Stable Isotope Labelled Compounds Market Synopsis:

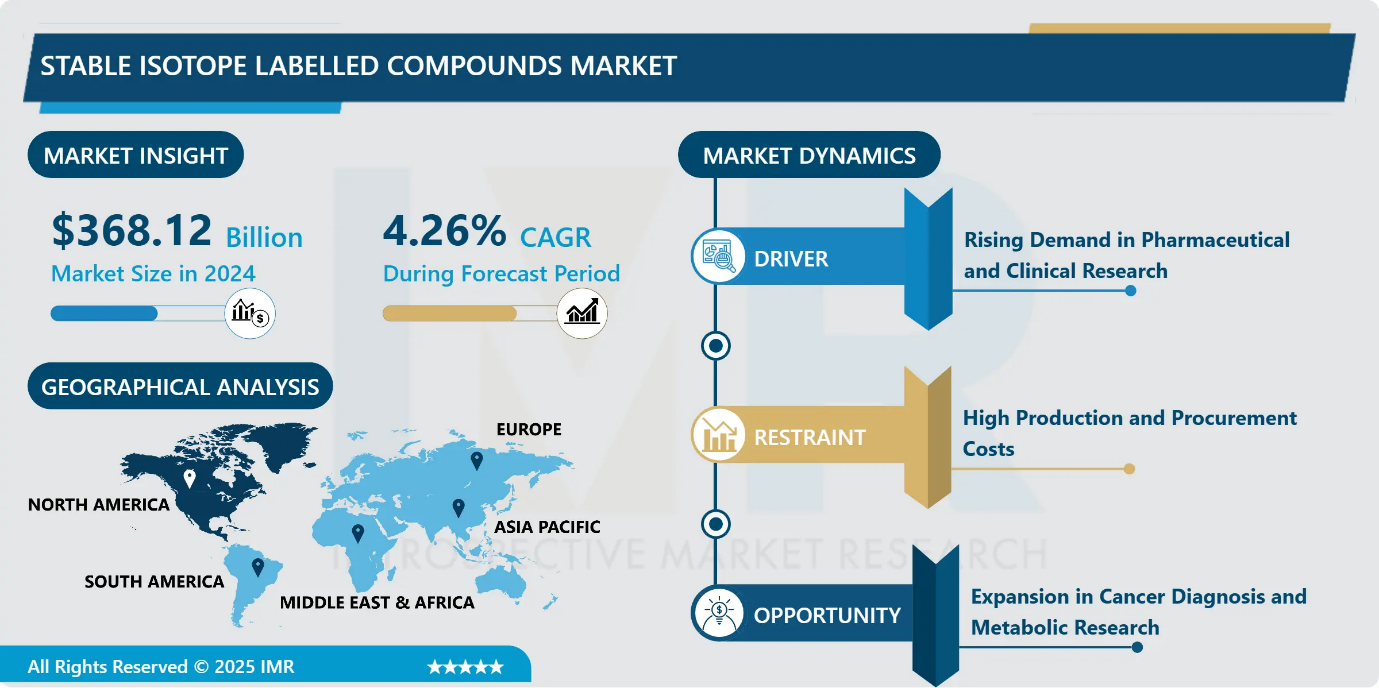

The Stable Isotope Labelled Compounds Market was valued at USD 368.12 billion in 2024 and is projected to reach USD 582.48 billion by 2035, growing at a CAGR of 4.26% from 2025 to 2035.

The compounds are isotopically enriched chemical substances in which one or more elements are replaced with their non-radioactive isotopic form, such as Carbon-13, Nitrogen-15, or Deuterium. They are widely used in pharmacokinetics, metabolic research, clinical trials, and drug development processes to trace and analyse molecular pathways.

The rising burden of chronic diseases and cancer has led to an increase in research and development activities in biotechnology and pharmaceutical industries, thereby boosting the demand for these compounds. Additionally, stable isotope compounds are vital in understanding chemical reactions and testing drug efficacy and safety.

Governments and healthcare institutions across the globe are investing in clinical studies, which further supports market growth. As laboratory techniques and mass spectrometry technologies advance, the use of stable isotope compounds is expected to become more cost-effective and widespread in academic and industrial research.

Stable Isotope Labelled Compounds Market Growth and Trend Analysis:

Stable Isotope Labelled Compounds Market Growth Driver - Rising Demand in Pharmaceutical and Clinical Research

-

The key driver for this market is the rising demand for stable isotope labelled compounds in pharmaceutical R&D and clinical testing. These compounds are highly valuable for tracing metabolic pathways, studying drug metabolism, and identifying biomarkers in biological systems. Pharmaceutical companies use them to ensure regulatory compliance and gather detailed data during clinical trials.

- With the increasing number of drug approvals and personalized treatment approaches, the need for accurate and sensitive tracing techniques has grown, directly increasing the use of stable isotopes. The compounds are also essential in bioavailability and bioequivalence studies, which are mandatory for generic drug development. As the global pharmaceutical sector continues to grow, especially in emerging economies, the use of stable isotopes in research is expected to rise. Furthermore, academic and research institutes are expanding their research budgets, which will add momentum to the market.

