Progressive Cavity Pump (PCP) Market Overview

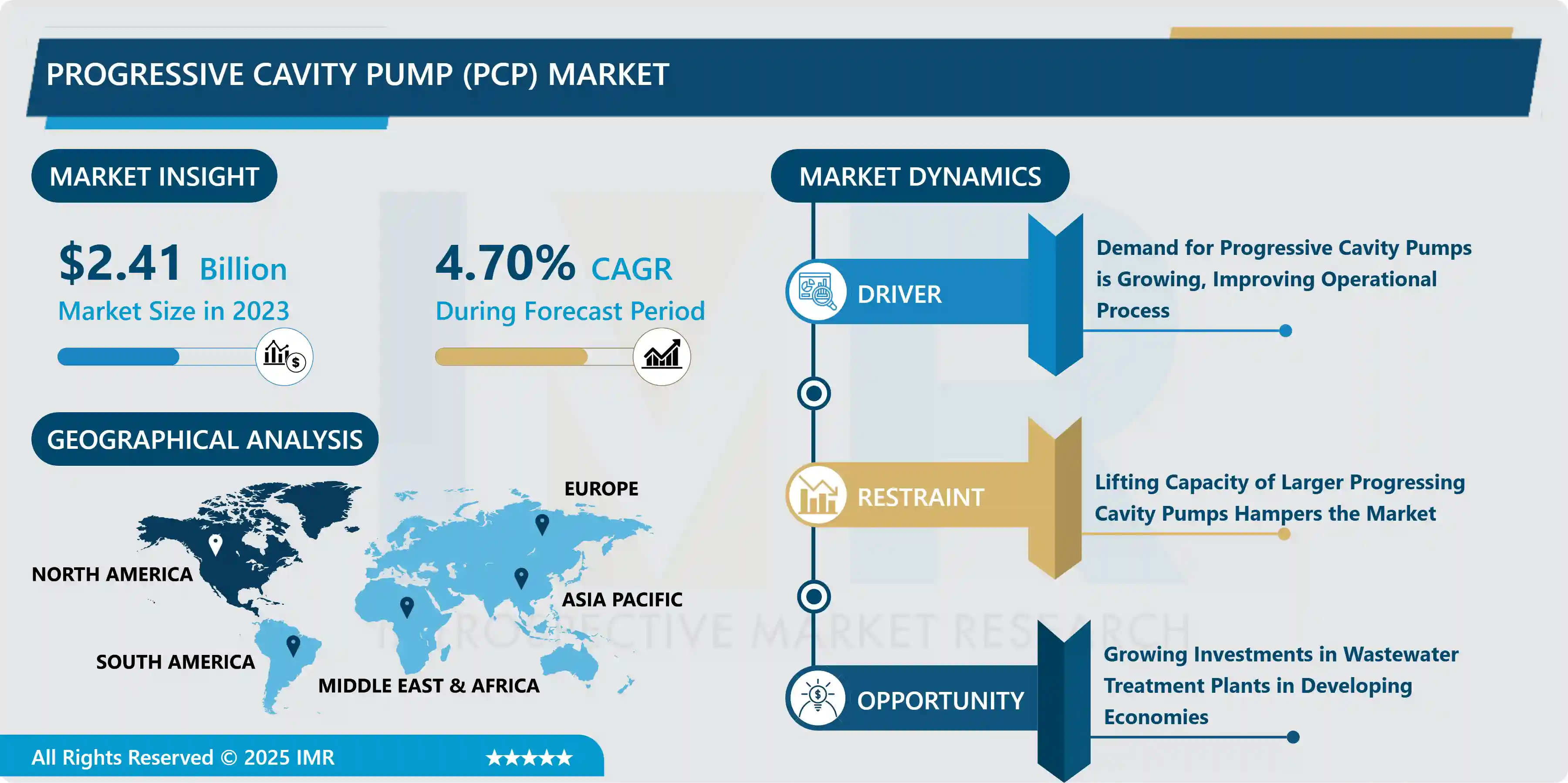

Protective Headgear Market Size Was Valued at USD 2.41 Billion in 2023, and is Projected to Reach 3.64 USD Billion by 2032, Growing at a CAGR of 4.7% From 2024-2032.

