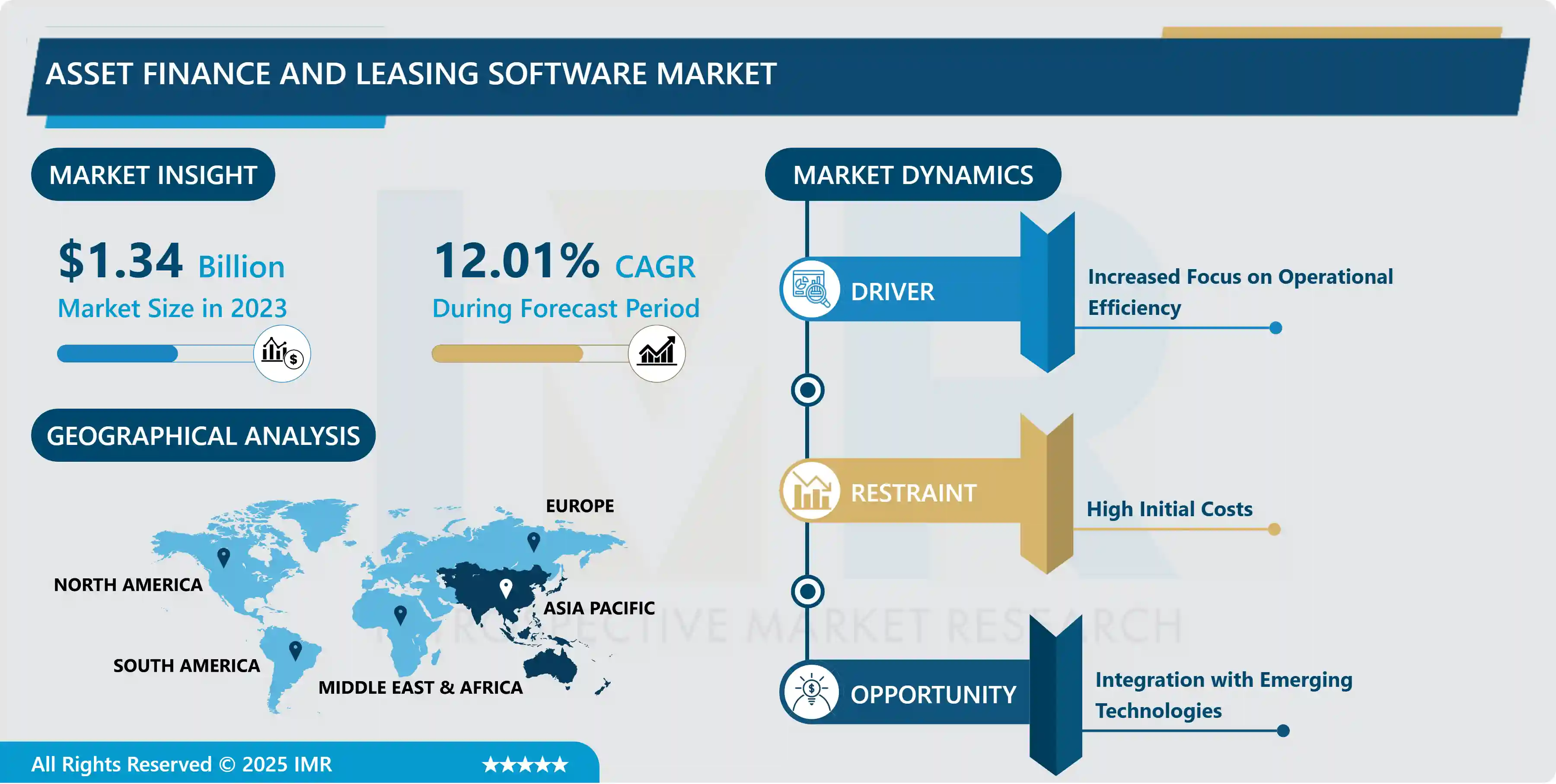

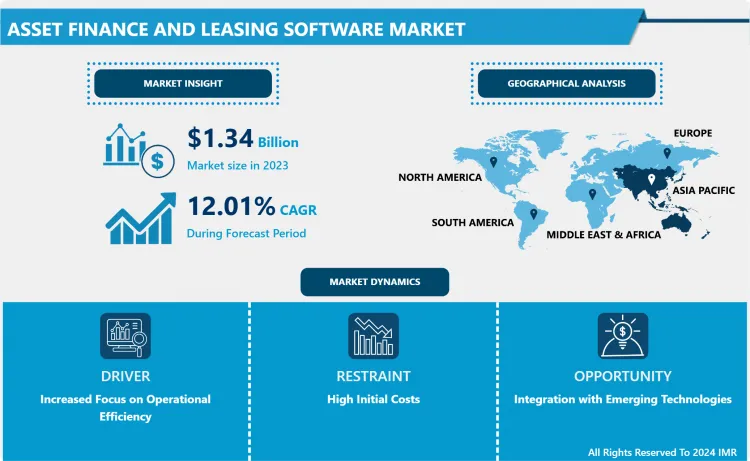

The Asset Finance and Leasing Software Market was valued at USD 1.34 Billion in 2023 and is projected to reach USD 3.72 Billion by 2032, growing at a CAGR of 12.01% from 2024 to 2032.

Asset Finance and Leasing Software are specialized tools designed to streamline and automate the management of asset financing and leasing processes for businesses. These solutions cater to industries where companies rely on leasing or financing arrangements for acquiring assets such as vehicles, equipment, or machinery. The software helps in tracking lease agreements, managing asset portfolios, and handling financial transactions associated with leasing and financing.

Applications of Asset Finance and Leasing Software include lease origination, contract management, accounting, and reporting. These tools enhance efficiency by automating tasks like payment processing, compliance monitoring, and risk assessment. They also provide insights into asset performance and financial health, enabling better decision-making for businesses.

In the current market, there is a growing demand for Asset Finance and Leasing Software due to the increasing complexity of financial transactions, regulatory requirements, and the need for operational efficiency. Trends include the integration of artificial intelligence and machine learning for risk assessment and predictive analytics. Cloud-based solutions are gaining popularity for their scalability and accessibility. Additionally, mobile applications are becoming more prevalent, offering users the flexibility to manage leasing and financing activities on the go. Overall, the market trends reflect a shift towards more advanced, technology-driven solutions to meet the evolving needs of businesses in the asset finance and leasing sector.

Asset Finance and Leasing Software Market Trend Analysis

Increased Focus on Operational Efficiency

- Businesses across industries are recognizing the importance of optimizing their operational processes to remain competitive and agile in today's dynamic marketplace. Asset Finance and Leasing Software play a crucial role in achieving this optimization by automating and streamlining complex leasing and financing workflows.

