Agile Project Management Software Market Synopsis:

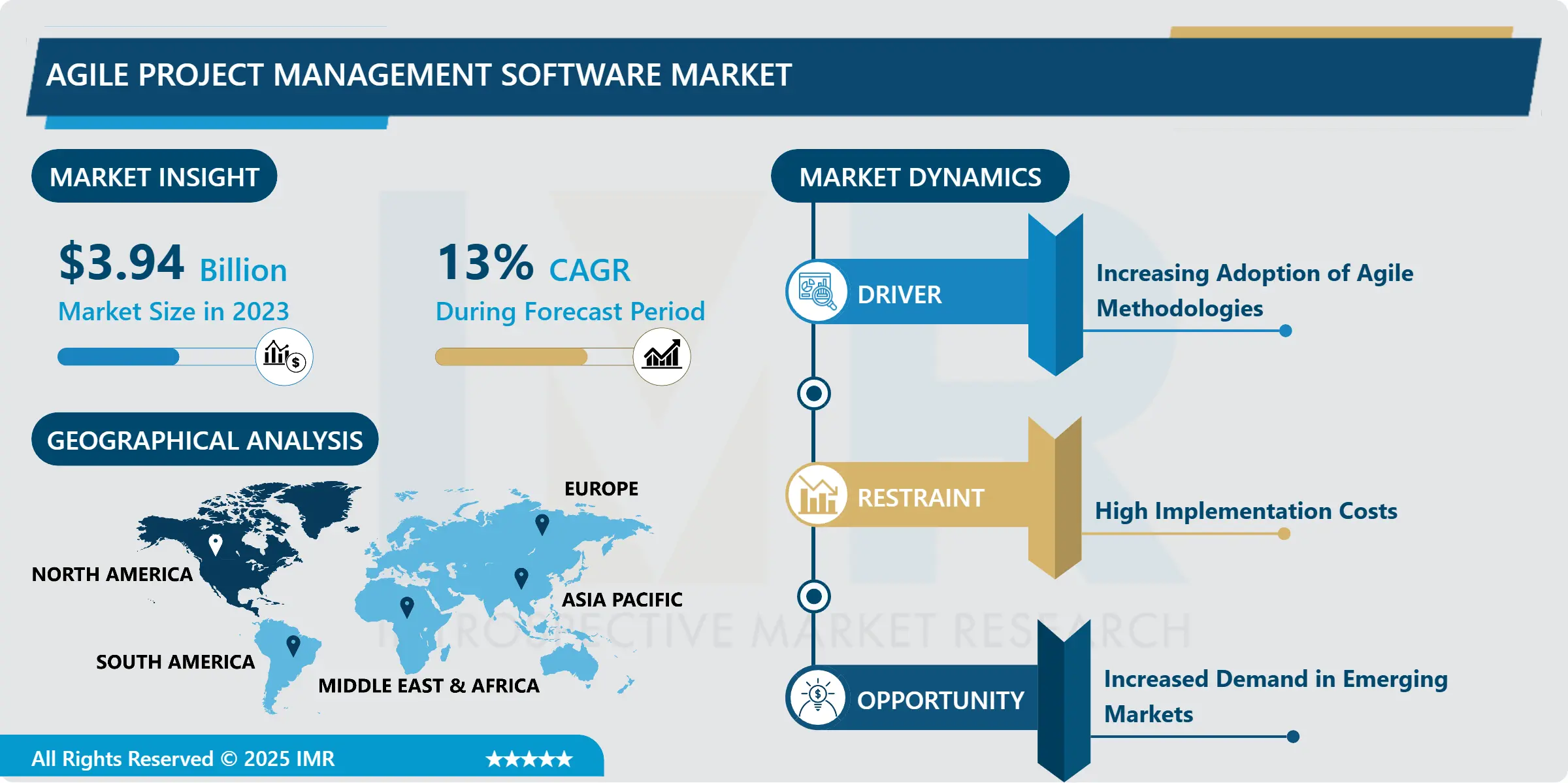

Agile Project Management Software Market Size Was Valued at USD 3.94 Billion in 2023, and is Projected to Reach USD 11.84 Billion by 2032, Growing at a CAGR of 13.00% From 2024-2032.

The Agile Project Management Software Market defines itself as a collection of instruments and platforms that are designed to respond to the approaches embraced by agile methodologies. These solutions allow teams to organize work around planning, implementation, and control of projects with the outlook on the improvements, collaboration, and subsequent developments. These include; sprint planning, task management, customization of working processes, and reporting, which help to easily track and manage new changes that arise in the project process. Given that these software tools are developed to promote better communication and visibility between the related interests, project management agility leads to increased efficiency, shorter time to market, and improved results. This market is driven by the advancement in using agile practices in industries including Information Technology, health, construction, and marketing.

