Laboratory Information Systems Market Synopsis:

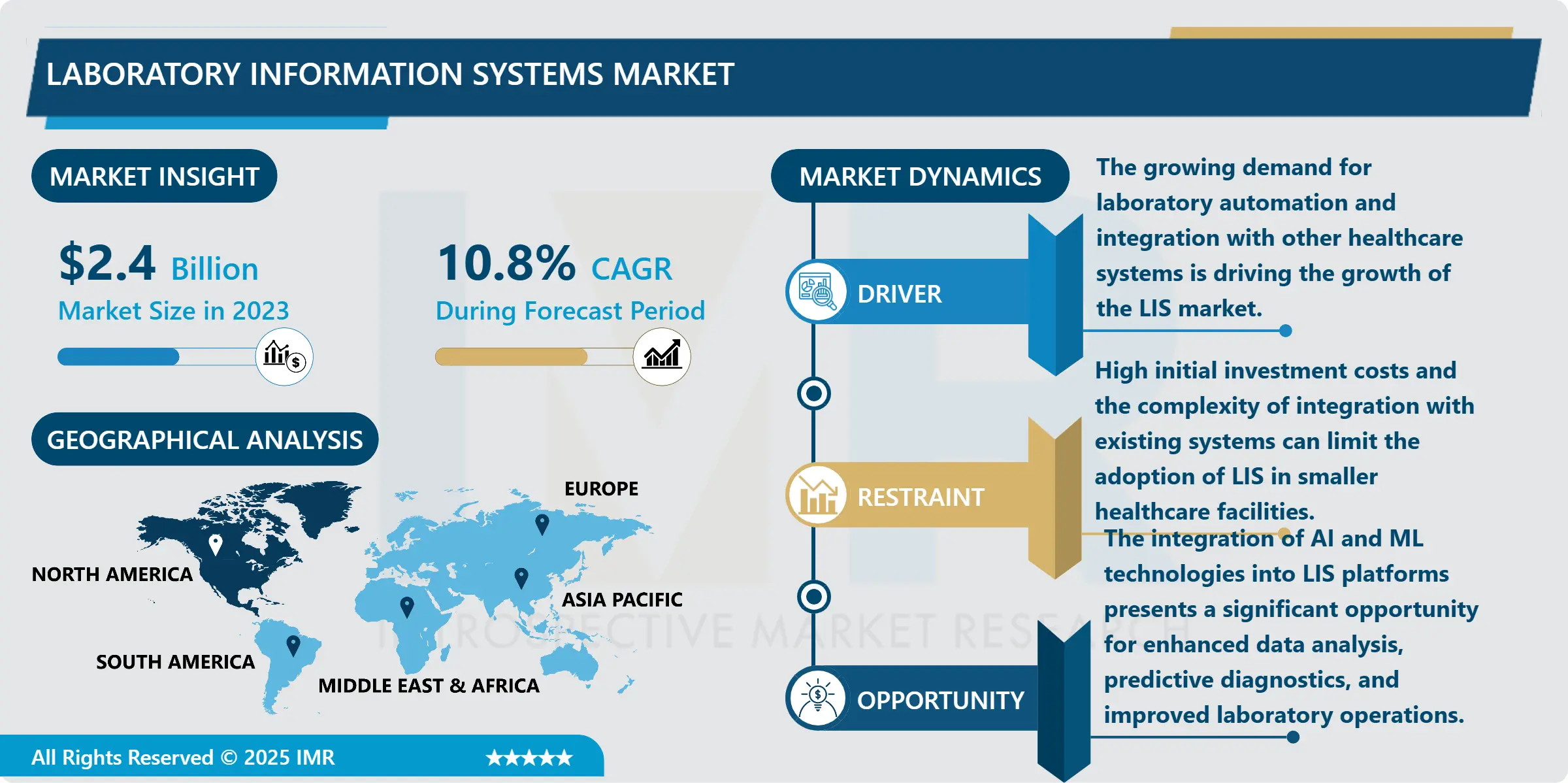

Laboratory Information Systems Market Size Was Valued at USD 2.4 Billion in 2023, and is Projected to Reach USD 6.04 Billion by 2032, Growing at a CAGR of 10.8% From 2024-2032.

A Laboratory Information System or System of Lab Information is a program that encompasses the management, storage and/or analysis of information generated from testing and research in a laboratory. LIS solutions are usually applied in different clinical, medical, pharmaceutical, research, and industrial laboratories for such activities as the ordering of tests, tracking of samples, reporting of results and adherence to the regulatory requirements. The system promotes the achievement of enhanced patient outcomes, enhances efficiency in managing laboratory systems, and guarantees precise and timely outcomes.

