3D Surgical Microscope Systems Market Synopsis

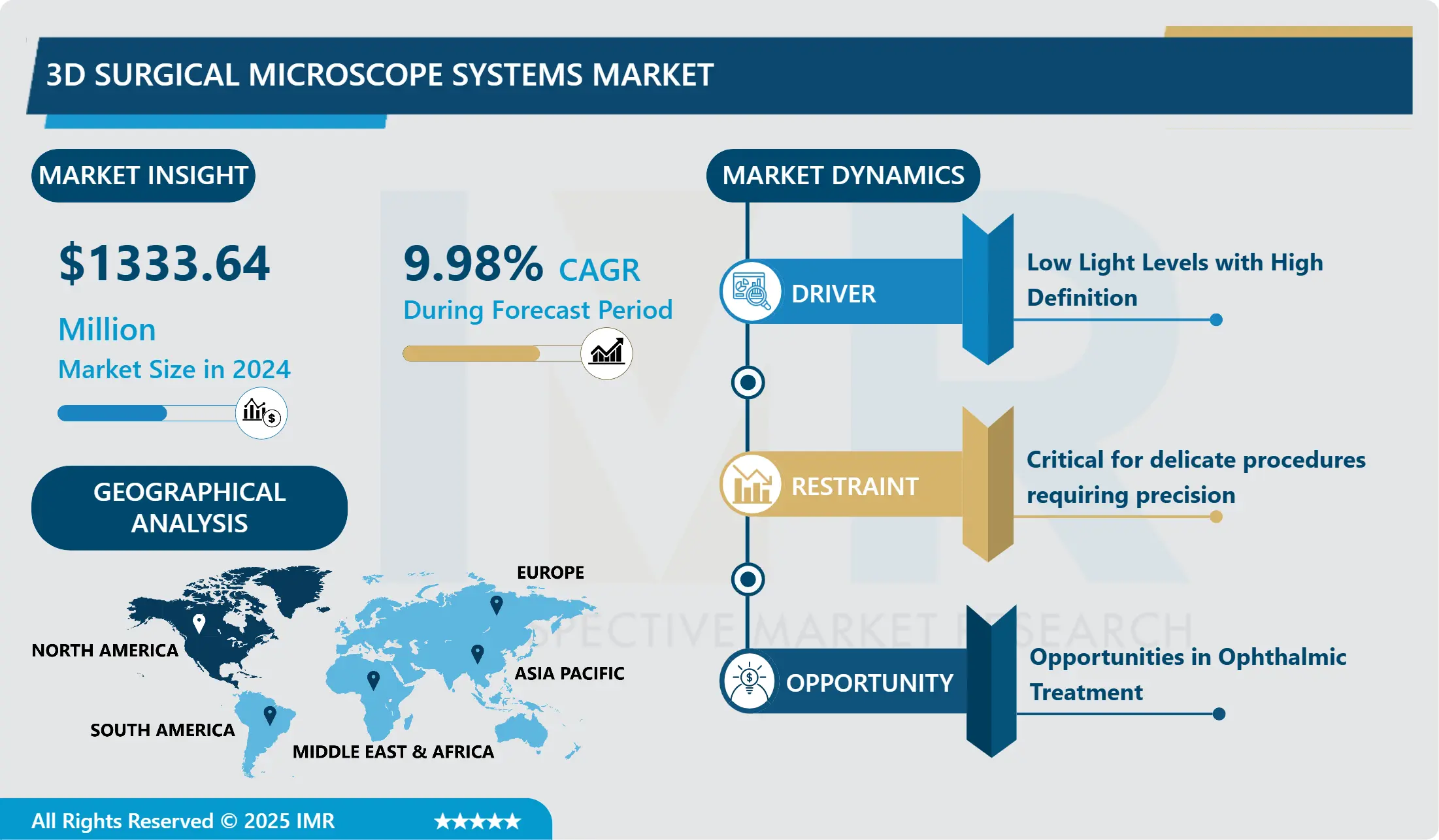

3D Surgical Microscope Systems Market Size was valued at USD 1333.64 Million in 2024 and is projected to reach USD 2854.62 Million by 2032, Growing at a CAGR of 9.98% From 2025-2032.

The component of the 3D Surgical System is a camera unit that is referred to be placed on traditional surgical microscopes. It provides real-time visualization by sending stereoscopic pictures and movies to a sizable high-definition (HD) monitor that is placed close to the surgeon.

The advantage of the 3D Surgical System is its extended color spectrum, which allows for precise identification of lesions, blood vessels, and tissue borders. Different observation and filter modes, such as infrared, narrow-band imaging, and blue light, make this easier.

