Cell Culture Market Synopsis

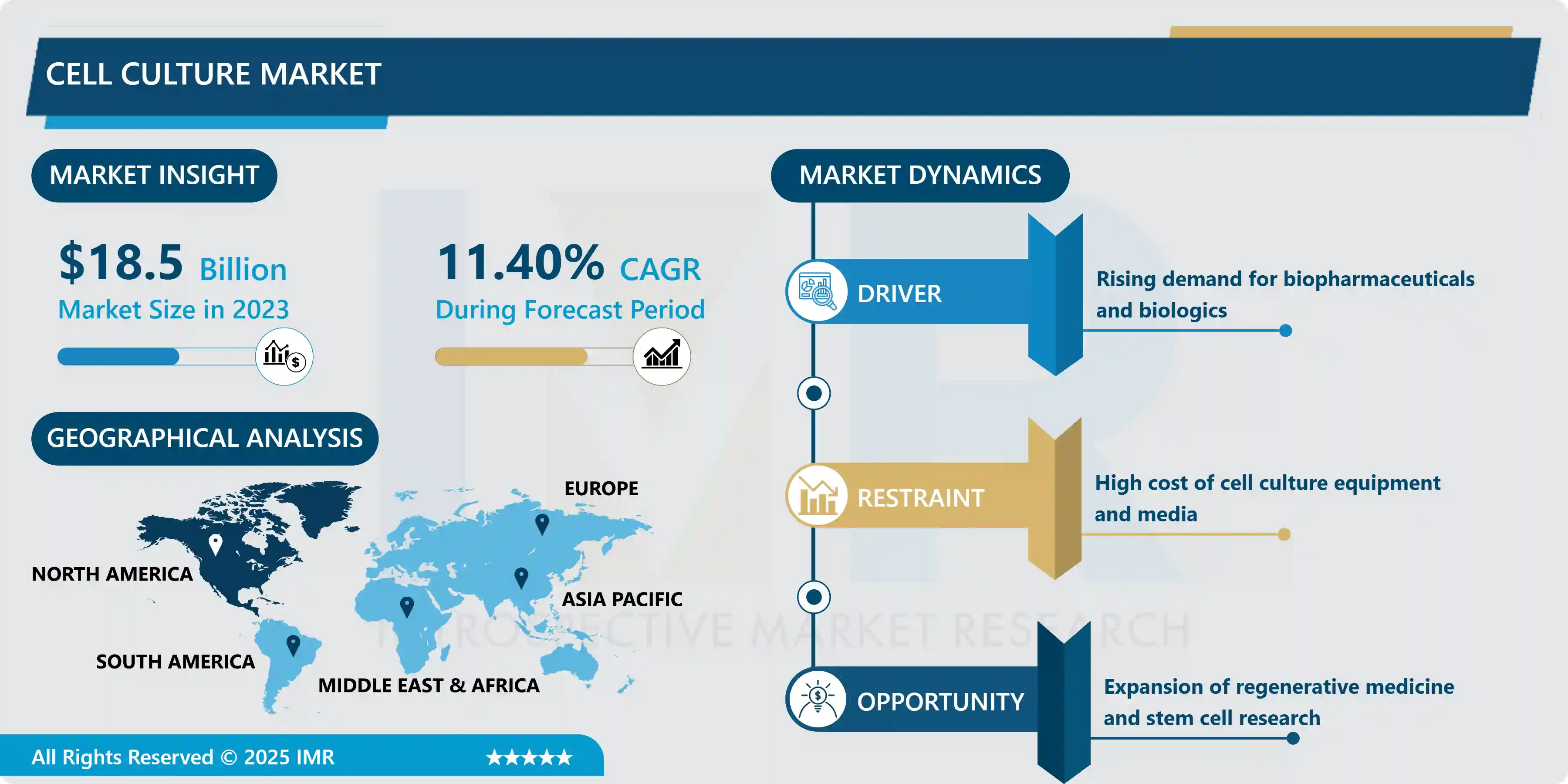

Cell Culture Market Size Was Valued at USD 18.5 Billion in 2023, and is Projected to Reach USD 48.9 Billion by 2032, Growing at a CAGR of 11.4% From 2024-2032.

Cell Culture Market Definition The cell culture market refers to a market that focuses on the management and manipulation of cells in a culture medium, for the production of therapeutic proteins. Cell Culture Market can therefore be defined as the market for growing and supporting cells in essentially artificial conditions pertaining outside the normal environment. This process is widely used in most scientific investigations, biotechnology, pharmaceuticals, and pharmacology in drug synthesis, disease simulation, in tissue engineering, and in the manufacturing of biologics. The market includes consumables, equipment and software production that provide optimal conditions for cell proliferation and growth, research purposes. The center is crucial in biopharmaceutical manufacturing, vaccine and therapeutics development and the ongoing advancement in precision medicine.

