Rapid Medical Diagnostic Kits Market Synopsis:

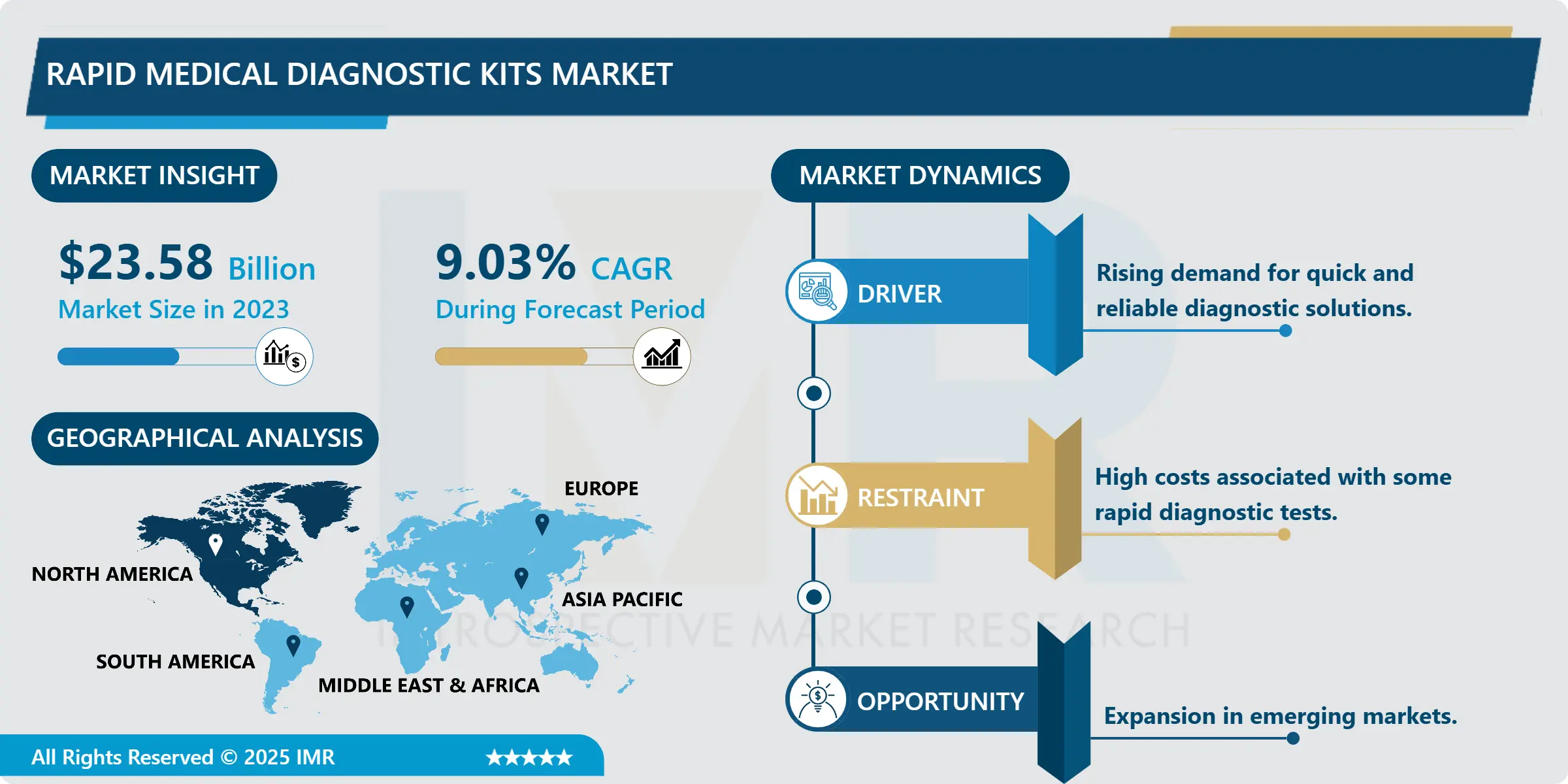

Rapid Medical Diagnostic Kits Market Size Was Valued at USD 23.58 Billion in 2023, and is Projected to Reach USD 51.34 Billion by 2032, Growing at a CAGR of 9.03% From 2024-2032.

