Pulmonary Function Testing Systems Market Synopsis

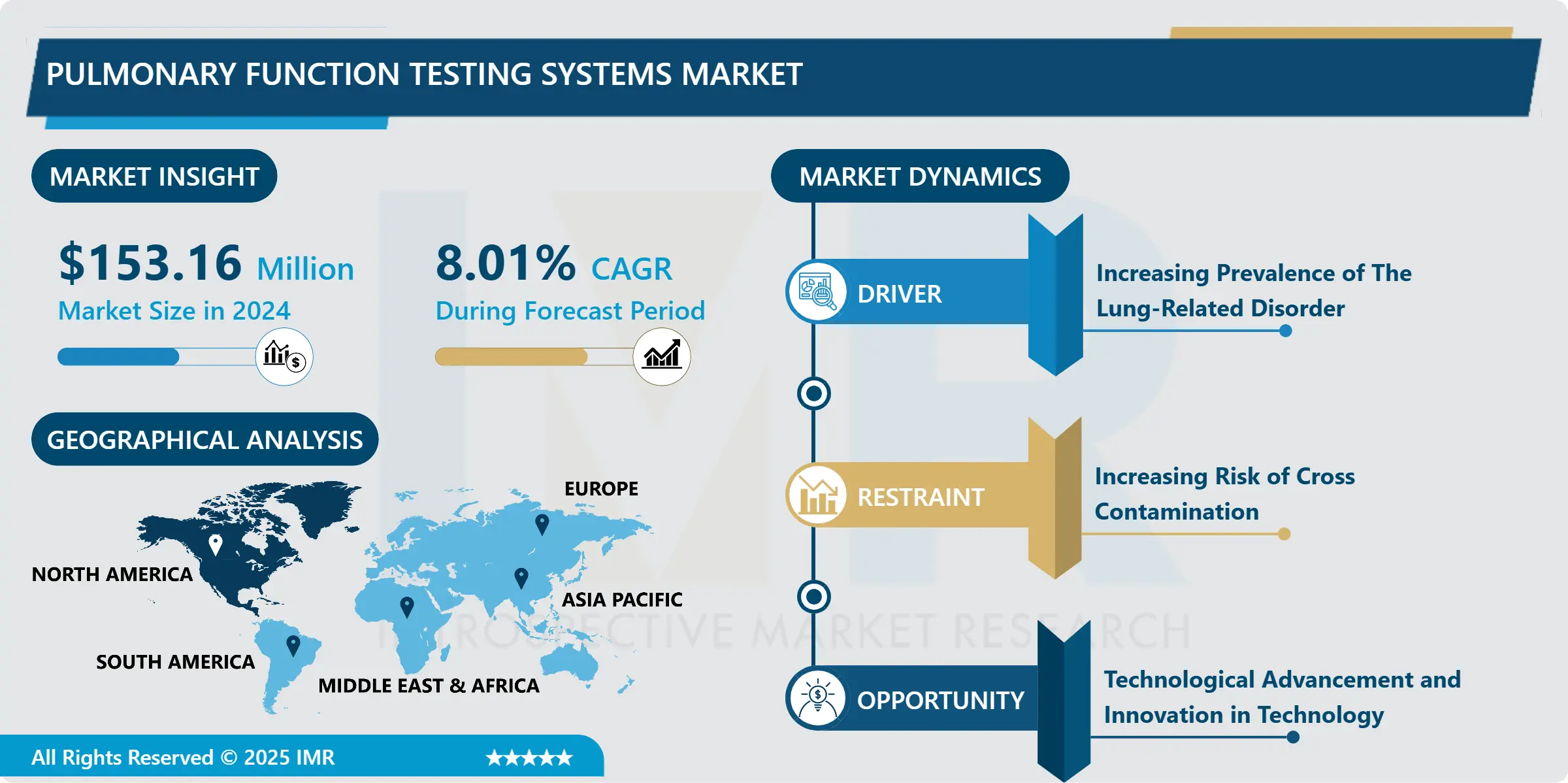

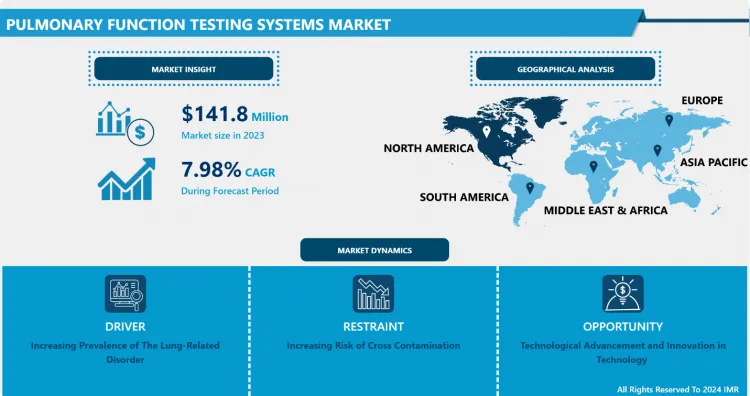

Pulmonary Function Testing Systems Market size was valued at USD 153.16 million in 2024, and is projected to reach USD 357.48 mllion by 2035, growing at a CAGR of 8.01% from 2025-2035.

Pulmonary function tests are non-invasive tests that determine how well the lungs work. The tests measure lung volume, gas exchange, and rates of flow. This test helps physicians and healthcare workers to diagnose and decide the treatment of lung disorders.

Lungs perform the function of the pulmonary. This involves breathing in air through the nasal passages leading to the lungs and taking in oxygen from the blood that travels to other parts of the body and exhaling carbon dioxide as waste through the nasal passages.

People are given a number of tests to check how well their lungs are working. These are done with pulmonary function testing equipment. Tests can be done for two reasons. First, if the airway is blocked or obstructed. Second, when the absorption of oxygen in the blood is limited or reduced.

