GMP Testing Service Market Synopsis

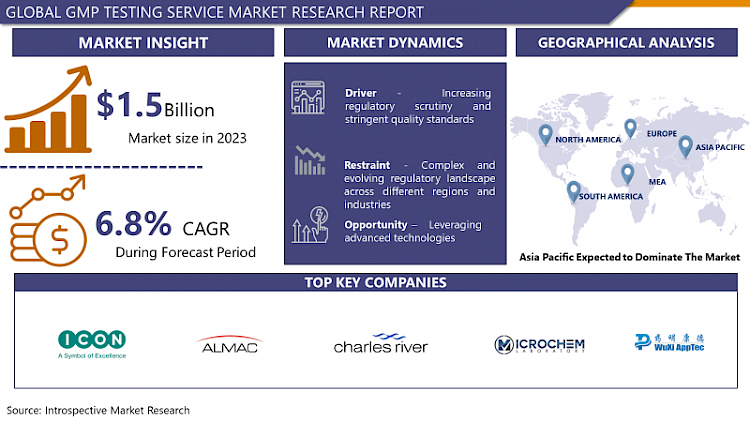

GMP Testing Service Market Size Was Valued at USD 1.5 Billion in 2023, and is Projected to Reach USD 2.7 Billion by 2032, Growing at a CAGR of 6.8% From 2024-2032.

Good Manufacturing Practice or GMP Testing Service involves a range of procedures followed with a view to guaranteeing that the manufactured products are manufactured and controlled to meet the required quality standards and Regulatory Framework for use in the intended applications. This service entails assessment and critique of the following aspects of manufacturing processes: Raw materials, equipments, facilities and employees with the aim of ascertaining whether they meet set GMP standards or not. Despite the fact that they are certified to provide good manufacturing practices, companies are able to use GMP Testing Services to assess their products and determine whether they are likely to cause harm when used by the consumers, hence enable a company make necessary changes so that it can improve its standards to meet its customers and regulatory requirements.

- Over the years, the GMP (Good Manufacturing Practice) Testing Service market has grown rapidly, primarily due to the development of consciousness regarding quality and related standardization prevalent globally, especially in pharmaceuticals and bio tech and food processing sectors. GMP testing services involve a range of testing like analytical testing, microbiological testing, stability testing, and quality control testing to ensure that food/biological products that are produced meet the regulatory quality benchmark and are safe for human consumption/use. The advancement in supply chain technology or outsourcing and increasing pressure from the regulatory authorities GMP testing service is anticipated to witness a steady growth rate as the companies’ concern for product safety and quality in order to retain the customer trust and regulatory compliance.

- The current market in the industry is highly saturated and populated, allowing many firms rto offer various industries competitive GMP testing services. Market players include large CROs as well as specialized niche firms which are all seek to gain a competitive edge through technological advancements, a broad service portfolio, and growth in geographical locations. Innovations in instrumental methods like chromatography, mass spectrometer, and PCR have an unprecedented impact in enhancing the services of GMP testing services by being faster and accurate in analyzing pharmaceutical, biological and food products.

- Industrial sectors are still faced with challenging regulatory policies and higher standards of quality and as more and more industries turn to third party GMP testing service market shows future growth potential.

GMP Testing Service Market Trend Analysis

Growing adoption of advanced technologies and automation

In an attempt to lower cost and increase efficiency of conducting their business while operating within expected turnaround time for compliance with set regulations, more organizations are now leaning towards automation testing platform and robotic systems. These technologies not only enhance the ways in which GMP testing is completed, though also provide the flexibility to process more samples, in line with the globally expanded, ever-faster paced manufacturing sector. Additionally, the adoption of AI technology and machine learning concepts for GMP test management could be the key to the future for predictive analysis and actionable planning involving identifying possible inefficiencies in quality and working on improving the entire testing procedure for better outcomes and following regulatory requirements.

Leveraging advanced technologies

- An opportunity for exploration in the GMP testing service market is that the advancement of various kinds of technologies such as automation, artificial intelligence, and machine learning in enhancing the GMP testing services in terms of efficiency, accuracy, and scalability is still a vast unexplored area. Applying robotics and automated workflows can introduce the enhancement of standard operations that are associated with repetitive testing, points out decreased turn-around-time and cost of labor, as well as increased precision and accuracy of the entire testing process. In addition, it is evident that AI and ML can be used to treat large data sets and continuously evaluate test results to guarantee quality by discovering trends that indicate possible quality risks to aid in decision-making. Accepting these advancements as essential also places GMP testing service providers on a pedestal of unveiling state of the art testing facilities, and provides them with the ability to effectively satisfy customer’s demand for quick, accurate and efficient testing services.

