Key Market Highlights

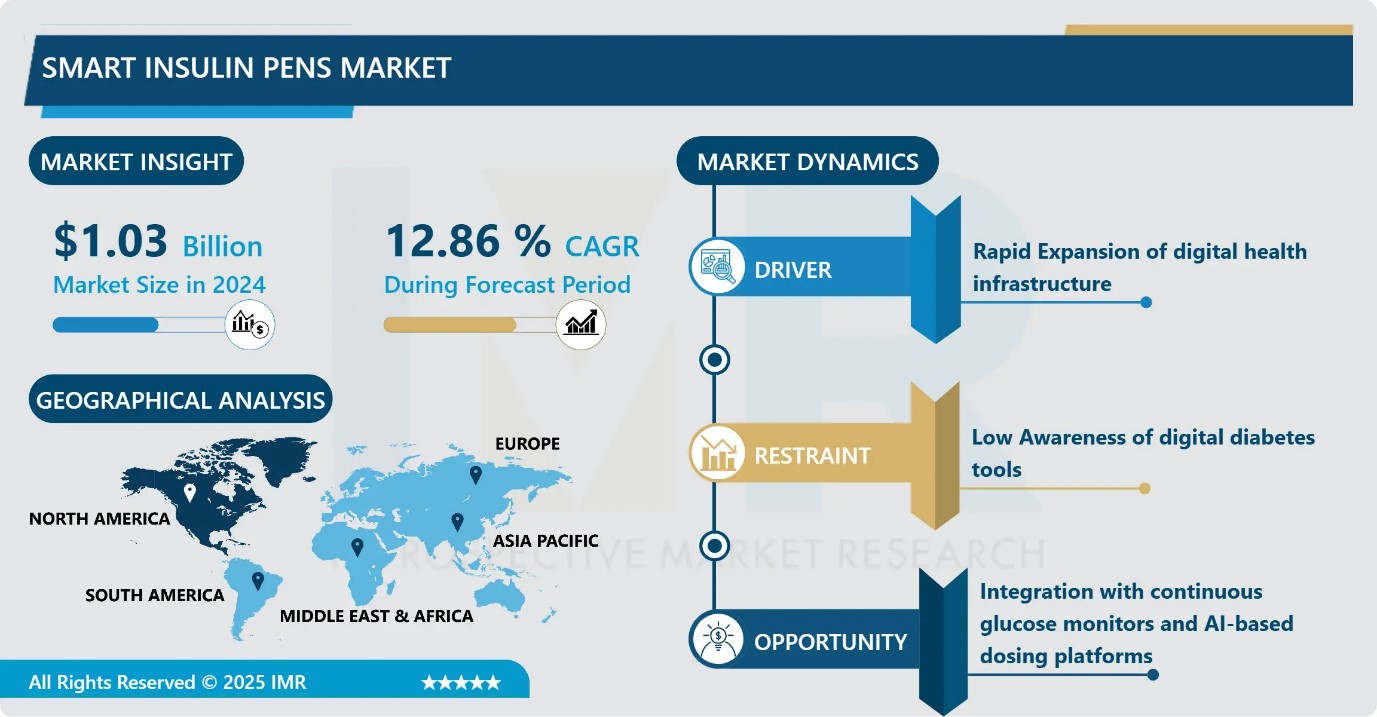

Smart Insulin Pens Market Size Was Valued at USD 1.03 Billion in 2024, and is Projected to Reach USD 3.45 Billion by 2035, Growing at a CAGR of 12.86% from 2025-2035.

- Market Size in 2024: USD 1.03 Billion

- Projected Market Size by 2035: USD 3.45 Billion

- CAGR (2025–2035): 12.86%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Product Type: The Reusable Smart Pens segment is anticipated to lead the market by accounting for 37.32% of the market share throughout the forecast period.

- By Insulin Compatibility: The Rapid Acting Analogs, segment is expected to capture 35.65% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 31.41% of the market share during the forecast period.

- Active Players: Abbott Laboratories (US), Cambridge Consultants Ltd (UK), Eli Lilly and Company (US), Embecta Corp (US), Medtronic plc (US), Novo Nordisk A/S (Denmark), Owen Mumford Ltd (UK), Roche Diabetes Care (Switzerland), Sanofi S.A. (France), and Other Active Players.

Smart Insulin Pens Market Synopsis:

The smart insulin pens market is defined as the segment of the medical device industry focused on the development, production, and sale of advanced, connected insulin delivery systems designed to help individuals with diabetes better manage their insulin administration. These devices combine traditional insulin pen technology with digital health solutions to improve adherence, safety, and glycaemic control

Smart Insulin Pens Market Dynamics and Trend Analysis:

Smart Insulin Pens Market Growth Driver- Rapid Expansion of digital health infrastructure

- Growth is also driven by the rapid expansion of digital health infrastructure. Smart insulin pens fit perfectly into this ecosystem by offering seamless data sharing with CGM devices, hospital platforms, and diabetes-management apps. This integration helps clinicians make faster treatment adjustments and gives patients clearer insights into their daily patterns.

