Web 3.0 Blockchain Market Overview

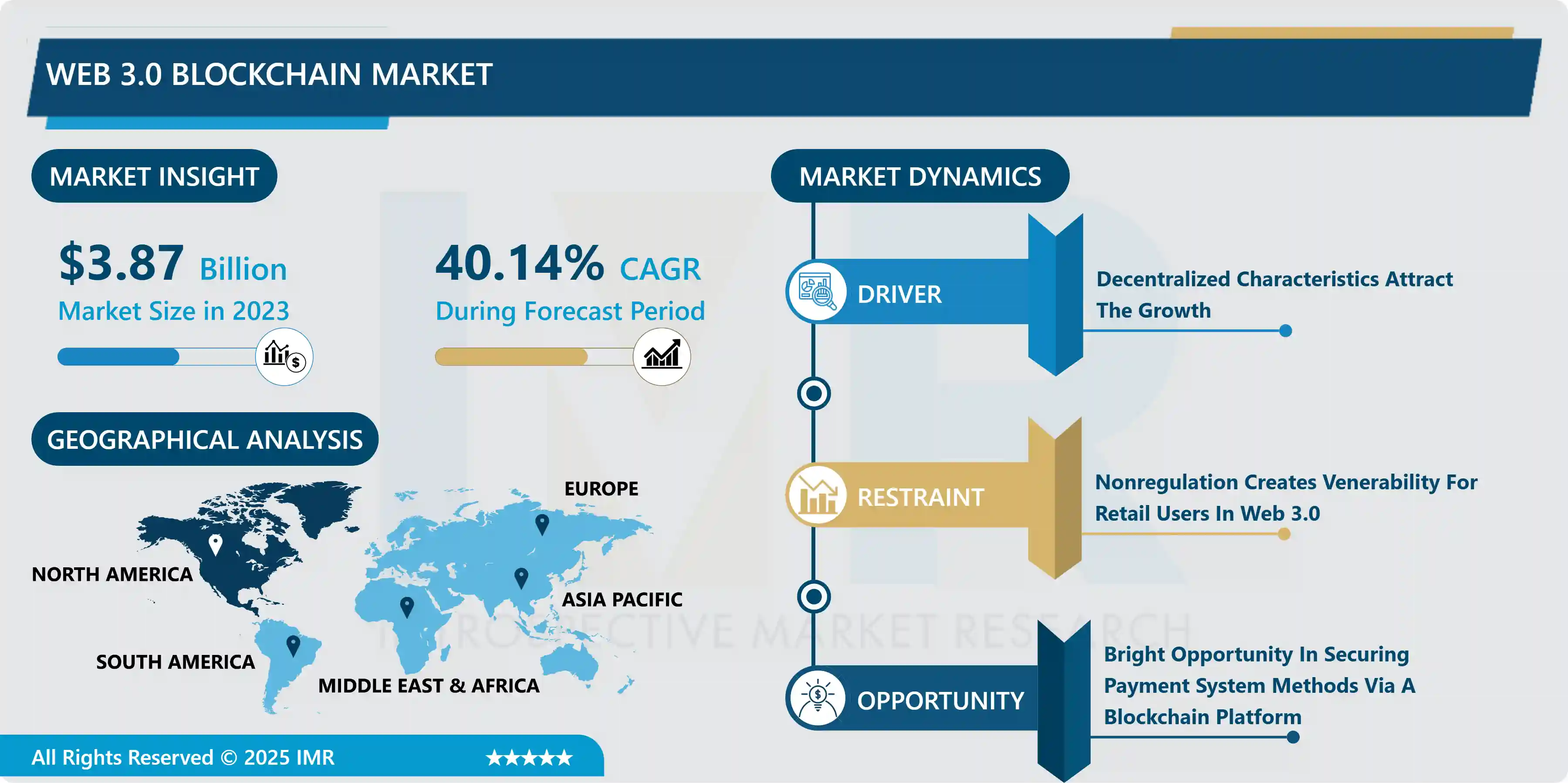

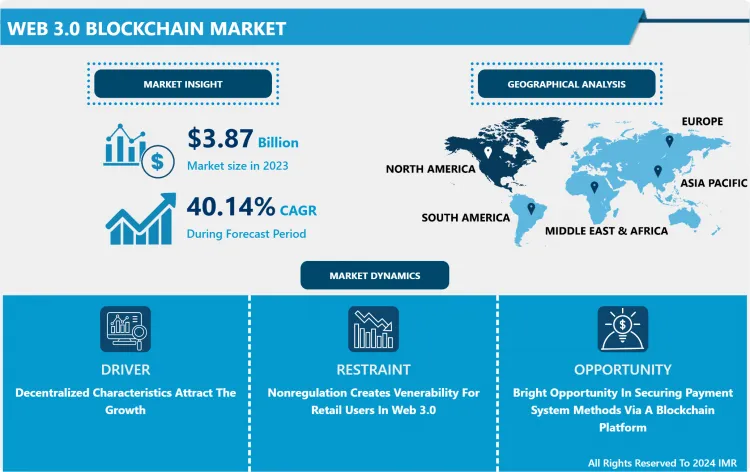

The Web 3.0 blockchain Market size was valued at USD 3.87 Billion in 2023 and is projected to reach USD 80.68 Billion by 2032, registering a CAGR of 40.14 % from 2023 to 2032.

Web 3.0 is the next iteration or phase of the web's/evolution. Because decentralization is the most prominent feature of blockchain, it gives it an ideal foundation for web 3.0 development. The three main pillars of web 3.0 blockchain technology are artificial intelligence (AI), machine learning (ML), and blockchain technology. The web 3.0 blockchain allows users to save data in decentralized storage and is focused on personal data privacy and security. Web 3.0 has revolutionized the way humans and machines communicate, allowing for data transfer, cryptocurrency payments, and quick ownership transfer. Users can pick which data to share using Web 3.0 blockchain technology. Personal data is controlled by the user rather than a third-party supplier with web 3.0 blockchain technology. This has aided in the transfer of personal data ownership from third-party providers to users. The concept of data ownership is gaining traction, and consumers are turning to web 3.0 blockchains to protect their data and reduce third-party vendor security and privacy concerns. Hence, the Web 3.0 Blockchain Market is anticipated to grow during the forecasted period.

Market Dynamics And Factors For Web 3.0 Blockchain Market

Drivers:

Decentralized Characteristics Attract The Growth

- The decentralized character of the web 3.0 blockchain is evident. As a result, all transactions are tracked and extremely transparent. Blockchain employs the information traceability technique, which ensures that data is not tampered with or altered. Web 3.0 blockchain technology improves the payment system's transparency, as each transaction is recorded and irreversible, which is advantageous to users during the audit. Web 3.0 blockchain technology's ability to record transactions is becoming increasingly significant in internet surveillance and regulation. People can also track government-related