Biosimilars Market Synopsis

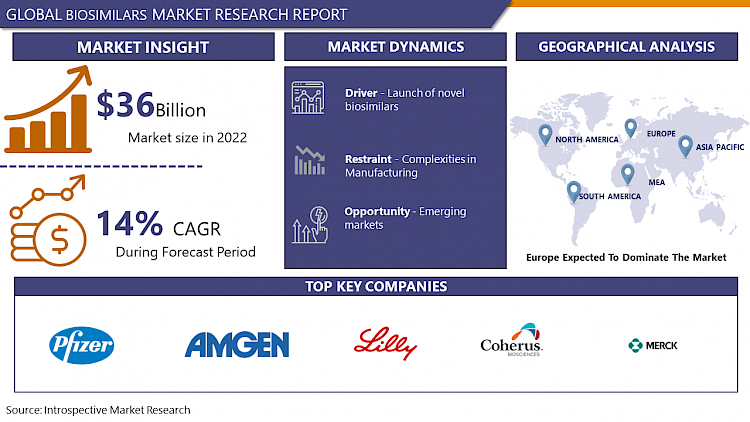

Global Biosimilars Market Size Was Valued at USD 34.01 Billion in 2023 and is Projected to Reach USD 143.97 Billion by 2032, Growing at a CAGR of 17.39% From 2024-2032.

Biosimilars are medical products derived from living cells using recombinant DNA technology, offering cost-effective alternatives to expensive originator biologics for medical conditions like cancer, autoimmune diseases, and chronic conditions. Despite inherent variability in biological systems, biosimilars undergo rigorous testing and regulatory approval processes to ensure safety and efficacy for patient use.

- Biosimilars present a range of benefits within the pharmaceutical sphere, fueling their growing demand and widespread applications across various medical fields. These advantages derive from their likeness to original biologics, alongside their potential for cost reduction and expanded patient accessibility. Biosimilars offer a more economical option compared to pricier biologic therapies, aiding in the containment of healthcare expenditures globally. This heightened affordability facilitates broader patient access to critical treatments, particularly in regions grappling with limited healthcare resources.

- The call for biosimilars continues to escalate across diverse medical domains, encompassing oncology, autoimmune disorders, hematological conditions, and infectious ailments. Biosimilars are progressively integrated into treatment regimens, boasting efficacy and safety profiles akin to their originator counterparts. Furthermore, with the expiration of patents for biologic drugs opening avenues for biosimilar development, the biosimilar market is poised for further expansion.

- Prominent trends in this market include the rise of strategic alliances and collaborations among pharmaceutical entities, advancements in biosimilar manufacturing technologies, and evolving regulatory frameworks designed to streamline biosimilar approvals. Additionally, the growing acceptance of biosimilars among healthcare professionals and patients, coupled with heightened awareness of their advantages, fosters market growth and adoption. Overall, biosimilars represent a promising avenue for enhancing healthcare affordability, elevating patient outcomes, and propelling innovation within the pharmaceutical sector.

Biosimilars Market Trend Analysis

Increased Prevalence of Chronic Diseases

- The escalating occurrence of chronic ailments stands out as a significant driver in propelling the biosimilars market forward. Chronic diseases, encompassing conditions like cancer, autoimmune disorders, diabetes, and inflammatory ailments, are becoming more widespread globally due to factors such as aging populations, sedentary lifestyles, and evolving dietary patterns. These conditions often necessitate long-term treatment with biological therapies, placing substantial strains on healthcare systems and patients alike.

- Biosimilars offer a financially viable substitute to original biologics for managing chronic diseases, providing comparable effectiveness and safety profiles at reduced costs. This enhanced affordability widens patient access to vital treatments, particularly in regions grappling with limited healthcare resources or prohibitively high medical expenses.

- The expiration of patents for biologic medications used in chronic disease management opens doors for biosimilar manufacturers to enter the market and offer more economical alternatives. By introducing biosimilars, healthcare systems can achieve cost efficiencies and allocate resources more effectively to meet the escalating demand for chronic disease care.

