Smart Contracts in Healthcare Market Synopsis

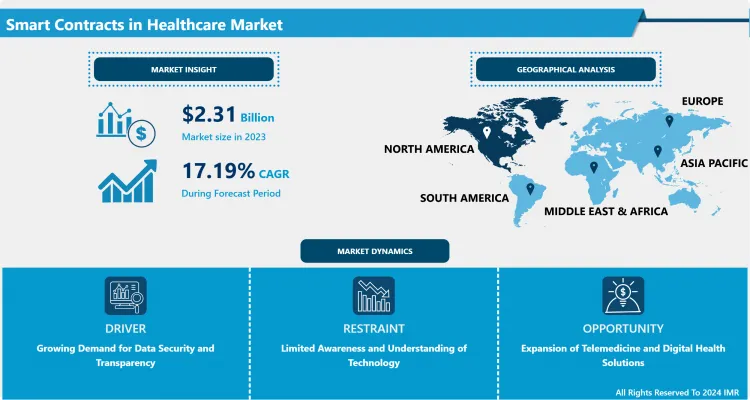

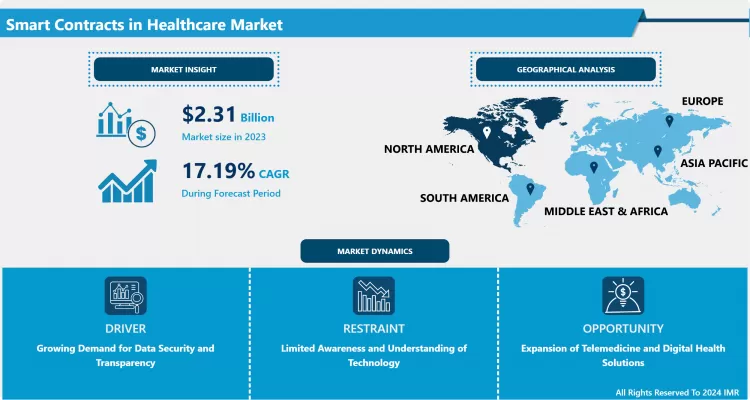

Smart Contracts in Healthcare Market Size is Valued at USD 2.31 Billion in 2023, and is Projected to Reach USD 6.18 Billion by 2032, Growing at a CAGR of 17.19% From 2024-2032.

Healthcare market smart contracts are digital contracts that contain the terms of the contract coded directly into the actions of a contract that will perform the obligations of the contract according to specific conditions. As self-executing smart contracts on a blockchain platform, such contracts offer a safe, seamless, and objective means of applying both simple and complex solutions in the healthcare industry through application in patient data sharing, billing and preparing, resource chain, and clinical experimentation. The presence of smart contracts also helps create reliability between the various parties involved since the need for middlemen is eliminated while at the same time helping to avoid or reduce on the chances of making mistakes.

- Smart Contract is another important factor driven by the demand for more open and secure healthcare transactions. The latest trends in the healthcare sector reveal a need for effective, high-quality solutions, which would provide the necessary protection of data breaches, or, in other words, ensure the confidentiality of the patient’s information. High levels of security and accountability locked in smart contracts of decentralized networks mean enhanced confidence from the patients and providers and insurers.

- Another key pressure is increasing costs of operating in the healthcare industry in the country. To oversimplify, conventional arrangements are generally complex, involving several layers of intermediary, with high costs and poor efficiency as inevitable consequences. Smart contracts simplify several operations and functions, for example, billing and claims, by handling this paperwork autonomously and minimizing the burden. This efficiency does not only reduce the cost it also speeds up the transactions on services being rendered on health hence ensuring its responsiveness.

Smart Contracts in Healthcare Market Trend Analysis

Increasing collaboration between healthcare providers and technology companies.

- The inevitable trends in the smart contract’s healthcare market are healthcare providers’ engagement with technology companies. Since most healthcare organizations have discovered the potential of blockchain and smart contracts, they are forging strategic partnerships with technology firms in order to fine-tune solutions to meet industry requirements. This trend is keeping people innovating and pushing the importance of smart contracts into the existing healthcare systems.

- Another typical tendency is the increasing significance of Act compliance and standardisation. As for smart contracts, there is a start to create frameworks for legal and ethical requirements of those contracts in the sphere of healthcare. This pressure for compliance is likely to help introduce wider usage of smart contracts as people feel safer with their application and usage.

The increasing demand for interoperability among healthcare systems.

- The continuous integration of healthcare facilities and necessity to create a single network is also a favorable sign for smart contracts. Smart contracts are also useful when care givers intend to transfer information across different platforms in as secure a manner as possible while respecting the patient’s rights to privacy. This capability can also direct patient care therefore driving better patient outcomes and decreasing the administrative work hence establishment a good business case for smart contracts.

- Also, the emerging application of telemedicine and digital health have created additional approaches to using smart contracts. In the midst of increased adoption of remote patient monitoring and virtual consultations, it becomes possible to apply smart contracts in different stages including consent management, billing among others regarding patients’ information. This automation can enhance the patient experience while at the same time helping healthcare providers to bring on efficiency to their operations making smart contracts a good acquisition to health industry that is experiencing a change through the use of technology.

