Rice Market Synopsis

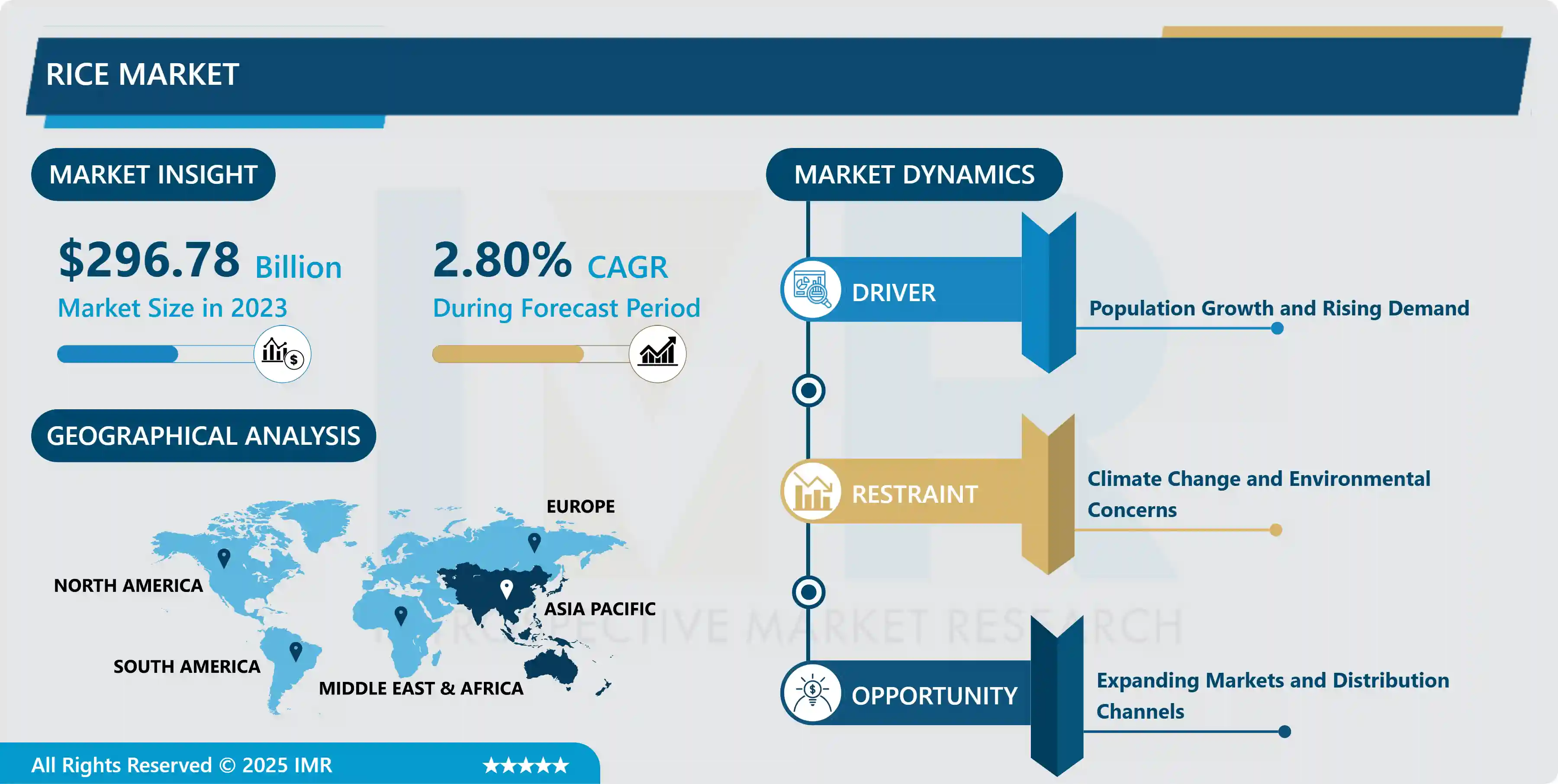

Rice Market Size Was Valued at USD 296.78 Billion in 2023 and is Projected to Reach USD 380.52 Billion by 2032, Growing at a CAGR of 2.8% From 2024-2032.

