Ruminant Feed Market Synopsis

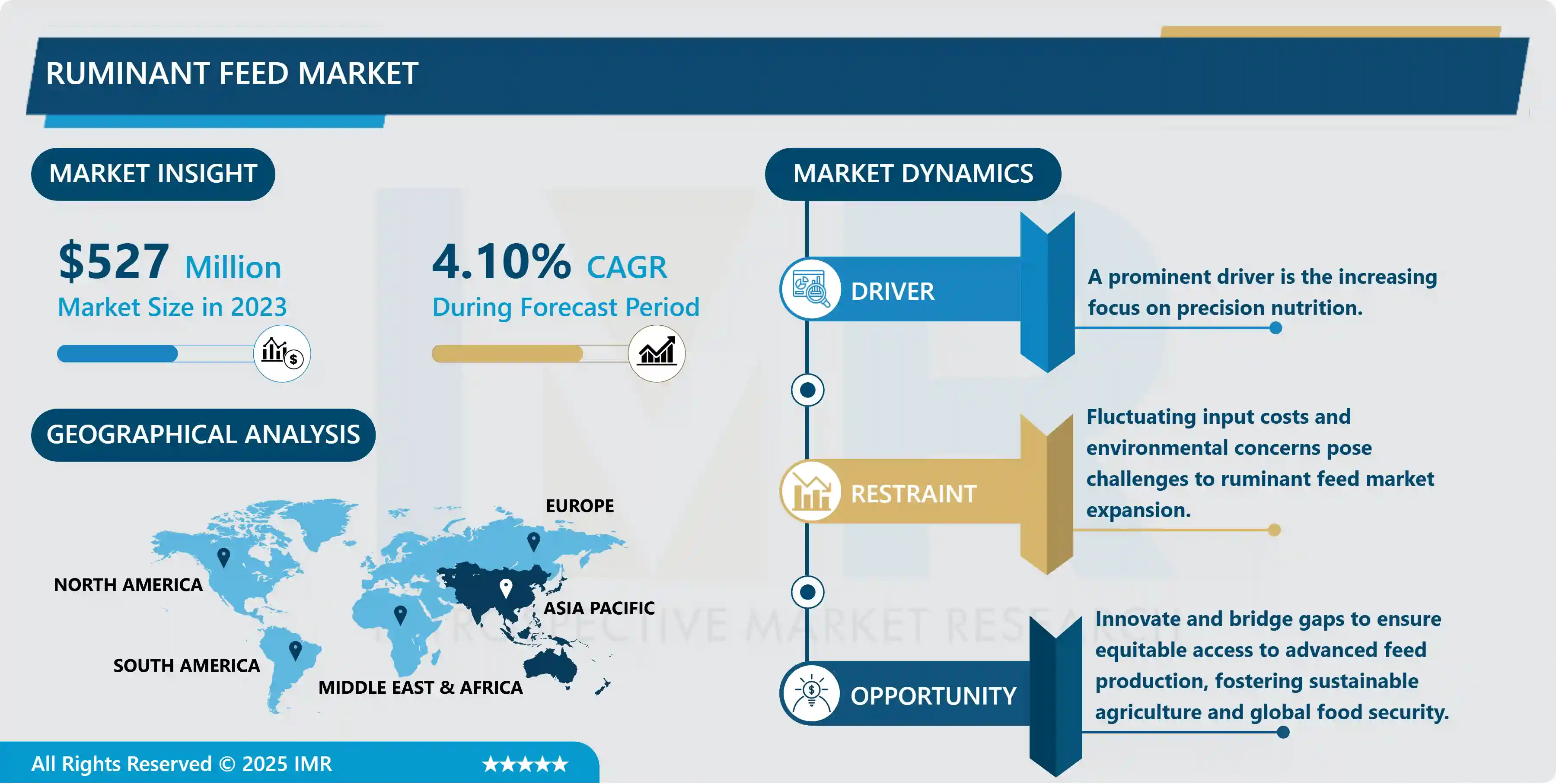

Ruminant Feed Market Size Was Valued at USD 527 Million in 2023 and is Projected to Reach USD 756.6 Million by 2032, Growing at a CAGR of 4.1% From 2024-2032.

