Digital Health Market Synopsis:

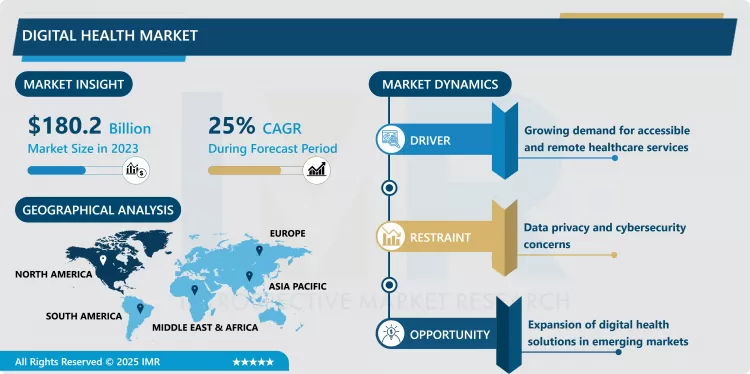

Digital Health Market Size Was Valued at USD 180.2 Billion in 2023, and is Projected to Reach USD 1342.59 Billion by 2032, Growing at a CAGR of 25% From 2024-2032.

Digital Health Market can be described as a cluster of technologies and services that are designed and implemented to optimize the healthcare process and systems through use of digital technologies. This market comprises telemedicine, mobile health, wearable technology, health IT, AI in diagnosis, EHR, and mHealth apps, precision medicine. Digital healthcare seeks to deliver health solutions that are cheaper and accessible while affording quality to meet the increasing need for proper and efficient healthcare services.

The global market of digital health care going through a continuous growth owing to Enhanced technologies and Acceptance of E-Health Records, Wearable equipment and M Health apps. With rising population aging and a consequent increase in the costs of healthcare, digital healthcare solutions are presented as valuable enabling technologies to increase the effectiveness of the delivery of care. Digital heath technologies help to collect data in real time, perform remote consultations, monitor patients’ health or other on-going conditions which have been pleasing in terms of yielding better health results at lesser costs for both the health providers and the consumers. Taking cue from COVID-19 outbreak, the application of digital healthcare has moved from sequential complementary ancillary to the core of the healthcare industry, despite development of innovations like remote diagnostics and virtual consultations.

Hospital systems across the globe are keen on adopting technology to meet the ever rising demand for patients especially from the aging population. Having promoted preventive service delivery, the society has also embraced technologies that offer information regarding one’s health risks as well as advice on how one may prevent having to face complications in future. Many Governments and Private health care sectors are exploring digital ways of delivering and managing health cares in a way that would reduce waiting time, and in equal extent, ensure that all health cares get to the needy. These trends justify the necessity for the Digital Health Market to develop optimal organizational structures for delivering health care that addresses the universal need for integrated, quality, and affordable, services.

Digital Health Market Trend Analysis:

Rise of Artificial Intelligence in Diagnostics

- Artificial intelligence or AI is gradually taking a central stage in the Digital Health Market, especially in diagnosing, prognosis or clinical decision support. Sophisticated computer algorithms can intake and analyze medical data, compare them to known cases, and prognosticate threatening future health conditions with great results. In diagnostics, the use of AI’s algorithms in the interpretation of imaging scans including MRI, CT scan and x-ray helps radiologists early diagnostic of diseases like cancers and cardiovascular diseases in their earlier, treatable stages. It does so not only in increasing certain technical elements of diagnosis for greater precision and speed, but also by lightening the burden of work on human analysis and enabling clinicians and pathologists, respectively, to concentrate on those more challenging cases.

- As AI technology is in the development stage, it will open tremendous opportunities for the diagnostics of health care in the near future. Because of this, diagnostic algorithms are more frequently improving and refining due to the inherent capability of AI to continuously learn from these diagnosis processes and the training related to it. Such advances create high expectations that AI will optimize the experience of a patient by providing timely intimate care and prevent cases of wrong diagnosis. This evolution shows the trend in the development of modern healthcare systems where incorporation of AI serves a paramount purpose of reaching patients needs by providing an efficient and accurate solution.