transactions that use their information. Because these tactics are so clear, they've gained popularity in recent years across a wide range of businesses. This technology has increased accountability and is assisting in the development of a transparent and accountable digital economy. In the anticipated timeframe, increased openness of the web 3.0 blockchain will play a significant role in boosting demand for web 3.0 blockchain technology.

Restraints:

Nonregulation Creates Venerability For Retail Users In Web 3.0

- Decentralization is a key component of Online 3.0, which means the web application is kept in a blockchain. All blockchain participants are the owners, and they decide on product changes through consensus. The essential issue is that the data is not under the control of a single authority. There are no laws or regulations that govern what type of show or content can be broadcast. Controlling it and determining who is responsible for harassment and scam stuff will be a major challenge. Because the regulation is disconnected from technology, more scammers will find new methods to exploit the system.

Opportunities:

Bright Opportunity In Securing Payment System Methods Via A Blockchain Platform

- Blockchain in Web 3.0 is a rapidly evolving technology. It offers significant advantages to the end-user, such as lower operational costs, increased speed, reduced cyber-attack risks, and individual data management. Blockchain and IoT integration, as well as the use of blockchain technology in logistics and operations, have all witnessed significant advancements in recent years. Major research and development are being done to improve the scalability of this technology so that it can be used effectively in businesses including currency exchange, social networking, chat platforms, data storage, and browsing. Web 3.0 technology has aided the emergence of NFT payment systems and digital collectibles in recent years. Other uses involving the technology include spatial web design, 3D graphics, and more. In the anticipated timeframe, the continued rise of web 3.0 will generate enormous growth potential and will touch numerous industrial sectors.

