Yeast Extract Market Synopsis

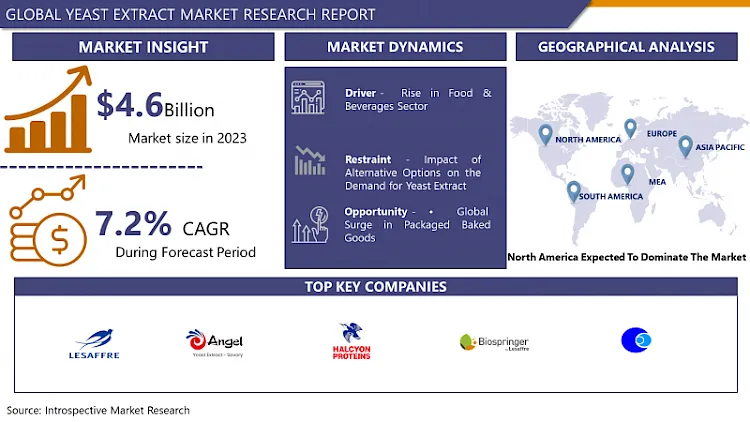

Yeast Extract Market Size Was Valued at USD 4.93 Billion in 2024, and is Projected to Reach USD 8.6 Billion by 2032, Growing at a CAGR of 7.2% From 2025-2032.

Yeast extract is a clean-label constituent that is used in different products such as sauces, soups, ready meals, and savory snacks. The product in question is obtained from fresh yeast, which is used in making bread and beers as well as in the preparation of wines. The substance is characterized by its distinctive tasty flavor and acts as a taste enhancer in the preparation of a variety of foods as a seasoning agent.

The foremost use of yeast extract is in the production of food and beverage products as a flavor enhancer and also in restaurants. Its use is to enhance the flavor of a range of foods and beverages as well as add flavor to sauces, soups, snacks, seasonings, meat products, prepared meals, and other food products. The food services sector is going through a strong growth phase and the top food processing firms are increasingly expressing their intentions to expand in the developing countries such as China & India. This is indicative of a rather robust growth chance for the market.

Consumer diets are shifting to products that can be consumed quickly due to the busy nature of their routines or increased earning capabilities due to economic growth. The market is experiencing increased consumption of packaged foods since it simplifies their usage as a consumers’ commodity. Yeast extract is widely used in the manufacture of frozen foods, snack goods, sauces, and soups to enhance the palatability of these products due to its rich, savory taste. The increasing demand for yeast extract in the global markets can be attributed to the growing consumption of processed foods during the forecast period.

The application of yeast extracts as products of baker’s yeast is further expected to grow at a compound annual growth rate of more than XX% for the timeframe till 2030. It is an important food that contains various nutrients such as amino acids, trace elements, peptides, nucleotides, and vitamins. These nutrients are essential in maintaining the metabolic activities of the bacteria and encouraging their growth. With improving economy and rising disposable income bread consumption has gone up especially in China and India enhancing the probable demand for bakery products. The industry growth will be boosted by the increased trend in the FDA regulation relating to the use of baker’s yeast extract in food products.

The major inputs used for the production of yeast extract include baker’s yeast especially saccharomyces cerevisiae, sugar molasse and nitrogen. The growth of the yeast extract market can also be under threat because of the fluctuations in the prices of such materials. Due to high costs for instance in holding buffers of molasses for biofuel production, there has been a consecutively declining supply of yeast extract to manufactures. This has in turn led to increased competition in the industry as players seek to achieve competitive advantages. In addition, competition from easily available and comparatively cheaper substitutes, use of ingredients such as MSG, HVPs, HAPs and nucleotides in foods also paradoxically put a limit on the consumption of yeast extracts on a global level.

.webp)

Yeast Extract Market Trend Analysis

Rising Trend in Veganism Adoption Drive the Market

- This dietary preference for veganism is expected to extend further and strengthen the use of Nutritional Yeast Extract as a well-entrenched pattern. Nutritional yeast has become widely known for its unique, nutty cheesy-like taste, and is perfect for those on a gluten free and vegan diet.

- There are global tendencies towards an increase in the consumption of food products without added or high amounts of salt, organic foods, vegan, and plant-based protein products. Recent observations reveal that inactive dried nutritional yeast is widely used in the domain of animal feed. By virtue of the aforementioned factors, the demand for nutritional yeast rises at a very high rate. Yeast refers to fungi that are made up of single cells; these microscopic organisms are found within plants and soil. For instance, yeast does not contain a cardiovascular or a nervous system, as one would expect in animals.