The market for Agile Project Management Software is rapidly growing due to increased demand for agile project management tools in several industries. The market is gaining momentum because of the growing need for products that facilitate iterative approach to project delivery, communication and team cooperation. It also contains features like sprint, priority and performance management to complete an Agile project; thus makes it an essential tool for any team, that seeks to change direction often depending on the project needs. As companies keep on emphasizing the digital agenda, the application of new intelligent technologies like AI and ML in projects of the agile management further drives the market expansion.

Regionally, the market is led by North America due to the increased utilization of agile practices in industries particularly the technology-based industries including information technology, software development, and financial services industries. The Asia-Pacific area, however, is predicted to achieve the highest growth rate within the forecast amount because of the emerging IT outsourcing and growing adoption of the agile approach in emergent economy nations. Thus, the key market players are targeting the enhancement of their positions and are primarily concentrating on the development of new products and service deliveries, primarily cloud-based solutions that can fully address the challenges of remote and hybrid work settings. As the projects are getting bigger and the demand for tools that will help manage the workflows are increasing the Agile Project Management Software Market is expected to have significant growth in the future.

Agile Project Management Software Market Trend Analysis:

Growing Adoption of Agile Practices and Advanced Features Driving Market Growth

- Different organisations today across industry sectors are seeking to incorporate agile practices as a means of increasing flexibility and productivity and as a way of easily responding to the numerous and complex challenges and competition experienced in the business world. IT, health care, manufacturing, BFSI are the front runners for this shift as these sectors propel their innovation speed and customer value proposition. The above industries can adopt agile methodologies to work proactively to various changes in the market while at the same time practicing efficiency. This adoption is further driven by the increasing emergence and importance of real time collaboration applications that allow for easy and efficient communication across different teams, an important requirement due to the new normal of work from home. Pre-built automation features within the project management tools are also emerging as they assist organizations in reducing routine efforts.

- Besides, features that are in-built in the agile project management software are enhancing the market greatly. Through storing information in vast databases and the use of AI-driven analytics, tools enable project teams to project future problems and schedule tasks with the help of a predicted timeline. On the basis of received data, organizations get customized dashboards allowing the assessment of the project’s dynamics and other parameters. These innovations not only improve decision making quality but also increase efficiency in the different activities’ phases making agile tools valuable to attain a firm’s objectives. This increasing reliance on advanced functionalities heightens the importance of flexible software in the achievement of business success in the environment that is rapidly becoming more complex.

Driving Factors and Opportunities in the Agile Project Management Software Market

- This explains why project management is rapidly evolving especially now that every sector is going digital. These software solutions provide real time tracking of project progresses, better and optimal utilization of resources, ability to make changes during the actual implementation of the project which are all crucial factors as organisations form partnerships in order to produce better results and quicker responses to the ever-changing market environments. Due to the recognition of the scalability and ability to aid in minimizing project work as accessed by SMEs, which are small and have minuscule resources, the agile software is steadily being incorporated. Thus, its increasing use by SMEs is expected to drive increased growth in the market, creating a robust growth opportunity for companies that supply agile project management software.

- Because agile work models are increasingly popular for remote and blended work arrangements, cloud-based solutions are even more important. These tools enable a team to be in agreement with the goals of a project regardless of whether they are located together or are in different regions. This means that organizations are in desperate need of technologies strong enough to provide support for distributed teams. Solutions that can be deployed through the cloud continue to draw interest due to their versatile nature, ease of access, and lower costs of implementation, which are critical to today’s workplaces. However, as companies go on adopting these models, the market for adapting and correcting project management software that is especially designed for remote collaboration is likely to grow in future.

Agile Project Management Software Market Segment Analysis:

Agile Project Management Software Market Segmented on the basis of By Deployment Type, Organization Size, Application Type, Features, Pricing Model, Mobile Platform, Integration Capability, and Region.

By Deployment Type , On-premises segment is expected to dominate the market during the forecast period

- The on-premises version of software that is, software that is hosted on a company’s own servers and equipment gives an organization full authority over the utilization of the system, its data, and protection. On-premises software is completely different from those cloud-based solutions and that means that the information of the businesses is not stored on the external servers and it means that the third-party interference is not an issue since everything is under the control of the company. This model is rather popular among the large enterprises or organizations which have distinct regulatory demands as within the framework of this model they are provided with a possibility to develop and enforce rather precise security measures and internal controls which complies with the industry standards and legislation. Large multinationals eradicating unique or sensitive information like in health or financial sectors may not embrace external hosting services due to the embedded risk of usage.

