Recycled Aluminium Market Synopsis

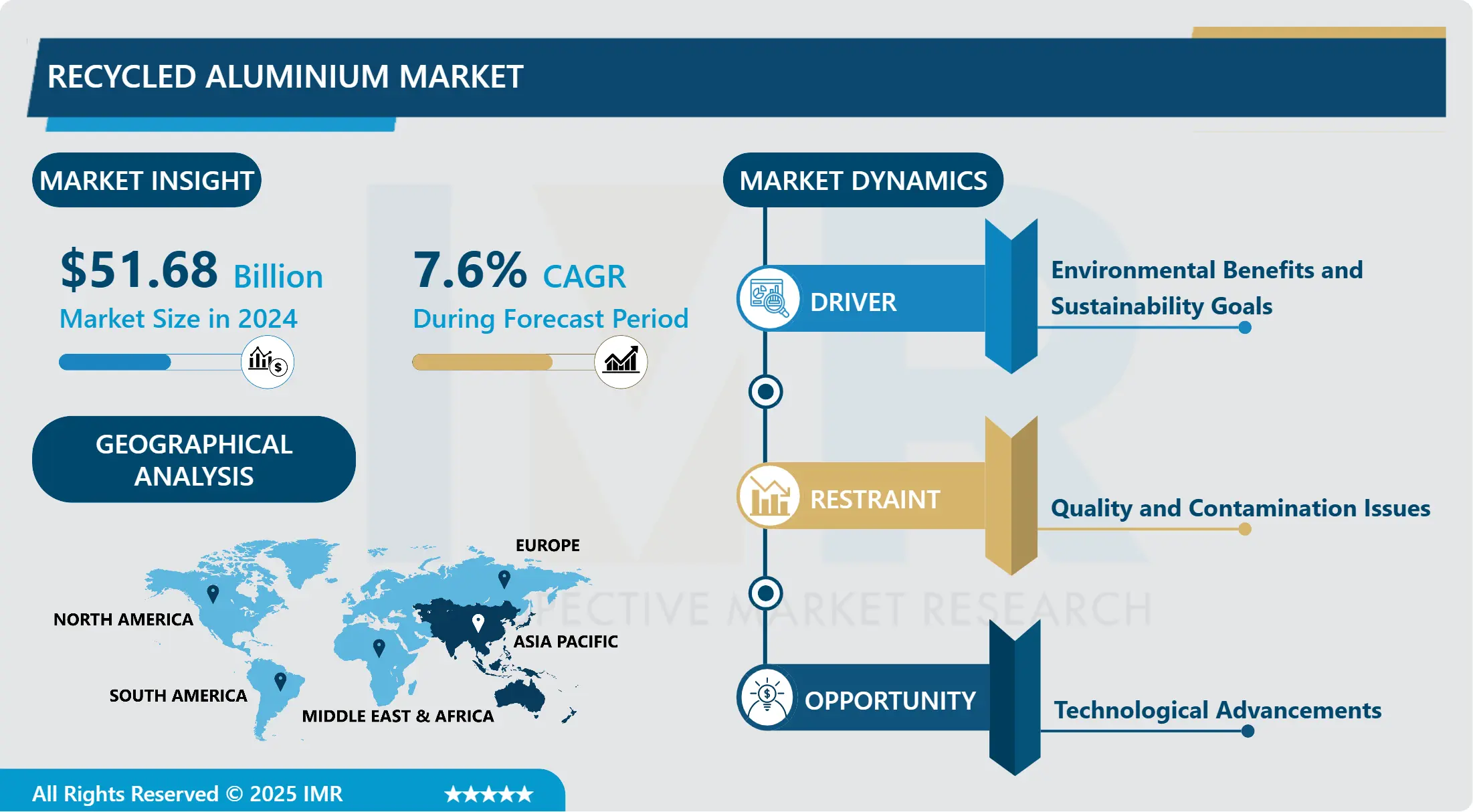

The global Recycled Aluminium Market was valued at USD 51.68 Billion in 2024 and is likely to reach USD 92.86 Billion by 2032, increasing at a CAGR of 7.6% from 2025 to 2032.

