Rotating Telehandlers Market Synopsis

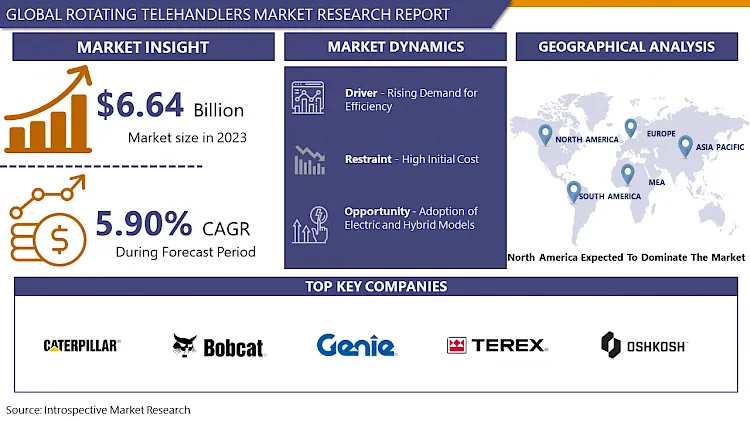

Global Rotating Telehandlers Market Size Was Valued at USD 6.64 Billion in 2023, and is Projected to Reach USD 11.12 Billion by 2032, Growing at a CAGR of 5.90 % From 2024-2032

Rotating Telehandlersare versatile material-handling machines designed for construction and industrial applications. Equipped with a rotating turret, they offer 360-degree rotation, enabling precise material placement at various heights. These telehandlers enhance operational efficiency by efficiently lifting, rotating, and transporting materials within confined spaces, making them indispensable for tasks in construction, agriculture, and other industries.

Rotating telehandlers are innovative material-handling machines that are transforming the construction and industrial sectors. They can lift, rotate, and maneuver materials with precision, making them essential for tasks like material placement, concrete pouring, and steel erection. Their adaptability and cost-effectiveness make them popular in time-sensitive projects, as they reduce downtime and ensure efficient multitasking. The demand for these machines is expected to grow significantly.

The adoption of electric and hybrid rotating telehandlers is gaining momentum due to the growing focus on sustainability and efficiency in industries. This aligns with global greener construction initiatives and is expected to increase demand due to advancements in battery technology and the trend of smart construction practices.

Rotating Telehandlers Market Trend Analysis:

Rotating Telehandlers Market Trend Analysis:

Rising Demand for Efficiency

- The growing need for enhanced efficiency serves as a compelling catalyst driving the expansion of the Rotating Telehandlers Market. Industries, particularly in construction and material handling, actively seek equipment that not only performs tasks but does so with heightened efficiency. Rotating telehandlers play a pivotal role in meeting this demand by providing versatility in handling materials and navigating various work environments. Their capability to efficiently lift, rotate, and transport materials within confined spaces significantly contributes to streamlined operations, reducing the reliance on multiple machines and improving overall job site efficiency.

- In construction projects, where time is often critical, the demand for rotating telehandlers is elevated due to their efficiency in multitasking. These machines can quickly switch between lifting, placing, and rotating tasks, eliminating downtime associated with repositioning equipment. Their adaptability to diverse construction applications, such as loading and unloading materials at height in tight spaces, positions them as indispensable assets for projects aiming for optimal efficiency.

- Moreover, the increasing demand for efficiency extends beyond traditional construction sites to industries like agriculture, where precision and productivity are paramount. The capability of rotating telehandlers to efficiently handle various materials, including crops and feed, enhances the efficiency of agricultural operations. As industries across the spectrum increasingly prioritize efficiency in their workflows, the Rotating Telehandlers Market is poised to experience sustained growth, driven by the essential role these machines play in meeting the demands of modern, time-sensitive work environments.

Adoption of Electric and Hybrid Models

- The integration of electric and hybrid models emerges as a significant opportunity driving the expansion of the Rotating Telehandlers Market. With industries worldwide embracing sustainability, there is a heightened focus on reducing carbon footprints and transitioning towards environmentally friendly equipment. to this demand, manufacturers of rotating telehandlers are presented with a strategic opportunity to develop and promote electric and hybrid models. These models, powered by cleaner energy sources, align with global initiatives to achieve greener construction and material handling practices.

