Refrigerants Market Synopsis:

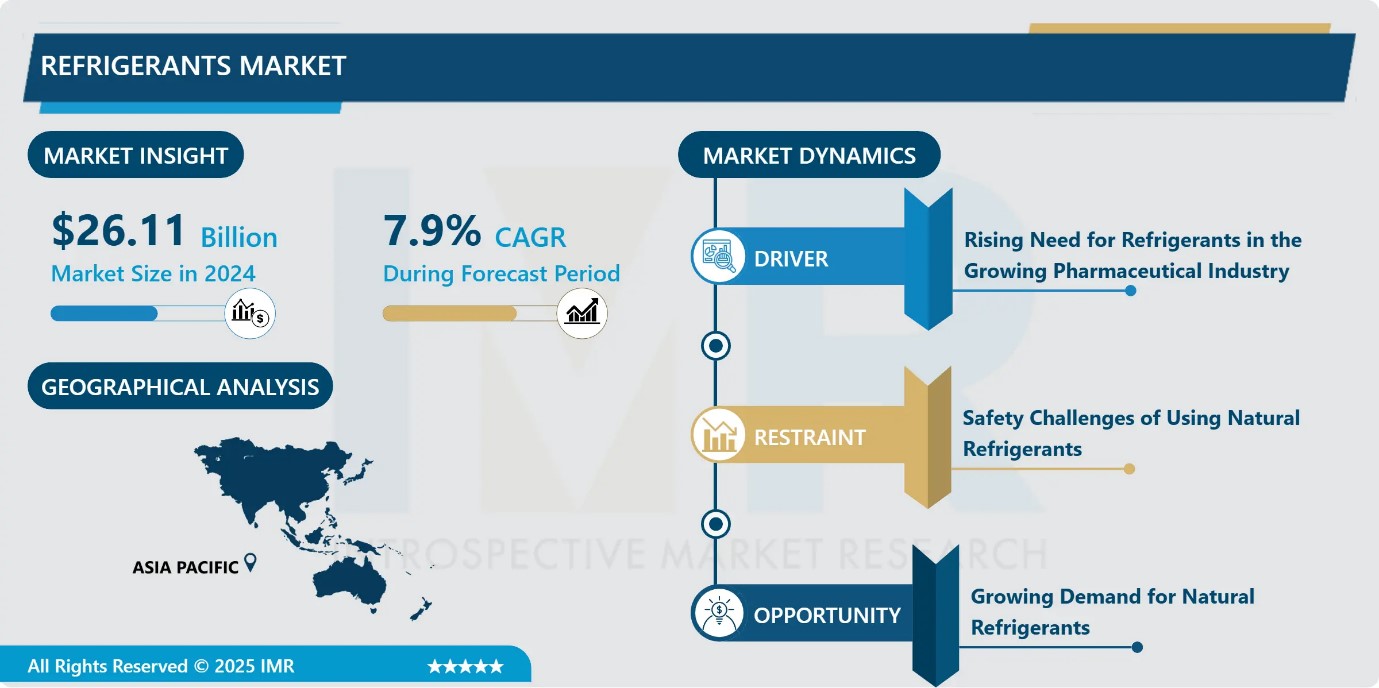

The Refrigerants Market Size Was Valued at USD 26.11 Billion in 2024, and is Projected to Reach USD 60.26 Billion by 2035, Growing at a CAGR of 7.9% From 2025–2035.

The refrigerants market is growing steadily as the demand for cooling appliances like air conditioners, refrigerators, and freezers increases around the world. Refrigerants are the fluids used in cooling systems to absorb and release heat. These are essential in homes, vehicles, and industries for keeping things cold and maintaining comfortable temperatures. As more people live in urban areas and global temperatures rise, the need for air conditioning and refrigeration grows.