Stable Isotope Labelled Compounds Market Limiting Factor - High Production and Procurement Costs

-

Despite their scientific importance, stable isotope labelled compounds remain expensive to produce and procure. The cost of isotope separation and enrichment, along with sophisticated infrastructure and equipment requirements, contributes to the high price of these compounds. Small and mid-sized laboratories, particularly in developing countries, often struggle to afford these materials, limiting their application in academic research.

- Moreover, the procurement process is complex due to regulatory compliance and handling requirements, which can delay research timelines. The high costs restrict market access for smaller players and reduce adoption among cost-conscious organizations, acting as a major market restraint.

Stable Isotope Labelled Compounds Market Expansion Opportunity - Expansion in Cancer Diagnosis and Metabolic Research

-

Growing opportunity in the use of stable isotope labelled compounds for cancer research and metabolic disease diagnosis. The compounds help track metabolic changes in cells, which is vital for identifying cancer biomarkers and treatment responses. With the global cancer burden rising, many healthcare institutions and pharmaceutical companies are increasing investments in oncology research. Stable isotopes are also being applied in non-invasive diagnostics, nutritional studies, and the development of targeted therapies.

- Additionally, governments and private institutions are funding academic studies that rely on isotopic tracing, opening doors for new research partnerships. As research becomes more advanced, the need for highly enriched and specific isotopes is expected to increase significantly.

Stable Isotope Labelled Compounds Market Challenge and Risk - Complex Regulatory Compliance and Supply Limitations

-

The stable isotope labelled compound market is the strict regulatory framework and technical complexity associated with the production, transportation, and usage of these compounds. Even though they are non-radioactive, these substances are often used in clinical studies and pharmaceutical research, which are highly regulated sectors. Suppliers must adhere to GMP (Good Manufacturing Practice) standards, ISO certifications, and safety documentation, particularly when compounds are used in human trials.

- The requirements increase production costs and limit participation to only well-established manufacturers. In addition, the production of stable isotopes often relies on complex separation technologies and limited global facilities, which restrict supply and cause delays. Any disruption in the supply chain, such as export bans or political instability in supplier countries, can impact availability. The niche nature of this market also means that few companies are equipped to meet custom requirements. The regulatory and logistical hurdles can slow innovation and discourage smaller players from entering the market.

Stable Isotope Labelled Compounds Market Segment Analysis:

Stable Isotope Labelled Compounds Market is segmented based on Type, Application, Distribution Channel, End-Users, and Region

By Type, Stable Isotope Labelled Compounds Segment is Expected to Dominate the Market During the Forecast Period

-

Deuterium is one of the most widely used stable isotopes due to its availability and application in both pharmaceutical and academic research. It is commonly used in bioavailability, pharmacokinetics, and drug metabolism studies, especially for new drug formulations and generic equivalents. Deuterated compounds are favoured because they are non-toxic, chemically stable, and easily traceable in mass spectrometry and NMR analysis.

- Pharmaceutical companies prefer deuterium-labelled drugs because they provide clear metabolic pathways, supporting accurate testing and faster regulatory approvals. With rising investments in chronic disease research and the emergence of personalized medicine, the use of deuterium is expected to increase further. Academic and government research institutes are also expanding their use of deuterated chemicals in molecular and nutritional studies.

By End-User, Stable Isotope Labelled Compounds Segment Held the Largest Share in 2024

-

Pharmaceutical companies form the biggest consumer base for stable isotope labelled compounds due to their extensive use in drug development and clinical trials. These compounds are essential in proving drug safety, absorption, and efficacy, especially during early-stage research and FDA submission. The increasing number of new drug applications (NDAs) and biosimilar development programs globally has led to steady demand for labelled compounds.

- Deuterium, carbon-13, and nitrogen-15 isotopes are used for both small molecule drugs and biologics testing, helping companies meet regulatory requirements. Large pharma players also invest in custom-labelled compounds to match specific research protocols, further boosting this segment’s growth. Growth in outsourcing of R&D and increasing collaborations with CROs and academic labs further strengthen this segment’s market hold.

Stable Isotope Labelled Compounds Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

-

North America, especially the United States, holds a major share due to its strong pharmaceutical R&D ecosystem and presence of major stable isotope manufacturers like Cambridge Isotope Laboratories and Cerillion Corporation. Academic institutions and biotech firms in the region are major users of labelled compounds for advanced metabolic, cancer, and drug tracing research.

- Government funding, especially from agencies like the NIH and FDA, supports ongoing demand from public health and regulatory research programs. Additionally, the region has a mature regulatory system that ensures high-quality standards, making it attractive for pharmaceutical testing. The growing demand for precision medicine and clinical diagnostics has also accelerated the use of labelled compounds in local healthcare research.