Improved Patient Targeting and Adherence

- Enhanced patient targeting and adherence emerge as pivotal opportunities within the biosimilars market, fostering better treatment outcomes and healthcare efficacy. The introduction of biosimilars widens the array of available treatment options for healthcare providers, enabling them to tailor therapeutic strategies to individual patient requirements and preferences. Biosimilars, with their demonstrated similarity in effectiveness and safety to originator biologics, instill confidence in healthcare professionals when prescribing these treatments to suitable patient cohorts.

- The accessibility of biosimilars at potentially reduced costs can facilitate greater patient access to biologic therapies, particularly in regions facing healthcare resource limitations or reimbursement challenges. This heightened accessibility is conducive to higher treatment adherence rates, as patients are more inclined to adhere to treatments that are both financially viable and readily accessible.

- Biosimilars may offer added benefits such as improved dosing convenience or alternative administration routes, thereby further bolstering patient adherence. By surmounting obstacles to treatment adherence and offering more precise therapeutic choices, biosimilars have the potential to optimize patient outcomes, alleviate disease burden, and enhance overall healthcare efficiency. Consequently, enhanced patient targeting and adherence stand as critical opportunities for biosimilar manufacturers to drive market expansion and distinction within the ever-evolving healthcare landscape.

Biosimilars Market Segment Analysis:

Biosimilars Market Segmented on the basis of Product Class, Application, and Distribution Channel.

By Product Class, Monoclonal Antibodies (mAbs) segment is expected to dominate the market during the forecast period

- The Monoclonal Antibodies (mAbs) segment is anticipated to emerge as the dominant force in the biosimilars market due to several key factors. To begin with, monoclonal antibodies encompass a broad spectrum of biological drugs utilized in treating a multitude of ailments, ranging from cancer to autoimmune disorders and inflammatory conditions. This extensive therapeutic scope translates into a substantial market opportunity for biosimilar manufacturers focusing on mAbs.

- Numerous blockbuster biologics belong to the monoclonal antibodies category, with many of these original products either having already lost patent protection or nearing patent expiration. This presents a significant opening for biosimilar developers to introduce lower-cost alternatives, thus spurring adoption and market expansion.

- Regulatory bodies like the United States Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have established clear pathways for approving biosimilar monoclonal antibodies. This regulatory transparency streamlines the development, evaluation, and commercialization processes, encouraging investment and innovation within the mAbs segment. Increasing acceptance of biosimilar monoclonal antibodies among healthcare providers and patients, owing to their proven efficacy, safety, and potential cost savings, further solidifies the segment's dominance in the biosimilar market.

By Application, Oncology segment is expected to dominate the market during the forecast period

- The oncology segment is anticipated to lead the biosimilar market due to several factors that underscore its prominence in driving market expansion. the widespread occurrence of cancer globally necessitates a continuous demand for effective and economical treatments, making oncology a focal point for biosimilar development. With biological therapies being pivotal in cancer care, the availability of biosimilars presents a promising avenue for broadening treatment options while alleviating the financial strain associated with cancer treatment.

- The expiration of patents for several blockbuster biologics used in oncology, coupled with the escalating costs of cancer therapies, creates a favorable climate for biosimilar adoption. Biosimilars offer comparable efficacy and safety profiles to originator biologics at potentially reduced costs, rendering them an appealing alternative for healthcare providers, payers, and patients alike.

- Regulatory authorities have streamlined pathways for biosimilar approval in oncology, facilitating their market entry and acceptance. This regulatory endorsement, combined with growing recognition among healthcare practitioners and patients, further solidifies the oncology segment's position as a key driver of biosimilar market dominance.

Biosimilars Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region is anticipated to take the lead in the biosimilar market due to several factors propelling its growth and prominence in the sector. Primarily, the escalating prevalence of chronic ailments, alongside the surge in healthcare spending, is driving the demand for economical treatment alternatives, notably biosimilars. With a substantial and expanding population, particularly evident in nations like India and China, the Asia-Pacific area presents a vast market potential for biosimilar manufacturers.

- Conducive regulatory frameworks and supportive governmental measures are expediting the development and approval processes for biosimilars across many Asia-Pacific nations. Governments are implementing policies to encourage biosimilar utilization, including stimulating local production, streamlining regulatory procedures, and establishing reimbursement schemes. These initiatives enhance market accessibility and affordability, consequently propelling adoption rates.