Rice, a starchy cereal grain and grass plant, is a staple food for about half of the world's population, including most of East and Southeast Asia. It is cooked by boiling or ground into flour and is consumed in various Asian, Middle Eastern, and other cuisines. Rice is also used in breakfast cereals, noodles, and alcoholic beverages like Japanese sake. Humans consume the majority of the world's rice crop.

The harvested rice kernel, paddy or rough rice, is enclosed by the hull or husk. Milling removes both the hull and bran layers, giving the kernel a glossy finish. Brown rice, processed only to remove the husks, contains about 8% protein and small amounts of fats, while white rice, milled to remove the bran, is significantly diminished in nutrients. White rice can lead to beriberi, a disease caused by thiamine and mineral deficiency. Parboiled white rice is processed before milling to retain most nutrients, while enriched rice contains iron and B vitamins.

Most of Asia's milling methods are primitive, with large mills operating in Japan and other regions. Hulling rice is typically done using pestle and mortar, but improvements are being made. The yield of milled rice depends on grain size, ripeness, and sun exposure. Large mills handle 500 to 1,000 tons of paddy daily and use modern milling techniques, relying on controlled drying plants instead of sun drying.

Milling by-products, such as bran and rice polish, are used as livestock feed, oil for food and industrial purposes, and broken rice for brewing, distilling, starch, and flour production. Hulls are used for fuel, packing material, industrial grinding, fertilizer, and furfural production. Straw is used for feed, livestock bedding, mats, garments, packing material, and broomstraws.

Rice Market Trend Analysis

Population Growth and Rising Demand

- Rice consumption growth has slowed or become negative globally, with Africa experiencing additional per capita demand. Future demand will mainly come from population growth in Africa and Asia. Past production growth has met global rice demand, but Africa still lags behind other continents in achieving desired yield levels. Further research is needed to produce varieties with higher yield potential and grain quality, focusing on Africa. The global demand for rice is expected to be 584 million tons or less by 2050. Technological developments will change rice agriculture, with Asia losing 5 million hectares and Africa gaining 10 million hectares by 2050.

- The global population growth, especially in regions where rice is a staple food, is causing a rise in demand for rice. This demand is driven by rising incomes and urbanization in developing countries, where people are shifting towards convenience foods and higher disposable incomes, which enable them to afford premium rice varieties and value-added products, further driving market growth. Rice is a primary source of calories and sustenance for billions worldwide.

Expanding Markets and Distribution Channels

- Globalization and advancements in transportation and communication enable rice producers to expand into new regions and consumer segments, increasing market penetration and revenue generation. Diversification of distribution channels, such as online platforms, supermarkets, specialty stores, and food service outlets, allows producers to cater to diverse consumer preferences. Emerging trends and consumer demands, such as convenience, organic, or specialty rice varieties, can differentiate offerings. Expanding markets also provide opportunities for innovation and product development, enhancing brand visibility and loyalty.

- Expanding rice markets and distribution channels can help rice producers enter regions with growing demand, such as emerging economies with rapid urbanization and rising incomes. These markets offer the potential for significant consumption growth, making them attractive for expansion and investment. E-commerce platforms and digital marketing enable rice producers to engage directly with consumers, bypassing intermediaries and gaining insights into consumer preferences. Strategic partnerships with retailers, distributors, and food service providers enhance market reach and accessibility. By capitalizing on these opportunities, rice producers can maximize their market share, revenue, and long-term sustainability in the global rice market.

Rice Market Segment Analysis:

Rice Market Segmented on the basis of Type, Grain Type, Application, and Distribution Channel.

By Type, Indica Rice segment is expected to dominate the market during the forecast period

- Indica varieties, which make up 80% of rice cultivation, are resistant to tissue culture and transformation. To maximize the use of biotechnology in global rice production, an efficient protocol for indica transformation using Agrobacterium tumefaciens is proposed. Immature embryos are co-cultivated with A. tumefaciens after pretreatment. This method has been successfully tested in elite indica cultivars, yielding between 5 and 15 independent transgenic plants per immature embryo. Immature embryos are recommended for gene transfer due to their efficiency and less genotype dependence compared to calluses.