Smart Contracts in Healthcare Market Segment Analysis:

Smart Contracts in Healthcare Market Segmented on the basis of type, Technology, application and End user.

By Type, Public Smart Contracts segment is expected to dominate the market during the forecast period

- Smart contracts in the healthcare market can be categorized into three main types: They are public smart contracts, private smart contracts and consortium smart contracts. Smart contracts defined as public are deployed on open blockchain platforms where everyone can engage with the smart contract to further increase its visibility and general accessibility. Private smart contracts, in contrast, are intended to be used only within an organization or between a small number of parties; they provide more power and control over the data and transactions that they process. Consortium smart contracts already are a type of smart contract solution that involves different organisations to coordinate the operation of the blockchain network, allowing transactions between certain defined members while keeping certain level of anonymity and protection.

By Application, Clinical Trials segment held the largest share in 2023

- The received results indicate various forms and usages of smart contracts in the healthcare market in relation to several key areas, such as clinical trials, supply chain, patient data management, billing and payments, as well as insurance claims. It has been noted that even in clinical trials, smart contracts come in handy specifically, because they help automate consent collection from participants, as well as data gathering, two aspects that make the process even more efficient and legal. In supply chain management they help maintain secure and open ways of tracking medical products in the market thus minimizing fraud while enhancing product quality. Smart contracts in patient data management helps to share patient’s records securely and safely to anyone who has the right access and promotes the free sharing of records between health care institutions. Further, they streamline financial management through invoice and transaction generation and management of payments which in turn helps cut short time and efforts. Last of all, in the insurance claims, smart contracts help make the process of claims processing more efficient with less dispute and faster claims processing of insurance claims.

Smart Contracts in Healthcare Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America region holds the largest market for smart contract’s healthcare business due to its dominant participation of major tech firms and healthcare entities. The area has a well-developed base to support technologically advanced products accompanied by severe emphasis on research. Also, the availability of favorable innovative policies for the acceptance of blockchain technology and smart contracts also strengthen North America to remain the market leader. • In addition, growing healthcare expenditure and still emerging healthcare technology investment by different countries; public and private in North America continue to propel smart contracts. althcare organizations. The region boasts a robust infrastructure for technological innovation, coupled with a strong focus on research and development. Additionally, the presence of supportive regulatory frameworks encourages the adoption of blockchain technology and smart contracts, further solidifying North America's leadership position in this market.

- Furthermore, the increasing investment in healthcare technology by both public and private sectors in North America is driving the growth of smart contracts. Measures launched by authorities in the form of boosting data protection and raising the general effectiveness of the healthcare system also increase the popularity of smart contracts among healthcare industry members. As the region moves forward to develop and deploy its healthcare system more and more it is not improbable for the region to retain its supremacy in the smart contract for its healthcare domain.

Active Key Players in the Smart Contracts in Healthcare Market

- IBM (United States)

- Microsoft (United States)

- Chronicled (United States)

- Guardtime (Estonia)

- DocuSign (United States)

- SimplyVital Health (United States)

- Solve.Care (United States)

- MedRec (United States)

- Gem Health (United States)

- R3 (United States)

- Others

|

Global Smart Contracts in Healthcare Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 2.31 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.19 % |

Market Size in 2032: |

USD 6.18 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Smart Contracts in Healthcare Market by Type (2018-2032)

4.1 Smart Contracts in Healthcare Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Public Smart Contracts

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Private Smart Contracts

4.5 Consortium Smart Contracts

Chapter 5: Smart Contracts in Healthcare Market by Technology (2018-2032)

5.1 Smart Contracts in Healthcare Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Blockchain Platforms (Ethereum

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Hyperledger

5.5 etc.)

5.6 Decentralized Applications (DApps)

Chapter 6: Smart Contracts in Healthcare Market by Application (2018-2032)

6.1 Smart Contracts in Healthcare Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Clinical Trials

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Supply Chain Management

6.5 Patient Data Management

6.6 Billing and Payments

6.7 Insurance Claims Processing

Chapter 7: Smart Contracts in Healthcare Market by End user (2018-2032)

7.1 Smart Contracts in Healthcare Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals and Clinics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Pharmaceutical Companies

7.5 Insurance Providers

7.6 Patients

7.7 Research Organizations

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Smart Contracts in Healthcare Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 IBM (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MICROSOFT (UNITED STATES)

8.4 CHRONICLED (UNITED STATES)

8.5 GUARDTIME (ESTONIA)

8.6 DOCUSIGN (UNITED STATES)

8.7 SIMPLYVITAL HEALTH (UNITED STATES)

8.8 SOLVE.CARE (UNITED STATES)

8.9 MEDREC (UNITED STATES)

8.10 GEM HEALTH (UNITED STATES)

8.11 R3 (UNITED STATES)

8.12 OTHERS

8.13

Chapter 9: Global Smart Contracts in Healthcare Market By Region

9.1 Overview

9.2. North America Smart Contracts in Healthcare Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Public Smart Contracts

9.2.4.2 Private Smart Contracts

9.2.4.3 Consortium Smart Contracts

9.2.5 Historic and Forecasted Market Size by Technology

9.2.5.1 Blockchain Platforms (Ethereum

9.2.5.2 Hyperledger

9.2.5.3 etc.)