- The presence of well-established pharmaceutical industries and growing expertise in biotechnology and manufacturing practices contribute to the region's leadership in biosimilar production. Companies based in countries such as South Korea and India have showcased their capabilities in biosimilar development and manufacturing, positioning themselves as key contenders in the global arena.

- Strategic collaborations and partnerships between domestic and international pharmaceutical firms facilitate knowledge exchange and technology transfer, fostering innovation and market expansion. Collectively, these elements position the Asia-Pacific region as a dominant force in the biosimilar market, offering significant prospects for further growth and market dominance in the foreseeable future.

Biosimilars Market Top Key Players:

- Coherus Biosciences (US)

- Viatris (US)

- Biogen Inc. (US)

- Merck & Co., Inc. (US)

- Pfizer Inc. (US)

- Amgen Inc. (US)

- Apobiologix (Canada)

- Biocad (Russia)

- Fresenius Kabi (Germany)

- Samsung Bioepis (South Korea)

- Celltrion Inc. (South Korea)

- Samsung Bioepis Co., Ltd. (South Korea)

- Novartis International AG (Switzerland)

- Sandoz (Switzerland)

- Bio-Thera Solutions (China)

- Dr. Reddy's Laboratories Ltd. (India)

- Biocon Ltd (India)

- Reliance Life Sciences (India)

- Intas Pharma (India)

- Zydus Cadila (India)

- Lupin Pharma (India)

- Teva Pharmaceutical Industries Ltd. (Israel), and Other Major Players.

Key Industry Developments in the Biosimilars Market:

- In May 2023, Boehringer Ingelheim obtained clearance from the U.S. Food and Drug Administration (FDA) for Cyltezo Pen, a newly introduced autoinjector option for Cyltezo (adalimumab-adbm). Cyltezo is an FDA-approved interchangeable biosimilar to Humira.

- In May 2022, Amneal Pharmaceuticals, Inc. secured approval from the United States Food and Drug Administration (FDA) for a Biologics License Application (BLA) related to pegfilgrastim-pbbk, a biosimilar referencing Neulasta. The approved product will be marketed under the brand name FYLNETRA.

|

Global Biosimilars Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.01 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.39% |

Market Size in 2032: |

USD 143.97 Bn. |

|

Segments Covered: |

By Product Class |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BIOSIMILARS MARKET BY PRODUCT CLASS (2016-2030)

- BIOSIMILARS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MONOCLONAL ANTIBODIES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RECOMBINANT HORMONES

- IMMUNOMODULATORS

- ANTI-INFLAMMATORY AGENTS

- BIOSIMILARS MARKET BY APPLICATION (2016-2030)

- BIOSIMILARS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BLOOD DISORDERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GROWTH HORMONAL DEFICIENCY

- CHRONIC AND AUTOIMMUNE DISORDERS

- ONCOLOGY

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BIOSIMILARS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- PFIZER, INC

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- Amgen, Inc.

- Eli Lilly and Company

- Coherus Biosciences, Inc.

- Merck & Co., Inc.

- AbbVie Inc.

- Biogen Inc.

- Epirus Biopharmaceuticals

- Apotex Inc.

- Mylan N.V.

- Alvotech

- Boehringer Ingelheim International GmbH

- Fresenius Kabi AG

- Formycon AG

- STADA Arzneimittel AG

- Novartis AG

- Samsung Bioepis Co., Ltd

- Celltrion Inc.

- Fujifilm Kyowa Kirin Biologics Co., Ltd.