- Efficiency gains are realized through the automation of tasks such as lease origination, payment processing, and compliance monitoring. By reducing manual efforts and minimizing errors, these software solutions enhance the overall speed and accuracy of operations. This not only leads to cost savings but also allows businesses to allocate resources more strategically, improving productivity.

- Furthermore, Asset Finance and Leasing Software contribute to better resource utilization by providing real-time insights into asset performance, financial health, and risk factors. With quick access to actionable data, organizations can make informed decisions promptly, contributing to smoother operations and improved financial outcomes.

- In an environment where businesses are continually seeking ways to do more with less, the pursuit of operational efficiency through the adoption of advanced software solutions has become imperative. As a result, the market for Asset Finance and Leasing Software is witnessing increased demand from companies looking to enhance their operational effectiveness and gain a competitive edge.

Integration with Emerging Technologies

- Integration with emerging technologies serves as a major opportunity for the Asset Finance and Leasing Software market, offering innovative solutions to address evolving industry demands. The incorporation of artificial intelligence (AI) and machine learning (ML) presents opportunities to enhance risk assessment, automate decision-making processes, and provide predictive analytics. AI-powered algorithms can analyze vast amounts of data, improving the accuracy of credit risk evaluations and helping businesses make more informed leasing and financing decisions.

- Blockchain technology is another emerging area with significant potential. It can be leveraged to enhance security, transparency, and efficiency in financial transactions. Implementing blockchain in Asset Finance and Leasing Software can streamline processes such as contract execution, payment processing, and asset tracking, reducing fraud risks and ensuring data integrity.

- Furthermore, the Internet of Things (IoT) integration can enable real-time monitoring of leased assets, providing valuable insights into their performance and maintenance needs. This data-driven approach enhances operational efficiency and supports proactive decision-making.

