Smart Thermostat Market Synopsis

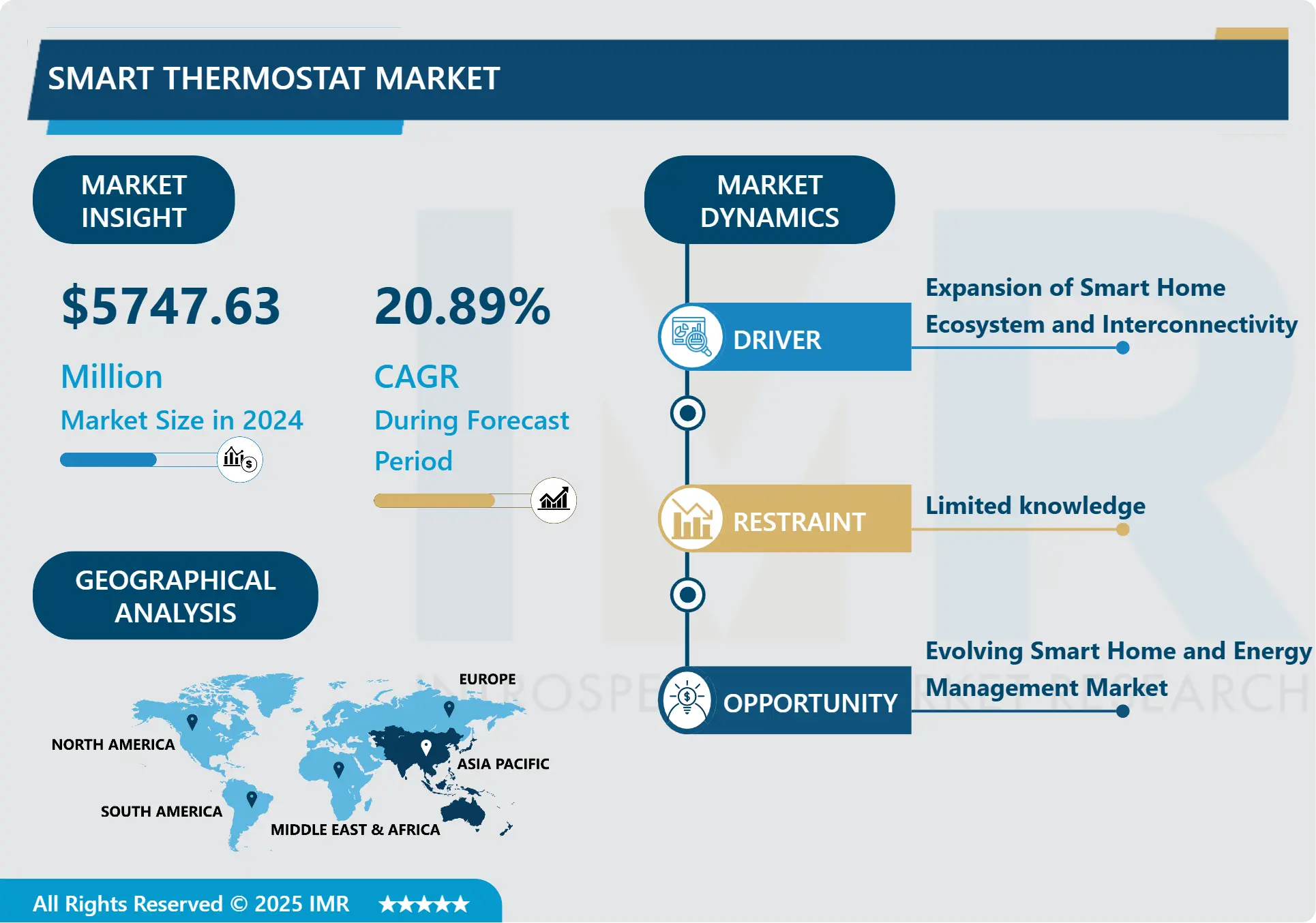

Smart Thermostat Market Size Was Valued at USD 5747.63 Million in 2024, and is Projected to Reach USD 26218.74 Million by 2032, Growing at a CAGR of 20.89% From 2025-2032.

Smart thermostats are Wi-Fi thermostats that can be used with home automation and are responsible for controlling a home's heating, ventilation, and air conditioning. They perform similar functions as a Programmable thermostat as they allow the user to control the temperature of their home throughout the day using a schedule, but also contain additional features, such as sensors and Wi-Fi connectivity, that improve upon the issues with programming.