The concept of fast-growing medical diagnostic kits industry deals with the terrestrial segment responsible for development and supply of diagnostic products meant for quick and efficient health assessment. These kits allow various forms of diagnostic testing by even consumers and healthcare professionals within minutes or hours, even if they do no not completely mimic traditional laboratory settings. Rapid Diagnostic kits have found application in testing of infectious diseases, cardiac biomarkers, health status and other indicators and have seen a steady increase in usage because of factors such as quick result generation, effective, and critically important for early diagnosis and management.

This industry has experienced steady growth over the past years because of rising concerns in the need for fast accurate diagnosis of diseases and the shortage of health facilities all over the world. Rapid diagnostic kits are widely used in Infectious diseases including malaria, HIV, influenza, and many others; there has been an increased demand for them because of the current COVID-19 pandemic. These kits enable the healthcare providers to do quick evaluation and isolation of patients saving lot of disease burden and its spread. These factors made the kits available at hospitals, clinics, pharmacies and other possible utilization options have fuelled market growth as patient and healthcare system requirements for instant and accurate tests materialized.

The shift from centralized healthcare systems has created demand for such diagnostic kits thanks to the high convenience, accuracy, and portability. Technological advancements like point of care testing, mobile diagnostic have enabled medical testing to be taken closer to the patients in areas where they are rarely reached or where there is minimal accreditation and personnel. As the health industry globally shifts toward preventive care models, these diagnostic instruments are crucial in enabling initial-stage treatment, reducing hospitalization, and improving client results.

Rapid Medical Diagnostic Kits Market Trend Analysis:

The Rise of At-Home Testing Kits

- At-Home Testing Kits has emerged as the leading trend in the Rapid Medical Diagnostic Kits market owing to the growing demand for easy and private testing for any disease in the home. Self-testing for things like blood glucose levels, pregnancy, COVID 19, and even cholesterol has become popular because people now feel in a position to take their health conditions into their own hands. Such kits became popular due to the pandemic, and firms started developing the rapid COVID-19 testing kits to cater for the need for high-scale, low turnaround time testing.

- Additionally, the trends in digital health technology have been instrumental in the designing of these at-home diagnostics. Smart application integration, wearable devices, and remote consultation services have helped in real-time health monitoring to boost up the user satisfaction zone and increases the actuality of information to a greater extent. This trend is especially more prevalent in the developed regions that healthcare facilities are taking with patient-centered care. With the general trend toward decentralization of healthcare, diagnostics will inevitably also become embedded into our homes as a trend of personal diagnostics and health management kits stabilizes and grows.

Expansion in Emerging Markets

- Rapid medical diagnostic kits have a significant potential for emerging markets as there is much more emphasis being placed on developing healthcare service delivery and affordable solutions. Countries in Asia-Pacific, Africa and part of Latin America have witnessed incline in investment in health sector along with perception towards preventive healthcare. The poor access to healthcare in rural and other hard-to-reach regions also means that rapid diagnostic kits make a lot of sense because they require little in terms of laboratory setup.

Rapid Medical Diagnostic Kits Market Segment Analysis:

Rapid Medical Diagnostic Kits Market is Segmented on the basis of Type, Purchase, End User, and Region.

By Type, Infectious Disease Testing segment is expected to dominate the market during the forecast period

- The Rapid Medical Diagnostic Kits market is expected to categorize by segments and is projected to have the Infectious Disease Testing segment leading the market during the forecast period owing to the rising need to test for infectious diseases across the world especially at the point of care. More complications like malaria, HIV, flu, and the present coronavirus have made people seek rapid and portable diagnostic technologies that return high accuracy within a short time. It improves the diagnostic capabilities, prompt treatment though in such conditions, disease control via these tests is essential in resource poor and outbreaks. Advanced technologies that have been developed in the point-of-care diagnostics and increased usage of testing equipment in clinics, hospitals and even home based are some of the factors that have contributed immensely to the growth of the infectious disease testing segment to be a major driver of the growth of the market.