At the same time, governments and organizations are pushing for refrigerants that are safer for the environment. Older refrigerants, such as CFCs and HCFCs, harm the ozone layer and contribute to global warming. Because of this, countries are switching to newer, eco-friendly refrigerants with low global warming potential (GWP). Regulations and programs like the U.S. Environmental Protection Agency’s SNAP (Significant New Alternatives Policy) are helping guide this change. Additionally, the U.S. Department of Energy (DOE) is working to make energy use in buildings more efficient, which also supports the use of better refrigerants. Overall, the market is expected to grow strongly as both demand and environmental awareness increase.

Refrigerants Market Growth and Trend Analysis:

Refrigerants Market Growth Driver - Rising Need for Refrigerants in the Growing Pharmaceutical Industry

- The Refrigerants market is a sector of the global economy that produces and distributes refrigerants, which are substances used to cool and preserve food and other items. Refrigerants are used in a variety of applications, including air conditioning, refrigeration, and industrial cooling.

- The pharmaceutical industry needs low temperatures to safely store and transport medicines. Many drugs, especially vaccines, insulin, and other special medicines, must be kept cold so they do not spoil. This is why refrigerants, which help in cooling, are very important in this industry.

- There is a growing demand for biologics and specialty medicines, which often need strict temperature control. This demand is especially rising in developing Asian countries. As these countries grow and improve their healthcare systems, they need more cold storage and transport solutions. Countries like China and India are seeing fast growth in their pharmaceutical industries. This growth is increasing the need for refrigerants. Not only are these countries making more medicines, but many companies are also moving their research work from Europe to places like India, China, and Brazil. This shift is happening because these countries offer lower costs and a large market. In summary, the growing pharmaceutical industry, especially in Asia and other emerging markets, is pushing up the need for refrigerants to keep medicines safe and effective.

Refrigerants Market Limiting Factor- Safety Challenges of Using Natural Refrigerants

- Refrigerants like ammonia, carbon dioxide (CO?), and hydrocarbons (HCs) are often used for cooling, but they come with some safety risks. At high levels, these gases can be harmful. For example, ammonia is toxic and can corrode copper if they come into contact. Because of this, refrigeration systems that use ammonia are usually made of steel. However, steel is more expensive than copper, which increases the cost of the system.

- Carbon dioxide also has its challenges. If it touches the air suddenly, it can turn into dry ice. This can be dangerous, so CO? systems need special valves to stop this from happening. Hydrocarbons, while useful, are flammable and must be handled with care.

- Overall, while these natural refrigerants are better for the environment than traditional ones, they need extra safety measures. Special equipment and materials are often required to prevent accidents and ensure smooth operation. This makes the systems more expensive and complex but necessary for safe and eco-friendly cooling solutions. effective.

Refrigerants Market Expansion Opportunity- Growing Demand for Natural Refrigerants

- The need for eco-friendly cooling solutions is rising all over the world. People and companies are becoming more aware of environmental problems, and many countries now have strict rules to reduce pollution from cooling gases. This is leading to a higher demand for natural refrigerants.

- Natural refrigerants like carbon dioxide (CO?), ammonia, and hydrocarbons are better for the environment. They have low Global Warming Potential (GWP) and do not harm the ozone layer. These qualities make them a good replacement for synthetic refrigerants, especially in industries.

- The Sectors such as food processing, cold storage, and retail are quickly adopting natural refrigerants. These industries want to reduce their impact on the environment and meet sustainability goals. Companies that make cooling systems are working on new designs to make natural refrigerant systems safer and more efficient. As more businesses look for green solutions, the market for natural refrigerants is expected to grow. Major companies are also focusing on innovation to stay competitive. This creates a big opportunity for further development and use of natural refrigerants in the future.

Refrigerants Market Challenge and Risk- Illegal Refrigerant Imports and Their Impact

- The illegal import of refrigerants is a serious problem for the global refrigerants market. It goes against international rules and makes it harder to reduce harmful emissions. This issue is especially important for hydrofluorocarbons (HFCs), which are being slowly phased out under global agreements like the Kigali Amendment and the Montreal Protocol.