In a progressive cavity pump, the positive displacement concept is utilized. Progressive cavity pumps are typically employed when treating viscous fluids at high flow rates and high discharge pressure is necessary. Progressive cavity pumps are frequently utilized for fluids from wastewater treatment facilities, anaerobic digestion facilities, and paper recycling facilities. Before the development of synthetic elastomers and adhesives, progressing cavity pumps (PCP) were used as fluid transfer pumps in a variety of manufacturing and industrial applications.

Progressive cavity pumps are also seen to be a great alternative for preserving a constant flow rate despite the fluid's variable viscosity. As a result, downhole PC pumps and associated surface drive systems are the two key elements that set this sort of artificial lift apart from others. Furthermore, it is anticipated that more common situations, including high-temperature applications, water-source wells, and hostile fluid conditions, would increase the use of developing cavity pumps.

Market Dynamics And Factors For Progressive Cavity Pump (PCP) Market

Drivers:

Demand for Progressive Cavity Pumps is Growing, Improving Operational Process

- Progressing cavity pumps can streamline production for wells with high sand cut and highly viscous fluid (PCPs). These positive displacement pumps are designed to produce variable rates and constant heads and are superior at lifting sand. They can handle many different types of applications. Because of their easy design and installation, lower power consumption when compared to other artificial lift technologies, and cheaper operational and capital expenditures, they are the most affordable and effective artificial lift option. PCPs are typically accepted by end users for modest net positive suction heads (NPSH). Because transferring liquids that are frequently close to vapor pressure needs a more complex pumping system design, the NPSH is a daily worry in industries like oil and gas. Low NPSH may be handled with this pump without the need for any additional construction or design. These pumps can handle materials with high viscosities and a variety of solid impurities and offer decreased loose inefficiency. Additionally, compared to other pump technologies, progressive cavity pump technology is more tolerant of cavitation; as a result, the pump does not malfunction when end-users suffer cavities and may typically start the PCP once the fault is corrected to avoid major system damage. Based on this, it is anticipated that the acceptance of these pumps would increase among a variety of End-users, creating a market dynamic.

Restraints:

Lifting Capacity of Larger Progressing Cavity Pumps Hampers the Market

- Over the projected period, it is anticipated that the global market for progressing cavity pumps will face challenges due to limited production rates and the lower lifting capacities of larger progressing cavity pumps. Additionally, the need for highly experienced staff to install and run systems as well as problems with paraffin control in waxy crude applications are likely to restrain market expansion throughout the projection period. In addition, a fluid coating is required to maintain the lubrication of the sliding (contacting) surfaces. When left running dry, these pumps stop working. Progressive cavity pumps don't generate a lot of flow and move more slowly. VFDs (variable frequency drives) and/or gear reducers, which raise installation costs, can solve this problem. A VFD could not be advantageous depending on the application. When viscous fluid doesn't flow into the pump rapidly enough, it can reduce the volumetric efficiency of the pump. As a result, it's critical to follow the speed limitations for the particular fluid and viscosity (and should be carefully checked and adhered to). PC pumps have a finite range of motion. The rotor/stator fittings might result in significant slippage rates, which reduces the pump's efficiency.

Opportunities:

Growing Investments in Wastewater Treatment Plants in Developing Economies

- The growing spending on wastewater treatment facilities in developing nations as they work toward sustainability objectives is expanding the market for progressive cavity pump suppliers. Environmental research and development efforts are being boosted all around the world as a result of the mounting sewage, rubbish, and wastewater concerns. We need new technology. Every year, the water and wastewater treatment market expands and introduces new tools and methods. The Progressive Cavity Pump (PCP) Market is anticipated to benefit from these lucrative opportunities in the years to come.

