Terminal Tractor Market Overview

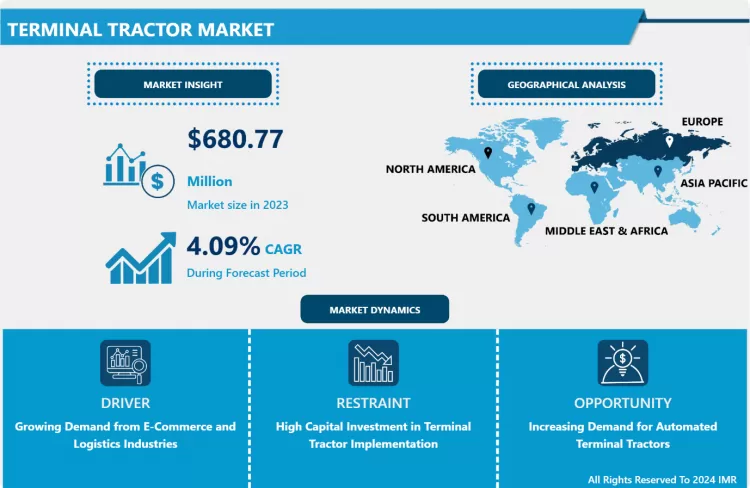

Terminal Tractor Market is expected to grow from USD 680.77 million in 2023 to USD 976.52 million by 2032, at a CAGR of 4.09% during the forecast period (2024-2032).

A terminal tractor is a specialty truck that is developed for fast, safe, and coherent movement of semi-trailers or cargo containers. In addition, terminal tractors are used at terminals, distribution centers, ports, and various other industrial applications that boost the efficiency of the movement of goods. A Terminal Tractor provides the operator the ability to "spot" and "stage" trailers up to 3 or 4 times faster than a traditional truck tractor. In addition to speed and efficiency, it can also reduce the Worker's Compensation Insurance exposure. The operator can spot a trailer without leaving the cab platform area that means the least opportunity for the operator to sustain an injury related to moving trailers. Terminal Tractors or Yard Trucks as they are sometimes referred to are available in several different configurations, depending on your company's individual need.

COVID-19 Impact on Terminal Tractor Market

The effects of COVID-19 are being felt over the globe, causing interruptions in trading activities, logistics, manufacturing, and supply chains, which have produced geopolitical uncertainties. These disruptions have also hampered the growth of the terminal tractor market. Lockdowns across regions have influenced freight, transportation, and distribution services owing to the scarcity of labor and closure of borders, as such, influencing the growth of the terminal tractor market, as they are widely in these industries. Nevertheless, rising trade activities between emerged and emerging economies for the supply of essential goods are foreseen to reinforce the demand for terminal tractors to improve efficiency at ports and other end-use segments. Additionally, the consumer shift towards e-Commerce platforms is providing a significant opportunity to terminal tractor producers for their applicability in logistics and distribution handling. At the same time, manufacturers are optimistic that the resumption of production plants over the different economies will allow them to move towards a recovery phase, which is anticipated to stabilize the progression of the terminal tractor market.

Market Dynamics And Factors For The Terminal Tractor Market:

Drivers:

Globalization has head to rising domestic and international trade relations between nations. Further, as many international companies lean towards globalization and market expansions, logistical challenges have become more composite than ever. Supply chain systems have reached wider and vital importance in the last few years, as a result of high competition in the product-based market. Therefore, many industry verticals are ensuring a strong supply chain for reaching out to their customers. Terminal tractors help the operational flow of the supply chain at the initial stage. This factor is expected to gain traction in the coming times having a significant impact on the terminal tractor market. The global terminal tractor market has been observing vigorous growth owing to factors such as the ability to place, pick up, and stack containers automatically, which leads to increased productivity of the business. Contributions of various regions and swift globalization of businesses have been driving the growth of the global terminal tractor market. Urbanization and developing digital technologies are turning a wave of disruptive innovation, which is expected to increase the demand for terminal tractors.

Growing demand from e-commerce and logistics industries is another growth factor for the terminal tractor market. The rising number of container shipments results in the increased demands on the seaport container terminals, container logistics, and management, as well as on technical equipment. Raised competition between seaports, particularly between geographically close ones, is a result of this expansion. Moreover, the leading e-commerce companies are looking to stock large volumes of products in their warehouses and are working on rising order accuracy, same-day or same-hour delivery, and free returns to compete in the market. Infrastructure growth, adoption of trailer terminal tractors in warehouse management, and rising application of trailer terminal tractors in the metal industry are some other turning factors for the terminal tractor market.