Growing Demand for Remote Patient Monitoring

- Increase in the prevalence of chronic diseases, global population aging, and the need for Post Acute Care have eventually fostered the development of Remote Patient Monitoring (RPM) solutions and created ample market growth opportunities for the Digital Health Market. RPM technology helps the healthcare provider to assess patients’ health status regardless of their location, an advantage for chronic illness patients with diabetes, heart diseases or respiratory issues. Using RPM devices, medical workers can monitor clients’ vital signs, medication intake, and behaviour which might illustrate the development of various issues and would therefore be helpful in preventing the development of these problems. This cuts down the frequency early and frequent hospital readmissions and provides them more ongoing, individualized care – leads to better patient experienced outcomes.

- The growth of RPM solutions is set to increase dramatically owing to the advances in 5G technology and the expanding use of IoT devices. It is expected that improvements in connectivity solutions and capabilities of devices result in a higher efficiency and reliability of RPM, which in turn makes RPM more beneficial for patients as well as for the healthcare system. This aspect makes RPM not only an effective way of enhancing patient participation but also of decreasing the readmission rates and costs – a concern which is a financial burden in delivery of health care services. This increasing need for RPM solutions makes it appealing for the companies dealing with the remote healthcare technologies since they can get market in it.

Digital Health Market Segment Analysis:

Digital Health Market is Segmented on the basis of Technology, Application, End User, and Region

By Technology, telemedicine segment is expected to dominate the market during the forecast period

- The Digital Health Market is segmented by several technologies that have revolutionized the healthcare systems. Telemedicine is one of the widely adopted technologies that monitors and reduces face-to-face interactions with the doctor Telecare mHealth (Mobile Health) is another ranking technology as it utilizes mobile apps and other devices to keep patients” health under check without the need for physical exams. Health it is a use of Information technology in the delivery of healthcare services in that it utilizes EHRs, data analytics and health managerial care systems in optimizing clinical processes and decision making. Furthermore, portable equipment is becoming popular because it provides round-the-clock observation of other metrics such as life indicators and physical movement.

- AI is gradually finding application in the public health sector with applications in the activities like, prognosis, diagnosis and treatment recommendations. The devices which include; imaging analysis and natural language processing enhance the delivery of health care in accuracy and efficiency. Virtual Reality (VR) is also slowly finding its place in medicine as a train tool, a rehabilitation tool, and an analgesic tool for both patients and doctors. Last, The use of Blockchain technology is also being discussed to address the issues of storing and sharing of patient’s data in a secure manner with privacy and minimizing risk of fraud. In combination, these technologies are revolutionizing the healthcare industry and stepping-up the delivery of efficient services and positive results.

By Application, Diagnosis & Treatment segment expected to held the largest share

- The Digital Health Market is also on the rise in different various key applications that would improve the patient care services as well as the efficiency of the health care industry. Remote Patient Monitoring (RPM) usage is becoming more widespread because patients can be checked on without physically being present in a healthcare facility, especially for individuals with chronic diseases, so possible complications can rapidly be identified. Another important segment is the Diagnosis and Treatment applications where we have numerous fleet of tools that help in diagnosing the diseases and coming up with better treatment solutions where technologies like the Artificial Intelligence as part of it to make it more accurate. Up until now, Virtual Health Assistants are more commonly associated with-round-the-clock support to cover even simple health inquiries and appointments, enhancing the access to health care.

- The timely use of Electronic Health Records (EHR/EMR) has advanced digital health care through effectively providing ease to health care givers’ access to records previously stored on vastly different platforms as well as enhancing the diagnostic and treatment processes of care coordination. Personalized Medicine is another trend that concerns specific treatments that can be brought about by technologies which target certain person’s genetic imperfections, his/her lifestyles as well as the surrounding environment. Healthcare Management systems assist in the healthcare facility’s day to day management by eliminating or reducing paperwork, proper management of resources and expenses. Further, Clinical Trials are on the rise primarily due to digital health, tools where try extras are faster to recruit, monitor trial participants virtually, and capture data in real-time that speeds up drug development. All these applications work together and together, are causing the growth and the change of the Digital Healthcare.

Digital Health Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In 2023, North America remains the dominant region in the Digital Health Market, driven by its advanced healthcare infrastructure, high rates of technology adoption, and robust investments in digital health innovations. The United States and Canada have been pioneers in integrating digital health technologies, with both public and private sectors investing heavily in advancing solutions such as AI-powered diagnostics, wearable health technologies, and telemedicine platforms. This commitment has enabled North America to maintain a leading position, accounting for approximately 40% of the global Digital Health Market share. The region’s focus on improving healthcare delivery through technology has paved the way for widespread adoption of digital health solutions, from electronic health records (EHRs) to remote patient monitoring (RPM) systems.