- Also, there is a growing opportunity in offering more specific or niche GMP testing services for new and growing industries such as biotechnology, biomedical, and more recently the marijuana industries including the development of the unpopular but rapidly developing sectors like; personalized medicine, regenerative medicine, and more. In this regard, the role of specialized testing agencies becomes quite significant for the safety and effectiveness testing of new drugs, medical device, and over-the-counter products in the growing industries. If service providers focus more on gaining such expertise and developing advanced testing infrastructure then it would be easier for them to target such niches and get affiliate with organizations in effectively delivering GMP testing for maximizing regulatory compliances and product quality. Expanding the portfolio in such a manner not only opens up further sources of revenue but also enhances market presence by meeting specific demands within dynamically emerging sectors.

GMP Testing Service Market Segment Analysis:

GMP Testing Service Market is segmented on the basis of Service type, and end-users.

By Service Type, Product Validation Testing segment is expected to dominate the market during the forecast period

- The fact that the Product Validation Testing segment would remain most prominent throughout the GMP Testing Service Market the forecast period must not be underemphasised; it signifies the importance of guaranteeing the quality and standard of products that are developed before being hosted on the market. Product validation testing covers such testing activities as stability testing, method validation, process validation which in most actual production lines such as the production of pharmaceuticals and biotechnology products are important strategies proving the reliability of manufactured products. As the major regulatory agencies set higher bar in compliance measures for products that need validation to address risks and protect consumers, ongoing need for testing services to check manufactured products’ processes and performance is likely to persist.

- Due to the increasing occurrence of strict regulatory policies and standards across the globe, it becomes crucial for the companies to develop their products within the shortest possible time to avoid encountering regulatory hurdles that can slow down their growth pace significantly, This makes the Product Validation Testing segment to remain buoyant and dominant in the GMP Testing Service Market.

By End Users, Pharmaceutical and Biopharmaceutical Companies segment expected to held the largest share

- The fact that the pharmaceutical and biopharmaceutical companies have a commanding position in the GMP testing service market makes it a trend where it is believed that this segment would hold the largest share. EFNB’s stringent guidelines on manufacturing and distribution of pharmaceutical products demand elaborate analytical tests to conform to GMP compliance. The pharmaceutical and biopharmaceutical industries fundamentally depend on GMP testing services to qualify, compare and check the general and particular performance and the safety of products from the procurement of raw material through production to the end product.

- Given factors, these companies need various tests such as analytical testing, microbiological testing, stability testing, as well as the quality control testing for meeting these regulatory requirements and product quality testing. In addition, development of novel pharmaceuticals, advanced and complex formulations such as biologics, biosimilars, and specialty drugs increases the need for testing specialization and technology that supports testing specific and complex products. Over the years, pharmaceutical and Biopharmaceutical industries have begun to diversify through research and development, as well as expansion of their products and services portfolio, consequently the market for GMP testing services is expected to have bright future and would act as a major growth factor for GMP testing services market.

GMP Testing Service Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Their market dominance throughout the GMP testing service market over the forecast period can be attributed to several factors. First is the increased primary healthcare spending across the globe, the demand for innovative therapeutic products, the growth of the target pharmaceutical and biotechnology cluster, and growing populations with stronger healthcare access. There is a growing need for the sophisticated and systematic evaluation of GMP regulations or general management principles in as these industries grow to enhance the quality of the products and prevent compromise of the regulatory standards.

- Additionally, the Asia-Pacific region provides the right cost incentives for outsourcing GMP testing services since it is a region of strategic importance and low cost for outsourcing pharmaceutical and biotech firms to efficiently carry out their testing activities. Some of the leading outsourcing destinations currently are India, China, and Singapore, where the culture embraces capability, resources, and friendly regulatory climates for business development.

- Also, the increased food and beverage production across the region due to industrialization, consumers’ sensitization to the quality of foods they consume and prevailing tightening food laws within the food markets further fuel the GMP testing market. Today, to meet international quality standards and timely fulfill consumers’ expectations for safe food products, food manufacturers are under tremendous pressure to test their products.

