Veterinary Oncology Market Synopsis

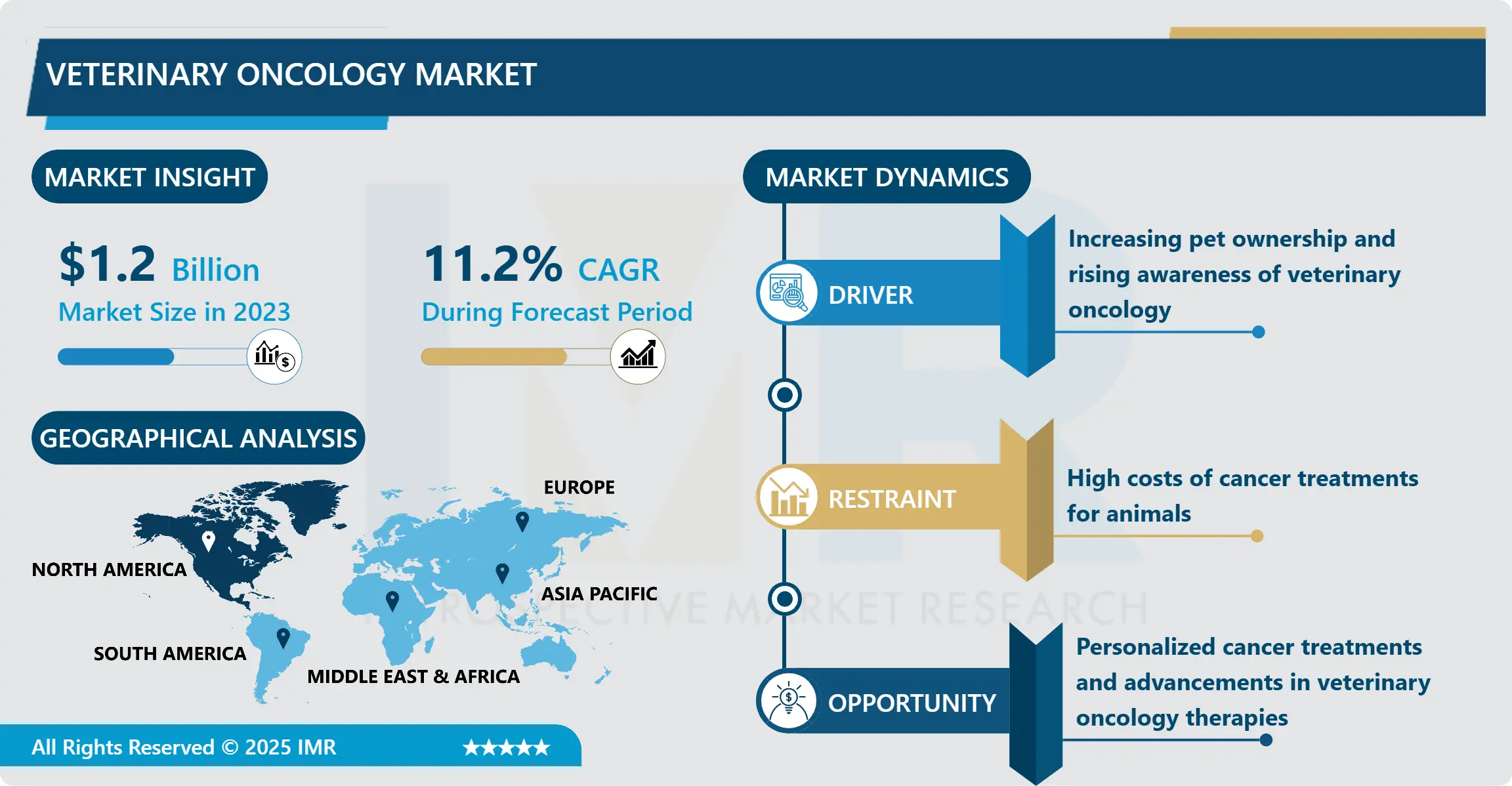

Veterinary Oncology Market Size Was Valued at USD 1.2 Billion in 2023, and is Projected to Reach USD 3.1 Billion by 2032, Growing at a CAGR of 11.2% From 2024-2032.