By Purchase, OTC segment expected to held the largest share

- The OTC segment is expected to occupy the largest market share of the rapid medical diagnostic kits since more people are seeking easy-to-use and home-based diagnostic products. Over-the-counter diagnostic kits are small devices that people use to conduct tests on their own, without the help of a doctor or a Prescription, to check for pregnancy, blood sugar, cholesterol, or infections. These kits are extremely popular among health-conscious consumers as the can be easily used privately from the comfort of one’s home and they yield quick results. The concern for individual well-being and effective availability of OTC products in pharmacies, Internet resources, and retail outlets are stimulating active development in this segment and contributing to the fact that it has become one of the leaders in the market.

Rapid Medical Diagnostic Kits Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- According to the analysis highlighted in the report in the rapid medical diagnostic kits market, North America has become the largest region in this market in 2023, primarily due to the primary factors such as developed healthcare systems, higher health consciousness and greater acceptances of technological advancements in the healthcare sector.. Especially, the U.S. contributed a major portion to this industry and dominated a little more than one third of the total world market share. The global dominance is attributed to good and developed healthcare infrastructure in the region, strong emphasis on research and development and the access to various types of rapid diagnostic kits covering both clinic and home care segments.

Active Key Players in the Rapid Medical Diagnostic Kits Market:

- Abacus Diagnostica (Finland)

- Abbott Laboratories (USA)

- Becton, Dickinson and Company (USA)

- bioMérieux SA (France)

- Bio-Rad Laboratories (USA)

- Cardinal Health (USA)

- Chembio Diagnostics (USA)

- Danaher Corporation (USA)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Meridian Bioscience (USA)

- OraSure Technologies, Inc. (USA)

- Quidel Corporation (USA)

- Siemens Healthineers (Germany)

- Thermo Fisher Scientific (USA)

- Trinity Biotech (Ireland), and Other Active Players

|

Rapid Medical Diagnostic Kits Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.58 Billion |

|

Forecast Period 2024-32 CAGR: |

9.03 % |

Market Size in 2032: |

USD 51.34 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Purchase |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Rapid Medical Diagnostic Kits Market by Type

4.1 Rapid Medical Diagnostic Kits Market Snapshot and Growth Engine

4.2 Rapid Medical Diagnostic Kits Market Overview

4.3 Infectious Disease Testing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Infectious Disease Testing: Geographic Segmentation Analysis

4.4 Glucose Monitoring

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Glucose Monitoring: Geographic Segmentation Analysis

4.5 Cardiometabolic Testing

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Cardiometabolic Testing: Geographic Segmentation Analysis

4.6 Tumor/Cancer Marker Testing Products

4.6.1 Introduction and Market Overview

4.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.6.3 Key Market Trends, Growth Factors and Opportunities

4.6.4 Tumor/Cancer Marker Testing Products: Geographic Segmentation Analysis

Chapter 5: Rapid Medical Diagnostic Kits Market by Purchase

5.1 Rapid Medical Diagnostic Kits Market Snapshot and Growth Engine

5.2 Rapid Medical Diagnostic Kits Market Overview

5.3 OTC

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 OTC: Geographic Segmentation Analysis

5.4 Prescription

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Prescription: Geographic Segmentation Analysis

Chapter 6: Rapid Medical Diagnostic Kits Market by End User

6.1 Rapid Medical Diagnostic Kits Market Snapshot and Growth Engine

6.2 Rapid Medical Diagnostic Kits Market Overview

6.3 Hospitals & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Hospitals & Clinics: Geographic Segmentation Analysis

6.4 Home Care

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Home Care: Geographic Segmentation Analysis

6.5 Diagnostic Laboratories

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Diagnostic Laboratories: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Rapid Medical Diagnostic Kits Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABACUS DIAGNOSTICA (FINLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ABBOTT LABORATORIES (USA)