Active Key Players in Stable Isotope Labelled Compounds Market:

- Abell International Pte Ltd (Singapore)

- Amazon Hub Lockers (USA)

- Apex Supply Chain Technologies (USA)

- Bell and Howell (USA)

- Cleveron (Estonia)

- Click and Collect (Australia)

- Dynatronics Smart Lockers (USA)

- Hangzhou Dongcheng Electronics (China)

- HIVEBOX (China)

- InPost (Poland)

- KEBA AG (Austria)

- Locker & Lock (Singapore)

- LockTec GmbH (Germany)

- Luxer One (USA)

- My Parcel Locker (Australia)

- Packcity Lockers by Neopost/Quadient (France)

- Parcel Hive (Spain)

- Parcel Pending (USA)

- Penguin Lockers (Italy)

- Pitney Bowes (USA)

- Quadient (France)

- RUIY Tech (Taiwan)

- Shanghai Yishan Industrial (China)

- Shenzhen Zhilai Sci and Tech (China)

- Signifi Solutions (Canada)

- Smartbox Lockers (India)

- Smiota (USA)

- StrongPoint (Norway)

- TZ Limited (Australia)

- Vlocker (Australia)

- Others Active Players

Key Industry Development of Stable Isotope Labelled Compounds Market:

- In March 2024, CIL announced the relocation and expansion of its corporate headquarters to Tewksbury, Massachusetts. This move aims to enhance operational capabilities and support the company’s growth in stable isotope chemistry.

- In January 2024, Merck KGaA entered into a five-year agreement with India’s Heavy Water Board (HWB) to locally manufacture deuterated compounds. This strategic partnership aligns with Merck’s expansion plans in India, focusing on the production of stable isotope-labelled compounds.

- In February 2023, PerkinElmer introduced the En Vision Nexus system, a high-throughput screening (HTS) platform designed to accelerate drug discovery processes. While not exclusively focused on stable isotope-labelled compounds, this system enhances the company’s capabilities in pharmaceutical research.

|

Stable Isotope Labelled Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 368.12 billion |

|

Forecast Period 2025-35 CAGR: |

4.26% |

Market Size in 2035: |

USD 582.48 billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Stable Isotable Labeled Market by Product (2018-2035)

4.1 Stable Isotable Labeled Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Deuterium

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Carbon

4.5 Nitrogen

4.6 Oxygen

Chapter 5: Stable Isotable Labeled Market by Application (2018-2035)

5.1 Stable Isotable Labeled Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Pharmaceuticals Research

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Clinical Diagnostic

5.5 Environment Testing

Chapter 6: Stable Isotable Labeled Market by Distribution Channel (2018-2035)

6.1 Stable Isotable Labeled Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online Portals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Manufacturers

6.5 Authorised Distributors

6.6 Others

Chapter 7: Stable Isotable Labeled Market by End User (2018-2035)

7.1 Stable Isotable Labeled Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pharmaceutical Company

7.5 Research Institute

7.6 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Stable Isotable Labeled Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 AMAZON HUB LOCKERS (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 APEX SUPPLY CHAIN TECHNOLOGIES (USA)

8.4 BELL AND HOWELL (USA)

8.5 CLEVERON (ESTONIA)

8.6 CLICK AND COLLECT (AUSTRALIA)

8.7 DYNATRONICS SMART LOCKERS (USA)

8.8 HANGZHOU DONGCHENG ELECTRONICS (CHINA)

8.9 HIVEBOX (CHINA)

8.10 INPOST (POLAND)

8.11 KEBA AG (AUSTRIA)

8.12 LOCKER & LOCK (SINGAPORE)

8.13 LOCKTEC GMBH (GERMANY)

8.14 LUXER ONE (USA)

8.15 MY PARCEL LOCKER (AUSTRALIA)

8.16 PACKCITY LOCKERS BY NEOPOST/QUADIENT (FRANCE)

8.17 PARCEL HIVE (SPAIN)

8.18 PARCEL PENDING (USA)

8.19 PENGUIN LOCKERS (ITALY)

8.20 PITNEY BOWES (USA)

8.21 QUADIENT (FRANCE)

8.22 RUIY TECH (TAIWAN)

8.23 SHANGHAI YISHAN INDUSTRIAL (CHINA)

8.24 SHENZHEN ZHILAI SCI AND TECH (CHINA)

8.25 SIGNIFI SOLUTIONS (CANADA)

8.26 SMARTBOX LOCKERS (INDIA)

8.27 SMIOTA (USA)

8.28 STRONGPOINT (NORWAY)

8.29 TZ LIMITED (AUSTRALIA)

8.30 VLOCKER (AUSTRALIA)

8.31 OTHERS ACTIVE PLAYERS

Chapter 9: Global Stable Isotable Labeled Market By Region

9.1 Overview

9.2. North America Stable Isotable Labeled Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Stable Isotable Labeled Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Stable Isotable Labeled Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Stable Isotable Labeled Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Stable Isotable Labeled Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Stable Isotable Labeled Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 12 Analyst Viewpoint and Conclusion

Chapter 13 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 14 Case Study

Chapter 15 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

Stable Isotope Labelled Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 368.12 billion |

|

Forecast Period 2025-35 CAGR: |

4.26% |

Market Size in 2035: |

USD 582.48 billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||