Smart thermostats also record internal/external temperatures, the time the HVAC system has been running and can notify the user if the system's air filter needs to be replaced. This information is typically displayed later on an internet-connected device such as a smartphone. The smart thermostat uses occupancy sensors to save energy by automatically turning off the HVAC when occupants are sleeping or away. The system uses cheap, simple motion and door sensors installed throughout the home.

Based on these sensors, the system employs three energy saving techniques. First, the fast reaction algorithm uses a probabilistic model to process the sensor data and quickly estimate whether occupants are active, sleeping, or away. This algorithm can typically respond within minutes of the occupants leaving the house, without introducing false vacancy detections. Second, the system combines historical occupancy patterns with on-line sensor data to decide whether to preheat the home or to heat after the occupants arrive.

Finally, the system saves additional energy by allowing the temperature to drift further from the setpoint temperature when it is confident that the home is unoccupied. These three techniques allow the system to automatically save energy without sacrificing occupant comfort. AI-driven smart thermostats use weather predictions and occupancy trends to make proactive changes for customized temperature preferences and energy-saving tips. Setting up smart thermostats can raise the value of a house, since prospective buyers are drawn to contemporary, energy-saving technologies.

Smart Thermostat Market Trend Analysis

Smart Thermostat Market Growth Driver- Expansion of Smart home Ecosystem and Interconnectivity

-

Smart thermostats play a crucial role in the smart home network, interacting with components such as lighting, security systems, speakers, and automation centers. They provide streamlined home management by offering unified control through smart home hubs or voice assistants. Furthermore, they improve automation by modifying temperature according to variables such as time, presence, and weather prediction, leading to a more effective and pleasant atmosphere. IoT is boosting growth in the smart thermostat industry by enhancing device connectivity.

- Smart thermostats improve energy efficiency by using adaptive learning and providing energy reports, resulting in substantial cost savings. Machine learning is utilized to modify settings for comfort and efficiency, as well as offer analysis on energy usage to discover ways to save. Thermostats communicate with other gadgets, enhance energy savings, sense presence, and manage temperature. Consumers have the ability to conveniently monitor and modify settings using their smartphones for increased efficiency and energy conservation.

- Enhancements in smart thermostat technology now feature upgraded sensors, wireless connections, and user-friendly interfaces to improve accuracy, reliability, and accessibility for a wider range of users. Government rules and rewards promoting energy efficiency, like Energy Star approval and financial incentives, are leading to an increase in the smart thermostat industry. This aids in decreasing energy use and carbon footprints while attracting eco-friendly customers. Competition among market players encourages innovation in smart thermostat products, resulting in a variety of choices for consumers. More competition leads to lower prices, making smart thermostats more attainable for a broader range of customers.

- From this graph, it is shown that the constant revenue growth from $66.9 billion in 2019 to $134.8 billion in 2023 shows growing consumer adoption of smart home technologies, including smart thermostats. This segment benefits from the broader market expansion due to its energy efficiency and convenience. As the smart home system market more than doubled in size over five years, the smart thermostat market likely experienced similar growth, highlighting its rising importance and potential for continued innovation.

Smart Thermostat Market Opportunity- Technological Advancements and Enhanced Features

- Advanced smart thermostats with occupancy sensors are able to identify when individuals are present at home in order to maximize energy efficiency. Humidity sensors keep track of indoor humidity levels to ensure air quality is optimal for health. Smart thermostats utilize adaptive learning to modify settings according to user habits in order to enhance comfort and save energy. Additionally, they provide predictive maintenance services through the analysis of data from HVAC systems in order to avoid malfunctions and prolong the lifespan of the system.

- Smart thermostats use Wi-Fi, Bluetooth, Zigbee, and Z-Wave to enhance connectivity with other smart home devices. They smoothly blend in with Google Home, Amazon Alexa, and Apple HomeKit. Users can further link them to external applications such as energy monitoring systems and home protection services. This improved compatibility improves automated systems and builds a smarter home network that is more connected and reactive. Engaging in demand response programs involves making adjustments during periods of high demand, which supports grid reliability and leads to earning rewards.

- Smart thermostats nowadays come equipped with touchscreens that are easy to use and interactive functions, such as energy usage reports. Users can adjust their thermostat settings from afar using mobile applications, providing customization features, scheduling capabilities, and alerts on system functionality. This improves user interfaces and interactions, making monitoring and control easier. Smart thermostats provide energy-saving functions such as in-depth energy reports and comparisons with other households to enhance consumption habits. They are able to connect with home renewable energy systems to enhance heating and cooling efficiency.