The addition of 3D microscopy equipment is transforming operational efficiency and visualization, meeting the need for error-free surgeries in the face of a scarcity of medical professionals. In addition, despite manpower shortages, these developments have the potential to improve patient outcomes and expedite surgical procedures.

The incorporation of 3D microscopy equipment is revolutionizing the efficiency and accuracy of surgery. Surgeons can perform complex procedures with previously unheard-of accuracy thanks to high-resolution 4K 3D digital pictures. Surgical teams may work together even more effectively with a huge 55-inch 4K 3D monitor, which also reduces tiredness and improves decision-making.

3D Surgical Microscope Systems Market Trend Analysis

Low Light Levels with High Definition

- The 3D surgical microscope systems market is being driven forward by the integration of high-quality imaging capabilities with low light levels. By integrating a high dynamic range camera with typical analog operating microscopes, physicians gain access to unmatched visualization during surgical procedures.

- This technology ensures optimal visibility within the surgical field by enabling detailed imaging even in low light, an essential aspect for treatments requiring precision.

- The demand for 3D surgical microscope systems is expected to rise significantly as more surgeons from a variety of specialties realize the transformative potential of these cutting-edge technologies.

- Surgeons can tailor their visual experience with digital filters, highlighting specific ocular structures and tissue layers while minimizing light exposure to ensure patient safety—a feature particularly valuable in delicate procedures like cataract surgery.

Opportunities in Ophthalmic Treatment

- The development of 3D surgical microscope systems is a major advancement in the field of ocular surgery. By improving depth perception and spatial awareness, these technologies give surgeons previously unheard-of accuracy and precision when executing complex surgeries.

- In addition to enhancing surgical results, 3D systems' ergonomic designs lessen surgeon fatigue and promote sustained concentration throughout extended procedures.

- The future of ophthalmic surgery will be shaped by the incorporation of 3D surgical microscope systems, as their advantages become increasingly widely recognized.

- New opportunities for innovation and improvement open up as surgeons’ experiment with and adjust to these cutting-edge instruments, spurring ongoing improvements in methods and technology. The ophthalmology community improves patient care and advances surgical practice toward ever-higher efficiency and precision by adopting this state-of-the-art methodology.

3D Surgical Microscope Systems Market Segment Analysis:

3D surgical microscope systems market is segmented based on Type, Application, End-users, and Region.

By Type, ENT Microscopes segment is expected to dominate the market during the forecast period

- ENT specialists rely on ENT microscopes for visualizing the surgical site, crucial for various otolaryngology procedures like neurinoma surgery, otosclerosis surgery, schwannoma surgery, cholesteatoma surgery, cochlear implant surgery, stapedectomy, tympanoplasty, myringoplasty, and myringoplasty.

- Optimal optical quality, adaptability, and intuitive operation are key features when selecting an ENT microscope. Microscopes with small optics carriers enable proximity to the patient, enhancing hand-eye coordination and ergonomic positioning for both the ENT specialist and the side assistant.

- This ergonomic advantage not only improves comfort but also enhances procedural efficiency. ENT microscopes are the most significant surgical microscope systems since they are essential for sophisticated ENT surgeries because they provide deep and precise imaging.

By Application, Neuro & Spine Surgery segment held the largest share in 2024

- The details and complexity of the operations involved, neurosurgery, and spine surgery are the main fields in the field of 3D surgical microscope systems. For these surgical specialists to execute intricate procedures and navigate delicate tissues, they require unparalleled vision and precision.

- Brain aneurysm repair, tumor resections, AVM treatment, cerebral artery bypass surgery, and epilepsy surgery are just a few of the many treatments that fall within the broad category of neurosurgery.

- The use of 3D surgical microscope systems with cutting-edge features like robotic control and image-guided surgery (IGS) is essential for improving surgical accuracy and decision-making.

3D Surgical Microscope Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- Healthcare organizations that perform daily surgeries, the United States dominates the majority of North America in the adoption and use of 3D surgical microscope systems. This allows for the widespread integration of cutting-edge surgical technologies.

- Hospitals place a high priority on effectiveness, accuracy, and patient outcomes, which makes 3D visualization and laparoscopic surgery essential instruments in contemporary surgical operations.

- Hospital investments in cutting-edge technology, such as 3D surgical microscope systems, further cement the nation's leadership in this crucial area of surgical innovation as they work to improve surgical results and patient care.