The veterinary oncology market includes diagnostic and therapeutic equipment, stages of cancer diagnostic and therapies and products exclusively concerned with cancer treatment of animal species, particularly animals being kept as pets such as dogs and cats. This market targets the expanded care manner such as surgeries, chemotherapies, radiation therapies among other immunotherapies for various forms of cancer. As more pet owners learn about the importance of their pets’ health and spend more monies on veterinary care, the need for oncology services has surged, driving the market.

The current market of veterinary oncology has been growing steadily over the recent past due to the growing trends towards pet ownership and therefore improving the knowledge regarding the treatment of cancery diseases in animals. Pets suffering from cancer have been given hope due to development in medical science where treatment options have been expanded comprehensively bestowing minimally invasive surgeries, different targeted medicines and newest radiation therapies. This market has steadily grown as more veterinarians are schooled in oncology and oncological services as well as animal healthcare infrastructure is established. Also, there was increased uptake of pet insurance so that some of the costs of exploiting expensive cancer treatments are catered for and more treatment options are available to the owners that would have otherwise crumbled under the bills.

Second, increased geriatric pet prevalence adds to this market’s growth because cancer rates are higher in senior pets. With more people regarding their pets as part of the family, global concern for companion animals’ welfare is growing, and thus more money is being spent on veterinary oncology services. The services for pets are now more demanding due to growing urbanization, nuclear families, and change in customer’s disposable income which encourages pet owners to spend heavily towards treatment of their pets thus acting as a major growth engine for the veterinary oncology market.

Veterinary Oncology Market Trend Analysis:

Rise in Targeted Therapies

-

Currently, targeted therapies are one of the most influential factors affecting the growth of the veterinary oncology market. With trends in the veterinary medicine; oncologists are now able to treat the disease with more friendly technique that can easily target cancerous cells without affecting the normal cells. These include the ones like monoclonal bodies and kinase inhibitors, promising dealing with tumors in pets without major side like in chemotherapy and radiation therapy. This trend has been similar to progress observed in human oncology and has established the groundwork for future developments that will probably help for enhanced survival for animals who are receiving cancer therapy.

Growing Focus on Personalized Treatment

-

Targeted therapies have been identified as a strong growth driver in the current and further development of the veterinary oncology market. This has made it easier for veterinarians to prescribe treatments based on genetic testing using molecular diagnostics where treatments can be based on subtypes of cancer, the specific breed of the animal and even its genetic predisposition. This approach is being adopted since it enhances the probability of positive outcomes with least negative impact. hangs are increasingly seeking genetic tests for their pets in veterinary clinics because more and more people want a unique approach to their pegs’ health. The changes we see here translate to vast sales prospects for veterinary hospitals, clinics, and service providers with specialized oncology divisions.

Veterinary Oncology Market Segment Analysis:

Veterinary Oncology Market Segmented based on Therapy, Animal Type, Cancer Type, and Region.

By Therapy, the Surgery segment is expected to dominate the market during the forecast period

-

In the treatment option in veterinary oncology, the surgery segment is anticipated to lead the market throughout the prediction period. Surgical oncology is therefore important in tumor resection, tumor volume reduction, and enhancement of well well-being of animals. Veterinary surgeons then act a premier protagonists of cancer treatment especially for solid tumor types that call for excision. Increased usage of minimally invasive techniques and increasing numbers of veterinary surgeons with specializations mean that the surgery segment continues to dominate. Ever increasing incidence of cancer in pets in early stages keep surgery an essential part of the cancer treatment mix, which is why it enjoys so much demand.

By Animal Type, Canine segment expected to held the largest share

-

The canine segment is thus anticipated to dominate the veterinary oncology market mainly because dogs are some of the most prone to cancer the among the three categories of animals. The findings of research suggest that an estimate of one out of every four dogs is likely to get cancer at some time in their lifetimes with superb predispositions. Dogs, among the most owned companion animals around the world, are now experiencing a rise in oncological diseases, and therefore their owners are seeking oncology treatments for their pets thereby facilitating growth in the veterinary oncology services. Many of the canine cancer therapies include surgeries, chemotherapy, and radiation that are being made available and hence there are increased likelihood of veterinary oncology specializing in the cancers affecting the canine. This segment currently holds the largest share and is expected to maintain that position in the future years.

