SSD Controller Market Synopsis

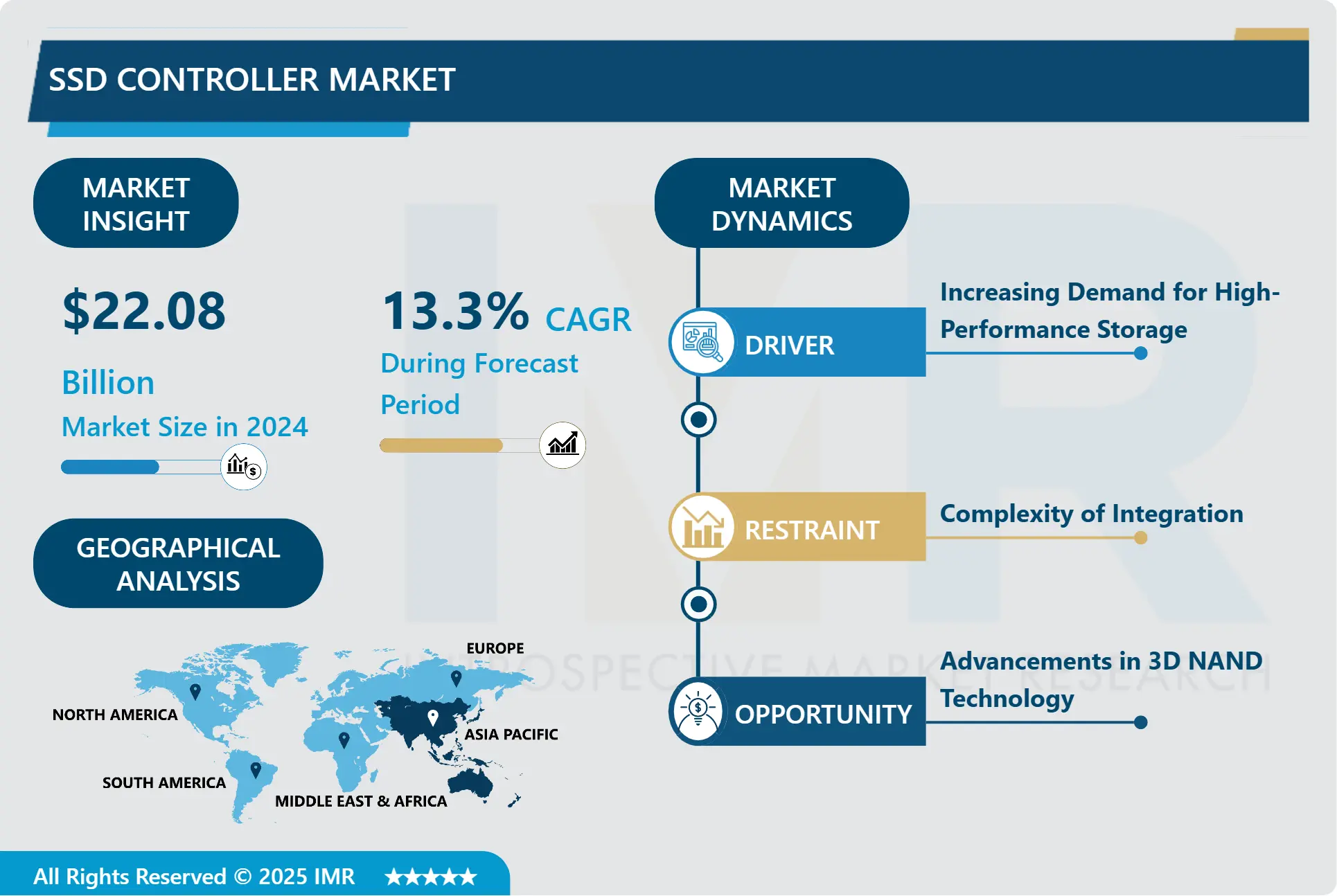

The global SSD Controller Market was valued at USD 22.08 billion in 2024 and is likely to reach USD 59.96 billion by 2032, increasing at a CAGR of 13.3% from 2025 to 2032.

SSD (SSD) is a Solid-State Storage device. This ensures continuous data storage with no moving parts. It is sometimes called a solid-state memory device or a solid-state device; it is also called a solid-state drive because it is often connected to the host system in the same way as a hard drive.

