RF Transceiver Chip Market Synopsis

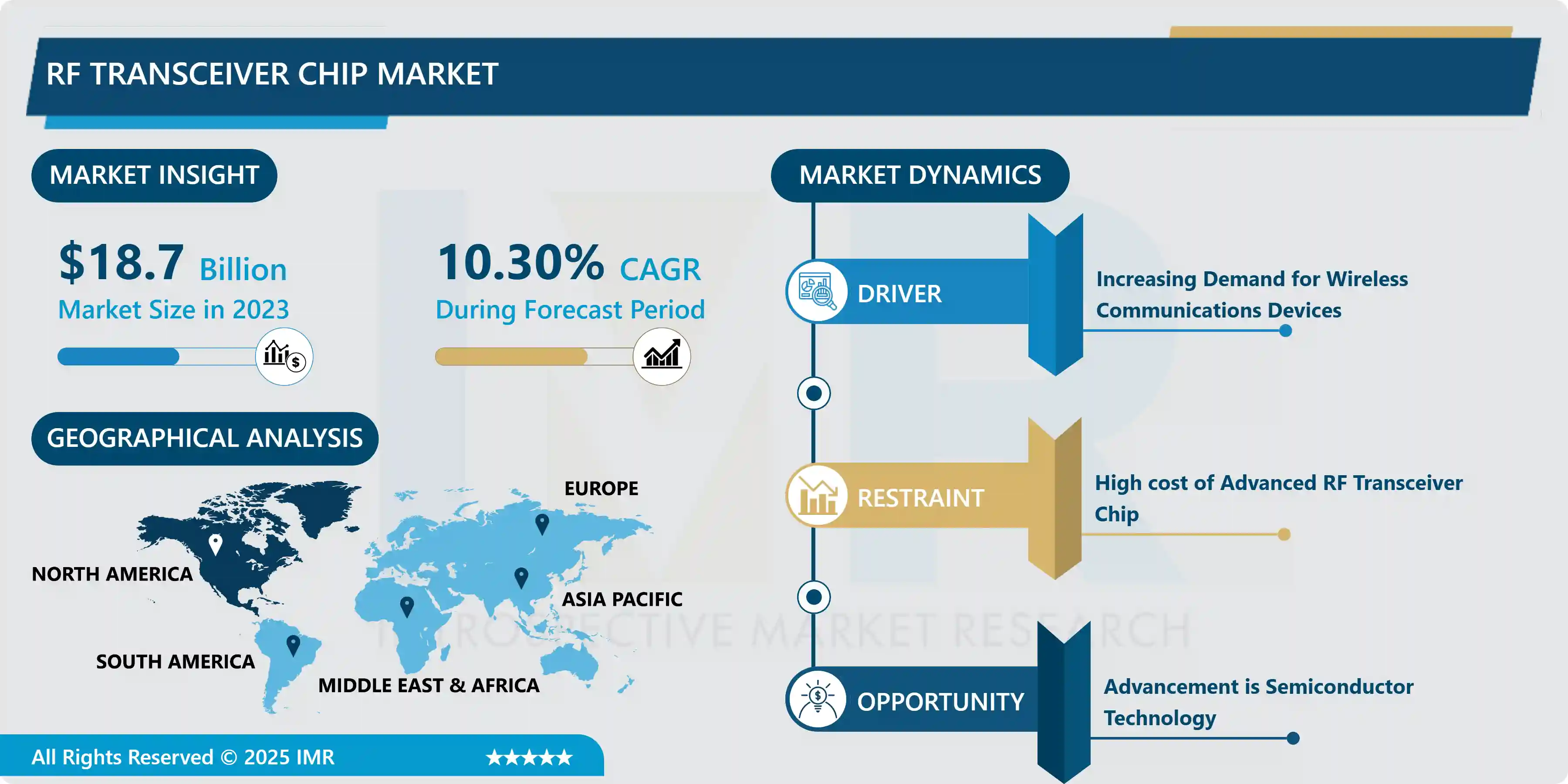

RF Transceiver Chip Market Size Was Valued at USD 18.7 Billion in 2023, and is Projected to Reach USD 45.3 Billion by 2032, Growing at a CAGR of 10.3% From 2024-2032.

Increasing demand for wireless networking in various industries is the key factor fueling the significant growth of RF transceiver semiconductor market. For the wireless communication Act in device including smartphone, IoT, Automotive system and the like, it is impossible without RF Transceiver Processor.

Some of the key factors that are significant in the advancement of the market include the increasing usage of IoT, the expanding scope of 5G technology, and the growing demand for fast data rates. Moreover, the ongoing progress in the manufacturing of semiconductors boosts the effectiveness as well as efficiency of the processors of RF transceiver which also serves as a driving factor for the growth of the market.

