Dental Implants Market Synopsis

Dental Implants Market Size Was Valued at USD 4.44 Billion in 2023, and is Projected to Reach USD 8.09 Billion by 2032, Growing at a CAGR of 6.9% From 2024-2032.

A dental implant is a prosthesis that connects to the jaw or skull bone to support dental prosthetics like crowns, bridges, dentures, or facial prostheses. Modern implants are based on osseointegration, a biological process where titanium or zirconia forms an intimate bond with the bone. The implant fixture is placed to osseointegrate, and a dental prosthetic is added. The process takes time, with varying healing times, before the prosthetic is attached to the implant or an abutment holds it.

Implant therapy involves the use of a final prosthetic, either fixed or removable, which is attached to an abutment. Fixed prosthetics have a crown, bridge, or denture fixed to the abutment using lag screws or dental cement. Removable prosthetics have an adapter placed in the prosthetic to secure the two pieces together. Risks and complications in implant therapy include during surgery, within the first six months, and long term. In the presence of healthy tissues, well-integrated implants can have 5-year plus survival rates of 93-98 percent and 10- to 15-year lifespans for prosthetic teeth. Long-term studies show a 16- to 20-year success rate of 52%-76%, with complications occurring up to 48% of the time. Artificial intelligence is currently used as the basis for clinical decision support systems to determine implant success rates.

Dental implants are used to support dental prosthetics, a biological process where bone fuses to titanium and ceramic surfaces. This integration can support physical loads for decades without failure, ensuring long-lasting prosthetic support. Dental implants are a powerful replacement for missing teeth, restoring full chewing power and allowing patients to eat normally. They last a lifetime and are made from titanium, making them bio-compatible and non-toxic. Implants prevent bone loss by replacing the root and tooth, restoring chewing to normal. They also keep adjacent teeth stable, preventing crooked teeth from shifting towards the gap, affecting bite, chewing, and appearance. They also help prevent gum disease, as missing tooth gaps trap food and bacteria, and prevent facial sagging and premature aging. Overall, dental implants are a powerful solution for maintaining healthy teeth and overall well-being.

.webp)

Dental Implants Market Trend Analysis

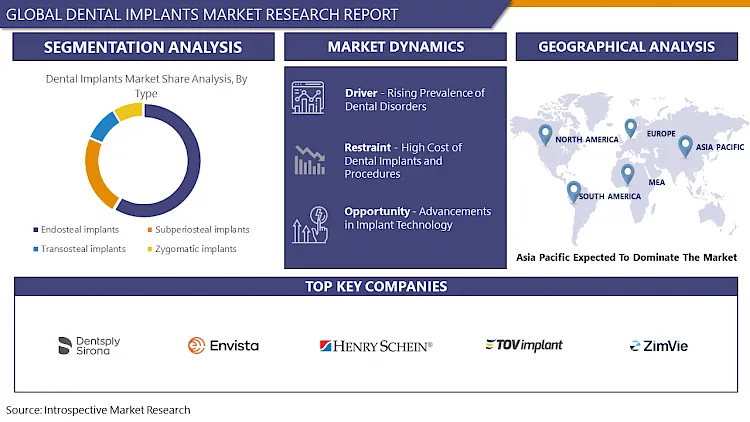

Rising Prevalence of Dental Disorders

- The dental implant market is driven by the increasing prevalence of dental disorders, such as tooth decay, periodontal diseases, and dental trauma, due to factors like poor oral hygiene, unhealthy diets, tobacco use, and aging population demographics. These conditions often lead to tooth loss or irreparable damage, resulting in a growing demand for effective tooth replacement solutions like dental implants. Dental implants offer a durable, long-term solution for replacing missing teeth, restoring oral function, and enhancing aesthetics. They provide a stable foundation, mimicking the natural tooth structure, and improve chewing and speaking functions.

- The global prevalence of oral diseases is increasing due to urbanization and changing living conditions. This is primarily due to inadequate fluoride exposure, high sugar content in food, and poor access to oral health care services. The marketing of sugary foods, tobacco, and alcohol has led to a rise in consumption of these products, contributing to oral health conditions and other chronic diseases.

Advancements in Implant Technology

- Bounds Green Dental & Implants in Wood Green, Haringey, uses advanced dental implant technology to place same-day implants, requiring a minimum of six weeks of healing time before placing artificial teeth. This process, known as "immediate loading," simplifies the surgical process and leads to faster healing times. In select cases, implants can be placed simultaneously with tooth extractions, reducing the number of surgical procedures. This technology also allows for the extraction of teeth and placement of implants with crowns at one visit.

