Surgical Robots Market Synopsis

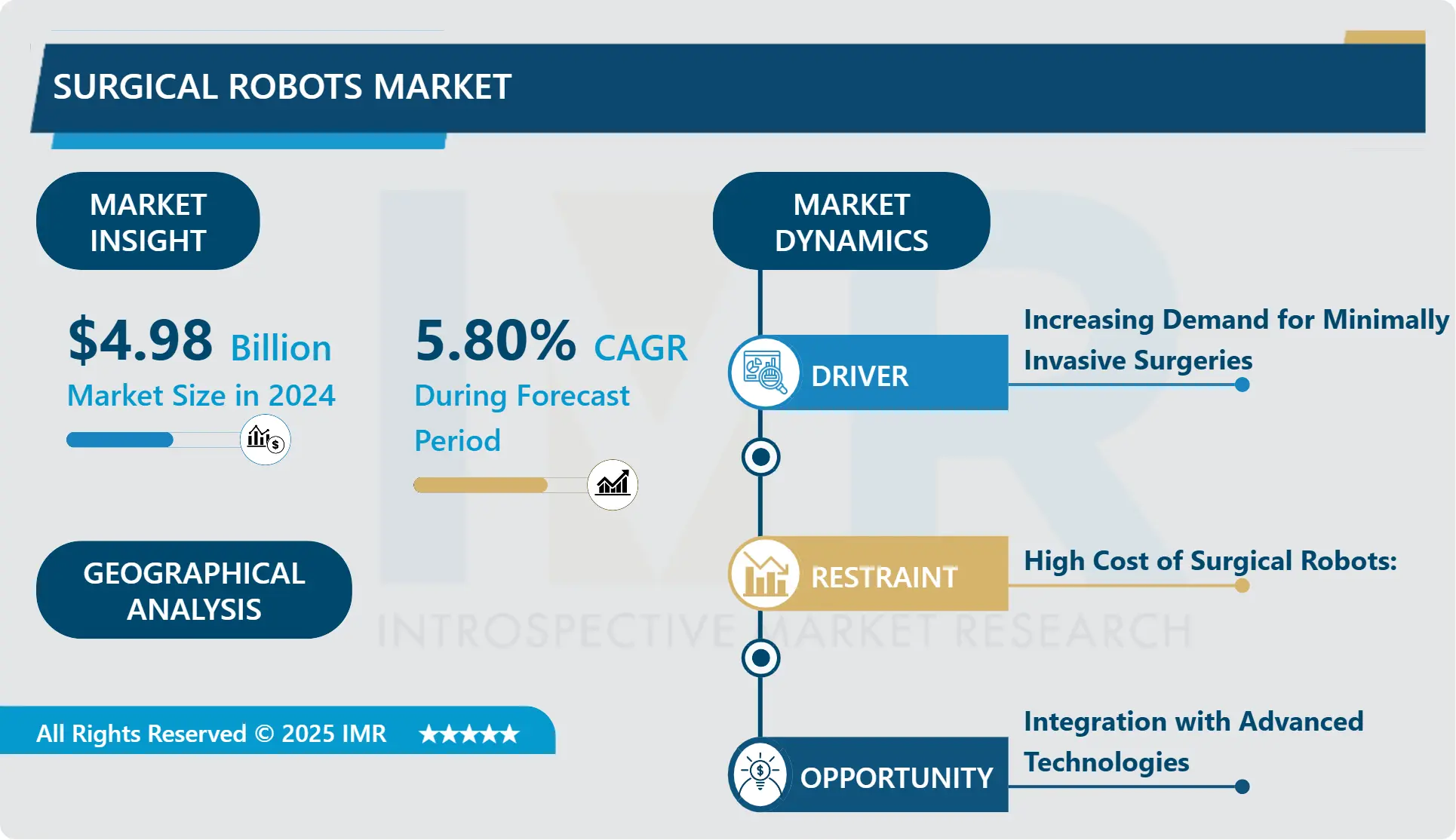

Surgical Robots Market Size Was Valued at USD 4.98 Billion in 2024, and is Projected to Reach USD 7.82 Billion by 2032, Growing at a CAGR of 5.80% From 2025-2032.