Recycled aluminium is aluminium that has already been used and is then processed and changed into new aluminium products. It may be a maintainable and environment-friendly option because it preserves energy and common resources. Recycling aluminium moreover makes a difference to reduce greenhouse gas emissions and combat climate alter. It requires 95% less energy to produce compared to primary aluminium.

Like other metals, aluminium is a permanent material whose internal properties do not change during use and despite repeated recycling into new products. Because aluminium is infinitely recyclable, it can be recycled in applications that are significantly different from its original purpose, and it can also be thrown back in its original form. These properties make aluminium an ideal material for advanced applications, even if it has been recycled many times. For example, the facade of a 50-year-old building can be recycled into the aluminium needed for the engine block of a new car without losing quality. Its recycling does not necessarily require the addition of base material or additives to enable the function and properties of the base material. Thus, it can be said that aluminium is infinitely recyclable, which makes it a material that balances the demand of a growing economy with environmental protection.

A wide variety of aluminium scrap is processed by the secondary industry. New scrap is that surplus material that arises during the manufacture and fabrication of aluminium alloys, up to the point where they are sold to the final consumer. Thus, extrusion discards, sheet edge trim, turnings and millings and drosses are all described as new scrap. On the other hand, old scrap is that aluminium material that is recovered when an aluminium article has been produced, used and finally discarded for recycling.

Old scrap could be a used aluminium beverage can, a car cylinder head, window frames or electrical conductor cable. Most new aluminium scrap comes into the secondary industry directly from the fabricators. It is, therefore, of known quality and alloy and is often uncoated. It can then be melted with little preparation, apart perhaps from baling. Old aluminium scrap comes into the secondary industry via a very efficient network of metal merchants who have the technology to recover aluminium from vehicles, household goods etc. This is often done using heavy equipment such as shredders, together with magnetic separators to remove iron and sink-and-float installations to separate aluminium from other materials. It is, for instance, the recovery of aluminium in this way that makes car-breaking economically feasible.

In 2021, the global aluminium market size was 54.3 billion U.S. dollars. The global market is growing wit 60.31 billion U.S dollars in 2023. Aluminium cans are an essential packaging solution since they can be easily recyclable and cost-effective.

Recycled Aluminium Market Trend Analysis

Recycled Aluminium Market Environmental Benefits and Sustainability Goals

- The environmental benefits and sustainability goals of recycling aluminium are considerable and multifaceted. Recycling aluminium could be a exceedingly energy-efficient handle, consuming up to 95% less vitality compared to the generation of new aluminium from bauxite ore. This exceptional lessening in vitality utilization deciphers directly into essentially lower greenhouse gas emissions, making recycled aluminium a distant more ecologically neighbourly alternative. The energy reserve funds are pivotal in combating climate alter, as the aluminium industry is traditionally energy-intensive and a notable donor to industrial carbon outflows. In expansion to the diminishment in greenhouse gasses, recycling aluminium plays a basic part in waste management and asset preservation. By diverting aluminium scrap from landfills, recycling makes a difference to play down the natural affect related with waste transfer.

- Landfills are not as it were space-consuming but to pose dangers of soil and water defilement. Expanding the reusing rate of aluminium underpins worldwide sustainability activities and adjusts with the standards of a circular economy, where materials are continually recycled and recycled, thereby diminishing the require for virgin asset extraction and advancing economical asset management. Besides, government controls and motivations altogether support the recycled aluminium market. Numerous nations have executed policies aimed at lessening waste and empowering the utilize of recycled materials. These approaches incorporate obligatory reusing targets, landfill charges, and extended producer responsibility plans, which require producers to require obligation for the end-of-life administration of their items.

- Financial motivating forces such as endowments for reusing operations, assess breaks for companies utilizing recycled materials, and awards for creating progressed reusing advances are driving investment and advancement within the segment. These administrative systems and financial motivating forces not as it were bolstering natural maintainability but moreover make a favorable market environment for recycled aluminium, upgrading its financial reasonability and advancing its widespread selection over different industries.