Smart Thermostat Market Segment Analysis:

Smart Thermostat Market Segmented on the basis of Technology, Product Type, Connectivity, End-User, Application, And Region.

By Connectivity Type, Wireless Segment Is Expected to Dominate the Market During the Forecast Period

- Installing wireless thermostats is simpler than installing wired ones and doesn't need professional help. They have the flexibility to be positioned in any area of the house, offering convenience and accommodating a diverse group of consumers. Smart thermostats use IoT technology to easily connect with other smart home devices, improving functionality and convenience. They work with popular smart home systems such as Amazon Alexa, Google Assistant, and Apple HomeKit, enabling users to manage them using voice prompts.

- Wireless smart thermostats use machine algorithms for adaptive learning to adjust settings based on user preferences and presence sensors to regulate temperature for comfort, enhancing energy efficiency. Mobile apps enable users to remotely manage smart thermostats, modifying settings, monitoring energy consumption, and receiving notifications from any location. Continuous monitoring of temperature data is particularly advantageous for individuals who travel often and those with unpredictable schedules.

- The rising interest in smart homes is fuelling the popularity of wireless smart thermostats that offer advanced features such as geofencing and multi-zone control. These thermostats are capable of receiving firmware updates wirelessly, guaranteeing they stay current with the newest features. Consumers opt for wireless options due to their convenience and adaptability, which is evident in market trends and sales data. Wireless smart thermostats cut down on energy costs by enhancing efficiency. Users have the ability to track energy consumption and access comprehensive reports to improve energy management and make informed choices to save money.

By End-User, Residential Segment Held the Largest Share In 2024

- Consumer interest in smart home technology, specifically smart thermostats, is increasing as awareness grows. People who own homes are becoming aware of the benefits of these devices in terms of saving both energy and money, causing an increase in demand in the housing market driven by those who are knowledgeable about technology. Smart thermostats help homeowners save money by maximizing HVAC efficiency and offering energy-saving advantages. Governments and utility providers provide incentives to promote the use of energy-efficient and sustainable practices. This assistance boosts expansion in the home smart thermostat industry.

- Smart thermostats are essential in smart homes as they connect with other devices such as lights, security systems, and home assistants. The presence of voice control and advanced automation features makes them attractive and easy to use for homeowners. Smart thermostats offer personalized comfort through adjusting temperatures based on user preferences that have been learned over time. Homeowners have the ability to set temperature controls automatically according to their daily habits to enhance comfort and save energy.

- There is a growing trend of increasing home renovations and upgrades, specifically to include modern smart home technologies such as HVAC systems and smart thermostats. The incorporation of these features into new residential constructions as standard is increasing their accessibility to homeowners. Smart thermostats are simple to set up and operate, with numerous models providing do-it-yourself installation options. The convenience and attractiveness of user-friendly features is increased by the option to remotely control home temperatures using mobile apps. Homes equipped with smart home features differentiate themselves in a crowded housing market, with smart thermostats being a worthwhile purchase for sellers.

Smart Thermostat Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The growth of cities and industries in China and India leads to the expansion of infrastructure, prompting a higher need for smart thermostats. Increased economic growth leads to greater disposable incomes, which in turn makes smart home devices such as thermostats more accessible to consumers. Asian Pacific governments are implementing energy conservation policies and offering incentives for energy-efficient appliances, encouraging the adoption of smart thermostats. Consumer awareness of the environmental consequences of energy usage is growing, resulting in a greater number of people utilizing smart thermostats.

- Technology giants and new businesses in the area are pushing for innovation in smart thermostat technology, resulting in the development of high-tech yet cost-effective products. Tech-savvy consumers in the Asia Pacific region are drawn to smart thermostats due to their integration with IoT and smart home ecosystems. Government backing in countries like China, Japan, and South Korea is stimulating the uptake of smart home technologies, like affordable smart thermostats, appreciations to subsidies and rebates.

- The increasing number of middle-class individuals in the Asia Pacific area, coupled with their increasing incomes, is fuelling the need for smart home technologies such as smart thermostats. Middle-class consumers desire to improve their lifestyles, and higher levels of disposable income enable them to spend more on these devices. The rapid uptake of smart home gadgets is driven by a tech-savvy demographic in Japan and South Korea, where widespread smartphone and internet usage facilitates convenient remote management and monitoring.