The surgical robots market can be defined as the market that concerns the development, manufacturing, and distribution of the robotic systems used to support surgery procedures. These robots increase accuracy, control, and dexterity in minimally invasive operations, lower the incidence of complications, and thus improve the overall wellbeing of the patient. Some types of robotic systems in the market include the robotic-assisted surgery (RAS), autonomous surgical robot, and telesurgical systems. Some of the essential parts are the robotic arms, control systems, and the software which helps in the movement and control of the system and also provides feedback on the movement. This market is influenced by the development of technology, the increasing usage of the equipment in the hospitals and surgical centers, and the rising need for the minimally invasive surgical procedures across various specialties in the healthcare sector.

The surgical robots market has shown remarkable growth in the past few years due to factors such as technological improvements and the growing preference for minimally invasive surgeries. Surgical robots are capable of increasing the precision, control, and dexterity of operations by giving the surgeon the ability to carry out intricate procedures. These systems have several advantages: they help save blood, shorten the time a patient has to spend in the hospital, and enable the patient to recover faster; all of which are critical factors that are boosting the uptake of these systems across many specialties, including gynecology, urology, orthopedic surgery, and general surgery.

The market is currently occupied by a few big players, including Intuitive Surgical with its flagship product the da Vinci Surgical System – and new market entrants trying to come up with new ideas and explore new possibilities in the field of robotic surgery. Some of the most significant opportunities for growth and expansion include the use of AI and machine learning, as well as advanced imaging options. Moreover, chronic diseases, demographic changes, especially, the growing senior population, and constantly rising costs of healthcare are expected to boost the surgical robots market. But the high cost of developing and implementing robotic systems as well as the issue of training may be a drawback. Nonetheless, the surgical robots market remains one of the most promising fields and is expected to revolutionize the surgical processes and results in the global scale.

Surgical Robots Market Trend Analysis- Advancements in Artificial Intelligence (AI) and Machine Learning (ML)

- The growth of the surgical robots market can be attributed to the growing use of minimally invasive surgeries, technological improvements in the robotic systems, and the increased focus on automation in the medical sector. The use of surgical robots provides increased control, improved dexterity, and enhanced vision to the surgical environment thus enhancing surgical outcomes and decreasing recovery time.

- The development of sophisticated artificial intelligence and machine learning algorithms is rapidly transforming surgical robotics because robots can learn from data, improve their performance, and make decisions in real time. Some of the applications of AI are in image recognition, motion planning, and analyzing data to make predictions about the future, which are improving the performance of surgical robots and therefore making the surgeries more effective and safer.

- New surgical robots are being developed with artificial intelligence and machine learning features built in by the manufacturers. These technologies help robots to interpret and understand the data, recognize certain patterns, and make rational choice in the middle of the operation and, thus, improve the outcomes of interventions.

- Another new concept is autonomous surgical robots that are able to operate on patients independently or at least with minimal human supervision. These robots apply Artificial Intelligence, Machine Learning and state-of-art perception systems to move around the surgical sphere, sense the tissues and organs and perform certain actions on its own. Nevertheless, fully autonomous surgery is yet to become a reality, although the current studies and developments point towards the possibility of future usage in healthcare.

Expansion into New Surgical Specialties

- Due to the constant development of the technology and people’s growing confidence in the robotic surgery, there is a tendency towards the further enhancement of robotic systems in the sphere of new surgical specializations that were not initially associated with the use of robotics. At the beginning, surgical robots were applied mainly in specializations such as urology and gynaecology. But there has been an increasing application in the surgical disciplines like orthopedics, neurosurgery, cardiovascular surgery, general surgery etc. This expansion is based on the understanding of the advantages of introducing robot into the operating room such as increase in the level of accuracy, decreased trauma, short recovery time, and better results of the patient.

- AI and ML are emerging as key enablers of the advancement of robotic surgery into more sub-specialties. These technologies allow robots to process huge amounts of information related to patient history, surgical images, and procedures in order to enhance the efficiency of surgeries, tailor treatment regimens, and advance surgical results. Some of the benefits of using AI for surgeons during complex operations include the Real-time analysis, Predictive analysis, and decision-making based on previous experience and research information.

