Virtual Pipelines Market Synopsis

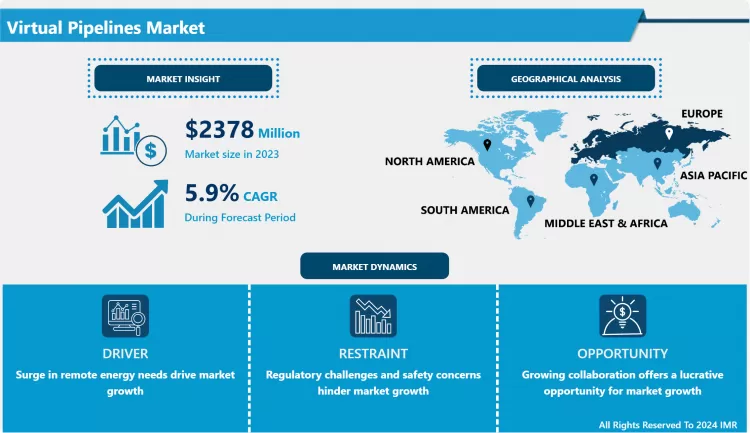

Virtual Pipelines Market Size Was Valued at USD 2,378 Million in 2023, and is Projected to Reach USD 3983.60 Million by 2032, Growing at a CAGR of 5.9% From 2024-2032.

The market is growing due to the escalating demand on natural gas and the expectation for other forms of transportation beyond physical assets. A form of virtual pipelines is an efficient way of transporting natural gas from remote or stranded gas reserves to the end-users without necessitating new pipelines. Those factors that falling in its market are increase in energy consumption, increase in production of shale gas, and increasing development in natural gas industry. This is because a number of regions are adopting advanced energy systems so as to reduce their dependency on traditional sources of energy which are characterized by high emission levels. That is why natural gas is used in significantly higher volumes to replace coal and oil in industries including electric power, transportation and industrial processes. Moreover, with virtual pipelines, it eliminates the need for long construction of pipelines hence being favourable for areas which have limited pipeline infrastructure or where constructing the pipes is not possible.

- Virtual pipelines provide flexibility in gas transportation, allowing suppliers to adjust delivery schedules and quantities based on demand fluctuations. This scalability is particularly advantageous for industries with seasonal or variable gas requirements.

- The virtual pipelines market is experiencing significant expansion globally, with regions such as North America, Europe, Asia Pacific, and Latin America witnessing increased adoption. This expansion is fueled by factors like energy security concerns, infrastructure limitations, and economic development.

- Government regulations and policies play a crucial role in shaping the virtual pipelines market. Regulatory frameworks governing gas transportation, safety standards, and environmental regulations influence the market dynamics and investment decisions of stakeholders.

- In conclusion, the virtual pipelines market presents immense opportunities for companies involved in gas production, transportation, and distribution. With the right technological innovations, regulatory support, and strategic partnerships, the market is poised for continued growth and evolution in the coming years.

Virtual Pipelines Market Trend Analysis

Expansion of Natural Gas Virtual Pipelines

- Virtual pipelines for the natural gas is yet another space that is experiencing a significant expansion as the world shifts towards the use of clean energy resources. When different countries want to cut down their emission levels and get rid of the conventional fossil fuels then the natural gas provide a good platform to get into because of these relatively lower emission levels that are in comparison.

- Virtual pipelines allow an extension of natural gas supplies to regions that cannot sustain pipeline infrastructure due to various factors or are very expensive to undertake. It can also make industries like power generation, manufacturing, and residential heating possible in areas where advanced pipelines have not been feasible before.

- The Global virtual pipelines market is also progressing because organisations are increasingly appreciating the fact that this is a mode of transport that is flexible and can also be closely scaled up. Due to modularity and mobility in their infrastructure, virtual pipelines offer convenience in responding to fluctuations in demand and supply among consumers and the energy providing organization in both the urban and the rural areas.

- Other factors include improved compression and liquefaction techniques and enhanced means of transportation that fuel virtual pipelines business growth. These new technologies increase efficiency, decrease operational costs, raise safety standards and have a combination of both factors making natural gas a more appealing source of energy to consumers all over the globe. Therefore, it could be seen that faces bright future in the subsequent years and the additional diversification in the subsequent years.