The market for SSD (Solid State Drive) Controllers includes all of the integrated circuits that control how data is stored in solid-state drives. These controllers coordinate operations including data reading, writing, error correction, and wear-leveling algorithms. They act as the central processing unit for SSDs. They are essential in improving SSD endurance, performance, and dependability, which in turn influences the efficacy and efficiency of storage solutions in a range of applications.

The creation, production, and marketing of controller chips specifically designed to satisfy the changing needs of contemporary storage systems are the main activities driving the SSD Controllers Market. In order to meet the range of consumer, business, and industrial storage requirements, this requires accommodating several storage interfaces, such as SATA (Serial Advanced Technology Attachment), NVMe (Non-Volatile Memory Express), and PCIe (Peripheral Component Interconnect Express).

The constant search for reduced power consumption, higher storage capacity, and quicker data transfer rates are major factors driving the growth of the SSD Controllers market. Producers never stop coming up with new ways to use cutting-edge semiconductor technology, such NAND flash memory, and to optimize controller designs to give more reliability and performance at a lower cost. The market for SSD (Solid State Drive) Controllers includes all of the integrated circuits that control how data is stored in solid-state drives. These controllers coordinate operations including data reading, writing, error correction, and wear-leveling algorithms. They act as the central processing unit for SSDs. They are essential in improving SSD endurance, performance, and dependability, which in turn influences the efficacy and efficiency of storage solutions in a range of applications.

SSD Controller Market Trend Analysis

SSD Controller Market Growth Driver- Increasing Demand for High-Performance Storage

- The demand for high-performance storage solutions is accelerating as a result of the massive data era from cutting-edge advances and applications such as artificial intelligence (AI), huge data analytics, and the Web of Things (IoT). AI and machine learning calculations require vast sums of data to train models and perform real-time induction, necessitating storage systems that can handle quick read/write operations and large data sets effectively. Additionally, huge information analytics forms colossal volumes of information to extricate noteworthy bits of knowledge, requiring storage arrangements with tall throughput and moo inactivity.

- IoT devices continuously produce and transmit information, which has to be processed and put away quickly to empower real-time decision-making and analytics. Traditional capacity solutions battle to meet these high-performance necessities, driving to a growing request for progressed SSD controllers that can optimize data flow, enhance speed, and guarantee unwavering quality. These controllers are significant for maintaining the execution and productivity of SSDs, empowering them to support the intensive capacity needs of modern applications and driving their broad selection over various industries.

SSD Controller Market Opportunities- Advancements in 3D NAND Technology

- Advancements in 3D NAND technology have significantly changed the scene of solid-state storage. Unlike traditional planar NAND, which organizes memory cells in a two-dimensional cluster, 3D NAND stacks memory cells vertically in numerous layers, thereby exponentially expanding capacity thickness without extending the physical impression of the chip. This architectural innovation permits for more information to be stored within the same or even littler form factors, making SSDs more compact and proficient. Besides, the expanded capacity thickness deciphers into a lower taken a toll per gigabyte, making high-capacity SSDs more reasonable and accessible to a broader run of buyers and enterprises. These progressions in 3D NAND innovation too upgrade the performance and endurance of SSDs, as the vertical stacking diminishes the separate for electron travel, leading to faster read/write operations and improved reliability.

- Thus, the request for modern SSD controllers that can viably oversee the complexities of 3D NAND is on the rise. These controllers must handle tasks such as error correction, wear levelling, and productive information management, ensuring ideal execution and life span of the SSDs. In this way, the improvement of 3D NAND innovation not as it were drives down costs but too opens up unused opportunities for the creation of more progressed and cost-effective SSD controllers, impelling the by and large growth of the SSD market.

Market Segment Analysis:

Market Segmented based on Type, by Storage Interface, by Application, and region.

By Storage Interface, PCle Is Expected to Dominate the Market During the Forecast Period 2025-2032

By Storage Interface segmented as SATA, SAS, PCIe

- The dominance of PCIe (Peripheral Component Interconnect Express) and NVMe (Non-Volatile Memory Express) over PCIe within the SSD advertise is largely driven by their prevalent performance capabilities, lower idleness, and adaptability compared to older interfacing like SATA and SAS. PCIe gives a high-speed interface that directly interfaces capacity gadgets to the CPU, bypassing traditional bottlenecks and conveying significantly faster data exchange rates. NVMe, a convention designed specifically for streak memory, advance optimizes this association by reducing overhead and making strides command efficiencies, driving to lower inactivity and higher throughput. This combination has gotten to be particularly pivotal in today's environment where the request for fast information handling and large-scale capacity arrangements is ever-increasing.