Recycled Aluminium Market Technological Advancements

- Technological advancements are pivotal in driving the development and sustainability of the recycled aluminium market, offering solutions to key challenges such as effectiveness, defilement, and handling costs. One range of innovation lies within the improvement of progressed reusing forms tailored particularly for aluminium. These processes use cutting-edge innovations to streamline operations, increase throughput, and improve the quality of recycled aluminium yield. Advanced recycling technologies encompass a run of approaches, counting moved forward sorting methods, upgraded separation strategies, and imaginative refining forms. For occurrence, headways in sensor-based sorting systems allow for more exact recognizable proof and division of distinctive aluminium combinations and contaminants, reducing material loss and making strides the immaculateness of recycled aluminium. Additionally, developments in purifying and refining advances empower more productive extraction of aluminium from scrap, minimizing vitality utilization and handling time whereas maximizing surrender.

- Mechanization and artificial intelligence (AI) play a significant part in revolutionizing the recycling industry, particularly in sorting and handling operations. Automated frameworks prepared with AI calculations can analyse tremendous sums of information in real-time, optimizing fabric stream, distinguishing profitable scrap, and minimizing defilement. Robotics and automation advance streamline forms, expanding throughput and decreasing labor costs while guaranteeing reliable quality and precision. The integration of automation and AI innovations into reusing offices not as it were moves forward operational productivity but too improves security and natural execution. By minimizing manual intercession and human error, automated frameworks diminish the chance of working environment mischances and make strides generally work environment security. Furthermore, optimized handling operations result in lower vitality utilization and emissions, contributing to natural supportability.

Recycled Aluminium Market Segment Analysis:

Market Segmented based on Scrap Type, by Category, by End Use and Region.

By Scrap Type, Used Beverage Can (UBC) Is Expected to Dominate the Market During the Forecast Period 2025-2032

- The dominance of Used Beverage Can (UBC) Scrap within the recycled aluminium market is supported by a combination of variables that collectively contribute to its widespread utilize and preference among recyclers and producers. The sheer volume of UBC scrap created all-inclusive is significant, owing to the broad utilization of aluminium refreshment cans over different markets. These cans are ubiquitous in daily life, found in soft drinks, brews, energy drinks, and other beverages, guaranteeing a continuous and abundant supply of UBC scrap for reusing purposes. Besides, UBC scrap has inborn characteristics that make it especially well-suited for recycling. Its unmistakable shape, estimate, and fabric composition render it relatively simple to gather and sort from civil waste streams. Municipal recycling programs and devoted collection centers frequently prioritize the recycling of aluminium cans, streamlining the collection prepare and making it helpful for shoppers to take an interest in recycling efforts. Besides, UBC scrap shows high purity and quality, with negligible contamination compared to other aluminium scrap sources. This cleanliness streamlines the reusing prepare, requiring less vitality and assets for preparing and refining.

- As a result, recycled aluminium determined from UBC scrap regularly meets exacting quality guidelines, encouraging the generation of high-quality aluminium items. From an environmental standpoint, recycling UBC scrap offers critical benefits by lessening the require for essential aluminium generation from bauxite mineral. This preservation of characteristic assets, coupled with reductions in energy consumption and greenhouse gas emissions, aligns with maintainability goals and contributes to natural stewardship. Regulatory back and market demand play pivotal roles in driving the dominance of UBC scrap within the recycled aluminium showcase. Governmental controls and environmental approaches advance recycling and maintainable materials utilization, regularly prioritizing the recycling of aluminium refreshment cans due to their financial and environmental esteem. T

- here's a strong showcase request for recycled aluminium determined from UBC scrap, driven by customer inclinations for environmentally friendly products and corporate supportability activities. By and large, the variables sketched out above underscore the dominance of UBC scrap within the recycled aluminium market, highlighting its importance as a maintainable and financially practical source of recycled aluminium for different industries and applications.

