Key Market Highlights

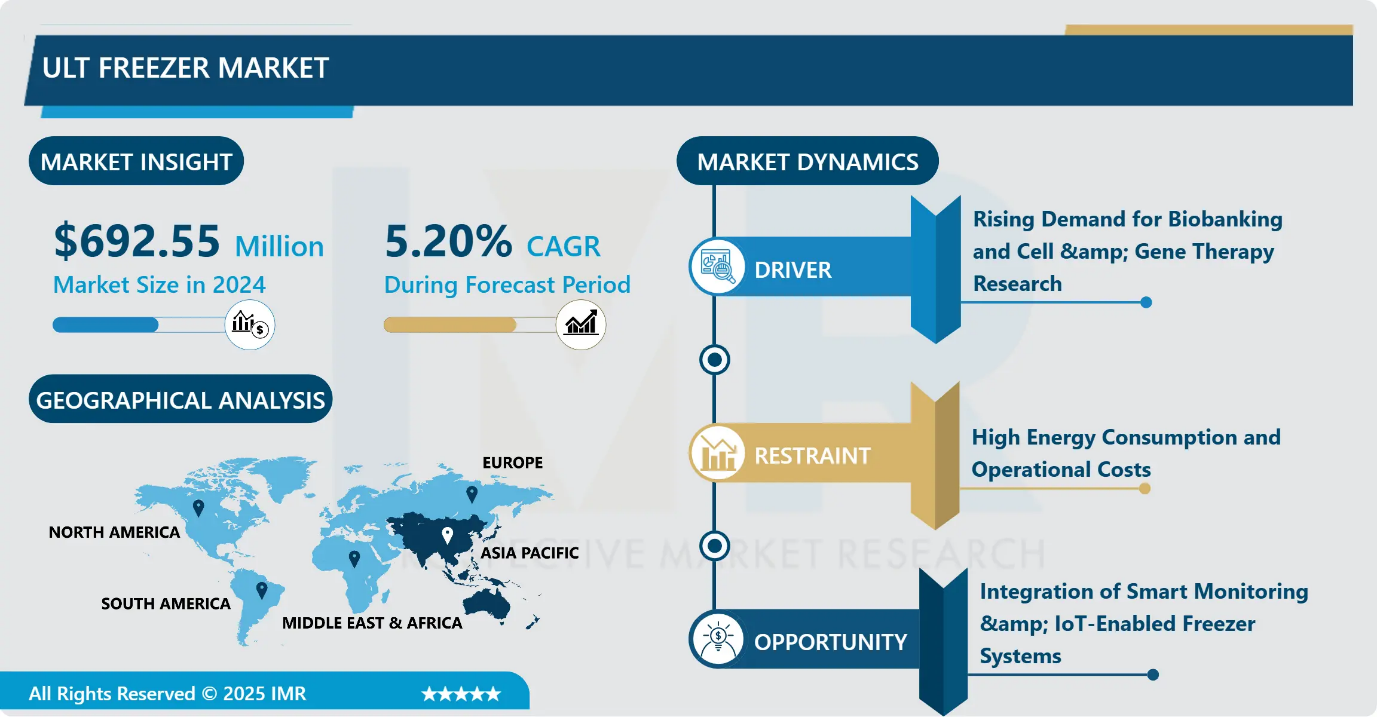

ULT Freezer Market Size Was Valued at USD 692.55 Million in 2024, and is Projected to Reach USD 1,108.80 Million by 2035, Growing at a CAGR of 5.2% from 2025-2035.

- Market Size in 2024: USD 692.55 Million

- Projected Market Size by 2035: USD 1108 Million/Billion

- CAGR (2025–2035): 5.2%

- Leading Market in 2024: Asia-Pacific

- Fastest-Growing Market: North America

- By Type: The Upright ULT Freezer segment is anticipated to lead the market by accounting for 58.61% of the market share throughout the forecast period.

- By Technology: The Automated segment is expected to capture 60.43% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: Asia-Pacific region is projected to hold 31.56% of the market share during the forecast period.

