Radar Simulator Market Synopsis

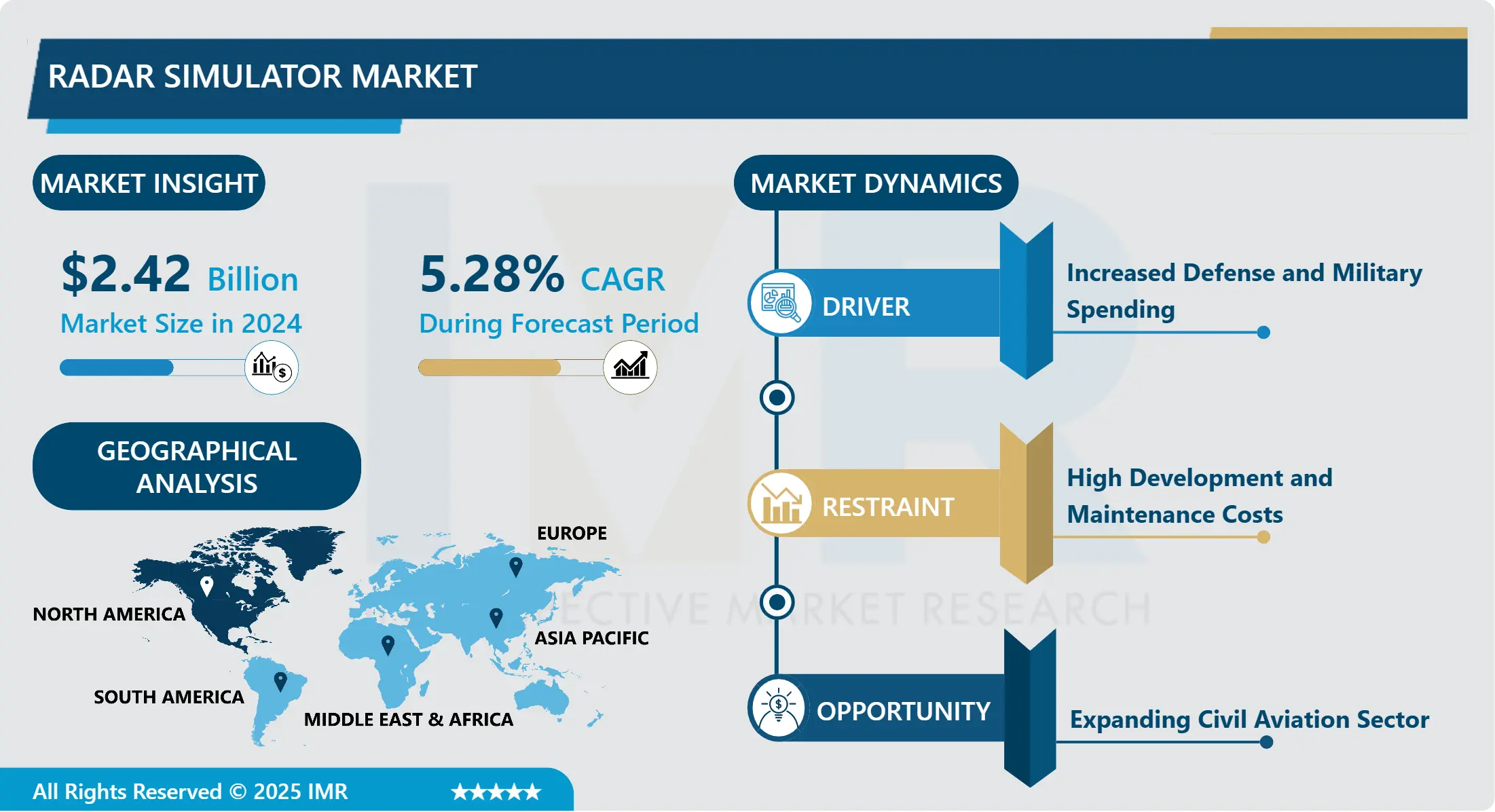

Radar Simulator Market Size Was Valued at USD 2.42 Billion in 2024, and is Projected to Reach USD 3.65 Billion by 2032, Growing at a CAGR of 5.28% From 2025-2032.

Radar simulators are specialized software or hardware systems designed to replicate the operation of radar systems and environments for training, testing, and research purposes. They provide a virtual or simulated representation of radar functionalities and scenarios, enabling users to practice and evaluate radar operations without the need for actual radar equipment.

The market is driven by various factors such as the emergence of modern warfare systems, affordability of simulation training, increasing defense spending in the contingency economy, demand for skilled and trained operators, and increasing R&D activities in the field of military simulation. Radar simulators provide an effective way to train operators on the intricacies of modern technology, ensuring that they are well-equipped to handle complex situations. These simulators enable aviation professionals to enhance their skills in navigating complex airspaces and responding to various situations, contributing to increased safety and efficiency.