Veterinary Oncology Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

The veterinary oncology market share of North America is expected to be highest in 2023 due to higher usage of veterinary healthcare services, higher levels of pet adoption, and increased awareness about pet cancer treatments. The United States in turn has a lot of specialists in veterinary practices and the best oncology services that will enable the animals to be handled with a lot of care. Moreover, local presence of major participants influences its lucrative position; moreover, the tendency to obtain pet insurance distinguishes North America. The research indicates that North America took the largest market share of veterinary oncology with 40% in 2023.

Active Key Players in the Veterinary Oncology Market

- AB Science (France)

- Boehringer Ingelheim (Germany)

- Elanco (U.S.)

- Elekta (Sweden)

- IDEXX Laboratories (U.S.)

- Karyopharm Therapeutics (U.S.)

- Medtronic (Ireland)

- Merck Animal Health (U.S.)

- PetCure Oncology (U.S.)

- Regeneus (Australia)

- Varian Medical Systems (U.S.)

- VetMedica (Germany)

- Vetoquinol (France)

- Virbac (France)

- Zoetis (U.S.)

- Other Active Players

|

Veterinary Oncology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.2 Billion |

|

Forecast Period 2024-32 CAGR: |

11.2 % |

Market Size in 2032: |

USD 3.1 Billion |

|

Segments Covered: |

By Therapy |

|

|

|

By Animal Type |

|

||

|

By Cancer Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Veterinary Oncology Market by Therapy (Surgery, Radiotherapy, Chemotherapy, Immunotherapy, Others), Animal Type

4.1 Veterinary Oncology Market Snapshot and Growth Engine

4.2 Veterinary Oncology Market Overview

4.3 Canine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Canine: Geographic Segmentation Analysis

4.4 Feline

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Feline: Geographic Segmentation Analysis

4.5 Equine)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Equine): Geographic Segmentation Analysis

4.6 Cancer Type

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Cancer Type: Geographic Segmentation Analysis

Chapter 5: Company Profiles and Competitive Analysis

5.1 Competitive Landscape

5.1.1 Competitive Benchmarking

5.1.2 Veterinary Oncology Market Share by Manufacturer (2023)

5.1.3 Industry BCG Matrix

5.1.4 Heat Map Analysis

5.1.5 Mergers and Acquisitions

5.2 ZOETIS

5.2.1 Company Overview

5.2.2 Key Executives

5.2.3 Company Snapshot

5.2.4 Role of the Company in the Market

5.2.5 Sustainability and Social Responsibility

5.2.6 Operating Business Segments

5.2.7 Product Portfolio

5.2.8 Business Performance

5.2.9 Key Strategic Moves and Recent Developments

5.2.10 SWOT Analysis

5.3 ELANCO

5.4 MERCK ANIMAL HEALTH

5.5 BOEHRINGER INGELHEIM

5.6 VIRBAC

5.7 OTHER ACTIVE PLAYERS

Chapter 6: Global Veterinary Oncology Market By Region

6.1 Overview

6.2. North America Veterinary Oncology Market

6.2.1 Key Market Trends, Growth Factors and Opportunities

6.2.2 Top Key Companies

6.2.3 Historic and Forecasted Market Size by Segments

6.2.4 Historic and Forecasted Market Size By Therapy (Surgery, Radiotherapy, Chemotherapy, Immunotherapy, Others), Animal Type

6.2.4.1 Canine

6.2.4.2 Feline

6.2.4.3 Equine)

6.2.4.4 Cancer Type

6.2.5 Historic and Forecast Market Size by Country

6.2.5.1 US

6.2.5.2 Canada

6.2.5.3 Mexico

6.3. Eastern Europe Veterinary Oncology Market

6.3.1 Key Market Trends, Growth Factors and Opportunities

6.3.2 Top Key Companies

6.3.3 Historic and Forecasted Market Size by Segments

6.3.4 Historic and Forecasted Market Size By Therapy (Surgery, Radiotherapy, Chemotherapy, Immunotherapy, Others), Animal Type