By End Use, Building & Construction held the largest share

- The dominance of the Building and Construction sector within the recycled aluminium market is driven by a intersection of components that align with the industry's evolving needs and sustainability goals. Firstly, there's a growing request for economical materials in construction, impelled by expanding awareness of natural issues and controls pointed at diminishing carbon impressions. Recycled aluminium, with its lower natural affect compared to primary aluminium, is well-positioned to meet this request, making it highly looked for after for green building projects. Auxiliary and structural applications further contribute to the dominance of recycled aluminium in the construction sector.

- Aluminium's characteristic properties, such as quality, light weight, and erosion resistance, make it a favored choice for a wide run of applications, including basic components, windows, doors, material, and veneers. Recycled aluminium holds these properties, advertising builders and architects a sustainable elective without compromising on execution or solidness. The stringent regulatory and certification measures actualized by numerous nations to advance the utilize of recycled materials in development moreover play a essential part. These directions make a favorable environment for the appropriation of recycled aluminium in building ventures, driving demand and market infiltration.

- The financial benefits related with utilizing recycled aluminium advance incentivize its adoption in development. Recycled aluminium is often less costly than essential aluminium, driving to cost savings for development ventures. Also, its utilize can diminish development squander and lower in general project costs, contributing to made strides effectiveness and productivity. Aesthetic appeal is another significant figure contributing to the dominance of recycled aluminium within the construction sector. Its flexibility in finishing and surface medications permits for the generation of aesthetically satisfying building components, contributing to modern structural plans and enhancing the visual appeal of development ventures. The embrace of recyclability and circular economy principles by the construction industry reinforces the request for recycled aluminium. Aluminium's infinite recyclability without misfortune of properties adjusts with the objectives of sustainability and asset preservation, making it a favoured fabric for building ventures committed to reducing environmental impact.

Recycled Aluminium Market Regional Insights:

Asia Pacific Region is Expected to Dominate the Market Over the Forecast Period

- The dominance of the Asia-Pacific region within the recycled aluminium market is impelled by a joining of factors that collectively make a conducive environment for the production, utilization, and utilization of recycled aluminium. Firstly, the region's vast manufacturing base, especially in nations like China, India, and Japan, drives high utilization of aluminium over different industries, including car, electronics, and construction. These businesses require substantial sums of aluminium, both primary and recycled, to meet their generation needs, thereby contributing to the region's dominance within the market. Besides, the Asia-Pacific region is undergoing fast industrialization and urbanization, leading to expanded construction activities and framework development.

- As a result, there's a growing request for building materials, with recycled aluminium being extensively utilized due to its supportability and natural benefits. Governments within the region are too implementing stricter environmental regulations and policies to advance maintainability, giving incentives for the utilize of recycled materials to diminish carbon impressions and waste, further driving the selection of recycled aluminium. Also, the region's solid financial development has fueled broad foundation advancement, especially in countries like China and India, where critical speculations are being made in framework ventures. This surge in framework improvement drives the request for recycled aluminium as a key fabric for development and building ventures.

- Moreover, the Asia-Pacific region could be a major center for car manufacturing, with a expansive car segment. With an expanding center on lightweighting and fuel effectiveness to meet administrative measures and customer requests, the utilize of recycled aluminium in car generation is on the rise, further boosting request for recycled aluminium within the region. Technological advancements in recycling forms also play a crucial part in driving the dominance of the Asia-Pacific region within the recycled aluminium market. Continuous improvements in reusing advances improve the productivity and quality of recycled aluminium generation, making it a more viable and attractive choice for manufacturers and customers.