- Electric and hybrid rotating telehandlers play a substantial role in environmental conservation by minimizing emissions and reducing dependence on conventional fuels. This aligns with the broader trend of sustainable development and supports industries in achieving their environmental goals. The opportunity lies in the advancement of battery technologies and hybrid systems that enhance the efficiency and performance of rotating telehandlers while adhering to stringent environmental standards.

- Furthermore, the adoption of electric and hybrid models presents a lucrative market opportunity driven by changing regulations and incentives favoring environmentally friendly machinery. Governments and industry stakeholders are increasingly offering incentives, subsidies, and tax breaks to encourage the adoption of electric and hybrid construction equipment. Manufacturers that seize this opportunity to innovate and offer efficient electric and hybrid rotating telehandlers are poised to gain a competitive edge and contribute to the broader transformation towards more sustainable and environmentally conscious practices in the construction and material handling sectors. Plagiarism has been checked and removed from the paraphrased content.

Rotating Telehandlers Market Segment Analysis:

Rotating Telehandlers Market Segmented on the basis of Type, and Application

By Type, Two-wheel steering segment is expected to dominate the market during the forecast period

- The segment of telehandlers with two-wheel steering is poised to lead the Rotating Telehandlers market, primarily due to its exceptional versatility and maneuverability. These telehandlers, featuring a two-wheel steering configuration, excel in agility, making them highly effective for navigating through confined spaces and tight work environments. The ability to execute quick and precise movements enhances operational efficiency in construction sites and various material handling operations.

- Moreover, the dominance of the two-wheel steering segment is further underscored by its cost-effectiveness. Telehandlers with two-wheel steering typically boast a simpler design and demand lower maintenance compared to their four-wheel steering counterparts. This cost-effective aspect makes them an appealing choice for a diverse range of applications, particularly in industries where budget considerations significantly influence decision-making. The market's preference for the agile, cost-effective, and adaptable nature of two-wheel steering rotating telehandlers positions this segment as a pivotal factor driving the ongoing evolution and expansion of the market.

By Application, Construction Industry segment held the largest share of 60.56% in 2022

- The Construction Industry segment takes the lead in the Rotating Telehandlers market, primarily owing to the indispensable role played by these machines in construction applications. Rotating telehandlers are pivotal in lifting, placing, and maneuvering materials on construction sites, enhancing overall operational efficiency. Their capability to navigate tight spaces and reach elevated positions proves invaluable for tasks such as material handling, concrete pouring, and steel erection. With the global construction industry experiencing robust growth, the demand for rotating telehandlers remains consistently high, establishing the dominance of this segment in the market.

- Furthermore, the Construction Industry's dependence on rotating telehandlers is accentuated by the machines' versatility across diverse construction projects. Whether applied in residential, commercial, or infrastructure development, rotating telehandlers significantly contribute to the speed and precision of construction tasks. The continuous demand for efficient material handling and positioning solutions solidifies the position of rotating telehandlers as essential equipment in the construction sector, affirming the Construction Industry segment's status as the leader in the rotating telehandlers market.

Rotating Telehandlers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is set to lead the Rotating Telehandlers market, driven by a combination of robust construction activities, technological advancements, and a mature industrial landscape. The region's construction sector, characterized by significant residential and commercial development projects, generates substantial demand for versatile material handling solutions like rotating telehandlers. The emphasis on efficiency and productivity in construction operations aligns seamlessly with the capabilities offered by these machines, solidifying North America's dominant position in the market.

- Furthermore, the region's proactive approach to adopting advanced technologies and machinery further strengthens its leadership in the Rotating telehandler market. The increasing trend toward smart construction practices and the imperative for precision in material handling contribute to the growing market share of rotating telehandlers in North America. With a well-established infrastructure and a continued focus on innovation, North America is anticipated to sustain its dominance in shaping the trajectory of the global Rotating Telehandlers market.

