U.S. Frozen Bakery Market Overview

The U.S. Frozen Bakery Market was valued at USD 7.5 billion in 2023 and is projected to reach USD 12.63 billion by 2032, registering a CAGR of 5.96 % from 2024 to 2032.

- Bakery goods that can be frozen and used for later future instances are known as frozen bakery products. Frozen Bakery Products have a frozen shelf life of 6 months to 18 months thus, they are long-lasting food products. The movement of the water contained in the product is prevented using Individual Quick-Frozen Technology, turning the water into ice crystals, thereby inhibiting microbiological degradation of food. Moreover, there has been an increase in the consumption of bakery products mostly because of changing lifestyles and the ease of availability of bakery products. In addition, the bakery stores have grown in large numbers to meet the demand of the growing population. Frozen bakery products are day-to-day use products for the US population as they come in ready to eat and ready to bake categories. Furthermore, individuals want to avoid the tedious process of cooking food thus promoting the market players to provide consumers, bakery products that are convenient for cooking. The growing concern in the US population is obese, near two-thirds of US adults are overweight according to a report published in Healthline. Therefore, manufacturers are launching gluten-free segments of frozen bakery products. Gluten-free bakery products help in aiding digestion as well as in losing weight thus promoting individuals in the overweight category to add them to their diet as these helps in reducing weight. A report published by American Frozen Food Institute (AFFI), stated a rise in sales of frozen foods by 18.2% in 2020 thus, the U.S. Frozen Bakery Market is anticipated to grow at a significant growth rate in the forecast period.

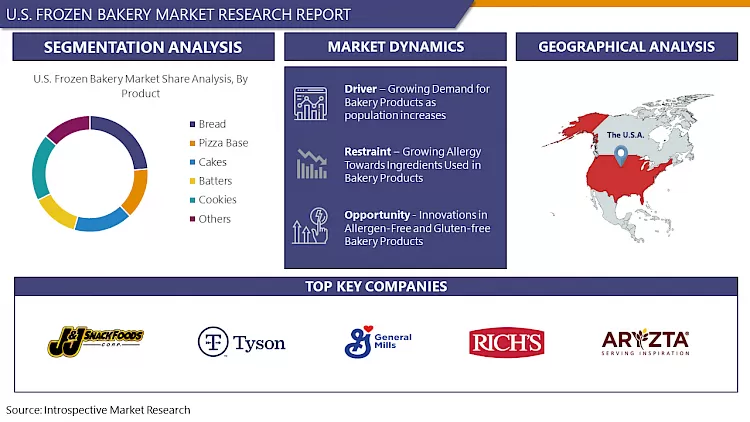

Market Dynamics And Factors For The U.S. Frozen Bakery Market

Drivers:

Growing Demand for Bakery Products as population increases

- An increasing number of manufacturing companies and a well-deployed retail and service sector are driving the growth of the U.S. Frozen Bakery Market in the forecast period. The sudden increase in manufacturing companies is attributed to the increasing population. Moreover, culture in the US is promoting market growth as festival occasions are incomplete without the consumption of bakery products. Furthermore, the modern lifestyle and busy work schedules of US individuals are compelling them to adopt frozen bakery products as they are easily available, long shelf life, and are economically preferable. To supply proper nutrition, market players are using food supplements in bakery products to increase their nutritional value, such nutrition enriched frozen bakery products are attracting individuals. Additionally, manufacturers have successfully added whole grains and more fiber in baked goods, many are experimenting with the addition of other nutritious ingredients, such as Omega-3 and Omega-6 fatty acids, protein, vitamins, minerals, prebiotics, and probiotics thus, supporting the development of U.S. Frozen Bakery Market throughout the forecast period.

- Moreover, the use of environmentally friendly and safe-to-eat preservatives is promoting market growth during the forecast period. The growing demand for gluten-free and sugar-free frozen bakery products is stimulating the market players to come up with gluten-free and sugar-free segments in frozen bakery products. Flexible government policies are one of the factors propelling the market growth. The majority of US women come under the working category thus significantly helping the frozen bakery products market to expand. Digitization, transparency, and traceability of ingredients are some of the main factors promoting U.S. Frozen Bakery Market growth during the forecast period.

Restraints:

Growing Allergy Towards Ingredients Used in Bakery Products

- The growing concern of a healthy diet among the young US population and the growing trend of physical fitness is going to hamper the U.S. Frozen Bakery Market growth in the forecast period. Moreover, diabetic and obese people will prefer a nutritious diet rather than consuming bakery products. Competition between commercial bakeries, retail bakeries, and online services provided by some household individuals is going to impact the U.S. Frozen Bakery Market expansion negatively. Refrigerants are required for the storage of frozen bakery products and they are environmentally damaging substances. Furthermore, growing awareness towards environmental preservation will restrict the use of these refrigerants thus, hindering the U.S. Frozen Bakery Market growth in the forecast period. Automobiles having cooling devices are required for transportation of frozen bakery products as these goods are temperature sensitive and a temperature rise can spoil the freshness and quality of the products. In addition, the utilization of these vehicles for transportation is costly thus, restraining the development of the U.S. Frozen Bakery Market throughout the forecast period.