This research provides a detailed look at the LIS, and it has been concluded that the evolution of LIS to a complex HIT system has spurred the growth of the market over recent years due to increasing healthcare needs and the need for automation of laboratory services. The implementation of LIS has becomes fast and rampant in clinical laboratories, healthcare centers and research hospitals since these systems bring about efficiency, data management and compliance. With testing services under increasing pressure to increase laboratory work flow productivity, decrease errors and improve patient outcomes, the opportunity to expand LIS functionality has grown rapidly. Also, the increasing implementation of integrated medical care systems that require the exchange of sensitive data between laboratories and other organizational branches contributes positively to the market’s growth.

One of the major trends that has emerged recently in the LIS market is the outsourcing of the solutions into the cloud. The benefits of the cloud computing are as follows: these are flexibility in terms of capacity, cheaper price as well as flexible accessibility from any location. As time goes, it has become common to see many laboratory systems moving their data to-cloud based systems since this makes it easier for laboratories to handle large volume of data. It is also benefiting laboratories by decreasing operating expenses while enhancing the speed and flexibility at which labs function. Not only that, cloud-based LIS can also allow interoperability of information between multiple sites and laboratories which in turn will contribute to better patient outcomes. These trends suggest that further development of laboratory organizations will also adopt the use of cloud technologies.

Laboratory Information Systems Market Trend Analysis:

Cloud-Based LIS Solutions Revolutionizing the Market

- Another important trend birth in the LIS market is the prevalence of cloud solutions. Cloud scaling makes it possible for laboratories to obtain data from nearly any location, which enhances the ability of health care professionals to communicate and share information. It also eliminates the obvious factor of having pre-existing infrastructure, it also cuts out the maintenance costs as well as the enhancement of the scalability of a system. LIS platform in the cloud is quickly gaining popularity among healthcare centers because the models possess several advantages such as increased flexibility, integrated automatic updates, and optimum protection of data. Furthermore, these platforms provide improved options for disaster recovery, so critical laboratory data is never lost and can be recovered whenever necessary.

- In addition, the expandability of cloud implementations provides the increasing data handling demands of the modern laboratory. With the increase in size of the patient data as well as the pressure of time that goes an advocating for cloud solutions enables large data volumes to be processed without necessarily using locally hosted expensive servers. This has contributed to clinic and research laboratories to adopt cloud based LIS platforms drawing the uptake rate for this technology across places. It is assumed that as cloud technology advances more laboratories are going to switch to the cloud applications which in its turn will propel the market development and revolutionize the laboratory environment.

Integration with Artificial Intelligence and Machine Learning

- Another compelling concept for the market is the use of Artificial Intelligence (AI) and Machine Learning (ML) with Laboratory Information Systems (LIS). AI and ML can complement LIS by what is explained as follows; Those are automation, diagnostics, and workflow optimization. The integration of AI algorithms into LIS can improve test results interpretation and facilitate more informed and quicker correct decisions in laboratories, and can ultimately benefit the patient as well. That is why AI solutions in LIS can also contribute to the identification of regularities in the results of tests, and, therefore, more efficient diagnosis of diseases and decisions on their treatment. In addition, repetitive work will be handled by the AI and ML with reduced chances of errors as witnessed in human operation thus improving on efficiency in a laboratory.

- AI and ML application to laboratory systems also lead to the possibility of introducing further developments in the sphere of personalized medicine. By combining patient information with AI algorithms, laboratories can deliver better analytical results and personalized test reports, that refine medical therapies and overall patient care. This integration of AI and LIS is likely to redefine the status of the health care industry and offer additional impetus to future progression of the market. Therefore, there is a chance for the LIS providers to expand their work on the creation of the AI for the enhancement of the accuracy of identifying the patients’ needs in the field of precision medicine and data-driven health care. The integration of AI and ML into LIS will remain in progress, thereby providing vast possibilities for the growth of the market.

Laboratory Information Systems Market Segment Analysis:

Laboratory Information Systems Market is Segmented on the basis of Type, Application, End User, and Region.