- The dental implants market is experiencing significant growth due to advancements in implant materials, such as titanium alloys and zirconia ceramics, which offer improved biocompatibility, strength, and durability. Computer-aided design and manufacturing techniques enable the creation of customized implants tailored to individual patient anatomy, improving fit and functionality.

- Technological innovations like guided implant surgery and digital dentistry streamline treatment planning, reducing surgical time and improving accuracy. As implant technology evolves, there is a growing opportunity to address unmet market needs, expand treatment indications, and improve patient satisfaction and success rates, presenting a promising landscape for growth and advancement.

Dental Implants Market Segment Analysis:

Dental Implants Market Segmented on the basis of Type, Material, Procedure, Demographics, and End User.

By Type, Endosteal Implants segment is expected to dominate the market during the forecast period

- Endosteal implants are a dental procedure that can last up to fifteen years and improve a smile by strengthening the jawbone without the need for adjacent teeth. They are more convenient than other restorative dentistry methods, with minimal discomfort and a high success rate. Endosteal implants can prevent problems caused by tooth loss, such as slurred speech and deteriorating alveolar bone, which can make a person appear older. They also reduce fracture risk and improve chewing ability. In addition, endosteal implants can prevent the wear and tear of the alveolar bone, resulting in a more youthful appearance.

- Endosteal implants also help regrow the surrounding bone, preventing bone resorption and increasing bone density in areas where a tooth was lost. Endosteal implants are a popular type of dental implant due to their success rates, versatility, and long-term stability. They are surgically placed into the jawbone, providing a secure foundation for prosthetic teeth. They integrate with the surrounding bone through osseointegration, ensuring excellent stability and durability.

- Advancements in implant materials, design, and surgical techniques have further enhanced their popularity. Innovations like tapered designs, surface modifications, and computer-guided placement have improved outcomes and patient satisfaction. Scientific evidence supporting the efficacy and reliability of endosteal implants solidifies their dominance in the market. The endosteal implants segment is anticipated to dominate the dental implants market due to several key factors.

By Procedure, Root-form dental implants segment is expected to dominate the market during the forecast period

- Root-form dental implants are an ancient and popular type of implant, similar in size and shape to tooth roots. They can be placed during tooth extraction, minimizing waiting time and bone loss. This method helps preserve natural facial contours and minimizes bone loss after extraction. The root-form dental implants segment is expected to dominate the market due to their ability to mimic natural tooth roots, providing a stable foundation for prosthetic teeth. This design is suitable for various clinical situations, including single-tooth replacements, multiple-tooth restorations, and full arch rehabilitations.

- Root-form implants have a long history of clinical success and scientific documentation, resulting in predictable outcomes and high patient satisfaction. Advancements in implant materials, surface coatings, and surgical techniques have further enhanced the performance and longevity of root-form implants, with innovations like tapered designs, bioactive surface modifications, and computer-guided implant placement contributing to their long-term success.

Dental Implants Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific is poised to dominate the dental implants market due to its rapidly growing population, rising disposable incomes, and increasing awareness about oral health and aesthetics. The region's medical tourism industry, particularly in countries like Thailand, India, and Malaysia, attracts patients worldwide due to affordable treatment costs, high-quality healthcare infrastructure, and internationally trained dental professionals.

- Advancements in technology and innovation in dental implant materials and techniques are driving growth in the region, with countries like China, India, and South Korea investing in healthcare infrastructure development and implementing oral health promotion programs. The presence of key market players and dental implant manufacturers in Asia Pacific further strengthens the region's dominance in the global dental implant market. With a combination of growing demand, technological innovation, supportive policies, and a robust healthcare ecosystem, Asia Pacific is poised to continue leading the dental implants market in the foreseeable future.

Dental Implants Market Top Key Players:

- Dentsply Sirona (US)

- Henry Schein, Inc. (US)

- ZimVie Inc. (Zimmer Biomet) (US)

- BioHorizons (US)

- Envista Holdings Corporation (Danaher) (US)

- Zest Dental Solutions (US)

- Bicon, LLC (US)

- Cortex (Canada)

- Neoss Limited (U.K.)

- Osstem (U.K.)

- Adin Global (U.K.)