- When refrigerants are traded illegally, it becomes difficult for countries to meet their environmental goals. These illegal products are often of poor quality or fake. Using them can damage cooling systems, such as refrigerators and air conditioners, and may even cause dangerous accidents.

- Poor-quality refrigerants can reduce the performance of HVAC systems, making them less energy efficient. This increases energy use and costs. More importantly, it also puts users and technicians at risk due to possible leaks, fires, or explosions.

- This challenge not only harms the environment but also affects the trust and safety of the refrigerants market. Stronger enforcement of rules and better awareness are needed to stop illegal trade and protect both people and the planet.

Refrigerants Market Segment Analysis:

Refrigerants Market is segmented based on Type, Application, End-Users, and Region

By Type, Refrigerants Market segment is expected to dominate the market during the forecast period

By Application, Refrigerants Market segment held the largest share in 2024

- The stationary air conditioning, heat pumps, and chillers segment became the largest part of the refrigerants market. These systems are very important in heating, ventilation, and air conditioning (HVAC). They are widely used in homes, offices, factories, shopping malls, hospitals, and other buildings. Their main job is to control the temperature indoors, making spaces cooler in summer and warmer in winter.

- These machines work by using refrigerants, which are special fluids that help move heat from one place to another. For example, in an air conditioner, the refrigerant absorbs the heat from inside a room and releases it outside, making the room cooler. In heat pumps, the refrigerant works in the opposite way during winter it takes heat from outside and brings it inside to warm up the room.

- Because people and businesses want better control over indoor climate, the demand for these HVAC systems is growing fast. This is especially true in countries with very hot or very cold weather. Also, as cities grow and more buildings are built, the need for air conditioning and heating systems increases. Another reason for their growing popularity is energy efficiency. Newer models of air conditioners, chillers, and heat pumps use less energy and are better for the environment. This helps people save money on electricity bills and also supports efforts to reduce pollution and fight climate change.

- Governments in many countries are also encouraging the use of eco-friendly systems by offering rebates or tax benefits. This has made more people and companies interested in upgrading to modern HVAC systems that use better refrigerants ones that don’t harm the ozone layer and have a lower impact on global warming.

- In conclusion, stationary air conditioning, heat pumps, and chillers are leading the refrigerants market because they are needed in many areas of daily life. Their role in keeping spaces comfortable and energy-efficient makes them essential in today’s world.

Refrigerants Market Regional Insights:

- The Asia Pacific (APAC) region is expected to lead the global refrigerants market in the coming years. This growth is mainly due to the rising demand for air conditioning and refrigeration systems in industries like automotive and electronics. As cities grow and more commercial buildings and supermarkets are built, the need for cooling equipment increases. In countries like China and India, there is a strong demand for inorganic refrigerants because they are replacing older types like HCFCs and HFCs, which are being phased out due to their harmful environmental effects. This shift is helping the region grow even faster in the refrigerants market.

- North America is also seeing strong growth in the refrigerants market, especially from the automotive and industrial sectors. Regulations in the United States and Canada support the use of safer and more eco-friendly refrigerants. Many companies are switching to hydro fluor olefins (HFOs) and other alternatives that have less impact on the climate. This is helping reduce the use of older, more harmful refrigerants.