Segmentation Analysis Of Progressive Cavity Pump (PCP) Market

- By Pumping Capacity, the 0 to 500 GPM segment is anticipated to hold the maximum market share over the forecast period. The highest market share for PCPs worldwide is held by progressing cavity pumps with pumping capacities between 0 and 500 GPM. Due to the variety of operations that these pumps offer, the sector accounted for more than 65% of the market in 2020. These pumps are small in size and require less powerful electric or hydraulic motors, which are favored globally for their great operational efficiency and inexpensive cost. One of the main reasons why end-use industries like small motors over their more powerful counterparts are that they have lower operational costs. Due to the relatively modest flow rate requirements for fluid processing, the food and beverage industry ranks among the major consumers of these pumps.

- By Pumping Capacity, up to 50 HP segment is anticipated to hold the maximum market share over the forecast period. In demanding pumping applications, PCPs up to 50 hp are primarily employed for abrasion resistance. When the viscosity of the liquid grows, PCPs become mechanical, their volumetric efficiency increases, and they require less power and flow than conventional pumps. Agro and food (for handling creams, emulsions, wine, and olive oils); food & beverages (for handling dairy products, beverages, convenience food, fruits and vegetables, baked goods, sauce and starch, personal care, meat, fish, and animal products); chemicals (for handling detergents, varnish, paints, inks, and soaps); buildings (for handling cement and bentonite). Progressing cavity pumps with such power rating is not highly used in the oil & gas industry owing to the fact that the oil & gas industry demands high power rated operational equipment.

- By End User, water & wastewater is the largest end-user of PCPs among all the industries. The use of PCP units for the processing of polymers, waste, sludge, and flocculants in the water and wastewater industry is expected to increase as a result of the need to lower life cycle costs and increase operating margins. Future needs for water and wastewater management would also be driven by an increase in the need for freshwater, the handling of liquids with increasing viscosities, and a clean environment, opening up the potential for the use of PCPs. These pumps will certainly become more popular as a result of new plant construction, unit improvements, and unit expansions. The UN predicts that by 2025, there will be 8.1 billion people on the planet, up from 7.2 billion in 2013. Therefore, the expansion of the water and wastewater industry would be aided by factors including population growth, particularly in urban areas, industrial development, an increase in the importance of wastewater treatment, international commitments and targets, and governmental regulations. Furthermore, the UN aims to provide everyone with fair access to basic sanitation and safe, cheap drinking water by 2030. This necessitates significant investments in the water and wastewater industries. In consequence, this would increase the demand for PCPs during the projection period.

Regional Analysis Of Progressive Cavity Pump (PCP) Market

- The Asia Pacific region was the largest market for progressing cavity pumps in 2020 and accounted significant market share of the global market. China, Australia, India, and Japan have all investigated the PCP market in the Asia Pacific region. Thailand, Malaysia, the Philippines, Singapore, and South Korea are among the other Asian nations considered in the study. The region's economy is still expected to grow strongly, and it continues to be the most dynamic in the world economy, according to the research study. The region, which is home to many of the top economies in the world, including China, India, and Japan, is predicted to develop at 5.6 percent through 2022. The water and wastewater treatment, oil and gas, and food and beverage sectors are some of the biggest end users of progressive cavity pumps in the area.

- The fast-expanding economies of China and India, along with their robust industrial development rates, will dominate this region's market. Southeast Asian nations like Malaysia and Thailand have developed their markets to varying degrees. By 2022, the Malaysian government wants to provide clean water to 99.5% of the population, up from 95.5% in 2015. Such goals will probably have a positive impact on the PCP market. The Indian Ministry of Finance reports that the nation intends to invest USD 646 billion by 2022 in numerous growth sectors. Power, roads, and urban infrastructure would each receive about 70% of the investment.

- North America is expected to grow at a significant pace over the forecast period. Progressive pumps are projected to be in high demand from sectors including water and wastewater. To put things in perspective, in Canada, municipal wastewater systems have provided service to close to 86 percent of the population. Additionally, the United States accounts for 68.9 billion barrels of the proven reserve, according to the BP Statistical Energy Market Report, which supports the usage of progressive cavity pumps by various oil and gas end-users.

