Key Market Highlights

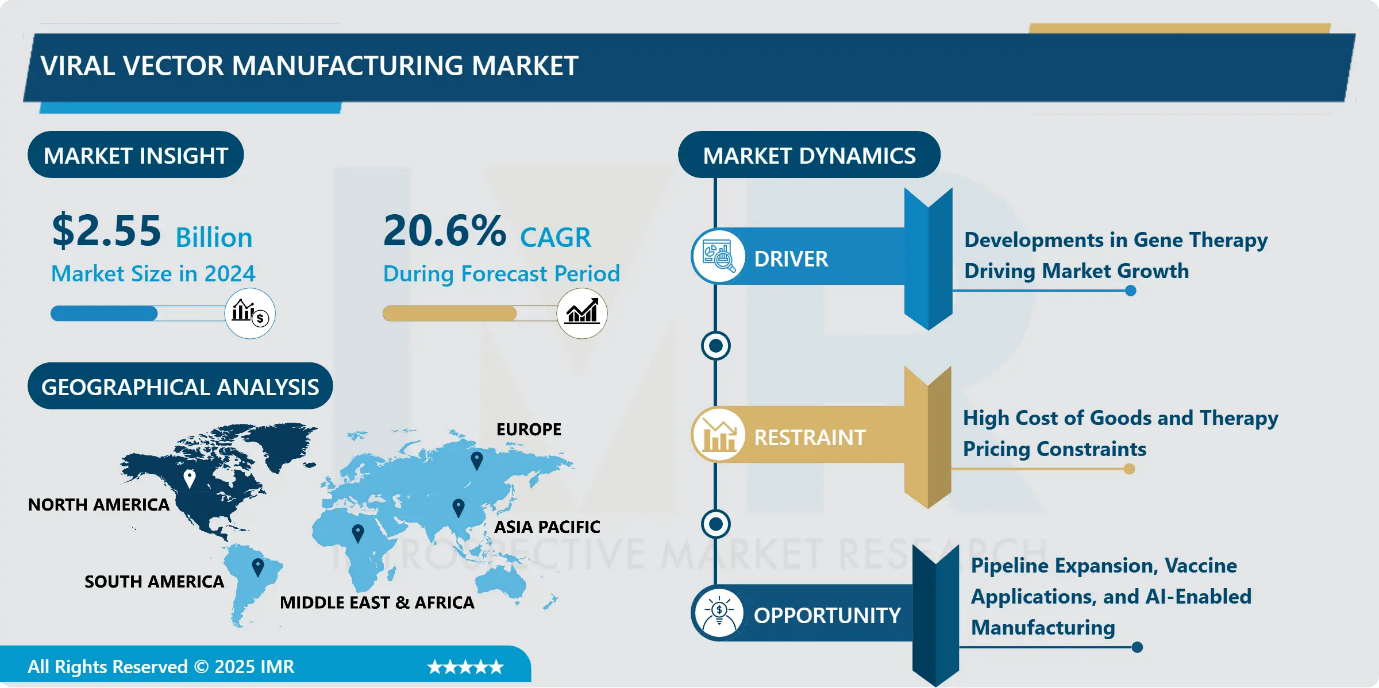

Viral Vector Manufacturing Market Size Was Valued at USD 2.55 Billion in 2024, and is Projected to Reach USD 20.02 Billion by 2035, Growing at a CAGR of 20.6% from 2025-2035.

- Market Size in 2024: USD 2.55 Billion

- Projected Market Size by 2035: USD 20.02 Billion

- CAGR (2025–2035): 20.6%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Vector: The Adeno-Associated Viral (AAV) Vectors segment is anticipated to lead the market by accounting for 31.03% of the market share throughout the forecast period.

- By Application: The Gene Therapies segment is expected to capture 36.78% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 30.90% of the market share during the forecast period.

- Active Players: AGC Biologics (Japan), Aldevron, LLC (USA), Batavia Biosciences B.V. (Netherlands), Catalent, Inc. (USA), Charles River Laboratories International, Inc. (USA), and Other Active Players.

