Third Brake Lights Market Synopsis

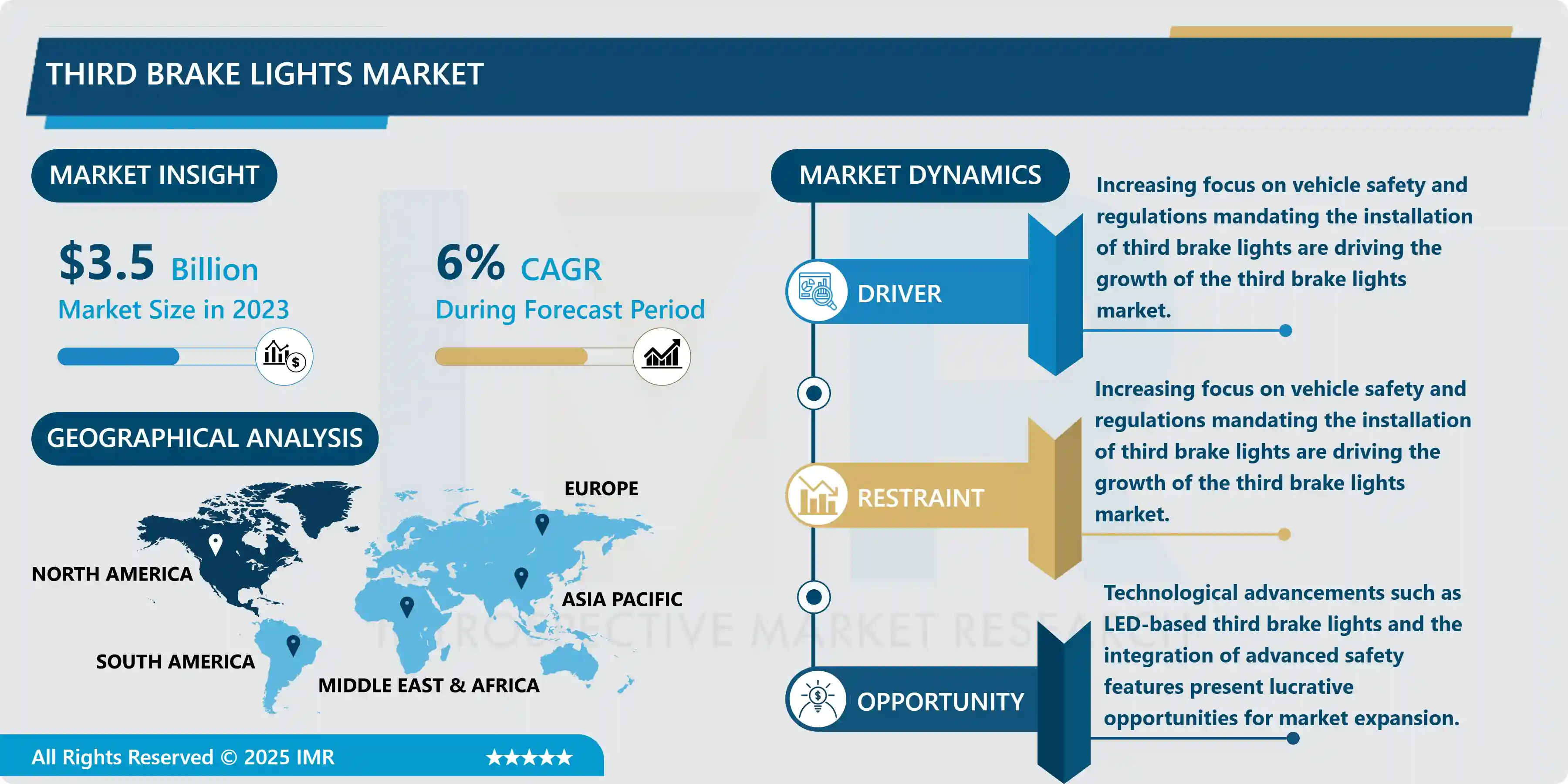

Third Brake Lights Size Was Valued at USD 3.5 Billion in 2023, and is Projected to Reach USD 5.91 Billion by 2032, Growing at a CAGR of 6% From 2024-2032.

The third brake lights market is a part of the automatic industry which deals with the manufacturing, supply, and sales of different third brake lights, or in other words, the center high mount stop lamp (CHMSL). These lights are placed above the standard brake lights on cars and generally at eye level or effectively above the rear window. Their most important use is as warning devices to vehicles behind to increase visibility and safety by alerting the driver behind when the vehicle in front is applying brakes hence preventing crushes from the back.

The global third brake lights market has been on the rise for the past few years due to some factors such as the road safety laws, the consumers’ knowledge regarding the vehicle’s safety components, and the further development of the automobile lighting industry. Also the increasing cars production and sales globally enhance the development of this market.

The factor that is one of the major contributors in the market growth is the safety policies and mandates laid down by different governments and government organizations across different regions. These regulations require all vehicles to have third brake lights that enhance safety and help minimize the number of accidents on such roads. Consequently, car manufacturers are forced to incorporate these lights on their cars, which helps increase sales of third brake lights.

