Tablet Processing & Packaging Equipment Market Synopsis:

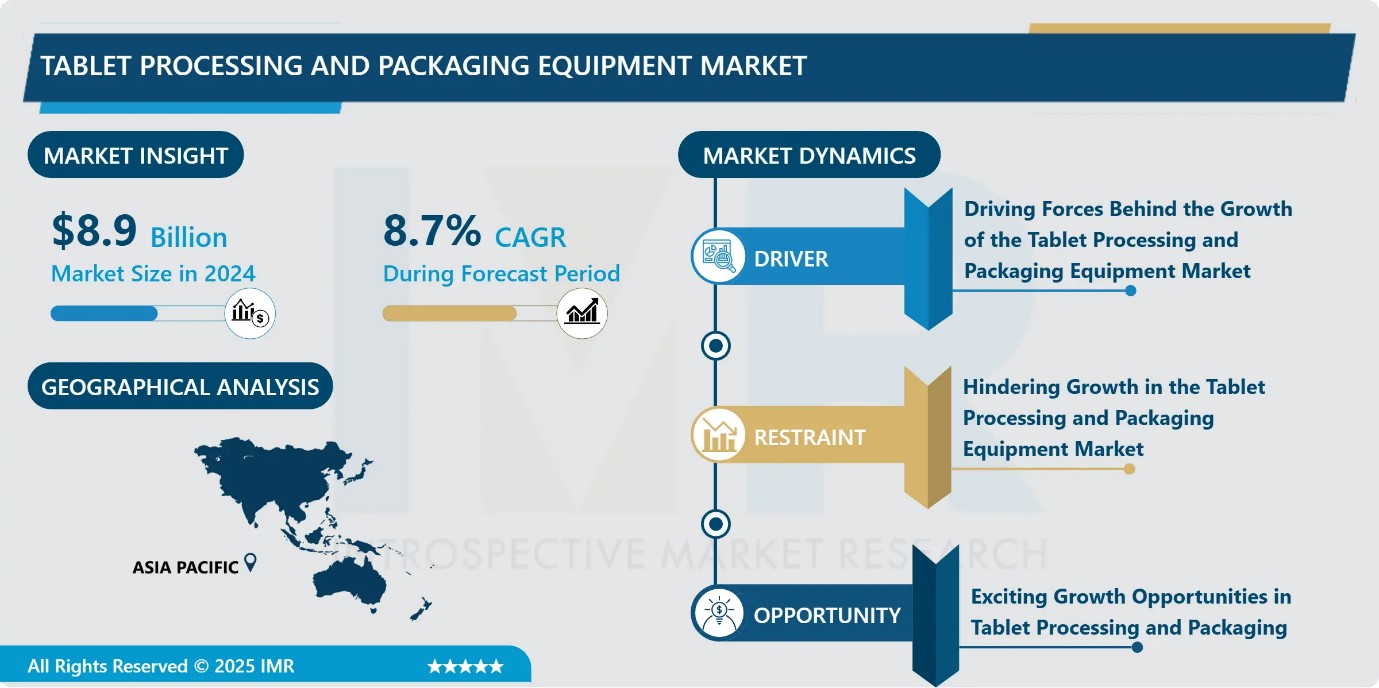

Tablet Processing Market Size Was Valued at USD 8.9 Billion in 2024, and is Projected to Reach USD 22.28 Billion by 2035, Growing at a CAGR of 8.7% From 2025–2035.

Tablet processing is the process of making medicine tablets. It involves mixing the ingredients, shaping them into tablets, and making sure they are strong and safe to use. This includes steps like grinding the powders, mixing them well, compressing the mixture into tablets, and sometimes coating the tablets to protect them or make them easier to swallow.

Packaging is the next step after making the tablets. It means putting the tablets into containers like bottles, blister packs, or strips so they are safe, easy to handle, and protected from damage or contamination. Good packaging also helps keep the tablets fresh and shows important information like the medicine name, dosage, and expiry date.

Together, tablet processing and packaging make sure that medicines are made properly and reach customers safely and effectively. These processes use special machines designed to work quickly and follow strict quality rules to make sure the medicine is reliable and safe for patients.

Tablet Processing & Packaging Equipment Market Growth and Trend Analysis:

Tablet Processing & Packaging Equipment Market Growth Driver- Driving Forces Behind the Growth

- The Tablet Processing & Packaging Equipment industry is witnessing steady growth due to several interrelated drivers that collectively strengthen market dynamics. A primary driver is the rising global demand for pharmaceutical tablets, attributed to increasing healthcare needs, an aging population, and a surge in chronic disease prevalence. This, in turn, fuels demand for efficient, high-capacity processing and packaging equipment to meet large-scale production requirements while ensuring safety and compliance.

