Synchronous Wind Turbine Tower Market Synopsis

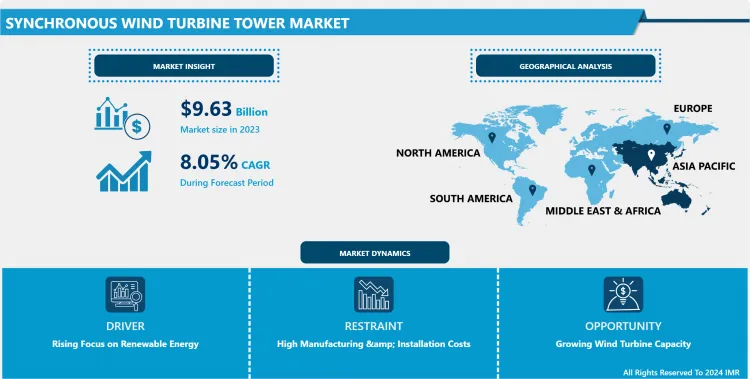

The Synchronous Wind Turbine Tower Market was valued at USD 9.63 Billion in 2023 and is projected to reach USD 19.33 Billion by 2032, growing at a CAGR of 8.05% from 2024 to 2032.

A synchronous wind turbine tower refers to a type of wind turbine structure designed to rotate in sync with the direction of the wind, optimizing energy generation efficiency. This design allows the turbine blades to align with the wind flow, maximizing the capture of wind energy and improving overall turbine performance.

The application of synchronous wind turbine towers is pivotal in renewable energy generation, particularly in wind farms and individual wind turbine installations. These towers utilize advanced control systems and sensors to adjust the orientation of turbine blades in real time, ensuring optimal alignment with wind direction for maximum energy capture. This application is crucial for enhancing the efficiency and output of wind turbines, contributing significantly to the overall renewable energy production landscape.

Synchronous wind turbine towers lie in their ability to improve energy conversion rates and operational performance. By synchronizing with wind patterns, these towers can generate more electricity consistently, leading to higher energy yields and improved cost-effectiveness over the long term. Additionally, their adaptive design enables them to operate efficiently across varying wind speeds and directions, making them suitable for diverse geographical locations and wind conditions.

Synchronous wind turbine towers are expected to be driven by the global shift towards sustainable energy sources and the increasing focus on reducing carbon emissions. As governments, industries, and communities prioritize renewable energy adoption, the demand for advanced wind turbine technologies, including synchronous towers, is projected to rise. This trend is further fueled by technological advancements, such as AI-driven control systems and predictive maintenance solutions, which enhance the reliability, performance, and economic viability of synchronous wind turbines, positioning them as key contributors to the renewable energy transition.

Synchronous Wind Turbine Tower Market Trend Analysis:

Rising Focus on Renewable Energy

- The growing emphasis on renewable energy stands out as a major driver propelling the growth of the synchronous wind turbine tower market. With increasing concerns about climate change and environmental sustainability, governments, businesses, and communities worldwide are shifting towards cleaner energy sources. Wind energy, in particular, has gained traction as a key renewable energy option due to its abundance and potential for large-scale electricity generation.

- As a result of this rising focus on renewable energy, there is a significant surge in investments and installations of wind farms and wind energy projects. Synchronous wind turbine towers play a crucial role in this landscape by improving the efficiency and performance of wind turbines. These towers are designed to optimize energy capture by synchronizing with wind direction and speed, leading to higher electricity production and better operational output.

- Moreover, the drive towards renewable energy is supported by government policies, incentives, and regulations aimed at promoting clean energy adoption and reducing reliance on fossil fuels. This favorable regulatory environment encourages industry players to invest in advanced wind turbine technologies, including synchronous towers, to meet growing energy demands sustainably. As the momentum towards renewable energy continues to grow, driven by environmental awareness and economic considerations, the synchronous wind turbine tower market is poised for significant expansion in the coming years.

Growing Wind Turbine Capacity

- The increasing capacity of wind turbines presents a significant opportunity for driving the growth of the synchronous wind turbine tower market. As wind turbine technology advances, turbines are becoming larger and more powerful, capable of generating higher amounts of electricity. This growing capacity is driven by innovations in turbine design, blade materials, and control systems, resulting in turbines with greater energy output potential.

- Synchronous wind turbine towers in this scenario are their ability to support larger and more efficient turbines. These towers are designed to handle the increased loads and stresses associated with larger turbine sizes, ensuring stable operation and optimal performance. By aligning with the direction of the wind and maximizing energy capture, synchronous towers complement the growing capacity of modern wind turbines, enhancing overall energy production.

- Moreover, the trend towards growing wind turbine capacity is fueled by the global shift towards renewable energy and the increasing demand for clean electricity sources. Governments, utilities, and energy companies are investing in wind power projects with larger turbines to meet renewable energy targets and reduce carbon emissions. This surge in demand for high-capacity wind turbines creates a favorable market environment for synchronous wind turbine tower manufacturers, who can capitalize on the opportunity to provide advanced tower solutions that support the next generation of wind energy infrastructure.