Segmentation Analysis of Web 3.0 Blockchain Market

- By Blockchain Type, the Public blockchain type dominates the Web 3.0 Blockchain Market. Public blockchain focuses to maintain a high degree of security standards since shared networks are frequently targets of online hacking assaults. True decentralization is one of the main attractions for any public blockchain company. The network is not maintained by a single central platform; rather, it is a distributed system in which each user owns a copy of the ledger. The ledger is updated on a consensual basis, and maintenance operations are performed from various nodes. For Instance, Ethereum is a highly used public blockchain network that has global users. Most people are familiar with Ethereum, which is a public blockchain network that handles billions of dollars in transactions. However, many individuals are unaware that the Ethereum codebase is also used by businesses all over the world to create corporate blockchain networks. Many of these private, permissioned Ethereum instances are independent of the main Ethereum network, albeit they can connect to data or value on the main Ethereum network. Hence, the Public blockchain type is expected to grow in the Web 3.0 Blockchain Market.

- By Application, the Cryptocurrency segment is expected to dominate the Web 3.0 Blockchain Market. Cryptocurrency is a Web 3.0 digital payment layer that allows for faster and less expensive transactions. As a result, the increased use of cryptocurrencies around the world is likely to boost industry growth. Coinbase, a cryptocurrency exchange, reported 8.8 million monthly active users in 2021, up from 2.8 million in 2020. Various governments around the world are working to legalize cryptocurrencies to attract new participants and boost their economies. For example, as part of its plan to become a Web 3.0 hub, Dubai announced in March 2022 that it had passed a new cryptocurrency law to oversee the activities of digital assets and cryptocurrencies. The UAE intends to establish a Dubai Virtual Assets Regulatory Authority under the new law, which will be responsible for regulating blockchain-based virtual assets.

- By Vertical, the BFSI segment is expected to be dominating in the Web 3.0 Blockchain Market. FinTech firms will have a natural edge, but banks and other traditional financial institutions will be able to catch up quickly once they have access to large capital and can develop partnerships with innovative FinTech firms. Financial institutions must begin investing in and developing their in-house technology capabilities now. 20 Collaboration and partnership will also be important, and we are already witnessing this. Depending on the sort of financial organization, different approaches to AI are taken. For the most part, AI is employed in FinTech and financial organizations for algorithmic trading, fraud detection, and portfolio optimization. Meanwhile, fraud detection, recommendation systems, and sales and marketing optimization are among the top AI applications for banks. The use of blockchain-based web 3.0 is expected to increase exponentially. For Instance, The Royal Bank of Canada is leveraging millions of data points to train its proprietary AI in a fraction of the time, which has resulted in fewer client calls and faster delivery of new applications for the bank's clients. Meanwhile, BNY Mellon, the world's largest cross-border payments service provider, has improved the accuracy of its AI and machine learning models to predict fraud by 20%. By crunching real-time market data within nanoseconds, AI is being integrated with high-performance computing to provide traders with greater and faster intelligence.

Regional Analysis of Web 3.0 Blockchain Market

- North America dominates the Web 3.0 Blockchain Market. The United States region is favored by tech companies as business-friendly rules and regulations attract the new web 3.0 and crypto-based startups from all over the globe. The Internal Revenue Service (IRS) has established official rules for the taxation of cryptocurrencies in the United States. The Securities and Exchange Commission keeps track of all ICO-related activity. Cryptocurrency gains are taxed in the United States. When it comes to blockchain, the United States is the greatest regional spender. Western Europe will be the technology's second-largest customer ($1.6 billion), followed by China ($777 million). The U.S. Government is actively seeking to utilize the power of the blockchain (or, as it is more formally known, distributed ledger technology or DLT) to enhance government systems across various platforms and agencies. For example, the US Navy's recent Phase II Small Business Innovation Research (SBIR) award to SIMBA Chain demonstrates the government's interest in engaging with both large and small government contractors to tackle its blockchain concerns and the potential use and growth of Web 3.0 blockchain. Similarly, the publicly traded cryptocurrency Constellation ($DAG) was recently awarded a Phase I SBIR project to improve the Air Force's data utilization and administration. Therefore, Web 3.0 Blockchain is expected to be growing substantially during the forecasted period.

