UAE Dental Devices Market Synopsis:

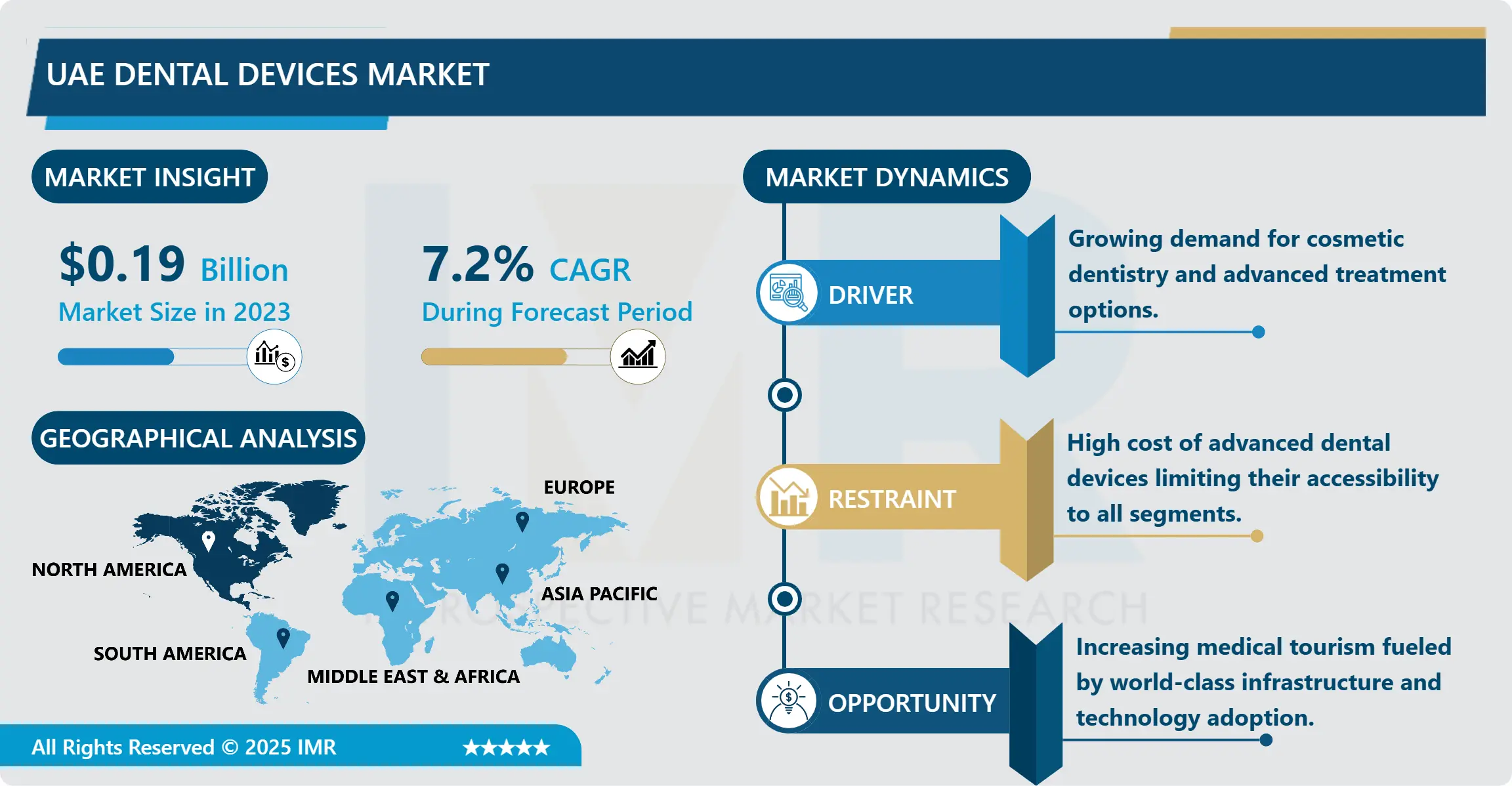

UAE Dental Devices Market Size Was Valued at USD 0.19 Billion in 2023, and is Projected to Reach USD 0.36 Billion by 2032, Growing at a CAGR of 7.20% From 2024-2032.