Synchronous Wind Turbine Tower Market Segment Analysis:

Synchronous Wind Turbine Tower Market Segmented on the basis of Material, Capacity, Application, and End-User.

By Material, Steel segment is expected to dominate the market during the forecast period

- The steel segment is expected to dominate the growth of the synchronous wind turbine tower market. This dominance is attributed to the widespread use of steel in manufacturing wind turbine towers due to its strength, durability, and suitability for tall structures. Steel offers structural integrity and resistance to harsh weather conditions, making it an ideal material for supporting wind turbines in various environments.

- Additionally, advancements in steel manufacturing technologies, such as high-strength steel alloys and innovative fabrication methods, contribute to the dominance of the steel segment in the synchronous wind turbine tower market. These advancements enable the production of taller and more robust steel towers that can accommodate larger turbines and optimize energy capture efficiency. As the demand for high-capacity wind turbines increases, driven by the growing focus on renewable energy, the steel segment is poised to maintain its dominance in providing reliable and cost-effective solutions for wind turbine tower construction.

By End-User, the Industrial segment held the largest share of 43.52% in 2023

- The industrial segment has secured the largest share in driving the growth of the synchronous wind turbine tower market. This segment encompasses a wide range of industries, including manufacturing, energy, construction, and infrastructure development, which rely on wind power for electricity generation. The industrial sector's significant contribution to the adoption of wind energy projects and the installation of wind turbines has propelled the demand for synchronous wind turbine towers.

- Industrial players recognize the economic and environmental benefits of harnessing wind energy and are actively investing in wind turbine installations. Synchronous wind turbine towers play a crucial role in these projects by providing stable and efficient support structures for large-scale wind turbines, ensuring optimal energy production and operational reliability. As the industrial sector continues to prioritize sustainability and clean energy solutions, the demand for synchronous wind turbine towers is expected to grow, further strengthening the industrial segment's position in the market.

Synchronous Wind Turbine Tower Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Asia Pacific is poised to dominate as the leading region for the growth of the synchronous wind turbine tower market due to various factors. These include the rapid expansion of wind power capacity, driven by government initiatives promoting renewable energy and increasing investments in wind energy projects across countries such as China, India, Japan, and Australia. Additionally, the region benefits from favorable regulatory frameworks, supportive policies, and a growing awareness of environmental sustainability, all contributing to the robust growth of the synchronous wind turbine tower market in Asia Pacific.

- Furthermore, the demand for clean energy sources and the imperative to reduce carbon emissions are significant drivers propelling the adoption of wind energy technologies in the region. The countries in Asia Pacific are undergoing substantial economic growth and urbanization, leading to increased energy demands that can be effectively met through renewable sources like wind power, There is a heightened focus on enhancing wind energy infrastructure, including the installation of advanced synchronous wind turbine towers, to leverage the region's abundant wind resources and drive sustainable energy development.

Synchronous Wind Turbine Tower Market Top Key Players:

- Enerpac Tool Group (U.S.)

- Clipper Windpower (U.S.)

- Nordex Group (Germany)

- Enercon GmbH (Germany)

- Kenersys GmbH (Germany)

- Senvion GmbH (Germany)

- Siemens Gamesa Renewable Energy (Spain)

- General Electric (France)

- EWT Wind Turbines (Netherlands)

- Vestas Wind Systems (Denmark)

- Goldwind Science & Technology Co., Ltd (China)

- Envision Energy (China)

- Mingyang Smart Energy Group Co., Ltd (China)

- Sinovel Wind Group Co., Ltd

- XEMC Windpower Co., Ltd

- Mitsubishi Power (Japan)

- Toshiba Energy Systems & Solutions Corporation (Japan)

- Suzlon (India), and Other Major Players

Key Industry Developments in the Synchronous Wind Turbine Tower Market:

- In April 2023, Siemens Gamesa announced the GreenerTower, a wind turbine tower made of more sustainable steel. Towers consist of approximately 80% steel plates. The new GreenerTower will ensure a CO2 reduction of at least 63% in the tower steel plates compared to conventional steel. Siemens Gamesa’s new thorough qualification process will verify that only a maximum of 0.7 tons of CO2-equivalent emissions are permitted per ton of steel.

|

Global Synchronous Wind Turbine Tower Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.63 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.05% |

Market Size in 2032: |

USD 19.33 Bn. |

|

Segments Covered: |

By Material |

|

|

|

By Capacity |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Synchronous Wind Turbine Tower Market by Material (2018-2032)

4.1 Synchronous Wind Turbine Tower Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Steel

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Concrete

4.5 Composites

Chapter 5: Synchronous Wind Turbine Tower Market by Capacity (2018-2032)

5.1 Synchronous Wind Turbine Tower Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Up to 750 kW

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 750 kW - 1200 kW

5.5 1200 kW - 1500 kW

5.6 Above 1500 kW

Chapter 6: Synchronous Wind Turbine Tower Market by Application (2018-2032)

6.1 Synchronous Wind Turbine Tower Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Tourist Attractions

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Border Defense

6.5 Municipal Administration

Chapter 7: Synchronous Wind Turbine Tower Market by End-User (2018-2032)