- COMPETITIVE LANDSCAPE

- GLOBAL BIOSIMILARS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Class

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Biosimilars Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.01 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.39% |

Market Size in 2032: |

USD 143.97 Bn. |

|

Segments Covered: |

By Product Class |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BIOSIMILARS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BIOSIMILARS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BIOSIMILARS MARKET COMPETITIVE RIVALRY

TABLE 005. BIOSIMILARS MARKET THREAT OF NEW ENTRANTS

TABLE 006. BIOSIMILARS MARKET THREAT OF SUBSTITUTES

TABLE 007. BIOSIMILARS MARKET BY TYPE

TABLE 008. RECOMBINANT NON-GLYCOSYLATED PROTEINS

HUMAN GROWTH HORMONES

GRANULOCYTE COLONY-STIMULATING FACTOR (G-CSF)

INTERFERONS

INSULIN

(HUMAN GROWTH HORMONES MARKET OVERVIEW (2016-2028)

TABLE 009. GRANULOCYTE COLONY-STIMULATING FACTOR (G-CSF) MARKET OVERVIEW (2016-2028)

TABLE 010. INTERFERONS MARKET OVERVIEW (2016-2028)

TABLE 011. INSULIN) MARKET OVERVIEW (2016-2028)

TABLE 012. HUMAN GROWTH HORMONES MARKET OVERVIEW (2016-2028)

TABLE 013. GRANULOCYTE COLONY-STIMULATING FACTOR (G-CSF) MARKET OVERVIEW (2016-2028)

TABLE 014. INTERFERONS MARKET OVERVIEW (2016-2028)

TABLE 015. INSULIN MARKET OVERVIEW (2016-2028)

TABLE 016. RECOMBINANT GLYCOSYLATED PROTEINS

ERYTHROPOIETIN

MONOCLONAL ANTIBODIES

FOLLITROPIN

(ERYTHROPOIETIN MARKET OVERVIEW (2016-2028)

TABLE 017. MONOCLONAL ANTIBODIES MARKET OVERVIEW (2016-2028)

TABLE 018. FOLLITROPIN) MARKET OVERVIEW (2016-2028)

TABLE 019. ERYTHROPOIETIN MARKET OVERVIEW (2016-2028)

TABLE 020. MONOCLONAL ANTIBODIES MARKET OVERVIEW (2016-2028)

TABLE 021. FOLLITROPIN MARKET OVERVIEW (2016-2028)

TABLE 022. BIOSIMILARS MARKET BY APPLICATION

TABLE 023. BLOOD DISORDERS MARKET OVERVIEW (2016-2028)

TABLE 024. GROWTH HORMONAL DEFICIENCY MARKET OVERVIEW (2016-2028)

TABLE 025. CHRONIC AND AUTOIMMUNE DISORDERS MARKET OVERVIEW (2016-2028)

TABLE 026. ONCOLOGY MARKET OVERVIEW (2016-2028)

TABLE 027. AND OTHER APPLICATIONS MARKET OVERVIEW (2016-2028)

TABLE 028. NORTH AMERICA BIOSIMILARS MARKET, BY TYPE (2016-2028)

TABLE 029. NORTH AMERICA BIOSIMILARS MARKET, BY APPLICATION (2016-2028)

TABLE 030. N BIOSIMILARS MARKET, BY COUNTRY (2016-2028)

TABLE 031. EUROPE BIOSIMILARS MARKET, BY TYPE (2016-2028)

TABLE 032. EUROPE BIOSIMILARS MARKET, BY APPLICATION (2016-2028)

TABLE 033. BIOSIMILARS MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC BIOSIMILARS MARKET, BY TYPE (2016-2028)

TABLE 035. ASIA PACIFIC BIOSIMILARS MARKET, BY APPLICATION (2016-2028)

TABLE 036. BIOSIMILARS MARKET, BY COUNTRY (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA BIOSIMILARS MARKET, BY TYPE (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA BIOSIMILARS MARKET, BY APPLICATION (2016-2028)

TABLE 039. BIOSIMILARS MARKET, BY COUNTRY (2016-2028)

TABLE 040. SOUTH AMERICA BIOSIMILARS MARKET, BY TYPE (2016-2028)

TABLE 041. SOUTH AMERICA BIOSIMILARS MARKET, BY APPLICATION (2016-2028)

TABLE 042. BIOSIMILARS MARKET, BY COUNTRY (2016-2028)

TABLE 043. NOVARTIS AG (SWITZERLAND): SNAPSHOT

TABLE 044. NOVARTIS AG (SWITZERLAND): BUSINESS PERFORMANCE

TABLE 045. NOVARTIS AG (SWITZERLAND): PRODUCT PORTFOLIO

TABLE 046. NOVARTIS AG (SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. PFIZER INC. (US): SNAPSHOT