Thus, the cell culture market has experienced high growth in the recent past as more and more biologics and biopharmaceuticals depend on cell cultivation for manufacturing. This market is stimulated by the demand for other modern treatments such as regenerative medicinal treatment, stem cell treatment and others. Scientists can grow cells in a culture and mimic diseases, introduce drugs to study and predict effects on human beings without having to use animals. Future growth of this market is predictable, especially given the continuous interest in investing in life science research, pharma organizations, and biotech companies. Some of the major drivers are increase in incidences of diseases, growth of cancer related diseases, immunization requirements, effective gene therapy and stem cell research.

Additionally, growth in technology has encouraged the creation of new cell culture instruments which enable effective control and more accurate conditions required for cell growth. This has been complemented by the development of new tools in automated systems for large scale cell cultures for drug discovery through high-throughput screening. Businesses are targeting optimizing of individual media for the exactitude and proficiency in research and production procedures with the help of new cell culture media, reagents and 3D cell culture systems. Public-private support as a major source of research and development funding and the advancement of the global biopharmaceutical sector remain to drive the global cell culture market.

Cell Culture Market Trend Analysis

3D Cell Culture Technologies

- Market trends evident in the cell culture market include the utilization of 3D cell culture technologies in the market. Compared to the usual 2D culture technique where cells are cultured in a monolayer, 3D culture system offers a more physiological model of cells. This trend is necessitated by the complexity of disease profiles especially in cancer research field where tumor microenvironments are highly complex and need better modeling.Most researchers now use 3D cultures in drug discovery and toxicology testing because the technique offers better prospects on how drugs will react when introduced in human bodily systems. Thus, while researchers do more studies on the possibilities of utilizing 3D cultures, this segment is likely to expand significantly and create fresh opportunities for pharmaceutical and tissue engineering industries.

Increase in the consumer purchase of Biopharmaceuticals

- The availability of diversified biopharmaceuticals offers a vast prospect to the cell culture market. Cell culture plays an important role in manufacture of biopharmaceutical products such as Monoclonal antibodies, vaccine, and gene therapies. LC treatment relies on biologics and due to a growing number of chronic diseases such as cancer and autoimmune diseases the demand for specific biologics has also risen. Such therapies are dependent on cell culture since this process provides a controlled milieu for the synthesis of biologic drugs with purity and exactness. It has bolstered the versatility of cell culture systems in developing the next generation therapeutics with the help of new gene editing technologies like CRISPR. One advantage of this opportunity is the rather increased funding of biotechnology research and also entry of many biopharmaceutical firms.

Cell Culture Market Segment Analysis:

Cell Culture Market Segmented on the basis of Product and application.

By Product, Consumables segment is expected to dominate the market during the forecast period

- Among the products, consumables shall continue to lead the cell culture market in the coming years. They refer to such things like the media and sera and reagents, and culture vessels which are crucial in cell culture. The need for consumables is high because of the limited reuse factor where they help to eliminate contamination in cell growth and experimentation. Because biopharmaceutical manufacturing and life science research and development operations are increasingly located in more places across the globe, the demand for consistent supply of consumable products will ensure market growth. However, the increase in formulation and the introduction of specific media for certain cell cultures have greatly increased demand in this segment. Business are also improving their product offerings to come up with consumables that are easy to use, time saving by researchers and manufacturers.

By Application, Biopharmaceutical Production segment expected to held the largest share

- Based on application, the biopharmaceutical production segment is likely to dominate the cell culture market. Biopharmaceutical manufacturing employs cell culture to grow therapeutic substances like biologics, including monoclonal antibodies, recombinant proteins, and vaccines. The realization that chronic diseases such as cancer, diabetes, autoimmune diseases, and others have increased the need for biopharmaceuticals compared to chemical drugs with better targeting. The use of a bioreactor cell culture technology enables the large scale production of these biologics in a sterile manner producing high quality therapeutic products. There is a growing use of cell culture technologies in biopharmaceutical manufacturing with increasing interest by pharmaceutical firms in biologics and biosimilars, as well as the adoption of advanced technologies for manufacturing more complex products, which will fuel strong market growth in this market application segment.

Cell Culture Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- According to the researchers, North America will lead the global cell culture market in 2023 and the region will account for the major market shares because of well developed health care sector, high investment in biotechnology and strong biopharmaceutical industry. The US for example hosts the majority of key pharma and biotech industry and research facilities that heavily depend on cell culture systems for drug discovery, disease modeling, and production of many biologic products. North Americadomesticated by significantgovernment supportfor life sciencesresearch and, in particular,cancer and stem celldiseases. The well established rules and regulations in the region guarantee the quality and safety of the bio logics hence enhancing the use of cell culture systems. North America in particular is anticipated to command more than 40% of the global cell culture market by 2023 thereby maintaining its importance in both research and in the biopharmaceutical industry.