9.2.5.4 Decentralized Applications (DApps)

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Clinical Trials

9.2.6.2 Supply Chain Management

9.2.6.3 Patient Data Management

9.2.6.4 Billing and Payments

9.2.6.5 Insurance Claims Processing

9.2.7 Historic and Forecasted Market Size by End user

9.2.7.1 Hospitals and Clinics

9.2.7.2 Pharmaceutical Companies

9.2.7.3 Insurance Providers

9.2.7.4 Patients

9.2.7.5 Research Organizations

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Smart Contracts in Healthcare Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Public Smart Contracts

9.3.4.2 Private Smart Contracts

9.3.4.3 Consortium Smart Contracts

9.3.5 Historic and Forecasted Market Size by Technology

9.3.5.1 Blockchain Platforms (Ethereum

9.3.5.2 Hyperledger

9.3.5.3 etc.)

9.3.5.4 Decentralized Applications (DApps)

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Clinical Trials

9.3.6.2 Supply Chain Management

9.3.6.3 Patient Data Management

9.3.6.4 Billing and Payments

9.3.6.5 Insurance Claims Processing

9.3.7 Historic and Forecasted Market Size by End user

9.3.7.1 Hospitals and Clinics

9.3.7.2 Pharmaceutical Companies

9.3.7.3 Insurance Providers

9.3.7.4 Patients

9.3.7.5 Research Organizations

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Smart Contracts in Healthcare Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Public Smart Contracts

9.4.4.2 Private Smart Contracts

9.4.4.3 Consortium Smart Contracts

9.4.5 Historic and Forecasted Market Size by Technology

9.4.5.1 Blockchain Platforms (Ethereum

9.4.5.2 Hyperledger

9.4.5.3 etc.)

9.4.5.4 Decentralized Applications (DApps)

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Clinical Trials

9.4.6.2 Supply Chain Management

9.4.6.3 Patient Data Management

9.4.6.4 Billing and Payments

9.4.6.5 Insurance Claims Processing

9.4.7 Historic and Forecasted Market Size by End user

9.4.7.1 Hospitals and Clinics

9.4.7.2 Pharmaceutical Companies

9.4.7.3 Insurance Providers

9.4.7.4 Patients

9.4.7.5 Research Organizations

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Smart Contracts in Healthcare Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Public Smart Contracts

9.5.4.2 Private Smart Contracts

9.5.4.3 Consortium Smart Contracts

9.5.5 Historic and Forecasted Market Size by Technology

9.5.5.1 Blockchain Platforms (Ethereum

9.5.5.2 Hyperledger

9.5.5.3 etc.)

9.5.5.4 Decentralized Applications (DApps)

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Clinical Trials

9.5.6.2 Supply Chain Management

9.5.6.3 Patient Data Management

9.5.6.4 Billing and Payments

9.5.6.5 Insurance Claims Processing

9.5.7 Historic and Forecasted Market Size by End user

9.5.7.1 Hospitals and Clinics

9.5.7.2 Pharmaceutical Companies

9.5.7.3 Insurance Providers

9.5.7.4 Patients

9.5.7.5 Research Organizations

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Smart Contracts in Healthcare Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Public Smart Contracts

9.6.4.2 Private Smart Contracts

9.6.4.3 Consortium Smart Contracts

9.6.5 Historic and Forecasted Market Size by Technology

9.6.5.1 Blockchain Platforms (Ethereum

9.6.5.2 Hyperledger

9.6.5.3 etc.)

9.6.5.4 Decentralized Applications (DApps)

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Clinical Trials

9.6.6.2 Supply Chain Management

9.6.6.3 Patient Data Management

9.6.6.4 Billing and Payments

9.6.6.5 Insurance Claims Processing

9.6.7 Historic and Forecasted Market Size by End user

9.6.7.1 Hospitals and Clinics

9.6.7.2 Pharmaceutical Companies

9.6.7.3 Insurance Providers

9.6.7.4 Patients

9.6.7.5 Research Organizations

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Smart Contracts in Healthcare Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Public Smart Contracts

9.7.4.2 Private Smart Contracts

9.7.4.3 Consortium Smart Contracts

9.7.5 Historic and Forecasted Market Size by Technology

9.7.5.1 Blockchain Platforms (Ethereum

9.7.5.2 Hyperledger

9.7.5.3 etc.)

9.7.5.4 Decentralized Applications (DApps)

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Clinical Trials

9.7.6.2 Supply Chain Management

9.7.6.3 Patient Data Management

9.7.6.4 Billing and Payments

9.7.6.5 Insurance Claims Processing

9.7.7 Historic and Forecasted Market Size by End user

9.7.7.1 Hospitals and Clinics

9.7.7.2 Pharmaceutical Companies

9.7.7.3 Insurance Providers

9.7.7.4 Patients

9.7.7.5 Research Organizations

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Smart Contracts in Healthcare Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 2.31 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.19 % |

Market Size in 2032: |

USD 6.18 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||