However, a number of regulatory barriers and spectrum issues might create problems and slow down the development of the market. Based on the above discussion it is safe to say that the market for RF transceiver chips will likely grow in the foreseeable future due to continuing innovations in the field of wireless technologies and the steady demand for connectivity.

The RF transceiver semiconductor market has seen significant growth in recent years, fuelled by increasing demand for wireless connectivity across several industries, such as smartphones, IoT (Internet of Things) products, and automobiles. Through the years, the market has seen significant growth due to the focus on novel and enhanced wireless standards such as 5G, Wi-Fi 6, and Bluetooth.

This rapid growth in the innovations of semiconductors has led to the development of RF transceiver processors which are power optimized and are of a high degree of integration. Manufactures have been focusing on increasing the data rate of transmission, reducing latency, and improving the quality of transmission for the various wireless communication systems to better meet the system demands.

The RF transceiver processors have numerous applications including automotive infotainment systems, smart home appliances, mobile devices, industrial automation, healthcare devices and many more. These factors, alongside the growing popularity of smart cities and the overall expansion of the Internet of Things, make for a higher demand for RF transceiver processors.

Some of the leading players in the RF transceiver chips market continue to push for steep competition through extensive research and development. Strategic alliances, cost leadership and legal requirements are all important factors that have an influence on markets. Also, there is potential impact of supply chain disruptions and geopolitical conditions on the price and shipment of RF transceiver processors.

RF Transceiver Chip Market Trend Analysis

5G Integration growing demand for RF transceiver Market

- The change in the market for RF transceiver chips has faced a major trend owing to the rising demand for the 5G technological connectivity. The global growth of 5G network has resulted in the growth in the demand for RF transceiver processors that have capabilities that allow them to meet the complex requirements of 5G technology.

- 5G networks require the enhanced data rate and latency performance as well as for the spectral efficiency in compare with previous generations of wireless technology. Here are some of the key factors that are triggering this trend. Because they make the reception and transmission of signals on High-frequency radio and across the different frequency bands possible, the RF transceiver processors are crucial for the actualization of these abilities.

- To address this demand, manufacturers are now intensively engaged in the process of creating RF transceiver processors that are highly specialized for the needs of 5G. Such processors often feature complex signal processing functional blocks capable of running specific algorithms, multiband/mode support, and enhanced power efficiency to address the high-performance requirements of 5G networks while minimizing power consumption.

- Moreover, the introduction of the 5G option is helping to accelerate the introduction of new communication standards and the use of new frequency bands, which inevitably leads to further development and the need for new radio frequency transceiver processors that provide the necessary flexibility and allow you to work in a wide frequency range and ensure functionality for a variety of communication protocols.

- As a whole, the gradual expansion of the sphere of application of 5G communication technologies leads to market transformations for RF transceiver chips. This trend is a concern for manufacturers as it is necessary to introduce new 5G networks and devices that end-users will find unique and distinct from previous models. We also expect this trend to continue and support the growth in the RF transceiver chip market associated with the broader development and application of 5G networks.

Internet of Things (IoT) Connectivity there's a rising need for RF transceiver chips that can enable seamless connectivity.

- This rising need for 5G connectivity, coupled with the coming together of two fundamental shifts in how IoT devices are connected to the internet, has significantly altered the RF transceiver chip market. There is a growing demand for RF processor transceivers due to the increased use of the Internet of Things (IoT) technology that ensures continuous communication between different devices. In order to support numerous use-cases such as IoT smart homes, manufacturing plants, hospitals’ infrastructure, and so on, these devices require trustworthy and efficient means of communication.

- Similarly, the growing rollout of 5G infrastructure is also spurring increased demand for high-performance RF transceiver processors. The 5G is the fifth generation of wireless technology which is expected to provide high network capacity, low latency, and high rates. The RF transceiver processors are indispensable in achieving these functions given their role in modulating and demodulating high-frequency radio signals in multiple bands through differing modes of operation.

- And it is not hard to understand how the concept of 5G integration and the idea of connecting everything through the IoT become interrelated in the context of the RF transceiver chip development. Chipmakers are exploring the development of chips that can not only handle the many communication standards that IoT devices need to function, but also include the additional features necessary for 5G communication. These processors also commonly include optimized signal processing algorithms and radio hardware, along with support for multiple bands and modes used by IoT applications and 5G networks, as well as powerful efficiency enhancements.