- The region's success is also attributed to its well-established regulatory framework and high levels of patient engagement, which together create an ecosystem that supports the continued growth of digital healthcare. Healthcare providers in North America have shown increasing interest in digital solutions, driven by the need for cost-effective, accessible, and personalized care. With significant resources dedicated to innovation and the presence of key industry players, North America is expected to maintain its leadership position as digital healthcare continues to evolve and expand globally. The market is set to grow further with advancements in AI, telehealth, and IoT, making the region a hub for digital healthcare development and adoption.

Active Key Players in the Digital Health Market:

- Allscripts (United States)

- American Well Corporation (United States)

- Apple Inc. (United States)

- Cerner Corporation (United States)

- Cisco Systems, Inc. (United States)

- Epic Systems Corporation (United States)

- GE Healthcare (United States)

- Google Health (United States)

- IBM Watson Health (United States)

- Koninklijke Philips N.V. (Netherlands)

- Medtronic PLC (Ireland)

- Microsoft Corporation (United States)

- Teladoc Health, Inc. (United States)

- Wolters Kluwer N.V. (Netherlands)

- Other Active Players

|

Global Digital Health Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 180.2 Billion |

|

Forecast Period 2024-32 CAGR: |

25 % |

Market Size in 2032: |

USD 1342.59 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Device Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Digital Health Market by Technology (2018-2032)

4.1 Digital Health Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Telemedicine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 mHealth (Mobile Health)

4.5 Health Information Technology (Health IT)

4.6 Wearable Devices

4.7 Artificial Intelligence (AI) in Healthcare

4.8 Virtual Reality (VR) in Healthcare

4.9 Blockchain in Healthcare

Chapter 5: Digital Health Market by Application (2018-2032)

5.1 Digital Health Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Remote Patient Monitoring (RPM)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Diagnosis & Treatment

5.5 Virtual Health Assistants

5.6 EHR/EMR

5.7 Personalized Medicine

5.8 Healthcare Management

5.9 Clinical Trials

Chapter 6: Digital Health Market by End User (2018-2032)

6.1 Digital Health Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Healthcare Providers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Healthcare Payers

6.5 Patients

6.6 Pharmaceuticals

6.7 Healthcare IT Companies

Chapter 7: Digital Health Market by Device Type (2018-2032)

7.1 Digital Health Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Wearable Medical Devices

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Diagnostic Devices

7.5 Therapeutic Devices

7.6 Monitoring Devices

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Digital Health Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 TELEFÓNICA S.AEPIC SYSTEMS CORPORATION

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 QSI MANAGEMENT

8.4 LLC

8.5 AT&T

8.6 AIRSTRIP TECHNOLOGIES

8.7 GOOGLE INCHIMS & HERS HEALTH INCORANGE

8.8 SOFTSERVE

8.9 COMPUTER PROGRAMS AND SYSTEMS INCVOCERA COMMUNICATIONS

8.10 IBM CORPORATION

8.11 CISCO SYSTEMS INCAPPLE INCORACLE CERNER

8.12 VERADIGM

8.13 MCKESSON CORPORATION

8.14 HIMS & HERS HEALTH INCVODAFONE GROUP

8.15 QUALCOMM TECHNOLOGIES INCSAMSUNG ELECTRONICS COLTDOTHER KEY PLAYERS

Chapter 9: Global Digital Health Market By Region

9.1 Overview

9.2. North America Digital Health Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Technology

9.2.4.1 Telemedicine

9.2.4.2 mHealth (Mobile Health)

9.2.4.3 Health Information Technology (Health IT)

9.2.4.4 Wearable Devices

9.2.4.5 Artificial Intelligence (AI) in Healthcare

9.2.4.6 Virtual Reality (VR) in Healthcare

9.2.4.7 Blockchain in Healthcare

9.2.5 Historic and Forecasted Market Size by Application

9.2.5.1 Remote Patient Monitoring (RPM)

9.2.5.2 Diagnosis & Treatment

9.2.5.3 Virtual Health Assistants

9.2.5.4 EHR/EMR

9.2.5.5 Personalized Medicine

9.2.5.6 Healthcare Management

9.2.5.7 Clinical Trials

9.2.6 Historic and Forecasted Market Size by End User

9.2.6.1 Healthcare Providers

9.2.6.2 Healthcare Payers

9.2.6.3 Patients

9.2.6.4 Pharmaceuticals

9.2.6.5 Healthcare IT Companies

9.2.7 Historic and Forecasted Market Size by Device Type

9.2.7.1 Wearable Medical Devices

9.2.7.2 Diagnostic Devices

9.2.7.3 Therapeutic Devices

9.2.7.4 Monitoring Devices

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Digital Health Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Technology