- Active Players: Thermo (U.S), So-Low (U.S), VWR (U.S), GFL (Canada), Eppendorf (Germany), Nuaire (U.K), Froilabo (U.K), Binder (Germany), Haier (China), Aucma (China), Panasonic (Japan), Nihon Freezer (Japan), Esco Global (Singapore), IlShin (South Korea), and Other Major Players

ULT Freezer Market Synopsis:

Ultra-low temperature (ULT) Freezers are specialized refrigeration units designed to reach and maintain extremely low temperatures. Freezers are crucial for preserving the integrity of biological samples, vaccines, and other temperature-sensitive materials in various industries. The ability to sustain such low temperatures is vital for the long-term storage of biological specimens, ensuring the viability of research materials and the efficacy of pharmaceuticals.

The importance of ULT freezers is particularly evident in the healthcare, biotechnology, and pharmaceutical sectors. In healthcare, ULT freezers are essential for storing blood components, tissues, and vaccines, ensuring that these critical medical supplies remain viable for use. In biotechnology and pharmaceuticals, ULT freezers play a pivotal role in preserving enzymes, proteins, and DNA samples, supporting ongoing research and development efforts.

ULT Freezer Market Dynamics and Trend Analysis:

ULT Freezer Market Growth Driver - Rising Demand for Biobanking and Cell & Gene Therapy Research

-

One of the strongest drivers for the Ultra-Low Temperature (ULT) Freezer market is the rapid expansion of biobanking and advanced therapeutic research, particularly in cell and gene therapy, personalized medicine, and vaccine development. As healthcare systems and pharmaceutical companies increasingly focus on long-term preservation of high-value biological samples.

- DNA, RNA, stem cells, plasma, and vaccine dose the need for reliable storage at –80°C to –150°C has accelerated. Large-scale biorepositories, clinical trial growth, and regulatory emphasis on sample integrity are pushing research institutions and biotech companies to invest in high-capacity, automated ULT freezers with enhanced temperature stability, energy efficiency, and remote monitoring capabilities.

ULT Freezer Market Limiting Factor - High Energy Consumption and Operational Costs

-

A key restraint in the Ultra-Low Temperature (ULT) Freezer market is the high energy consumption and associated operating costs required to maintain temperatures between –80°C and –150°C. Traditional ULT freezers can consume significantly more electricity than standard laboratory equipment, increasing the financial burden on research institutions, academic laboratories, and small biotech facilities with limited budgets.

- Additionally, the need for continuous power backup systems and regular maintenance to ensure temperature stability further raises operating expenses. As sustainability goals become more stringent and energy prices fluctuate, cost sensitivity may delay replacement cycles and limit adoption, especially in emerging markets and smaller research environments.

ULT Freezer Market Expansion Opportunity - Integration of Smart Monitoring & IoT-Enabled Freezer Systems

-

A major growth opportunity for the ULT freezer market lies in the increasing adoption of IoT-enabled and smart monitoring systems that provide real-time temperature tracking, predictive maintenance, and automated sample management. As laboratories transition toward digital and remote operations, demand is rising for freezers equipped with cloud connectivity, AI-based alerts, energy optimization controls, and integration with Laboratory Information Management Systems (LIMS).

- These technologies reduce manual intervention, minimize sample loss risk, and improve operational efficiency particularly valuable for large bio-banks, vaccine storage hubs, and pharmaceutical R&D facilities. Growing investments in digital lab automation and smart infrastructure globally are expected to accelerate the adoption of advanced connected ULT freezer solutions.

ULT Freezer Market Challenge and Risk - Supply Chain Vulnerability and Component Reliability Issues

-

A significant challenge for the ULT freezer market is the vulnerability of supply chains for critical components such as high-performance compressors, specialized refrigerants, sensors, and electronic control systems. Disruptions caused by geopolitical tensions, raw material shortages, or transportation delays can lead to extended production cycles and increased manufacturing costs.

- Additionally, ULT freezers operate under extreme conditions, and any component failure may result in catastrophic sample loss, creating high risk exposure for pharmaceutical companies, biobanks, and research institutions. This elevates expectations around product reliability, service response time, and strict quality validation putting pressure on manufacturers to balance performance with cost efficiency.