- In addition, BY avoiding cruel products and opting for yeast products, we eliminate animal suffering and exploitation. This is in parity with the ethical principles and values as embraced among vegans. The products contain a high proportion of mineral trace elements, vitamins, and antioxidant accumulators. It is widely used as an active ingredient in a broad category of food items serving to accelerate the improvement of the texture and taste of these foods in addition to boosting their nutritional value.

Global Widespread Use in Food and Beverage Sector boost the sales

- Yeast extract is considered to be one of the essential ingredients which contribute to leavening of bread in the baking industry. This particular substance is vividly used within the food and beverage industry to enhance the fermentation process of draft beers via adding glucose. These vital nutrients consist of selenium, chromium, protein, potassium, zinc, magnesium, and iron among others. These nutrients are known for their health benefits when taken as a dietary supplement. The product in question has a high application flexibility and should be familiar to many individuals due to its common uses in culinary preparations including bouillons, seasoning sauces, soups, and savory snacking. Moreover, this particular product is very useful when it comes to preparing vegetarian and vegan dishes. The key trend that promotes the yeast extract market development is the increase in the consumption of alcoholic beverages and the efforts of producers to provide consumers with quality products containing natural components for healthy diets.

Yeast Extract Market Segment Analysis:

Yeast Extract Market Segmented based on Type, Application, and Region

By type, autolyzed segment is expected to dominate the market during the forecast period

- The autolyzed technology segment exhibited a high market penetration in 2020, accounting for a large share of 63%. 99%. Moving further, the segment in question is expected to witness high dominance within the study period of 2022-2029. This can be considered as due to the fact that the product proved to be very popular in terms of taste and this makes it suitable for a great number of foods such as soups, dressings and bakery products. The tested product has a satisfactory level of vitamin B as well as micronutrients. The primary driving force for the clean label products growth is the consumer preference for products which contain natural food ingredients to enhance their quality.

- There are two commonly employed methodologies for the production of yeast extract: There are two hydrolysis types: autolysis and hydrolysis.

- Self-degradation is a naturally occurring phenomenon that occurs post cell death. The action described here is related to the process of controlled self-destruction in a yeast cell that takes place due to the action of endo-exonucleases – the enzymes created by the cell to digest it. The autolysis process has limitations as follows; difficulties in separating the clarified liquid from the insoluble solids, and also low extraction efficiency. These disadvantages are attributed mainly due to the fact that time taken in incubations may lead to contamination by microbes.

By application, food and beverage segment held the largest share in 2024

- Yeast extracts have seen widespread acceptance in the F&B processing industry and are used across every food sector including dairy alternatives, bakery, energy drinks, and confectionery industries. Yeast extracts are also used more in recent days due to the many health benefits that are associated with the use of yeast extracts. They work as an efficient method of producing specific and unique tastes by intensifying one or more ingredients, and eradicating the need for other components for good, when these relate to healthier eating or clean label. Yeast extracts have found to be very effective in a variety of processed meat and poultry products, convenience foods such as canned and frozen products, and other food and beverage products both in savory and sweet categories. Also, yeasts are additive, which is considered most appropriate for applying to vegan and vegetarian foods due to the exclusion of artificial, animal, and synthetic components.

Yeast Extract Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Burgeoning demand for clean label ingredients and additives is fuelling growth in North American region, which is considered as one of the most important region in the global market. Moreover, it is believed that the regional market will expand due to the rising interest in convenience products like ready to eat food items. This need can therefore be associated with changes which have occurred in consumer diets. It is used as a natural additive, mainly as a salt replacer and a food conditioner that is used in baked goods, canned and frozen soups and sauces, meat products, fish, and seasoned mixes.

- This growth can be attributed to the use of flavor enhancers with good and clean tastes and smells. The consumer demographics of the region are showing a rising trend of health and environment consciousness amongst consumers. This is well illustrated through the increase in the awareness of factors such as traceability, naturality, sustainability, and the effects of food choices on nutrition.

Active Key Players in the Yeast Extract Market

- Lesaffre (France)

- AngelYeast Co., Ltd (China)

- Halcyon Proteins, (Australia)

- Biospringer. (France)

- Thai Foods International (Thailand)

- Alltech (U.S.)

- Synergy Flavors (U.S.)