In the defense sector, radar simulators facilitate realistic training exercises, allowing personnel to practice surveillance tactics, target tracking, and electronic warfare in simulated yet realistic environments, preparing them for various operational challenges. Additionally, radar simulators enable testing and validation of new radar systems and tactics, ensuring optimal performance and preparedness in real-world scenarios.

The increase in defense spending in emerging economies has a positive impact on target markets. As countries invest in strengthening their defense capabilities, there is also a need to effectively train military personnel. Countries such as Russia and China are investing heavily in the defense sector. For example, Russia's draft 2024 budget, which is awaiting approval by the State Duma, plans to spend 6% of GDP on the military, exceeding social spending for the first time. This trend underscores the importance of maintaining a well-trained and capable defense workforce to meet ever-changing security challenges.The affordability of simulation training has become a key factor for the target market. Traditional live training exercises involving actual radio detection and ranging systems can be expensive and logistically difficult. Radar simulators provide a cost-effective alternative by providing realistic training scenarios without requiring expensive equipment and resources.

Simulators also reduce wear and tear on actual radio detection and ranging systems, extending their operational life. As defense budgets come under scrutiny, the cost-effectiveness of simulation training becomes increasingly attractive, leading to higher adoption rates and driving growth in the target market.

Radar Simulator Market Trend Analysis

Radar Simulator Market Growth Driver- Increased Defense and Military Spending

- The surge in defense budgets and military speculations all-inclusive has gotten to be a noteworthy driver for the radar test system advertise. As countries contribute intensely in their defense capabilities, there's an expanding request for progressed preparing arrangements that guarantee military work force are well-prepared for complex operational scenarios. Radar test systems play a basic part in this setting by giving reasonable and controlled situations where military administrators can hone radar operations, target following, and danger discovery.

- These test systems offer a secure and cost-effective way to prepare work force without the dangers and costs related with live works out. By duplicating real-world radar frameworks and scenarios, radar test systems offer assistance upgrade operational preparation, progress decision-making aptitudes, and guarantee that military strengths are prepared to handle different dangers and challenges. Subsequently, the developing accentuation on defense and military readiness drives the request for modern radar test systems, which are basic for keeping up a tall level of strategic capability and key advantage.

Radar Simulator Market Expansion Opportunity- Expanding Civil Aviation Sector

- The growing respectful flying division is driving expanded request for radar test systems, which are fundamental for preparing discuss activity controllers and pilots. As discuss activity administration gets to be more complex due to rising flight volumes, different airplane sorts, and complex airspace structures, the require for modern preparing devices has developed. Radar test systems play a vital part in this setting by giving practical reenactments of different flight scenarios, activity conditions, and crisis circumstances. These test systems permit discuss activity controllers and pilots to hone and refine their aptitudes in a controlled environment, guaranteeing they can handle the complexities and challenges of present day discuss activity administration.

- By advertising a hands-on, immersive encounter that closely mirrors real-world conditions, radar test systems offer assistance upgrade the precision and effectiveness of preparing programs, subsequently moving forward security and operational adequacy within the respectful flying industry. As the division proceeds to develop and advance, the dependence on progressed radar test systems to get ready experts for the requests of their roles is anticipated to extend essentially.

Radar Simulator Market Segment Analysis:

Radar Simulator market is segmented on the basis of Component, Product, Type, Application, and Region.

By Type, Marine Segment Is Expected to Dominate the Market During the Forecast Period

- Among the different sorts of radar test systems, Marine radar test systems are regularly the prevailing portion. This dominance is generally due to the broad utilize of radar innovation in oceanic operations for route, collision shirking, and climate observing. Marine radar test systems are pivotal for preparing work force in dealing with complex sea scenarios, counting route through congested waters, deciphering radar signals completely different climate conditions, and reacting to potential collisions.

- The marine division depends intensely on radar frameworks for secure and proficient operation of ships and vessels. As sea activity proceeds to extend all inclusive, the request for progressed radar test systems that can precisely duplicate marine situations and scenarios is developing. These test systems offer assistance prepare dispatch operators and pilots to viably utilize radar frameworks, making strides their capacity to form basic choices in real-time and improving in general oceanic security.

- Moreover, marine radar test systems are regularly utilized by sea preparing educate and maritime strengths to guarantee that work force are well-prepared for the special challenges of ocean route. The capacity to recreate different ocean conditions, vessel intelligent, and navigational risks makes these test systems basic devices for comprehensive oceanic preparing. Subsequently, the broad application and basic part of radar in oceanic operations contribute to the dominance of marine radar test systems within the showcase.