- Alabama led the state with 386 Medicare-certified ambulatory surgery centers (ASCs) in 2022, followed by Alaska with 18, Arizona with 211, and Georgia with 18. With an astounding 845 ASCs, California stood out in the meanwhile. Not to mention the additional count of ASCs per state, Florida topped the list with 463, while Colorado had 136 ASCs. This extensive network of ASCs in several states suggests a strong healthcare system, which could fuel demand for cutting-edge medical devices like 3D surgical microscope systems. Given the size of ASCs, especially in highly populated areas like Florida and California, there is probably a large market for 3D surgical microscope systems because of the strong demand for state-of-the-art medical technologies.

Active Key Players in the 3D Surgical Microscope Systems Market

- TrueVision 3D Surgical Inc. (USA)

- Avante Health Solutions (USA)

- Seiler Instrument Inc. (USA)

- Endure Medical Inc. (USA)

- NovaProbe (USA)

- Synaptive Medical (Canada)

- Leica Microsystems (Germany)

- Carl Zeiss Ag (Germany)

- Möller-Wedel (Germany)

- Haag-Streit Surgical (Germany)

- Leininger (Germany)

- Karl Kaps (Germany)

- Optomic (Spain)

- Optofine Instruments Pvt Ltd (India)

- Inami & Ltd (Japan)

- Olympus Corporation (Japan)

- Takagi Seiko Ltd (Japan)

- Topcon Corp (Japan)

- Nidek Co Ltd (Japan)

- Huvitz (South Korea)

- Medstar (South Korea)

- Chammed Ltd (South Korea)

- Alcon (Switzerland)

- Optopol Technology (Poland)

- Other Active Players

Key Industry Developments in the 3D Surgical Microscope Systems Market:

- In March 2024, the acquisition of the advanced surgical microscope by Hanoi French Hospital brought numerous benefits to patients, including a wider range of surgical capabilities, shorter surgery times, reduced risks of infections and complications, and faster recovery. The KINEVO 900 system provided 4x to over 20x times greater magnification with excellent visibility and images, and delivered more functionality than any other surgical microscope at the time, helping surgeons achieve the most optimal results.

- In March 2024, Zeiss showcased new surgical and visualization technologies, extending its workflow offerings. The ARTEVO 850 3D heads-up ophthalmic microscope, used in both anterior and posterior surgical cases, featured true color imaging thanks to the HDR monitor and two 4K 3-chip cameras, enabling a high-resolution display of the surgical field. Leveraging the expanded depth of field available with the new Smart DoF (Depth of Field) setting, surgeons could increase the depth of field by nearly 60 percent.

|

Global 3D Surgical Microscope Systems Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1333.64 Mn. |

|

Forecast Period 2025-32 CAGR: |

9.98% |

Market Size in 2032: |

USD 2854.62 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: 3D Surgical Microscope Systems Market by Type (2018-2032)

4.1 3D Surgical Microscope Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 ENT

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Ophthalmic

4.5 Colposcopy

4.6 Dental

4.7 Orthopaedic

Chapter 5: 3D Surgical Microscope Systems Market by Application (2018-2032)

5.1 3D Surgical Microscope Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Neuro & Spine Surgery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plastic & Reconstructive Surgery

5.5 Oncology

5.6 Ophthalmology

5.7 Dental Surgeries

5.8 Orthopaedic Surgeries

Chapter 6: 3D Surgical Microscope Systems Market by End-User (2018-2032)

6.1 3D Surgical Microscope Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Diagnostic Laboratories

6.5 Research Organizations

6.6 Outpatient Surgical Centers

6.7 Ambulatory Surgical Centers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 3D Surgical Microscope Systems Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BEMIS COMPANY INC. (U.S.)