Active Key Players in the GMP Testing Service Market

- ICON INC. (Ireland)

- Almac group (UK)

- Charles River Laboratory (United States)

- Microchem Laboratory (United States)

- Wuxi App Tec (China)

- Intertek Group PLC (UK)

- Merck KgaA (Germany)

- Sartorius AG (Germany)

- Nelson Laboratories (United States)

- Eurofins Scientific (Luxembourg)

- Other key Players

|

Global GMP Testing Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.8 % |

Market Size in 2032: |

USD 2.7 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- GMP TESTING SERVICE MARKET BY SERVICE TYPE (2017-2032)

- GMP TESTING SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PACKAGING AND SHELF-LIFE TESTING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PRODUCT VALIDATION TESTING

- BIOANALYTICAL SERVICES

- OTHERS

- GMP TESTING SERVICE MARKET BY END USER (2017-2032)

- GMP TESTING SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEDICAL DEVICE COMPANIES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- GMP TESTING SERVICE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ICON INC. (IRELAND)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ALMAC GROUP (UK)

- CHARLES RIVER LABORATORY (UNITED STATES)

- MICROCHEM LABORATORY (UNITED STATES)

- WUXI APP TEC (CHINA)

- INTERTEK GROUP PLC (UK)

- MERCK KGAA (GERMANY)

- SARTORIUS AG (GERMANY)

- NELSON LABORATORIES (UNITED STATES)

- EUROFINS SCIENTIFIC (LUXEMBOURG)

- COMPETITIVE LANDSCAPE

- GLOBAL GMP TESTING SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Service Type

- Historic And Forecasted Market Size By End Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global GMP Testing Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.8 % |

Market Size in 2032: |

USD 2.7 Bn. |

|

Segments Covered: |

By Service Type |

|

|

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. GMP TESTING SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. GMP TESTING SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. GMP TESTING SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. GMP TESTING SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. GMP TESTING SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. GMP TESTING SERVICE MARKET BY TYPE

TABLE 008. PRODUCT VALIDATION TESTING MARKET OVERVIEW (2016-2028)

TABLE 009. BIOANALYTICAL SERVICES MARKET OVERVIEW (2016-2028)

TABLE 010. PACKAGING MARKET OVERVIEW (2016-2028)

TABLE 011. SHELF-LIFE TESTING MARKET OVERVIEW (2016-2028)

TABLE 012. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 013. GMP TESTING SERVICE MARKET BY END-USER

TABLE 014. PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES MARKET OVERVIEW (2016-2028)

TABLE 015. MEDICAL DEVICES COMPANY MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA GMP TESTING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA GMP TESTING SERVICE MARKET, BY END-USER (2016-2028)

TABLE 018. N GMP TESTING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE GMP TESTING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE GMP TESTING SERVICE MARKET, BY END-USER (2016-2028)

TABLE 021. GMP TESTING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC GMP TESTING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC GMP TESTING SERVICE MARKET, BY END-USER (2016-2028)

TABLE 024. GMP TESTING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA GMP TESTING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA GMP TESTING SERVICE MARKET, BY END-USER (2016-2028)

TABLE 027. GMP TESTING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA GMP TESTING SERVICE MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA GMP TESTING SERVICE MARKET, BY END-USER (2016-2028)

TABLE 030. GMP TESTING SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 031. EUROFINS SCIENTIFIC: SNAPSHOT

TABLE 032. EUROFINS SCIENTIFIC: BUSINESS PERFORMANCE

TABLE 033. EUROFINS SCIENTIFIC: PRODUCT PORTFOLIO

TABLE 034. EUROFINS SCIENTIFIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. PPD INC.: SNAPSHOT

TABLE 035. PPD INC.: BUSINESS PERFORMANCE

TABLE 036. PPD INC.: PRODUCT PORTFOLIO

TABLE 037. PPD INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. MICROCHEM LABORATORY: SNAPSHOT

TABLE 038. MICROCHEM LABORATORY: BUSINESS PERFORMANCE

TABLE 039. MICROCHEM LABORATORY: PRODUCT PORTFOLIO

TABLE 040. MICROCHEM LABORATORY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. SARTORIUS AG: SNAPSHOT

TABLE 041. SARTORIUS AG: BUSINESS PERFORMANCE

TABLE 042. SARTORIUS AG: PRODUCT PORTFOLIO

TABLE 043. SARTORIUS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. NORTH AMERICAN SCIENCE ASSOCIATES INC.: SNAPSHOT

TABLE 044. NORTH AMERICAN SCIENCE ASSOCIATES INC.: BUSINESS PERFORMANCE

TABLE 045. NORTH AMERICAN SCIENCE ASSOCIATES INC.: PRODUCT PORTFOLIO

TABLE 046. NORTH AMERICAN SCIENCE ASSOCIATES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. LABORATORY CORPORATION OF AMERICA HOLDINGS (COVANCE INC.): SNAPSHOT