- Moreover, it is expected that the introduction of 5G networks will mean faster adoption of IoT applications and devices because the 5G technology will create the necessary foundation for secure and faster connectivity. Thus, the need for RF transceiver processors capable of supporting and enabling the efficient interconnection of IoT units with 5G networks will also rise.

- In summary, there is a strong need for 5G implementation and the parallel development of IoT devices, which are fuelling new opportunities in the RF transceiver chip market. Nowadays, there are attempts to create chips that meet both the performance requirements of 5G networks and the niche needs peculiar to IoT devices. We expect a strong development and outlooks for the RF transceiver semiconductor market concerning the current and future development of the IoT and 5G areas.

RF Transceiver Chip Market Segment Analysis:

RF Transceiver Chip Market is segmented on the basis of By Type and Application

By Type, Rf Microwave segment is expected to dominate the market during the forecast period

- The RF transceiver semiconductor industry has been growing significantly especially due to the development of the technologies related to wireless communication. This market has been defined to comprise of two distinct segments that include millimeter-wave and RF microwave transceiver circuits.

- RF microwave transceiver circuits are available that operate in a frequency spectrum from 300 MHz to 3000 GHz. Some of the important applications are satellite communication radar system, cellular networks and Wi-Fi and others.

- On the opposite side, millimetre-wave transceiver processors work at increased frequency stages, typically above 30 GHz, up to 300 GHz. They have become quite important in new developing usages like the automotive radar, the autonomous vehicles, and the high-speed wireless backhaul.

- The extended usage of wireless communication technologies in various spheres, growing request for high-speed data transfer and low-latency communication also boosts the demand for such chips as RF transceiver processors.

- Dominant companies in the industry of RF transceiver chip are investing heavily in research and development with the intention of bringing new solutions that will offer better performance, increased efficiency and power, and compactness.

- Moreover, the mutual cooperation and strategic alliances between the other participant of the technology sector market are also the new trend in the sphere in order to accelerate the process of innovation and utilization of other professionals’ skills.

- In the view of rapidly rising demand for faster and more reliable wireless transmissions, the global market for products associated with RF transceiver chips is expected to continue to show a steady growth in the years to come, offering sound opportunities for the existing leaders of the industry, along with new market entrants.

By Application, Military segment held the largest share in 2023

- In particular, the field of military systems is the critical area of ??the application of RF transceiver processors for radar, electronic warfare, communication, and UAV systems and the like. Defence-grade transceiver processors uphold enhanced reliability, safety, and security standards, making communication in difficult conditions possible.

- The development potential of RF transceiver chips is extremely high for a variety of industries related to the civil sphere – automotive, medical, consumer, telecommunications, and industrial industries

- These devices supply power to wireless communication networks, assist with monitoring and controlling surveillance from remote locations, new technologies like the IoT and 5G, and wireless connectivity for smart devices.

- The demand for RF transceiver processors is high, both in the military as well as in the civilian environment. This is due to the increasing number of wireless communication technologies, the requirement of higher connectivity levels and the continuously pursued higher data rates. In addition, there have been significant developments in the production of semiconductors that are being used to produce energy efficient and compact transceiver processors that are very versatile in usage.

- Due to the emphasis given in the ongoing world towards communication capabilities for the military and civil sectors the RF transceiver chip market is expected to show an ongoing growth trend and development for which there is a wide range of opportunities available for the improvements and diversification in a lot of fields.

- The expected effect is that further advancement in the RF transceiver chip technology will be fuelled by the mutual efforts of research institutions and industry participants; thus, the market will be able to address new challenges and activate new ways for entrants to gain a foothold in this constantly transforming sphere.

RF Transceiver Chip Market Regional Insights:

Europe, on the other hand, is a mature market for RF transceiver chips, with countries such as Germany, France, and the United Kingdom leading the region.

- Europe is classified as a developed RF transceiver processor market based on their advancement in technological sectors wherein renowned countries likes Germany, France, and United Kingdom are the main supporters for technology advancement. RF transceiver processors for the telecommunications, automotive, aerospace and defense industries of Europe has a long history of innovation and this is fuelling demand for many years now or for a much longer period of time.

- The RF transceiver chip semiconductor segments in Germany encompasses a number of key organizations that further elevate engineering and innovations within the industry across recognized leader in engineering – the country. Due to the aerospace and defense sectors, France needs effective RF transceiver processors for applications such as satellite communication and radar systems. In a way, similar to the United States, strong leadership positions in the domains of consumer electronics and telecommunications compel the implementation of RF transceiver processors in various industries in the United Kingdom.