Smart Thermostat Market Active Players

- Daikin Industries, Ltd. (Japan)

- Samsung Electronics Co., Ltd. (South Korea)

- LG Electronics Inc. (South Korea)

- Hitachi, Ltd. (Japan)

- Panasonic Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Haier Smart Home Co., Ltd. (China)

- TCL Technology (China)

- Fujitsu General Limited (Japan)

- GREE Electric Appliances Inc. of Zhuhai (China)

- Honeywell (China) Co., Ltd. (China)

- Oakter (India)

- Sensibo (Israel)

- Nest Labs (Google) (USA)

- Ecobee, Inc. (Canada)

- Honeywell International Inc. (USA)

- Johnson Controls International plc (Ireland)

- Emerson Electric Co. (USA)

- Schneider Electric SE (France)

- Siemens AG (Germany)

- Lennox International Inc. (USA)

- Carrier Global Corporation (USA)

- Trane Technologies plc (Ireland)

- And Other Active Player

|

Global Smart Thermostat Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 5747.63 Mn. |

|

Forecast Period 2025-32 CAGR: |

20.89 % |

Market Size in 2032: |

USD 26218.74 Mn. |

|

Segments Covered: |

By Technology |

|

|

|

By Product Type |

|

||

|

By Connectivity |

|

||

|

By End-User |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Thermostat Market by Technology (2018-2032)

4.1 Smart Thermostat Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Wi-Fi

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Zigbee

4.5 Bluetooth

4.6 Z-Wave

4.7 Infrared

Chapter 5: Smart Thermostat Market by Product Type (2018-2032)

5.1 Smart Thermostat Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Standalone

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Connected

5.5 Learning

Chapter 6: Smart Thermostat Market by Connectivity (2018-2032)

6.1 Smart Thermostat Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Wireless

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Wired

Chapter 7: Smart Thermostat Market by End-User (2018-2032)

7.1 Smart Thermostat Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Residential

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

7.5 Industrial

Chapter 8: Smart Thermostat Market by Application (2018-2032)

8.1 Smart Thermostat Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Air Conditioning

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Heating

8.5 Ventilation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Smart Thermostat Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 DAIKIN INDUSTRIES LTD. (JAPAN)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 SAMSUNG ELECTRONICS COLTD. (SOUTH KOREA)

9.4 LG ELECTRONICS INC. (SOUTH KOREA)

9.5 HITACHI LTD. (JAPAN)

9.6 PANASONIC CORPORATION (JAPAN)

9.7 MITSUBISHI ELECTRIC CORPORATION (JAPAN)

9.8 HAIER SMART HOME COLTD. (CHINA)

9.9 TCL TECHNOLOGY (CHINA)

9.10 FUJITSU GENERAL LIMITED (JAPAN)

9.11 GREE ELECTRIC APPLIANCES INC. OF ZHUHAI (CHINA)

9.12 HONEYWELL (CHINA) COLTD. (CHINA)

9.13 OAKTER (INDIA)

9.14 SENSIBO (ISRAEL)

9.15 NEST LABS (GOOGLE) (USA)

9.16 ECOBEE INC. (CANADA)

9.17 HONEYWELL INTERNATIONAL INC. (USA)

9.18 JOHNSON CONTROLS INTERNATIONAL PLC (IRELAND)

9.19 EMERSON ELECTRIC CO. (USA)

9.20 SCHNEIDER ELECTRIC SE (FRANCE)

9.21 SIEMENS AG (GERMANY)

9.22 LENNOX INTERNATIONAL INC. (USA)

9.23 CARRIER GLOBAL CORPORATION (USA)

9.24 TRANE TECHNOLOGIES PLC (IRELAND)

9.25 RESIDEO TECHNOLOGIES INC. (USA)

9.26 LUX PRODUCTS CORPORATION (USA)

9.27 NETATMO (LEGRAND) (FRANCE)

9.28 TADO GMBH (GERMANY)

Chapter 10: Global Smart Thermostat Market By Region

10.1 Overview

10.2. North America Smart Thermostat Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Technology

10.2.4.1 Wi-Fi

10.2.4.2 Zigbee

10.2.4.3 Bluetooth

10.2.4.4 Z-Wave

10.2.4.5 Infrared

10.2.5 Historic and Forecasted Market Size by Product Type

10.2.5.1 Standalone

10.2.5.2 Connected

10.2.5.3 Learning

10.2.6 Historic and Forecasted Market Size by Connectivity

10.2.6.1 Wireless

10.2.6.2 Wired

10.2.7 Historic and Forecasted Market Size by End-User

10.2.7.1 Residential

10.2.7.2 Commercial

10.2.7.3 Industrial

10.2.8 Historic and Forecasted Market Size by Application

10.2.8.1 Air Conditioning

10.2.8.2 Heating

10.2.8.3 Ventilation

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Smart Thermostat Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Technology

