Market Overview of theTextured Soy Protein Market

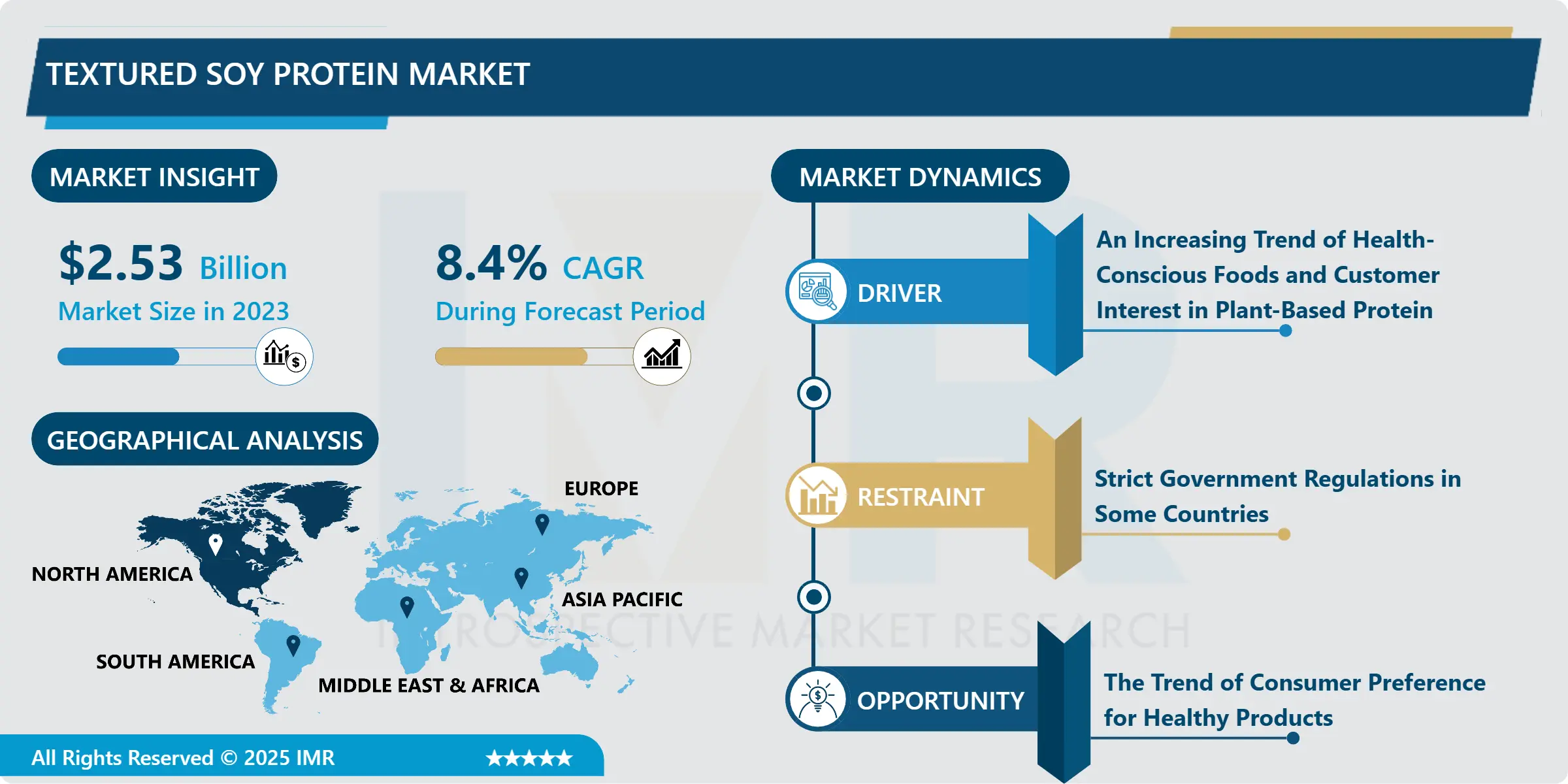

Global Textured Soy Protein Market Estimated At USD 2.53 Billion In The Year 2023, Is Projected To Reach A Revised Size Of USD 5.23 Billion By 2032, Growing At A CAGR Of 8.4% Over The Analysis Period 2024-2032.

