Security Screening Market Synopsis

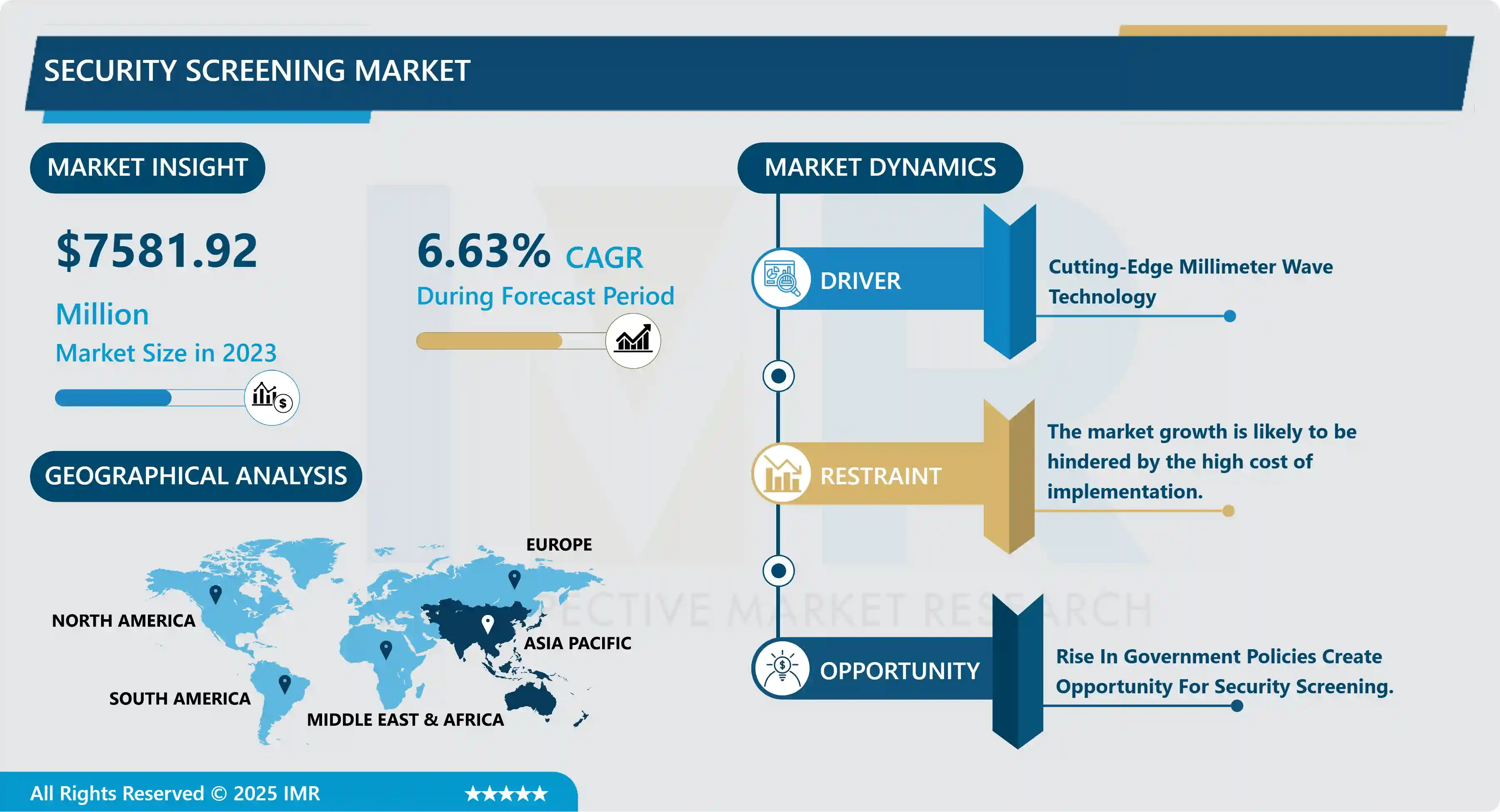

Security Screening Market Size Was Valued at USD 7581.92 Billion in 2023 and is Projected to Reach USD 13511.2 Billion by 2032, Growing at a CAGR of 6.63% From 2024-2032.

Security checkpoints, such as those employed at airports, sporting events, schools, and other similar environments, are designed to maintain a secure environment by preventing the introduction of dangerous items and/or individuals. Each checkpoint provides a controlled location where permissible elements can pass through and prohibited elements can be kept out. Although security at each checkpoint might have unique components, visual search—looking at individuals and their belongings to identify potential threats —is a common denominator.

Unfortunately, visual search is fraught with pitfalls that can lead to costly mistakes, and this poses an important threat to security performance (Schwaninger, 2005). Technological advances have successfully enhanced search performance at checkpoints, and some security screenings depend largely upon information obtained by nonhumans. For example, explosive material can be detected both by sensors (e.g., Singh, 2007) and trained animals (e.g., Furton & Myers, 2001). However, whereas significant advances in technology have increased success rates (e.g., von Bastian, Schwaninger, & Michel, 2008; Michel & Schwaninger, 2009), the human element remains a pivotal link for most security screening tasks (Schwaninger, 2006). As such, security screening is subject to the shortcomings of human performance, and it is critical to understand what challenges are imposed upon the searcher by almost any security screening.

Security Screening Market Trend Analysis

Cutting-Edge Millimeter Wave Technology

-

Millimeter wave technology offers better resolution for precise detection of hidden objects on people, creating 3D images to reveal concealed items under clothing without the need for physical contact, improving overall security efficiency. Millimeter wave technology, which is safe and non-ionizing, is perfect for busy locations such as airports when it comes to security scans. Users are at ease and follow procedures, leading to acceptance. High-resolution millimeter wave scanners quickly examine and visualize, decreasing wait times at security checkpoints. Improving traveler and personnel experience by increasing flow and efficiency in crowded areas.

- Privacy-centric millimeter wave scanners utilize automated threat detection algorithms to pinpoint suspicious areas on a standard figure, instead of displaying intricate anatomical images, guaranteeing strong security measures while upholding privacy. Millimeter wave technology, which was originally used for aviation security, is now being deployed in government, corrections, events, and corporate offices to improve security screening across different sectors.

- Combining millimeter wave scanners with biometric systems and AI improves security through merging threat detection, identity verification, and intelligent analytics to provide thorough protection against different threats. Although it requires significant upfront investment, implementing high-resolution millimeter wave technology can result in lasting advantages such as decreased operational expenses, heightened security results, increased precision, productivity, and reduced staffing costs.

Increased requirement for automatic explosive detection

- Sophisticated explosive detection systems at airports, which use technologies such as CT scanners and artificial intelligence, improve security by effectively detecting threats and minimizing incorrect alarms. Adherence to rules guarantees elevated security levels and promotes the development of screening technologies through increased investments. Automated explosive detection systems improve efficiency by rapidly inspecting bags, and decreasing wait times at security checkpoints. They also decrease human mistakes, enhancing the overall efficiency of airport security for a more secure travel experience.

- Biometric verification and surveillance technology can be combined with automatic explosive detection systems to improve security measures. These systems can be adjusted and customized to fit various airport sizes, guaranteeing efficient screening for any number of passengers. Although the upfront expense is significant, automated systems result in lower operational costs and enhanced security results in the long run. Combining different security measures with cost efficiency, automatic explosive detection systems are a beneficial investment for airports of any size.

- IoT security screening systems provide the capability to monitor in real-time and analyze data, giving immediate visibility into security procedures. Improved connectivity among security systems enhances coordination and efficiency in identifying and responding to threats. IoT technology anticipates when security screening equipment requires maintenance, cutting down on downtime and expenses. Efficient screening process utilizing IoT technology enhances passenger satisfaction and travel experiences by reducing wait times and disruptions.

- Tailored scalable IoT security systems for airports of varying sizes enhance threat detection and response capabilities with advanced security measures. Connected devices and sensors offer immediate data to help rapidly address security threats. Automated systems decrease the need for manual involvement, leading to cost savings and improved effectiveness. IoT systems provide lasting financial advantages, making the adoption of advanced security technologies economically viable for both large international airports and smaller regional facilities.

Security Screening Market Segment Analysis:

Security Screening Market Segmented on the basis of Type, Nature, Form, Technology, Application, And End-Use.

By Type, Baggage & Cargo Screening Segment Is Expected to Dominate the Market During the Forecast Period

- The Baggage & Cargo Screening sector prevails in the security field because of stringent security protocols. Airports, seaports, and transportation hubs are making investments in advanced screening technologies to fight against terrorism and security threats. This proactive method guarantees the safety and tranquility of travelers. The segment continues to lead with the ongoing advancement of advanced screening technologies such as X-ray scanners and explosives detection systems, essential for identifying banned items and possible dangers. Technological progress, including artificial intelligence, machine learning, and data analytics, has improved the Baggage & Cargo Screening industry.

- Upgraded screening systems now provide quicker processing, better detection, and reduced false alarms. AI systems enhance their ability to detect threats by constantly refining their accuracy through the analysis of large volumes of data. The continuous advancements in technology further strengthen the segment's control of the market in current security operations. Adherence to strict regulations from organizations like TSA and ICAO has enhanced the Baggage & Cargo Screening market's position. Companies must follow designated screening technologies and procedures to uphold global safety standards, driving the demand for advanced solutions and continuous compliance updates.

- Economic factors are the main driver behind the dominance of Baggage & Cargo Screening. Investing in cutting-edge technology enhances security and efficiency, which outweighs the expenses associated with breaches. This supports the decision to keep investing in screening solutions. With the expansion of air travel worldwide, the significance of the Baggage & Cargo Screening sector increases to protect passengers and maintain cargo quality. The need for advanced screening systems is growing due to the building and growing of airports.

- Growing worries about cargo security have increased the importance of the Baggage & Cargo Screening sector. The risk of illicit activities is heightened due to the increased complexity of global trade, leading to a greater need for advanced screening technologies. Competition in the market drives innovation, prompting top companies to create new technologies to stay ahead. Having many competitors in the industry encourages a strong competitive environment, promoting growth and upholding strict security measures.

By End-Use, Transportation Segment Held the Largest Share In 2023

- Transportation hubs such as airports, train stations, and seaports handle large quantities of passengers every day, necessitating continuous security checks to ensure traveler safety. Advanced screening technologies are crucial for overseeing large groups and ensuring seamless functioning. Worldwide governments implement strict security measures in transportation centers to combat terrorism and criminal acts. Adhering to rules prompts investments in state-of-the-art screening technologies, guaranteeing ongoing improvements in security infrastructure.

- The aviation, maritime, and rail sectors, which are valuable transportation facilities, are at high risk of security threats because of their significant strategic importance. Strong security measures and efficient screening systems are necessary to guarantee safety. Advanced screening technologies improve operational efficiency at transportation hubs by substituting manual inspections with automated systems, decreasing delays from bottleneck and enhancing throughput to manage large passenger and cargo volumes, guaranteeing passenger contentment.

- Transportation hubs utilize sophisticated screening technologies such as X-ray imaging, CT scans, and explosive detection in order to thwart terrorism and smuggling. These technologies identify dangers, stop unauthorized item passage, and safeguard passengers and infrastructure. Specialized solutions are in demand due to critical security requirements in different transportation modes. Comprehensive screening systems are necessary for passengers, baggage, cargo, and containers in aviation, maritime, and railway transportation. Screening technologies play a major role in generating revenue in the security screening market. The increase in travelers and goods is driving the need for enhanced security screening in transportation centers.

Security Screening Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- North America boasts an extensive airport infrastructure with a total of 16,694 airports spread across the United States, Canada, and Mexico. Advanced security screening is necessary due to the heavy traffic, which opens up possibilities for the security sector. The area is currently facing increasing security risks such as elevated levels of crime, smuggling, and terrorism. The smuggling of illicit fentanyl has risen, particularly at the border between the US and Mexico. Between 2020 and 2023, there was a 480% increase in fentanyl seizures at the border, highlighting the necessity for improved screening technologies.

- Stringent government regulations in North America, particularly regarding security in transportation and public spaces, are in place. These regulations necessitate the use of advanced screening technology, resulting in substantial investments in security systems. Adherence guarantees ongoing improvement and expansion in the security screening industry. The application of biometric technologies such as fingerprint, iris, and facial recognition enhances the accuracy of security screening, which is crucial for high-security areas. The growth of the market in North America is fueled by the implementation of these solutions.

- It is estimated that worldwide passenger traffic will reach 94% of 2019 levels in 2023, with North America reaching 99.8%. Security measures are necessary. The North American market is benefitted by technological advancements in security screening, including X-ray scanners and automated solutions. Sophisticated screening methods are needed to avoid unauthorized entry into high-security sites such as government buildings and military installations in the area. The demand for strict security measures is the reason why North America leads the worldwide security screening sector. North America is at the forefront of the security screening market because of its airport infrastructure, security threats, regulations, and advanced technologies. The demand for strong solutions is growing due to the recovery of passenger traffic and increased security measures, with improvements and the use of biometrics making operations more effective and efficient.

Security Screening Market Active Players

- Smiths Detection (United Kingdom)

- OSI Systems, Inc. (United States)

- L3Harris Technologies (United States)

- Thales Group (France)

- FLIR Systems (United States)

- Nuctech Company Limited (China)

- Safran (France)

- Analogic Corporation (United States)

- Rapiscan Systems (United States)

- Implant Sciences Corporation (United States)

- American Science and Engineering, Inc. (United States)

- Leidos Holdings, Inc. (United States)

- 3DX-RAY Ltd. (United Kingdom)

- Autoclear, LLC (United States)

- CEIA SpA (Italy)

- Astrophysics, Inc. (United States)

- Tek84 Engineering Group (United States)

- VOTI Detection (Canada)

- Evolv Technology (United States)

|

Security Screening Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 7581.92 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.63 % |

Market Size in 2032: |

USD 13511.2 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature, |

|

||

|

By Form |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Security Screening Market by Type (2018-2032)

4.1 Security Screening Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Baggage and Cargo Screening

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Personnel Screening

4.5 Vehicle Screening

Chapter 5: Security Screening Market by Nature, (2018-2032)

5.1 Security Screening Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Portable

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Fixed

Chapter 6: Security Screening Market by Form (2018-2032)

6.1 Security Screening Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Metal Detectors

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 X-ray Systems

6.5 Biometric Systems

6.6 Explosive Detection Systems

6.7 Body Scanners

Chapter 7: Security Screening Market by Technology (2018-2032)

7.1 Security Screening Market Snapshot and Growth Engine

7.2 Market Overview

7.3 X-ray Imaging

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Computed Tomography (CT)

7.5 Explosive Trace Detection (ETD)

7.6 Electromagnetic Fields (EMF)

7.7 Millimeter Wave Technology

7.8 Biometrics

7.9 Artificial Intelligence (AI) and Machine Learning

7.10 Infrared and Thermal Imaging

Chapter 8: Security Screening Market by Application (2018-2032)

8.1 Security Screening Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Airport Security

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Border Security

8.5 Critical Infrastructure Protection

8.6 Event Security

8.7 Industrial Security

8.8 Government Buildings

8.9 Educational Institutions

8.10 Maritime Security

Chapter 9: Security Screening Market by End-Use (2018-2032)

9.1 Security Screening Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Government and Law Enforcement

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Transportation {Airports

9.5 Railways

9.6 Seaports}

9.7 Defense and Military

9.8 Public Venues and Events

9.9 Industrial Sector

9.10 Educational Institutions

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Security Screening Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 SMITHS DETECTION (UNITED KINGDOM)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 OSI SYSTEMS INC. (UNITED STATES)

10.4 L3HARRIS TECHNOLOGIES (UNITED STATES)

10.5 THALES GROUP (FRANCE)

10.6 FLIR SYSTEMS (UNITED STATES)

10.7 NUCTECH COMPANY LIMITED (CHINA)

10.8 SAFRAN (FRANCE)

10.9 ANALOGIC CORPORATION (UNITED STATES)

10.10 RAPISCAN SYSTEMS (UNITED STATES)

10.11 IMPLANT SCIENCES CORPORATION (UNITED STATES)

10.12 AMERICAN SCIENCE AND ENGINEERING INC. (UNITED STATES)

10.13 LEIDOS HOLDINGS INC. (UNITED STATES)

10.14 3DX-RAY LTD. (UNITED KINGDOM)

10.15 AUTOCLEAR

10.16 LLC (UNITED STATES)

10.17 CEIA SPA (ITALY)

10.18 ASTROPHYSICS INC. (UNITED STATES)

10.19 TEK84 ENGINEERING GROUP (UNITED STATES)

10.20 VOTI DETECTION (CANADA)

10.21 EVOLV TECHNOLOGY (UNITED STATES)

10.22 MORPHO DETECTION

10.23 LLC (UNITED STATES)

10.24 ICX TECHNOLOGIES (UNITED STATES)

10.25 MAGAL SECURITY SYSTEMS LTD. (ISRAEL)

10.26 COBALT LIGHT SYSTEMS LTD. (UNITED KINGDOM)

10.27 SMITHS GROUP PLC (UNITED KINGDOM)

10.28 CHINA NORTH INDUSTRIES GROUP CORPORATION (NORINCO) (CHINA)

10.29 AMERICAN INNOVATIONS INC. (UNITED STATES)

10.30 ADANI SYSTEMS INC. (UNITED STATES)

10.31 DIGITAL BARRIERS PLC (UNITED KINGDOM)

10.32 ARGUS GLOBAL PTY LTD (AUSTRALIA)

10.33 GENERAL ELECTRIC COMPANY (GE SECURITY) (UNITED STATES)

Chapter 11: Global Security Screening Market By Region

11.1 Overview

11.2. North America Security Screening Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Type

11.2.4.1 Baggage and Cargo Screening

11.2.4.2 Personnel Screening

11.2.4.3 Vehicle Screening

11.2.5 Historic and Forecasted Market Size by Nature,

11.2.5.1 Portable

11.2.5.2 Fixed

11.2.6 Historic and Forecasted Market Size by Form

11.2.6.1 Metal Detectors

11.2.6.2 X-ray Systems

11.2.6.3 Biometric Systems

11.2.6.4 Explosive Detection Systems

11.2.6.5 Body Scanners

11.2.7 Historic and Forecasted Market Size by Technology

11.2.7.1 X-ray Imaging

11.2.7.2 Computed Tomography (CT)

11.2.7.3 Explosive Trace Detection (ETD)

11.2.7.4 Electromagnetic Fields (EMF)

11.2.7.5 Millimeter Wave Technology

11.2.7.6 Biometrics

11.2.7.7 Artificial Intelligence (AI) and Machine Learning

11.2.7.8 Infrared and Thermal Imaging

11.2.8 Historic and Forecasted Market Size by Application

11.2.8.1 Airport Security

11.2.8.2 Border Security

11.2.8.3 Critical Infrastructure Protection

11.2.8.4 Event Security

11.2.8.5 Industrial Security

11.2.8.6 Government Buildings

11.2.8.7 Educational Institutions

11.2.8.8 Maritime Security

11.2.9 Historic and Forecasted Market Size by End-Use

11.2.9.1 Government and Law Enforcement

11.2.9.2 Transportation {Airports

11.2.9.3 Railways

11.2.9.4 Seaports}

11.2.9.5 Defense and Military

11.2.9.6 Public Venues and Events

11.2.9.7 Industrial Sector

11.2.9.8 Educational Institutions

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Security Screening Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Type

11.3.4.1 Baggage and Cargo Screening

11.3.4.2 Personnel Screening

11.3.4.3 Vehicle Screening

11.3.5 Historic and Forecasted Market Size by Nature,

11.3.5.1 Portable

11.3.5.2 Fixed

11.3.6 Historic and Forecasted Market Size by Form

11.3.6.1 Metal Detectors

11.3.6.2 X-ray Systems

11.3.6.3 Biometric Systems

11.3.6.4 Explosive Detection Systems

11.3.6.5 Body Scanners

11.3.7 Historic and Forecasted Market Size by Technology

11.3.7.1 X-ray Imaging

11.3.7.2 Computed Tomography (CT)

11.3.7.3 Explosive Trace Detection (ETD)

11.3.7.4 Electromagnetic Fields (EMF)

11.3.7.5 Millimeter Wave Technology

11.3.7.6 Biometrics

11.3.7.7 Artificial Intelligence (AI) and Machine Learning

11.3.7.8 Infrared and Thermal Imaging

11.3.8 Historic and Forecasted Market Size by Application

11.3.8.1 Airport Security

11.3.8.2 Border Security

11.3.8.3 Critical Infrastructure Protection

11.3.8.4 Event Security

11.3.8.5 Industrial Security

11.3.8.6 Government Buildings

11.3.8.7 Educational Institutions

11.3.8.8 Maritime Security

11.3.9 Historic and Forecasted Market Size by End-Use

11.3.9.1 Government and Law Enforcement

11.3.9.2 Transportation {Airports

11.3.9.3 Railways

11.3.9.4 Seaports}

11.3.9.5 Defense and Military

11.3.9.6 Public Venues and Events

11.3.9.7 Industrial Sector

11.3.9.8 Educational Institutions

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Security Screening Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Type

11.4.4.1 Baggage and Cargo Screening

11.4.4.2 Personnel Screening

11.4.4.3 Vehicle Screening

11.4.5 Historic and Forecasted Market Size by Nature,

11.4.5.1 Portable

11.4.5.2 Fixed

11.4.6 Historic and Forecasted Market Size by Form

11.4.6.1 Metal Detectors

11.4.6.2 X-ray Systems

11.4.6.3 Biometric Systems

11.4.6.4 Explosive Detection Systems

11.4.6.5 Body Scanners

11.4.7 Historic and Forecasted Market Size by Technology

11.4.7.1 X-ray Imaging

11.4.7.2 Computed Tomography (CT)

11.4.7.3 Explosive Trace Detection (ETD)

11.4.7.4 Electromagnetic Fields (EMF)

11.4.7.5 Millimeter Wave Technology

11.4.7.6 Biometrics

11.4.7.7 Artificial Intelligence (AI) and Machine Learning

11.4.7.8 Infrared and Thermal Imaging

11.4.8 Historic and Forecasted Market Size by Application

11.4.8.1 Airport Security

11.4.8.2 Border Security

11.4.8.3 Critical Infrastructure Protection

11.4.8.4 Event Security

11.4.8.5 Industrial Security

11.4.8.6 Government Buildings

11.4.8.7 Educational Institutions

11.4.8.8 Maritime Security

11.4.9 Historic and Forecasted Market Size by End-Use

11.4.9.1 Government and Law Enforcement

11.4.9.2 Transportation {Airports

11.4.9.3 Railways

11.4.9.4 Seaports}

11.4.9.5 Defense and Military

11.4.9.6 Public Venues and Events

11.4.9.7 Industrial Sector

11.4.9.8 Educational Institutions

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Security Screening Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Type

11.5.4.1 Baggage and Cargo Screening

11.5.4.2 Personnel Screening

11.5.4.3 Vehicle Screening

11.5.5 Historic and Forecasted Market Size by Nature,

11.5.5.1 Portable

11.5.5.2 Fixed

11.5.6 Historic and Forecasted Market Size by Form

11.5.6.1 Metal Detectors

11.5.6.2 X-ray Systems

11.5.6.3 Biometric Systems

11.5.6.4 Explosive Detection Systems

11.5.6.5 Body Scanners

11.5.7 Historic and Forecasted Market Size by Technology

11.5.7.1 X-ray Imaging

11.5.7.2 Computed Tomography (CT)

11.5.7.3 Explosive Trace Detection (ETD)

11.5.7.4 Electromagnetic Fields (EMF)

11.5.7.5 Millimeter Wave Technology

11.5.7.6 Biometrics

11.5.7.7 Artificial Intelligence (AI) and Machine Learning

11.5.7.8 Infrared and Thermal Imaging

11.5.8 Historic and Forecasted Market Size by Application

11.5.8.1 Airport Security

11.5.8.2 Border Security

11.5.8.3 Critical Infrastructure Protection

11.5.8.4 Event Security

11.5.8.5 Industrial Security

11.5.8.6 Government Buildings

11.5.8.7 Educational Institutions

11.5.8.8 Maritime Security

11.5.9 Historic and Forecasted Market Size by End-Use

11.5.9.1 Government and Law Enforcement

11.5.9.2 Transportation {Airports

11.5.9.3 Railways

11.5.9.4 Seaports}

11.5.9.5 Defense and Military

11.5.9.6 Public Venues and Events

11.5.9.7 Industrial Sector

11.5.9.8 Educational Institutions

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Security Screening Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Type

11.6.4.1 Baggage and Cargo Screening

11.6.4.2 Personnel Screening

11.6.4.3 Vehicle Screening

11.6.5 Historic and Forecasted Market Size by Nature,

11.6.5.1 Portable

11.6.5.2 Fixed

11.6.6 Historic and Forecasted Market Size by Form

11.6.6.1 Metal Detectors

11.6.6.2 X-ray Systems

11.6.6.3 Biometric Systems

11.6.6.4 Explosive Detection Systems

11.6.6.5 Body Scanners

11.6.7 Historic and Forecasted Market Size by Technology

11.6.7.1 X-ray Imaging

11.6.7.2 Computed Tomography (CT)

11.6.7.3 Explosive Trace Detection (ETD)

11.6.7.4 Electromagnetic Fields (EMF)

11.6.7.5 Millimeter Wave Technology

11.6.7.6 Biometrics

11.6.7.7 Artificial Intelligence (AI) and Machine Learning

11.6.7.8 Infrared and Thermal Imaging

11.6.8 Historic and Forecasted Market Size by Application

11.6.8.1 Airport Security

11.6.8.2 Border Security

11.6.8.3 Critical Infrastructure Protection

11.6.8.4 Event Security

11.6.8.5 Industrial Security

11.6.8.6 Government Buildings

11.6.8.7 Educational Institutions

11.6.8.8 Maritime Security

11.6.9 Historic and Forecasted Market Size by End-Use

11.6.9.1 Government and Law Enforcement

11.6.9.2 Transportation {Airports

11.6.9.3 Railways

11.6.9.4 Seaports}

11.6.9.5 Defense and Military

11.6.9.6 Public Venues and Events

11.6.9.7 Industrial Sector

11.6.9.8 Educational Institutions

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Security Screening Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Type

11.7.4.1 Baggage and Cargo Screening

11.7.4.2 Personnel Screening

11.7.4.3 Vehicle Screening

11.7.5 Historic and Forecasted Market Size by Nature,

11.7.5.1 Portable

11.7.5.2 Fixed

11.7.6 Historic and Forecasted Market Size by Form

11.7.6.1 Metal Detectors

11.7.6.2 X-ray Systems

11.7.6.3 Biometric Systems

11.7.6.4 Explosive Detection Systems

11.7.6.5 Body Scanners

11.7.7 Historic and Forecasted Market Size by Technology

11.7.7.1 X-ray Imaging

11.7.7.2 Computed Tomography (CT)

11.7.7.3 Explosive Trace Detection (ETD)

11.7.7.4 Electromagnetic Fields (EMF)

11.7.7.5 Millimeter Wave Technology

11.7.7.6 Biometrics

11.7.7.7 Artificial Intelligence (AI) and Machine Learning

11.7.7.8 Infrared and Thermal Imaging

11.7.8 Historic and Forecasted Market Size by Application

11.7.8.1 Airport Security

11.7.8.2 Border Security

11.7.8.3 Critical Infrastructure Protection

11.7.8.4 Event Security

11.7.8.5 Industrial Security

11.7.8.6 Government Buildings

11.7.8.7 Educational Institutions

11.7.8.8 Maritime Security

11.7.9 Historic and Forecasted Market Size by End-Use

11.7.9.1 Government and Law Enforcement

11.7.9.2 Transportation {Airports

11.7.9.3 Railways

11.7.9.4 Seaports}

11.7.9.5 Defense and Military

11.7.9.6 Public Venues and Events

11.7.9.7 Industrial Sector

11.7.9.8 Educational Institutions

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Security Screening Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 7581.92 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.63 % |

Market Size in 2032: |

USD 13511.2 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Nature, |

|

||

|

By Form |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||