The key manufacturers of pulmonary function testing systems are focused on partnership, acquisition, and collaboration to boost market growth. For instance, add Medical Technologies announced its new partnership with Biomedix, a provider of front-line diagnostic solutions for delivering value-based care. Biomedix offers various platforms that centralize data for analyzing population health across multiple chronic conditions, including COPD.

The Pulmonary Function Testing Systems Market Trend Analysis

Increasing Prevalence of The Lung-Related Disorder

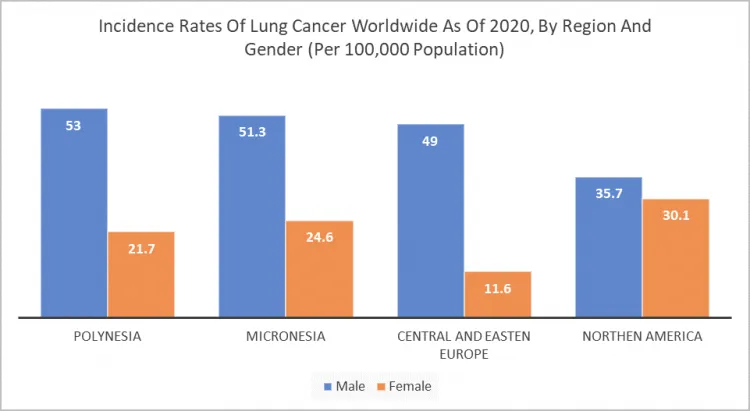

- The increasing prevalence of lung cancer and lung-related disorders boosts the market growth. For instance, according to world cancer research world fund international, lung cancer is the second-most common cancer around the world. There were more than 2.2 million new cases of lung cancer in 2020. Moreover, an increase in air pollution which leads to breathing problems drives the market growth.

- Smoking and drinking habits cause lung cancer so the demand for pulmonary function equipment is increasing and it’s a major factor that drives the market growth. For instance, according to Statista, the age-standardized incidence rate of lung cancer among males around the world was 31.5 per 100,000 population. In 2020 the incidence rate of lung cancer among males was highest in Polynesia.