- In shopper markets, PCIe/NVMe SSDs are presently standard in high-performance PCs, gaming systems, and tablets, offering faster boot times, quicker application dispatches, and moved forward by and large framework responsiveness. In venture situations, the require for productive information centers, cloud computing, and huge data analytics has quickened the selection of PCIe/NVMe SSDs, empowering businesses to handle seriously workloads and expansive datasets more successfully. As a result, the move to PCIe/NVMe has been quick and broad, setting a unused standard for capacity performance over different divisions.

By Application, Data Center held the largest share

By Application segmented as Data Center, Enterprise, Client, Retail

- Data centers dominate the SSD controller market basically due to their massive capacity requirements and the ought to handle the dangerous development of data created by cloud computing, enormous information analytics, AI, and IoT applications. These situations demand endless amounts of high-capacity storage solutions, and SSDs, driven by progressed controllers, are essential to meet these needs effectively. Performance may be a basic priority in data centers, which require quick read/write speeds, low latency, and high IOPS (Input/Output Operations Per Second). SSD controllers are indispensable in delivering these execution measurements, ensuring smooth and quick data get too essential for data center operations.

- Data centers require storage solutions with high reliability and endurance to ensure uninterrupted service and data integrity. Advanced SSD controllers offer features such as blunder rectification, wear levelling, and over-provisioning, which are crucial for maintaining the life span and reliability of SSDs in these data-intensive environments. In addition, energy efficiency is a crucial consideration due to the high costs associated with control utilization and cooling in information centers. SSDs, overseen by efficient controllers, consume essentially less control compared to traditional HDDs, making them more alluring for information center applications. This combination of high capacity, superior execution, reliability, and energy efficiency solidifies the dominance of the data center segment in the SSD controller market.

Market Regional Insights:

Asia Pacific Region is Expected to Dominate the Market Over the Forecast Period

- The Asia-Pacific region stands at the forefront of the SSD controller showcase, largely due to a joining of key factors. Home to major players like Samsung Electronics, SK Hynix, and Toshiba (Kioxia), the region boasts a wealthy pool of driving SSD producers and semiconductor giants continually pushing the boundaries of advancement in SSD controllers and NAND flash memory. This ability is assist bolstered by a strong fabricating base over nations such as China, South Korea, Taiwan, and Japan, enabling large-scale production of SSDs and their components. Substantial speculations in research and development underscore the region's commitment to technological progression, driving continuous changes in SSD execution, capacity, and cost-effectiveness. Besides, the Asia-Pacific's thriving consumer electronics market, characterized by a surging demand for laptops, smartphones, and digital devices, acts as a catalyst for the appropriation of productive and high-performance capacity solutions, in this manner impelling the SSD controller advertise forward.

- Supportive government approaches and initiatives in key nations like China and South Korea, including subsidies, tax incentives, and key partnerships, assist nurture the growth of the semiconductor industry, fostering an environment conducive to development and worldwide competitiveness. This supportive ecosystem, coupled with collaborative endeavors among suppliers, manufacturers, and research institutions, quickens the development and deployment of cutting-edge SSD advances, setting the Asia-Pacific region's dominance within the SSD controller market for the predictable future.

Market Top Key Players:

The top key companies in the SSD Controller Market are:

- Samsung Electronics (South Korea)

- Intel Corporation (Usa)

- Western Digital Corporation (Usa)

- Micron Technology, Inc. (Usa)

- Sk Hynix Inc. (South Korea)

- Toshiba Memory Corporation (Kioxia) (Japan)

- Marvell Technology Group Ltd. (Usa)

- Phison Electronics Corporation (Taiwan)

- Silicon Motion Technology Corporation (Taiwan)

- Adata Technology Co., Ltd. (Taiwan)

- Seagate Technology (Ireland/Usa)

- Kingston Technology Corporation (Usa)

- Sandisk Llc (A Western Digital Company) (Usa)

- Transcend Information, Inc. (Taiwan)

- Pny Technologies, Inc. (Usa)