Restraints:

High Capital Investment in Terminal Tractor Implementation

Developed technologies such as semi-automated terminal tractors, automated terminal tractors, and electric terminal tractors have also increased the intricacy of these machines. The production and installation costs of battery-operated and hydrogen fuel cell terminal tractors are also high compared to ICE terminal tractors. The maximum installation cost is one of the key factors preventing manufacturers from entering emerging markets, such as the Asia Pacific and the Middle East & Africa. Furthermore, there are maintenance, fuel, and servicing costs are factors restraints the market. These costs vary with the operation and application of terminal tractors. The equipment also requires to be handled by trained professionals, therefore adding up to the cost, as these professionals need to be paid high wages. Hence, the higher cost of handling port equipment such as forklifts, cranes, and terminal tractors might poorly affect the growth of the terminal tractor market.

Opportunities:

Increasing Demand for Automated Terminal Tractors

The growth in fuel prices contributes to the demand for electric terminal tractors. Traits like zero emissions and relatively less energy utilization have made them a viable choice among various end-users. In addition, electric terminal tractors are flatter, far smoother, and slicker than traditional diesel-operated terminal tractors. The 8700S SerieS tractors by AGCO are suitable for multiple farming activities. When the 5?x 9? touchscreen offers the operator with the facility to elevate the overall tractor functions, the highly integrated technology within ensures the much-needed control of the tractor and its gears. The Datatronic 5's video mode shows relevant images and depictions from an onboard camera through the console shade, helping operators to rear the tractors in a much safer way. Ottawa, on the other hand, is one of the major terminal tractors in the market. Apart from supplying the required clout and control, this model also keeps up a variety of eco-friendly improvements that can help diminish the severe impact a business has on the environment.

Market Segmentation

Segmentation Analysis of Terminal Tractor Market:

Based on the Propulsion, the diesel segment is anticipated to register the maximum market share during the forecast period. High power and load stacking requirements and the cheap cost of diesel make diesel the first choice for equipment producers. Nevertheless, the latest emission norms for NOx, PM, and CO2 reductions and the growing trend of automation for port equipment would push producers to develop power-efficient equipment with reduced emission levels. The Asia Pacific region is projected to be the third-largest market for diesel terminal tractors due to the presence of a large number of small and mid-sized terminals in the region, apart from the various ports in economies such as Singapore, China, Japan, and South Korea. The electric infrastructure at these port terminals is not sufficient to fulfill the rising demand. The demand for diesel-based equipment is, therefore, increasing at a substantial rate in this region.

Based on the Ownership, the industrial & commercial segment is expected to dominate the terminal tractor market during the forecast period. Boosting business conditions and rising investments in the manufacturing sector in emerging economies are anticipated to contribute significantly to the growth of the terminal tractor market. Furthermore, the anticipated increase in the production of automobiles in Asian countries after the pandemic has been brought under control will accelerate the terminal tractor market in the region. Due to these factors, the industrial and commercial segment in the terminal tractor market will turn in demand over the forecast period.

Based on the Tonnage, the 50–100-ton segment is expected to dominate the terminal tractor market over the forecast period. The highest number of equipment utilized for stacking laden containers at port terminals. Terminal tractors with a tonnage capacity of 50–100 tons are utilized to hold the majority of containers, ranging from empty containers to laden containers, in the port and logistic sectors. As the 50–100-ton terminal tractors are highly utilized for stacking single-laden containers, electric variants are expected to become successful for container handling applications.

Based on the End Use, Inland Waterways & Marine Services segment is expected to record the maximum terminal tractor market share over the forecast period. Growing marine activities in emerging economies and growth in demand for resource inspection are the major drivers of the terminal tractor market. The development in population has increased the demand for raw materials and completed products over the years. Increased demand has motivated the producers of terminal tractors and other port equipment to provide technologically improved equipment that helps in performing better marine operations.

Regional Analysis of Terminal Tractor Market:

Europe is anticipated to be the largest market over the forecast period owing to the presence of robust economies of European countries such as the United Kingdom, Germany, and Spain, along with the presence of major key players of terminal tractors such as Kalmar, Konecranes, MAFI, CVS Ferrari, and MOL CY are serving to the global terminal tractor market through dealer and distribution networks. In addition to this region has a high adoption rate of automation technologies. Equipment with high automation levels raises productivity. This region is home to automated terminals such as the ECT Delta Port terminal (Netherlands) and the HHLA CTA terminal (Germany). The number of automated terminals is anticipated to increase in this region, further turning the growth of the terminal tractor market

In North America, the US is the major contributor to the overall terminal tractor sales (approximately 91%) in the North American region in 2020. The growth of the US market can be attributed to a maximum industrial base in the country, comprising automotive manufacturing, aerospace and defense, and industrial verticals.