- Regulatory compliance is another key factor. Stringent regulations imposed by health authorities such as the FDA and EMA necessitate robust processing and packaging solutions that ensure product integrity, traceability, and tamper-evidence. Equipment that aligns with these regulatory standards sees higher adoption rates.

- Additionally, the rise of contract manufacturing and pharmaceutical outsourcing has expanded the global footprint of production facilities. These facilities require scalable and versatile equipment, thereby increasing demand across emerging markets. Moreover, consumer preferences for convenient, safe, and clearly labelled medications have influenced packaging trends, pushing for smart and flexible packaging solutions.

- In summary, the industry’s growth is propelled by a combination of market demand, technological innovation, regulatory requirements, and evolving production models, all of which support logical projections of continued expansion in the tablet processing and packaging equipment sector.

Tablet Processing & Packaging Equipment Market Limiting Factor- Hindering Growth in the Tablet Processing & Packaging Equipment Market

- While the Tablet Processing & Packaging Equipment market is growing, there are several challenges that slow down its progress. One of the main problems is strict government rules and regulations. Companies must follow detailed guidelines to make sure their equipment is safe and meets quality standards. This can increase costs and delay the launch of new machines.

- Another issue is Supply chain disruptions. These can happen due to natural disasters, political problems, or global events like the COVID-19 pandemic. When key parts or raw materials are delayed, it affects the entire production process. This can lead to slower delivery times and increased prices for both manufacturers and buyers.

- Changing consumer preferences also play a role in slowing down the market. People are now looking for more personalized medicines or different packaging types, which may not fit with traditional equipment. Companies must adapt quickly, which can be costly and time-consuming. The COVID-19 pandemic had a big impact on the industry. Many factories were closed or operated with fewer workers, and transportation was limited. This caused delays in equipment production and delivery, and some companies paused or cancelled new investments.

- Understanding these challenges is important for companies. By studying these restraints, they can find ways to reduce their impact, such as by improving supply chains, upgrading technology, or staying updated with regulations. This helps businesses plan better and continue growing, even when faced with difficulties.

Tablet Processing & Packaging Equipment Market Expansion Opportunity- Exciting Growth Opportunities in Tablet Processing and Packaging

- The Tablet Processing & Packaging Equipment market offers many exciting opportunities for both new companies and existing manufacturers. As the demand for tablets continues to grow worldwide. Mainly due to increasing health concerns, an aging population, and the rising number of people with chronic illnesses there is a strong need for better and faster equipment to make and package these tablets.

- One major opportunity lies in developing countries where the pharmaceutical industry is still growing. These regions often need modern equipment to improve their production processes. Companies that enter these markets early can build strong relationships and gain a competitive edge. Another big opportunity comes from technological innovation. Manufacturers can create more advanced machines that are automated, easy to use, and require less human effort. These smart machines can help companies make tablets faster, with higher accuracy and fewer mistakes. This makes production more efficient and cost-effective.

- There is also growing interest in eco-friendly and sustainable packaging. Companies that offer equipment supporting green packaging materials or reduced waste can attract customers who care about the environment. Additionally, the trend of outsourcing pharmaceutical manufacturing is growing. This opens the door for equipment makers to supply contract manufacturers around the world who are looking to upgrade their facilities.

- In summary, there are many areas in this market where manufacturers can grow by offering innovative, efficient, and sustainable solutions. By taking advantage of these opportunities, companies can strengthen their position and achieve long-term success.

Tablet Processing & Packaging Equipment Market Challenge and Risk- Challenges in the Tablet Processing & Packaging Equipment Market

- The tablet processing and packaging equipment market faces some important problems that can slow down its growth. One big challenge is that technology keeps changing very quickly. Companies need to spend a lot of money on research and development (R&D) to improve their machines and stay up to date. But this can be expensive, and smaller companies may find it hard to afford.

- Another problem is tough competition. Many companies are trying to get more customers, which sometimes leads to price wars. When companies lower their prices to attract buyers, their profits become smaller. This makes it harder for them to grow or improve their products.

- Supply chain problems also create difficulties. The COVID-19 pandemic showed how supply chains can break down. For example, manufacturing in the U.S. dropped by about 12% during the worst times of the pandemic. This caused delays in making and delivering tablet processing and packaging equipment, which affected the whole market.

- Because of these challenges, companies need to find better ways to handle supply problems, invest wisely in new technology, and compete smartly. Solving these issues will help the industry grow stronger and last longer.