9.3.4.1 Telemedicine

9.3.4.2 mHealth (Mobile Health)

9.3.4.3 Health Information Technology (Health IT)

9.3.4.4 Wearable Devices

9.3.4.5 Artificial Intelligence (AI) in Healthcare

9.3.4.6 Virtual Reality (VR) in Healthcare

9.3.4.7 Blockchain in Healthcare

9.3.5 Historic and Forecasted Market Size by Application

9.3.5.1 Remote Patient Monitoring (RPM)

9.3.5.2 Diagnosis & Treatment

9.3.5.3 Virtual Health Assistants

9.3.5.4 EHR/EMR

9.3.5.5 Personalized Medicine

9.3.5.6 Healthcare Management

9.3.5.7 Clinical Trials

9.3.6 Historic and Forecasted Market Size by End User

9.3.6.1 Healthcare Providers

9.3.6.2 Healthcare Payers

9.3.6.3 Patients

9.3.6.4 Pharmaceuticals

9.3.6.5 Healthcare IT Companies

9.3.7 Historic and Forecasted Market Size by Device Type

9.3.7.1 Wearable Medical Devices

9.3.7.2 Diagnostic Devices

9.3.7.3 Therapeutic Devices

9.3.7.4 Monitoring Devices

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Digital Health Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Technology

9.4.4.1 Telemedicine

9.4.4.2 mHealth (Mobile Health)

9.4.4.3 Health Information Technology (Health IT)

9.4.4.4 Wearable Devices

9.4.4.5 Artificial Intelligence (AI) in Healthcare

9.4.4.6 Virtual Reality (VR) in Healthcare

9.4.4.7 Blockchain in Healthcare

9.4.5 Historic and Forecasted Market Size by Application

9.4.5.1 Remote Patient Monitoring (RPM)

9.4.5.2 Diagnosis & Treatment

9.4.5.3 Virtual Health Assistants

9.4.5.4 EHR/EMR

9.4.5.5 Personalized Medicine

9.4.5.6 Healthcare Management

9.4.5.7 Clinical Trials

9.4.6 Historic and Forecasted Market Size by End User

9.4.6.1 Healthcare Providers

9.4.6.2 Healthcare Payers

9.4.6.3 Patients

9.4.6.4 Pharmaceuticals

9.4.6.5 Healthcare IT Companies

9.4.7 Historic and Forecasted Market Size by Device Type

9.4.7.1 Wearable Medical Devices

9.4.7.2 Diagnostic Devices

9.4.7.3 Therapeutic Devices

9.4.7.4 Monitoring Devices

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Digital Health Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Technology

9.5.4.1 Telemedicine

9.5.4.2 mHealth (Mobile Health)

9.5.4.3 Health Information Technology (Health IT)

9.5.4.4 Wearable Devices

9.5.4.5 Artificial Intelligence (AI) in Healthcare

9.5.4.6 Virtual Reality (VR) in Healthcare

9.5.4.7 Blockchain in Healthcare

9.5.5 Historic and Forecasted Market Size by Application

9.5.5.1 Remote Patient Monitoring (RPM)

9.5.5.2 Diagnosis & Treatment

9.5.5.3 Virtual Health Assistants

9.5.5.4 EHR/EMR

9.5.5.5 Personalized Medicine

9.5.5.6 Healthcare Management

9.5.5.7 Clinical Trials

9.5.6 Historic and Forecasted Market Size by End User

9.5.6.1 Healthcare Providers

9.5.6.2 Healthcare Payers

9.5.6.3 Patients

9.5.6.4 Pharmaceuticals

9.5.6.5 Healthcare IT Companies

9.5.7 Historic and Forecasted Market Size by Device Type

9.5.7.1 Wearable Medical Devices

9.5.7.2 Diagnostic Devices

9.5.7.3 Therapeutic Devices

9.5.7.4 Monitoring Devices

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Digital Health Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Technology

9.6.4.1 Telemedicine

9.6.4.2 mHealth (Mobile Health)