TABLE 047. PFIZER INC. (US): BUSINESS PERFORMANCE

TABLE 048. PFIZER INC. (US): PRODUCT PORTFOLIO

TABLE 049. PFIZER INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. DR. REDDY’S LABORATORIES LTD. (INDIA): SNAPSHOT

TABLE 050. DR. REDDY’S LABORATORIES LTD. (INDIA): BUSINESS PERFORMANCE

TABLE 051. DR. REDDY’S LABORATORIES LTD. (INDIA): PRODUCT PORTFOLIO

TABLE 052. DR. REDDY’S LABORATORIES LTD. (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. AMGEN INC. (US): SNAPSHOT

TABLE 053. AMGEN INC. (US): BUSINESS PERFORMANCE

TABLE 054. AMGEN INC. (US): PRODUCT PORTFOLIO

TABLE 055. AMGEN INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ELI LILLY AND COMPANY (US): SNAPSHOT

TABLE 056. ELI LILLY AND COMPANY (US): BUSINESS PERFORMANCE

TABLE 057. ELI LILLY AND COMPANY (US): PRODUCT PORTFOLIO

TABLE 058. ELI LILLY AND COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL): SNAPSHOT

TABLE 059. TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL): BUSINESS PERFORMANCE

TABLE 060. TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL): PRODUCT PORTFOLIO

TABLE 061. TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. FRESENIUS SE & CO. KGAA (GERMANY): SNAPSHOT

TABLE 062. FRESENIUS SE & CO. KGAA (GERMANY): BUSINESS PERFORMANCE

TABLE 063. FRESENIUS SE & CO. KGAA (GERMANY): PRODUCT PORTFOLIO

TABLE 064. FRESENIUS SE & CO. KGAA (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. STADA ARZNEIMITTEL AG (GERMANY): SNAPSHOT

TABLE 065. STADA ARZNEIMITTEL AG (GERMANY): BUSINESS PERFORMANCE

TABLE 066. STADA ARZNEIMITTEL AG (GERMANY): PRODUCT PORTFOLIO

TABLE 067. STADA ARZNEIMITTEL AG (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. BOEHRINGER INGELHEIM (GERMANY): SNAPSHOT

TABLE 068. BOEHRINGER INGELHEIM (GERMANY): BUSINESS PERFORMANCE

TABLE 069. BOEHRINGER INGELHEIM (GERMANY): PRODUCT PORTFOLIO

TABLE 070. BOEHRINGER INGELHEIM (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. GEDEON RICHTER PLC (HUNGARY): SNAPSHOT

TABLE 071. GEDEON RICHTER PLC (HUNGARY): BUSINESS PERFORMANCE

TABLE 072. GEDEON RICHTER PLC (HUNGARY): PRODUCT PORTFOLIO

TABLE 073. GEDEON RICHTER PLC (HUNGARY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. CELLTRION (SOUTH KOREA): SNAPSHOT

TABLE 074. CELLTRION (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 075. CELLTRION (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 076. CELLTRION (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. SAMSUNG BIOLOGICS (SOUTH KOREA): SNAPSHOT

TABLE 077. SAMSUNG BIOLOGICS (SOUTH KOREA): BUSINESS PERFORMANCE

TABLE 078. SAMSUNG BIOLOGICS (SOUTH KOREA): PRODUCT PORTFOLIO

TABLE 079. SAMSUNG BIOLOGICS (SOUTH KOREA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. COHERUS BIOSCIENCES (US): SNAPSHOT

TABLE 080. COHERUS BIOSCIENCES (US): BUSINESS PERFORMANCE

TABLE 081. COHERUS BIOSCIENCES (US): PRODUCT PORTFOLIO

TABLE 082. COHERUS BIOSCIENCES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. BIOCON LIMITED (INDIA): SNAPSHOT

TABLE 083. BIOCON LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 084. BIOCON LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 085. BIOCON LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. VIATRIS INC. (US): SNAPSHOT