10.3.4.1 Wi-Fi

10.3.4.2 Zigbee

10.3.4.3 Bluetooth

10.3.4.4 Z-Wave

10.3.4.5 Infrared

10.3.5 Historic and Forecasted Market Size by Product Type

10.3.5.1 Standalone

10.3.5.2 Connected

10.3.5.3 Learning

10.3.6 Historic and Forecasted Market Size by Connectivity

10.3.6.1 Wireless

10.3.6.2 Wired

10.3.7 Historic and Forecasted Market Size by End-User

10.3.7.1 Residential

10.3.7.2 Commercial

10.3.7.3 Industrial

10.3.8 Historic and Forecasted Market Size by Application

10.3.8.1 Air Conditioning

10.3.8.2 Heating

10.3.8.3 Ventilation

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Smart Thermostat Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Technology

10.4.4.1 Wi-Fi

10.4.4.2 Zigbee

10.4.4.3 Bluetooth

10.4.4.4 Z-Wave

10.4.4.5 Infrared

10.4.5 Historic and Forecasted Market Size by Product Type

10.4.5.1 Standalone

10.4.5.2 Connected

10.4.5.3 Learning

10.4.6 Historic and Forecasted Market Size by Connectivity

10.4.6.1 Wireless

10.4.6.2 Wired

10.4.7 Historic and Forecasted Market Size by End-User

10.4.7.1 Residential

10.4.7.2 Commercial

10.4.7.3 Industrial

10.4.8 Historic and Forecasted Market Size by Application

10.4.8.1 Air Conditioning

10.4.8.2 Heating

10.4.8.3 Ventilation

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Smart Thermostat Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Technology

10.5.4.1 Wi-Fi

10.5.4.2 Zigbee

10.5.4.3 Bluetooth

10.5.4.4 Z-Wave

10.5.4.5 Infrared

10.5.5 Historic and Forecasted Market Size by Product Type

10.5.5.1 Standalone

10.5.5.2 Connected

10.5.5.3 Learning

10.5.6 Historic and Forecasted Market Size by Connectivity

10.5.6.1 Wireless

10.5.6.2 Wired

10.5.7 Historic and Forecasted Market Size by End-User

10.5.7.1 Residential

10.5.7.2 Commercial

10.5.7.3 Industrial

10.5.8 Historic and Forecasted Market Size by Application

10.5.8.1 Air Conditioning

10.5.8.2 Heating

10.5.8.3 Ventilation

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Smart Thermostat Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Technology

10.6.4.1 Wi-Fi

10.6.4.2 Zigbee

10.6.4.3 Bluetooth

10.6.4.4 Z-Wave

10.6.4.5 Infrared

10.6.5 Historic and Forecasted Market Size by Product Type

10.6.5.1 Standalone

10.6.5.2 Connected

10.6.5.3 Learning

10.6.6 Historic and Forecasted Market Size by Connectivity

10.6.6.1 Wireless

10.6.6.2 Wired

10.6.7 Historic and Forecasted Market Size by End-User

10.6.7.1 Residential

10.6.7.2 Commercial

10.6.7.3 Industrial

10.6.8 Historic and Forecasted Market Size by Application

10.6.8.1 Air Conditioning

10.6.8.2 Heating

10.6.8.3 Ventilation

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Smart Thermostat Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Technology

10.7.4.1 Wi-Fi

10.7.4.2 Zigbee

10.7.4.3 Bluetooth

10.7.4.4 Z-Wave

10.7.4.5 Infrared

10.7.5 Historic and Forecasted Market Size by Product Type

10.7.5.1 Standalone

10.7.5.2 Connected

10.7.5.3 Learning

10.7.6 Historic and Forecasted Market Size by Connectivity

10.7.6.1 Wireless

10.7.6.2 Wired

10.7.7 Historic and Forecasted Market Size by End-User

10.7.7.1 Residential

10.7.7.2 Commercial

10.7.7.3 Industrial

10.7.8 Historic and Forecasted Market Size by Application

10.7.8.1 Air Conditioning

10.7.8.2 Heating

10.7.8.3 Ventilation

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Smart Thermostat Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 5747.63 Mn. |

|

Forecast Period 2025-32 CAGR: |

20.89 % |

Market Size in 2032: |

USD 26218.74 Mn. |

|

Segments Covered: |

By Technology |

|

|

|

By Product Type |

|

||

|

By Connectivity |

|

||

|

By End-User |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||