Recombinant Dna Technology Market Synopsis

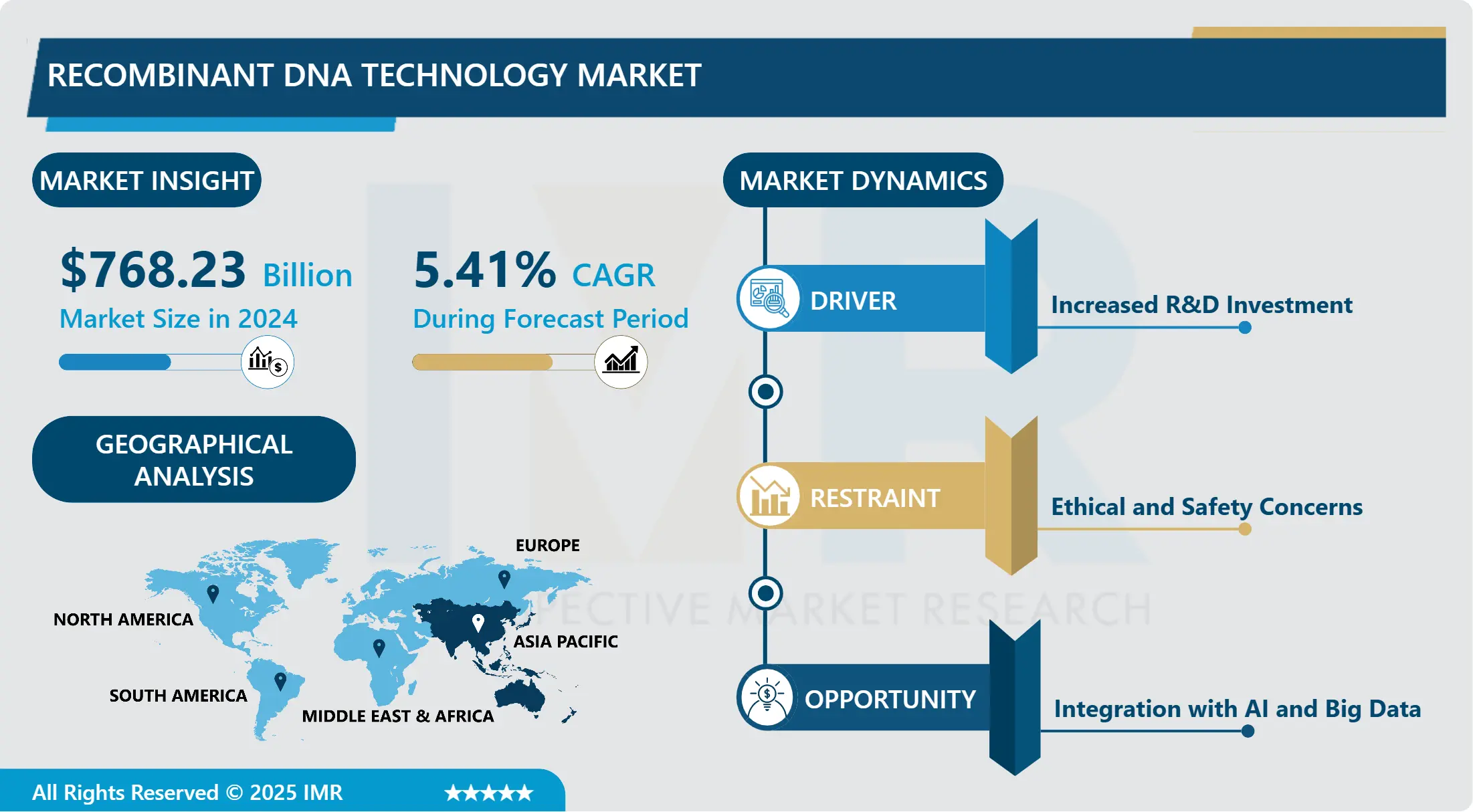

Recombinant Dna Technology Market Size Was Valued at USD 768.23 Billion in 2024 and is Projected to Reach USD 1371.49 Billion by 2035, Growing at a CAGR of 5.41% From 2025-2035

Recombinant DNA technology is a method used to manipulate and combine DNA from different sources to create genetically modified organisms or produce specific proteins. By using techniques such as gene cloning, genetic engineering, and molecular scissors (like restriction enzymes and CRISPR), scientists can insert, delete, or modify genes within an organism's genome. This technology is widely used in biotechnology and pharmaceutical industries for applications such as developing new treatments, producing vaccines, and enhancing crop traits. Its precision and versatility have made it a cornerstone of modern genetic research and bioengineering.