The nutritional concern for ruminants centers around energy (i.e., carbohydrates), protein, minerals, vitamins, and water. Energy (carbohydrates) is responsible for the maintenance and growth functions of the animal and the generation of heat. Protein grows tissue and performs other vital functions. Other nutrients and minerals such as vitamins A and E, calcium, phosphorus, and selenium can be fed “free choice” as a mineral supplement. The following section explores the nutrient requirements of ruminants, beginning with intake.

Intake is critically important for the acquisition of nutrients by ruminants. Palatability is the flavor and texture of the feedstuff. Ruminants seek sweetness in their feed, probably because sweet is an indicator of soluble carbohydrates, the most critical dietary element for the animal after water. Ruminants will in turn avoid feedstuffs that are bitter, as these often are associated with toxic secondary chemicals. The digestive anatomy and physiology of ruminants is markedly different to that of monogastric animals, including pigs and man.

Microbial feed additives therefore have several objectives quite different to those used with nonruminants. During early life, when milk is the main ingredient of the diet, the rumen tissue structure is undeveloped (Figure 1), and food tends to bypass the rumen. According to the Food and Agriculture Organization of the United Nations, livestock contributes an estimated 39.98% of the global agriculture output; also, it offers food security for an estimated 1.3 billion people worldwide. Demand for nutritious feed for cattle healthcare is expected to drive the global ruminant feed market growth during the forecast period. The UN Food and Agricultural Organisation (FAO) estimates that the world will have to produce ca. 60% more food by 2050 and we believe that animal protein production will grow even more – meats (poultry/swine/beef) will double, as well as dairy, and fish production will almost triple by 2050. In order to support the spreading of good manufacturing practice and higher feed safety standards around the globe, in 2020 IFIF and FAO published the new Manual ‘Good Practices for the Feed Sector: Implementing the Codex Alimentarius Code of Practice on Good Animal Feeding’ to increase safety and feed quality at the production level.

Ruminant Feed Market Trend Analysis

A prominent trend is the increasing focus on precision nutrition

- Livestock producers are increasingly using customized feed formulations for individual animals to improve nutrition and performance, driven by a focus on sustainability. This includes eco-friendly sourcing and production practices, exploring alternative protein sources, and implementing circular economy principles. Digital technologies such as sensors and data analytics are transforming the ruminant feed sector, optimizing production processes and monitoring animal health. There is also a growing demand for functional feed additives to enhance animal health and address environmental concerns, with plant-based and specialty feeds aligning with consumer preferences.

- Precision animal nutrition or precision feeding concerns the use of feeding techniques that provide animals with diets tailored according to the production objectives (i.e., maximum or controlled production rates), including environmental and animal welfare issues. Precision livestock feeding is presented in this document as the practice of feeding individual animals or groups of animals while accounting for the changes in nutrient requirements that occur over time for the variation in nutrient requirements that exist among animals. As defined in this document, the accurate determination of available nutrients in feeds and feed ingredients, precise diet formulation, and the determination of the nutrient requirements of individual animals or groups of animals should be included in the development of precision livestock feeding

- The success of the development of PLF and precision livestock feeding depends on the automatic and continuous collection of data, data processing and interpretation, and the control of farm processes. The advancement of precision livestock feeding requires the development of new nutritional concepts and mathematical models able to estimate individual animal nutrient requirements in real-time. Further advances for these technologies will require the coordination of different experts (e.g., nutritionists, researchers, engineers, technology suppliers, economists, farmers, and consumers) and stakeholders. For the adoption of PLF and precision livestock feeding the development of integrated user-friendly systems and the end-user training is imperative. The development of PLF will not just be a question of technology, but a successful marriage between knowledge and technology in which improved and intelligent mathematical models will be essential components.

Opportunity

Innovate and bridge gaps to ensure equitable access to advanced feed production, fostering sustainable agriculture and global food security

- The industry that produces commercial feed is very important in global agriculture and has an estimated yearly revenue of over 400 billion USD. The importance of this industry is highlighted by its capacity to satisfy the increasing need for animal protein, propelled mainly by population growth, urbanization, and higher disposable income in developing countries. As more individuals shift to city living and increase their earnings, there is a corresponding increase in the need for meat, dairy, and other products obtained from animals.

- The increased demand for global feed is evident in the growth of production, both in quantity and quality. To cater to the growing population, commercial feed producers are constantly developing and adjusting, making use of cutting-edge technologies and methods to increase productivity and production. The increase in feed production helps maintain the livestock sector and also contributes to global food security and economic growth.