The UAE Dental Devices Market refers to the current state and activity related to the manufacturing, sale, and utilization of innovative devices and instruments to support dental techniques and services such as diagnosis, treatment, and restoration. This market consists of dental implants and crowns and bridges and dental lasering and intra-oral scanners and orthodontic appliances. It is available for use by general practitioners, orthodontists, oral surgeons and other dental specialist with an aim of promoting oral health as well as aesthetic dentistry.

The UAE Dental Devices Market has been growing at a healthy rate due to a rise in the population being sensitive towards dental hygiene and disorders like caries, periodontal diseases and oral cancer. The growth in the medical tourism sector in the country along with its intent towards the improvement of the health care industry in the region supports this market. The average disposable income in the UAE and loyal demand for the high-end brand in health care create a rich market for adopting the latest technologies in dentistry, which makes the country a dominant player in adopting the latest dental technologies in the Middle Eastern region.

There are many reasons which have fuelled the growth of the market; some of these include increasing demand for cosmetic dentistry. Since looks matter in the current world, then methods that include whitening, dental veneers, and orthodontics are considered. CAD/CAM systems and 3D imaging technology have become the topical technologies within the dental field in the UAE delivering better and quicker treatment. In addition, current and planned policies to foster oral health and developments of health care centres in the un served areas are likely to reinforce the strengths for the market.

UAE Dental Devices Market Trend Analysis:

Digital Dentistry Revolution

-

UAE is experiencing a digital shift in dental industry, and digital dentistry is becoming the new norm across the traditional practices. Intraoral scanners, 3D printing and CAD CAM systems are now common in dentistry due to the precision, efficiency, and convenience they afford to dental treatment. They allow dentists to diagnose more accurately and quickly, give patients better experiences, as well as deliver treatment results more efficiently. This proved to be rather suitable change in principle also at the level, which is trends to focus more on the less invasive and patient-centric approach to care delivery and increasing patient’s expectations to rationalized and individualized care processes.

- Digital dentistry is central to serve the cosmetically conscious UAE population where it helps to deliver localized solutions such as single-visit crowns or veneers, aligners and more. The increase in the usage of these products is due to offer of specialized training and affiliation with dental technology producers. They ensure that dental professionals in the UAE remain with the newest ideas to adopting which they can offer the most advanced dental solutions and at the same time establishing the nation as a hub of the newest techniques in dental care in the Middle East region.

Medical Tourism Driving Market Expansion

-

The competition from Medical tourism has created a big market for the UAE Dental Devices Market by taking advantage of good status in treating patients at cheaper prices. The UAE is located in a point of convergence of Europe, Asia, and Africa, and hence a point of attraction to neighbouring regions for dental treatments. The UAE has started attracting more and more dentistry tourism due to availability of advanced facilities of medical technologies and mandatory educated dental specialists, who are capable of providing both aesthetic and reconstructive oral dentition.

- To further enhance this opportunity, the UAE government has recently launched several measures facilitating the flow and organization of medical tourism; including free visa on arrival for medical tourism, and the creation of health-city medical tourism complexes. These are intended for making communication between international patients and high-quality dentistry simpler, as well as making the local dental devices market more popular. Due to the increasing number of clinics outsourcing with international technology suppliers, the UAE is gradually becoming a medical tourist destination with dental services being among major services being promoted.

UAE Dental Devices Market Segment Analysis:

UAE Dental Devices Market is Segmented on the basis of Product Type, Application and End User.

By Product Type, Orthodontic Devices segment is expected to dominate the market during the forecast period

-

The UAE Dental Devices Market is segmented by the type of product required for specific treatments and procedures which is quite diverse. The main consumer products include dental implants in a market that has shown high growth in the teeth replacement procedure. Appliances including brace and aligners that are associated with orthodontic treatment are also on a high rise in demand because of the overall focus on aesthetic appearance of the teeth. Dental chairs are necessary for any practice, and dental radiology equipment and dental lasers used for diagnoses and less invasive procedures also play a integers part in this market.