- With increasing adoption of Robot Assisted Surgery in various fields, there is a clear focus on developing specific robotic systems for various procedures. These systems may be equipped with specific robotic arms, end-effectors, and instruments that are intended to address the distinct issues and concerns related to different surgical disciplines. For instance, the robotic systems for neurosurgery may include enhanced imaging and navigation features than the ones designed for orthopedic surgery which focus on bone excision and implant positioning.

- Another trend is the increased application of multimodal robotic systems that enable cooperation between surgeons, assistants, and robotic systems. Such systems allow the active collaboration of the multi-disciplinary teams and the effective use of both human knowledge and robotic equipment. Collaborative robotics improves work interface, co-operation, and productivity in the operating room; resulting to increased patient care and satisfaction.

Surgical Robots Market Segment Analysis:

Surgical Robots Market is segmented based on Product & Service, Application and End User

By Product & Service, Robotic Systems segment is expected to dominate the market during the forecast period.

- This segment includes various equipment and attachments that are employed in the robotic surgery, including the robotic arms, end effectors, imaging systems, and surgical instruments. These components are relevant for doing surgeries that require small incisions while offering accuracy in the procedure. The growth of the market for instruments and accessories in the present scenario is on the rise due to the increased uptake of robotic surgery across multiple specialties.

- The robotic systems segment consists of the actual robotic equipment that is applied in surgeries. These systems are developed to offer surgeons better control, finger dexterity and visual feedback during operations. In this segment, there are laparoscopy robotic systems, orthopedic robotic systems, neurosurgical robotic systems as well as other specialized robotic systems that are suitable for different surgical specialties.

- Laparoscopy robotic systems are the subcategory of the robotic systems used in the minimally invasive laparoscopic surgeries. These systems present advantages including enhanced ergonomics, three dimensional visualization and wristed instruments, allowing the surgeons to carry out procedures not easily done with ease due to reduced incisions. The rising usage of laparoscopy robotic systems is fueling the growth of the market within this segment.

- The orthopedic robotic systems and neurosurgical robotic systems are designed for the orthopedic and neurosurgical application respectively. These systems incorporate advanced technologies like imaging, navigation, and robotic guidance to help surgeons in procedures like bone resection, implant positioning, and tumor excision. Increased rate of orthopedic and neurosurgical procedures along with the need for enhanced accuracy and precision in surgeries is also driving the use of robotic systems in orthopedics and neurosurgery.

By Application, Gynecological Surgery segment held the largest share in 2024

- The general surgery is a branch of surgery that deals with operations of the abdomen, the digestive system and other organs in the body. Surgical robots have been applied commonly in general surgery for operations like cholecystectomy, hernia repair, and colorectal surgery. The robotic systems provide higher accuracy and better visualization of the operative field and thus lead to better surgical results, fewer complications and shorter time to recovery in the general surgical interventions.

- Gynecological surgery encompasses operations pertaining to the female reproductive organs such as the uterus, fibroid, cervix and ovaries such as hysterectomy, myomectomy and cystectomy respectively. Robotic surgeries have gained popularity in gynecological operations as they provide enhanced precision and reduced invasiveness and morbidity. Robotic systems as tools assist the surgeons to provide better dexterity, 3D visualization and control as well as less blood loss in gynecological operations.

- Orthopedic surgery is a branch of surgery that deals specifically with the musculoskeletal system of the human body for instance, joint diseases, bone fractures and sports injuries. The utilization of robotic-assisted orthopedic surgery has been on the rise in the recent past especially in procedures such as total knee arthroplasty and partial knee resurfacing. Robotic systems allow the surgeon to place implants in the ideal position and orientation in relation to the other bones and soft tissues of the joint, which results in better joint function and longer lasting joint replacements.

- This is a surgical subspecialty that deals with the diagnosis and management of diseases of the urinary tract in men and women and the male reproductive system. Surgical robots are widely applied in urological surgeries including prostatectomy, nephrectomy, cystectomy and other operations. Robotic assisted surgery in urology has advantages of improved visualisation and control, refined tissue handling, and improved technique especially in the area of nerve sparing, thus improving the post operative urinary and sexual function of the patient.