6.3.4.1 Canine

6.3.4.2 Feline

6.3.4.3 Equine)

6.3.4.4 Cancer Type

6.3.5 Historic and Forecast Market Size by Country

6.3.5.1 Russia

6.3.5.2 Bulgaria

6.3.5.3 The Czech Republic

6.3.5.4 Hungary

6.3.5.5 Poland

6.3.5.6 Romania

6.3.5.7 Rest of Eastern Europe

6.4. Western Europe Veterinary Oncology Market

6.4.1 Key Market Trends, Growth Factors and Opportunities

6.4.2 Top Key Companies

6.4.3 Historic and Forecasted Market Size by Segments

6.4.4 Historic and Forecasted Market Size By Therapy (Surgery, Radiotherapy, Chemotherapy, Immunotherapy, Others), Animal Type

6.4.4.1 Canine

6.4.4.2 Feline

6.4.4.3 Equine)

6.4.4.4 Cancer Type

6.4.5 Historic and Forecast Market Size by Country

6.4.5.1 Germany

6.4.5.2 UK

6.4.5.3 France

6.4.5.4 The Netherlands

6.4.5.5 Italy

6.4.5.6 Spain

6.4.5.7 Rest of Western Europe

6.5. Asia Pacific Veterinary Oncology Market

6.5.1 Key Market Trends, Growth Factors and Opportunities

6.5.2 Top Key Companies

6.5.3 Historic and Forecasted Market Size by Segments

6.5.4 Historic and Forecasted Market Size By Therapy (Surgery, Radiotherapy, Chemotherapy, Immunotherapy, Others), Animal Type

6.5.4.1 Canine

6.5.4.2 Feline

6.5.4.3 Equine)

6.5.4.4 Cancer Type

6.5.5 Historic and Forecast Market Size by Country

6.5.5.1 China

6.5.5.2 India

6.5.5.3 Japan

6.5.5.4 South Korea

6.5.5.5 Malaysia

6.5.5.6 Thailand

6.5.5.7 Vietnam

6.5.5.8 The Philippines

6.5.5.9 Australia

6.5.5.10 New Zealand

6.5.5.11 Rest of APAC

6.6. Middle East & Africa Veterinary Oncology Market

6.6.1 Key Market Trends, Growth Factors and Opportunities

6.6.2 Top Key Companies

6.6.3 Historic and Forecasted Market Size by Segments

6.6.4 Historic and Forecasted Market Size By Therapy (Surgery, Radiotherapy, Chemotherapy, Immunotherapy, Others), Animal Type

6.6.4.1 Canine

6.6.4.2 Feline

6.6.4.3 Equine)

6.6.4.4 Cancer Type

6.6.5 Historic and Forecast Market Size by Country

6.6.5.1 Turkiye

6.6.5.2 Bahrain

6.6.5.3 Kuwait

6.6.5.4 Saudi Arabia

6.6.5.5 Qatar

6.6.5.6 UAE

6.6.5.7 Israel

6.6.5.8 South Africa

6.7. South America Veterinary Oncology Market

6.7.1 Key Market Trends, Growth Factors and Opportunities

6.7.2 Top Key Companies

6.7.3 Historic and Forecasted Market Size by Segments

6.7.4 Historic and Forecasted Market Size By Therapy (Surgery, Radiotherapy, Chemotherapy, Immunotherapy, Others), Animal Type

6.7.4.1 Canine

6.7.4.2 Feline

6.7.4.3 Equine)

6.7.4.4 Cancer Type

6.7.5 Historic and Forecast Market Size by Country

6.7.5.1 Brazil

6.7.5.2 Argentina

6.7.5.3 Rest of SA

Chapter 7 Analyst Viewpoint and Conclusion

7.1 Recommendations and Concluding Analysis

7.2 Potential Market Strategies

Chapter 8 Research Methodology

8.1 Research Process

8.2 Primary Research

8.3 Secondary Research

|

Veterinary Oncology Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.2 Billion |

|

Forecast Period 2024-32 CAGR: |

11.2 % |

Market Size in 2032: |

USD 3.1 Billion |

|

Segments Covered: |

By Therapy |

|

|

|

By Animal Type |

|

||

|

By Cancer Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||