- Lsi Corporation (Part Of Broadcom Inc.) (Usa)

- Jmicron Technology Corporation (Taiwan)

- Maxiotek Corporation (Taiwan)

- Greenliant Systems (Usa)

- Via Labs, Inc. (Taiwan)

- Solidigm (A Sk Hynix Company) (Usa/South Korea)

- Apacer Technology Inc. (Taiwan)

- Realtek Semiconductor Corp. (Taiwan)

- Innodisk Corporation (Taiwan)

- Microsemi Corporation (A Microchip Technology Company) (Usa)

- Teclast Electronics Co., Ltd. (China)

- Zadak (A Brand Of Apacer Technology Inc.) (Taiwan)

- Union Memory (Shenzhen Longsys Electronics Co., Ltd.) (China)

- Biwin Storage Technology Co., Ltd. (China)

- Unigen Corporation (Usa) and Other Active Players.

Key Industry Developments in the Market:

- In June 2024, Silicon Motion have revealed a new SSD controller that is more powerful and efficient than their competitors’ offerings. In Q4 2024, Silicon Motion will be launching their SM2508 SSD controller, a low power PCIe 5.0 SSD controller that uses TSMC’s 6nm lithography technology. With peak power consumption of 3.5W, Silicon Motion’s new PCIe 5.0 SSD controller is much cooler running than other high-end PCIe 5.0 controllers. That means that new drives using Silicon Motion’s new SSD controller are unlikely to need advanced cooling solutions.

- In Feb 2024, Samsung recently expanded its lineup of solid-state drives with the launch of its latest 990 EVO SSD. With better energy efficiency, the SSD 990 EVO claims to deliver powerful performance which is designed to enhance everyday computing experiences like gaming, work and video/photo editing. The SSD is equipped with a sequential read/write speed of up to 5,000 MB/s and up to 4,200 MB/s.

|

Global SSD Controller Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018-2023 |

Market Size In 2024: |

USD 22.08 Bn |

|

Forecast Period 2025-32 CAGR: |

13.3% |

Market Size In 2032: |

USD 59.96 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Storage Interface |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in The Report: |

Samsung Electronics (South Korea),Intel Corporation (USA),Western Digital Corporation (USA),Micron Technology, Inc. (USA),SK Hynix Inc. (South Korea),Toshiba Memory Corporation (Kioxia) (Japan),Marvell Technology Group Ltd. (USA) and Other Active Players |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: SSD Controller Market by Type (2018-2032)

4.1 SSD Controller Market Snapshot and Growth Engine

4.2 Market Overview

4.3 SLL (Single Level Cell)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 MLL (Multi Level Cell)

4.5 TLL (Triple Level Cell)

Chapter 5: SSD Controller Market by Storage Interface (2018-2032)

5.1 SSD Controller Market Snapshot and Growth Engine

5.2 Market Overview

5.3 SATA

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 SAS

5.5 PCIe

Chapter 6: SSD Controller Market by Application (2018-2032)

6.1 SSD Controller Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Data Center

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Enterprise

6.5 Client

6.6 Retail

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 SSD Controller Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SAMSUNG ELECTRONICS (SOUTH KOREA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 INTEL CORPORATION (USA)