7.4 SHOTT AG (GERMANY)

7.5 WEST PHARMACEUTICAL SERVICES INC. (U.S.)

7.6 DUPONT (U.S.)

7.7 GERRESHEIMER AG (GERMANY)

7.8 COOPERSURGICAL INC. (U.S.)

7.9 TEKNI-PLEX (U.S.)

7.10 PLACON (U.S.)

7.11 SONOCO PRODUCTS COMPANY (U.S.)

7.12 JANCO INC. (U.S.)

7.13 TELEFLEX INCORPORATED (U.S.)

7.14 MEDTRONIC (U.S.)

7.15 COLOPLAST (DENMARK)

7.16 RIVERSIDE MEDICAL PACKAGING COMPANY LTD (U.K.)

7.17 SHANGHAI MEDICAL INSTRUMENTS (GROUP) LTDCORP. (CHINA)

7.18 STERIPACK CONTRACT MANUFACTURING (IRELAND)

7.19 AMCOR PLC (SWITZERLAND)

7.20

Chapter 8: Global 3D Surgical Microscope Systems Market By Region

8.1 Overview

8.2. North America 3D Surgical Microscope Systems Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 ENT

8.2.4.2 Ophthalmic

8.2.4.3 Colposcopy

8.2.4.4 Dental

8.2.4.5 Orthopaedic

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Neuro & Spine Surgery

8.2.5.2 Plastic & Reconstructive Surgery

8.2.5.3 Oncology

8.2.5.4 Ophthalmology

8.2.5.5 Dental Surgeries

8.2.5.6 Orthopaedic Surgeries

8.2.6 Historic and Forecasted Market Size by End-User

8.2.6.1 Hospitals

8.2.6.2 Diagnostic Laboratories

8.2.6.3 Research Organizations

8.2.6.4 Outpatient Surgical Centers

8.2.6.5 Ambulatory Surgical Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe 3D Surgical Microscope Systems Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 ENT

8.3.4.2 Ophthalmic

8.3.4.3 Colposcopy

8.3.4.4 Dental

8.3.4.5 Orthopaedic

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Neuro & Spine Surgery

8.3.5.2 Plastic & Reconstructive Surgery

8.3.5.3 Oncology

8.3.5.4 Ophthalmology

8.3.5.5 Dental Surgeries

8.3.5.6 Orthopaedic Surgeries

8.3.6 Historic and Forecasted Market Size by End-User

8.3.6.1 Hospitals

8.3.6.2 Diagnostic Laboratories

8.3.6.3 Research Organizations

8.3.6.4 Outpatient Surgical Centers

8.3.6.5 Ambulatory Surgical Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe 3D Surgical Microscope Systems Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 ENT

8.4.4.2 Ophthalmic

8.4.4.3 Colposcopy

8.4.4.4 Dental

8.4.4.5 Orthopaedic

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Neuro & Spine Surgery

8.4.5.2 Plastic & Reconstructive Surgery

8.4.5.3 Oncology

8.4.5.4 Ophthalmology

8.4.5.5 Dental Surgeries

8.4.5.6 Orthopaedic Surgeries

8.4.6 Historic and Forecasted Market Size by End-User

8.4.6.1 Hospitals

8.4.6.2 Diagnostic Laboratories

8.4.6.3 Research Organizations

8.4.6.4 Outpatient Surgical Centers

8.4.6.5 Ambulatory Surgical Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific 3D Surgical Microscope Systems Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 ENT

8.5.4.2 Ophthalmic

8.5.4.3 Colposcopy

8.5.4.4 Dental

8.5.4.5 Orthopaedic

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Neuro & Spine Surgery

8.5.5.2 Plastic & Reconstructive Surgery

8.5.5.3 Oncology

8.5.5.4 Ophthalmology

8.5.5.5 Dental Surgeries

8.5.5.6 Orthopaedic Surgeries

8.5.6 Historic and Forecasted Market Size by End-User

8.5.6.1 Hospitals

8.5.6.2 Diagnostic Laboratories

8.5.6.3 Research Organizations

8.5.6.4 Outpatient Surgical Centers

8.5.6.5 Ambulatory Surgical Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa 3D Surgical Microscope Systems Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 ENT

8.6.4.2 Ophthalmic

8.6.4.3 Colposcopy

8.6.4.4 Dental

8.6.4.5 Orthopaedic

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Neuro & Spine Surgery

8.6.5.2 Plastic & Reconstructive Surgery

8.6.5.3 Oncology

8.6.5.4 Ophthalmology

8.6.5.5 Dental Surgeries

8.6.5.6 Orthopaedic Surgeries

8.6.6 Historic and Forecasted Market Size by End-User

8.6.6.1 Hospitals

8.6.6.2 Diagnostic Laboratories

8.6.6.3 Research Organizations

8.6.6.4 Outpatient Surgical Centers

8.6.6.5 Ambulatory Surgical Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America 3D Surgical Microscope Systems Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 ENT

8.7.4.2 Ophthalmic

8.7.4.3 Colposcopy

8.7.4.4 Dental

8.7.4.5 Orthopaedic

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Neuro & Spine Surgery

8.7.5.2 Plastic & Reconstructive Surgery

8.7.5.3 Oncology

8.7.5.4 Ophthalmology

8.7.5.5 Dental Surgeries

8.7.5.6 Orthopaedic Surgeries

8.7.6 Historic and Forecasted Market Size by End-User

8.7.6.1 Hospitals

8.7.6.2 Diagnostic Laboratories

8.7.6.3 Research Organizations

8.7.6.4 Outpatient Surgical Centers

8.7.6.5 Ambulatory Surgical Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global 3D Surgical Microscope Systems Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1333.64 Mn. |

|

Forecast Period 2025-32 CAGR: |

9.98% |

Market Size in 2032: |

USD 2854.62 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||