- The growing demand for minimally invasive tests to design an appropriate method of lung testing disease and increasing in the rate of mortality boosts the market growth in the upcoming years. Additionally, the increase in the geriatric population and people's awareness is also driving the demand for portable lung function testing devices as they can be easily used in home healthcare.

Technological Advancement and Innovation in Technology

- The excessive consumption of tobacco in the form of cigarettes and the use of this test to ensure lung health and the infection-free nature of the body's airways are driving the growth of the pulmonary function testing market.

- As awareness of the systematic examination of a patient's lung health through chest x-rays, physical tests, arterial blood gas analysis, and examination of the patient's habits and medical history has increased, so has a concern about lung damage that can affect normal lung function. Life and the need to limit their impact and severity are also influencing the pulmonary function testing market. In addition, improvements in healthcare infrastructure, growth in research and development, and growth in healthcare costs are positively affecting the pulmonary function testing market growth.

- Technological advancements and technological innovations will create more growth opportunities for pulmonary function testing system market players during the forecast period. Life expectancy has increased, which means that there are a large number of elderly people who need medical care. Diseases such as lung cancer, pulmonary congestion, and asthma are more common in the elderly. Such factors provide additional growth opportunities for the market.

Segmentation Analysis of The Pulmonary Function Testing Systems Market

Pulmonary Function Testing Systems market segments cover the Type, Test, Application, and End User. By End Users, the hospital segment is anticipated to dominate the Market Over the Forecast period.

- The segmental growth is the result of an increase in the number of patients with COPD and asthma visiting hospitals. Moreover, the segment is anticipated to rise in the upcoming years due to hospitals' increasing usage of comprehensive systems for patient diagnosis. The category for physician groups is anticipated to grow fast throughout the forecast period.

- The rise in the prevalence of chronic respiratory disorders, the increased focus of market leaders on developing portable systems for hospitals, and an increase in the use of these systems in clinics are all factors that drive the segment's growth. For instance, in August 2019, Ruby Hall in Pune, India, announced the installation of the CareFusion-produced Vyntus Body pulmonary function test system. Moreover, the increased number of patients visiting hospitals for the diagnosis of lung disorders boosts the market growth in the upcoming years.

Regional Analysis of The Pulmonary Function Testing Systems Market

North America is Expected to Dominate the Pulmonary Function Testing Systems Market Over the Forecast period.

- In North America advanced medical infrastructure and the high disposable income of consumers increase the growth in pulmonary function testing systems can boost the market growth. In this region well, developed healthcare infrastructure as well as the rising prevalence of pulmonary disorders and respiratory diseases drives the market growth in this region.

- North America due to increasing research and development facilities for approval and development of novel drug therapies as well as rising demand for advanced medical devices for treatment boosts the market growth. Various government policies support the purchase of advanced pulmonary function testing and increasing genetic diseases boost the market growth. Also, technologically advanced products offering more features in function testing systems are the driving factor in this region. Additionally, an increase in the per capita healthcare expenditure with increasing hospital admissions drives the growth of the pulmonary function testing system market in this region in the upcoming years.

Top Key Players Covered in The Pulmonary Function Testing Systems Market

- MGC Diagnostics Corporation (US)

- Morgan Scientific Inc. (US)

- Omron Healthcare Inc(Japan)

- Cosmed Srl (Italy)

- Ganshorn Medizin Electronic (Germany)

- ndd Medizintechnik AG (Switzerland)

- Schiller AG (Switzerland)

- Vyaire Medical, Inc (US)

- Minato Holdings Inc. (Japan)

- Eco Medics Ag (Switzerland)

- Chest M.I., Inc (Japan)

- Koninklijke Philips N.V. (Netherlands)

- PulmOne Advanced Medical Devices (Israel)

- KoKo PFT (US), and Other Major Players.

