Utilities Wheeled Loader Market Synopsis

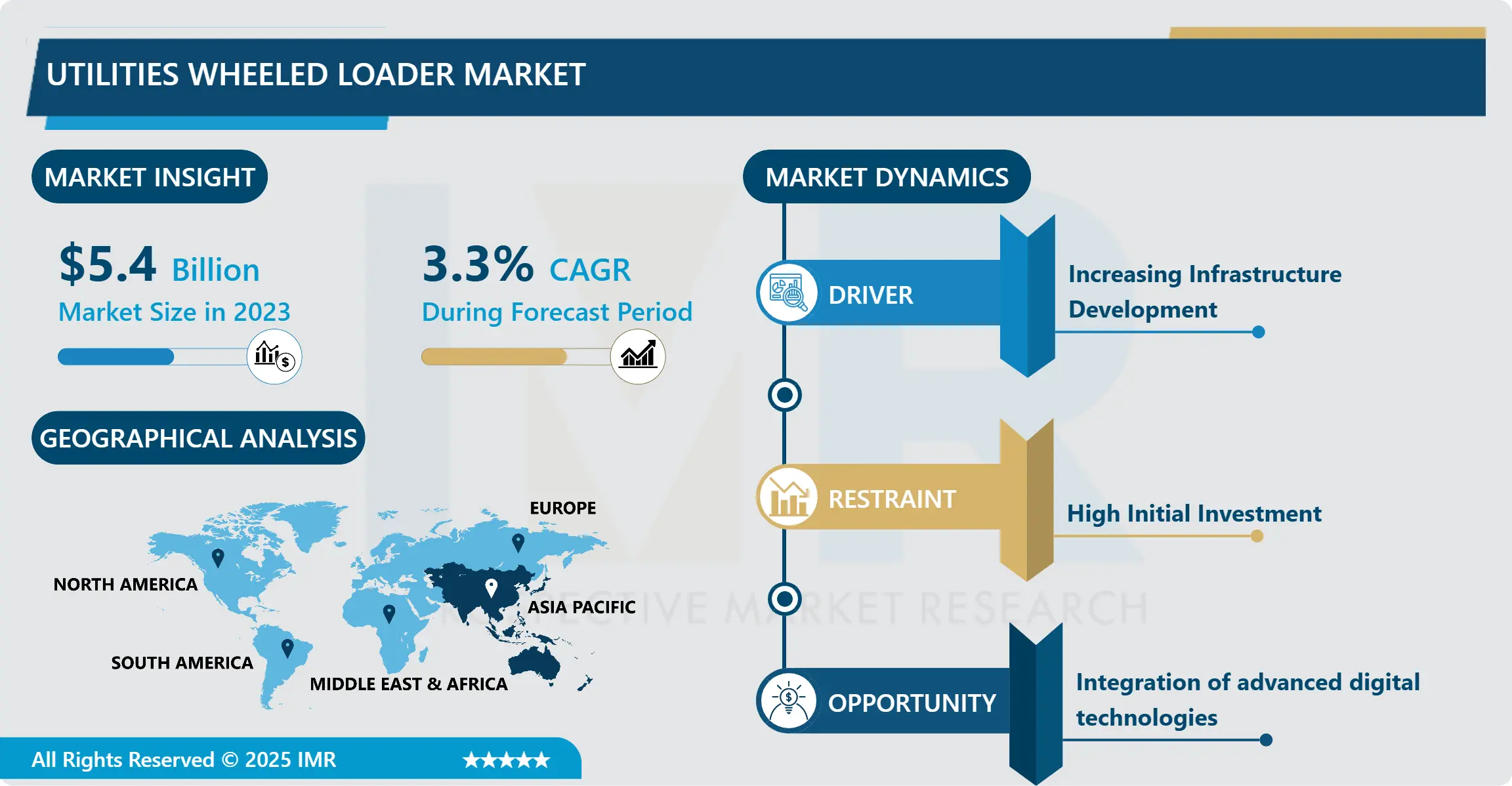

Utilities Wheeled Loader Market Size Was Valued at USD 5.4 Billion in 2023, and is Projected to Reach USD 7.2 Billion by 2032, Growing at a CAGR of 3.3% From 2024-2032.