- Employing of the intraoral scanners is rapidly growing due to the efficient working and high accuracy of definite treatments. Crowns and bridges constitute one of the principal practices of restorative dentistry as both, a treatment for damaged teeth and tooth replacement. Full and part dentures remain one of the most common solutions to missing teeth, especially in an ageing society. The market also consists of other dental instruments and products, for example, sterilizers and dental instrument, every one of them contributed to the constant sophistication of the UAE dental care market. Altogether, these products find use in virtually all categories of precautions, diagnostics, therapies, aesthetics, restorations, and other dental needs.

By Application, diagnostic segment expected to held the largest share

-

Diagnostic tool also has a substantial contribution but there exist different tools used in dentistry like dental radiology equipment and intraoral scanners used in detecting dental ailments like cavity, gum diseases even oral cancer at early stages. These diagnostic tools help dental professionals evaluate the overall health of a patient’s mouth satisfactorily, as well as coming up with solutions to cater for the patient’s individual needs. The therapeutic is equipment employed in operations like root canal, periodontal therapy and surgery thus, serving as solutions to most dental problems.

- The aesthetic application is in a rapid increase in the UAE because of the increasing interest in procedures like whitening and reshaping of teeth and the use of ortho devices such as braces and aligners. This segment is the response to more and more attention towards enhancing the looks of teeth and smiles. The final large segment is the restorative application which includes products like crowns and bridges, implants, fillings and dentures for the restoration of diseased or missing teeth. As a numerous people require solutions in regards to tooth restoration and tooth replacement, this segment is crucial in improving the functional and esthetic aspects of oral care. Combined, these applications encompass the full range of Care maintenance and restoration inclusive of restorative and Cosmetically services in the Dental Health Industry.

UAE Dental Devices Market Regional Insights:

UAE is Expected to Dominate the Market Over the Forecast period

- The UAE Dental Devices Market shows that out of all the emirates wherein the dental devices business thrives, Dubai is the leading area with a market share of 40-45% in 2023. This dominance is particularly majorly due to the fact that the city hosts some well-equipped and well-developed health care facilities, which comprise of numerous specialized clinics – dental clinics in particular, to be precise – that can offer consumer modern dental services. Currently, Dubai has also placed great focus on medical tourism, and the demand for superior dental care services has also increased as a consequence. Increased patients’ traffic from the adjacent areas and individual foreigners, attracted by the availability of high-quality dental care services, has once again underlined the primary place of the city in the field of dental industry.

- It has been revealed that adoption of advance technology, including diagnostic tools based on artificial intelligence, three-dimensional printing technology, and digital dentistry, has distinguished the region of Dubai from the parts of the UAE. The city’s ability to maintaining a stiff regulatory standard, thus, the solidarity between local dental suppliers and international manufacturers put Dubai in a formidable position regarding dental facilities. Therefore, the region still has the demand of native people and Medical tourism for superior dental treatments hence has significantly enhanced the growth of UAE Dental Devices Market.

Active Key Players in the UAE Dental Devices Market

- 3M (USA)

- A-Dec Inc. (USA)

- Align Technology (USA)

- Biolase Inc. (USA)

- Carestream Dental (USA)

- Dentsply Sirona (USA)

- Envisat Holdings Corporation (USA)

- GC Corporation (Japan)

- Ivoclar Vivadent (Liechtenstein)

- KaVo Kerr (USA)

- Midmark Corporation (USA)

- Nobel Bio care (Switzerland)

- Planmeca Oy (Finland)

- Straumann Group (Switzerland)

- Zimmer Biomet (USA)

- Other Active Players.

|

UAE Dental Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.19 Billion |

|

Forecast Period 2024-32 CAGR: |

7.20% |

Market Size in 2032: |

USD 0.36 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: UAE Dental Devices Market by Product Type