Integration of Renewable Gases

- The demand for renewable gases, such as biomethane, hydrogen, and synthetic natural gas (SNG), is on the rise due to the growing emphasis on sustainable energy sources and the consequent rise in environmental concerns. These gases, generated through electrolysis, power-to-gas processes, or organic refuse, provide carbon-neutral or even carbon-negative energy solutions.

- Recent Developments in Gas Conversion Technologies: The conversion of renewable sources into gases that are suitable for energy consumption has become more feasible as a result of technological advancements. This includes efficient biogas purification, hydrogen production via electrolysis, and SNG production via methanation processes.

- Virtual Pipelines are expanding to transport gas via vehicles, ships, or containers rather than traditional pipelines in order to accommodate renewable gases. This enables flexible conveyance and distribution, particularly in regions with fluctuating demand or a lack of pipeline infrastructure.

- The integration of renewable gases into virtual pipelines presents substantial market opportunities and attracts investment from both established energy companies and entrepreneurs. The government's support, through regulations and incentives, further stimulates this market segment.

Virtual Pipelines Market Segment Analysis:

Virtual Pipelines Market Segmented on the basis of By Fuel Type, By Mode of Transport and By End-Use

By Fuel Type, CNG is expected to dominate the market during the forecast period.

- Marketing natural gas in areas without physical pipeline networks has thus been a big challenge and one that has been addressed through the concept of virtual pipeline. It is most apparent in segments where ordinary pipelines are simply at an economic or geographic disadvantage.

- CNG has emerged as the most sought-after segment of the virtual pipeline market with various industries quickly embracing it, especially in the transportation and manufacturing industries. This has pushed CNG into many uses due to its ability to cause lesser pollution than other fuels.

- LNG has also emerged as the rising star in the virtual pipeline market due to key features such as it has relatively higher energy density as well as easy storability and transportability as compared to LPG. This adaptability leads it to be suitable for application industries that demand bulk energy supplies for production including electric power generation and specifically seaborne shipping.

- Recent developments and improvements in compression and liquefaction techniques have ensured steady and enhanced virtual pipeline systems. This combined with changes in design and introduction of safer ways of monitoring and operating the CNG and LNG solutions has made these solutions more viable, thus more attractive.

By Mode of Transport, Truck segment held the largest share in 2023

- The vertical pipeline market segmented by mode of transport namely truck, barge, rail and ship depict the high degree of competition in this market due to the need for an adaptive and efficient mode of transportation of energy. Trucks comprise most of this sector, providing flexibility and access to the well pads, especially in areas that have no pipeline networks.

- BARGE- this is a vessel that operates on waterways to address the issue of transportation at a cheaper price especially over long distances, they are preferred when moving lots of goods. Rail is a strong medium due to its ability to transport large volumes of products and services at short notice and across long distances given the network it has. Criticizing the convenience of using ships, it is impossible to deny the need for them in international operations, and such products as LNG or CNG will always need shipping for transportation.

- All of the modes have their strengths but all are associated with certain problems such as restrictions due to regulation, infrastructural issues and problems related to the environment. However, the demands of efficient storage and transport technology, advance solutions in storage and transportation as well as incorporation of digital tools in the management of logistics are some of the factors that are steadily propelling the market forward. Modern virtual pipelines also have an appropriately modern outlook with biomethane and hydrogen as renewable fuels that offer a glimpse of a sustainable future.

- This transformation is particularly evident as the demand for cleaner sources of energy increases whereby virtual pipelines are seen as an integral factor of energy supply based on flexibility and reliability. This paper aims to provide a comprehensive insight into each transport mode, which is crucial for the identification of key opportunities in this constantly changing market.

Virtual Pipelines Market Regional Insights:

Europe dominated the largest market in 2024

- Europe has turn into the key player at the international level especially in the sphere of virtual pipelines. Business models with high levels of innovation such as virtual pipelines for natural gas transport through digital platforms rather than the actual steel pipelines also expanded at the global level. Historically, Europe dominated this market due to a number of reasons.

- First of all, Europe has become a perfect location for virtual pipeline association due to its good geographical position and great network of connections. The gas transport infrastructure of the region was largely effortless as the regional possessed well-established ports, terminals, and several distribution centres.