In addition, there is an increasing concern among consumers about vehicle safety and the development of safety technologies in automobiles, which shifts consumers’ preferences toward cars with advanced safety technologies such as third brake lights.

People are gradually tuning their minds towards buying safer cars that have high visibility and third brake lights are gradually finding a stable market for selling their products.

Third, developments in technology for automotive lighting, including an increased focus on the introduction of LED (Light Emitting Diode) and OLED (Organic Light Emitting Diode) lighting in rear lighting, have positively influenced the performance, efficiency, and durability of third brake lights. Due to these technological developments the incorporation of unique lighting options for automobiles is possible especially within the third brake lights market.

Finally, the research shows that the global third brake lights market sales volume would keep increasing with a swift pace in the next few years.

The safety concerns currently prevalent among consumers as well as the respective regulatory bodies are likely to ensure the high popularity of automobiles featuring third brake light in the future, which will stimulate the development of this market.

Third Brake Lights Market Trend Analysis

LED (Light Emitting Diode) technology continues to dominate the third brake lights market.

- Using the LED (Light Emitting Diode) technology has been a great advancement within the automotive industry and particularly in its third brake light applications. These miniature lights that consume little energy and last long have been the preferred lights for automobiles in all parts of the globe.

- There is a single major factor that can explain why LED products are taking the lead – they demonstrate better characteristics than simple incandescent lamps. LEDs provide more brightness and this can improve driver’s visibility especially under rainy or foggy conditions or during darkness. This makes it easier for other motorists to spot the vehicle, thereby minimizing the risk of a rear-end collision.

- Furthermore, LED third brake lights possess much sturdier construction in relation to incandescent alternatives. LED bulbs also last so much longer – typically measured in tens of thousands of hours as opposed to the traditional incandescent bulbs – meaning owners of vehicles using LED bulbs spend much less on maintenance costs.

- The effectiveness of LEDs also resonates with the concern for sustainability that the automotive industry is currently taking seriously. LEDs require less energy; therefore they are better for environmental conservation by consuming lesser power in the vehicle.

- Moreover, LED third brake lights are more ideal for designers and can be easily styled using various customization features. These lights can be easily incorporated in any designing car, which helps the automobile makers in developing the unique and attractive arrangements of the brake light in a car.

Third brake lights market is their integration with advanced driver assistance systems (ADAS).

- The integration of the third brake light with the ADAS is a new advancement in the automobile sector and has affected the improvement of vehicle safety systems. Through offering help as well as providing cautions in numerous driving scenarios, the range of technologies that comes with ADAS seek to further increase both comfort and safety of the driver.

- One of the most important aspects of this integration includes the correlation between collision avoidance systems and third party brake indicators. The third brake light that is more common in vehicles that are equipped with the ADAS system may flash repeatedly in case the car’s system detects an oncoming collision or sudden slowing down of the car, which may help the operator of a car and other drivers see the nearing danger. This synchronized warning enhances the control of vehicle movements by increasing situational awareness to avoid rear end collisions.

- Moreover, AEB systems and other ADAS functionalities may include third-party brake lights. Therefore, with an AEB system initiated to reduce the risk of collision, the third brake light could illuminate more intensely, or flash more rapidly for additional blink patterns, to increase visibility for the drivers and/or pedestrians of oncoming vehicles for overall safety.

- Third brake indicators in ADAS also help to develop more advanced intervehicle communication technologies, besides the above. Other future possibilities are the introduction of the vehicle-to-vehicle communication, using which the ADAS-equipped vehicles can communicate information related to deceleration intention and status among other things for the purpose of effective collision avoidance and traffic flow management.

- On the whole, the fact that third brake lights are incorporated into ADAS implies that there has been an endeavor by the automotive industry and the safety systems’ manufacturers to employ advanced technologies and overcome visibility and communication barriers in vehicles to enhance road safety. This rising trend in the adoption of ADAS will make it critical to connect third-party brake lights to these systems to better leverage the advantages they provide for improving road safety.

Third Brake Lights Market Segment Analysis:

Third Brake Lights Market is Segmented on the basis of Type and Application

By Type, Gas Brake Light segment is expected to dominate the market during the forecast period.

- The market for automotive brake lights can be further segmented by type – which includes gas brake lights and LED brake lights – and third brake lights is expanding rapidly. There is a rise in the use of LED brake lights because of the energy conservation, longer lifetime, and brighter light that they emit when contrasted with gas brake lights. This is further supported by factors such rising awareness about energy conservation and the improvement of the lighting technology.

- Moreover, the third brake lights, or the centre high mount stop lamps (CHMSL), that are required in most regions, contributed to the growth in safety features offered in vehicles. They help increase visibility and prevent cars behind from hitting theirs when the latter slow down or stop.