Asia-Pacific is anticipated to expand at the fastest rate in the terminal tractor market over the forecasted period. Due to the high number of container ports where the demand for the terminal tractor is high within this region.

Players Covered in Terminal Tractor market are :

- Kalmar

- Orange EV

- TTS

- Terberg Special Vehicles

- Capacity Trucks

- Volvo

- Sany

- Konecranes

- MAFI Transport-Systeme GmbH

- TICO Tractors

- Blyyd

- Crane Carrier Company

- CVS Ferrari

- Terberg

- Hoist Liftruck

- Hyster

- Liebherr

- Linde

- MOL CY

- REV Group and other major players.

Key Industry Developments In The Terminal Tractor Market

- In June 2024, Volvo Penta and MOL collaborated on RoRo electric tractors the vehicle features a Volvo Penta driveline consisting of three battery packs totalling 270 kWh of installed energy, an EPT802 gearbox, and two 200 kW propulsion motors. A separate 50 kW motor powers the hydraulic system and the fifth wheel. Designed for high productivity and performance, the RME225 aims to operate a full shift and provide an alternative to its diesel counterparts. This collaboration represents a significant step towards more sustainable and efficient port logistics.

- In January 2024, Commercial Trailer Leasing, Inc. (CTL) announced a partnership with Orange EV to deploy pure-electric and zero-emission, DOT-compliant yard trucks throughout the United States. The Orange EV yard trucks, along with their paired, on-site charging cabinets, will be under lease with various customers within the food distribution and logistics industry segments.

- In September 2023, Kalmar agreed to acquire the intellectual property rights associated with the electric terminal tractor product line from Lonestar Specialty Vehicles (LSV) in the US. As part of this arrangement, LSV will transfer intangible assets to Kalmar and assume the role of Kalmar’s contract manufacturing partner for the acquired electric terminal tractor product range.

|

Terminal Tractor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 680.77 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.09% |

Market Size in 2032: |

USD 976.52 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Propulsion |

|

||

|

By Ownership |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Terminal Tractor Market by Type (2018-2032)

4.1 Terminal Tractor Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Manual

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Automated

Chapter 5: Terminal Tractor Market by Propulsion (2018-2032)

5.1 Terminal Tractor Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Diesel

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Hybrid

5.5 Electric

5.6 CNG

Chapter 6: Terminal Tractor Market by Ownership (2018-2032)

6.1 Terminal Tractor Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Rental

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Industrial & Commercial

Chapter 7: Terminal Tractor Market by End-Use Industry (2018-2032)

7.1 Terminal Tractor Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Retail

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Food & Beverages

7.5 Inland Waterways & Marine Services

7.6 Rail Logistics

7.7 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Terminal Tractor Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 MITSUBISHI ELECTRIC CORPORATION

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 NIDEC CORPORATION

8.4 MVD AUTO COMPONENTS PVT.LTDSTONERIDGE INCAPTIV PLC

8.5 BITRON INDUSTRIE S.P.A

8.6 BORGWARNER INCCONTINENTAL AG

8.7 CUMSA CORPORATION-LOCKCARFT

8.8 GLOBAL POINT MAGNETICS ASIA CO. LTDDENSO CORPORATION

8.9 GKN PLC

8.10 HITACHI LTDHUSCO INTERNATIONAL INCROBERT BOSCH GMBH

8.11 JOHNSON ELECTRIC HOLDINGS LTDPARKER HANNIFIN CORPORATION

8.12 SCHAEFFLER AG

8.13 KENDRION NV

8.14 MAGNET - SCHULTZ GMBH & CO. KG

8.15 ROTEX AUTOMATION LIMITED

8.16 PADMINI VNA MECHATRONICS PVT LTD

8.17 PNEUMADYNE INCTLX TECHNOLOGIES LLCWABCO HOLDINGS INC.

Chapter 9: Global Terminal Tractor Market By Region

9.1 Overview

9.2. North America Terminal Tractor Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Manual

9.2.4.2 Automated

9.2.5 Historic and Forecasted Market Size by Propulsion

9.2.5.1 Diesel

9.2.5.2 Hybrid

9.2.5.3 Electric

9.2.5.4 CNG

9.2.6 Historic and Forecasted Market Size by Ownership

9.2.6.1 Rental

9.2.6.2 Industrial & Commercial

9.2.7 Historic and Forecasted Market Size by End-Use Industry

9.2.7.1 Retail

9.2.7.2 Food & Beverages

9.2.7.3 Inland Waterways & Marine Services

9.2.7.4 Rail Logistics

9.2.7.5 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Terminal Tractor Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Manual

