Global Echocardiography Market Overview

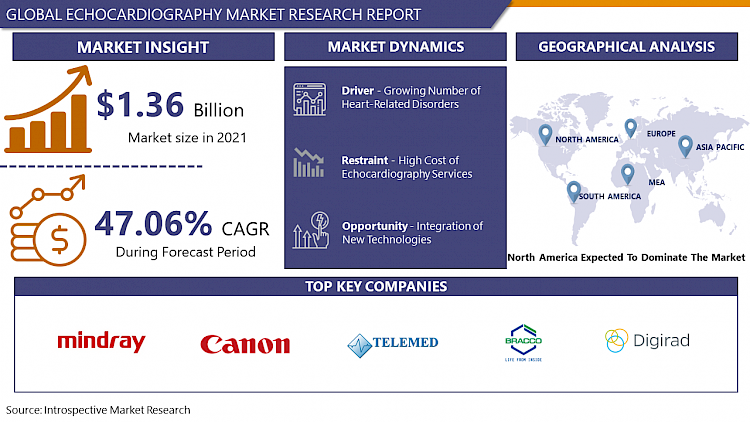

The Echocardiography Market was valued at USD 1.36 Billion in 2021 and is projected to reach USD 20.16 Billion by 2028, growing at a CAGR of 47.06% from 2022 to 2028.

The heart is one of the vital organs of the body that plays an important role in pumping oxygen-rich blood to various parts of the body. The heart has four chambers, two uppers known as atria, and two lower ones known as ventricles. An unhealthy lifestyle, poor diet, lack of exercise, smoking, overweight, and consumption of alcohol has resulted in a rise in the number of individuals suffering from heart disorders. To check the functioning of the heart echocardiography is done, and it is a non-invasive ultrasound procedure. Echocardiogram utilizes high-frequency sound waves (ultrasound), to provide a picture of the heart’s chamber, valves and helps the clinician to evaluate the pumping action of the heart. Echocardiography is often combined with color Doppler, and Doppler ultrasound to check the blood flow inside the heart. During the procedure, a transducer is placed on the chest that emits sound waves at a higher frequency. These sound waves travel through the skin and other human tissues to the heart tissues, where they bounce or echo off of the heart structures when the transducer is positioned on the chest at specific positions and angles. These sound waves are sent to a computer, which generates moving pictures of the heart's walls and valves. The growing usage of echocardiograms for monitoring the functioning of the heart is boosting the growth of the echocardiography market over the forecast period.

Market Dynamics And Key Factors For Echocardiography Market

Drivers:

Integration of AI in electrocardiography

Artificial intelligence (AI) has grown at an exponential rate in recent decades, with deep learning currently providing enormous opportunities. According to a paper published in the journal Echocardiography, automation, and AI are transforming the landscape of echocardiography by delivering complementary tools to clinicians to improve patient care. Manufacturers are collaborating with software vendors to accommodate AI in the echocardiogram. AI has influenced every step of echocardiography from image acquisition to automatic measurement and interpretation. Echocardiography is sometimes affected by the level of experience of the observer but, AI can overcome this barrier and provide reproducible measures, enabling accurate diagnosis. Additionally, AI can provide clinically essential insights from non-specific data and subtle data such as the variations in the myocardial texture in individuals suffering from the myocardial disease.

A growing number of heart-related disorders

Over the few decades, there has been a significant change in lifestyle patterns. There has been a rapid shift towards fast food due to hectic and bust schedules. People in their 20s and 30s are the most consumers of fast food thus, the incidences of heart attacks are becoming more prevalent in these age groups. The increasing consumption of fast food has led to an unprecedented rise in the number of heart-related disorders. Fast food increases calorie intake and causes the deposition of fats in arteries (atherosclerosis). This creates a shortage of blood supply to vital body parts, and when this plaque gets deposited in the coronary arteries it increases the possibilities of a heart attack. According to WHO, cardiovascular diseases (CVDs) are the global leading cause of death, responsible for an estimated 17.9 million deaths each year. CVDs account for 32% of the total deaths worldwide. Unhealthy food consumption, smoking, drinking, and lack of exercise are some of the factors that are responsible for heart diseases thus, the demand for echocardiography is expected to increase in the forecast period.