Recombinant DNA technology has revolutionized the fields of genetics, molecular biology, and biotechnology by enabling the manipulation of genetic material to create new DNA sequences. This technology involves combining DNA from different sources, which can then be inserted into a host organism to produce proteins or other substances that are beneficial in medical, agricultural, and industrial applications.

The recombinant DNA technology market is experiencing significant growth driven by increasing demand for personalized medicine, advancements in genetic research, and the rising prevalence of chronic diseases. Pharmaceutical companies are leveraging recombinant DNA technology to develop novel therapies, including monoclonal antibodies, vaccines, and gene therapies, which are transforming treatment approaches and offering new solutions to previously untreatable conditions.

In the agricultural sector, recombinant DNA technology is enhancing crop yields and resistance to pests and diseases, leading to the development of genetically modified crops that meet the demands of a growing global population. The industrial applications of recombinant DNA technology include the production of enzymes used in various processes, such as biofuel production and waste management.

Geographically, North America holds a dominant position in the recombinant DNA technology market due to its advanced research infrastructure, high level of investment in biotechnology, and strong presence of key market players. However, the Asia Pacific region is emerging as a significant market due to increasing investments in biotechnology research and development, coupled with rising healthcare needs.

Despite its growth potential, the recombinant DNA technology market faces challenges such as ethical concerns, regulatory hurdles, and high costs associated with research and development. Addressing these challenges while continuing to innovate and expand applications will be crucial for sustaining market growth and realizing the full potential of recombinant DNA technology.

Overall, the recombinant DNA technology market is poised for robust growth, driven by continuous advancements in technology and increasing applications across various sectors.

Recombinant Dna Technology Market Trend Analysis

Recombinant Dna Technology Market Growth Driver- Expanding Applications of Recombinant DNA Technology

- The expansion of recombinant DNA technology across various sectors is transforming traditional approaches and opening new avenues for innovation. In agriculture, the technology is facilitating the development of genetically modified (GM) crops with enhanced traits, such as increased resistance to pests, diseases, and environmental stressors. This not only improves crop yield and quality but also contributes to sustainability by reducing the need for chemical pesticides and fertilizers. With the global population on the rise, these advancements are crucial for addressing food security challenges and ensuring a stable food supply. The ability to engineer crops with specific traits also allows for the creation of crops that can thrive in suboptimal conditions, thus supporting agriculture in regions facing climate-related challenges.

- In the healthcare sector, recombinant DNA technology is revolutionizing drug development and therapeutic interventions. It enables the production of high-precision biopharmaceuticals, such as monoclonal antibodies and hormone therapies, which are tailored to target specific disease mechanisms. The technology is also pivotal in developing vaccines, including those for new and emerging diseases, by allowing rapid and efficient production. The shift towards personalized medicine, which involves customizing treatments based on an individual’s genetic makeup, is further accelerating the market. By integrating genetic information into treatment plans, healthcare providers can offer more effective and targeted therapies, improving patient outcomes and reducing adverse effects. The convergence of recombinant DNA technology with personalized medicine underscores its transformative impact on modern healthcare.

Recombinant Dna Technology Market Expansion Opportunity- Advancements in Precision Medicine and Gene Editing

- The rise of precision medicine and advanced gene editing tools like CRISPR-Cas9 is significantly advancing the recombinant DNA technology market. Precision medicine, which tailors medical treatment to individual genetic profiles, is revolutionizing patient care by enabling more accurate diagnoses and targeted therapies. This approach promises to enhance treatment efficacy and minimize adverse effects by considering a patient's unique genetic makeup. CRISPR-Cas9, a revolutionary gene-editing technology, provides unprecedented precision in modifying DNA, allowing for the correction of genetic mutations responsible for a variety of inherited diseases. The ability to make precise alterations at specific locations in the genome opens up new possibilities for treating previously incurable genetic disorders and advancing research in gene therapy.

- The growth of the recombinant DNA technology market is further supported by substantial investments in research and development, along with favorable government policies and funding initiatives. Public and private sector funding is fueling innovation, enabling the development of new technologies and applications. Governments worldwide are implementing policies that encourage biotechnology research and provide financial support for groundbreaking projects, fostering a conducive environment for growth. As these investments drive technological advancements and the integration of precision medicine and gene editing into clinical practice, the recombinant DNA technology market is expected to continue expanding, offering promising prospects for both healthcare and scientific research.

Recombinant Dna Technology Market Segment Analysis:

Recombinant Dna Technology Market Segmented based on Product, Component, Application, End User, and Region.

By Product, Vaccines segment is expected to dominate the market during the forecast period

- Vaccines hold a dominant position in the biotechnology and pharmaceuticals market primarily because of their essential role in preventing infectious diseases. The significant global health impact of vaccines is evident from their success in reducing the incidence of diseases such as influenza, COVID-19, and various childhood illnesses. This effectiveness has led to widespread vaccination programs and initiatives aimed at controlling and eradicating diseases. The extensive research and development dedicated to vaccine development, driven by both public and private sectors, ensure that vaccines continue to evolve and address emerging health threats. Moreover, the global commitment to vaccination programs is reinforced by substantial government funding and public health campaigns, which further solidify the market presence of vaccines.