- Secondly, emission controls in Europe were making it difficult to use oil products and hence the turn to natural gas as a cleaner source of energy boosting the virtual pipelines sale market. Virtual pipelines also offered a solution that was more sustainable as the countries within the region sought ways in which they could reduce their carbon footprint while delivering natural gas via pipelines.

- Also, the chances, determination and actions of Europe towards energy security also contributed to the virtual pipelines market significantly. The quest for reducing reliance with the conventional energy suppliers and licence agreement for increasing the use of other sources of energy adapted the need for the flexible and multiple purpose gas transportation.

- Finally, technological development and increasing research and development of Europe led this region to aviation on virtual pipeline. Organizations in this region led improvements in the development of superior compression and storage solutions for the VLP model, increasing its effectiveness and dependability. Taken collectively, it establishes Europe as the leading region in the global virtual pipelines market in 2024, thus continuing in its role as the fore-front of novel thinking in energy industry.

Active Key Players in the Virtual Pipelines Market

- GE Oil and Gas (U.S.)

- Kinder Morgan (U.S.)

- SUB161° (Australia)

- Eniday (Italy)

- Galileo Technologies S.A. (Argentina)

- CNG Services Limited (U.K)

- SENER Group (Spain)

- Pentagon Energy LLC (U.S.)

- Xpress Natural Gas LLC (U.S.)

- OsComp Holdings LLC (U.S.)

- NG Advantage LLC (U.S.)

- REV LNG LLC (U.S.)

- Others

Key Industry Developments in the Virtual Pipelines Market:

- August 2022, In another merger news, North American Natural Resources along with North American Biofuels and Central was purchased by Kinder Morgan at a deal of USD $135 million. The agreement involves seven volumetric measures of gas from landfills for use in electricity generation plants. In this transaction, Kinder Morgan also makes the FID to invest US$ 175 Million ($ 4/ 7 Gas-to-power facilities for upgrading to RNG facilities).

|

Global Virtual Pipelines Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2,378 Mn. |

|

Forecast Period 2023-30 CAGR: |

5.9% |

Market Size in 2032: |

USD 3983.60 Mn. |

|

Segments Covered: |

By Fuel Type |

|

|

|

By Mode of Transport |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

REV LNG LLC (U.S.) and Others

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Virtual Pipelines Market by Fuel Type (2018-2032)

4.1 Virtual Pipelines Market Snapshot and Growth Engine

4.2 Market Overview

4.3 CNG

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 LNG

Chapter 5: Virtual Pipelines Market by Mode of Transport (2018-2032)

5.1 Virtual Pipelines Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Truck

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Barge

5.5 Rail

5.6 Ship

Chapter 6: Virtual Pipelines Market by End-Use (2018-2032)

6.1 Virtual Pipelines Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Residential

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Transportation

6.5 Commercial

6.6 Industrial

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Virtual Pipelines Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 GE OIL AND GAS (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 KINDER MORGAN (U.S.)

7.4 SUB161° (AUSTRALIA)

7.5 ENIDAY (ITALY)

7.6 GALILEO TECHNOLOGIES S.A. (ARGENTINA)

7.7 CNG SERVICES LIMITED (U.K)

7.8 SENER GROUP (SPAIN)

7.9 PENTAGON ENERGY LLC (U.S.)

7.10 XPRESS NATURAL GAS LLC (U.S.)

7.11 OSCOMP HOLDINGS LLC (U.S.)

7.12 NG ADVANTAGE LLC (U.S.)

7.13 REV LNG LLC (U.S.)

7.14 OTHERS

Chapter 8: Global Virtual Pipelines Market By Region

8.1 Overview

8.2. North America Virtual Pipelines Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Fuel Type

8.2.4.1 CNG

8.2.4.2 LNG

8.2.5 Historic and Forecasted Market Size by Mode of Transport

8.2.5.1 Truck

8.2.5.2 Barge

8.2.5.3 Rail

8.2.5.4 Ship

8.2.6 Historic and Forecasted Market Size by End-Use

8.2.6.1 Residential

8.2.6.2 Transportation

8.2.6.3 Commercial

8.2.6.4 Industrial

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Virtual Pipelines Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Fuel Type