7.4 WESTERN DIGITAL CORPORATION (USA)

7.5 MICRON TECHNOLOGY INC. (USA)

7.6 SK HYNIX INC. (SOUTH KOREA)

7.7 TOSHIBA MEMORY CORPORATION (KIOXIA) (JAPAN)

7.8 MARVELL TECHNOLOGY GROUP LTD. (USA)

7.9 PHISON ELECTRONICS CORPORATION (TAIWAN)

7.10 SILICON MOTION TECHNOLOGY CORPORATION (TAIWAN)

7.11 ADATA TECHNOLOGY COLTD. (TAIWAN)

7.12 SEAGATE TECHNOLOGY (IRELAND/USA)

7.13 KINGSTON TECHNOLOGY CORPORATION (USA)

7.14 SANDISK LLC (A WESTERN DIGITAL COMPANY) (USA)

7.15 TRANSCEND INFORMATION INC. (TAIWAN)

7.16 PNY TECHNOLOGIES INC. (USA)

7.17 LSI CORPORATION (PART OF BROADCOM INC.) (USA)

7.18 JMICRON TECHNOLOGY CORPORATION (TAIWAN)

7.19 MAXIOTEK CORPORATION (TAIWAN)

7.20 GREENLIANT SYSTEMS (USA)

7.21 VIA LABS INC. (TAIWAN)

7.22 SOLIDIGM (A SK HYNIX COMPANY) (USA/SOUTH KOREA)

7.23 APACER TECHNOLOGY INC. (TAIWAN)

7.24 REALTEK SEMICONDUCTOR CORP. (TAIWAN)

7.25 INNODISK CORPORATION (TAIWAN)

7.26 MICROSEMI CORPORATION (A MICROCHIP TECHNOLOGY COMPANY) (USA)

7.27 TECLAST ELECTRONICS COLTD. (CHINA)

7.28 ZADAK (A BRAND OF APACER TECHNOLOGY INC.) (TAIWAN)

7.29 UNION MEMORY (SHENZHEN LONGSYS ELECTRONICS COLTD.) (CHINA)

7.30 BIWIN STORAGE TECHNOLOGY COLTD. (CHINA)

7.31 UNIGEN CORPORATION (USA)

Chapter 8: Global SSD Controller Market By Region

8.1 Overview

8.2. North America SSD Controller Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 SLL (Single Level Cell)

8.2.4.2 MLL (Multi Level Cell)

8.2.4.3 TLL (Triple Level Cell)

8.2.5 Historic and Forecasted Market Size by Storage Interface

8.2.5.1 SATA

8.2.5.2 SAS

8.2.5.3 PCIe

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Data Center

8.2.6.2 Enterprise

8.2.6.3 Client

8.2.6.4 Retail

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe SSD Controller Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 SLL (Single Level Cell)

8.3.4.2 MLL (Multi Level Cell)

8.3.4.3 TLL (Triple Level Cell)

8.3.5 Historic and Forecasted Market Size by Storage Interface

8.3.5.1 SATA

8.3.5.2 SAS

8.3.5.3 PCIe

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Data Center

8.3.6.2 Enterprise

8.3.6.3 Client

8.3.6.4 Retail

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe SSD Controller Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 SLL (Single Level Cell)

8.4.4.2 MLL (Multi Level Cell)

8.4.4.3 TLL (Triple Level Cell)

8.4.5 Historic and Forecasted Market Size by Storage Interface

8.4.5.1 SATA

8.4.5.2 SAS

8.4.5.3 PCIe

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Data Center

8.4.6.2 Enterprise

8.4.6.3 Client

8.4.6.4 Retail

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific SSD Controller Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 SLL (Single Level Cell)

8.5.4.2 MLL (Multi Level Cell)

8.5.4.3 TLL (Triple Level Cell)

8.5.5 Historic and Forecasted Market Size by Storage Interface

8.5.5.1 SATA

8.5.5.2 SAS

8.5.5.3 PCIe

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Data Center

8.5.6.2 Enterprise

8.5.6.3 Client

8.5.6.4 Retail

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa SSD Controller Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 SLL (Single Level Cell)

8.6.4.2 MLL (Multi Level Cell)

8.6.4.3 TLL (Triple Level Cell)

8.6.5 Historic and Forecasted Market Size by Storage Interface

8.6.5.1 SATA

8.6.5.2 SAS

8.6.5.3 PCIe

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Data Center

8.6.6.2 Enterprise

8.6.6.3 Client

8.6.6.4 Retail

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America SSD Controller Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 SLL (Single Level Cell)

8.7.4.2 MLL (Multi Level Cell)

8.7.4.3 TLL (Triple Level Cell)

8.7.5 Historic and Forecasted Market Size by Storage Interface

8.7.5.1 SATA

8.7.5.2 SAS

8.7.5.3 PCIe

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Data Center

8.7.6.2 Enterprise

8.7.6.3 Client

8.7.6.4 Retail

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global SSD Controller Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018-2023 |

Market Size In 2024: |

USD 22.08 Bn |

|

Forecast Period 2025-32 CAGR: |

13.3% |

Market Size In 2032: |

USD 59.96 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Storage Interface |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in The Report: |

Samsung Electronics (South Korea),Intel Corporation (USA),Western Digital Corporation (USA),Micron Technology, Inc. (USA),SK Hynix Inc. (South Korea),Toshiba Memory Corporation (Kioxia) (Japan),Marvell Technology Group Ltd. (USA) and Other Active Players |

||