- However, some areas are seeing quick advancements in feed production, while others are falling behind with consistent or slow growth. Issues like lack of resources, inadequate infrastructure, and regulatory obstacles may hinder the growth of feed production in these regions. Closing these divides and guaranteeing fair access to top-notch feed is crucial for promoting sustainable agricultural growth and tackling worldwide food security issues.

Ruminant Feed Market Segment Analysis:

Ruminant Feed Market is Segmented on the basis of Animal Type, Feed Type, Ingredient type, and End-user.

By Animal Type, Cattle Segment Is Expected to Dominate the Market During the Forecast Period

- The animal feed market was led by the cattle sector in 2023, due to the strong worldwide interest in beef and dairy items. This request emphasizes the significance of well-balanced nutrition feeds for promoting optimal cattle growth, milk production, and overall health. Sheep and goats have different needs compared to cattle, so they need specific feed formulations despite sharing some nutritional requirements. The demand for sheep and goat feed is on the rise because of the growing popularity of lamb and goat meat, in addition to the increasing recognition of the advantages of tailored nutrition for these creatures.

- There is a high demand for dairy cattle feed that is expected to keep increasing due to the growing consumption of milk and milk products. Likewise, there is significant potential for growth in the beef cattle feed sector. Although beef cattle typically roam freely and graze on pasture, higher demand and extreme drought in certain areas have caused a shift towards using ruminant feed to help them grow larger and reach marketable sizes.

- In general, these elements are causing a strong worldwide need for ruminant feed, which is expected to propel market expansion throughout the evaluation period. This increase mirrors the overall patterns in the livestock sector, where a specialized diet and the capacity to adjust to environmental obstacles are vital to fulfilling the increasing need for animal goods.

- Based on the data from the FAS/USDA(Head) and other sources, the global distribution of cattle population in 2022-2023 highlights significant regional variations. India has the largest cattle population, reflecting its deep-rooted agricultural practices and cultural reverence for cattle. Brazil follows, driven by its vast pasturelands and major beef production industry. China, with its increasing demand for dairy and meat products, also has a substantial cattle population. The United States and the European Union are prominent due to their advanced dairy and beef industries.

By Ingredient Type, Cereals Segment Held the Largest Share In 2023

- The ruminant feed market is divided based on the type of ingredients like cereals, cakes and meals, food wastages, feed additives, and others. Corn, barley, and oats are the main players in the market because of their abundant carbohydrates, which offer crucial energy for ruminant animals. Cakes and meals made from soybeans and canola, sourced from oilseeds, are essential as they provide important protein and fat elements to promote growth, milk production, and overall animal well-being. The importance of high-quality protein sources in ruminant diets is evident in the demand within this sector.

- The cereals industry is seeing advantages from the high worldwide need for animal products, fueled by an increasing population. Cereals are crucial for ideal animal growth and performance as they offer necessary carbohydrates. Fluctuations in the economy have a major effect on the accessibility and cost of cereals, which in turn affects how feed is formulated and the costs for producers. Furthermore, highlighting the importance of sustainable farming and environmental consciousness highlights the significance of cereals as a renewable and resource-efficient source of feed. The significance of cereals in reducing the environmental impact of livestock nutrition is increased by the increased interest of consumers in ethical production methods.

- In 2022, the largest portion of revenue in the cattle feed market was from the cereals and grains sector, thanks to key grain producers like Cargill, Inc. and BASF SE, who streamline costs and logistics by being involved throughout the value chain. Companies like Charoen Pokphand (CP) and Alltech engage in backward integration to manufacture raw materials and final products, thus lowering the expenses related to raw materials.

- The FAO predicts that there will be a 55% rise in dairy products and a 70% increase in beef products by 2050, due to growing demand in developing countries. This request is speeding up the process of industrializing cattle farming, leading to the growth of the ruminant feed market.

Ruminant Feed Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Numerous important factors are causing substantial expansion in the animal feed market in the Asia Pacific region. The need for higher protein intake is increasing because of fast urbanization and an expanding middle class, leading to higher consumption of meat, dairy, and poultry items. The growth of the economy and higher disposable incomes also contribute to this increase in demand. The diverse agricultural surroundings in the area are crucial in determining the availability and acquisition of feed ingredients, impacting the market dynamics as a whole.