Tablet Processing & Packaging Equipment Market Segment Analysis:

Tablet Processing & Packaging Equipment Market is segmented based on Type, Application, End-Users, and Region

By Type, Tablet Processing & Packaging Equipment segment is expected to dominate the market during the forecast period

- Tablet press machines are very important in the pharmaceutical and related industries because they compress powders or granules into solid tablets. These machines are widely used because tablets are one of the most common forms of medicine and supplements. Among tablet presses, rotary tablet presses are very popular because they can produce a large number of tablets quickly and efficiently. These machines work by pressing the powder between two punches to form tablets of a specific shape and size.

- One major trend in tablet press machines is the move towards automation and digital control systems. Modern tablet presses now come with advanced computer controls that help monitor and adjust the tablet production process in real-time. This helps ensure the tablets are consistent in size, weight, and quality. Some machines also include sensors and software that detect problems early and reduce waste, which improves overall productivity.

- Tablet press machines are mainly used in the pharmaceutical industry for making medicines, but they are also important in the nutraceutical sector, where vitamins and supplements are produced in tablet form. There is also some use in the cosmetics industry for making compact powders or other pressed products.

- In summary, tablet press machines continue to be a key part of tablet manufacturing, with ongoing improvements in automation, precision, and integration to meet the growing demand for high-quality tablets.

By Application, Tablet Processing & Packaging Equipment segment held the largest share in 2024

- In 2024, the Tablet Processing & Packaging Equipment market was mainly driven by the pharmaceutical application segment, which held the largest share. This is because pharmaceuticals require high-quality, precise, and safe manufacturing and packaging processes due to strict regulatory standards. Tablets are the most common dosage form in the pharmaceutical industry, so the demand for efficient tablet processing equipment like tablet presses, granulators, and coating machines remains very high. Similarly, packaging equipment such as blister machines, labelling, and cartooning machines are essential to ensure product safety, traceability, and patient convenience.

- Besides pharmaceuticals, the nutraceuticals sector also contributed significantly to the market growth. Nutraceuticals, including vitamins and dietary supplements, are increasingly consumed worldwide as health awareness rises. These products also need specialized processing and packaging to maintain quality and shelf life.

- Other applications like food products, cosmetics, and animal health are growing but currently have smaller shares compared to pharmaceuticals and nutraceuticals. However, these sectors are adopting advanced tablet processing and packaging equipment to improve product quality and meet consumer demands.

- Overall, the pharmaceutical industry’s stringent quality requirements and large-scale production volumes keep it as the dominant application segment in the tablet processing and packaging equipment market, with nutraceuticals following closely behind.

Tablet Processing & Packaging Equipment Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- In North America, the Tablet Processing & Packaging Equipment Market is growing steadily. This is mainly due to the strong pharmaceutical industry and advanced healthcare system in the region. Many companies are investing in new technologies to improve tablet production and packaging. Automation is becoming more common, helping manufacturers work faster and more efficiently.

- Government regulations also play a big role in shaping the market. Strict rules ensure that medicines are packaged safely and correctly. As a result, companies must follow high standards, which drives innovation in packaging equipment.

- Another important trend is the focus on eco-friendly packaging. Many businesses are looking for ways to reduce waste and use sustainable materials. This is becoming more important as consumers and regulators push for greener solutions.

- Overall, North America remains a key player in the global market, with strong demand for advanced and efficient tablet processing and packaging equipment.

Tablet Processing & Packaging Equipment Market Active Players:

- Accura Pharmaquip Pvt. Ltd. (India)

- Bosch Packaging Technology (Germany)

- Cadmach Machinery Co. Pvt. Ltd. (India)

- Charles Ross & Sons Company (USA)

- Fette Compacting GmbH (Germany)

- Fuji Machinery Co. Ltd. (Japan)

- Gamlen Tableting Ltd (UK)

- GEA Group (Germany)

- Groupe Breteche Industrie (France)

- Hata Iron Works Co. Ltd. (Japan)

- I.M.A Industria Macchine Automatiche S.P.A (Italy)

- IDEX Corporation (USA)

- Kevin Process Technologies Pvt. Ltd. (India)

- Key International Inc. (USA)

- KG Pharma GmbH & Co. KG (Germany)

- Korsch AG (Germany)

- L.B. Bohle Maschinen + Verfahren GmbH (Germany)

- LMT Group (USA)

- Manesty Machines Ltd (UK)

- MG America LLC (USA)

- Nicomac Srl (Italy)

- O'Hara Technologies Inc. (USA)

- Prism Pharma Machinery (India)

- Robert Bosch GmbH (Germany)

- Romaco Group (Germany)

- Solace Engineers (Mktg.) Pvt. Ltd. (India)

- The Elizabeth Companies (USA)

- Uhlmann Pac-Systeme GmbH & Co. KG (Germany)

- Yenchen Machinery Co. Ltd. (Taiwan)