Viral Vector Manufacturing Market Synopsis:

Viral and non-viral vectors are essential tools for delivering genetic material to target cells, forming the backbone of modern gene and cell therapies. The growing approval of viral vector-based gene therapies and a robust clinical pipeline are driving demand for large-scale vector manufacturing. While viral vectors face challenges like immunogenicity and complex characterization, non-viral alternatives are gaining attention. Technological innovations, such as high-density cell culture systems and automated platforms, are enhancing production efficiency. With over 230 global manufacturers, rising investments, and expanding applications in gene therapy, cell therapy, and vaccines, the viral and non-viral vector market is poised for significant growth.

Viral Vector Manufacturing Market Dynamics and Trend Analysis:

Viral Vector Manufacturing Market Growth Driver - Developments in Gene Therapy Driving Market Growth

-

Rapid advances in gene therapy are a major driver of growth in the viral vector and plasmid DNA manufacturing market. Gene therapy offers transformative potential for treating genetic disorders, cancers, and infectious diseases through targeted delivery of therapeutic genes using viral vectors or plasmid DNA. By 2024, more than 2,000 gene therapies were in development, reflecting a strong and expanding pipeline.

- Recent clinical successes, such as AAV-based treatments for rare neurological disorders and hemophilia, have strengthened regulatory and payer confidence, leading to larger clinical trials and higher manufacturing volumes. Simultaneously, increased investments in biotechnology R&D by pharmaceutical companies and research institutions are accelerating innovation. These factors collectively fuel demand for high-quality, scalable, and compliant vector manufacturing solutions, driving sustained market expansion.

Viral Vector Manufacturing Market Limiting Factor - High Cost of Goods and Therapy Pricing Constraints

-

High operational costs associated with viral vector and cell and gene therapy manufacturing represent a major limitation to market growth. AAV production involves lengthy timelines, complex processes, and high material costs, with manufacturing expenses significantly exceeding those of conventional biologics. Inefficiencies such as empty capsid formation further increase cost burdens. As a result, commercial gene therapies are priced at exceptionally high levels, raising affordability and reimbursement concerns among payers. Additionally, limited manufacturing capacity and reliance on expensive adherent production systems constrain scalability. These cost pressures restrict patient access, particularly in price-sensitive regions, and slow broader adoption despite growing clinical demand.

Viral Vector Manufacturing Market Expansion Opportunity - Pipeline Expansion, Vaccine Applications, and AI-Enabled Manufacturing

-

Significant growth opportunities are emerging from the expanding cell and gene therapy pipeline, as increasing numbers of therapies progress from preclinical stages to clinical and commercial development. Manufacturers can capitalize by offering integrated services, including process development, scale-up, and cGMP-compliant production. Additional opportunities are arising from the growing application of viral vectors and plasmid DNA in vaccines and infectious disease prevention, accelerated by the success of gene-based COVID-19 vaccines.

- Furthermore, the integration of AI-driven bioprocess optimization and standardized manufacturing platforms presents a transformative opportunity to improve yield predictability, reduce costs, and accelerate timelines. Platform-based approaches enable CDMOs to efficiently serve multiple programs, enhancing scalability, operational efficiency, and long-term market competitiveness.

Viral Vector Manufacturing Market Challenge and Risk - Key Regulatory and Manufacturing Challenges Impacting the Viral Vector Manufacturing Market

-

The viral vector manufacturing market faces significant challenges due to the biological complexity of production processes and escalating regulatory compliance requirements. Manufacturing vectors such as AAV and lentivirus demands advanced bioprocessing capabilities under stringent cGMP conditions, substantially increasing production costs compared to research-scale manufacturing.

- Divergent regulatory expectations across regions, particularly between the FDA and EMA, require extensive characterization, potency testing, and replication-competent virus assays, often necessitating parallel validation strategies. In addition, batch-to-batch variability, complex purification requirements, and limited availability of specialized analytical infrastructure contribute to delays and higher costs. Workforce shortages in specialized bioprocessing skills further constrain scalability, extending development timelines and slowing commercialization despite growing demand.

Viral Vector Manufacturing Market Trend - Customization, Single-Use Technologies, and Advanced Bioprocessing in Viral Vector Manufacturing

-

The viral vector and plasmid DNA manufacturing market is witnessing strong demand for customized vector designs, driven by advances in gene-editing technologies such as CRISPR-Cas9. Developers increasingly require tailored vectors with enhanced targeting, controlled gene expression, reduced immunogenicity, and improved safety profiles to address specific therapeutic needs. In parallel, the adoption of single-use and automated manufacturing technologies is accelerating, as these systems offer flexibility, faster scale-up, lower contamination risk, and cost efficiency compared to traditional stainless-steel setups.