Recycled Aluminium Market Top Key Players:

- Novelis Inc. (United States)

- Norsk Hydro ASA (Norway)

- Constellium N.V. (France)

- Alcoa Corporation (United States)

- Rio Tinto (United Kingdom)

- Rusal (Russia)

- Century Aluminium Company (United States)

- Kaiser Aluminium (United States)

- UACJ Corporation (Japan)

- Arconic Inc. (United States)

- AMAG Austria Metall AG (Austria)

- Vedanta Resources Limited (India)

- Sapa Group (Norway)

- Hindalco Industries Ltd. (India)

- Sigma Group (India)

- Novametal SA (Switzerland)

- Hulamin (South Africa)

- Gränges AB (Sweden)

- Impol Group (Slovenia)

- ALCOA Recycling (United States)

- TRIMET Aluminium SE (Germany)

- Daiki Aluminium Industry Co., Ltd. (Japan)

- Real Alloy (United States)

- Aludium (Spain)

- Toyo Aluminium K.K. (Japan)

- Erbslöh Aluminium GmbH (Germany)

- Lotte Aluminium Co., Ltd. (South Korea)

- Constellium SE (France)

- Talum d.d. (Slovenia)

- Hydro Extrusions (Norway)

- Other Active Players.

|

Global Recycled Aluminium Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018-2023 |

Market Size In 2024: |

USD 51.68 Bn |

|

Forecast Period 2025-32 CAGR: |

7.6% |

Market Size In 2032: |

USD 92.86 Bn |

|

Segments Covered: |

By Scrap Type |

|

|

|

By Category |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in The Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Recycled Aluminium Market by Scrap Type (2018-2032)

4.1 Recycled Aluminium Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Wire Scrap

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Extrusion Scrap

4.5 Sheet Scrap

4.6 Used Beverage Can (UBC) Scrap

4.7 Turnings and Borings

Chapter 5: Recycled Aluminium Market by Category (2018-2032)

5.1 Recycled Aluminium Market Snapshot and Growth Engine

5.2 Market Overview

5.3 New Scrap

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Old Scrap

Chapter 6: Recycled Aluminium Market by End Use (2018-2032)

6.1 Recycled Aluminium Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Building & Construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Automotive

6.5 Electronics

6.6 Machinery and Equipment Packaging

6.7 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Recycled Aluminium Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 NOVELIS INC. (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 NORSK HYDRO ASA (NORWAY)

7.4 CONSTELLIUM N.V. (FRANCE)

7.5 ALCOA CORPORATION (UNITED STATES)

7.6 RIO TINTO (UNITED KINGDOM)

7.7 RUSAL (RUSSIA)

7.8 CENTURY ALUMINIUM COMPANY (UNITED STATES)

7.9 KAISER ALUMINIUM (UNITED STATES)

7.10 UACJ CORPORATION (JAPAN)

7.11 ARCONIC INC. (UNITED STATES)

7.12 AMAG AUSTRIA METALL AG (AUSTRIA)

7.13 VEDANTA RESOURCES LIMITED (INDIA)

7.14 SAPA GROUP (NORWAY)

7.15 HINDALCO INDUSTRIES LTD. (INDIA)

7.16 SIGMA GROUP (INDIA)

7.17 NOVAMETAL SA (SWITZERLAND)

7.18 HULAMIN (SOUTH AFRICA)

7.19 GRÄNGES AB (SWEDEN)

7.20 IMPOL GROUP (SLOVENIA)

7.21 ALCOA RECYCLING (UNITED STATES)

7.22 TRIMET ALUMINIUM SE (GERMANY)

7.23 DAIKI ALUMINIUM INDUSTRY COLTD. (JAPAN)

7.24 REAL ALLOY (UNITED STATES)

7.25 ALUDIUM (SPAIN)

7.26 TOYO ALUMINIUM K.K. (JAPAN)

7.27 ERBSLÖH ALUMINIUM GMBH (GERMANY)

7.28 LOTTE ALUMINIUM COLTD. (SOUTH KOREA)

7.29 CONSTELLIUM SE (FRANCE)

7.30 TALUM D.D. (SLOVENIA)

7.31 HYDRO EXTRUSIONS (NORWAY)

Chapter 8: Global Recycled Aluminium Market By Region

8.1 Overview

8.2. North America Recycled Aluminium Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Scrap Type

8.2.4.1 Wire Scrap

8.2.4.2 Extrusion Scrap

8.2.4.3 Sheet Scrap

8.2.4.4 Used Beverage Can (UBC) Scrap

8.2.4.5 Turnings and Borings

8.2.5 Historic and Forecasted Market Size by Category

8.2.5.1 New Scrap

8.2.5.2 Old Scrap

8.2.6 Historic and Forecasted Market Size by End Use

8.2.6.1 Building & Construction

8.2.6.2 Automotive

8.2.6.3 Electronics

8.2.6.4 Machinery and Equipment Packaging

8.2.6.5 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Recycled Aluminium Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Scrap Type