- Zhejiang Hualian Pharmaceutical Machinery Co. Ltd. (China)

- Other active players

|

Tablet Processing & Packaging Equipment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 8.9 Billion

|

|

Forecast Period 2025-35 CAGR: |

8.7% |

Market Size in 2035: |

USD 22.28 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material Type |

|

||

|

By Application |

|

||

|

Automation Level |

|

||

|

End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Tablet Processing and Packaging Equipment Market by Type (2018-2035)

4.1 Tablet Processing and Packaging Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Tablet Press

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Coating Machines

4.5 Granulators

4.6 Fillers

4.7 Packaging Machines

Chapter 5: Tablet Processing and Packaging Equipment Market by Application (2018-2035)

5.1 Tablet Processing and Packaging Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pharmaceuticals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Nutraceuticals

5.5 Cosmetics

5.6 Food Products

5.7 Animal Health

Chapter 6: Tablet Processing and Packaging Equipment Market by Automation Level (2018-2035)

6.1 Tablet Processing and Packaging Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Manual

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Semi-Automated

6.5 Fully Automated

Chapter 7: Tablet Processing and Packaging Equipment Market by End User (2018-2035)

7.1 Tablet Processing and Packaging Equipment Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Contract Manufacturers

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pharmaceutical Companies

7.5 Research Institutions

7.6 Full-Service Providers

7.7 Small Enterprises

Chapter 8: Tablet Processing and Packaging Equipment Market by Material Type (2018-2035)

8.1 Tablet Processing and Packaging Equipment Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Plastic

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Glass

8.5 Metal

8.6 Composite Materials

8.7 Others

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Tablet Processing and Packaging Equipment Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 ACCURA PHARMAQUIP PVT. LTD. (INDIA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 BOSCH PACKAGING TECHNOLOGY (GERMANY)

9.4 CADMACH MACHINERY CO. PVT. LTD. (INDIA)

9.5 CHARLES ROSS & SONS COMPANY (USA)

9.6 FETTE COMPACTING GMBH (GERMANY)

9.7 FUJI MACHINERY CO. LTD. (JAPAN)

9.8 GAMLEN TABLETING LTD (UK)

9.9 GEA GROUP (GERMANY)

9.10 GROUPE BRETECHE INDUSTRIE (FRANCE)

9.11 HATA IRON WORKS CO. LTD. (JAPAN)

9.12 I.M.A INDUSTRIA MACCHINE AUTOMATICHE S.P.A (ITALY)

9.13 IDEX CORPORATION (USA)

9.14 KEVIN PROCESS TECHNOLOGIES PVT. LTD. (INDIA)

9.15 KEY INTERNATIONAL INC. (USA)

9.16 KG PHARMA GMBH & CO. KG (GERMANY)

9.17 KORSCH AG (GERMANY)

9.18 L.B. BOHLE MASCHINEN + VERFAHREN GMBH (GERMANY)

9.19 LMT GROUP (USA)

9.20 MANESTY MACHINES LTD (UK)

9.21 MG AMERICA LLC (USA)

9.22 NICOMAC SRL (ITALY)

9.23 O'HARA TECHNOLOGIES INC. (USA)

9.24 PRISM PHARMA MACHINERY (INDIA)

9.25 ROBERT BOSCH GMBH (GERMANY)

9.26 ROMACO GROUP (GERMANY)

9.27 SOLACE ENGINEERS (MKTG.) PVT. LTD. (INDIA)

9.28 THE ELIZABETH COMPANIES (USA)

9.29 UHLMANN PAC-SYSTEME GMBH & CO. KG (GERMANY)

9.30 YENCHEN MACHINERY CO. LTD. (TAIWAN)

9.31 ZHEJIANG HUALIAN PHARMACEUTICAL MACHINERY CO. LTD. (CHINA)

9.32 AND OTHER ACTIVE PLAYERS

Chapter 10: Global Tablet Processing and Packaging Equipment Market By Region

10.1 Overview

10.2. North America Tablet Processing and Packaging Equipment Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Tablet Processing and Packaging Equipment Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Tablet Processing and Packaging Equipment Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Tablet Processing and Packaging Equipment Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Tablet Processing and Packaging Equipment Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Tablet Processing and Packaging Equipment Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

14.1 Sources

14.2 List of Tables and figures

14.3 Short Forms and Citations

14.4 Assumption and Conversion

14.5 Disclaimer

|

Tablet Processing & Packaging Equipment Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 8.9 Billion

|

|

Forecast Period 2025-35 CAGR: |

8.7% |

Market Size in 2035: |

USD 22.28 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Material Type |

|

||

|

By Application |

|

||

|

Automation Level |

|

||

|

End-User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||