Restraints:

High cost of echocardiography services

This imaging procedure is non-invasive and does not pose a threat to the person undergoing echocardiography. Some may have discomfort from the positioning of the transducer, as it can put pressure on the surface of the body. In some individuals, having to lie still on the exam table for the length of the procedure may cause some discomfort or pain. The cost of echocardiography is high thus, making it unaffordable for individuals living in lower strata of the society thus, hampering the expansion of the echocardiography market over the forecast period.

Opportunities:

Integration of new technologies

Technological advancement has led to the development of new innovative ways that increase the credibility and functionality of echocardiogram devices. The rise of AI technology has dramatically changed echocardiogram services. AI can eliminate the human errors that occur during the procedure. Another technological trend is the Point-of-care ultrasound (POCUS). POCUS not only provides more detailed information, but also is an effective tool that can lower the cost of advanced imaging, enhance patient care and safety, and boost doctor-patient interactions, resulting in higher patient satisfaction. Furthermore, 3D imaging is also becoming popular as it can improve the accuracy of the echocardiographic evaluation of cardiac chambers. In addition, 3D imaging offers realistic and unique comprehensive images of cardiac valves and congenital abnormalities. Along with this technological trend, the growing prevalence of heart-related diseases globally is creating an opportunity for the market players to develop innovative technologies in echocardiography that are more sustainable and affordable.

Market Segmentation

Segmentation Analysis of Echocardiography Market:

Depending on test type, the transthoracic echocardiogram segment is forecasted to have the highest share of the market. Transthoracic echocardiogram is the most common type of echocardiogram and it utilizes a transducer that sends and receives sound waves that bounce back from the heart. Due to its low cost, mobility, broad availability, absence of ionizing radiation, and capacity to examine both anatomy and function of the heart, it is frequently used as a first-line imaging technique in the evaluation of cardiac disease. Transthoracic echocardiogram coupled with 3D imaging can give multiple images of the heart and from different angles thus, supporting the growth of the segment in the forecasted timeframe.

Depending on the technology, 3D & The 4D segment is anticipated to dominate the market in the projected period. 3D & 4D echocardiography devices provide real-time, high-quality images of the heart which helps surgeons to choose the appropriate treatment. This technology can be used to monitor heart conditions in patients having CVDs such as cardiomyopathy, pericardial disease, and heart failure. It also helps in analyzing coronary artery diseases, rhythmic disorders, and more. 3D & 4D technology enables the doctor to see the size, shape, thickness, and movement of the heart. It also allows checking whether the valves are working properly or there is any leakage thus, the demand for 3D & 4D technology is expected to rise in the period of forecast.

Depending on end-users, the hospital segment is expected to lead the echocardiography market throughout the analysis. Hospitals offer personalized care and are well equipped with advanced devices utilized for echocardiography. Hospitals offer insurance benefits for several procedures including echocardiography. Hospitals have trained medical staff that can give proper treatment and medication throughout the hospital stay. Additionally, hospitals have ready access to rehabilitation if any adverse situation arises after the procedure thus, driving the expansion of this segment during the projected timeframe.

Regional Analysis of Echocardiography Market:

The North American region is anticipated to dominate the echocardiography market in the forecast period attributed to government spending on healthcare expenditure. The United States government spent US$ 4.1 trillion on healthcare in 2020. It accounted for US$ 12,530 per person and a total of 19.7% of the total GDP. Moreover, the rate of CVDs prognosis in this region has increased in recent times. In the United States, about 659,000 people die from heart-related disorders, that’s 1 in every 4 deaths. The growing prevalence of heart diseases has increased the demand for echocardiography services thus, propelling the expansion of the market during the projected period.

The European region is expected to have the second-highest share of the echocardiography market in the projected timeframe. CVD is the most common cause of death in the European region. According to the European Society of Cardiology, more than 11 million new cases are registered each year in the EU, and approximately 49 million people are living with the disease in the EU. CVDs costs the EU an estimated amount of US$ 238 billion annually. Furthermore, European countries have the highest consumption of alcohol globally. The rise in alcohol consumption can gradually increase the chances of having CVDs thus, promoting the expansion of the echocardiography market in the forecast period.