Opportunities:

Innovations in Allergen-Free and Gluten-free Bakery Products

- According to Food Allergy Research and Education (FARE) conducted by McKinsey and the company, there was a whopping sale of US$19 billion associated with allergen-free food products. Moreover, this allergen-friendly food segment is growing at an annual growth rate of 27%, thus promoting market players to invest in the research and development of allergen-free frozen bakery products. Furthermore, 71% of people are including allergen-free food in their diet and 68% of people trust allergy-free brands thus providing more opportunities for market players to innovate new products in this segment. According, to Statista 64% of US consumers are shifting towards gluten-free or wheat-free food products as they consider these products as very healthy. The main reason for adopting gluten-free products is a gastrointestinal gluten allergy. Moreover, the rising diabetic population and their demand for sugar-free frozen bakery products are instigating market players to launch sugar-free frozen bakery products.

Challenges:

Use of Safe to Eat Preservatives

- Using safe-to-eat preservatives and maintaining a continuous supply of frozen bakery products are the biggest challenges for market players. According to a report published in FOOD DIVE, one in four Americans is having a food allergy. To provide allergen-free frozen bakery products and to manufacture them profitably are new challenges for market players. The demand for frozen bakery products rich in fats and sugar may reduce significantly as these products are not preferred by individuals’ sufferings from diabetes and the growing health concern among individuals may also limit the intake of these products thus providing a vital challenge for market players to manufacture frozen bakery products in low sugar content.

Segmentation Analysis of U.S. Frozen Bakery Market

- By product, the bread segment is expected to have the highest share of the U.S. Frozen Bakery Market in the forecast period. The main factor driving the growth of this segment is the high fiber content and the launch of flavored bread with fortified nutrients and minerals. Moreover, the presence of a large number of bread manufacturers and the growing consumer preference for bread as a morning meal are vital factors supporting the expansion of the U.S. Frozen Bakery Market. Individuals in this region prefer fresh packaged bread. According to Statists, the number of individuals consuming bread in 2020 was 326.91 million thus encouraging the development of this segment. Pastries and Cakes are predicted to have the second-highest share of the U.S. Frozen Bakery Market. The availability of different flavors and innovations in making high-quality pastries and cakes is the main factor driving the segment's growth.

- By source, wheat is anticipated to dominate the U.S. Frozen Bakery Market during the forecast period. Wheat is the main source for the production of bread and other bakery products. Moreover, wheat has many other nutritional qualities such as high fiber and protein content which makes it the prime choice of manufacturers thus supporting the expansion of the segment.

- By category, the sugar-free segment is predicted to lead the U.S. Frozen Bakery Market. According to CDC, 34.2 million people in the U.S. suffer from diabetes and approximately 88 million have prediabetes, therefore, providing these individuals with bakery products that are low in sugar content is the main factor driving the growth of this segment. Many bakery product manufacturers have started producing sugar-free products. Furthermore, the growing inclination towards sugar-free products is supporting the expansion of the U.S. Frozen Bakery Market in the forecast period.

- By type, the ready-to-eat segment is forecasted to have the highest growth rate. The busy lifestyle of the majority of individuals is the main factor encouraging the expansion of this segment. In the U.S. majority of women are engaged in the service sector. To avoid the tedious process of cooking food individuals are opting for ready-to-eat frozen bakery products thus, promoting the growth of the U.S. Frozen Bakery Market.

- By distribution channel, the supermarket & hypermarket segment is expected to lead the U.S. Frozen Bakery Market. The transparency in the content of bakery products and the availability of different fresh bakery products are the main element stimulating the development of this segment. According to a survey conducted by Vixxo, 87% of people among 1260 individuals preferred purchasing in physical stores thus consolidating the segment's expansion.

COVID-19 Impact Analysis On U.S. Frozen Bakery Market

- The outbreak of COVID-19 in 2020 has adversely affected the functioning of several industries. There was an unprecedented rise in the number of COVID-19 cases in the U.S. which forced the government to implement restrictions in certain parts of the country. The restrictions on the transportation system resulted in the shortage of the raw material required for the production of frozen bakery products. There was a huge gap in demand and supply of frozen bakery products owing to the shortage of laborers which forced bakers to shut their operations. As the number of cases declined government allowed the reopening of shops. The demand for bakery products such as bread observed a tremendous rise. Moreover, the high adoption rate of frozen bakery products among U.S. individuals owing to COVID-19 has propelled the growth of the U.S. Frozen Bakery Market. The pandemic has escalated the consumption of frozen bakery products owing to the long shelf life of these goods. Usage of frozen bakery products restricted individuals from leaving home and thus lowered the chances of contact with the COVID-19 virus. The inclinations towards online services have promoted the expansion of the U.S. Frozen Bakery Market as ordering frozen bakery products through web services has become more convenient. Furthermore, COVID-19 forced the restaurants to shut down which promoted cooking and baking different frozen bakery products at home thus, COVID-19 bolstered the development of the U.S. Frozen Bakery Market.

Top Key Players Covered In The U.S. Frozen Bakery Market

- Tyson Foods Inc.