- Rising acceptance of remote monitoring, teleconsultations, and AI-based dose recommendations increases the value of connected pens. Pharmaceutical companies and device makers are also forming partnerships to link insulin, sensors, and software into unified systems. This shift toward connected care is becoming a major force pushing the market forward.

Smart Insulin Pens Market Limiting Factor- Low Awareness of digital diabetes tools

- Adoption is slowed mainly by cost barriers. Smart pens and their companion apps are still more expensive than traditional insulin pens, especially in price-sensitive markets. Limited insurance coverage in many countries further reduces accessibility. Another constraint is technology dependence patients who are older or less comfortable with digital tools often hesitate to shift from familiar manual pens.

- Connectivity issues, data-privacy concerns, and uneven integration with different insulin brands also create friction. In some regions, weak healthcare infrastructure and low awareness of digital diabetes tools keep penetration low, holding back broader market expansion.

Smart Insulin Pens Market Expansion Opportunity- Integration with continuous glucose monitors and AI-based dosing platforms

- A major growth opportunity lies in expanding smart insulin pens into emerging markets where diabetes prevalence is rising but digital tools are still limited. As healthcare systems in Asia-Pacific, Latin America, and the Middle East push for better chronic-disease management, affordable smart-pen models and connected caps can capture large untapped demand.

- Integration with continuous glucose monitors and AI-based dosing platforms also opens new revenue streams through data-driven care. Partnerships with insurers and telehealth providers can further boost adoption by reducing costs and enabling remote monitoring. Overall, the shift toward personalized, connected diabetes care creates strong room for market expansion.

Smart Insulin Pens Market Challenge and Risk- Stringent Regulatory Approvals

- The biggest challenge is dependence on digital infrastructure. If connectivity fails, data becomes unreliable, defeating the purpose of a smart pen. Regulatory pressure is another risk device–software combinations face stricter approval timelines, delaying launches. Data-privacy laws add compliance costs and expose companies to security risks if patient data is mishandled.

- Hardware reliability is also a concern; any dosing error can trigger safety investigations or product recalls. Market fragmentation creates compatibility issues between pens, apps, and insulin brands, limiting seamless adoption. Finally, high costs and inconsistent reimbursement threaten long-term uptake, especially in developing regions.

Smart Insulin Pens Market Trend- Integration with digital health ecosystems.

- A clear trend is integration with digital health ecosystems. Smart insulin pens are increasingly designed to connect with continuous glucose monitors, mobile apps, and cloud platforms. This trend moves diabetes care from manual tracking to real-time, data-driven management, giving patients and clinicians better insight into glucose patterns and dosing behaviour.

- Artificial intelligence and predictive analytics are being added to suggest dose adjustments and personalize treatment. Additionally, wearable and IoT connectivity improvements are making these devices more user-friendly and reliable. Overall, the market is shifting toward connected, smart, and personalized diabetes solutions rather than standalone dosing pens.

Smart Insulin Pens Market Segment Analysis:

Smart Insulin Pens Market is segmented based on Type, Application, End-Users, and Region

By Type, Reusable Smart pens segment is expected to dominate the market with around 37.32% share during the forecast period.

- Reusable smart insulin pens lead the market because they give patients more value for money. Once bought, only cartridges need replacement, making long-term use far cheaper than buying new disposable pens. These pens also offer stronger digital features, better dosing accuracy, and smoother integration with diabetes apps, which patients and clinicians prefer.

- Their durability, user-friendly design, and familiarity among insulin-dependent patients make them the default choice. Hospitals also recommend them because dose tracking is more reliable. Overall, they balance cost, convenience, and technology better than any other product type, which naturally pushes them into the top market position.

By Insulins Type compatibility, Rapid-acting insulin analogs is expected to dominate with close to 35.65% market share during the forecast period.

- Rapid-acting insulin analogs hold the largest share because they are used several times a day for mealtime and correction doses, making accurate tracking essential. Smart insulin pens add real value here by recording timing, calculating recommended doses, and preventing missed or duplicate injections. Since rapid-acting insulin drives most daily dosing decisions, patients and clinicians naturally prefer devices that support tighter, real-time control.

- These pens also integrate smoothly with glucose-monitoring apps, giving users quick feedback after meals. Overall, the combination of frequent use, strong clinical relevance, and clear digital benefits makes rapid-acting insulin the dominant compatibility segment.

Smart Insulin Pens Market Regional Insights:

North America region is estimated to lead the market with around 31,41% share during the forecast period.

- North America leads the smart insulin pens market because the region has a large diabetes population, high insulin-dependent cases, and strong adoption of digital health tools. Patients, clinicians, and payers are already comfortable with connected devices, which accelerates uptake. Insurance coverage for advanced diabetes management solutions is wider compared to most regions, reducing cost barriers.

- The presence of major innovators like Medtronic, Eli Lilly, and Abbott also pushes faster product launches and integrations with glucose-monitoring platforms. On top of that, strong healthcare infrastructure, high awareness, and active clinical guidelines create an environment where smart insulin pens scale quickly.