- Indica rice, primarily grown in South and Southeast Asia, is favored by large populations with a strong cultural preference. This demographic factor contributes to its dominance in these markets. Indica rice varieties are known for their higher yields and adaptability to diverse climatic conditions, making them a preferred choice for farmers seeking reliable crop performance and economic returns. The Indica rice segment is anticipated to dominate the rice market due to several factors.

By Application, Human Consumption segment is expected to dominate the market during the forecast period

- Rice is a vital source of carbohydrates, essential for energy and exercise. Brown rice is a rich source of nutrients like fiber, manganese, selenium, magnesium, and B vitamins. Dietary Guidelines recommend at least half of grains be whole grains, including brown rice. Rice is a staple food for a significant portion of the global population, particularly in Asia, Africa, and Latin America. Its affordability, versatility, and nutritional value make it essential in daily diets. With increasing global population urbanization, and rising incomes in developing countries, the demand for rice as a primary source of calories and nutrients is expected to rise. Cultural preferences and culinary traditions also favor rice consumption, making it a central part of the culinary heritage of numerous cultures worldwide.

- Rice's dominance in the human consumption segment is due to its health benefits, gluten-free nature, low-fat content, and essential vitamins, minerals, and dietary fiber. As awareness of these health benefits grows, demand for rice as a staple food in balanced diets continues to rise. Rice's versatility in culinary applications, from traditional dishes like sushi and paella to modern adaptations in salads, desserts, and beverages, further contributes to its popularity among consumers seeking diverse and flavorful meal options.

Rice Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Rice is a staple food in many Asian countries, with its population size and consumption tradition driving global demand. The Asia Pacific region's diverse rice varieties, including Basmati and Jasmine rice, contribute to its dominance in the market. The Asia Pacific region, including countries like China, India, Indonesia, Bangladesh, and Vietnam, is a major producer of rice due to its large population base, cultural significance, and production power. Rice is a staple food in many Asian societies, playing a central role in traditions, rituals, and celebrations.

- The region's favorable climatic conditions, extensive cultivation areas, and centuries-old agricultural practices contribute to its dominance in rice production. Government support, such as subsidies, price controls, and investment in agricultural infrastructure, ensures food security, stabilizes prices, and supports rural livelihoods. Several Asian countries, like Thailand, Vietnam, and India, are significant exporters of rice to regional and global markets, bolstering their position as dominant players in the international rice trade. The region's growing population, rapid urbanization, and changing dietary patterns drive increasing demand for rice-based products, including convenience foods, snacks, and ready-to-eat meals.

Rice Market Top Key Players:

- American Rice Inc (US)

- RiceTec AG (US)

- Mahatma Rice (US)

- Riceland Foods (US)

- Louis Dreyfus Company (Netherlands)

- Tilda Ltd. (UK)

- Rice Partners Ltd. (Germany)

- Ebro Foods (Spain)

- SunRice (Australia)

- Amira Nature Foods Ltd (United Arab Emirates)

- Bush Foods Overseas Pvt. Ltd. (India)

- Kohinoor Foods Ltd. (India)

- Dunar Foods Ltd. (India)

- KRBL Limited (India)

- LT Foods (India)

- Indo World Trading Corporation (India)

- Asia Golden Rice (Singapore)

- Olam International (Singapore)

- Thai Rice Exporters Association (Thailand)

- Vietnam Food Association (Vietnam)

- Mega Global Food Industry (Thailand)

- Amado Group (Thailand)

- Windmill Group (Sri Lanka)

- Tsuruha Holdings Inc. (Japan)

- Matco Foods Limited (Pakistan), and Other Major Players.