Refrigerants Market Active Players:

- ABB Ltd. (Switzerland)

- Blue Star Limited (India)

- Bosch Thermo technology (Germany)

- Carrier Transicold (USA)

- Danfoss A/S (Denmark)

- Electrolux AB (Sweden)

- Emerson Climate Technologies (USA)

- Fujitsu General Ltd. (Japan)

- GE Appliances (USA)

- Goodman Manufacturing (USA)

- Hisense Group (China)

- Honeywell Building Technologies (USA)

- Ingersoll Rand Inc. (USA)

- Lennox International Inc. (USA)

- LG Electronics Inc. (South Korea)

- Rheem Manufacturing Company (USA)

- Rockwell Automation, Inc. (USA)

- Samsung Electronics Co., Ltd. (South Korea)

- Sanyo Electric Co., Ltd. (Japan)

- Schneider Electric SE (France)

- Sharp Corporation (Japan)

- Siemens AG (Germany)

- SPX Corporation (USA)

- TCL Technology (China)

- Thermo Fisher Scientific Inc. (USA)

- United Technologies Corporation (USA)

- Voltas Limited (India)

- Whirlpool Corporation (USA)

- York International Corporation (USA)

- Other active players

|

Refrigerants Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 26.11 Billion |

|

Forecast Period 2025-35 CAGR: |

7.9% |

Market Size in 2035: |

USD 60.26 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User

|

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Refregients Market by Type (2018-2035)

4.1 Refregients Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Fluorocarbon

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 HFC Blends

4.5 Isobutane

4.6 Propane

4.7 Ammonia

4.8 Carbon Dioxide

Chapter 5: Refregients Market by Application (2018-2035)

5.1 Refregients Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Refrigerators

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large-Scale Refrigerators

5.5 Chillers

5.6 Air Conditioners

5.7 Heat Pumps

5.8 Others

Chapter 6: Refregients Market by End User (2018-2035)

6.1 Refregients Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Domestic Household Refrigeration

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Light Commercial Refrigeration

6.5 Commercial Racks and Condensing Units

6.6 Industrial Refrigeration

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Refregients Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 ABB LTD. (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 BLUE STAR LIMITED (INDIA)

7.4 BOSCH THERMOTECHNOLOGY (GERMANY)

7.5 CARRIER TRANSICOLD (USA)

7.6 DANFOSS A/S (DENMARK)

7.7 ELECTROLUX AB (SWEDEN)

7.8 EMERSON CLIMATE TECHNOLOGIES (USA)

7.9 FUJITSU GENERAL LTD. (JAPAN)

7.10 GE APPLIANCES (USA)

7.11 GOODMAN MANUFACTURING (USA)

7.12 HISENSE GROUP (CHINA)

7.13 HONEYWELL BUILDING TECHNOLOGIES (USA)

7.14 INGERSOLL RAND INC. (USA)

7.15 LENNOX INTERNATIONAL INC. (USA)

7.16 LG ELECTRONICS INC. (SOUTH KOREA)

7.17 RHEEM MANUFACTURING COMPANY (USA)

7.18 ROCKWELL AUTOMATION

7.19 INC. (USA)

7.20 SAMSUNG ELECTRONICS CO.

7.21 LTD. (SOUTH KOREA)

7.22 SANYO ELECTRIC CO.

7.23 LTD. (JAPAN)

7.24 SCHNEIDER ELECTRIC SE (FRANCE)

7.25 SHARP CORPORATION (JAPAN)

7.26 SIEMENS AG (GERMANY)

7.27 SPX CORPORATION (USA)

7.28 TCL TECHNOLOGY (CHINA)

7.29 THERMO FISHER SCIENTIFIC INC. (USA)

7.30 UNITED TECHNOLOGIES CORPORATION (USA)

7.31 VOLTAS LIMITED (INDIA)

7.32 WHIRLPOOL CORPORATION (USA)

7.33 YORK INTERNATIONAL CORPORATION (USA)

7.34 AND OTHER ACTIVE PLAYERS

Chapter 8: Global Refregients Market By Region

8.1 Overview

8.2. North America Refregients Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe Refregients Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe Refregients Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific Refregients Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa Refregients Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America Refregients Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 11 Case Study

Chapter 12 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

Refrigerants Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 26.11 Billion |

|

Forecast Period 2025-35 CAGR: |

7.9% |

Market Size in 2035: |

USD 60.26 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User

|

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||