- Some of the factors that have an impact on the market are for instance automotive manufacturing, safety standards and customers’ responsiveness to the appearance and features of cars and other vehicles. Due to the constant evolution of the field and the increasing number of automotive manufacturers focusing on the introduction of more advanced lighting systems for cars, the brake light market is expected to continue on a positive trend.

By Application, OEMs segment held the largest share in 2023

- Third brake light market by application – Growth rate, Revenue, Major Players – OEM, Aftermarket. Automakers are another important customer for third brake light because these elements are mounted in vehicles during their production to make the transport safe. In addition, many OEMs focus on high-quality and well-controlled parts, which are essential for cars to work properly and comply with legal requirements.

- On the other hand, the aftermarket segment is also witnessing significant growth due to factors like vehicle modifications, repair or replacement of defective or obsolete parts, and increased demand for safer cars and trucks. Buyers look into aftermarket third brake lights for their reliability, design choices, and functions over and above legality.

- Some of the relevant factors in the market dynamics include automotive production trends, safety regulations, consumer preferences, and development of the lighting systems in vehicles. Increasing knowledge about safety measures and inspiration to follow vehicle customization patterns in the future will lead to an evolution of both the OEM third brake light market and the aftermarket third brake light market.

Third Brake Lights Market Regional Insights:

Asia Pacific Third Brake Lights Market is expected to register the fastest growth in CAGR over the forecast period.

- The Asia Pacific region is expected to be the third brake lights market leader with a higher CAGR during the forecast period.

- The centre high mount stop lamp (CHMSL) or third brake lights serves the vital function of giving a signal to the following motor vehicle that the vehicle ahead has applied its brakes.

- The following are some of the factors that will lead to an increased demand for third brake lights in the Asia pacific. The growth in the automobile industry and the high population rate in highly populated cities thus causing high road fatalities are some of the factors that is responsible for the high rate of road safety equipment consumption. Moreover, the emergence of strict government requirements that dictate the need for vehicles to have a third brake light also contributes to overall market expansion.

- In addition, the technology used to improve the automotive lighting, through the increased use of light-emitting diodes (LEDs) for brightening and energy-saving purposes, is further promoting the acceptability of third brake lights among automotive manufacturers and customers.

- Many countries such as China, India, Japan, and South Korea are expected to be the key drivers of the region’s growth powered by the growing automotive industry and an increase in the disposable income.

- In conclusion, the overall Asia Pacific third brake lights market will see substantial growth due to numerous factors and developments, ranging from legal requirements to new technology applications and initiatives to promote car safety and the driving experience through enhanced car production.

Active Key Players in the Third Brake Lights Market

- Dorman (United States)

- Anzo (United States)

- Koito (Japan)

- Magneti Marelli (Italy)

- Valeo (France)

- Hella (Germany)

- Stanley Electric (Japan)

- Ichikoh (Japan)

- ZKW Group (Austria)

- SL Corporation (South Korea)

- Varroc (India)

- TYC (Taiwan)

- DEPO (Taiwan)

- Xingyu (China)

- Hyundai IHL (South Korea)

- Others Key Players

|

Third Brake Lights Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

6 % |

Market Size in 2032: |

USD 5.91 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Third Brake Lights Market by Type (2018-2032)

4.1 Third Brake Lights Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Gas Brake Light

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 LED Brake Light

Chapter 5: Third Brake Lights Market by Application (2018-2032)

5.1 Third Brake Lights Market Snapshot and Growth Engine

5.2 Market Overview

5.3 OEMs

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Aftermarket

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Third Brake Lights Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 GFS(US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DALBY(US)

6.4 USI ITALIA (ITALY)

6.5 NOVA VERTA(US)

6.6 ZONDA(US)

6.7 FUJITORONICS(JAPAN)

6.8 COL-MET(US)

6.9 STL(INDIA)

6.10 GUANGZHOU GUANGLI EFE CO.(CHINA)

6.11 OTHER KEY PLAYERS

6.12

Chapter 7: Global Third Brake Lights Market By Region

7.1 Overview

7.2. North America Third Brake Lights Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Gas Brake Light

7.2.4.2 LED Brake Light

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 OEMs

7.2.5.2 Aftermarket

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Third Brake Lights Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Gas Brake Light

7.3.4.2 LED Brake Light

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 OEMs

7.3.5.2 Aftermarket

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Third Brake Lights Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Gas Brake Light

7.4.4.2 LED Brake Light

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 OEMs

7.4.5.2 Aftermarket

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Third Brake Lights Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Gas Brake Light

7.5.4.2 LED Brake Light

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 OEMs

7.5.5.2 Aftermarket

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Third Brake Lights Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Gas Brake Light

7.6.4.2 LED Brake Light

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 OEMs

7.6.5.2 Aftermarket

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Third Brake Lights Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Gas Brake Light

7.7.4.2 LED Brake Light

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 OEMs

7.7.5.2 Aftermarket

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Third Brake Lights Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

6 % |

Market Size in 2032: |

USD 5.91 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

Report of Third Brake Lights Market is covering the summarized study of several factors encouraging the growth of the market such as market size, market type, major regions and end user applications. By using the report customer can recognize the several drivers that impact and govern the market.