- CeraRoot SL (Spain)

- TOV Implant LTD (France)

- BEGO GmbH & Co. KG (Germany)

- Nobel Biocare Services AG (Switzerland)

- Institut Straumann AG (Switzerland)

- Sweden & Martina S.p.A. (Sweden)

- NEOBIOTECH (South Korea)

- Osstem Implant (South Korea)

- Dentium (South Korea)

- ProScan (India)

- KYOCERA Corporation (Japan)

- Alpha-Bio Tec Ltd (Israel)

- Cortex (Israel), and Other Major Players.

Key Industry Developments in the Dental Implants Market:

- In June 2022, ZimVie Inc. introduced the FDA-cleared T3 PRO Tapered Implant and Encode Emergence Healing Abutment in the U.S. market. The T3 PRO expands ZimVie's range of dental implants, leveraging the success of the existing T3 Tapered Implant solutions.

- In May 2022, Scientists from New Zealand unveiled mini dental implants designed for tooth replacement. These implants utilize cutting-edge dental technology to deliver comparable functional and aesthetic advantages to traditional implants but with significantly reduced treatment time and patient inconvenience.

|

Global Dental Implants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.44 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.9 % |

Market Size in 2032: |

USD 8.09 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Procedure |

|

||

|

By Demographics |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Dental Implants Market by Type (2018-2032)

4.1 Dental Implants Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Endosteal implants

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Subperiosteal implants

4.5 Transosteal implants

4.6 Zygomatic implants

Chapter 5: Dental Implants Market by Material (2018-2032)

5.1 Dental Implants Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Titanium

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Zirconium

5.5 Ceramic

Chapter 6: Dental Implants Market by Procedure (2018-2032)

6.1 Dental Implants Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Root-Form Dental Implants

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Plate-Form Dental Implants

Chapter 7: Dental Implants Market by Demographics (2018-2032)

7.1 Dental Implants Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Geriatric

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Middle Aged

7.5 Adult

Chapter 8: Dental Implants Market by End User (2018-2032)

8.1 Dental Implants Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Dental Clinics

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Dental Hospitals

8.5 Dental Academic and Research Institutes

8.6 Dental Laboratories

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Dental Implants Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 DENTSPLY SIRONA (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 HENRY SCHEIN INC. (US)

9.4 ZIMVIE INC. (ZIMMER BIOMET) (US)

9.5 BIOHORIZONS (US)

9.6 ENVISTA HOLDINGS CORPORATION (DANAHER) (US)

9.7 ZEST DENTAL SOLUTIONS (US)

9.8 BICON

9.9 LLC (US)

9.10 CORTEX (CANADA)

9.11 NEOSS LIMITED (U.K.)

9.12 OSSTEM (U.K.)

9.13 ADIN GLOBAL (U.K.)

9.14 CERAROOT SL (SPAIN)

9.15 TOV IMPLANT LTD (FRANCE)

9.16 BEGO GMBH & CO. KG (GERMANY)

9.17 NOBEL BIOCARE SERVICES AG (SWITZERLAND)

9.18 INSTITUT STRAUMANN AG (SWITZERLAND)

9.19 SWEDEN & MARTINA S.P.A. (SWEDEN)

9.20 NEOBIOTECH (SOUTH KOREA)

9.21 OSSTEM IMPLANT (SOUTH KOREA)

9.22 DENTIUM (SOUTH KOREA)

9.23 PROSCAN (INDIA)

9.24 KYOCERA CORPORATION (JAPAN)

9.25 ALPHA-BIO TEC LTD (ISRAEL)

9.26 CORTEX (ISRAEL)

9.27

Chapter 10: Global Dental Implants Market By Region

10.1 Overview

10.2. North America Dental Implants Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Endosteal implants

10.2.4.2 Subperiosteal implants

10.2.4.3 Transosteal implants

10.2.4.4 Zygomatic implants

10.2.5 Historic and Forecasted Market Size by Material

10.2.5.1 Titanium

10.2.5.2 Zirconium

10.2.5.3 Ceramic

10.2.6 Historic and Forecasted Market Size by Procedure

10.2.6.1 Root-Form Dental Implants

10.2.6.2 Plate-Form Dental Implants

10.2.7 Historic and Forecasted Market Size by Demographics

10.2.7.1 Geriatric

10.2.7.2 Middle Aged

10.2.7.3 Adult

10.2.8 Historic and Forecasted Market Size by End User

10.2.8.1 Dental Clinics

10.2.8.2 Dental Hospitals

10.2.8.3 Dental Academic and Research Institutes

10.2.8.4 Dental Laboratories

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Dental Implants Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Endosteal implants