The echocardiography market in the Asia-Pacific region is projected to develop at the highest CAGR owing to population explosion, and growing prevalence of CVDs in the younger population. China's rapid socioeconomic development has had a significant impact on its lifestyle. As a result of these changes in lifestyle, urbanization, and population aging, the risk of cardiovascular disease (CVD) has increased. The echocardiography market in China is anticipated to develop at a CAGR of 4.9%. According to the Indian Heart Association, 25% of the total heart attacks in Indian men occur under 40 years of age. The Association also stated that the mortality rate is higher in the women population. Therefore, the growing prevalence of heart diseases in the younger population is expected to support the development of the echocardiography market in the projected timeframe.

Players Covered in Echocardiography Market are:

• General Electric Company

• Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

• ContextVision AB

• Koninklijke Philips N.V.

• Canon Medical Systems Corporation

• Esaote S.p.A

• Hitachi Medical Corporation

• Bay Labs Inc.

• Fujifilm Holdings Corporation

• Bracco Imaging S.p.A

• Samsung Electronics Co. Ltd.

• Digirad Corporation

• Siemens Healthcare Private Limited

• Telemed Ultrasound

• Boston Scientific Corporation

• CHISON Medical Technologies Co., Ltd.

• ALPINION MEDICAL SYSTEMS

• Biosense Webster

• Carestream Health

• Ecare Medical Technology

• St. Jude Medical (Abbott Laboratories)

• Medtronic

• Terumo Corporation

• Philips Healthcare

• Toshiba Medical Systems

COVID-19 Impact on Echocardiography Market

The Outbreak of the COVID-19 pandemic drastically affected the functioning of several industry verticals. The healthcare facilities were under tremendous stress due to the rising number of infected patients. In order to check the spread of the virus in the lungs, ultrasound imaging of the lungs is performed. Cardiac failure was noted in a significant number of hospitalized patients. Thus, to check the functioning of the heart in critically ill patients’ echocardiography was done. Moreover, people having cardiovascular diseases also have a regular checkup to monitor the condition of the heart. The pandemic decreased the number of OPD patients that used to visit hospitals or clinical laboratories for echocardiography. The fear of getting infected by the disease prevented the majority of the population from undergoing echocardiography. According to the National Health Service of the UK, 70% of the sites discontinued their stress echocardiography services in the wake of the rapidly spreading pandemic. There was also a shortage of new devices as there were strict restrictions imposed on the imports and exports of commodities. COVID-19 pandemic resulted in a smaller number of workers, working in the manufacturing utilities thus, there was a significant drop in the number of new echocardiogram devices produced. To summarize, with the growing vaccination rate the number of people returning to clinical laboratories, and hospitals for echocardiography is expected to rise therefore, it will strengthen the expansion of the echocardiography market in the projected period.

Recent Industry Developments In Echocardiography Market

- In December 2021, Philips launched an innovative echocardiography solution, that brings together AI-driven automated measurements, remote access, and new transducer technology. The new AI-enhanced Auto Measure application decreases the echo quantification time, and improves the patient and staff experience.

- In June 2021, Siemens Healthineers announced that it has received a CE Mark for the AcuNav Volume ICE (Intracardiac Echocardiography) catheter. This new catheter is a therapy-enabling imaging guide that enables real-time, wide-angle visualization of heart anatomy during Structural Heart and Electrophysiology procedures. AcuNav Volume ICE is the first Volume ICE catheter on the market, built on a 20-year history of ICE invention.

|

Global Echocardiography Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.36 Bn. |

|

Forecast Period 2022-28 CAGR: |

47.06% |

Market Size in 2028: |

USD 20.16 Bn. |

|

Segments Covered: |

By Test Type |

|

|

|

By Technology |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Test Type

3.2 By Technology

3.3 By End-Users

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Echocardiography Market by Test Type