Key Industry Developments in the Rice Market:

- In March 2023, The cost of rice shipments from Vietnam surged following the reopening of trade routes to China. This uptick was driven by speculation among traders who anticipated heightened demand from buyers seeking alternative sources amid the Russia-Ukraine crisis.

- In January 2023, The Tamil Nadu Agricultural University (TNAU) in India introduced a novel rice strain named 'TRY 5'. Specifically tailored for regions with salt-affected soil, this early-maturing variety offers a promising solution to agricultural challenges in affected areas.

- In May 2024, Clayton Dubilier & Rice (CD&R) finalized the acquisition of Shearer’s Foods from Ontario Teachers’ Pension Plan Board. Shearer’s Foods, known for its diverse range of high-quality snacks, operated across 17 manufacturing facilities in various locations. Former CEO Mark McNeil expressed optimism, citing CD&R’s leadership as a catalyst for accelerating Shearer’s growth trajectory.

|

Global Rice Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 296.78 Bn. |

|

Forecast Period 2024-32 CAGR: |

2.8% |

Market Size in 2032: |

USD 380.52 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Grain Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Rice Market by Type (2018-2032)

4.1 Rice Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Brown Rice

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Indica Rice

4.5 Black Rice

4.6 Red Rice

4.7 Bomba Rice

4.8 Others

Chapter 5: Rice Market by Grain Type (2018-2032)

5.1 Rice Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Long-Grain Rice

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Medium-Grain Rice

5.5 Short-Grain Rice

Chapter 6: Rice Market by Application (2018-2032)

6.1 Rice Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Human Consumption

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Animal Feed

6.5 Industrial Uses

Chapter 7: Rice Market by Distribution Channel (2018-2032)

7.1 Rice Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hypermarket/Supermarket

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Convenience Store

7.5 Departmental Retail Stores

7.6 Online Stores

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Rice Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AMERICAN RICE INC (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 RICETEC AG (US)

8.4 MAHATMA RICE (US)

8.5 RICELAND FOODS (US)

8.6 LOUIS DREYFUS COMPANY (NETHERLANDS)

8.7 TILDA LTD. (UK)

8.8 RICE PARTNERS LTD. (GERMANY)

8.9 EBRO FOODS (SPAIN)

8.10 SUNRICE (AUSTRALIA)

8.11 AMIRA NATURE FOODS LTD (UNITED ARAB EMIRATES)

8.12 BUSH FOODS OVERSEAS PVT. LTD. (INDIA)

8.13 KOHINOOR FOODS LTD. (INDIA)

8.14 DUNAR FOODS LTD. (INDIA)

8.15 KRBL LIMITED (INDIA)

8.16 LT FOODS (INDIA)

8.17 INDO WORLD TRADING CORPORATION (INDIA)

8.18 ASIA GOLDEN RICE (SINGAPORE)

8.19 OLAM INTERNATIONAL (SINGAPORE)

8.20 THAI RICE EXPORTERS ASSOCIATION (THAILAND)

8.21 VIETNAM FOOD ASSOCIATION (VIETNAM)

8.22 MEGA GLOBAL FOOD INDUSTRY (THAILAND)

8.23 AMADO GROUP (THAILAND)

8.24 WINDMILL GROUP (SRI LANKA)

8.25 TSURUHA HOLDINGS INC. (JAPAN)

8.26 MATCO FOODS LIMITED (PAKISTAN)

8.27

Chapter 9: Global Rice Market By Region

9.1 Overview

9.2. North America Rice Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Brown Rice

9.2.4.2 Indica Rice

9.2.4.3 Black Rice

9.2.4.4 Red Rice

9.2.4.5 Bomba Rice

9.2.4.6 Others

9.2.5 Historic and Forecasted Market Size by Grain Type

9.2.5.1 Long-Grain Rice

9.2.5.2 Medium-Grain Rice

9.2.5.3 Short-Grain Rice

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Human Consumption

9.2.6.2 Animal Feed

9.2.6.3 Industrial Uses

9.2.7 Historic and Forecasted Market Size by Distribution Channel

9.2.7.1 Hypermarket/Supermarket

9.2.7.2 Convenience Store

9.2.7.3 Departmental Retail Stores

9.2.7.4 Online Stores

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Rice Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Brown Rice