By Application, Military Segment Held the Largest Share In 2024

- Within the radar test system showcase, the Military application is for the most part overwhelming over the Commercial segment. This dominance is essentially driven by the tall request for progressed reenactment innovations inside military settings for preparing, operational status, and mission arrangement. Military radar test systems are utilized broadly to prepare staff in complex radar operations, target following, and risk discovery, giving practical scenarios that plan them for real-world combat and defense circumstances. The military's require for high-fidelity test systems is fueled by the basic part that radar frameworks play in cutting edge defense methodologies. These test systems must reproduce modern radar frameworks and a wide run of combat scenarios to guarantee that military work force are altogether prepared and can work progressed radar advances viably.

- The center on security, precision, and mission victory drives noteworthy speculations in radar reenactment innovations for defense purposes. In differentiate, whereas commercial applications—such as those for discuss activity control, sea route, and mechanical monitoring—also utilize radar test systems, the scale and speculation in these frameworks are by and large littler compared to the military segment.

- Commercial applications frequently prioritize cost-effectiveness and down to earth usefulness, which can constrain the degree of recreation constancy and complexity required. In general, the broad requirements for military preparing and operational readiness, combined with the significant defense budgets and accentuation on progressed innovation, contribute to the dominance of military applications within the radar test system showcase.

Radar Simulator Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- The North American region, particularly the United States, dominates the global radar simulator market. This leadership is driven by several factors, including substantial defense budgets and a high level of investment in advanced military and aerospace technologies. The U.S. is home to many of the world's leading defense contractors and technology companies, such as Raytheon Technologies, Northrop Grumman, and Lockheed Martin, which are major players in developing and deploying radar simulation technologies.

- The region's focus on maintaining technological superiority and readiness through simulation and training exercises fuels demand for sophisticated radar simulators. Additionally, the U.S. government's emphasis on research and development in defense and security, coupled with substantial funding for modernization programs, supports the growth of the radar simulator market. The presence of well-established defense and aerospace industries, along with ongoing advancements in simulation technology, reinforces North America's dominant position in the global market.

Radar Simulator Market Active Players

- Leonardo S.p.A. (Italy)

- Thales Group (France)

- Raytheon Technologies Corporation (Usa)

- Hewlett Packard Enterprise (Hpe) (Usa)

- Northrop Grumman Corporation (Usa)

- Bae Systems Plc (Uk)

- Elbit Systems Ltd. (Israel)

- Saab Ab (Sweden)

- Indra Sistemas S.A. (Spain)

- Kongsberg Gruppen Asa (Norway)

- General Dynamics Mission Systems (Usa)

- L3 Technologies, Inc. (Usa)

- Rohde & Schwarz Gmbh & Co. Kg (Germany)

- Boeing Defense, Space & Security (Usa)

- Harris Corporation (Now Part Of L3 Technologies) (Usa)

- Cobham Plc (Uk)

- Mercury Systems, Inc. (Usa)

- Leonardo Drs, Inc. (Usa)

- Ansys, Inc. (Usa)

- Adacel Technologies Limited (Australia)

- Synthetaic Inc. (Usa)

- Teledyne Technologies Incorporated (Usa)

- Mti Instruments, Inc. (Usa)

- Vayavision Technologies (Israel)

- Meggitt Plc (Uk)

- Other Active Players.

Key Industry Developments in the Radar Simulator Market:

- In September 2023, Cambridge Pixel announced the launch of RadarLink, an innovative software solution designed to optimise radar video transmission over low bandwidth or unreliable data links. The product includes intelligent data link monitoring, adaptive prioritisation based on radio detection and telemetry data importance, configurable encoding controls, seamless integration with existing systems and a user-friendly interface, providing operators with optimal video quality in challenging network conditions.

- In August 2023, Micro Nav Limited was awarded a contract by NATS to deliver BEST Radar and Tower simulation capabilities at three UK airports: Glasgow, Aberdeen and Southampton. The contract includes upgrading the existing BEST 2D Tower systems in Glasgow and Aberdeen to 3D tower simulation capabilities and providing a new BEST 3D Tower simulator to Southampton Airport, demonstrating Micro Navan’s commitment to advancing air traffic control training technology.

|

Global Radar Simulator Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.42 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.28% |

Market Size in 2032: |

USD 3.65 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Product |

|

||

|

By Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Radar Simulator Market by Component (2018-2032)

4.1 Radar Simulator Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Hardware

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Software

Chapter 5: Radar Simulator Market by Product (2018-2032)

5.1 Radar Simulator Market Snapshot and Growth Engine

5.2 Market Overview

5.3 System Testing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Operator Testing

Chapter 6: Radar Simulator Market by Type (2018-2032)