4.1 UAE Dental Devices Market Snapshot and Growth Engine

4.2 UAE Dental Devices Market Overview

4.3 Dental Implants

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Dental Implants: Geographic Segmentation Analysis

4.4 Orthodontic Devices

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Orthodontic Devices: Geographic Segmentation Analysis

4.5 Dental Chairs

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Dental Chairs: Geographic Segmentation Analysis

4.6 Dental Radiology Equipment

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Dental Radiology Equipment: Geographic Segmentation Analysis

4.7 Dental Lasers

4.7.1 Introduction and Market Overview

4.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.7.3 Key Market Trends, Growth Factors and Opportunities

4.7.4 Dental Lasers: Geographic Segmentation Analysis

4.8 Intraoral Scanners

4.8.1 Introduction and Market Overview

4.8.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.8.3 Key Market Trends, Growth Factors and Opportunities

4.8.4 Intraoral Scanners: Geographic Segmentation Analysis

4.9 Crowns and Bridges

4.9.1 Introduction and Market Overview

4.9.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.9.3 Key Market Trends, Growth Factors and Opportunities

4.9.4 Crowns and Bridges: Geographic Segmentation Analysis

4.10 Dentures

4.10.1 Introduction and Market Overview

4.10.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.10.3 Key Market Trends, Growth Factors and Opportunities

4.10.4 Dentures: Geographic Segmentation Analysis

4.11 Others)

4.11.1 Introduction and Market Overview

4.11.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.11.3 Key Market Trends, Growth Factors and Opportunities

4.11.4 Others): Geographic Segmentation Analysis

4.12

4.12.1 Introduction and Market Overview

4.12.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.12.3 Key Market Trends, Growth Factors and Opportunities

4.12.4 : Geographic Segmentation Analysis

Chapter 5: UAE Dental Devices Market by Application

5.1 UAE Dental Devices Market Snapshot and Growth Engine

5.2 UAE Dental Devices Market Overview

5.3 Diagnostic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Diagnostic: Geographic Segmentation Analysis

5.4 Therapeutic

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Therapeutic: Geographic Segmentation Analysis

5.5 Aesthetic

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Aesthetic: Geographic Segmentation Analysis

5.6 Restorative)

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Restorative): Geographic Segmentation Analysis

5.7

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 : Geographic Segmentation Analysis

Chapter 6: UAE Dental Devices Market by End User

6.1 UAE Dental Devices Market Snapshot and Growth Engine

6.2 UAE Dental Devices Market Overview

6.3 Dental Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Dental Hospitals: Geographic Segmentation Analysis

6.4 Dental Clinics

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Dental Clinics: Geographic Segmentation Analysis

6.5 Dental Laboratories

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Dental Laboratories: Geographic Segmentation Analysis

6.6 Academic and Research Institutes)

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Academic and Research Institutes) : Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 UAE Dental Devices Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALIGN TECHNOLOGY

7.4 BIOLASE INC.

7.5 DENTSPLY SIRONA

7.6 STRAUMANN GROUP

7.7 OTHER ACTIVE PLAYERS

Chapter 8: Global UAE Dental Devices Market By Region

8.1 Overview

8.2. North America UAE Dental Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Product Type

8.2.4.1 Dental Implants

8.2.4.2 Orthodontic Devices

8.2.4.3 Dental Chairs

8.2.4.4 Dental Radiology Equipment

8.2.4.5 Dental Lasers

8.2.4.6 Intraoral Scanners

8.2.4.7 Crowns and Bridges

8.2.4.8 Dentures

8.2.4.9 Others)

8.2.4.10

8.2.5 Historic and Forecasted Market Size By Application

8.2.5.1 Diagnostic

8.2.5.2 Therapeutic

8.2.5.3 Aesthetic

8.2.5.4 Restorative)

8.2.5.5

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Dental Hospitals

8.2.6.2 Dental Clinics

8.2.6.3 Dental Laboratories

8.2.6.4 Academic and Research Institutes)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe UAE Dental Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Product Type