Key Industry Developments in the Pulmonary Function Testing Systems Market

- In March 2023, Vitalograph, a respiratory diagnostic devices manufacturer, announced the launch of the VitaloPFT Pulmonary Function Testing Series at the annual Arab Health Exhibition in Dubai. The product was launched with an aim for use in secondary care.

- January 2023, CAIRE Inc., a subsidiary of NGK SPARK PLUG CO., LTD., expanded its expertise in pulmonary disease by acquiring MGC Diagnostics Corporation. The acquisition allowed CAIRE to strengthen its position in the respiratory care market. This strategic move aligned with the company's goal to enhance its product offerings and provide advanced solutions for diagnosing and treating pulmonary conditions.

|

Global Pulmonary Function Testing Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 153.16 Mn. |

|

Forecast Period 2025-35 CAGR: |

8.01% |

Market Size in 2035: |

USD 357.48 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Test |

|

||

|

By Application |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Pulmonary Function Testing Systems Market by Type (2018-2032)

4.1 Pulmonary Function Testing Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Portable PFT Systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Complete PFT Systems

Chapter 5: Pulmonary Function Testing Systems Market by Test (2018-2032)

5.1 Pulmonary Function Testing Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Gas Exchange Testing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Oxygen Titration Test

5.5 Spirometry

5.6 Lung Volume

5.7 Others

Chapter 6: Pulmonary Function Testing Systems Market by Application (2018-2032)

6.1 Pulmonary Function Testing Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Restrictive Lung Disease

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Chronic Obstructive Pulmonary Disease

6.5 Asthma

6.6 Other

Chapter 7: Pulmonary Function Testing Systems Market by End-Users (2018-2032)

7.1 Pulmonary Function Testing Systems Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Clinical Laboratories

7.5 Diagnostics Laboratories

7.6 Other

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Pulmonary Function Testing Systems Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ALLSCRIPTS HEALTHCARE SOLUTIONS INC. (UNITED STATES)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 BECTON

8.4 DICKINSON(UNITED STATES)

8.5 CERNER CORP (UNITED STATES)

8.6 MCKESSON CORP (UNITED STATES)

8.7 OMNICELL INC. (UNITED STATES)

8.8 OPTUM INC. (UNITED STATES)

8.9 MEDTRONIC(UNITED STATES)

8.10 SURGICAL INFORMATION SYSTEMS (UNITED STATES)

8.11 STRYKER CORPORATION (UNITED STATES)

8.12 PICIS CLINICAL SOLUTIONS (UNITED STATES)

8.13 HILLROM (UNITED STATES)

8.14 ALTERA DIGITAL HEALTH INC (UNITED STATES)

8.15 GETINGE AB (SWEDEN)

8.16 NEXUS AG (GERMANY)

8.17 RICHARD WOLF GMBH (GERMANY)

8.18 CARESYNTAX (GERMANY)

8.19 COMEG MEDICAL TECHNOLOGIES (GERMANY)

8.20 BRAINLAB (GERMANY)

8.21 STERIS PLC (UNITED KINGDOM)

8.22 PROXIMIE (UNITED KINGDOM)

8.23 EIZO (JAPAN)

Chapter 9: Global Pulmonary Function Testing Systems Market By Region

9.1 Overview

9.2. North America Pulmonary Function Testing Systems Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Portable PFT Systems

9.2.4.2 Complete PFT Systems

9.2.5 Historic and Forecasted Market Size by Test

9.2.5.1 Gas Exchange Testing

9.2.5.2 Oxygen Titration Test

9.2.5.3 Spirometry

9.2.5.4 Lung Volume

9.2.5.5 Others

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Restrictive Lung Disease

9.2.6.2 Chronic Obstructive Pulmonary Disease

9.2.6.3 Asthma

9.2.6.4 Other

9.2.7 Historic and Forecasted Market Size by End-Users

9.2.7.1 Hospitals

9.2.7.2 Clinical Laboratories

9.2.7.3 Diagnostics Laboratories

9.2.7.4 Other

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Pulmonary Function Testing Systems Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Portable PFT Systems