- Textured soy protein is a meat alternative product that's prepared from soybeans, although it's also possible to produce a similar meat alternative product from other foods. It's a highly processed food item that's produced by separating (isolating) the soy protein from other components found in whole soybeans. Defatted soy protein is flattened into granules or chunks, and usually dried and rehydrated before cooking. Additionally, textured soy protein is made from soy flour that has had the fat removed from it. The flour is cooked under pressure and then dried and this process is called "extrusion cooking." It is a thermo-mechanical process, which combines high pressure, high shear, and high heat to form a product that can be molded into various forms for different uses. There are several variations to the process and this can affect the resulting product's texture, taste, and nutritional make-up.

- Furthermore, soy protein provides all the amino acids humans requirements. Due to it is a complete source of protein, some medical experts recommend it as a potentially healthier alternative for meat. According to the research study, consuming soybeans can lower cholesterol and overcome the risk of cardiovascular disease. Texturized soy protein stands out when compared to other protein sources since it is environmentally friendly. The market is also observing a healthy growth rate owing to a rise in demand from various end-use industries such as dairy substitutes, bakeries, and others.

Market Dynamics And Factors For The Textured Soy Protein Market

Drivers:

- An increasing trend of health-conscious foods and customer interest in plant-based protein have affected the textured soy protein market. In recent years, vegetarianism has to gain popularity. The product's importance in decreasing the incidence of heart disease, osteoporosis, and some types of cancer is of particular relevance. Owing to the product's high protein content and adaptability in the development of meat analogs and milk substitutes, textured soy protein is a nutritious solution for vegetarians.

- Growing soy crop cultivation in emerging regions such as South America and the Asia Pacific, in addition to the already widespread cultivation of soybean over the world, has raised the accessibility of soy products such as textured soy proteins. Raw materials for deriving textured soy protein are therefore easy to produce from contract farmers or oilseed crushers providing soy meal. The low processing costs related to textured soy proteins are suitable for the operational demands of manufacturers and thereby allow the processors to spend sufficiently on product development. As a result of these trends, the cost of textured soy protein is lower cost when compared to that of other protein sources such as meat, whey proteins, and dairy. In addition, the prices of conventional dairy products have increased in the recent past, and textured soy protein, being one of the major plant sources of protein, is one of the most suitable substitutes considered in terms of price.

Restraints:

- The European Union (EU) has strict regulations in place for genetically modified (GM) crops owing to the risks related to humans and the environment. Soy, one of the highest sources of plant protein and the largest plant-based protein ingredient, if genetically modified in seed form, could have severe effects if consumed and is hence limited in the European region. The revolting flavor of soy-derived products including oil, chunks, and others is resulting in slower adoption of these products, which could hinder sales growth of the global textured soy protein market.

Opportunities:

- Rising consciousness associated with the cheaper cost and largest nutritional value of these products among processed food producers and consumers, and the possibility of masking the unpleasant flavor of soy-based products are factors anticipated to producer lucrative opportunities for players planning to grab the idea and obtain a large customer base. Furthermore, the trend of consumer preference for healthy products is growing, wherein marketing campaigns are designed for highlighting their use and health benefit claims. Emerging economies such as China and India are projected to experience a rise in demand for textured soy protein in the upcoming years from these regions. In addition, the Asia Pacific region offers a cost advantage in terms of production and processing. High demand, coupled with low cost of production, would help the providers, eventually turning the growth of the textured soy protein market in the region.

Market Segmentation

Segmentation Analysis of Textured Soy Protein Market:

- Based on Type, non-GMO textured soy proteins are anticipated to dominate the market over the forecast period. Non-GMO textured soy proteins are rich protein products that are also high in dietary fibers, contain no cholesterol, lactose, or casein, minerals, and are free from microbiological contamination. The organic segment is estimated to rise at the highest CAGR over the forecast period. Natural textured soy proteins are obtained from organic soy, in the form of isolates, concentrates, and flour, and find wide-scale applications in snacks, meat alternatives, nutritional supplements, and extenders. The need for organic soy protein is growing rapidly, with more people becoming health aware and demanding organic products. The busy lifestyle of consumers has led to the growing demand for organic food & beverage products containing textured soy proteins. Producers are targeting product innovation in organic soy protein to serve the rising demand.