Surgical Robots Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominates the surgical robots market, primarily due to the high adoption rate of advanced medical technologies, substantial healthcare spending, and the presence of key market players. The region's robust healthcare infrastructure is a critical driver, facilitating the rapid integration of innovative surgical technologies. Hospitals and medical centers in North America are well-equipped with state-of-the-art facilities, allowing for the seamless adoption of robotic surgical systems. Furthermore, substantial healthcare spending in the region supports continuous advancements and updates in medical technology, ensuring that healthcare providers have access to the latest and most effective tools for patient care. The presence of major players in the market, such as Intuitive Surgical, Medtronic, and Johnson & Johnson, also propels the market forward, as these companies invest heavily in research and development, marketing, and training programs to promote the use of their robotic systems.

- The United States stands out as a significant contributor to the market's growth, benefiting from a combination of factors that create an optimal environment for the proliferation of surgical robots. The country’s well-established healthcare infrastructure includes numerous hospitals and surgical centers that prioritize cutting-edge technology to improve patient outcomes. Favorable reimbursement policies further enhance the market by making robotic-assisted surgeries more accessible to patients and financially viable for healthcare providers. Additionally, extensive research and development activities conducted by both private companies and academic institutions drive continuous innovation in robotic surgery. The increasing prevalence of chronic diseases, such as cancer and cardiovascular disorders, also fuels demand for robotic-assisted surgeries, as these procedures offer greater precision, reduced recovery times, and fewer complications compared to traditional surgical methods. Consequently, the U.S. remains at the forefront of the surgical robots market, setting trends and standards that influence global practices.

Active Key Players in the Surgical Robots Market

- Smith & Nephew;

- Medrobotics corporation;

- TransEnterix Surgical, Inc.;

- Intuitive Surgical;

- Renishaw plc;

- Medtronic plc;

- Stryker Corporation;

- Zimmer Biomet Holdings, Inc.;

- THINK Surgical, Inc.

- Other Major Players, Other Active Players

|

Global Surgical Robots Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 4.98 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.80% |

Market Size in 2032: |

USD 7.82 Bn. |

|

Segments Covered: |

By Product & Service |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Surgical Robots Market by Product & Service (2018-2032)

4.1 Surgical Robots Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Instruments & Accessories

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Robotic Systems

4.5 Laparoscopy Robotic Systems

4.6 Orthopedic Robotic Systems

4.7 Neurosurgical Robotic Systems

4.8 Other Systems

4.9 Services

Chapter 5: Surgical Robots Market by Application (2018-2032)

5.1 Surgical Robots Market Snapshot and Growth Engine

5.2 Market Overview

5.3 General Surgery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Gynecological Surgery

5.5 Orthopedic Surgery

5.6 Urological Surgery

5.7 Neurosurgery

5.8 Other Applications

Chapter 6: Surgical Robots Market by End User (2018-2032)

6.1 Surgical Robots Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgery Centers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Surgical Robots Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 JOHNSON & JOHNSON (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CONMED CORPORATION (US)

7.4 REACH SURGICAL INC. (US)

7.5 MICROLINE SURGICAL (US)

7.6 STRYKER CORPORATION (US)

7.7 3M HEALTHCARE (FORMERLY COVIDIEN) (US)