A Utilities Wheeled Loader can be defined as a type of wheeled vehicle used in performing utility related tasks that are contained in construction as well as in maintenance. This type of loader includes several features and additional tools that are used for usage in many types of utility work including digging, lifting, and transporting materials for work in the urban or rural environments for construction. Utilities wheeled loaders generally provide the abilities to navigate the difficult-to-traversed but required regions in efficiency and security scenarios ranging from trenching for pipelines, loading for utility project needs, or clearing obstructs from utility paths. They play a significant role in the provision and development of utility networks, providing support in efficiency and growth of several services consisting in water supply, power and light, communicating and waste disposal.

This Utilities Wheeled Loader market is highly significant to the upkeep of utilities related to services such as water companies, electricity providers, telecommunications and waste disposal. Thus, the following conclusions could be made: Due to the increase of urbanization and industrialization all over the world, the request to efficient and effective equipment such as utilities wheeled loaders will rise as well. They are used in trenching, material movement and other general duties in the utility networks’ construction and maintenance.

The potential factors that provoke the development of the Utilities Wheeled Loader market include the continuous development of infrastructures in the developed countries and increasing urbanization in the developing region. The prime minister’s recent comments on infrastructure highlight that both governments and private entities are always investing in the refurbishment of dilapidated structures and the expansion of utility facilities as demands continue to rise. This trend increases the need for better alternatives of loaders that will be efficient and safer, have low emission and are mechanically improved. Also, through aspects like telematics and automation systems, new technologies are changing these machines to be more efficient and user friendly. In summary, the market for Utility Wheeled Loader will remain bright as infrastructure requirements are expected heighten globally.

Utilities Wheeled Loader Market Trend Analysis

Increasing adoption of electric and hybrid models

- Another key trend associated with the Utilities Wheeled Loader is an extended use of electrical and hybrid wheeled loaders. With growing emphasis placed on environmental degradation and climate change, the focus is transferred to finding cleaner sources of energy, and construction equipment is no different. Over the past decade and a half electric and hybrid wheeled loaders have been reported to produce lower emissions than the conventional diesel models. This shift is as a result of demand for low emission levels, incentives offered to equipment producers to produce environmentally friendly equipment and reduced operational costs such as fuel and force needed to maintain equipment with low fuel consumption.

- However, electric-loader technologies are becoming increasingly feasible for high-intensity use, such as in utility maintenance and construction due to innovations in battery development. They have the popularity in the densely populated region due to noise and air pollution problem. It has also been noted that manufacturers are currently focusing on enhancing the performance characteristics of the electric and hybrid utilities wheeled loaders, the range, and respective charging facilities since specialists expect an increased demand for the efficient construction solutions with reduced environmental impact in the close years.

Integration of advanced digital technologies

- A futuristic trend in Wheeled Loader market of the Utility sector is the application of innovative technology solutions which include, artificial intelligence and IoT functionalities. These technologies can help operators foster a revolution in how they handle wheeled loaders in utility use.

- A specific opportunity is the prospect of smart loaders that incorporate Artificial Intelligence, which is capable of implementing a self-maintenance feature. The specific loaders that were discussed in this article can feature sensors and use big data to analyze the situation and diagnose various problems in real-time, thus preventing significant complications and expenses. This form of health management indeed improves the reliability of the machines while equally minimizing the duration they take before they are fixed, and the cost of fixing them, which will be important gains to utility companies.

- Moreover, the integration of wheeled loaders under the IoT umbrella of utilities can be a part of the broader smart ecosystem of structure. It can transmit the operating conditions, the fuel consumption rate, and productivity standards to centrally located control boards. This RTDS visibility of the mobile assets allows fleet managers to best allocate the equipment’s usage in the field, as well as assess the assets’ performances remotely, and thus effectively decide on how best to augment the efficiency of the entire operation.