TABLE 047. LABORATORY CORPORATION OF AMERICA HOLDINGS (COVANCE INC.): BUSINESS PERFORMANCE

TABLE 048. LABORATORY CORPORATION OF AMERICA HOLDINGS (COVANCE INC.): PRODUCT PORTFOLIO

TABLE 049. LABORATORY CORPORATION OF AMERICA HOLDINGS (COVANCE INC.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. SOTERA HEALTH (NELSON LABORATORIES LLC): SNAPSHOT

TABLE 050. SOTERA HEALTH (NELSON LABORATORIES LLC): BUSINESS PERFORMANCE

TABLE 051. SOTERA HEALTH (NELSON LABORATORIES LLC): PRODUCT PORTFOLIO

TABLE 052. SOTERA HEALTH (NELSON LABORATORIES LLC): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. ALMAC GROUP: SNAPSHOT

TABLE 053. ALMAC GROUP: BUSINESS PERFORMANCE

TABLE 054. ALMAC GROUP: PRODUCT PORTFOLIO

TABLE 055. ALMAC GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. PACE ANALYTICAL: SNAPSHOT

TABLE 056. PACE ANALYTICAL: BUSINESS PERFORMANCE

TABLE 057. PACE ANALYTICAL: PRODUCT PORTFOLIO

TABLE 058. PACE ANALYTICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. WUXI APPTEC: SNAPSHOT

TABLE 059. WUXI APPTEC: BUSINESS PERFORMANCE

TABLE 060. WUXI APPTEC: PRODUCT PORTFOLIO

TABLE 061. WUXI APPTEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. INTERTEK GROUP PLC: SNAPSHOT

TABLE 062. INTERTEK GROUP PLC: BUSINESS PERFORMANCE

TABLE 063. INTERTEK GROUP PLC: PRODUCT PORTFOLIO

TABLE 064. INTERTEK GROUP PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. CHARLES RIVER LABORATORIES: SNAPSHOT

TABLE 065. CHARLES RIVER LABORATORIES: BUSINESS PERFORMANCE

TABLE 066. CHARLES RIVER LABORATORIES: PRODUCT PORTFOLIO

TABLE 067. CHARLES RIVER LABORATORIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 068. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 069. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 070. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. GMP TESTING SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. GMP TESTING SERVICE MARKET OVERVIEW BY TYPE

FIGURE 012. PRODUCT VALIDATION TESTING MARKET OVERVIEW (2016-2028)

FIGURE 013. BIOANALYTICAL SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 014. PACKAGING MARKET OVERVIEW (2016-2028)

FIGURE 015. SHELF-LIFE TESTING MARKET OVERVIEW (2016-2028)

FIGURE 016. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 017. GMP TESTING SERVICE MARKET OVERVIEW BY END-USER

FIGURE 018. PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES MARKET OVERVIEW (2016-2028)

FIGURE 019. MEDICAL DEVICES COMPANY MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA GMP TESTING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE GMP TESTING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC GMP TESTING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA GMP TESTING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA GMP TESTING SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the GMP Testing Service Market research report is 2024-2032.

ICON INC., almac group, Charles River Laboratory, Microchem Laboratory, and Other Major Players.

The GMP Testing Service Market is segmented into Service Type, End Users, and region. By Service Type, the market is categorized into Packaging and Shelf-Life Testing, Product Validation Testing, Bioanalytical Services and Others. By End Users, the market is categorized into Pharmaceutical and Biopharmaceutical Companies, Medical Device Companies. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Good Manufacturing Practice or GMP Testing Service involves a range of procedures followed with a view to guaranteeing that the manufactured products are manufactured and controlled to meet the required quality standards and Regulatory Framework for use in the intended applications. This service entails assessment and critique of the following aspects of manufacturing processes: Raw materials, equipments, facilities and employees with the aim of ascertaining whether they meet set GMP standards or not. Despite the fact that they are certified to provide good manufacturing practices, companies are able to use GMP Testing Services to assess their products and determine whether they are likely to cause harm when used by the consumers, hence enable a company make necessary changes so that it can improve its standards to meet its customers and regulatory requirements.

GMP Testing Service Market Size Was Valued at USD 1.5 Billion in 2023, and is Projected to Reach USD 2.7 Billion by 2032, Growing at a CAGR of 6.8% From 2024-2032.