By Type, Clinical LIS segment is expected to dominate the market during the forecast period

- The Laboratory Information Systems (LIS) is divided largely into Clinical LIS, Anatomical LIS and Molecular LIS as the market requirements in the laboratory. Clinical LIS is a system that is specially used to deal with data that is actually involved in patient care and clinical lab tests data. These systems can be utilized for many unit operations of the clinical laboratory such as test ordering, reporting and handling of patient data. Clinical LIS is implemented in almost all the hospitals, diagnostic labs, and healthcare facilities for faster and accurate diagnosis of different tests like blood test, urine test and biochemistry testing.

- On the other hand, Anatomical LIS and Molecular LIS are more specialized form of LIS which is being implemented in organization holding some for of laboratory functions. Anatomical LIS is used in managing data on districts that involve histology, cytology and pathology labs in which tissue and cell analyzation is done. It is credited for enforcing a technique that is vital in reporting pathways from functional test results like biopsies and cancer diagnosis. On the other hand, Molecular LIS is applied in developing LIS in molecular diagnostic laboratories such as genetic diagnostic laboratories, DNA sequencing laboratories, molecular biology laboratories, and any other laboratory engaged in molecular diagnostic tests. This type of LIS is critical in coping with other complicated data stemming from molecular tests to boost personalized medicine and genetics.

By Application, Pathology segment expected to held the largest share

- Applications of the Laboratory Information Systems (LIS) market include Blood Bank, Microbiology, Pathology, Clinical Chemistry and more. Blood Bank applications are based on the organization of blood collection and transfusion, as well as on identification of blood types and compatibility. LIS is playing an important role in blood banks by identifying the matching between the donors and recipients, managing the stock and dealing with the legal requirements. These systems have been particularly effective in enhancing the safety of patients particularly in relation to transfusion errors.

- Other important solutions in LIS market comprise Microbiology, Pathology, and Clinical Chemistry. Microbiology LIS specializes in tests concerning infection diseases, culture and microbial resistance. It also applies to the LIS management of tissue samples and biopsies and autopsies that help the pathologists determine the diseases including cancer. Clinical Chemistry refers to the branch of LIS that deals with the flow of data obtained from tests that determine the content of chemicals in body fluids like blood, glucose, cholesterol and liver enzyme data. Besides these, there are other LIS solutions for applications like Haematology, Virology and Toxicology are also available in the market and increasing the domain across all facials of the laboratory.

Laboratory Information Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America will remain the largest consumer of Laboratory Information Systems (LIS) in the forecast period of 2023. Many of the largest health care systems and research facilities are located in the region and they represent the core consumer base of comprehensive LIS solutions. North America enjoys a robust healthcare Industry and also because LIS solutions play a crucial role as there is growing demand for laboratory automation and data management. There is a high demand for these Systems in clinical Laboratories and Research centers in United States mainly because they are rampantly used in hospitals.

- According to market share, North America dominated the global Laboratory Information Systems market and would account for 40% to 45% in 2023. This dominance is explained by technological developments, high expenditure on healthcare, and key players who increasingly invest in LIS system improvement across the region. Moreover, the push for more efficient healthcare and better patient care by government of North American countries has boosted the growth of LIS. Therefore, this area remains the leader in the global LIS market, and according to the trend, it will remain the leading market in the coming years.

Active Key Players in the Laboratory Information Systems Market:

- Agilent Technologies (USA)

- Auto Genomics (USA)

- Cerner Corporation (USA)

- Campgroup Medical (Germany)

- EPIC Systems Corporation (USA)

- Fujifilm Holdings Corporation (Japan)

- GeBBS Healthcare Solutions (USA)

- Hamilton Robotics (USA)

- Honeywell Life Sciences (USA)

- LabCorp (USA)

- McKesson Corporation (USA)

- MEDITECH (USA)

- Roche Diagnostics (Switzerland)

- Soft Computer Consultants (USA)

- Other Active Players.

|

Laboratory Information Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.4 Billion |

|

Forecast Period 2024-32 CAGR: |

10.8% |

Market Size in 2032: |

USD 6.04 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Laboratory Information Systems Market by Type

4.1 Laboratory Information Systems Market Snapshot and Growth Engine

4.2 Laboratory Information Systems Market Overview

4.3 Clinical LIS

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Clinical LIS: Geographic Segmentation Analysis

4.4 Anatomical LIS

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Anatomical LIS: Geographic Segmentation Analysis

4.5 Molecular LIS

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Molecular LIS: Geographic Segmentation Analysis

Chapter 5: Laboratory Information Systems Market by Application

5.1 Laboratory Information Systems Market Snapshot and Growth Engine

5.2 Laboratory Information Systems Market Overview

5.3 Blood Bank

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Blood Bank: Geographic Segmentation Analysis