Utilities Wheeled Loader Market Segment Analysis:

Utilities Wheeled Loader Market Segmented on the basis of product type and application.

By Product Type, Compact Wheeled Loader segment is expected to dominate the market during the forecast period

- It also indicated that, Out of all the Utilities Wheeled Loader segments, the Compact Wheeled Loader segment is expected to dominate the market in the given forecast period on account of few factors. These loaders are particularly appreciated for flexibility and for manoeuvrability which means that they can be used in the dense city contexts and often limited spaces characteristic for utility maintenance. Bearing a small footprint, the models provide operators with the opportunity to engage them in a variety of tasks from loading, digging, to handling materials without a doubt sacrificing horsepower and productivity.

- In addition, technology improvement has expanded the versatility of compact wheeled loaders as utility applications such that they gain enhanced ability to perform tasks efficiently and with minimized impact on the environment. Depending on the wheeled loader, its application is closely tied to investment in utility infrastructure schemes that are still growing today in certain continents and cities characterized by high population density and limited space for civil constructions, thus calling for high-utility compact lines of wheeled loaders to be launched into the market.

By Application, Construction segment expected to held the largest share

- Some of the key market segments or applications in the global Wheeled Loader market for Utilities Construction sector includes construction, and others the construction segment is expected to have the largest market share due to its use in construction activities related to utilities. Wheeled loaders are useful particularly in the performing construction tasks including digging, loading, grading, and transporting of the construction material which are vital in the construction and development of utility such as water, electricity, and even telecommunication. With a constantly rising trend as the world shifts to more urbanization, the construction industry will always have an increasing demand for more and improved utility services and because utilities wheeled loaders play a big part in construction and infrastructural developments, their demand is likely to remain firm in the future.

- Further, continuous capital expenditure been made towards infrastructures development projects in the both developed as well as in the emerging economies provide the enhanced chances of growth to this segment. Utilities wheeled loaders are vital equipment in construction industries due to its flexibility, effectiveness, and ability; are therefore key enablers in meeting the infrastructure demand of today’s urban and industrial economy.

Utilities Wheeled Loader Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- A critical understanding of the Utilities Wheeled Loader market in the Asia Pacific region and forecast over the upcoming years can hence be easily arrived at. These trends are therefore underscored by the following factors. First of all, the fast pace of change in urbanization and industrialization processes in the countries like China and india as well as in a number of SEA nations leads to the significant investments in infrastructure projects, including utility ones: water supply systems, electric networks, telephone and other communications networks. These are big tasks for which one needs tough and effective machineries such as the wheel loader, especially for digging tasks, trenches, materials and site development.

- Additionally, effector governments have shifted attention toward infrastructure development to accommodate the growing economy and land use. Smart infrastructure and global concerns for sustainable development also contribute towards the growth in the use of advanced construction equipment that is efficient in its performance and is eco-friendly. Motor market in the Asia Pacific region is boosted by increased construction industry, growing per-capita income, and increasing largeness of populations in urban areas which in return leads to steady market demand for utilities wheeled loaders.

Active Key Players in the Utilities Wheeled Loader Market

- Caterpillar Inc. (USA)

- CNH Industrial N.V. (Italy)

- Doosan Infracore (South Korea)

- Hitachi Construction Machinery Co., Ltd. (Japan)

- Hyundai Construction Equipment Co., Ltd. (South Korea)

- JCB (United Kingdom)

- Komatsu Ltd. (Japan)

- Kubota Corporation (Japan)

- Liebherr Group (Switzerland)

- SANY Group (China)

- Terex Corporation (USA)

- Volvo Construction Equipment (Sweden)

- Wacker Neuson SE (Germany)

- XCMG Group (China)

- Yanmar Holdings Co., Ltd. (Japan)

- Other key Players

Key Industry Developments in the Utilities Wheeled Loader Market:

- October 2023, Caterpillar Inc. has unveiled a compact wheeled loader of the future that is equipped with sophisticated telematics features and enhanced fuel efficiency, thereby meeting the changing requirements of a variety of industries.