9.3.4.2 Indica Rice

9.3.4.3 Black Rice

9.3.4.4 Red Rice

9.3.4.5 Bomba Rice

9.3.4.6 Others

9.3.5 Historic and Forecasted Market Size by Grain Type

9.3.5.1 Long-Grain Rice

9.3.5.2 Medium-Grain Rice

9.3.5.3 Short-Grain Rice

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Human Consumption

9.3.6.2 Animal Feed

9.3.6.3 Industrial Uses

9.3.7 Historic and Forecasted Market Size by Distribution Channel

9.3.7.1 Hypermarket/Supermarket

9.3.7.2 Convenience Store

9.3.7.3 Departmental Retail Stores

9.3.7.4 Online Stores

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Rice Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Brown Rice

9.4.4.2 Indica Rice

9.4.4.3 Black Rice

9.4.4.4 Red Rice

9.4.4.5 Bomba Rice

9.4.4.6 Others

9.4.5 Historic and Forecasted Market Size by Grain Type

9.4.5.1 Long-Grain Rice

9.4.5.2 Medium-Grain Rice

9.4.5.3 Short-Grain Rice

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Human Consumption

9.4.6.2 Animal Feed

9.4.6.3 Industrial Uses

9.4.7 Historic and Forecasted Market Size by Distribution Channel

9.4.7.1 Hypermarket/Supermarket

9.4.7.2 Convenience Store

9.4.7.3 Departmental Retail Stores

9.4.7.4 Online Stores

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Rice Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Brown Rice

9.5.4.2 Indica Rice

9.5.4.3 Black Rice

9.5.4.4 Red Rice

9.5.4.5 Bomba Rice

9.5.4.6 Others

9.5.5 Historic and Forecasted Market Size by Grain Type

9.5.5.1 Long-Grain Rice

9.5.5.2 Medium-Grain Rice

9.5.5.3 Short-Grain Rice

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Human Consumption

9.5.6.2 Animal Feed

9.5.6.3 Industrial Uses

9.5.7 Historic and Forecasted Market Size by Distribution Channel

9.5.7.1 Hypermarket/Supermarket

9.5.7.2 Convenience Store

9.5.7.3 Departmental Retail Stores

9.5.7.4 Online Stores

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Rice Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Brown Rice

9.6.4.2 Indica Rice

9.6.4.3 Black Rice

9.6.4.4 Red Rice

9.6.4.5 Bomba Rice

9.6.4.6 Others

9.6.5 Historic and Forecasted Market Size by Grain Type

9.6.5.1 Long-Grain Rice

9.6.5.2 Medium-Grain Rice

9.6.5.3 Short-Grain Rice

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Human Consumption

9.6.6.2 Animal Feed

9.6.6.3 Industrial Uses

9.6.7 Historic and Forecasted Market Size by Distribution Channel

9.6.7.1 Hypermarket/Supermarket

9.6.7.2 Convenience Store

9.6.7.3 Departmental Retail Stores

9.6.7.4 Online Stores

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Rice Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Brown Rice

9.7.4.2 Indica Rice

9.7.4.3 Black Rice

9.7.4.4 Red Rice

9.7.4.5 Bomba Rice

9.7.4.6 Others

9.7.5 Historic and Forecasted Market Size by Grain Type

9.7.5.1 Long-Grain Rice

9.7.5.2 Medium-Grain Rice

9.7.5.3 Short-Grain Rice

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Human Consumption

9.7.6.2 Animal Feed

9.7.6.3 Industrial Uses

9.7.7 Historic and Forecasted Market Size by Distribution Channel

9.7.7.1 Hypermarket/Supermarket

9.7.7.2 Convenience Store

9.7.7.3 Departmental Retail Stores

9.7.7.4 Online Stores

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Rice Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 296.78 Bn. |

|

Forecast Period 2024-32 CAGR: |

2.8% |

Market Size in 2032: |

USD 380.52 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Grain Type |

|

||

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||