5.1 Echocardiography Market Overview Snapshot and Growth Engine

5.2 Echocardiography Market Overview

5.3 Transthoracic Echocardiogram

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Transthoracic Echocardiogram: Grographic Segmentation

5.4 Transesophageal Echocardiogram

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Transesophageal Echocardiogram: Grographic Segmentation

5.5 Stress Echocardiogram

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Stress Echocardiogram: Grographic Segmentation

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Grographic Segmentation

Chapter 6: Echocardiography Market by Technology

6.1 Echocardiography Market Overview Snapshot and Growth Engine

6.2 Echocardiography Market Overview

6.3 2D

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 2D: Grographic Segmentation

6.4 3D & 4D

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 3D & 4D: Grographic Segmentation

6.5 Doppler Imaging

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Doppler Imaging: Grographic Segmentation

6.6 Others

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Others: Grographic Segmentation

Chapter 7: Echocardiography Market by End-Users

7.1 Echocardiography Market Overview Snapshot and Growth Engine

7.2 Echocardiography Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Hospitals: Grographic Segmentation

7.4 Diagnostic Centers

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Diagnostic Centers: Grographic Segmentation

7.5 Ambulatory Care Centers

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Ambulatory Care Centers: Grographic Segmentation

7.6 Others

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2016-2028F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Others: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Echocardiography Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Echocardiography Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Echocardiography Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 GENERAL ELECTRIC COMPANY

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO. LTD.

8.4 CONTEXTVISION AB

8.5 KONINKLIJKE PHILIPS N.V.

8.6 CANON MEDICAL SYSTEMS CORPORATION

8.7 ESAOTE S.P.A

8.8 HITACHI MEDICAL CORPORATION

8.9 BAY LABS INC.

8.10 FUJIFILM HOLDINGS CORPORATION

8.11 BRACCO IMAGING S.P.A

8.12 SAMSUNG ELECTRONICS CO. LTD.

8.13 DIGIRAD CORPORATION

8.14 SIEMENS HEALTHCARE PRIVATE LIMITED

8.15 TELEMED ULTRASOUND

8.16 OTHER MAJOR PLAYERS

Chapter 9: Global Echocardiography Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Test Type

9.2.1 Transthoracic Echocardiogram

9.2.2 Transesophageal Echocardiogram

9.2.3 Stress Echocardiogram

9.2.4 Others

9.3 Historic and Forecasted Market Size By Technology

9.3.1 2D

9.3.2 3D & 4D

9.3.3 Doppler Imaging

9.3.4 Others

9.4 Historic and Forecasted Market Size By End-Users

9.4.1 Hospitals

9.4.2 Diagnostic Centers

9.4.3 Ambulatory Care Centers

9.4.4 Others

Chapter 10: North America Echocardiography Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Test Type

10.4.1 Transthoracic Echocardiogram

10.4.2 Transesophageal Echocardiogram

10.4.3 Stress Echocardiogram

10.4.4 Others

10.5 Historic and Forecasted Market Size By Technology

10.5.1 2D

10.5.2 3D & 4D

10.5.3 Doppler Imaging

10.5.4 Others

10.6 Historic and Forecasted Market Size By End-Users

10.6.1 Hospitals

10.6.2 Diagnostic Centers

10.6.3 Ambulatory Care Centers

10.6.4 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Echocardiography Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Test Type

11.4.1 Transthoracic Echocardiogram

11.4.2 Transesophageal Echocardiogram

11.4.3 Stress Echocardiogram

11.4.4 Others

11.5 Historic and Forecasted Market Size By Technology

11.5.1 2D

11.5.2 3D & 4D

11.5.3 Doppler Imaging

11.5.4 Others

11.6 Historic and Forecasted Market Size By End-Users

11.6.1 Hospitals

11.6.2 Diagnostic Centers

11.6.3 Ambulatory Care Centers

11.6.4 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Echocardiography Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Test Type