9.3.4.2 Complete PFT Systems

9.3.5 Historic and Forecasted Market Size by Test

9.3.5.1 Gas Exchange Testing

9.3.5.2 Oxygen Titration Test

9.3.5.3 Spirometry

9.3.5.4 Lung Volume

9.3.5.5 Others

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Restrictive Lung Disease

9.3.6.2 Chronic Obstructive Pulmonary Disease

9.3.6.3 Asthma

9.3.6.4 Other

9.3.7 Historic and Forecasted Market Size by End-Users

9.3.7.1 Hospitals

9.3.7.2 Clinical Laboratories

9.3.7.3 Diagnostics Laboratories

9.3.7.4 Other

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Pulmonary Function Testing Systems Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Portable PFT Systems

9.4.4.2 Complete PFT Systems

9.4.5 Historic and Forecasted Market Size by Test

9.4.5.1 Gas Exchange Testing

9.4.5.2 Oxygen Titration Test

9.4.5.3 Spirometry

9.4.5.4 Lung Volume

9.4.5.5 Others

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Restrictive Lung Disease

9.4.6.2 Chronic Obstructive Pulmonary Disease

9.4.6.3 Asthma

9.4.6.4 Other

9.4.7 Historic and Forecasted Market Size by End-Users

9.4.7.1 Hospitals

9.4.7.2 Clinical Laboratories

9.4.7.3 Diagnostics Laboratories

9.4.7.4 Other

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Pulmonary Function Testing Systems Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Portable PFT Systems

9.5.4.2 Complete PFT Systems

9.5.5 Historic and Forecasted Market Size by Test

9.5.5.1 Gas Exchange Testing

9.5.5.2 Oxygen Titration Test

9.5.5.3 Spirometry

9.5.5.4 Lung Volume

9.5.5.5 Others

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Restrictive Lung Disease

9.5.6.2 Chronic Obstructive Pulmonary Disease

9.5.6.3 Asthma

9.5.6.4 Other

9.5.7 Historic and Forecasted Market Size by End-Users

9.5.7.1 Hospitals

9.5.7.2 Clinical Laboratories

9.5.7.3 Diagnostics Laboratories

9.5.7.4 Other

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Pulmonary Function Testing Systems Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Portable PFT Systems

9.6.4.2 Complete PFT Systems

9.6.5 Historic and Forecasted Market Size by Test

9.6.5.1 Gas Exchange Testing

9.6.5.2 Oxygen Titration Test

9.6.5.3 Spirometry

9.6.5.4 Lung Volume

9.6.5.5 Others

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Restrictive Lung Disease

9.6.6.2 Chronic Obstructive Pulmonary Disease

9.6.6.3 Asthma

9.6.6.4 Other

9.6.7 Historic and Forecasted Market Size by End-Users

9.6.7.1 Hospitals

9.6.7.2 Clinical Laboratories

9.6.7.3 Diagnostics Laboratories

9.6.7.4 Other

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Pulmonary Function Testing Systems Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Portable PFT Systems

9.7.4.2 Complete PFT Systems

9.7.5 Historic and Forecasted Market Size by Test

9.7.5.1 Gas Exchange Testing

9.7.5.2 Oxygen Titration Test

9.7.5.3 Spirometry

9.7.5.4 Lung Volume

9.7.5.5 Others

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Restrictive Lung Disease

9.7.6.2 Chronic Obstructive Pulmonary Disease

9.7.6.3 Asthma

9.7.6.4 Other

9.7.7 Historic and Forecasted Market Size by End-Users

9.7.7.1 Hospitals

9.7.7.2 Clinical Laboratories

9.7.7.3 Diagnostics Laboratories

9.7.7.4 Other

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Pulmonary Function Testing Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 153.16 Mn. |

|

Forecast Period 2025-35 CAGR: |

8.01% |

Market Size in 2035: |

USD 357.48 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Test |

|

||

|

By Application |

|

||

|

By End-Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||