- European Region is expected to grow exponentially during the forecasted period. Europe is on the verge of consolidating the legal, regulatory, and policy frameworks governing crypto assets and decentralized web platforms such as web 3.0 throughout European Union member states. The European Commission published a proposal for a "Regulation of the European Parliament and of the Council on Markets in Crypto-Assets," also known as the MiCA proposal, in September 2020. The MiCA proposal is a comprehensive set of measures aimed at further enabling and supporting the potential of digital finance in terms of innovation and competition while mitigating the risks. The Digital Finance package also contains a proposal for a pilot regime on distributed ledger technology (DLT) market infrastructures, a proposal for digital operational resilience, and a proposal to clarify or alter certain associated EU financial services legislation, in addition to the MiCA plan. The European Union's plan places a high priority on ensuring that the EU's financial services regulatory environment is open to innovation and does not obstruct the adoption of new technology. The MiCA proposal, along with the proposal for a DLT pilot program, is the first concrete step in this direction. Such regulatory efforts are certainly beneficial for the growth of the Web 3.0 Blockchain Market.

Players Covered in Web 3.0 Blockchain Market are

- Polkadot (Web3 Foundation)

- Helium Systems Inc.

- Ocean Protocol Foundation Ltd.

- Decentraland

- Flux

- Filecoin

- Kadena

- ZCash and other major players.

Key Industry Developments In Web 3.0 Blockchain Market

- In July 2024, ETC Group, in partnership with HANetf, launched the ETC Group Web 3.0 UCITS ETF, tracking the newly introduced Solactive ETC Group Web 3.0 Index. This index targets companies positioned to thrive in the emerging Web 3.0 landscape, which leverages blockchain technology for enhanced security and privacy. Utilizing Solactive’s ARTIS® algorithm, the index identifies firms across sectors like NFTs, blockchain, and AI, while ensuring compliance with ESG criteria.

|

Web 3.0 Blockchain Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.87 Bn. |

|

Forecast Period 2024-32 CAGR: |

40.14% |

Market Size in 2032: |

USD 80.68 Bn. |

|

Segments Covered: |

By Blockchain Type |

|

|

|

By Application |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Web 3.0 blockchain Market by Blockchain Type (2018-2032)

4.1 Web 3.0 blockchain Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Public

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Private

4.5 Consortium

4.6 Hybrid

Chapter 5: Web 3.0 blockchain Market by Application (2018-2032)

5.1 Web 3.0 blockchain Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cryptocurrency

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Conversational AI

5.5 Data & transaction storage

5.6 Payments

5.7 Smart contracts

Chapter 6: Web 3.0 blockchain Market by Vertical (2018-2032)

6.1 Web 3.0 blockchain Market Snapshot and Growth Engine

6.2 Market Overview

6.3 BFSI

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 E-commerce & Retail

6.5 Media & entertainment

6.6 Healthcare & pharmaceuticals

6.7 IT & telecom

6.8 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Web 3.0 blockchain Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 GENERAL MILLS INC