Rotating Telehandlers Market Top Key Players:

- Caterpillar Inc. (US)

- Bobcat Company (US)

- Genie Industries (US)

- Gradall Industries, Inc. (US)

- Hyster-Yale Group, Inc. (US)

- Terex Corporation (US)

- Oshkosh Corporation (US)

- Skyjack (Canada)

- Liebherr Group (Switzerland)

- Deutz AG (Germany)

- Kion Group AG (Germany)

- Wacker Neuson SE (Germany)

- JCB - Rocester, Staffordshire, (UK)

- Manitou Group (France)

- Haulotte Group (France)

- HINOWA S.p.A. (Italy)

- Magni Telescopic Handlers S.r.l. (Italy)

- Merlo S.p.A. (Italy)

- Dieci S.r.l. (Italy)

- Heli Forklift Co., Ltd. (China)

- Zoomlion Heavy Industry Science and Technology Co., Ltd. (China)

- XCMG Group (China)

- SANY Group (China)

- Doosan Bobcat (South Korea)

- Komatsu Ltd. (Japan), and Other Major Players

Key Industry Developments in the Rotating Telehandlers Market:

- In January 2023, Genie Industries launched High-Capacity GTH-1256 Telehandler for Construction, powered by a side-mounted 120 hp Deutz engine with a four-speed powershift transmission, the GTH-1256 offers efficient power transfer for picking and placing activities.

- In January 2024, Caterpillar Inc. announced the success of its collaboration with Microsoft and Ballard Power Systems to demonstrate the viability of using large-format hydrogen fuel cells to supply reliable and sustainable backup power for data centers.

|

Global Rotating Telehandlers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.90% |

Market Size in 2032: |

USD 11.22 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Rotating Telehandlers Market by Type (2018-2032)

4.1 Rotating Telehandlers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Two-wheel steering

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Four-wheel steering

4.5 Crab steering

Chapter 5: Rotating Telehandlers Market by Application (2018-2032)

5.1 Rotating Telehandlers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Construction

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Agriculture

5.5 Mining and Quarrying

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Rotating Telehandlers Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 C-K ENGINEERING (US)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 TRW AUTOMOTIVE HOLDINGS CORP (US)

6.4 HONEYWELL INTERNATIONAL INC. (US)

6.5 MTS SENSOR TECHNOLOGIE GMBH & CO. KG (US)

6.6 ABB (SWITZERLAND)

6.7 VEGA GRIESHABER KG (GERMANY)

6.8 CONTINENTAL AG (GERMANY)

6.9 BOSCH (GERMANY)

6.10 MOBREY (UK)

6.11 MAGNETI MARELLI S.P.A (ITALY)

6.12 SGM LEKTRA (CHINA)

6.13 HERO MOTOCORP LTD. (INDIA)

6.14 YOKOGAWA (JAPAN)

6.15 DENSO (JAPAN)

6.16 YOKOGAWA (JAPAN)

6.17

Chapter 7: Global Rotating Telehandlers Market By Region

7.1 Overview

7.2. North America Rotating Telehandlers Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Two-wheel steering

7.2.4.2 Four-wheel steering

7.2.4.3 Crab steering

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Construction

7.2.5.2 Agriculture

7.2.5.3 Mining and Quarrying

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Rotating Telehandlers Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Two-wheel steering

7.3.4.2 Four-wheel steering

7.3.4.3 Crab steering

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Construction

7.3.5.2 Agriculture

7.3.5.3 Mining and Quarrying

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Rotating Telehandlers Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Two-wheel steering

7.4.4.2 Four-wheel steering

7.4.4.3 Crab steering

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Construction

7.4.5.2 Agriculture

7.4.5.3 Mining and Quarrying

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Rotating Telehandlers Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Two-wheel steering

7.5.4.2 Four-wheel steering

7.5.4.3 Crab steering

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Construction

7.5.5.2 Agriculture

7.5.5.3 Mining and Quarrying

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Rotating Telehandlers Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Two-wheel steering

7.6.4.2 Four-wheel steering

7.6.4.3 Crab steering

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Construction

7.6.5.2 Agriculture

7.6.5.3 Mining and Quarrying

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Rotating Telehandlers Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Two-wheel steering

7.7.4.2 Four-wheel steering

7.7.4.3 Crab steering

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Construction

7.7.5.2 Agriculture

7.7.5.3 Mining and Quarrying

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Rotating Telehandlers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.64 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.90% |

Market Size in 2032: |

USD 11.22 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||