ULT Freezer Market Trend- Shift toward energy - efficient, smart, and sustainable ULT freezer solutions

-

There is a clear trend within the ULT freezer market toward adoption of energy-efficient models with improved insulation, advanced compressors, and lower power consumption. the same time, manufacturers are increasingly integrating “smart” features such as remote temperature monitoring, automated alarms, data logging for sample integrity, and compatibility with laboratory information management systems (LIMS) reflecting growing demand from biobanks, pharmaceutical research labs, and vaccine-storage facilities for reliability and regulatory compliance.

- This shift is driven not only by operational cost concerns (energy consumption, maintenance) but also by regulatory and quality-assurance requirements as biological sample storage becomes more critical. As labs scale up sample storage, especially in biotech, clinical research, and biobanking, the demand rises for freezers that combine ultra-low temperature capability with energy efficiency and intelligent monitoring.

ULT Freezer Market Segment Analysis:

ULT Freezer Market is segmented based on Type, Capacity, Technology, and Region

By Type, Upright ULT Freezers segment is expected to dominate the market with around 58.61% share during the forecast period.

-

Upright ULT freezers currently represent the largest revenue-generating segment within the market due to their high storage density and ease of sample access. They are widely preferred in pharmaceutical and biotechnology companies, biobanks, and large academic research facilities because they support organized sample management, multi-shelf configuration, and efficient retrieval for high-throughput workflows.

- Their space-efficient vertical design allows laboratories to store a higher volume of samples without expanding physical facility footprint. As automation and remote monitoring become priorities, upright models are increasingly being equipped with IoT connectivity, inventory tracking, and enhanced alarm systems, driving premium pricing and strong future growth.

By Technology, Automated ULT Freezers is expected to dominate with close to 60.43% market share during the forecast period.

-

Automated ULT freezers represent the fastest-growing technology segment driven by increasing demand for precision sample handling, digital traceability, and minimal human intervention. These systems integrate IoT connectivity, AI-based temperature control, predictive maintenance, automated alarms, and inventory management, often linked to Laboratory Information Management Systems (LIMS).

- Automated freezers help reduce risk of sample loss, maintain regulatory compliance, and improve workflow efficiency critical for biobanks, pharmaceutical R&D, vaccine storage facilities, and large research institutions dealing with thousands of specimens. Although the initial cost and technical complexity are higher, automation delivers long-term value through energy optimization and reduced manpower dependency, positioning this segment for strong future adoption.

ULT Freezer Market Regional Insights:

Asia Pacific region is estimated to lead the market with around 31.56% share during the forecast period.

-

The healthcare sector in the region is experiencing a swift in research and development activities, particularly in biotechnology and life sciences. The rising necessity for the preservation of biological samples, vaccines, and other temperature-sensitive materials is driving the widespread adoption of ULT freezers across research institutions, pharmaceutical companies, and healthcare facilities throughout the Asia Pacific. The region's deliberate efforts to expand healthcare infrastructure, complemented by government initiatives supporting scientific research, are providing additional momentum to the ULT freezer market.

- Moreover, the market's growth in the region is driven by the presence of key players, both domestic and international. These companies are actively investing in innovative solutions to enhance the efficiency and sustainability of ULT freezers, aligning with the growing emphasis on environmentally friendly technologies. The Asia Pacific ULT freezer market is growing due to dynamic economic conditions and rising advanced storage solutions in the biopharmaceutical sector.

ULT Freezer Market Active Players:

- Aucma (China)

- Binder (Germany)

- Eppendorf (Germany)

- Esco Global (Singapore)

- Froilabo (U.K)

- GFL (Canada)

- Haier (China)

- IlShin (South Korea)

- Nihon Freezer (Japan)

- Nuaire (U.K)

- Panasonic (Japan)

- So-Low (U.S)

- Thermo (U.S)

- VWR (U.S), and Other Active Players

Key Industry Developments in the ULT Freezer Market:

-

In April 2024, Thermo Fisher Scientific has unveiled its new TSX Universal Series ULT Freezers, designed to deliver stronger performance, faster temperature recovery, and up to 33% energy savings. Leveraging universal V-Drive technology and an expanded temperature setpoint range, the units accommodate a broad range of research and pharmaceutical workflows from high-use academic labs to long-term storage environments. The launch reflects growing industry demand for reliable, regulatory-aligned cold storage solutions that also advance organizational sustainability objectives.