- Technological advancements and digital transformation are fueling creativity in feed manufacturing and distribution, resulting in heightened effectiveness and output across the supply chain. The progress in technology is helping producers meet the growing demand more efficiently while still maintaining quality and safety standards. Geopolitical factors such as trade agreements and policies have a strong impact on the Asia Pacific animal feed market. These factors affect the capacity to access markets, conduct trade across regions, and the level of competition, affecting stakeholders at both local and global scales.

- Moreover, there is a growing acknowledgment of the significance of environmental sustainability in the region. This awareness is leading to an increase in the adoption of eco-friendly practices and a rise in demand for sustainable feeding solutions. Producers are increasingly focused on reducing the environmental effects of feed production, aligning with global trends towards sustainability and responsible consumption.

- Overall, the Asia Pacific animal feed market experiences significant growth and evolving characteristics due to a range of factors including economic, technological, geopolitical, and environmental influences.

Ruminant Feed Market Active Players

- Cargill Inc. (US)

- Archer Daniels Midland Company (ADM) (US)

- Nutreco N.V. (Netherlands)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Charoen Pokphand Group (Thailand)

- DSM N.V. (Netherlands)

- Land O Lakes Inc. (US)

- JBS S.A (Brazil)

- Tyson Foods Inc. (US)

- Perdue Farms Inc. (US)

- BRF Ingredients (Brazil)

- New Hope Group (China)

- Muyuan Foods (China)

- ForFarmers N.V. (Netherlands)

- Alltech Inc. (US)

- De Heus (Netherlands)

- Haid Group (China)

- Chr. Hansen A/S (Denmark)

- Kemin Industries Inc. (US)

- Balchem Corporation (US)

- Ridley Corporation Limited (Australia)

- Kent Nutrition Group, Inc. (US)

|

Ruminant Feed Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 527 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.1 % |

Market Size in 2032: |

USD 756.6 Mn. |

|

Segments Covered: |

By Animal type |

|

|

|

By Feed Type |

|

||

|

By Ingredient type |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ruminant Feed Market by Animal type (2018-2032)

4.1 Ruminant Feed Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cattles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Goats

4.5 Sheep

Chapter 5: Ruminant Feed Market by Feed Type (2018-2032)

5.1 Ruminant Feed Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Forage

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Concentrates

5.5 Mixed Rations

Chapter 6: Ruminant Feed Market by Ingredient type (2018-2032)

6.1 Ruminant Feed Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cereals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Oil Cakes& Meals

6.5 Feed Additives

6.6 Food Wastages

Chapter 7: Ruminant Feed Market by End-user (2018-2032)

7.1 Ruminant Feed Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Veterinary Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Dairy Farm

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Ruminant Feed Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CARGILL INC. (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 ARCHER DANIELS MIDLAND COMPANY (ADM) (US)