- September 2023, Volvo Construction Equipment has introduced a compact wheeled loader that is designed for applications that necessitate precision and robust performance, and it boasts improved maneuverability and durability.

|

Utilities Wheeled Loader Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.3 % |

Market Size in 2032: |

USD 7.2 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Utilities Wheeled Loader Market by Product Type (2018-2032)

4.1 Utilities Wheeled Loader Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Compact Wheeled Loader

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Mini Wheeled Loader

4.5 Large Wheeled Loader

Chapter 5: Utilities Wheeled Loader Market by Application (2018-2032)

5.1 Utilities Wheeled Loader Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Construction

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Mining

5.5 Agriculture

5.6 Landscaping

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Utilities Wheeled Loader Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 CATERPILLAR INC. (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CNH INDUSTRIAL N.V. (ITALY)

6.4 DOOSAN INFRACORE (SOUTH KOREA)

6.5 HITACHI CONSTRUCTION MACHINERY COLTD. (JAPAN)

6.6 HYUNDAI CONSTRUCTION EQUIPMENT COLTD. (SOUTH KOREA)

6.7 JCB (UNITED KINGDOM)

6.8 KOMATSU LTD. (JAPAN)

6.9 KUBOTA CORPORATION (JAPAN)

6.10 LIEBHERR GROUP (SWITZERLAND)

6.11 SANY GROUP (CHINA)

6.12 TEREX CORPORATION (USA)

6.13 VOLVO CONSTRUCTION EQUIPMENT (SWEDEN)

6.14 WACKER NEUSON SE (GERMANY)

6.15 XCMG GROUP (CHINA)

6.16 YANMAR HOLDINGS COLTD. (JAPAN)

6.17 OTHER KEY PLAYERS

Chapter 7: Global Utilities Wheeled Loader Market By Region

7.1 Overview

7.2. North America Utilities Wheeled Loader Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Product Type

7.2.4.1 Compact Wheeled Loader

7.2.4.2 Mini Wheeled Loader

7.2.4.3 Large Wheeled Loader

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Construction

7.2.5.2 Mining

7.2.5.3 Agriculture

7.2.5.4 Landscaping

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Utilities Wheeled Loader Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Product Type

7.3.4.1 Compact Wheeled Loader

7.3.4.2 Mini Wheeled Loader

7.3.4.3 Large Wheeled Loader

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Construction

7.3.5.2 Mining

7.3.5.3 Agriculture

7.3.5.4 Landscaping

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Utilities Wheeled Loader Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Product Type

7.4.4.1 Compact Wheeled Loader

7.4.4.2 Mini Wheeled Loader

7.4.4.3 Large Wheeled Loader

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Construction

7.4.5.2 Mining

7.4.5.3 Agriculture

7.4.5.4 Landscaping

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Utilities Wheeled Loader Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Product Type

7.5.4.1 Compact Wheeled Loader

7.5.4.2 Mini Wheeled Loader

7.5.4.3 Large Wheeled Loader

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Construction

7.5.5.2 Mining

7.5.5.3 Agriculture

7.5.5.4 Landscaping

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Utilities Wheeled Loader Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Product Type

7.6.4.1 Compact Wheeled Loader

7.6.4.2 Mini Wheeled Loader

7.6.4.3 Large Wheeled Loader

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Construction

7.6.5.2 Mining

7.6.5.3 Agriculture

7.6.5.4 Landscaping

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Utilities Wheeled Loader Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Product Type

7.7.4.1 Compact Wheeled Loader

7.7.4.2 Mini Wheeled Loader

7.7.4.3 Large Wheeled Loader

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Construction

7.7.5.2 Mining

7.7.5.3 Agriculture

7.7.5.4 Landscaping

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Utilities Wheeled Loader Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 5.4 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.3 % |

Market Size in 2032: |

USD 7.2 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||