8.3.4.1 CNG

8.3.4.2 LNG

8.3.5 Historic and Forecasted Market Size by Mode of Transport

8.3.5.1 Truck

8.3.5.2 Barge

8.3.5.3 Rail

8.3.5.4 Ship

8.3.6 Historic and Forecasted Market Size by End-Use

8.3.6.1 Residential

8.3.6.2 Transportation

8.3.6.3 Commercial

8.3.6.4 Industrial

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Virtual Pipelines Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Fuel Type

8.4.4.1 CNG

8.4.4.2 LNG

8.4.5 Historic and Forecasted Market Size by Mode of Transport

8.4.5.1 Truck

8.4.5.2 Barge

8.4.5.3 Rail

8.4.5.4 Ship

8.4.6 Historic and Forecasted Market Size by End-Use

8.4.6.1 Residential

8.4.6.2 Transportation

8.4.6.3 Commercial

8.4.6.4 Industrial

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Virtual Pipelines Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Fuel Type

8.5.4.1 CNG

8.5.4.2 LNG

8.5.5 Historic and Forecasted Market Size by Mode of Transport

8.5.5.1 Truck

8.5.5.2 Barge

8.5.5.3 Rail

8.5.5.4 Ship

8.5.6 Historic and Forecasted Market Size by End-Use

8.5.6.1 Residential

8.5.6.2 Transportation

8.5.6.3 Commercial

8.5.6.4 Industrial

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Virtual Pipelines Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Fuel Type

8.6.4.1 CNG

8.6.4.2 LNG

8.6.5 Historic and Forecasted Market Size by Mode of Transport

8.6.5.1 Truck

8.6.5.2 Barge

8.6.5.3 Rail

8.6.5.4 Ship

8.6.6 Historic and Forecasted Market Size by End-Use

8.6.6.1 Residential

8.6.6.2 Transportation

8.6.6.3 Commercial

8.6.6.4 Industrial

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Virtual Pipelines Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Fuel Type

8.7.4.1 CNG

8.7.4.2 LNG

8.7.5 Historic and Forecasted Market Size by Mode of Transport

8.7.5.1 Truck

8.7.5.2 Barge

8.7.5.3 Rail

8.7.5.4 Ship

8.7.6 Historic and Forecasted Market Size by End-Use

8.7.6.1 Residential

8.7.6.2 Transportation

8.7.6.3 Commercial

8.7.6.4 Industrial

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Virtual Pipelines Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2,378 Mn. |

|

Forecast Period 2023-30 CAGR: |

5.9% |

Market Size in 2032: |

USD 3983.60 Mn. |

|

Segments Covered: |

By Fuel Type |

|

|

|

By Mode of Transport |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

REV LNG LLC (U.S.) and Others

|

||

Frequently Asked Questions :

The forecast period in the Virtual Pipelines Market research report is 2024-2032.

GE Oil and Gas (U.S.),Kinder Morgan (U.S.),SUB161° (Australia),Eniday (Italy),Galileo Technologies S.A. (Argentina),CNG Services Limited (U.K),SENER Group (Spain),Pentagon Energy LLC (U.S.),Xpress Natural Gas LLC (U.S.),OsComp Holdings LLC (U.S.),NG Advantage LLC (U.S.),REV LNG LLC (U.S.) and Others

The by Fuel Type (CNG and LNG), By Mode of Transport (Truck, Barge, Rail, and Ship), By End-Use (Residential, Transportation, Commercial, and Industrial) and By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Virtual pipelines refer to the transportation of natural gas or other fuels through alternative methods such as compressed natural gas (CNG), liquefied natural gas (LNG), or other modular solutions instead of traditional pipelines. This approach enables the delivery of energy resources to locations that are not served by conventional pipelines due to geographical constraints or economic considerations. Virtual pipelines often utilize trucks, railcars, or ships to transport the fuel from production sites to end-users, providing flexibility and scalability in delivering energy resources to remote or underserved areas. Additionally, virtual pipelines can offer temporary or supplemental solutions during pipeline maintenance or construction, ensuring uninterrupted energy supply to consumers.

Virtual Pipelines Market Size Was Valued at USD 2,378 Million in 2023, and is Projected to Reach USD 3983.60 Million by 2032, Growing at a CAGR of 5.9% From 2024-2032.