7.4 BECTON

7.5 DICKINSON AND COMPANY (USA)

7.6 BIOMÉRIEUX SA (FRANCE)

7.7 BIO-RAD LABORATORIES (USA)

7.8 CARDINAL HEALTH (USA)

7.9 CHEMBIO DIAGNOSTICS (USA)

7.10 DANAHER CORPORATION (USA)

7.11 F. HOFFMANN-LA ROCHE LTD (SWITZERLAND)

7.12 MERIDIAN BIOSCIENCE (USA)

7.13 ORASURE TECHNOLOGIES INC. (USA)

7.14 QUIDEL CORPORATION (USA)

7.15 SIEMENS HEALTHINEERS (GERMANY)

7.16 THERMO FISHER SCIENTIFIC (USA)

7.17 TRINITY BIOTECH (IRELAND)

7.18 OTHER ACTIVE PLAYERS

Chapter 8: Global Rapid Medical Diagnostic Kits Market By Region

8.1 Overview

8.2. North America Rapid Medical Diagnostic Kits Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Type

8.2.4.1 Infectious Disease Testing

8.2.4.2 Glucose Monitoring

8.2.4.3 Cardiometabolic Testing

8.2.4.4 Tumor/Cancer Marker Testing Products

8.2.5 Historic and Forecasted Market Size By Purchase

8.2.5.1 OTC

8.2.5.2 Prescription

8.2.6 Historic and Forecasted Market Size By End User

8.2.6.1 Hospitals & Clinics

8.2.6.2 Home Care

8.2.6.3 Diagnostic Laboratories

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Rapid Medical Diagnostic Kits Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Type

8.3.4.1 Infectious Disease Testing

8.3.4.2 Glucose Monitoring

8.3.4.3 Cardiometabolic Testing

8.3.4.4 Tumor/Cancer Marker Testing Products

8.3.5 Historic and Forecasted Market Size By Purchase

8.3.5.1 OTC

8.3.5.2 Prescription

8.3.6 Historic and Forecasted Market Size By End User

8.3.6.1 Hospitals & Clinics

8.3.6.2 Home Care

8.3.6.3 Diagnostic Laboratories

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Rapid Medical Diagnostic Kits Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Type

8.4.4.1 Infectious Disease Testing

8.4.4.2 Glucose Monitoring

8.4.4.3 Cardiometabolic Testing

8.4.4.4 Tumor/Cancer Marker Testing Products

8.4.5 Historic and Forecasted Market Size By Purchase

8.4.5.1 OTC

8.4.5.2 Prescription

8.4.6 Historic and Forecasted Market Size By End User

8.4.6.1 Hospitals & Clinics

8.4.6.2 Home Care

8.4.6.3 Diagnostic Laboratories

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Rapid Medical Diagnostic Kits Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Type

8.5.4.1 Infectious Disease Testing

8.5.4.2 Glucose Monitoring

8.5.4.3 Cardiometabolic Testing

8.5.4.4 Tumor/Cancer Marker Testing Products

8.5.5 Historic and Forecasted Market Size By Purchase

8.5.5.1 OTC

8.5.5.2 Prescription

8.5.6 Historic and Forecasted Market Size By End User

8.5.6.1 Hospitals & Clinics

8.5.6.2 Home Care

8.5.6.3 Diagnostic Laboratories

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Rapid Medical Diagnostic Kits Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Type

8.6.4.1 Infectious Disease Testing

8.6.4.2 Glucose Monitoring

8.6.4.3 Cardiometabolic Testing

8.6.4.4 Tumor/Cancer Marker Testing Products

8.6.5 Historic and Forecasted Market Size By Purchase

8.6.5.1 OTC

8.6.5.2 Prescription

8.6.6 Historic and Forecasted Market Size By End User

8.6.6.1 Hospitals & Clinics

8.6.6.2 Home Care

8.6.6.3 Diagnostic Laboratories

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Rapid Medical Diagnostic Kits Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Type

8.7.4.1 Infectious Disease Testing

8.7.4.2 Glucose Monitoring

8.7.4.3 Cardiometabolic Testing

8.7.4.4 Tumor/Cancer Marker Testing Products

8.7.5 Historic and Forecasted Market Size By Purchase

8.7.5.1 OTC

8.7.5.2 Prescription

8.7.6 Historic and Forecasted Market Size By End User

8.7.6.1 Hospitals & Clinics

8.7.6.2 Home Care

8.7.6.3 Diagnostic Laboratories

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Rapid Medical Diagnostic Kits Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 23.58 Billion |

|

Forecast Period 2024-32 CAGR: |

9.03 % |

Market Size in 2032: |

USD 51.34 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Purchase |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||