5.4 Microbiology

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Microbiology: Geographic Segmentation Analysis

5.5 Pathology

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Pathology: Geographic Segmentation Analysis

5.6 Clinical Chemistry

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Clinical Chemistry: Geographic Segmentation Analysis

5.7 Others

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Others: Geographic Segmentation Analysis

Chapter 6: Laboratory Information Systems Market by End User

6.1 Laboratory Information Systems Market Snapshot and Growth Engine

6.2 Laboratory Information Systems Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals: Geographic Segmentation Analysis

6.4 Diagnostic Laboratories

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Diagnostic Laboratories: Geographic Segmentation Analysis

6.5 Research Institutes

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Research Institutes: Geographic Segmentation Analysis

6.6 Other Healthcare Institutions

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Other Healthcare Institutions: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Laboratory Information Systems Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AGILENT TECHNOLOGIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AUTO GENOMICS (USA)

7.4 CERNER CORPORATION (USA)

7.5 CAMPGROUP MEDICAL (GERMANY)

7.6 EPIC SYSTEMS CORPORATION (USA)

7.7 FUJIFILM HOLDINGS CORPORATION (JAPAN)

7.8 GEBBS HEALTHCARE SOLUTIONS (USA)

7.9 HAMILTON ROBOTICS (USA)

7.10 HONEYWELL LIFE SCIENCES (USA)

7.11 LABCORP (USA)

7.12 MCKESSON CORPORATION (USA)

7.13 MEDITECH (USA)

7.14 ROCHE DIAGNOSTICS (SWITZERLAND)

7.15 SOFT COMPUTER CONSULTANTS (USA)

7.16 .

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Laboratory Information Systems Market By Region

8.1 Overview

8.2. North America Laboratory Information Systems Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Clinical LIS

8.2.4.2 Anatomical LIS

8.2.4.3 Molecular LIS

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Blood Bank

8.2.5.2 Microbiology

8.2.5.3 Pathology

8.2.5.4 Clinical Chemistry

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals

8.2.6.2 Diagnostic Laboratories

8.2.6.3 Research Institutes

8.2.6.4 Other Healthcare Institutions

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Laboratory Information Systems Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Clinical LIS

8.3.4.2 Anatomical LIS

8.3.4.3 Molecular LIS

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Blood Bank

8.3.5.2 Microbiology

8.3.5.3 Pathology

8.3.5.4 Clinical Chemistry

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals

8.3.6.2 Diagnostic Laboratories

8.3.6.3 Research Institutes

8.3.6.4 Other Healthcare Institutions

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Laboratory Information Systems Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Clinical LIS

8.4.4.2 Anatomical LIS

8.4.4.3 Molecular LIS

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Blood Bank

8.4.5.2 Microbiology

8.4.5.3 Pathology

8.4.5.4 Clinical Chemistry

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals

8.4.6.2 Diagnostic Laboratories

8.4.6.3 Research Institutes

8.4.6.4 Other Healthcare Institutions

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Laboratory Information Systems Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Clinical LIS

8.5.4.2 Anatomical LIS

8.5.4.3 Molecular LIS

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Blood Bank

8.5.5.2 Microbiology

8.5.5.3 Pathology

8.5.5.4 Clinical Chemistry

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals

8.5.6.2 Diagnostic Laboratories

8.5.6.3 Research Institutes

8.5.6.4 Other Healthcare Institutions

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Laboratory Information Systems Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Clinical LIS

8.6.4.2 Anatomical LIS

8.6.4.3 Molecular LIS

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Blood Bank

8.6.5.2 Microbiology

8.6.5.3 Pathology

8.6.5.4 Clinical Chemistry

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals

8.6.6.2 Diagnostic Laboratories

8.6.6.3 Research Institutes

8.6.6.4 Other Healthcare Institutions

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Laboratory Information Systems Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Clinical LIS

8.7.4.2 Anatomical LIS

8.7.4.3 Molecular LIS

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Blood Bank

8.7.5.2 Microbiology

8.7.5.3 Pathology

8.7.5.4 Clinical Chemistry

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals

8.7.6.2 Diagnostic Laboratories

8.7.6.3 Research Institutes

8.7.6.4 Other Healthcare Institutions

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Laboratory Information Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.4 Billion |

|

Forecast Period 2024-32 CAGR: |

10.8% |

Market Size in 2032: |

USD 6.04 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||