- Lallemand, Inc. (Canada)

- Ohly (Germany)

- Leiber GmBH (Germany)

- Other Active Players

Key Industry Developments in the Yeast Extract Market:

- In June 2024, Lesaffre, a global fermentation and microorganisms’ expert, announced the acquisition of DSM-firmenich’s yeast extract business. This strategic move enhances Lesaffre’s capabilities in savory ingredients, expanding its product range and R&D expertise. The collaboration includes acquiring DSM-firmenich’s know-how and technology and strengthening Biospringer through Lesaffre’s market presence and customer offerings.

- In December 2023, Lallemand’s Bio-Ingredients and Specialty Cultures have launched Natural Rosé, a yeast extract-based product designed to reduce color formulation in processed meat products. This innovative solution offers a natural alternative for meat processors, enhancing the appeal of their products while maintaining quality and color consistency.

|

Global Yeast Extract Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 4.93 Bn. |

|

Forecast Period 2025-32 CAGR: |

7.2 % |

Market Size in 2032: |

USD 8.6 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Yeast Extract Market by Type (2018-2032)

4.1 Yeast Extract Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Autolyzed

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hydrolyzed

Chapter 5: Yeast Extract Market by Application (2018-2032)

5.1 Yeast Extract Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food and Beverages

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Animal Feed

5.5 Pharmaceuticals

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Yeast Extract Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 SACMA GROUP (ITALY)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 HATEBUR UMFORMMASCHINEN AG (SWITZERLAND)

6.4 NATIONAL MACHINERY LLC (UNITED STATES)

6.5 CHUN ZU MACHINERY INDUSTRY COLTD. (TAIWAN)

6.6 SAKAMURA MACHINE COLTD. (JAPAN)

6.7 NEDSCHROEF MACHINERY (NETHERLANDS)

6.8 WRENTHAM TOOL GROUP (UNITED STATES)

6.9 TANISAKA IRON WORKS COLTD. (JAPAN)

6.10 CARLO SALVI S.P.A. (ITALY)

6.11 NAKASHIMADA ENGINEERING WORKS LTD. (JAPAN)

6.12 HARITON MACHINERY COLTD. (TAIWAN)

6.13 CHUN YU WORKS & COLTD. (TAIWAN)

6.14 COLD HEADING COMPANY (UNITED STATES)

6.15 REED MACHINERY INC. (UNITED STATES)

6.16 HAPPE & KRANZLER GMBH (GERMANY)

6.17 NATIONAL MACHINERY CHINA (CHINA)

6.18 HYODONG MACHINE COLTD. (SOUTH KOREA)

6.19 WAFIOS AG (GERMANY)

6.20 HEI YAN GROUP (CHINA)

6.21 CHUN CHAN TECH COLTD. (TAIWAN)

6.22 HENGHUI PRECISION MACHINERY COLTD. (CHINA)

6.23 NAKASHIMADA ENGINEERING WORKS OF AMERICA INC. (UNITED STATES)

6.24 ASAHI SUNAC CORPORATION (JAPAN)

6.25 HATEBUR BCK USA INC. (UNITED STATES)

6.26 SHANDONG WANTONG HYDRAULIC COLTD. (CHINA)

Chapter 7: Global Yeast Extract Market By Region

7.1 Overview

7.2. North America Yeast Extract Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Autolyzed

7.2.4.2 Hydrolyzed

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Food and Beverages

7.2.5.2 Animal Feed

7.2.5.3 Pharmaceuticals

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Yeast Extract Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Autolyzed

7.3.4.2 Hydrolyzed

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Food and Beverages

7.3.5.2 Animal Feed

7.3.5.3 Pharmaceuticals

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Yeast Extract Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Autolyzed

7.4.4.2 Hydrolyzed

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Food and Beverages

7.4.5.2 Animal Feed

7.4.5.3 Pharmaceuticals

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Yeast Extract Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Autolyzed

7.5.4.2 Hydrolyzed

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Food and Beverages

7.5.5.2 Animal Feed

7.5.5.3 Pharmaceuticals

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Yeast Extract Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Autolyzed

7.6.4.2 Hydrolyzed

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Food and Beverages

7.6.5.2 Animal Feed

7.6.5.3 Pharmaceuticals

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Yeast Extract Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Autolyzed

7.7.4.2 Hydrolyzed

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Food and Beverages

7.7.5.2 Animal Feed

7.7.5.3 Pharmaceuticals

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Yeast Extract Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 4.93 Bn. |

|

Forecast Period 2025-32 CAGR: |

7.2 % |

Market Size in 2032: |

USD 8.6 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||