- Additionally, the financial investment in vaccine research and development is considerable, reflecting their critical importance in global health strategies. Governments and health organizations allocate significant resources to vaccine development, ensuring rigorous testing and approval processes to maintain high safety and efficacy standards. The high level of investment from private companies also contributes to the advancement of vaccine technologies, such as mRNA vaccines, which have revolutionized responses to pandemics. This ongoing investment and innovation help maintain vaccines as a leading product category, driving their continued dominance in the market and underscoring their pivotal role in safeguarding public health worldwide.

By End User, Biotechnology and Pharmaceutical Companies segment held the largest share in 2024

- Biotechnology and pharmaceutical companies are the largest end users in the biotechnology and pharmaceutical markets due to their central role in advancing drug development, conducting genetic research, and producing biologics. These companies are at the forefront of innovation, leveraging cutting-edge technologies to discover and develop new therapies and treatments. Their extensive involvement spans the entire drug development lifecycle, from initial research and clinical trials to regulatory approval and market launch. This comprehensive engagement allows them to drive significant advancements in medicine and biotechnology, ensuring that new and improved therapies reach patients effectively.

- Moreover, the substantial market share held by biotechnology and pharmaceutical companies is a direct result of their continuous investment in research and development. These companies allocate considerable resources to explore novel drug candidates, enhance existing therapies, and create innovative biologics. Their commitment to R&D is crucial for maintaining a competitive edge in the market, addressing unmet medical needs, and responding to emerging health challenges. The commercialization of new products not only contributes to their market dominance but also impacts public health outcomes by providing access to advanced treatments and therapies. This dynamic involvement underscores their pivotal role in shaping the future of healthcare and biotechnology.

Recombinant Dna Technology Market Regional Insights:

Asia-Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia-Pacific region is undergoing substantial growth in the recombinant DNA technology market, driven by a confluence of factors including increasing investments in biotechnology, expanding healthcare infrastructure, and a rising demand for advanced medical treatments. China stands out as a major player in this landscape, bolstered by substantial government funding and a strategic focus on biotechnology. The Chinese government has implemented various initiatives to foster innovation in the biotech sector, including the "Made in China 2025" plan, which emphasizes advancements in biomedicine and genetic research. China's rapidly growing pharmaceutical industry further supports market expansion, as the country increasingly adopts recombinant DNA technologies for drug development and personalized medicine.

- In addition to China, India is making significant strides in the recombinant DNA technology market. The Indian government is actively promoting biotech research through funding programs and incentives, aiming to position the country as a global leader in biotechnology. The expansion of India's healthcare infrastructure, along with a burgeoning biotech sector, contributes to the growth of recombinant DNA technologies in the region. Japan and South Korea are also notable contributors, with Japan leading in gene therapy advancements and South Korea excelling in biotech innovations and clinical research. Both countries are investing heavily in biotechnological research and development, further accelerating the market's growth in Asia-Pacific. The combined efforts of these nations are setting a strong trajectory for the recombinant DNA technology market in the region.

Active Key Players in the Recombinant Dna Technology Market

- Novartis AG,

- Thermo Fisher Scientific Inc.,

- Sanofi Pasteur Limited,

- Merck KGaA,

- Genentech Inc.,

- GlaxoSmithKline plc.,

- Eli Lilly and Company,

- Pfizer Inc.,

- Janssen Pharmaceuticals Inc

- Other Active Players

|

Global Recombinant Dna Technology Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 768.23 Bn. |

|

Forecast Period 2025-35 CAGR: |

5.41% |

Market Size in 2035: |

USD 1371.49 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Component |

|

||

|

By Application |

|

||

|

By End User

|

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Recombinant Dna Technology Market by Product (2018-2035)

4.1 Recombinant Dna Technology Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Vaccines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Therapeutic Agents

4.5 Recombinant Protein

4.6 Others

Chapter 5: Recombinant Dna Technology Market by Component (2018-2035)

5.1 Recombinant Dna Technology Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Vectors

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Expression System

5.5 Others

Chapter 6: Recombinant Dna Technology Market by Application (2018-2035)

6.1 Recombinant Dna Technology Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Diagnostics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Therapeutic

6.5 Food and Agriculture

6.6 Others

Chapter 7: Recombinant Dna Technology Market by End User (2018-2035)

7.1 Recombinant Dna Technology Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Biotechnology and Pharmaceutical Companies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Diagnostic Laboratories