- Based on the Source, soy protein concentrates are expected to account for the maximum market share during the forecast period. Soy protein concentrates are easily digestible, spray-dried forms, and accessible in granule, flour, and cheap. They are preferable for consumers of all age groups, including children, pregnant & lactating women, and the geriatric population. Based on the volume, the soy protein isolates segment was the second-largest owing to its higher protein content (90%). Soy protein isolates are also estimated to be the fastest-growing, during the forecast period, both in terms of value and volume.

- Based on Application, textured soy proteins are becoming popular owing to the rising demand for meat alternatives, which is probably to accelerate the segment growth. Soya proteins act as a significant role as a source of complementary & supplementary proteins and help improve the solubility, viscosity, texture, emulsification, water absorption, and anti-oxidation, which in turn, boosts their demand. Furthermore, soya supports in preventing various chronic diseases, such as heart disease, osteoporosis, hypertension, diabetes, certain cancers. Additionally, it also helps in maintaining body function and is a source of major amino acids. Hence, it has a massive demand in the food application segment.

Regional Analysis of Textured Soy Protein Market:

- The North American region is expected to dominate the textured soy protein market over the forecast period. Among customers soy foods, functional foods, and dairy replacers are estimated to be the fastest-increasing segments in North America. The demand for textured soy protein is rising at a high rate; switching consumer preference from meat to plant protein is one of the main reasons turning the market for soy protein. Also, soy-based proteins are a major source of protein for vegans globally. The high nutritional profile, low carbon footprint, and low price of plant-sourced protein are turning the utilization of these proteins in food applications. The global demand for textured soy protein is rising significantly, especially in emerged economies such as the US and nations in the European Union.

Players Covered in Textured Soy Protein market are :

- Archer Daniels Midland Company (US)

- Cargill Inc. (the US)

- Bremil Group (Brazil)

- Shandong Yuxin Bio-Tech (China)

- DowDuPont Inc(US)

- Sonic Biochem Extraction Pvt.Ltd (India)

- Victoria Group A. D. (Serbia)

- DPS/Dutch Protein & Services B.V. (Netherlands)

- Linyi Shansong Biological Products Co.Ltd. (China)

- Wilmar International Ltd (Singapore)

- Crown Soya Protein Group (China)

- Sonic Biochem (India)

- Hung Yang Foods Co.Ltd. (Netherlands) and other major players.

Key Industry Developments In Textured Soy Protein Market

-

In March 2024, Azelis, a leading innovation service provider in specialty chemicals and food ingredients, announced a collaboration with Soy Austria, a prominent manufacturer of sustainable soy-based food ingredients. This partnership expanded Azelis' portfolio with natural, plant-based solutions, enhancing its offerings in the food industry. The collaboration reflected both companies' shared commitment to innovation and sustainability, delivering high-quality, eco-friendly solutions to customers.

-

In July 2023, Bunge announced the construction of a new USD 500 million soybean processing facility in Morristown, Indiana. The fully integrated plant, set to open in mid-2025, was designed to produce soy protein concentrates and textured soy protein concentrates, catering to the growing plant-based foods market.

|

Textured Soy Protein Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.74 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.4% |

Market Size in 2032: |

USD 5.23 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Textured Soy Protein Market by Type (2018-2032)

4.1 Textured Soy Protein Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Non-GMO

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Conventional

4.5 Organic

4.6 Others

Chapter 5: Textured Soy Protein Market by Source (2018-2032)

5.1 Textured Soy Protein Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Soy Protein Isolates

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Soy Protein Concentrates

5.5 Soy Flour

Chapter 6: Textured Soy Protein Market by Application (2018-2032)

6.1 Textured Soy Protein Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Food Products

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Bakery Products

6.5 Cereals & Snacks

6.6 Dairy Alternatives

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Textured Soy Protein Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ROMER LABS DIVISION HOLDING GMBH (AUSTRIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 VWR INTERNATIONAL LLC (U.S.)