- The open nature of on-premises deployment also lets business make changes to the application to suit their needs. These could involve modifying functionality of a software, changes within the process or embedding with other enterprise tools. Such level of control may be indispensable to many firms, especially those who need to implement solutions that cannot be provided by existent software packages. Thirdly, on-premise configurations can help deliver better availability and response time and can be more effective when organizations have the volume to invest and create their own IT systems. However, there is a high initial cost, and the internal IT department needs continuous investment for maintaining the system, which is a disadvantage, especially for the large organization that has enough resources to implement such a setup.

By Integration Capability, Integration with Project segment expected to held the largest share

- Project management integration is significant to organizations with existing project management systems and tools. In such organizations, incorporation of new project management software makes it possible for efficient management by avoiding the creation of sub groups with similar roles to another group within the same organization. This integration enables working teams to have a monolithic picture of the project’s schedule and the errors, tasks, and resources allocation that help avoid numerous upgrades through various systems manually. When integrated with planning applications, communication platforms, and to-do lists, combined with automated reporting as to the progress of projects, businesses can ensure a smooth constant process whereby all forms of relevant information from different branches of the organization are immediately accessible and updated. It also aids in discouraging errors or inconsistencies which might occur when two separate systems are used.

- The integration process with other project management software allows sustaining the workflow and that is critical in large-scale projects implemented in departments or teams. It also allows project managers to manage project from one end to the other without being interrupted. For instance, if a team is using a different platform for issue tracking or resource management integration will enable the new software to exchange data with the former. This makes it easier for departments to share information across organizations and also gives current status updates of a project’s progress. Lastly, when the project management software is linked with other applications, organizations can achieve better work efficiency, improved collaboration, and strong project control without extensive human interaction.

Agile Project Management Software Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The Agile Project Management Software Market in North America, especially in the United States and Canada, is steadily growing due to the growing propensity for agile strategies across various industries including Information Technology, Health care and the financial sector. Many organisations in these industries are adopting agile paradigms to foster communication, increase collaboration, and increase the speed of their projects. Ever, there is pressure on the adoption of digital business models from the leadership and constant search for new solutions to improve operations, organizations are putting resources into agile project management software solutions to enhance their project monitoring and control. In addition, isolated circumstances that require think, build, and collaborate methods such as software to support distributed teams, which is vital for their work – have also contributed to the need for agile software solutions, which will see North America as a leader in market growth.

- This market growth in North America is also reinforced by good technology ecosystem, high number of software firms and key players such as Atlassian, Microsoft, Wrike etc. These companies provide various types of agile tools to meet with the several needs of organizations and thus enable organizations for implementing agile processes in a much easier and effective manner. Relatively high technological development in the region and a high uptake especially among enterprises looking for ways to compete effectively has put North America in a better place to lead the market. This need for cloud-based agile solutions points to a promising future as North America extols the lion’s share in revenue generation and defining the evolution of agile project management tools.

Active Key Players in the Agile Project Management Software Market

- Asana, Inc.,

- Atlassian Corporation Plc.,

- Basecamp LLC,

- Clarizen Ltd.,

- Jira Software

- Microsoft Corporation,

- Monday.com Ltd.,

- Smartsheet Inc.,

- Target process, Inc.,

- Teamwork.com Ltd.,

- Trello, Inc.,

- VersionOne, Inc.,

- Wrike, Inc.,

- Zoho Corporation Pvt. Ltd.,

- Other Active Players.

|

Global Agile Project Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.94 Billion |

|

Forecast Period 2024-32 CAGR: |

13.00% |

Market Size in 2032: |

USD 11.84 Billion |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Organization Size |

|

||

|

By Application Type |

|

||

|

By Features |

|

||

|

By Pricing Model |

|

||

|

By Mobile Platform |

|

||

|

By Integration Capability |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Agile Project Management Software Market by Deployment Type

4.1 Agile Project Management Software Market Snapshot and Growth Engine

4.2 Agile Project Management Software Market Overview

4.3 On-premises and Cloud-based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 On-premises and Cloud-based: Geographic Segmentation Analysis

Chapter 5: Agile Project Management Software Market by Organization Size

5.1 Agile Project Management Software Market Snapshot and Growth Engine

5.2 Agile Project Management Software Market Overview

5.3 Small and Medium Enterprises (SMEs) and Large Enterprises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Small and Medium Enterprises (SMEs) and Large Enterprises: Geographic Segmentation Analysis

Chapter 6: Agile Project Management Software Market by Application Type

6.1 Agile Project Management Software Market Snapshot and Growth Engine

6.2 Agile Project Management Software Market Overview

6.3 IT and Software Development

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 IT and Software Development: Geographic Segmentation Analysis

6.4 Construction and Engineering

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Construction and Engineering: Geographic Segmentation Analysis

6.5 Healthcare

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Healthcare: Geographic Segmentation Analysis

6.6 Education

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Education: Geographic Segmentation Analysis

6.7 Manufacturing and Others

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Manufacturing and Others: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Agile Project Management Software Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 TARGET PROCESS INC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CLARIZEN LTD.

7.4 VERSIONONE INC.

7.5 TEAMWORK.COM LTD.

7.6 BASECAMP LLC

7.7 TRELLO INC.

7.8 SMARTSHEET INC.

7.9 ASANA INC.

7.10 WRIKE INC.

7.11 MONDAY.COM LTD.

7.12 MICROSOFT CORPORATION

7.13 ATLASSIAN CORPORATION PLC.

7.14 ZOHO CORPORATION PVT. LTD.

7.15 AND JIRA SOFTWARE

7.16 OTHER ACTIVE PLAYERS

Chapter 8: Global Agile Project Management Software Market By Region

8.1 Overview

8.2. North America Agile Project Management Software Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Deployment Type

8.2.4.1 On-premises and Cloud-based

8.2.5 Historic and Forecasted Market Size By Organization Size

8.2.5.1 Small and Medium Enterprises (SMEs) and Large Enterprises

8.2.6 Historic and Forecasted Market Size By Application Type

8.2.6.1 IT and Software Development

8.2.6.2 Construction and Engineering

8.2.6.3 Healthcare

8.2.6.4 Education

8.2.6.5 Manufacturing and Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Agile Project Management Software Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Deployment Type

8.3.4.1 On-premises and Cloud-based

8.3.5 Historic and Forecasted Market Size By Organization Size

8.3.5.1 Small and Medium Enterprises (SMEs) and Large Enterprises

8.3.6 Historic and Forecasted Market Size By Application Type

8.3.6.1 IT and Software Development

8.3.6.2 Construction and Engineering

8.3.6.3 Healthcare

8.3.6.4 Education

8.3.6.5 Manufacturing and Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Agile Project Management Software Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Deployment Type

8.4.4.1 On-premises and Cloud-based

8.4.5 Historic and Forecasted Market Size By Organization Size

8.4.5.1 Small and Medium Enterprises (SMEs) and Large Enterprises

8.4.6 Historic and Forecasted Market Size By Application Type

8.4.6.1 IT and Software Development

8.4.6.2 Construction and Engineering

8.4.6.3 Healthcare

8.4.6.4 Education

8.4.6.5 Manufacturing and Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Agile Project Management Software Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Deployment Type

8.5.4.1 On-premises and Cloud-based

8.5.5 Historic and Forecasted Market Size By Organization Size

8.5.5.1 Small and Medium Enterprises (SMEs) and Large Enterprises

8.5.6 Historic and Forecasted Market Size By Application Type

8.5.6.1 IT and Software Development

8.5.6.2 Construction and Engineering

8.5.6.3 Healthcare

8.5.6.4 Education

8.5.6.5 Manufacturing and Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Agile Project Management Software Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Deployment Type

8.6.4.1 On-premises and Cloud-based

8.6.5 Historic and Forecasted Market Size By Organization Size

8.6.5.1 Small and Medium Enterprises (SMEs) and Large Enterprises

8.6.6 Historic and Forecasted Market Size By Application Type

8.6.6.1 IT and Software Development

8.6.6.2 Construction and Engineering

8.6.6.3 Healthcare

8.6.6.4 Education

8.6.6.5 Manufacturing and Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Agile Project Management Software Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Deployment Type

8.7.4.1 On-premises and Cloud-based

8.7.5 Historic and Forecasted Market Size By Organization Size

8.7.5.1 Small and Medium Enterprises (SMEs) and Large Enterprises

8.7.6 Historic and Forecasted Market Size By Application Type

8.7.6.1 IT and Software Development

8.7.6.2 Construction and Engineering

8.7.6.3 Healthcare

8.7.6.4 Education

8.7.6.5 Manufacturing and Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Agile Project Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.94 Billion |

|

Forecast Period 2024-32 CAGR: |

13.00% |

Market Size in 2032: |

USD 11.84 Billion |

|

Segments Covered: |

By Deployment Type |

|

|

|

By Organization Size |

|

||

|

By Application Type |

|

||

|

By Features |

|

||

|

By Pricing Model |

|

||

|

By Mobile Platform |

|

||

|

By Integration Capability |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||