12.4.1 Transthoracic Echocardiogram

12.4.2 Transesophageal Echocardiogram

12.4.3 Stress Echocardiogram

12.4.4 Others

12.5 Historic and Forecasted Market Size By Technology

12.5.1 2D

12.5.2 3D & 4D

12.5.3 Doppler Imaging

12.5.4 Others

12.6 Historic and Forecasted Market Size By End-Users

12.6.1 Hospitals

12.6.2 Diagnostic Centers

12.6.3 Ambulatory Care Centers

12.6.4 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Echocardiography Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Test Type

13.4.1 Transthoracic Echocardiogram

13.4.2 Transesophageal Echocardiogram

13.4.3 Stress Echocardiogram

13.4.4 Others

13.5 Historic and Forecasted Market Size By Technology

13.5.1 2D

13.5.2 3D & 4D

13.5.3 Doppler Imaging

13.5.4 Others

13.6 Historic and Forecasted Market Size By End-Users

13.6.1 Hospitals

13.6.2 Diagnostic Centers

13.6.3 Ambulatory Care Centers

13.6.4 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Echocardiography Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Test Type

14.4.1 Transthoracic Echocardiogram

14.4.2 Transesophageal Echocardiogram

14.4.3 Stress Echocardiogram

14.4.4 Others

14.5 Historic and Forecasted Market Size By Technology

14.5.1 2D

14.5.2 3D & 4D

14.5.3 Doppler Imaging

14.5.4 Others

14.6 Historic and Forecasted Market Size By End-Users

14.6.1 Hospitals

14.6.2 Diagnostic Centers

14.6.3 Ambulatory Care Centers

14.6.4 Others

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Echocardiography Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.36 Bn. |

|

Forecast Period 2022-28 CAGR: |

47.06% |

Market Size in 2028: |

USD 20.16 Bn. |

|

Segments Covered: |

By Test Type |

|

|

|

By Technology |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ECHOCARDIOGRAPHY MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ECHOCARDIOGRAPHY MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ECHOCARDIOGRAPHY MARKET COMPETITIVE RIVALRY

TABLE 005. ECHOCARDIOGRAPHY MARKET THREAT OF NEW ENTRANTS

TABLE 006. ECHOCARDIOGRAPHY MARKET THREAT OF SUBSTITUTES

TABLE 007. ECHOCARDIOGRAPHY MARKET BY TEST TYPE

TABLE 008. TRANSTHORACIC ECHOCARDIOGRAM MARKET OVERVIEW (2016-2028)

TABLE 009. TRANSESOPHAGEAL ECHOCARDIOGRAM MARKET OVERVIEW (2016-2028)

TABLE 010. STRESS ECHOCARDIOGRAM MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. ECHOCARDIOGRAPHY MARKET BY TECHNOLOGY

TABLE 013. 2D MARKET OVERVIEW (2016-2028)

TABLE 014. 3D & 4D MARKET OVERVIEW (2016-2028)

TABLE 015. DOPPLER IMAGING MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. ECHOCARDIOGRAPHY MARKET BY END-USERS

TABLE 018. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 019. DIAGNOSTIC CENTERS MARKET OVERVIEW (2016-2028)

TABLE 020. AMBULATORY CARE CENTERS MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA ECHOCARDIOGRAPHY MARKET, BY TEST TYPE (2016-2028)

TABLE 023. NORTH AMERICA ECHOCARDIOGRAPHY MARKET, BY TECHNOLOGY (2016-2028)

TABLE 024. NORTH AMERICA ECHOCARDIOGRAPHY MARKET, BY END-USERS (2016-2028)

TABLE 025. N ECHOCARDIOGRAPHY MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE ECHOCARDIOGRAPHY MARKET, BY TEST TYPE (2016-2028)

TABLE 027. EUROPE ECHOCARDIOGRAPHY MARKET, BY TECHNOLOGY (2016-2028)

TABLE 028. EUROPE ECHOCARDIOGRAPHY MARKET, BY END-USERS (2016-2028)

TABLE 029. ECHOCARDIOGRAPHY MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC ECHOCARDIOGRAPHY MARKET, BY TEST TYPE (2016-2028)

TABLE 031. ASIA PACIFIC ECHOCARDIOGRAPHY MARKET, BY TECHNOLOGY (2016-2028)