9.3.4.2 Automated

9.3.5 Historic and Forecasted Market Size by Propulsion

9.3.5.1 Diesel

9.3.5.2 Hybrid

9.3.5.3 Electric

9.3.5.4 CNG

9.3.6 Historic and Forecasted Market Size by Ownership

9.3.6.1 Rental

9.3.6.2 Industrial & Commercial

9.3.7 Historic and Forecasted Market Size by End-Use Industry

9.3.7.1 Retail

9.3.7.2 Food & Beverages

9.3.7.3 Inland Waterways & Marine Services

9.3.7.4 Rail Logistics

9.3.7.5 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Terminal Tractor Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Manual

9.4.4.2 Automated

9.4.5 Historic and Forecasted Market Size by Propulsion

9.4.5.1 Diesel

9.4.5.2 Hybrid

9.4.5.3 Electric

9.4.5.4 CNG

9.4.6 Historic and Forecasted Market Size by Ownership

9.4.6.1 Rental

9.4.6.2 Industrial & Commercial

9.4.7 Historic and Forecasted Market Size by End-Use Industry

9.4.7.1 Retail

9.4.7.2 Food & Beverages

9.4.7.3 Inland Waterways & Marine Services

9.4.7.4 Rail Logistics

9.4.7.5 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Terminal Tractor Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Manual

9.5.4.2 Automated

9.5.5 Historic and Forecasted Market Size by Propulsion

9.5.5.1 Diesel

9.5.5.2 Hybrid

9.5.5.3 Electric

9.5.5.4 CNG

9.5.6 Historic and Forecasted Market Size by Ownership

9.5.6.1 Rental

9.5.6.2 Industrial & Commercial

9.5.7 Historic and Forecasted Market Size by End-Use Industry

9.5.7.1 Retail

9.5.7.2 Food & Beverages

9.5.7.3 Inland Waterways & Marine Services

9.5.7.4 Rail Logistics

9.5.7.5 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Terminal Tractor Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Manual

9.6.4.2 Automated

9.6.5 Historic and Forecasted Market Size by Propulsion

9.6.5.1 Diesel

9.6.5.2 Hybrid

9.6.5.3 Electric

9.6.5.4 CNG

9.6.6 Historic and Forecasted Market Size by Ownership

9.6.6.1 Rental

9.6.6.2 Industrial & Commercial

9.6.7 Historic and Forecasted Market Size by End-Use Industry

9.6.7.1 Retail

9.6.7.2 Food & Beverages

9.6.7.3 Inland Waterways & Marine Services

9.6.7.4 Rail Logistics

9.6.7.5 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Terminal Tractor Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Manual

9.7.4.2 Automated

9.7.5 Historic and Forecasted Market Size by Propulsion

9.7.5.1 Diesel

9.7.5.2 Hybrid

9.7.5.3 Electric

9.7.5.4 CNG

9.7.6 Historic and Forecasted Market Size by Ownership

9.7.6.1 Rental

9.7.6.2 Industrial & Commercial

9.7.7 Historic and Forecasted Market Size by End-Use Industry

9.7.7.1 Retail

9.7.7.2 Food & Beverages

9.7.7.3 Inland Waterways & Marine Services

9.7.7.4 Rail Logistics

9.7.7.5 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Terminal Tractor Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 680.77 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.09% |

Market Size in 2032: |

USD 976.52 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Propulsion |

|

||

|

By Ownership |

|

||

|

By End-Use Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Terminal Tractor Market research report is 2024-2032.

Kalmar, Orange EV, TTS, Terberg Special Vehicles, Capacity Trucks, Volvo, Sany, Konecranes, MAFI Transport-Systeme GmbH, TICO Tractors, Blyyd, Crane Carrier Company, CVS Ferrari, Terberg, Hoist Liftruck, Hyster, Liebherr, Linde, MOL CY, REV Group, and other major players.

The Terminal Tractors Market is segmented into type, propulsion, ownership, end-use industry, and region. By Type, the market is categorized into Manual and Automated. By Propulsion, the market is categorized into Diesel, Hybrid, Electric, and CNG. By Ownership, the market is categorized into Rental, and Industrial & Commercial. By End-Use Industry, the market is categorized into Retail, Food & Beverages, Inland Waterways & Marine Services, Rail Logistics, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A terminal tractor is a specialty truck that is developed for fast, safe, and coherent movement of semi-trailers or cargo containers. In addition, terminal tractors are used at terminals, distribution centers, ports, and various other industrial applications that boost the efficiency of the movement of goods.

Terminal Tractor Market is expected to grow from USD 680.77 million in 2023 to USD 976.52 million by 2032, at a CAGR of 4.09% during the forecast period (2024-2032).