- In June 2023, BioLife Solutions, Inc., a leading developer and supplier of biotechnology products and services for Cell and Gene Therapy (CGT) and broader biopharmaceutical markets announced the launch of a new High-Capacity Controlled Freezer (CRF) to expand its CRF range, now available in three different formats. This IntelliRate i67C benchtop freezer meets important customer needs for large-scale production of cell therapies.

Inside the ULT Freezer: Safeguarding Your Valuable Samples:

-

Ultra-Low Temperature (ULT) freezers are engineered to maintain extremely low storage temperatures ranging from –80°C to –150°C, essential for preserving the structural and biological integrity of sensitive materials such as DNA, RNA, proteins, stem cells, viral vectors, vaccines, and clinical specimens.

- They use a dual-cascade refrigeration system, where two independent compressor cycles work sequentially: the first stage cools to around – 40°C, and the second stage drives temperatures down to ultra-low ranges.

- High-performance insulation, vacuum-sealed panels, thermal buffers, and microprocessor-based monitoring systems ensure temperature stability even during frequent door openings. Precision sensors continuously track temperature distribution to prevent sample degradation or loss.

- In modern research and healthcare, sample integrity equals scientific reliability. A few degrees of variability can compromise years of research or high-value clinical trial materials, making dependable ultra-cold storage a critical backbone of biobanking, cell and gene therapy development, pandemic-response vaccine programs, and long-term population genomics studies. They also support compliance with global regulatory frameworks like GMP, GLP, and FDA/EMA bio sample handling standards.

- Recent innovations include IoT-enabled remote monitoring, AI-based predictive maintenance, automated sample inventory management, energy-efficient compressors reducing power use by up to 30 – 40%, natural refrigerants with low GWP, and integration with LIMS and robotics to support fully automated sample retrieval workflows. These advancements enable smarter, safer, and more sustainable cold-chain ecosystems fundamental for the next decade of personalized medicine and advanced biologics.

|

ULT Freezer Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 692.55 Mn. |

|

Forecast Period 2025-35 CAGR: |

5.2 % |

Market Size in 2035: |

USD 1108.80 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Technology

|

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: ULT Freezer Market by Type (2018-2032)

4.1 ULT Freezer Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Upright Freezer

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Chest Freezer

Chapter 5: ULT Freezer Market by Capacity (2018-2032)

5.1 ULT Freezer Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Less than 300 Liters

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 301-500 Liters

5.5 501-700 Liters

5.6 701-900 Liters

5.7 More than 900 Liters

Chapter 6: ULT Freezer Market by Technology (2018-2032)

6.1 ULT Freezer Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automated

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Semi-automated

Chapter 7: ULT Freezer Market by End User (2018-2032)

7.1 ULT Freezer Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Bio-Banks

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Academic and Research Laboratories

7.5 Pharmaceutical and Biotechnology Companies

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 ULT Freezer Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 AUCMA (CHINA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 BINDER (GERMANY)

8.4 EPPENDORF (GERMANY)

8.5 ESCO GLOBAL (SINGAPORE)

8.6 FROILABO (U.K)

8.7 GFL (CANADA)

8.8 HAIER (CHINA)

8.9 ILSHIN (SOUTH KOREA)

8.10 NIHON FREEZER (JAPAN)

8.11 NUAIRE (U.K)

8.12 PANASONIC (JAPAN)

8.13 SO-LOW (U.S)

8.14 THERMO (U.S)

8.15 VWR (U.S)

8.16 OTHER ACTIVE PLAYERS

Chapter 9: Global ULT Freezer Market By Region

9.1 Overview

9.2. North America ULT Freezer Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe ULT Freezer Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe ULT Freezer Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific ULT Freezer Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa ULT Freezer Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America ULT Freezer Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 12 Analyst Viewpoint and Conclusion

Chapter 13 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 14 Case Study

Chapter 15 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

ULT Freezer Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 692.55 Mn. |

|

Forecast Period 2025-35 CAGR: |

5.2 % |

Market Size in 2035: |

USD 1108.80 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application

|

|

||

|

By Technology

|

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||