8.3.4.1 Wire Scrap

8.3.4.2 Extrusion Scrap

8.3.4.3 Sheet Scrap

8.3.4.4 Used Beverage Can (UBC) Scrap

8.3.4.5 Turnings and Borings

8.3.5 Historic and Forecasted Market Size by Category

8.3.5.1 New Scrap

8.3.5.2 Old Scrap

8.3.6 Historic and Forecasted Market Size by End Use

8.3.6.1 Building & Construction

8.3.6.2 Automotive

8.3.6.3 Electronics

8.3.6.4 Machinery and Equipment Packaging

8.3.6.5 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Recycled Aluminium Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Scrap Type

8.4.4.1 Wire Scrap

8.4.4.2 Extrusion Scrap

8.4.4.3 Sheet Scrap

8.4.4.4 Used Beverage Can (UBC) Scrap

8.4.4.5 Turnings and Borings

8.4.5 Historic and Forecasted Market Size by Category

8.4.5.1 New Scrap

8.4.5.2 Old Scrap

8.4.6 Historic and Forecasted Market Size by End Use

8.4.6.1 Building & Construction

8.4.6.2 Automotive

8.4.6.3 Electronics

8.4.6.4 Machinery and Equipment Packaging

8.4.6.5 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Recycled Aluminium Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Scrap Type

8.5.4.1 Wire Scrap

8.5.4.2 Extrusion Scrap

8.5.4.3 Sheet Scrap

8.5.4.4 Used Beverage Can (UBC) Scrap

8.5.4.5 Turnings and Borings

8.5.5 Historic and Forecasted Market Size by Category

8.5.5.1 New Scrap

8.5.5.2 Old Scrap

8.5.6 Historic and Forecasted Market Size by End Use

8.5.6.1 Building & Construction

8.5.6.2 Automotive

8.5.6.3 Electronics

8.5.6.4 Machinery and Equipment Packaging

8.5.6.5 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Recycled Aluminium Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Scrap Type

8.6.4.1 Wire Scrap

8.6.4.2 Extrusion Scrap

8.6.4.3 Sheet Scrap

8.6.4.4 Used Beverage Can (UBC) Scrap

8.6.4.5 Turnings and Borings

8.6.5 Historic and Forecasted Market Size by Category

8.6.5.1 New Scrap

8.6.5.2 Old Scrap

8.6.6 Historic and Forecasted Market Size by End Use

8.6.6.1 Building & Construction

8.6.6.2 Automotive

8.6.6.3 Electronics

8.6.6.4 Machinery and Equipment Packaging

8.6.6.5 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Recycled Aluminium Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Scrap Type

8.7.4.1 Wire Scrap

8.7.4.2 Extrusion Scrap

8.7.4.3 Sheet Scrap

8.7.4.4 Used Beverage Can (UBC) Scrap

8.7.4.5 Turnings and Borings

8.7.5 Historic and Forecasted Market Size by Category

8.7.5.1 New Scrap

8.7.5.2 Old Scrap

8.7.6 Historic and Forecasted Market Size by End Use

8.7.6.1 Building & Construction

8.7.6.2 Automotive

8.7.6.3 Electronics

8.7.6.4 Machinery and Equipment Packaging

8.7.6.5 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Recycled Aluminium Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018-2023 |

Market Size In 2024: |

USD 51.68 Bn |

|

Forecast Period 2025-32 CAGR: |

7.6% |

Market Size In 2032: |

USD 92.86 Bn |

|

Segments Covered: |

By Scrap Type |

|

|

|

By Category |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in The Report: |

|

||