10.3.4.2 Subperiosteal implants

10.3.4.3 Transosteal implants

10.3.4.4 Zygomatic implants

10.3.5 Historic and Forecasted Market Size by Material

10.3.5.1 Titanium

10.3.5.2 Zirconium

10.3.5.3 Ceramic

10.3.6 Historic and Forecasted Market Size by Procedure

10.3.6.1 Root-Form Dental Implants

10.3.6.2 Plate-Form Dental Implants

10.3.7 Historic and Forecasted Market Size by Demographics

10.3.7.1 Geriatric

10.3.7.2 Middle Aged

10.3.7.3 Adult

10.3.8 Historic and Forecasted Market Size by End User

10.3.8.1 Dental Clinics

10.3.8.2 Dental Hospitals

10.3.8.3 Dental Academic and Research Institutes

10.3.8.4 Dental Laboratories

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Dental Implants Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Endosteal implants

10.4.4.2 Subperiosteal implants

10.4.4.3 Transosteal implants

10.4.4.4 Zygomatic implants

10.4.5 Historic and Forecasted Market Size by Material

10.4.5.1 Titanium

10.4.5.2 Zirconium

10.4.5.3 Ceramic

10.4.6 Historic and Forecasted Market Size by Procedure

10.4.6.1 Root-Form Dental Implants

10.4.6.2 Plate-Form Dental Implants

10.4.7 Historic and Forecasted Market Size by Demographics

10.4.7.1 Geriatric

10.4.7.2 Middle Aged

10.4.7.3 Adult

10.4.8 Historic and Forecasted Market Size by End User

10.4.8.1 Dental Clinics

10.4.8.2 Dental Hospitals

10.4.8.3 Dental Academic and Research Institutes

10.4.8.4 Dental Laboratories

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Dental Implants Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Endosteal implants

10.5.4.2 Subperiosteal implants

10.5.4.3 Transosteal implants

10.5.4.4 Zygomatic implants

10.5.5 Historic and Forecasted Market Size by Material

10.5.5.1 Titanium

10.5.5.2 Zirconium

10.5.5.3 Ceramic

10.5.6 Historic and Forecasted Market Size by Procedure

10.5.6.1 Root-Form Dental Implants

10.5.6.2 Plate-Form Dental Implants

10.5.7 Historic and Forecasted Market Size by Demographics

10.5.7.1 Geriatric

10.5.7.2 Middle Aged

10.5.7.3 Adult

10.5.8 Historic and Forecasted Market Size by End User

10.5.8.1 Dental Clinics

10.5.8.2 Dental Hospitals

10.5.8.3 Dental Academic and Research Institutes

10.5.8.4 Dental Laboratories

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Dental Implants Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Endosteal implants

10.6.4.2 Subperiosteal implants

10.6.4.3 Transosteal implants

10.6.4.4 Zygomatic implants

10.6.5 Historic and Forecasted Market Size by Material

10.6.5.1 Titanium

10.6.5.2 Zirconium

10.6.5.3 Ceramic

10.6.6 Historic and Forecasted Market Size by Procedure

10.6.6.1 Root-Form Dental Implants

10.6.6.2 Plate-Form Dental Implants

10.6.7 Historic and Forecasted Market Size by Demographics

10.6.7.1 Geriatric

10.6.7.2 Middle Aged

10.6.7.3 Adult

10.6.8 Historic and Forecasted Market Size by End User

10.6.8.1 Dental Clinics

10.6.8.2 Dental Hospitals

10.6.8.3 Dental Academic and Research Institutes

10.6.8.4 Dental Laboratories

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Dental Implants Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Endosteal implants

10.7.4.2 Subperiosteal implants

10.7.4.3 Transosteal implants

10.7.4.4 Zygomatic implants

10.7.5 Historic and Forecasted Market Size by Material

10.7.5.1 Titanium

10.7.5.2 Zirconium

10.7.5.3 Ceramic

10.7.6 Historic and Forecasted Market Size by Procedure

10.7.6.1 Root-Form Dental Implants

10.7.6.2 Plate-Form Dental Implants

10.7.7 Historic and Forecasted Market Size by Demographics

10.7.7.1 Geriatric

10.7.7.2 Middle Aged

10.7.7.3 Adult

10.7.8 Historic and Forecasted Market Size by End User

10.7.8.1 Dental Clinics

10.7.8.2 Dental Hospitals

10.7.8.3 Dental Academic and Research Institutes

10.7.8.4 Dental Laboratories

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Dental Implants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.44 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.9 % |

Market Size in 2032: |

USD 8.09 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Procedure |

|

||

|

By Demographics |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||