7.1 Synchronous Wind Turbine Tower Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

7.5 Industrial

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Synchronous Wind Turbine Tower Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AARTI INDUSTRIES LTD. (INDIA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ATUL LTD (INDIA)

8.4 BANCHEM INTERMEDIATES (INDIA)

8.5 JIUJIANG ZHONGXING MEDICINE CHEMICAL CO. LTDSOLVAY S.A (BELGIUM)

8.6 TCI CHEMICALS PRIVATE LIMITED (INDIA)

8.7 NANTONG VOLANTCHEM CORP. (CHINA)

8.8 HUAI'AN SHENGLI MATERIALS CO. LTD. (CHINA)

8.9 VERTELLUS HOLDINGS INC. (US)

8.10 BASF SE (GERMANY)

8.11 JIANGMEN YOUJU (CHINA)

8.12 SINO POLYMER (CHINA)OTHERS MAJOR PLAYERS

Chapter 9: Global Synchronous Wind Turbine Tower Market By Region

9.1 Overview

9.2. North America Synchronous Wind Turbine Tower Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Material

9.2.4.1 Steel

9.2.4.2 Concrete

9.2.4.3 Composites

9.2.5 Historic and Forecasted Market Size by Capacity

9.2.5.1 Up to 750 kW

9.2.5.2 750 kW - 1200 kW

9.2.5.3 1200 kW - 1500 kW

9.2.5.4 Above 1500 kW

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Tourist Attractions

9.2.6.2 Border Defense

9.2.6.3 Municipal Administration

9.2.7 Historic and Forecasted Market Size by End-User

9.2.7.1 Residential

9.2.7.2 Commercial

9.2.7.3 Industrial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Synchronous Wind Turbine Tower Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Material

9.3.4.1 Steel

9.3.4.2 Concrete

9.3.4.3 Composites

9.3.5 Historic and Forecasted Market Size by Capacity

9.3.5.1 Up to 750 kW

9.3.5.2 750 kW - 1200 kW

9.3.5.3 1200 kW - 1500 kW

9.3.5.4 Above 1500 kW

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Tourist Attractions

9.3.6.2 Border Defense

9.3.6.3 Municipal Administration

9.3.7 Historic and Forecasted Market Size by End-User

9.3.7.1 Residential

9.3.7.2 Commercial

9.3.7.3 Industrial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Synchronous Wind Turbine Tower Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Material

9.4.4.1 Steel

9.4.4.2 Concrete

9.4.4.3 Composites

9.4.5 Historic and Forecasted Market Size by Capacity

9.4.5.1 Up to 750 kW

9.4.5.2 750 kW - 1200 kW

9.4.5.3 1200 kW - 1500 kW

9.4.5.4 Above 1500 kW

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Tourist Attractions

9.4.6.2 Border Defense

9.4.6.3 Municipal Administration

9.4.7 Historic and Forecasted Market Size by End-User

9.4.7.1 Residential

9.4.7.2 Commercial

9.4.7.3 Industrial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Synchronous Wind Turbine Tower Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Material

9.5.4.1 Steel

9.5.4.2 Concrete

9.5.4.3 Composites

9.5.5 Historic and Forecasted Market Size by Capacity

9.5.5.1 Up to 750 kW

9.5.5.2 750 kW - 1200 kW

9.5.5.3 1200 kW - 1500 kW

9.5.5.4 Above 1500 kW

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Tourist Attractions

9.5.6.2 Border Defense

9.5.6.3 Municipal Administration

9.5.7 Historic and Forecasted Market Size by End-User

9.5.7.1 Residential

9.5.7.2 Commercial

9.5.7.3 Industrial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Synchronous Wind Turbine Tower Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Material

9.6.4.1 Steel

9.6.4.2 Concrete

9.6.4.3 Composites

9.6.5 Historic and Forecasted Market Size by Capacity

9.6.5.1 Up to 750 kW

9.6.5.2 750 kW - 1200 kW

9.6.5.3 1200 kW - 1500 kW

9.6.5.4 Above 1500 kW

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Tourist Attractions

9.6.6.2 Border Defense

9.6.6.3 Municipal Administration

9.6.7 Historic and Forecasted Market Size by End-User

9.6.7.1 Residential

9.6.7.2 Commercial

9.6.7.3 Industrial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Synchronous Wind Turbine Tower Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Material

9.7.4.1 Steel

9.7.4.2 Concrete

9.7.4.3 Composites

9.7.5 Historic and Forecasted Market Size by Capacity

9.7.5.1 Up to 750 kW

9.7.5.2 750 kW - 1200 kW

9.7.5.3 1200 kW - 1500 kW

9.7.5.4 Above 1500 kW

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Tourist Attractions

9.7.6.2 Border Defense

9.7.6.3 Municipal Administration

9.7.7 Historic and Forecasted Market Size by End-User

9.7.7.1 Residential

9.7.7.2 Commercial

9.7.7.3 Industrial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Synchronous Wind Turbine Tower Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.63 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.05% |

Market Size in 2032: |

USD 19.33 Bn. |

|

Segments Covered: |

By Material |

|

|

|

By Capacity |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||