- In seizing the opportunity to integrate these technologies, Asset Finance and Leasing Software providers can offer cutting-edge solutions that not only streamline current processes but also position businesses for future success in a rapidly evolving technological landscape. Clients are likely to prioritize software solutions that embrace these emerging technologies, providing a competitive advantage to providers that proactively incorporate them into their offerings.

Asset Finance and Leasing Software Market Segment Analysis:

Asset Finance and Leasing Software Market Segmented based on deployment, enterprise and application

By Deployment, the Cloud-based segment is expected to dominate the market during the forecast period

- The Cloud-based segment is anticipated to dominate the Asset Finance and Leasing Software market during the forecast period. This trend is driven by the numerous advantages offered by cloud deployment, including flexibility, scalability, and accessibility. Cloud-based solutions allow businesses to access the software and data from any location, facilitating remote collaboration and enhancing overall operational efficiency.

- Moreover, cloud deployment eliminates the need for significant upfront investments in hardware and infrastructure, making it a cost-effective option for businesses of all sizes. The scalability of cloud solutions ensures that companies can easily adapt to changing workloads and scale their operations without the constraints of traditional on-premises systems.

- As organizations increasingly prioritize agility and cost-effectiveness, the Cloud-based segment is poised to witness continued growth, solidifying its dominance in the Asset Finance and Leasing Software market.

By Application, the Commercial segment held the largest market share of 43.5% in 2022

- In the Asset Finance and Leasing Software market, the Commercial segment has emerged as the dominant force, holding the largest market share. This segment's supremacy is attributed to the extensive adoption of leasing and financing solutions by commercial enterprises across various industries. Businesses in the commercial sector, including manufacturing, transportation, and services, heavily rely on leasing arrangements for acquiring essential assets such as machinery, vehicles, and equipment.

- Commercial entities leverage Asset Finance and Leasing Software to streamline complex processes such as lease origination, contract management, and financial tracking. The software's ability to enhance operational efficiency, improve risk management, and provide valuable insights into asset performance resonates particularly well with the diverse and dynamic needs of commercial businesses. As the commercial sector continues to expand and evolve, the demand for advanced leasing software solutions is expected to maintain the Commercial segment's leadership in the market.

Asset Finance and Leasing Software Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is poised to dominate the Asset Finance and Leasing Software market over the forecast period, showcasing robust growth and market leadership. This dominance can be attributed to the region's burgeoning economies, increased industrialization, and a surge in the adoption of advanced technologies across various sectors. As businesses in Asia Pacific actively embrace leasing and financing strategies for asset acquisition, the demand for efficient software solutions is on the rise.

- Rapid urbanization, infrastructural development, and the expansion of manufacturing and logistics industries further contribute to the heightened demand for Asset Finance and Leasing Software in the region. Moreover, as regulatory environments evolve, businesses seek technologically advanced solutions to ensure compliance and operational efficiency. With a large and diverse market, Asia Pacific is positioned as a key growth hub for Asset Finance and Leasing Software, underscoring its anticipated dominance in the global market landscape.

Asset Finance and Leasing Software Market Top Key Players:

- Accruent (U.S.)

- Asset Panda (U.S.)

- Cassiopae (France)

- Costar Group (U.S.)

- Soft4leasing (Lithuania)

- Ibm Corporation (U.S.)

- Nakisa (Canada)

- Leaseaccelerator (U.S.)

- Leasequery (U.S.)

- Odessa Technologies (U.S.)

- Mri Software (U.S.)

- Oracle (U.S.)

- Realpage (U.S.)

- Visual Lease (U.S.)

- Vts (U.S.)

- Ids Group Companies (White Clarke Group) (U.K.)

- Paylease (U.S.) And Other Major Players

Key Industry Developments in the Asset Finance and Leasing Software Market:

- In October 2023, LTi Technology Solutions (LTi), a lease and loan cloud technology provider for equipment and asset finance companies, unveiled a partnership with US-based Capteris Capital. The collaboration aims to leverage LTi’s lifecycle leasing and loan finance platform, ASPIRE, to deliver enhanced services to the equipment finance industry, the two companies said in a press release.