- General Mills Inc.

- Rich Products Corp

- Aryzta AG

- Lancaster Colony Corporation

- J&J SNACK FOODS CORP

- Dawn Food Products Inc.

- Harlan Bakeries LLC

- TURANO BAKING CO

- Gonnella Baking Company

- Flowers Foods Inc

- CSM Bakery Products

- PEPPERIDGE FARM INCORPORATED

- Campbell Soup Co., and other major players.

Key Industry Developments in the U.S. Frozen Bakery Market

- In May 2024, Sara Lee Frozen Bakery introduces the Sara Lee Strawberry Angel Food Cake, a delicious, moist addition to its food service dessert line. Crafted with whipped egg whites, flour, and sugar, this cholesterol and fat-free sponge cake is ideal for dietary needs. Angel food cake, the top choice in U.S. hospitals, meets rising healthcare demand as spending by Healthcare operators is projected to grow by $3.5 billion by 2026. The new Strawberry Angel Food Cake promises indulgence with mindful ingredients.

|

U.S. Frozen Bakery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.5 Bn. |

|

Forecast Period 2022-28 CAGR: |

5.96 % |

Market Size in 2032: |

USD 5.96 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Source |

|

||

|

By Category |

|

||

|

By Consumption Type |

|

||

|

By Distribution Channel |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: U.S. Frozen Bakery Market by Product (2018-2032)

4.1 U.S. Frozen Bakery Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Bread

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pizza Base

4.5 Cakes

4.6 Batters

4.7 Cookies

4.8 Others

Chapter 5: U.S. Frozen Bakery Market by Source (2018-2032)

5.1 U.S. Frozen Bakery Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Wheat

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Rye

5.5 Barley

5.6 Others

Chapter 6: U.S. Frozen Bakery Market by Category (2018-2032)

6.1 U.S. Frozen Bakery Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Gluten-Free

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Sugar-Free

6.5 Conventional

Chapter 7: U.S. Frozen Bakery Market by Consumption Type (2018-2032)

7.1 U.S. Frozen Bakery Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Ready To Eat

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Ready To Bake

7.5 Raw Materials

Chapter 8: U.S. Frozen Bakery Market by Distribution Channel (2018-2032)

8.1 U.S. Frozen Bakery Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Supermarket & Hypermarkets

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Bakery Stores

8.5 Online Services

8.6 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 U.S. Frozen Bakery Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 ARBONNE(U.S.)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 BARE BLOSSOM (CANADA)

9.4 PHB ETHICAL BEAUTY LTD (U.K.)

9.5 BILLY JEALOUSY (U.S.)

9.6 ECCO BELLA(US)

9.7 EMMA JEAN COSMETICS (U.S.)

9.8 MODERN MINERALS MAKEUP (US)

9.9 MULONDON ORGANIC (UK)

9.10 NATURE’S GATE (INDIA)

9.11 PACIFICA (US)

9.12 NUTRIGLOW COSMETICS (INDIA)

9.13 GABRIELCOSMETICS (U.S.)

9.14 NATUR'ALLEY LTD (JAPAN)

9.15 GONATURE SP. Z O.O. (POLAND)

9.16 SERAPHINE BOTANICALS (U.S)

9.17 PLUM (INDIA)

9.18 DISGUISE COSMETICS (INDIA)

9.19 COTY INC. (U.S.)

9.20 G&M COSMETICS (AUSTRALIA)

9.21 AND OTHER MAJOR PLAYERS.

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

U.S. Frozen Bakery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.5 Bn. |

|

Forecast Period 2022-28 CAGR: |

5.96 % |

Market Size in 2032: |

USD 5.96 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Source |

|

||

|

By Category |

|

||

|

By Consumption Type |

|

||

|

By Distribution Channel |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the U.S. Frozen Bakery Market research report is 2024-2032.

Tyson Foods, General Mills, J&J SNACK FOODS CORP, Flowers Foods Inc, Rich Products Corp, Aryzta AG, Lancaster Colony Corporation, and Other Major Players.

The U.S. Frozen Bakery Market is segmented into Product, Source, Category, Consumption Type, Distribution Channel, and Region. By Product, the market is categorized into Bread, Pizza Base, Cakes, Batters, Cookies, and Others. By Source, the market is categorized into Wheat, Rye, Barley, and Others. By Category, the market is categorized into Gluten-Free, Sugar-Free, and Conventional. By Consumption Type, the market is categorized into Ready To Eat, Ready To Bake, and Raw Materials. By Distribution Channel, the market is categorized into Supermarket & Hypermarkets, Bakery Stores, Online Services, and Others.

Bakery products that can be frozen and used for later future purposes are known as frozen bakery products. Moreover, there has been an increase in the consumption of bakery products mostly because of changing lifestyles and the ease of availability of bakery products. Frozen bakery products are day-to-day use products for the US population as they come in ready to eat and ready to bake categories.

The U.S. Frozen Bakery Market was valued at USD 7.5 billion in 2023 and is projected to reach USD 12.63 billion by 2032, registering a CAGR of 5.96 % from 2024 to 2032.