TABLE 032. ASIA PACIFIC ECHOCARDIOGRAPHY MARKET, BY END-USERS (2016-2028)

TABLE 033. ECHOCARDIOGRAPHY MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA ECHOCARDIOGRAPHY MARKET, BY TEST TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA ECHOCARDIOGRAPHY MARKET, BY TECHNOLOGY (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA ECHOCARDIOGRAPHY MARKET, BY END-USERS (2016-2028)

TABLE 037. ECHOCARDIOGRAPHY MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA ECHOCARDIOGRAPHY MARKET, BY TEST TYPE (2016-2028)

TABLE 039. SOUTH AMERICA ECHOCARDIOGRAPHY MARKET, BY TECHNOLOGY (2016-2028)

TABLE 040. SOUTH AMERICA ECHOCARDIOGRAPHY MARKET, BY END-USERS (2016-2028)

TABLE 041. ECHOCARDIOGRAPHY MARKET, BY COUNTRY (2016-2028)

TABLE 042. GENERAL ELECTRIC COMPANY: SNAPSHOT

TABLE 043. GENERAL ELECTRIC COMPANY: BUSINESS PERFORMANCE

TABLE 044. GENERAL ELECTRIC COMPANY: PRODUCT PORTFOLIO

TABLE 045. GENERAL ELECTRIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO. LTD.: SNAPSHOT

TABLE 046. SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO. LTD.: BUSINESS PERFORMANCE

TABLE 047. SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO. LTD.: PRODUCT PORTFOLIO

TABLE 048. SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. CONTEXTVISION AB: SNAPSHOT

TABLE 049. CONTEXTVISION AB: BUSINESS PERFORMANCE

TABLE 050. CONTEXTVISION AB: PRODUCT PORTFOLIO

TABLE 051. CONTEXTVISION AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. KONINKLIJKE PHILIPS N.V.: SNAPSHOT

TABLE 052. KONINKLIJKE PHILIPS N.V.: BUSINESS PERFORMANCE

TABLE 053. KONINKLIJKE PHILIPS N.V.: PRODUCT PORTFOLIO

TABLE 054. KONINKLIJKE PHILIPS N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. CANON MEDICAL SYSTEMS CORPORATION: SNAPSHOT

TABLE 055. CANON MEDICAL SYSTEMS CORPORATION: BUSINESS PERFORMANCE

TABLE 056. CANON MEDICAL SYSTEMS CORPORATION: PRODUCT PORTFOLIO

TABLE 057. CANON MEDICAL SYSTEMS CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ESAOTE S.P.A: SNAPSHOT

TABLE 058. ESAOTE S.P.A: BUSINESS PERFORMANCE

TABLE 059. ESAOTE S.P.A: PRODUCT PORTFOLIO

TABLE 060. ESAOTE S.P.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. HITACHI MEDICAL CORPORATION: SNAPSHOT

TABLE 061. HITACHI MEDICAL CORPORATION: BUSINESS PERFORMANCE

TABLE 062. HITACHI MEDICAL CORPORATION: PRODUCT PORTFOLIO

TABLE 063. HITACHI MEDICAL CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. BAY LABS INC.: SNAPSHOT

TABLE 064. BAY LABS INC.: BUSINESS PERFORMANCE

TABLE 065. BAY LABS INC.: PRODUCT PORTFOLIO

TABLE 066. BAY LABS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. FUJIFILM HOLDINGS CORPORATION: SNAPSHOT

TABLE 067. FUJIFILM HOLDINGS CORPORATION: BUSINESS PERFORMANCE

TABLE 068. FUJIFILM HOLDINGS CORPORATION: PRODUCT PORTFOLIO

TABLE 069. FUJIFILM HOLDINGS CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. BRACCO IMAGING S.P.A: SNAPSHOT

TABLE 070. BRACCO IMAGING S.P.A: BUSINESS PERFORMANCE

TABLE 071. BRACCO IMAGING S.P.A: PRODUCT PORTFOLIO

TABLE 072. BRACCO IMAGING S.P.A: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. SAMSUNG ELECTRONICS CO. LTD.: SNAPSHOT