Active Key Players in the Cell Culture Market

- Agilent Technologies (USA)

- Becton, Dickinson and Company (USA)

- Bio-Techne Corporation (USA)

- Corning Incorporated (USA)

- Danaher Corporation (USA)

- Eppendorf AG (Germany)

- FUJIFILM Irvine Scientific (USA)

- GE Healthcare (USA)

- HiMedia Laboratories (India)

- Lonza Group (Switzerland)

- Merck KGaA (Germany)

- Promocell GmbH (Germany)

- Sartorius AG (Germany)

- Takara Bio Inc. (Japan)

- Thermo Fisher Scientific (USA), Other key Players

Cell Culture Market Scope:

|

Cell Culture Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.4% |

Market Size in 2032: |

USD 48.9 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cell Culture Market by Product (2018-2032)

4.1 Cell Culture Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Consumables

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Instruments

Chapter 5: Cell Culture Market by Application (2018-2032)

5.1 Cell Culture Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Biopharmaceutical Production

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Drug Development

5.5 Diagnostics

5.6 Tissue Culture & Engineering

5.7 Cell and Gene Therapy

5.8 Toxicity Testing

5.9 Other Applications

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Cell Culture Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 AGILENT TECHNOLOGIES (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BECTON

6.4 DICKINSON AND COMPANY (USA)

6.5 BIO-TECHNE CORPORATION (USA)

6.6 CORNING INCORPORATED (USA)

6.7 DANAHER CORPORATION (USA)

6.8 EPPENDORF AG (GERMANY)

6.9 FUJIFILM IRVINE SCIENTIFIC (USA)

6.10 GE HEALTHCARE (USA)

6.11 HIMEDIA LABORATORIES (INDIA)

6.12 LONZA GROUP (SWITZERLAND)

6.13 MERCK KGAA (GERMANY)

6.14 PROMOCELL GMBH (GERMANY)

6.15 SARTORIUS AG (GERMANY)

6.16 TAKARA BIO INC. (JAPAN)

6.17 THERMO FISHER SCIENTIFIC (USA)

6.18 OTHER KEY PLAYERS

6.19

Chapter 7: Global Cell Culture Market By Region

7.1 Overview

7.2. North America Cell Culture Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product

7.2.4.1 Consumables

7.2.4.2 Instruments

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Biopharmaceutical Production

7.2.5.2 Drug Development

7.2.5.3 Diagnostics

7.2.5.4 Tissue Culture & Engineering

7.2.5.5 Cell and Gene Therapy

7.2.5.6 Toxicity Testing

7.2.5.7 Other Applications

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Cell Culture Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product

7.3.4.1 Consumables

7.3.4.2 Instruments

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Biopharmaceutical Production

7.3.5.2 Drug Development

7.3.5.3 Diagnostics

7.3.5.4 Tissue Culture & Engineering

7.3.5.5 Cell and Gene Therapy

7.3.5.6 Toxicity Testing

7.3.5.7 Other Applications

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Cell Culture Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product

7.4.4.1 Consumables

7.4.4.2 Instruments

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Biopharmaceutical Production

7.4.5.2 Drug Development

7.4.5.3 Diagnostics

7.4.5.4 Tissue Culture & Engineering

7.4.5.5 Cell and Gene Therapy

7.4.5.6 Toxicity Testing

7.4.5.7 Other Applications

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Cell Culture Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product

7.5.4.1 Consumables

7.5.4.2 Instruments

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Biopharmaceutical Production

7.5.5.2 Drug Development

7.5.5.3 Diagnostics

7.5.5.4 Tissue Culture & Engineering

7.5.5.5 Cell and Gene Therapy

7.5.5.6 Toxicity Testing

7.5.5.7 Other Applications

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Cell Culture Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product

7.6.4.1 Consumables

7.6.4.2 Instruments

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Biopharmaceutical Production

7.6.5.2 Drug Development

7.6.5.3 Diagnostics

7.6.5.4 Tissue Culture & Engineering

7.6.5.5 Cell and Gene Therapy

7.6.5.6 Toxicity Testing

7.6.5.7 Other Applications

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Cell Culture Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product

7.7.4.1 Consumables

7.7.4.2 Instruments

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Biopharmaceutical Production

7.7.5.2 Drug Development

7.7.5.3 Diagnostics

7.7.5.4 Tissue Culture & Engineering

7.7.5.5 Cell and Gene Therapy

7.7.5.6 Toxicity Testing

7.7.5.7 Other Applications

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Cell Culture Market Scope:

|

Cell Culture Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

11.4% |

Market Size in 2032: |

USD 48.9 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||