7.5 Academic and Government Research Institutes

7.6 Other

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Recombinant Dna Technology Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 NOVARTIS AG THERMO FISHER SCIENTIFIC INC. SANOFI PASTEUR LIMITED MERCK KGAA GENENTECH INC. GLAXOSMITHKLINE PLC. ELI LILLY AND COMPANY PFIZER INC. JANSSEN PHARMACEUTICALS INCOTHER KEY PLAYERS

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3

Chapter 9: Global Recombinant Dna Technology Market By Region

9.1 Overview

9.2. North America Recombinant Dna Technology Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Product

9.2.4.1 Vaccines

9.2.4.2 Therapeutic Agents

9.2.4.3 Recombinant Protein

9.2.4.4 Others

9.2.5 Historic and Forecasted Market Size by Component

9.2.5.1 Vectors

9.2.5.2 Expression System

9.2.5.3 Others

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Diagnostics

9.2.6.2 Therapeutic

9.2.6.3 Food and Agriculture

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size by End User

9.2.7.1 Biotechnology and Pharmaceutical Companies

9.2.7.2 Diagnostic Laboratories

9.2.7.3 Academic and Government Research Institutes

9.2.7.4 Other

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Recombinant Dna Technology Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Product

9.3.4.1 Vaccines

9.3.4.2 Therapeutic Agents

9.3.4.3 Recombinant Protein

9.3.4.4 Others

9.3.5 Historic and Forecasted Market Size by Component

9.3.5.1 Vectors

9.3.5.2 Expression System

9.3.5.3 Others

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Diagnostics

9.3.6.2 Therapeutic

9.3.6.3 Food and Agriculture

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size by End User

9.3.7.1 Biotechnology and Pharmaceutical Companies

9.3.7.2 Diagnostic Laboratories

9.3.7.3 Academic and Government Research Institutes

9.3.7.4 Other

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Recombinant Dna Technology Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Product

9.4.4.1 Vaccines

9.4.4.2 Therapeutic Agents

9.4.4.3 Recombinant Protein

9.4.4.4 Others

9.4.5 Historic and Forecasted Market Size by Component

9.4.5.1 Vectors

9.4.5.2 Expression System

9.4.5.3 Others

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Diagnostics

9.4.6.2 Therapeutic

9.4.6.3 Food and Agriculture

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size by End User

9.4.7.1 Biotechnology and Pharmaceutical Companies

9.4.7.2 Diagnostic Laboratories

9.4.7.3 Academic and Government Research Institutes

9.4.7.4 Other

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Recombinant Dna Technology Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Product

9.5.4.1 Vaccines

9.5.4.2 Therapeutic Agents

9.5.4.3 Recombinant Protein

9.5.4.4 Others

9.5.5 Historic and Forecasted Market Size by Component

9.5.5.1 Vectors

9.5.5.2 Expression System

9.5.5.3 Others

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Diagnostics

9.5.6.2 Therapeutic

9.5.6.3 Food and Agriculture

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size by End User

9.5.7.1 Biotechnology and Pharmaceutical Companies

9.5.7.2 Diagnostic Laboratories

9.5.7.3 Academic and Government Research Institutes

9.5.7.4 Other

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Recombinant Dna Technology Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Product

9.6.4.1 Vaccines

9.6.4.2 Therapeutic Agents

9.6.4.3 Recombinant Protein

9.6.4.4 Others

9.6.5 Historic and Forecasted Market Size by Component

9.6.5.1 Vectors

9.6.5.2 Expression System

9.6.5.3 Others

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Diagnostics

9.6.6.2 Therapeutic

9.6.6.3 Food and Agriculture

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size by End User

9.6.7.1 Biotechnology and Pharmaceutical Companies

9.6.7.2 Diagnostic Laboratories

9.6.7.3 Academic and Government Research Institutes

9.6.7.4 Other

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Recombinant Dna Technology Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Product

9.7.4.1 Vaccines

9.7.4.2 Therapeutic Agents

9.7.4.3 Recombinant Protein

9.7.4.4 Others

9.7.5 Historic and Forecasted Market Size by Component

9.7.5.1 Vectors

9.7.5.2 Expression System

9.7.5.3 Others

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Diagnostics

9.7.6.2 Therapeutic

9.7.6.3 Food and Agriculture

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size by End User

9.7.7.1 Biotechnology and Pharmaceutical Companies

9.7.7.2 Diagnostic Laboratories

9.7.7.3 Academic and Government Research Institutes

9.7.7.4 Other

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Recombinant Dna Technology Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 768.23 Bn. |

|

Forecast Period 2025-35 CAGR: |

5.41% |

Market Size in 2035: |

USD 1371.49 Bn. |

|

Segments Covered: |

By Product |

|

|

|

By Component |

|

||

|

By Application |

|

||

|

By End User

|

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||