- Technological progress in synthetic biology, high-density cell culture, and digital bioprocessing is further improving productivity and process control. Additionally, rising collaborations and strategic partnerships aimed at expanding capacity, accessing novel platforms, and accelerating commercialization are reshaping the competitive landscape.

Viral Vector Manufacturing Market Segment Analysis:

Viral Vector Manufacturing Market is segmented based on Vector, Application, Therapeutic, Type of Manufacturer, End-User and Region.

By Vector, Adeno-Associated viral (AVV) segment is expected to dominate the market with around 31.03% share during the forecast period.

-

The adeno-associated viral (AAV) vector segment dominated the viral vector manufacturing market in 2024. Their non-pathogenic nature, favorable safety profile, long-term gene expression, and broad tissue tropism make AAVs ideal for gene therapy applications. The growing pipeline of AAV-based therapies including treatments for hemophilia and muscular dystrophy has driven strong clinical demand and investments in specialized manufacturing infrastructure. Over 225 active trials rely on AAV vectors, prompting CDMOs to develop dedicated suites using suspension bioreactors to enhance productivity. These factors collectively establish AAVs as the leading viral vector type in the market.

By Application, Gene Therapy is expected to dominate with close to 36.78% market share during the forecast period.

-

Gene therapy is the dominant application in the viral vector market, capturing an estimated 36.78% share in 2024. Its leadership is driven by the transition of gene therapies from experimental research to approved clinical treatments for genetic disorders, oncology, and rare diseases. The segment primarily relies on AAV and lentiviral vectors, requiring specialized manufacturing, advanced purification, and strict cGMP compliance. Rising FDA and EMA approvals, robust clinical pipelines, and increasing R&D investments have accelerated commercialization, further fueling demand.

- Vaccine development, particularly viral vector-based COVID-19 vaccines, is the fastest-growing application, leveraging established manufacturing infrastructure for next-generation infectious disease and therapeutic cancer vaccines. Gene therapy remains dominant due to clinical validation, regulatory support, and expanding treatment opportunities.

Viral Vector Manufacturing Market Regional Insights:

North America region is estimated to lead the market with around 30.90% share during the forecast period.

-

North America leads the global viral vector manufacturing market, capturing over 30.90% of the share in 2024. The region’s dominance stems from the U.S.’s robust biopharmaceutical ecosystem, comprising top-tier academic research centers, dense biotechnology clusters, and strong venture capital funding. The FDA’s progressive regulatory pathways, including RMAT designation and Priority Review, facilitate faster clinical-to-commercial transitions for gene and cell therapies. Advanced CDMOs, cutting-edge large-scale production technologies, and a skilled workforce enhance manufacturing efficiency and scalability. These factors innovative R&D, regulatory support, investment in capacity, and specialized talent position North America as the global hub for viral vector production.

Viral Vector Manufacturing Market Active Players:

- AGC Biologics (Japan)

- Aldevron, LLC (USA)

- Batavia Biosciences B.V. (Netherlands)

- Catalent, Inc. (USA)

- Charles River Laboratories International, Inc. (USA)

- Cobra Biologics (UK)

- FUJIFILM Diosynth Biotechnologies (USA/Japan)

- Genezen Laboratories (India)

- Lonza Group AG (Switzerland)

- Merck KGaA (Germany)

- Oxford Biomedica plc (UK)

- Regenxbio, Inc. (USA)

- Sartorius AG (Germany)

- Takara Bio Inc. (Japan)

- WuXi Biologics (WuXi AppTec) (China)

- Other Active Players

Key Industry Developments in the Viral Vector Manufacturing Market:

-

In March 2025, WuXi Biologics reported robust financial and operational results for 2024, highlighting strong growth across its biopharmaceutical services. The company also projected accelerated expansion in 2025, attributing it to the commissioning of new viral vector manufacturing facilities in the Asia-Pacific region, which are expected to increase production capacity and meet growing demand from gene and cell therapy developers globally.

- In February 2025, Takara Bio expanded its capabilities in viral vector manufacturing by launching a range of single-use bioreactors with capacities from 50 L up to 5,000 L. These bioreactors are designed to enable scalable, flexible, and efficient production of viral vectors, supporting both clinical and commercial-scale manufacturing for gene therapies, cell therapies, and other advanced biologics.