TABLE 073. SAMSUNG ELECTRONICS CO. LTD.: BUSINESS PERFORMANCE

TABLE 074. SAMSUNG ELECTRONICS CO. LTD.: PRODUCT PORTFOLIO

TABLE 075. SAMSUNG ELECTRONICS CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. DIGIRAD CORPORATION: SNAPSHOT

TABLE 076. DIGIRAD CORPORATION: BUSINESS PERFORMANCE

TABLE 077. DIGIRAD CORPORATION: PRODUCT PORTFOLIO

TABLE 078. DIGIRAD CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. SIEMENS HEALTHCARE PRIVATE LIMITED: SNAPSHOT

TABLE 079. SIEMENS HEALTHCARE PRIVATE LIMITED: BUSINESS PERFORMANCE

TABLE 080. SIEMENS HEALTHCARE PRIVATE LIMITED: PRODUCT PORTFOLIO

TABLE 081. SIEMENS HEALTHCARE PRIVATE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. TELEMED ULTRASOUND: SNAPSHOT

TABLE 082. TELEMED ULTRASOUND: BUSINESS PERFORMANCE

TABLE 083. TELEMED ULTRASOUND: PRODUCT PORTFOLIO

TABLE 084. TELEMED ULTRASOUND: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 085. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 086. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 087. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ECHOCARDIOGRAPHY MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ECHOCARDIOGRAPHY MARKET OVERVIEW BY TEST TYPE

FIGURE 012. TRANSTHORACIC ECHOCARDIOGRAM MARKET OVERVIEW (2016-2028)

FIGURE 013. TRANSESOPHAGEAL ECHOCARDIOGRAM MARKET OVERVIEW (2016-2028)

FIGURE 014. STRESS ECHOCARDIOGRAM MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. ECHOCARDIOGRAPHY MARKET OVERVIEW BY TECHNOLOGY

FIGURE 017. 2D MARKET OVERVIEW (2016-2028)

FIGURE 018. 3D & 4D MARKET OVERVIEW (2016-2028)

FIGURE 019. DOPPLER IMAGING MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. ECHOCARDIOGRAPHY MARKET OVERVIEW BY END-USERS

FIGURE 022. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 023. DIAGNOSTIC CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 024. AMBULATORY CARE CENTERS MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA ECHOCARDIOGRAPHY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE ECHOCARDIOGRAPHY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC ECHOCARDIOGRAPHY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA ECHOCARDIOGRAPHY MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA ECHOCARDIOGRAPHY MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Echocardiography Market research report is 2022-2028.

General Electric Company (US), Shenzhen Mindray Bio-Medical Electronics Co. Ltd. (China), ContextVision AB (Sweden), Koninklijke Philips N.V. (Netherlands), Canon Medical Systems Corporation (Japan), Esaote S.p.A (Italy), Hitachi Medical Corporation (US), Bay Labs Inc. (US), Fujifilm Holdings Corporation (Japan), Bracco Imaging S.p.A (Italy), Samsung Electronics Co. Ltd. (South Korea), Digirad Corporation (US), Siemens Healthcare Private Limited (Germany), Telemed Ultrasound (Italy) and other major players.

The Echocardiography Market is segmented into Test Type, Technology, End-Users, and region. By Test Type, the market is categorized into Transthoracic Echocardiogram, Transesophageal Echocardiogram, Stress Echocardiogram, and Others. By Technology, the market is categorized into 2D, 3D & 4D, Doppler Imaging, and Others. By End-Users, the market is categorized into Hospitals, Diagnostic Centers, Ambulatory Care Centers, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Echocardiography is often combined with color Doppler, and Doppler ultrasound to check the blood flow inside the heart. During the procedure, a transducer is placed on the chest that emits sound waves at a higher frequency. These sound waves travel through the skin and other human tissues to the heart tissues.

The Echocardiography Market was valued at USD 1.36 Billion in 2021 and is projected to reach USD 20.16 Billion by 2028, growing at a CAGR of 47.06% from 2022 to 2028.