TABLE 086. VIATRIS INC. (US): BUSINESS PERFORMANCE

TABLE 087. VIATRIS INC. (US): PRODUCT PORTFOLIO

TABLE 088. VIATRIS INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. AMEGA BIOTECH (ARGENTINA): SNAPSHOT

TABLE 089. AMEGA BIOTECH (ARGENTINA): BUSINESS PERFORMANCE

TABLE 090. AMEGA BIOTECH (ARGENTINA): PRODUCT PORTFOLIO

TABLE 091. AMEGA BIOTECH (ARGENTINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. APOTEX INC. (CANADA): SNAPSHOT

TABLE 092. APOTEX INC. (CANADA): BUSINESS PERFORMANCE

TABLE 093. APOTEX INC. (CANADA): PRODUCT PORTFOLIO

TABLE 094. APOTEX INC. (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. BIOCAD (RUSSIA): SNAPSHOT

TABLE 095. BIOCAD (RUSSIA): BUSINESS PERFORMANCE

TABLE 096. BIOCAD (RUSSIA): PRODUCT PORTFOLIO

TABLE 097. BIOCAD (RUSSIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. MABXIENCE (SPAIN): SNAPSHOT

TABLE 098. MABXIENCE (SPAIN): BUSINESS PERFORMANCE

TABLE 099. MABXIENCE (SPAIN): PRODUCT PORTFOLIO

TABLE 100. MABXIENCE (SPAIN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. PROBIOMED S.A. DE C.V. (MEXICO): SNAPSHOT

TABLE 101. PROBIOMED S.A. DE C.V. (MEXICO): BUSINESS PERFORMANCE

TABLE 102. PROBIOMED S.A. DE C.V. (MEXICO): PRODUCT PORTFOLIO

TABLE 103. PROBIOMED S.A. DE C.V. (MEXICO): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. FUJIFILM KYOWA KIRIN BIOLOGICS CO. LTD. (JAPAN): SNAPSHOT

TABLE 104. FUJIFILM KYOWA KIRIN BIOLOGICS CO. LTD. (JAPAN): BUSINESS PERFORMANCE

TABLE 105. FUJIFILM KYOWA KIRIN BIOLOGICS CO. LTD. (JAPAN): PRODUCT PORTFOLIO

TABLE 106. FUJIFILM KYOWA KIRIN BIOLOGICS CO. LTD. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. INTAS PHARMACEUTICALS LTD. (INDIA): SNAPSHOT

TABLE 107. INTAS PHARMACEUTICALS LTD. (INDIA): BUSINESS PERFORMANCE

TABLE 108. INTAS PHARMACEUTICALS LTD. (INDIA): PRODUCT PORTFOLIO

TABLE 109. INTAS PHARMACEUTICALS LTD. (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. THERMEX (UK): SNAPSHOT

TABLE 110. THERMEX (UK): BUSINESS PERFORMANCE

TABLE 111. THERMEX (UK): PRODUCT PORTFOLIO

TABLE 112. THERMEX (UK): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. RELIANCE LIFE SCIENCES (INDIA): SNAPSHOT

TABLE 113. RELIANCE LIFE SCIENCES (INDIA): BUSINESS PERFORMANCE

TABLE 114. RELIANCE LIFE SCIENCES (INDIA): PRODUCT PORTFOLIO

TABLE 115. RELIANCE LIFE SCIENCES (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. KASHIV BIOSCIENCES (US): SNAPSHOT

TABLE 116. KASHIV BIOSCIENCES (US): BUSINESS PERFORMANCE

TABLE 117. KASHIV BIOSCIENCES (US): PRODUCT PORTFOLIO

TABLE 118. KASHIV BIOSCIENCES (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BIOSIMILARS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BIOSIMILARS MARKET OVERVIEW BY TYPE

FIGURE 012. RECOMBINANT NON-GLYCOSYLATED PROTEINS

HUMAN GROWTH HORMONES

GRANULOCYTE COLONY-STIMULATING FACTOR (G-CSF)

INTERFERONS

INSULIN

(HUMAN GROWTH HORMONES MARKET OVERVIEW (2016-2028)

FIGURE 013. GRANULOCYTE COLONY-STIMULATING FACTOR (G-CSF) MARKET OVERVIEW (2016-2028)