Technical Overview of Viral Vector Manufacturing: Scalable Production, Upstream and Downstream Processes, Purification, and cGMP Compliance for Gene and Cell Therapy Applications.

-

Viral vector manufacturing involves the design, production, and purification of engineered viruses, such as adeno-associated virus (AAV), lentivirus, retrovirus, and adenovirus, for delivering genetic material to target cells. The process typically includes upstream production in mammalian or insect cell cultures using adherent or suspension systems, followed by vector amplification, harvesting, and downstream purification to ensure high potency, safety, and purity. Critical technical challenges include separating full and empty capsids, controlling immunogenicity, and maintaining genome integrity.

- Advanced technologies such as high-density cell culture platforms, perfusion bioreactors, and automated single-use systems enhance scalability and reproducibility. Process intensification, continuous manufacturing, and robust analytical characterization are increasingly employed to meet clinical and commercial demands, driving innovation in gene and cell therapy development while ensuring compliance with cGMP standards.

|

Viral Vector Manufacturing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 2.55 Bn. |

|

Forecast Period 2025-35 CAGR: |

20.6% |

Market Size in 2035: |

USD 20.02 Bn. |

|

Segments Covered: |

By Vector |

|

|

|

By Application

|

|

||

|

By Therapeutic |

|

||

|

By Manufacturer |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Viral Vector Manufacturing Market by Vector (2018-2035)

4.1 Viral Vector Manufacturing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Adeno-Associated Viral (AAV) Vectors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Adenoviral Vectors

4.5 Lentiviral Vectors

4.6 Retroviral Vectors

Chapter 5: Viral Vector Manufacturing Market by Application (2018-2035)

5.1 Viral Vector Manufacturing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Gene Therapies

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cell Therapies

5.5 Vaccines

Chapter 6: Viral Vector Manufacturing Market by Therapeutic (2018-2035)

6.1 Viral Vector Manufacturing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Oncological Disorders

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Rare Diseases

6.5 Neurological Disorders

6.6 Sensory Disorders

6.7 Metabolic Disorders

6.8 Musculoskeletal Disorders

6.9 Blood Disorders

6.10 Immunological Disorders

6.11 Other Disorders

Chapter 7: Viral Vector Manufacturing Market by Type of Manufacturer (2018-2035)

7.1 Viral Vector Manufacturing Market Snapshot and Growth Engine

7.2 Market Overview

7.3 In-house

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Contract Development and Manufacturing Organizations

Chapter 8: Viral Vector Manufacturing Market by End-User (2018-2032)

8.1 Viral Vector Manufacturing Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Pharmaceutical and Biopharmaceutical Companies

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Research Institutes

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Viral Vector Manufacturing Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 AGC BIOLOGICS (JAPAN)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 ALDEVRON

9.4 LLC (USA)

9.5 BATAVIA BIOSCIENCES B.V. (NETHERLANDS)

9.6 CATALENT

9.7 INC. (USA)

9.8 CHARLES RIVER LABORATORIES INTERNATIONAL

9.9 INC. (USA)

9.10 COBRA BIOLOGICS (UK)

9.11 FUJIFILM DIOSYNTH BIOTECHNOLOGIES (USA/JAPAN)

9.12 GENEZEN LABORATORIES (INDIA)

9.13 LONZA GROUP AG (SWITZERLAND)

9.14 MERCK KGAA (GERMANY)

9.15 OXFORD BIOMEDICA PLC (UK)

9.16 REGENXBIO

9.17 INC. (USA)

9.18 SARTORIUS AG (GERMANY)

9.19 TAKARA BIO INC. (JAPAN)

9.20 WUXI BIOLOGICS (CHINA) AND OTHER ACTIVE PLAYERS

Chapter 10: Global Viral Vector Manufacturing Market By Region

10.1 Overview

10.2. North America Viral Vector Manufacturing Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Viral Vector Manufacturing Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Viral Vector Manufacturing Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Viral Vector Manufacturing Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Viral Vector Manufacturing Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Viral Vector Manufacturing Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

Viral Vector Manufacturing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 2.55 Bn. |

|

Forecast Period 2025-35 CAGR: |

20.6% |

Market Size in 2035: |

USD 20.02 Bn. |

|

Segments Covered: |

By Vector |

|

|

|

By Application

|

|

||

|

By Therapeutic |

|

||

|

By Manufacturer |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||