7.8 TELEFLEX INCORPORATED (US)

7.9 APOLLO ENDOSURGERY INC. (US)

7.10 GRENA LTD. (POLAND)

7.11 B. BRAUN MELSUNGEN AG (GERMANY)

7.12 SMITH & NEPHEW PLC (UK)

7.13 PURPLE SURGICAL (UK)

7.14 GRENA THINK MEDICAL (UK)

7.15 EON SURGICAL LTD. (UK)

7.16 GASTROSTAPLER SAS (FRANCE)

7.17 DACH MEDICAL GROUP HOLDING AG (SWITZERLAND)

7.18 MEDTRONIC PLC (IRELAND)

7.19 WELFARE MEDICAL LTD. (CHINA)

7.20 VICTOR MEDICAL INSTRUMENTS COLTD. (CHINA)

7.21 TSI HEALTHCARE COLTD. (CHINA)

7.22 XNY MEDICAL (CHINA)

7.23 MERIL LIFE SCIENCES PVT. LTD. (INDIA)

7.24

Chapter 8: Global Surgical Robots Market By Region

8.1 Overview

8.2. North America Surgical Robots Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Product & Service

8.2.4.1 Instruments & Accessories

8.2.4.2 Robotic Systems

8.2.4.3 Laparoscopy Robotic Systems

8.2.4.4 Orthopedic Robotic Systems

8.2.4.5 Neurosurgical Robotic Systems

8.2.4.6 Other Systems

8.2.4.7 Services

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 General Surgery

8.2.5.2 Gynecological Surgery

8.2.5.3 Orthopedic Surgery

8.2.5.4 Urological Surgery

8.2.5.5 Neurosurgery

8.2.5.6 Other Applications

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospitals & Clinics

8.2.6.2 Ambulatory Surgery Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Surgical Robots Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Product & Service

8.3.4.1 Instruments & Accessories

8.3.4.2 Robotic Systems

8.3.4.3 Laparoscopy Robotic Systems

8.3.4.4 Orthopedic Robotic Systems

8.3.4.5 Neurosurgical Robotic Systems

8.3.4.6 Other Systems

8.3.4.7 Services

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 General Surgery

8.3.5.2 Gynecological Surgery

8.3.5.3 Orthopedic Surgery

8.3.5.4 Urological Surgery

8.3.5.5 Neurosurgery

8.3.5.6 Other Applications

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospitals & Clinics

8.3.6.2 Ambulatory Surgery Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Surgical Robots Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Product & Service

8.4.4.1 Instruments & Accessories

8.4.4.2 Robotic Systems

8.4.4.3 Laparoscopy Robotic Systems

8.4.4.4 Orthopedic Robotic Systems

8.4.4.5 Neurosurgical Robotic Systems

8.4.4.6 Other Systems

8.4.4.7 Services

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 General Surgery

8.4.5.2 Gynecological Surgery

8.4.5.3 Orthopedic Surgery

8.4.5.4 Urological Surgery

8.4.5.5 Neurosurgery

8.4.5.6 Other Applications

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospitals & Clinics

8.4.6.2 Ambulatory Surgery Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Surgical Robots Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Product & Service

8.5.4.1 Instruments & Accessories

8.5.4.2 Robotic Systems

8.5.4.3 Laparoscopy Robotic Systems

8.5.4.4 Orthopedic Robotic Systems

8.5.4.5 Neurosurgical Robotic Systems

8.5.4.6 Other Systems

8.5.4.7 Services

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 General Surgery

8.5.5.2 Gynecological Surgery

8.5.5.3 Orthopedic Surgery

8.5.5.4 Urological Surgery

8.5.5.5 Neurosurgery

8.5.5.6 Other Applications

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospitals & Clinics

8.5.6.2 Ambulatory Surgery Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Surgical Robots Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Product & Service

8.6.4.1 Instruments & Accessories

8.6.4.2 Robotic Systems

8.6.4.3 Laparoscopy Robotic Systems

8.6.4.4 Orthopedic Robotic Systems

8.6.4.5 Neurosurgical Robotic Systems

8.6.4.6 Other Systems

8.6.4.7 Services

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 General Surgery

8.6.5.2 Gynecological Surgery

8.6.5.3 Orthopedic Surgery

8.6.5.4 Urological Surgery

8.6.5.5 Neurosurgery

8.6.5.6 Other Applications

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospitals & Clinics

8.6.6.2 Ambulatory Surgery Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Surgical Robots Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Product & Service

8.7.4.1 Instruments & Accessories

8.7.4.2 Robotic Systems

8.7.4.3 Laparoscopy Robotic Systems

8.7.4.4 Orthopedic Robotic Systems

8.7.4.5 Neurosurgical Robotic Systems

8.7.4.6 Other Systems

8.7.4.7 Services

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 General Surgery

8.7.5.2 Gynecological Surgery

8.7.5.3 Orthopedic Surgery

8.7.5.4 Urological Surgery

8.7.5.5 Neurosurgery

8.7.5.6 Other Applications

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospitals & Clinics

8.7.6.2 Ambulatory Surgery Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Surgical Robots Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 4.98 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.80% |

Market Size in 2032: |

USD 7.82 Bn. |

|

Segments Covered: |

By Product & Service |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||