Smart Insulin Pens Market Active Players:

- Abbott Laboratories (US)

- Cambridge Consultants Ltd (UK)

- Eli Lilly and Company (US)

- Embecta Corp (US)

- Medtronic plc (US)

- Novo Nordisk A/S (Denmark)

- Owen Mumford Ltd (UK)

- Roche Diabetes Care (Switzerland)

- Sanofi S.A. (France)

- Other Active Players

Key Industry Developments in the Smart Insulin Pens Market:

- August 2024, Abbott a unique global partnership with Medtronic to collaborate on an integrated continuous glucose monitoring (CGM) system based on Abbott's most advanced, world-leading1 Freestyle Libre technology that will connect with Medtronic's automated insulin delivery (AID) and smart insulin pen systems.

- September 2023, The Medtronic Smart MDI system is the first to seamlessly integrate real-time CGM with a smart insulin pen powered by an adjustable algorithm that delivers personalized dosing recommendations. The InPenTM combined with the new SimpleraTM CGM provides users with actionable insights that reduce guesswork and complicated manual calculations to help simplify diabetes management.

Emerging Innovations Reshaping Smart Insulin Pen Performance

- Smart insulin pens combine precision dosing hardware with digital intelligence to improve diabetes management. At the core, these pens use micro-dosing mechanisms that allow accurate delivery of insulin in 0.5 to 1-unit increments, reducing human error compared to manual pens. Sensors within the pen track every injection, including dose quantity, time, and temperature exposure, ensuring insulin quality is maintained. Most devices use Bluetooth Low Energy to sync automatically with mobile apps, where dosing history, glucose trends, and reminders are stored. This connectivity enables real-time decision support by integrating data from continuous glucose monitors or glucometers.

- Advanced pens also feature dose calculators that consider previous injections, active insulin remaining in the body, and carbohydrate intake to prevent stacking and hypoglycaemia. Some models allow firmware updates, improving algorithms without replacing hardware. Connected caps offer an economical alternative by converting standard pens into smart devices using clip-on sensors. Cloud-based platforms analyze combined insulin and glucose data, giving clinicians remote visibility for therapy adjustments. Increasingly, machine-learning models are being incorporated to predict glucose fluctuations and suggest proactive dose changes.

- Interoperability is becoming a major technical focus. Manufacturers are working toward standardized APIs so pens can integrate across different insulin brands and digital platforms. Battery efficiency is also improving, with long-lasting rechargeable or replaceable cells designed for frequent daily use. Overall, smart insulin pens blend mechanical reliability with software intelligence, creating a comprehensive, data-driven approach that enhances safety, adherence, and personalization in diabetes care

|

Smart Insulin Pens Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.03 Bn. |

|

Forecast Period 2025-35 CAGR: |

12.86 % |

Market Size in 2035: |

USD 3.45 Bn. |

|

|

By Product Type |

|

|

|

By Insulin-Type Compatibility

|

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Smart Insulin Pens Market by Product Type (2018-2035)

4.1 Smart Insulin Pens Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Reusable Smart Pens

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Connected Cap/Attachment Devices

4.5 Others

Chapter 5: Smart Insulin Pens Market by Insulin-Type Compatibility (2018-2035)

5.1 Smart Insulin Pens Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Rapid-Acting Analogs

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Long-Acting/Basal Insulin Pens

5.5 Others

Chapter 6: Smart Insulin Pens Market by Distribution Channel (2018-2035)

6.1 Smart Insulin Pens Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospital Pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Others

Chapter 7: Smart Insulin Pens Market by End User (2018-2035)

7.1 Smart Insulin Pens Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Home-Care

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Hospitals & Clinics

7.5 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Smart Insulin Pens Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 ABBOTT LABORATORIES (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 CAMBRIDGE CONSULTANTS LTD (UK)

8.4 ELI LILLY AND COMPANY (US)

8.5 EMBECTA CORP (US)

8.6 MEDTRONIC PLC (US)

8.7 NOVO NORDISK A/S (DENMARK)

8.8 OWEN MUMFORD LTD (UK)

8.9 ROCHE DIABETES CARE (SWITZERLAND)

8.10 SANOFI SA (FRANCE)

8.11 AND OTHER ACTIVE PLAYERS.

Chapter 9: Global Smart Insulin Pens Market By Region

9.1 Overview

9.2. North America Smart Insulin Pens Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe Smart Insulin Pens Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe Smart Insulin Pens Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific Smart Insulin Pens Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa Smart Insulin Pens Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America Smart Insulin Pens Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

13.1 Sources

13.2 List of Tables and figures

13.3 Short Forms and Citations

13.4 Assumption and Conversion

13.5 Disclaimer

|

Smart Insulin Pens Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.03 Bn. |

|

Forecast Period 2025-35 CAGR: |

12.86 % |

Market Size in 2035: |

USD 3.45 Bn. |

|

|

By Product Type |

|

|

|

By Insulin-Type Compatibility

|

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||