7.4 SGS SA (SWITZERLAND)

7.5 EUROFINS SCIENTIFIC SE (LUXEMBURG)

7.6 INTERTEK GROUP PLC (UK)

7.7 ALS LIMITED (AUSTRALIA)

7.8 BIO-CHECK LTD (UK)

7.9 LGC LTD. (UK)

7.10 NEOGEN CORPORATION (U.S.)

7.11 LGC SCIENCE GROUP LTD. (U.K.)

7.12 SCIENTIFIC ANALYSIS LABORATORIES (U.K.)

7.13 GENETIC ID NA INC. (U.S.)

7.14 INTERNATIONAL LABORATORY SERVICES LTD. (U.K.)

7.15 AB SCIEX LLC (U.S.)

7.16 SYNLAB (GERMANY)

7.17 GENIUS LABORATORIES LTD. (U.K.)

Chapter 8: Global Textured Soy Protein Market By Region

8.1 Overview

8.2. North America Textured Soy Protein Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Non-GMO

8.2.4.2 Conventional

8.2.4.3 Organic

8.2.4.4 Others

8.2.5 Historic and Forecasted Market Size by Source

8.2.5.1 Soy Protein Isolates

8.2.5.2 Soy Protein Concentrates

8.2.5.3 Soy Flour

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Food Products

8.2.6.2 Bakery Products

8.2.6.3 Cereals & Snacks

8.2.6.4 Dairy Alternatives

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Textured Soy Protein Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Non-GMO

8.3.4.2 Conventional

8.3.4.3 Organic

8.3.4.4 Others

8.3.5 Historic and Forecasted Market Size by Source

8.3.5.1 Soy Protein Isolates

8.3.5.2 Soy Protein Concentrates

8.3.5.3 Soy Flour

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Food Products

8.3.6.2 Bakery Products

8.3.6.3 Cereals & Snacks

8.3.6.4 Dairy Alternatives

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Textured Soy Protein Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Non-GMO

8.4.4.2 Conventional

8.4.4.3 Organic

8.4.4.4 Others

8.4.5 Historic and Forecasted Market Size by Source

8.4.5.1 Soy Protein Isolates

8.4.5.2 Soy Protein Concentrates

8.4.5.3 Soy Flour

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Food Products

8.4.6.2 Bakery Products

8.4.6.3 Cereals & Snacks

8.4.6.4 Dairy Alternatives

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Textured Soy Protein Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Non-GMO

8.5.4.2 Conventional

8.5.4.3 Organic

8.5.4.4 Others

8.5.5 Historic and Forecasted Market Size by Source

8.5.5.1 Soy Protein Isolates

8.5.5.2 Soy Protein Concentrates

8.5.5.3 Soy Flour

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Food Products

8.5.6.2 Bakery Products

8.5.6.3 Cereals & Snacks

8.5.6.4 Dairy Alternatives

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Textured Soy Protein Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Non-GMO

8.6.4.2 Conventional

8.6.4.3 Organic

8.6.4.4 Others

8.6.5 Historic and Forecasted Market Size by Source

8.6.5.1 Soy Protein Isolates

8.6.5.2 Soy Protein Concentrates

8.6.5.3 Soy Flour

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Food Products

8.6.6.2 Bakery Products

8.6.6.3 Cereals & Snacks

8.6.6.4 Dairy Alternatives

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Textured Soy Protein Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Non-GMO

8.7.4.2 Conventional

8.7.4.3 Organic

8.7.4.4 Others

8.7.5 Historic and Forecasted Market Size by Source

8.7.5.1 Soy Protein Isolates

8.7.5.2 Soy Protein Concentrates

8.7.5.3 Soy Flour

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Food Products

8.7.6.2 Bakery Products

8.7.6.3 Cereals & Snacks

8.7.6.4 Dairy Alternatives

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Textured Soy Protein Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.74 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.4% |

Market Size in 2032: |

USD 5.23 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :