Sarcoma Biopsy Market Synopsis:

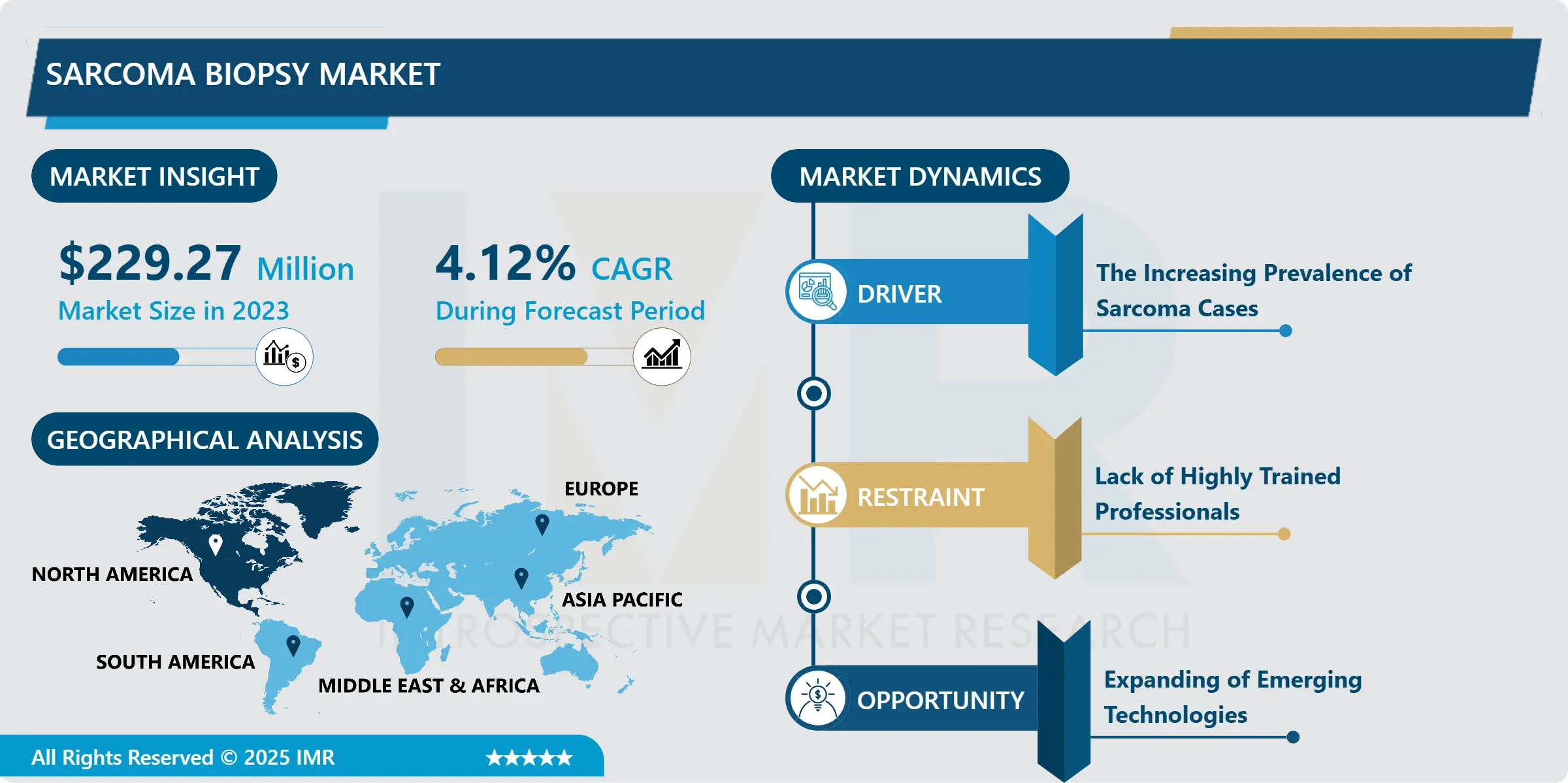

Sarcoma Biopsy Market Size Was Valued at USD 229.27 Million in 2023, and is Projected to Reach USD 298.76 Million by 2032, Growing at a CAGR of 4.12% From 2024-2032.

Sarcoma Biopsy Market is a niche market for oncology diagnostics, dedicated to the biopsy techniques applied to diagnose sarcomas, which are relatively rare and highly malignant varieties of cancer, which develop in muscles, bones, fats and cartilage. They include biopsy that plays decisive role in diagnosis of sarcoma, classification of the tumor as to its type, grade, and stage, and choice of treatment. Such biopsy techniques available in the market includes; needle biopsies; fine needle aspiration and core needle biopsy, surgical biopsies; incisional and excisional, and the relatively newer liquid biopsy products. There is CT-guided biopsies, MRI guided biopsies, as well as ultrasound guided biopsy which has increased precision and safety of the biopsies. As the global rate of incidence for sarcomas is gradually increasing, propelled by the need for early and accurate diagnosis of the disease, improved biopsy technology and parallel shift towards personalized medicine, the sarcoma biopsy market will continue to experience growth. However, the problems like high cost of using techniques for performing biopsy, the difficulty in identifying the main type of rare sarcoma subtypes are still remain problematic, although, the progressive developments in minimally invasive tool and application of artificial intelligence in diagnostics create a great potential for developing in this area.

One of the primary growth motor for the Sarcoma Biopsy Market is the high worldwide incidence of sarcoma, which is a rare but rampant type of cancer that affects connective tissues like muscles, bones, and cartilage. An important factor for mistreatment is that sarcoma frequently mimics other forms of cancer and is quite rare. Consequently, the accurate and timely pathologic diagnosis by biopsy techniques including needle biopsy, Fine Needle Aspiration (FNA) biopsy, Core Needle Biopsy, Surgical Biopsy and novel liquid biopsy approaches are crucial. Market is being driven by improvement of biopsy technologies like CT, MRI and ultrasound guided biopsies that increase the chances of correct tissue sampling and a higher success rate capacity on patients. These are not only enhancing the accuracy and precision of diagnosis, but are also involved in the implementation of less invasive treatments, which are less uncomfortable to the patients and which results in faster recovery time.

Further, there is a rising trend regarding early diagnosis of cancer and heightened focus on cure based on target with specific genotype of tumor. These are some of the reasons why there is increased desire of precise and elaborate biopsy results that would enable doctors recommend acceptable treatments. These regions together constitute a rapidly growing market for sarcoma diagnosis due to increasing healthcare access and improving diagnostic capabilities in Asian-Pacific and Latin American countries. Nevertheless, high costs associated with deep biopsy procedures, unfamiliarity with the technology in the legislating countries of the global developing world, as well complex diagnostic nature of sarcoma still averts market growth to some extent. However, there are certain challenges that currently restrict the growth of the sarcoma biopsy market – they include lack of diagnostic tools for early detection of sarcoma, absence of signs and symptoms in early stage and high cost of procedures and healthcare services in developed regions. But with the development of minimally invasive biopsy procedures and incorporation of AI in biopsy procedures, new opportunities are predicted to spur in the growth of the market for sarcoma biopsy in future.

Sarcoma Biopsy Market Trend Analysis:

Shift Toward Minimally Invasive Biopsy Techniques Drives Market Growth

- One of the trends most significantly contributing to the markets growth is the transition from Open Biopsy to less invasive procedures such as Minimally Invasive Biopsy. Historically accepted biopsy procedures, including surgical biopsy, generally results to larger incisions and more complex procedures that may lead to longer recovery time, complications and more patient’s suffering. However, fine needle aspiration (FNA) and core needle biopsy have recently attracted more attention because of the specific application of small needles to collect tissue samples which is less invasive and more patient-pleasing when compared to large core biopsies. They are usually associated with lesser complications, minimal scarring and shorter recovery time, which explains why most practitioners and patients are acquiring them. Moreover, there are improved techniques of image-guided biopsy including CT guided, MRI guided and ultrasound guided biopsy, make tissue sampling for biopsy much more definitive and precise giving healthcare professionals more targeted location of tumors. This trend is revolutionalizing the sarcoma biopsy area, producing quicker and more accurate diagnoses with less danger to the patient and discomfort.

- High interest in interventional procedures implies a liberal application of these refined biopsy methods across the wide range of clinics. Hospitals and diagnostic centers are adopting these methods more and more as they do not only offer improved diagnostic yield but also has an aggressive patient satisfaction level. All these techniques correlate with the current care delivery models that are being advaced towards patient centered care with minimal traumatogenic effects of procedures and speedy recovery. Furthermore, because minimally invasive biopsies are cheaper and take less time than the usual surgical modalities, health care delivery providers stand to benefit not only from improved patient outcome but also from a much lighter burden on their wallet and thus, uptake of the technology is encouraged. Altogether, the rising demand for these less invasive biopsy techniques coupled with better accuracy and timeliness afforded by these methods for diagnosing sarcomas contributes to the market expansion of the sarcoma biopsy system.

Emerging Markets Present Significant Growth Opportunities for Sarcoma Biopsy

- It can be found out that, the developing countries in Asia-Pacific, Latin America and Africa can generate good amount of_chance for the growth of sarcoma biopsy market. These regions are experiencing a progressive enhancement in the facility base especially hospitals, diagnostics and specialized oncology care. Consequently, the implemented care models are a means to increase the availability of diagnostic technologies, such as sarcoma biopsy methods, which may have been either unavailable or significantly less accessible in those geographic locations. Furthermore, it is observed that there is a growing prevalence of cancers including sarcomas and growing concern for timely diagnosis of the disease is increasing the requirement for more advanced diagnostic tools. Since, developing countries healthcare systems are still in the progressive period, there is much focus placed towards enhancing results of the cancer treatments as well as early detection solutions that definitely enhance the utilization of biopsies.

- Further, in these emerging economies with the help of government policies, health programs and with global associations tries to create awareness about this disease-cancer, about these unknown types of cancer like sarcoma. As cancer detection switches into focus, health care practitioners in these areas are embracing less invasive diagnostic methods including needle biopsies and image guided biopsies. By taking the time for detailed diagnostics like these advanced diagnosis services, not only is patient status being enhanced, but the sarcoma biopsy market is enlarging. Further and with regards to the growth of middle income consumers and improved health care financing the patients in these markets have better coverages to access better diagnostic and treat ment procedures. These factors creating increased access to healthcare, growing awareness about the disease, and a demand for early cancer diagnosis is anticipated to drive further growth of the sarcoma biopsy market across the regions.

Sarcoma Biopsy Market Segment Analysis:

Sarcoma Biopsy Market is Segmented on the basis of Type, Application, End User, and Region.

By Type, Soft Tissue Sarcomas segment is expected to dominate the market during the forecast period

- The Soft Tissue Sarcomas segment is expected to nab the largest share in the sarcoma biopsy market throughout the forecast period owing to the higher rate of occurrence and more comprehensive range of tumors involving the soft tissue as compared to the bone sarcomas. Approximately 50% of all sarcomas are STS, a group of tumors that originate from connective tissues including skeletal muscle, adipose tissue, blood vessels, and nerves. These tumors can occur almost anywhere in the body, but most frequently they begin in the limbs, abdomen or chest. Sophistication in the number of soft tissue sarcomas along with the enhancement in consciousness regarding the initial diagnosis is anticipated to boost the biopsy procedure market extensively in the coming years. Soft tissue sarcomas are relatively rare, with nonspecific clinical features; getting the right diagnosis by biopsy is crucial in identifying the type, grade and stage of the tumor. This makes biopsy procedures a pivotal measure in the clinical management of soft tissue sarcomas and consequently globally drives the demand for superior diagnostic equipment.

- Furthermore, soft tissue sarcomas are sometimes difficult to accurately localize and biopsy and hence many of them use special imaging methods. Needle biopsies including fine needle aspiration biopsy and core needle biopsy have emerged as the better choice for diagnosing soft tissue sarcomas because they are minimally invasive procedures with better prognosis, less morbidity, scant postoperative recovery period and finer accuracy. Ultrasound-guided biopsies as well as CT-guided and MRI-guided biopsies enables these approaches to be directed to soft tissue tumors and biopsy samples can be obtained from quite inaccessible regions. That is why, when such sophisticated imaging and biopsy techniques are incorporated into healthcare systems, which has already happened with Soft Tissue Sarcomas segment, the constant growth of the market can be expected. In addition, the subject of personalized medicine making patients with sarcoma to seek for differentiated diagnoses and treatments also boosts the demand for accurate soft tissue sarcoma biopsy market.

By Biopsy Type, Needle Biopsy segment expected to held the largest share

- The Needle Biopsy segment that encapsulates Fine Needle Aspiration (FNA) as well as the Core Needle Biopsy are regarded to dominate the market share in the forecast period for the global sarcoma biopsy market. Fine needle aspiration biopsies are gradually being accepted as a better method for obtaining tissue for diagnosis of sarcomas, especially soft tissue sarcomas, because of some of the advantages over surgical biopsies; these include, requirement of smaller incision, fewer complications and shorter recovery time. These procedures include a thin, tubular needle to biopsy or remove portions of the tissue inside the tumor while preserving the healthy ones. Needle biopsies have been increasingly used due to patient safety, comfort and faster recovery as healthcare systems and clinicians strive to deliver optimalmaximise the quality of diagnosis for sarcomas, especially when the tumours are situated in parts of the body that are easy to sample. Further, the increased use of image-guided biopsy techniques including, computed tomography guided, magnetic resonance imaging guided and ultrasound guided needle biopsies has improved the precision and efficiency of needle biopsies which also helps the market to dominate.

- Based on the features of needle biopsy, including low invasiveness of the procedure, short hospital stays, and the possibility to obtain results quickly, the method is increasingly used not only in clinical practice but also in research. With the development of the minimally invasive approaches, not only have needle biopsies are safer, but the diagnostic accuracy of a great number of subtypes of sarcoma has been increased significantly. Since the selection of the proper treatment option for sarcoma largely depends on diagnostic results, needle biopsy stands out as the most suitable approach because it yields high quality of the tissue while entering deep into the patient’s tissues. Moreover, needle biopsy procedures are generally less costly than surgical methods in terms of a biopsy, so posing more opportunities to healthcare providers depending on the developed and supply regions. The steady growth in the sarcoma-functioning diagnostic demands for sufficient and more efficient needle biopsy segment is further anticipated to fuel this structure’s growth as the largest segment of the market.

Sarcoma Biopsy Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Again, North America accounted for the largest share in the sarcoma biopsy market globally throughout the forecast period owing to the presence of developed healthcare infrastructure, higher awareness more stringently to the advanced diagnostic procedures, and increased focus in oncology research. The US itself has some of the best hospitals and cancer institutes that can provide the best diagnostic equipment for sarcoma and other related diseases with innovative image guided biopsy and other minimally invasive biopsy methods. The fact that the region has well developed healthcare system and make most of the diagnostic services available and of high quality means that it would be easy to diagnose rare cancers such as sarcoma. In addition, the increased emphasis on early cancer diagnosis and more awareness of the types of sarcoma and basic signs has created higher interest in better biopsy techniques. Robust diagnosis techniques along with the presence of a efficient medical infrastructure for diagnosis including trained professionals are anticipated to boost the growth of the global North American sarcoma biopsy market.

- Besides a well-developed healthcare system in North America research and development efforts in the field of oncology are significant. The area hosts many clinical trials and advancements regarding better resolution and sensitivity of sarcomas diagnostics. Thus, North America with more research funding for cancer including from the National Cancer Institute of United States continues to develop innovative biopsy technologies. This means, using AI+len to enhance biopsy evaluation and employment of digital pathology, incorporation of digital pathology into biopsy analysis, constant improvement of liquid biopsy devices and systems. The region also pays much attention to this area in molecular diagnostic methods and distinct treatment in line with biopsy results. Therefore, it will remain the market leader for a long time now that North America owns highly developed diagnostic capabilities and a powerful healthcare system, coupled with the constant progress in cancer diagnostics and biopsies.

Active Key Players in the Sarcoma Biopsy Market:

- Abbott Laboratories (United States)

- BD (Becton, Dickinson and Company) (United States)

- Bio-Rad Laboratories, Inc. (United States)

- Boston Scientific Corporation (United States)

- Canon Medical Systems Corporation (Japan)

- Exact Sciences Corporation (United States)

- GE Healthcare (United States)

- Hologic, Inc. (United States)

- Hologic, Inc. (United States)

- Johnson & Johnson (United States)

- Leica Biosystems (Germany)

- Medtronic PLC (Ireland)

- Philips Healthcare (Netherlands)

- Roche Diagnostics (Switzerland)

- Siemens Healthineers (Germany)

- Smith & Nephew (United Kingdom)

- Stryker Corporation (United States)

- Thermo Fisher Scientific Inc. (United States)

- Other Active Players

|

Sarcoma Biopsy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 229.27 Million |

|

Forecast Period 2024-32 CAGR: |

4.12 % |

Market Size in 2032: |

USD 298.76 Million |

|

Segments Covered: |

By Type |

|

|

|

By Biopsy Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Sarcoma Biopsy Market by Type

4.1 Sarcoma Biopsy Market Snapshot and Growth Engine

4.2 Sarcoma Biopsy Market Overview

4.3 Soft Tissue Sarcomas

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Soft Tissue Sarcomas: Geographic Segmentation Analysis

4.4 Bone Sarcomas)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Bone Sarcomas): Geographic Segmentation Analysis

4.5 Biopsy Type

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Biopsy Type: Geographic Segmentation Analysis

Chapter 5: Sarcoma Biopsy Market by End User

5.1 Sarcoma Biopsy Market Snapshot and Growth Engine

5.2 Sarcoma Biopsy Market Overview

5.3 Hospitals and Clinics

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hospitals and Clinics: Geographic Segmentation Analysis

5.4 Diagnostic Laboratories)

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Diagnostic Laboratories): Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Sarcoma Biopsy Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBOTT LABORATORIES (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BD (BECTON

6.4 DICKINSON AND COMPANY) (UNITED STATES)

6.5 BIO-RAD LABORATORIES INC. (UNITED STATES)

6.6 BOSTON SCIENTIFIC CORPORATION (UNITED STATES)

6.7 CANON MEDICAL SYSTEMS CORPORATION (JAPAN)

6.8 EXACT SCIENCES CORPORATION (UNITED STATES)

6.9 GE HEALTHCARE (UNITED STATES)

6.10 HOLOGIC INC. (UNITED STATES)

6.11 OTHER ACTIVE PLAYERS

Chapter 7: Global Sarcoma Biopsy Market By Region

7.1 Overview

7.2. North America Sarcoma Biopsy Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type

7.2.4.1 Soft Tissue Sarcomas

7.2.4.2 Bone Sarcomas)

7.2.4.3 Biopsy Type

7.2.5 Historic and Forecasted Market Size By End User

7.2.5.1 Hospitals and Clinics

7.2.5.2 Diagnostic Laboratories)

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Sarcoma Biopsy Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type

7.3.4.1 Soft Tissue Sarcomas

7.3.4.2 Bone Sarcomas)

7.3.4.3 Biopsy Type

7.3.5 Historic and Forecasted Market Size By End User

7.3.5.1 Hospitals and Clinics

7.3.5.2 Diagnostic Laboratories)

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Sarcoma Biopsy Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type

7.4.4.1 Soft Tissue Sarcomas

7.4.4.2 Bone Sarcomas)

7.4.4.3 Biopsy Type

7.4.5 Historic and Forecasted Market Size By End User

7.4.5.1 Hospitals and Clinics

7.4.5.2 Diagnostic Laboratories)

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Sarcoma Biopsy Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type

7.5.4.1 Soft Tissue Sarcomas

7.5.4.2 Bone Sarcomas)

7.5.4.3 Biopsy Type

7.5.5 Historic and Forecasted Market Size By End User

7.5.5.1 Hospitals and Clinics

7.5.5.2 Diagnostic Laboratories)

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Sarcoma Biopsy Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type

7.6.4.1 Soft Tissue Sarcomas

7.6.4.2 Bone Sarcomas)

7.6.4.3 Biopsy Type

7.6.5 Historic and Forecasted Market Size By End User

7.6.5.1 Hospitals and Clinics

7.6.5.2 Diagnostic Laboratories)

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Sarcoma Biopsy Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Type

7.7.4.1 Soft Tissue Sarcomas

7.7.4.2 Bone Sarcomas)

7.7.4.3 Biopsy Type

7.7.5 Historic and Forecasted Market Size By End User

7.7.5.1 Hospitals and Clinics

7.7.5.2 Diagnostic Laboratories)

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Sarcoma Biopsy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 229.27 Million |

|

Forecast Period 2024-32 CAGR: |

4.12 % |

Market Size in 2032: |

USD 298.76 Million |

|

Segments Covered: |

By Type |

|

|

|

By Biopsy Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||