8.3.4.1 Dental Implants

8.3.4.2 Orthodontic Devices

8.3.4.3 Dental Chairs

8.3.4.4 Dental Radiology Equipment

8.3.4.5 Dental Lasers

8.3.4.6 Intraoral Scanners

8.3.4.7 Crowns and Bridges

8.3.4.8 Dentures

8.3.4.9 Others)

8.3.4.10

8.3.5 Historic and Forecasted Market Size By Application

8.3.5.1 Diagnostic

8.3.5.2 Therapeutic

8.3.5.3 Aesthetic

8.3.5.4 Restorative)

8.3.5.5

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Dental Hospitals

8.3.6.2 Dental Clinics

8.3.6.3 Dental Laboratories

8.3.6.4 Academic and Research Institutes)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe UAE Dental Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Product Type

8.4.4.1 Dental Implants

8.4.4.2 Orthodontic Devices

8.4.4.3 Dental Chairs

8.4.4.4 Dental Radiology Equipment

8.4.4.5 Dental Lasers

8.4.4.6 Intraoral Scanners

8.4.4.7 Crowns and Bridges

8.4.4.8 Dentures

8.4.4.9 Others)

8.4.4.10

8.4.5 Historic and Forecasted Market Size By Application

8.4.5.1 Diagnostic

8.4.5.2 Therapeutic

8.4.5.3 Aesthetic

8.4.5.4 Restorative)

8.4.5.5

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Dental Hospitals

8.4.6.2 Dental Clinics

8.4.6.3 Dental Laboratories

8.4.6.4 Academic and Research Institutes)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific UAE Dental Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Product Type

8.5.4.1 Dental Implants

8.5.4.2 Orthodontic Devices

8.5.4.3 Dental Chairs

8.5.4.4 Dental Radiology Equipment

8.5.4.5 Dental Lasers

8.5.4.6 Intraoral Scanners

8.5.4.7 Crowns and Bridges

8.5.4.8 Dentures

8.5.4.9 Others)

8.5.4.10

8.5.5 Historic and Forecasted Market Size By Application

8.5.5.1 Diagnostic

8.5.5.2 Therapeutic

8.5.5.3 Aesthetic

8.5.5.4 Restorative)

8.5.5.5

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Dental Hospitals

8.5.6.2 Dental Clinics

8.5.6.3 Dental Laboratories

8.5.6.4 Academic and Research Institutes)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa UAE Dental Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Product Type

8.6.4.1 Dental Implants

8.6.4.2 Orthodontic Devices

8.6.4.3 Dental Chairs

8.6.4.4 Dental Radiology Equipment

8.6.4.5 Dental Lasers

8.6.4.6 Intraoral Scanners

8.6.4.7 Crowns and Bridges

8.6.4.8 Dentures

8.6.4.9 Others)

8.6.4.10

8.6.5 Historic and Forecasted Market Size By Application

8.6.5.1 Diagnostic

8.6.5.2 Therapeutic

8.6.5.3 Aesthetic

8.6.5.4 Restorative)

8.6.5.5

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Dental Hospitals

8.6.6.2 Dental Clinics

8.6.6.3 Dental Laboratories

8.6.6.4 Academic and Research Institutes)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America UAE Dental Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Product Type

8.7.4.1 Dental Implants

8.7.4.2 Orthodontic Devices

8.7.4.3 Dental Chairs

8.7.4.4 Dental Radiology Equipment

8.7.4.5 Dental Lasers

8.7.4.6 Intraoral Scanners

8.7.4.7 Crowns and Bridges

8.7.4.8 Dentures

8.7.4.9 Others)

8.7.4.10

8.7.5 Historic and Forecasted Market Size By Application

8.7.5.1 Diagnostic

8.7.5.2 Therapeutic

8.7.5.3 Aesthetic

8.7.5.4 Restorative)

8.7.5.5

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Dental Hospitals

8.7.6.2 Dental Clinics

8.7.6.3 Dental Laboratories

8.7.6.4 Academic and Research Institutes)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

UAE Dental Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.19 Billion |

|

Forecast Period 2024-32 CAGR: |

7.20% |

Market Size in 2032: |

USD 0.36 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||