8.4 NUTRECO N.V. (NETHERLANDS)

8.5 BASF SE (GERMANY)

8.6 EVONIK INDUSTRIES AG (GERMANY)

8.7 CHAROEN POKPHAND GROUP (THAILAND)

8.8 DSM N.V. (NETHERLANDS)

8.9 LAND O LAKES INC. (US)

8.10 JBS S.A (BRAZIL)

8.11 TYSON FOODS INC. (US)

8.12 PERDUE FARMS INC. (US)

8.13 BRF INGREDIENTS (BRAZIL)

8.14 NEW HOPE GROUP (CHINA)

8.15 MUYUAN FOODS (CHINA)

8.16 FORFARMERS N.V. (NETHERLANDS)

8.17 ALLTECH INC. (US)

8.18 DE HEUS (NETHERLANDS)

8.19 HAID GROUP (CHINA)

8.20 CHR. HANSEN A/S (DENMARK)

8.21 KEMIN INDUSTRIES INC. (US)

8.22 BALCHEM CORPORATION (US)

8.23 RIDLEY CORPORATION LIMITED (AUSTRALIA)

8.24 KENT NUTRITION GROUP INC. (US)

8.25 PURINA ANIMAL NUTRITION LLC (US)

8.26 AB VISTA (UK)

8.27 BENTOLI (US)

8.28 HIPRO ANIMAL NUTRITION (CHINA)

8.29 HI-PRO FEEDS LP (CANADA)

8.30 J. GRENNAN AND SONS (IRELAND)

8.31 PARRY NUTRACEUTICAL (INDIA)

Chapter 9: Global Ruminant Feed Market By Region

9.1 Overview

9.2. North America Ruminant Feed Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Animal type

9.2.4.1 Cattles

9.2.4.2 Goats

9.2.4.3 Sheep

9.2.5 Historic and Forecasted Market Size by Feed Type

9.2.5.1 Forage

9.2.5.2 Concentrates

9.2.5.3 Mixed Rations

9.2.6 Historic and Forecasted Market Size by Ingredient type

9.2.6.1 Cereals

9.2.6.2 Oil Cakes& Meals

9.2.6.3 Feed Additives

9.2.6.4 Food Wastages

9.2.7 Historic and Forecasted Market Size by End-user

9.2.7.1 Veterinary Hospitals

9.2.7.2 Dairy Farm

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Ruminant Feed Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Animal type

9.3.4.1 Cattles

9.3.4.2 Goats

9.3.4.3 Sheep

9.3.5 Historic and Forecasted Market Size by Feed Type

9.3.5.1 Forage

9.3.5.2 Concentrates

9.3.5.3 Mixed Rations

9.3.6 Historic and Forecasted Market Size by Ingredient type

9.3.6.1 Cereals

9.3.6.2 Oil Cakes& Meals

9.3.6.3 Feed Additives

9.3.6.4 Food Wastages

9.3.7 Historic and Forecasted Market Size by End-user

9.3.7.1 Veterinary Hospitals

9.3.7.2 Dairy Farm

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Ruminant Feed Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Animal type

9.4.4.1 Cattles

9.4.4.2 Goats

9.4.4.3 Sheep

9.4.5 Historic and Forecasted Market Size by Feed Type

9.4.5.1 Forage

9.4.5.2 Concentrates

9.4.5.3 Mixed Rations

9.4.6 Historic and Forecasted Market Size by Ingredient type

9.4.6.1 Cereals

9.4.6.2 Oil Cakes& Meals

9.4.6.3 Feed Additives

9.4.6.4 Food Wastages

9.4.7 Historic and Forecasted Market Size by End-user

9.4.7.1 Veterinary Hospitals

9.4.7.2 Dairy Farm

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Ruminant Feed Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Animal type

9.5.4.1 Cattles

9.5.4.2 Goats

9.5.4.3 Sheep

9.5.5 Historic and Forecasted Market Size by Feed Type

9.5.5.1 Forage

9.5.5.2 Concentrates

9.5.5.3 Mixed Rations

9.5.6 Historic and Forecasted Market Size by Ingredient type

9.5.6.1 Cereals

9.5.6.2 Oil Cakes& Meals

9.5.6.3 Feed Additives

9.5.6.4 Food Wastages

9.5.7 Historic and Forecasted Market Size by End-user

9.5.7.1 Veterinary Hospitals

9.5.7.2 Dairy Farm

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Ruminant Feed Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Animal type

9.6.4.1 Cattles

9.6.4.2 Goats

9.6.4.3 Sheep

9.6.5 Historic and Forecasted Market Size by Feed Type

9.6.5.1 Forage

9.6.5.2 Concentrates

9.6.5.3 Mixed Rations

9.6.6 Historic and Forecasted Market Size by Ingredient type

9.6.6.1 Cereals

9.6.6.2 Oil Cakes& Meals

9.6.6.3 Feed Additives

9.6.6.4 Food Wastages

9.6.7 Historic and Forecasted Market Size by End-user

9.6.7.1 Veterinary Hospitals

9.6.7.2 Dairy Farm

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Ruminant Feed Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Animal type

9.7.4.1 Cattles

9.7.4.2 Goats

9.7.4.3 Sheep

9.7.5 Historic and Forecasted Market Size by Feed Type

9.7.5.1 Forage

9.7.5.2 Concentrates

9.7.5.3 Mixed Rations

9.7.6 Historic and Forecasted Market Size by Ingredient type

9.7.6.1 Cereals

9.7.6.2 Oil Cakes& Meals

9.7.6.3 Feed Additives

9.7.6.4 Food Wastages

9.7.7 Historic and Forecasted Market Size by End-user

9.7.7.1 Veterinary Hospitals

9.7.7.2 Dairy Farm

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Ruminant Feed Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 527 Mn. |

|

Forecast Period 2024-32 CAGR: |

4.1 % |

Market Size in 2032: |

USD 756.6 Mn. |

|

Segments Covered: |

By Animal type |

|

|

|

By Feed Type |

|

||

|

By Ingredient type |

|

||

|

By End-user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||