- In May 2023, LeaseAccelerator, the world’s leader in Lease Lifecycle Automation software, announced that it had completed the acquisition of the LeaseController™ Software-as-a-Service (SaaS) product and related business operations from Deloitte.

|

Asset Finance and Leasing Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.34 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.01 % |

Market Size in 2032: |

USD 3.72 Bn. |

|

Segments Covered: |

By Deployment |

|

|

|

By Enterprise |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Asset Finance and Leasing Software Market by Deployment (2018-2032)

4.1 Asset Finance and Leasing Software Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cloud-based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 On-premises

Chapter 5: Asset Finance and Leasing Software Market by Enterprise (2018-2032)

5.1 Asset Finance and Leasing Software Market Snapshot and Growth Engine

5.2 Market Overview

5.3 SMEs

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large Enterprise

Chapter 6: Asset Finance and Leasing Software Market by Application (2018-2032)

6.1 Asset Finance and Leasing Software Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Commercial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Residential

6.5 Industrial

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Asset Finance and Leasing Software Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 L'ORÉAL (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ESTÉE LAUDER COMPANIES (U.S.)

7.4 SHISEIDO (JAPAN)

7.5 JOHNSON & JOHNSON (U.S.)

7.6 PROCTER & GAMBLE (U.S.)

7.7 UNILEVER (NETHERLANDS)

7.8 AMWAY (UNITED STATES)

7.9 BEIERSDORF AG (GERMANY)

7.10 KAO CORPORATION (JAPAN)

7.11 MARY KAY INC. (U.S.)

7.12 COLGATE-PALMOLIVE (U.S.)

7.13 COTY INC. (U.S.)

7.14 AVON PRODUCTS INC. (U.K.)

7.15 REVLON (U.S.)

7.16 ORIFLAME COSMETICS (SWEDEN)

7.17 BASF SE (GERMANY)

7.18 CLARINS GROUP (FRANCE)

7.19 NU SKIN ENTERPRISES (U.S.)

7.20 GSK (GLAXOSMITHKLINE) (U.K.)

7.21 LVMH (MOËT HENNESSY LOUIS VUITTON) (FRANCE)

Chapter 8: Global Asset Finance and Leasing Software Market By Region

8.1 Overview

8.2. North America Asset Finance and Leasing Software Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Deployment

8.2.4.1 Cloud-based

8.2.4.2 On-premises

8.2.5 Historic and Forecasted Market Size by Enterprise

8.2.5.1 SMEs

8.2.5.2 Large Enterprise

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Commercial

8.2.6.2 Residential

8.2.6.3 Industrial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Asset Finance and Leasing Software Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Deployment

8.3.4.1 Cloud-based

8.3.4.2 On-premises

8.3.5 Historic and Forecasted Market Size by Enterprise

8.3.5.1 SMEs

8.3.5.2 Large Enterprise

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Commercial

8.3.6.2 Residential

8.3.6.3 Industrial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Asset Finance and Leasing Software Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Deployment

8.4.4.1 Cloud-based

8.4.4.2 On-premises

8.4.5 Historic and Forecasted Market Size by Enterprise

8.4.5.1 SMEs

8.4.5.2 Large Enterprise

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Commercial

8.4.6.2 Residential

8.4.6.3 Industrial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Asset Finance and Leasing Software Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Deployment

8.5.4.1 Cloud-based

8.5.4.2 On-premises

8.5.5 Historic and Forecasted Market Size by Enterprise

8.5.5.1 SMEs

8.5.5.2 Large Enterprise

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Commercial

8.5.6.2 Residential

8.5.6.3 Industrial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Asset Finance and Leasing Software Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Deployment

8.6.4.1 Cloud-based

8.6.4.2 On-premises

8.6.5 Historic and Forecasted Market Size by Enterprise

8.6.5.1 SMEs

8.6.5.2 Large Enterprise

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Commercial

8.6.6.2 Residential

8.6.6.3 Industrial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Asset Finance and Leasing Software Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Deployment

8.7.4.1 Cloud-based

8.7.4.2 On-premises

8.7.5 Historic and Forecasted Market Size by Enterprise

8.7.5.1 SMEs

8.7.5.2 Large Enterprise

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Commercial

8.7.6.2 Residential

8.7.6.3 Industrial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Asset Finance and Leasing Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.34 Bn. |

|

Forecast Period 2024-32 CAGR: |

12.01 % |

Market Size in 2032: |

USD 3.72 Bn. |

|

Segments Covered: |

By Deployment |

|

|

|

By Enterprise |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||