FIGURE 014. INTERFERONS MARKET OVERVIEW (2016-2028)

FIGURE 015. INSULIN) MARKET OVERVIEW (2016-2028)

FIGURE 016. HUMAN GROWTH HORMONES MARKET OVERVIEW (2016-2028)

FIGURE 017. GRANULOCYTE COLONY-STIMULATING FACTOR (G-CSF) MARKET OVERVIEW (2016-2028)

FIGURE 018. INTERFERONS MARKET OVERVIEW (2016-2028)

FIGURE 019. INSULIN MARKET OVERVIEW (2016-2028)

FIGURE 020. RECOMBINANT GLYCOSYLATED PROTEINS

ERYTHROPOIETIN

MONOCLONAL ANTIBODIES

FOLLITROPIN

(ERYTHROPOIETIN MARKET OVERVIEW (2016-2028)

FIGURE 021. MONOCLONAL ANTIBODIES MARKET OVERVIEW (2016-2028)

FIGURE 022. FOLLITROPIN) MARKET OVERVIEW (2016-2028)

FIGURE 023. ERYTHROPOIETIN MARKET OVERVIEW (2016-2028)

FIGURE 024. MONOCLONAL ANTIBODIES MARKET OVERVIEW (2016-2028)

FIGURE 025. FOLLITROPIN MARKET OVERVIEW (2016-2028)

FIGURE 026. BIOSIMILARS MARKET OVERVIEW BY APPLICATION

FIGURE 027. BLOOD DISORDERS MARKET OVERVIEW (2016-2028)

FIGURE 028. GROWTH HORMONAL DEFICIENCY MARKET OVERVIEW (2016-2028)

FIGURE 029. CHRONIC AND AUTOIMMUNE DISORDERS MARKET OVERVIEW (2016-2028)

FIGURE 030. ONCOLOGY MARKET OVERVIEW (2016-2028)

FIGURE 031. AND OTHER APPLICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 032. NORTH AMERICA BIOSIMILARS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. EUROPE BIOSIMILARS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. ASIA PACIFIC BIOSIMILARS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. MIDDLE EAST & AFRICA BIOSIMILARS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. SOUTH AMERICA BIOSIMILARS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Biosimilars Market research report is 2024-2032.

Coherus Biosciences (US), Viatris (US), Biogen Inc. (US), Merck & Co., Inc. (US), Pfizer Inc. (US), Amgen Inc. (US), Apobiologix (Canada), Biocad (Russia), Fresenius Kabi (Germany), Samsung Bioepis (South Korea), Celltrion Inc. (South Korea), Samsung Bioepis Co., Ltd. (South Korea), Novartis International AG (Switzerland), Sandoz (Switzerland), Bio-Thera Solutions (China), Dr. Reddy's Laboratories Ltd. (India), Biocon Ltd (India), Reliance Life Sciences (India), Intas Pharma (India), Zydus Cadila (India), Lupin Pharma (India), Teva Pharmaceutical Industries Ltd. (Israel) and Other Major Players.

The Biosimilars Market is segmented into Product Class, Application, Distribution Channel, and region. By Product Class, the market is categorized into Monoclonal Antibodies (mAbs), Erythropoietin (EPO), Recombinant Hormones, Immunomodulators, Anti-Inflammatory Agents, Granulocyte Colony-stimulating Factor (G-CSF). By Application, the market is categorized into Oncology, Blood Disorders, Chronic Diseases, Growth Hormone Deficiency, and Infectious Diseases. By Distribution Channel, the market is categorized into Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Specialty Clinics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Biosimilars are medical products derived from living cells using recombinant DNA technology, offering cost-effective alternatives to expensive originator biologics for medical conditions like cancer, autoimmune diseases, and chronic conditions. Despite inherent variability in biological systems, biosimilars undergo rigorous testing and regulatory approval processes to ensure safety and efficacy for patient use.

Global Biosimilars Market Size Was Valued at USD 34.01 Billion in 2023 and is Projected to Reach USD 143.97 Billion by 2032, Growing at a CAGR of 17.39% From 2024-2032.