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MADE IN NATURE

7.4 RHYTHM SUPERFOODS

7.5 HEALTHY CRUNCH

7.6 VERMONT KALE CHIPS

7.7 BRAD'S PLANT BASEDLLCSIMPLY 7 SNACKSLLCTHE ANGEL KALE COMPANY

7.8 LYDIA'S FOODS INC

7.9 THE KALE FACTORY

Chapter 8: Global Web 3.0 blockchain Market By Region

8.1 Overview

8.2. North America Web 3.0 blockchain Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Blockchain Type

8.2.4.1 Public

8.2.4.2 Private

8.2.4.3 Consortium

8.2.4.4 Hybrid

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Cryptocurrency

8.2.5.2 Conversational AI

8.2.5.3 Data & transaction storage

8.2.5.4 Payments

8.2.5.5 Smart contracts

8.2.6 Historic and Forecasted Market Size by Vertical

8.2.6.1 BFSI

8.2.6.2 E-commerce & Retail

8.2.6.3 Media & entertainment

8.2.6.4 Healthcare & pharmaceuticals

8.2.6.5 IT & telecom

8.2.6.6 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Web 3.0 blockchain Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Blockchain Type

8.3.4.1 Public

8.3.4.2 Private

8.3.4.3 Consortium

8.3.4.4 Hybrid

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Cryptocurrency

8.3.5.2 Conversational AI

8.3.5.3 Data & transaction storage

8.3.5.4 Payments

8.3.5.5 Smart contracts

8.3.6 Historic and Forecasted Market Size by Vertical

8.3.6.1 BFSI

8.3.6.2 E-commerce & Retail

8.3.6.3 Media & entertainment

8.3.6.4 Healthcare & pharmaceuticals

8.3.6.5 IT & telecom

8.3.6.6 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Web 3.0 blockchain Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Blockchain Type

8.4.4.1 Public

8.4.4.2 Private

8.4.4.3 Consortium

8.4.4.4 Hybrid

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Cryptocurrency

8.4.5.2 Conversational AI

8.4.5.3 Data & transaction storage

8.4.5.4 Payments

8.4.5.5 Smart contracts

8.4.6 Historic and Forecasted Market Size by Vertical

8.4.6.1 BFSI

8.4.6.2 E-commerce & Retail

8.4.6.3 Media & entertainment

8.4.6.4 Healthcare & pharmaceuticals

8.4.6.5 IT & telecom

8.4.6.6 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Web 3.0 blockchain Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Blockchain Type

8.5.4.1 Public

8.5.4.2 Private

8.5.4.3 Consortium

8.5.4.4 Hybrid

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Cryptocurrency

8.5.5.2 Conversational AI

8.5.5.3 Data & transaction storage

8.5.5.4 Payments

8.5.5.5 Smart contracts

8.5.6 Historic and Forecasted Market Size by Vertical

8.5.6.1 BFSI

8.5.6.2 E-commerce & Retail

8.5.6.3 Media & entertainment

8.5.6.4 Healthcare & pharmaceuticals

8.5.6.5 IT & telecom

8.5.6.6 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Web 3.0 blockchain Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Blockchain Type

8.6.4.1 Public

8.6.4.2 Private

8.6.4.3 Consortium

8.6.4.4 Hybrid

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Cryptocurrency

8.6.5.2 Conversational AI

8.6.5.3 Data & transaction storage

8.6.5.4 Payments

8.6.5.5 Smart contracts

8.6.6 Historic and Forecasted Market Size by Vertical

8.6.6.1 BFSI

8.6.6.2 E-commerce & Retail

8.6.6.3 Media & entertainment

8.6.6.4 Healthcare & pharmaceuticals

8.6.6.5 IT & telecom

8.6.6.6 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Web 3.0 blockchain Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Blockchain Type

8.7.4.1 Public

8.7.4.2 Private

8.7.4.3 Consortium

8.7.4.4 Hybrid

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Cryptocurrency

8.7.5.2 Conversational AI

8.7.5.3 Data & transaction storage

8.7.5.4 Payments

8.7.5.5 Smart contracts

8.7.6 Historic and Forecasted Market Size by Vertical

8.7.6.1 BFSI

8.7.6.2 E-commerce & Retail

8.7.6.3 Media & entertainment

8.7.6.4 Healthcare & pharmaceuticals

8.7.6.5 IT & telecom

8.7.6.6 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Web 3.0 Blockchain Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.87 Bn. |

|

Forecast Period 2024-32 CAGR: |

40.14% |

Market Size in 2032: |

USD 80.68 Bn. |

|

Segments Covered: |

By Blockchain Type |

|

|

|

By Application |

|

||

|

By Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||