9.6.4.3 Health Information Technology (Health IT)

9.6.4.4 Wearable Devices

9.6.4.5 Artificial Intelligence (AI) in Healthcare

9.6.4.6 Virtual Reality (VR) in Healthcare

9.6.4.7 Blockchain in Healthcare

9.6.5 Historic and Forecasted Market Size by Application

9.6.5.1 Remote Patient Monitoring (RPM)

9.6.5.2 Diagnosis & Treatment

9.6.5.3 Virtual Health Assistants

9.6.5.4 EHR/EMR

9.6.5.5 Personalized Medicine

9.6.5.6 Healthcare Management

9.6.5.7 Clinical Trials

9.6.6 Historic and Forecasted Market Size by End User

9.6.6.1 Healthcare Providers

9.6.6.2 Healthcare Payers

9.6.6.3 Patients

9.6.6.4 Pharmaceuticals

9.6.6.5 Healthcare IT Companies

9.6.7 Historic and Forecasted Market Size by Device Type

9.6.7.1 Wearable Medical Devices

9.6.7.2 Diagnostic Devices

9.6.7.3 Therapeutic Devices

9.6.7.4 Monitoring Devices

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Digital Health Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Technology

9.7.4.1 Telemedicine

9.7.4.2 mHealth (Mobile Health)

9.7.4.3 Health Information Technology (Health IT)

9.7.4.4 Wearable Devices

9.7.4.5 Artificial Intelligence (AI) in Healthcare

9.7.4.6 Virtual Reality (VR) in Healthcare

9.7.4.7 Blockchain in Healthcare

9.7.5 Historic and Forecasted Market Size by Application

9.7.5.1 Remote Patient Monitoring (RPM)

9.7.5.2 Diagnosis & Treatment

9.7.5.3 Virtual Health Assistants

9.7.5.4 EHR/EMR

9.7.5.5 Personalized Medicine

9.7.5.6 Healthcare Management

9.7.5.7 Clinical Trials

9.7.6 Historic and Forecasted Market Size by End User

9.7.6.1 Healthcare Providers

9.7.6.2 Healthcare Payers

9.7.6.3 Patients

9.7.6.4 Pharmaceuticals

9.7.6.5 Healthcare IT Companies

9.7.7 Historic and Forecasted Market Size by Device Type

9.7.7.1 Wearable Medical Devices

9.7.7.2 Diagnostic Devices

9.7.7.3 Therapeutic Devices

9.7.7.4 Monitoring Devices

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Digital Health Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 180.2 Billion |

|

Forecast Period 2024-32 CAGR: |

25 % |

Market Size in 2032: |

USD 1342.59 Billion |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Device Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Digital Health Market research report is 2024-2032.

Allscripts (United States), American Well Corporation (United States), Apple Inc. (United States), Cerner Corporation (United States), Cisco Systems, Inc. (United States), Epic Systems Corporation (United States), GE Healthcare (United States), Google Health (United States), IBM Watson Health (United States), Koninklijke Philips N.V. (Netherlands), Medtronic PLC (Ireland), Microsoft Corporation (United States), Teladoc Health, Inc. (United States), Wolters Kluwer N.V. (Netherlands), and Other Active Players

The Digital Health Market is segmented into Technology, Application, End User and region. By Technology, the market is categorized into Telemedicine, mHealth (Mobile Health), Health Information Technology (Health IT), Wearable Devices, Artificial Intelligence (AI) in Healthcare, Virtual Reality (VR) in Healthcare, Blockchain in Healthcare. By Application, the market is categorized into Remote Patient Monitoring (RPM), Diagnosis & Treatment, Virtual Health Assistants, EHR/EMR, Personalized Medicine, Healthcare Management, Clinical Trials. By End User, the market is categorized into Healthcare Providers, Health care Payers, Patients, Pharmaceuticals, Healthcare IT Companies. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Digital Health Market can be described as a cluster of technologies and services that are designed and implemented to optimize the healthcare process and systems through use of digital technologies. This market comprises telemedicine, mobile health, wearable technology, health IT, AI in diagnosis, EHR, and mHealth apps, precision medicine. Digital healthcare seeks to deliver health solutions that are cheaper and accessible while affording quality to meet the increasing need for proper and efficient healthcare services.

Digital Health Market Size Was Valued at USD 180.2 Billion in 2023, and is Projected to Reach USD 1342.59 Billion by 2032, Growing at a CAGR of 25% From 2024-2032.