6.1 Radar Simulator Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Marine

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Airborne

6.5 Ground

Chapter 7: Radar Simulator Market by Application (2018-2032)

7.1 Radar Simulator Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Military

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Radar Simulator Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 LEONARDO S.P.A. (ITALY)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 THALES GROUP (FRANCE)

8.4 RAYTHEON TECHNOLOGIES CORPORATION (USA)

8.5 HEWLETT PACKARD ENTERPRISE (HPE) (USA)

8.6 NORTHROP GRUMMAN CORPORATION (USA)

8.7 BAE SYSTEMS PLC (UK)

8.8 ELBIT SYSTEMS LTD. (ISRAEL)

8.9 SAAB AB (SWEDEN)

8.10 INDRA SISTEMAS S.A. (SPAIN)

8.11 KONGSBERG GRUPPEN ASA (NORWAY)

8.12 GENERAL DYNAMICS MISSION SYSTEMS (USA)

8.13 L3 TECHNOLOGIES INC. (USA)

8.14 ROHDE & SCHWARZ GMBH & CO. KG (GERMANY)

8.15 BOEING DEFENSE

8.16 SPACE & SECURITY (USA)

8.17 HARRIS CORPORATION (NOW PART OF L3 TECHNOLOGIES) (USA)

8.18 COBHAM PLC (UK)

8.19 MERCURY SYSTEMS INC. (USA)

8.20 LEONARDO DRS INC. (USA)

8.21 ANSYS INC. (USA)

8.22 ADACEL TECHNOLOGIES LIMITED (AUSTRALIA)

8.23 SYNTHETAIC INC. (USA)

8.24 TELEDYNE TECHNOLOGIES INCORPORATED (USA)

8.25 MTI INSTRUMENTS INC. (USA)

8.26 VAYAVISION TECHNOLOGIES (ISRAEL)

8.27 MEGGITT PLC (UK)

Chapter 9: Global Radar Simulator Market By Region

9.1 Overview

9.2. North America Radar Simulator Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Component

9.2.4.1 Hardware

9.2.4.2 Software

9.2.5 Historic and Forecasted Market Size by Product

9.2.5.1 System Testing

9.2.5.2 Operator Testing

9.2.6 Historic and Forecasted Market Size by Type

9.2.6.1 Marine

9.2.6.2 Airborne

9.2.6.3 Ground

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Military

9.2.7.2 Commercial

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Radar Simulator Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Component

9.3.4.1 Hardware

9.3.4.2 Software

9.3.5 Historic and Forecasted Market Size by Product

9.3.5.1 System Testing

9.3.5.2 Operator Testing

9.3.6 Historic and Forecasted Market Size by Type

9.3.6.1 Marine

9.3.6.2 Airborne

9.3.6.3 Ground

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Military

9.3.7.2 Commercial

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Radar Simulator Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Component

9.4.4.1 Hardware

9.4.4.2 Software

9.4.5 Historic and Forecasted Market Size by Product

9.4.5.1 System Testing

9.4.5.2 Operator Testing

9.4.6 Historic and Forecasted Market Size by Type

9.4.6.1 Marine

9.4.6.2 Airborne

9.4.6.3 Ground

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Military

9.4.7.2 Commercial

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Radar Simulator Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Component

9.5.4.1 Hardware

9.5.4.2 Software

9.5.5 Historic and Forecasted Market Size by Product

9.5.5.1 System Testing

9.5.5.2 Operator Testing

9.5.6 Historic and Forecasted Market Size by Type

9.5.6.1 Marine

9.5.6.2 Airborne

9.5.6.3 Ground

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Military

9.5.7.2 Commercial

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Radar Simulator Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Component

9.6.4.1 Hardware

9.6.4.2 Software

9.6.5 Historic and Forecasted Market Size by Product

9.6.5.1 System Testing

9.6.5.2 Operator Testing

9.6.6 Historic and Forecasted Market Size by Type

9.6.6.1 Marine

9.6.6.2 Airborne

9.6.6.3 Ground

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Military

9.6.7.2 Commercial

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Radar Simulator Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Component

9.7.4.1 Hardware

9.7.4.2 Software

9.7.5 Historic and Forecasted Market Size by Product

9.7.5.1 System Testing

9.7.5.2 Operator Testing

9.7.6 Historic and Forecasted Market Size by Type

9.7.6.1 Marine

9.7.6.2 Airborne

9.7.6.3 Ground

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Military

9.7.7.2 Commercial

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Radar Simulator Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.42 Bn. |

|

Forecast Period 2025-32 CAGR: |

5.28% |

Market Size in 2032: |

USD 3.65 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Product |

|

||

|

By Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||