- Several other European countries, aside from the trailblazers already mentioned, also play significant roles in the RF transceiver semiconductor market by investing in research and development activities. This encourages collaboration between educational organizations, business companies, and government. Moreover, the EU’s focus on digital agenda, including initiatives like Horizon Europe, creates a favorable environment for investments and R&D of semiconductor technologies, including radio frequency transceiver processors.

- Despite being defined as a mature market, Europe continues to be open to positive growth factors associated with changes in the wireless communication segment and the development of new technologies, including the 5G standard, the IoT. Furthermore, efforts by different governments aimed at enhancing communication and infrastructure are essential factors that would help support the demand for RF transceiver processors and therefore make Europe a significant player in the global semiconductor market.

Active Key Players in the RF Transceiver Chip Market

- Qorvo Inc. (United States)

- Skyworks Solutions Inc. (United States)

- Texas Instruments Incorporated (United States)

- STMicroelectronics N.V. (Switzerland)

- On Semiconductor Corporation (United States)

- Analog Devices Inc. (United States)

- Ericsson (Sweden)

- Broadcom Inc. (United States)

- Qualcomm Incorporated (United States)

- NXP Semiconductors (Netherlands)

- Other Key Players

Key Industry Developments in the RF Transceiver Chip Market

- In June 2024, Qorvo, a leading global provider of connectivity and power solutions, announced the launch of three new highly integrated RF multi-chip modules (MCMs) designed for advanced radar applications. The new modules leveraged Qorvo’s advanced packaging and optimal process technology to deliver the compact size, superior performance, lower noise, and reduced power consumption required for modern phased array and multifunction radar systems.

- In May 2024, Skyworks announced the introduction of the Si82Ex/Fx Value and Performance Isolated Gate Drivers. Integrating a decade of customer feedback, the next-generation value and performance isolated gate driver families provided an upgrade path from the Si823x and Si823Hx ISODrivers. The Si82Ex value driver offered backward compatibility and a traditional voltage-controlled design paradigm, utilizing Skyworks' advanced, proprietary silicon isolation technology, which supported 6 kVRMS for one minute of isolation voltage.

Global RF Transceiver Chip Market Scope:

|

RF Transceiver Chip Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.3% |

Market Size in 2032: |

USD 45.3 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: RF Transceiver Chip Market by Type (2018-2032)

4.1 RF Transceiver Chip Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Rf Microwave

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Millimeter Wave

Chapter 5: RF Transceiver Chip Market by Application (2018-2032)

5.1 RF Transceiver Chip Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Military

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Civil

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 RF Transceiver Chip Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BAKER HUGHES COMPANY (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CAMERON INTERNATIONAL CORPORATION (U.S.)

6.4 SHELL (U.S.)

6.5 MCDERMOTT (U.S.)

6.6 WEATHERFORD INTERNATIONAL (U.S.)

6.7 NOV INC. (U.S.)

6.8 THYSSENKRUPP AG (GERMANY)

6.9 PETROFAC LIMITED (U.K.)

6.10 TECHNIPFMC PLC (U.K.)

6.11 FUGRO (NETHERLANDS)

6.12 TRANSOCEAN LTD (SWITZERLAND)

6.13 KONGSBERG MARITIME (NORWAY)

6.14 SAIPEM (ITALY)

6.15 WORLEY (AUSTRALIA)

6.16 KEPPEL CORPORATION (SINGAPORE)

6.17 MITSUBISHI HEAVY INDUSTRIES LTD (JAPAN)

6.18 YINSON HOLDINGS BERHAD (MALAYSIA)

6.19 HYUNDAI HEAVY INDUSTRIES COLTD (SOUTH KOREA)

6.20

Chapter 7: Global RF Transceiver Chip Market By Region

7.1 Overview

7.2. North America RF Transceiver Chip Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Rf Microwave

7.2.4.2 Millimeter Wave

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Military

7.2.5.2 Civil

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe RF Transceiver Chip Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Rf Microwave

7.3.4.2 Millimeter Wave

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Military

7.3.5.2 Civil

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe RF Transceiver Chip Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Rf Microwave

7.4.4.2 Millimeter Wave

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Military

7.4.5.2 Civil

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific RF Transceiver Chip Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Rf Microwave

7.5.4.2 Millimeter Wave

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Military

7.5.5.2 Civil

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa RF Transceiver Chip Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Rf Microwave

7.6.4.2 Millimeter Wave

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Military

7.6.5.2 Civil

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America RF Transceiver Chip Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Rf Microwave

7.7.4.2 Millimeter Wave

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Military

7.7.5.2 Civil

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

Global RF Transceiver Chip Market Scope:

|

RF Transceiver Chip Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 18.7 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.3% |

Market Size in 2032: |

USD 45.3 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||