- Similarly, the Europe region is expected to grow at a significant growth rate over the forecast period. With an increase in the need for clean water across diverse industries, countries throughout Europe are installing more water and wastewater treatment facilities. For example, in July 2020, H+E GmbH/Germany/Stuttgart, one of the top global providers of industrial process water and wastewater management systems, was awarded the contract for a supply water treatment plant for a German automaker.

- The Middle East & Africa area is also anticipated to experience significant growth during the projection period. Latin America is predicted to have a small market share for advancing cavity pumps globally, but it is predicted to increase rapidly throughout the projection period.

Top Key Players Covered In Progressive Cavity Pump (PCP) Market

- Netzsch Pumps & Systems

- Seepex GmbH

- Halliburton

- Weatherford International

- Viking Pump, Inc.

- Sulzer Ltd.

- GEA Group

- PSG Dover

- National Oilwell Varco (NOV)

- Tuthill Corporation

- Baker Hughes

- Hunan Oil Pump Co., Ltd.

- Xylem Inc.

- Kracht GmbH

- Wangen Pumps

- SPX Flow

- Ingersoll Rand

- ITT Inc.

- Emerson Electric Co.

- Grundfos Pumps Corporation, and Other Active Player.

Key Industry Development In The Progressive Cavity Pump (PCP) Market

- In October 2024, NETZSCH introduced a hermetically sealed and cost-effective upgrade for their existing NEMO progressing cavity pumps. The hermetic seal of the pumps ensures a safer working environment through the prevention of the escape of toxic liquids and gases. This upgrade contributes to significant cost savings as the sealing systems do not require maintenance.

- In February 2022, Atlas Copco announced the acquisition of Wangen Pumpen, a German-based manufacturer of progressive cavity pumps. The acquisition aims to strengthen Atlas Copco's position in the wastewater treatment and process industry sectors. Wangen Pumpen's products are popular in the market, making them a valuable addition to Atlas Copco's portfolio. The acquisition will enable Atlas Copco to expand its customer base and offer a broader range of pumping solutions.

|

Global Progressive Cavity Pump (PCP) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.41 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.7% |

Market Size in 2032: |

USD 3.64 Bn |

|

Segments Covered: |

By Pumping Capacity (GPM) |

|

|

|

By Power Rating (HP) |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Progressive Cavity Pump (PCP) Market by Pumping Capacity (GPM) (2018-2032)

4.1 Progressive Cavity Pump (PCP) Market Snapshot and Growth Engine

4.2 Market Overview

4.3 0 To 500

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 500 To 1000

4.5 Above 1000

Chapter 5: Progressive Cavity Pump (PCP) Market by Power Rating (HP) (2018-2032)

5.1 Progressive Cavity Pump (PCP) Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Up To 50

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 51 To 100

5.5 Above 100

Chapter 6: Progressive Cavity Pump (PCP) Market by End User (2018-2032)

6.1 Progressive Cavity Pump (PCP) Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Oil & Gas

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Water & Wastewater

6.5 Food & Beverages

6.6 Chemicals & Petrochemicals

6.7 Pulp & Paper

6.8 And Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Progressive Cavity Pump (PCP) Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 WASTE OIL RECYCLERS INC. (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BROCKLESBY LIMITED (UK)

7.4 GREASECYCLE (US)

7.5 BAKER COMMODITIES INC. (US)

7.6 VEOLIA ENVIRONNMENT S.A. (FRANCE)

7.7 DARLING INGREDIENTS INC. (US)

7.8 ARROWS OILS LTD (UK)

7.9 OLLECO LTD. (UK)

7.10 ARGENT ENERGY (UK)

7.11 GRAND NATURAL INC. (US)

7.12 AVERDA (DUBAI) OTHERS MAJOR PLAYERS.

Chapter 8: Global Progressive Cavity Pump (PCP) Market By Region

8.1 Overview

8.2. North America Progressive Cavity Pump (PCP) Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Pumping Capacity (GPM)

8.2.4.1 0 To 500

8.2.4.2 500 To 1000

8.2.4.3 Above 1000

8.2.5 Historic and Forecasted Market Size by Power Rating (HP)

8.2.5.1 Up To 50

8.2.5.2 51 To 100

8.2.5.3 Above 100

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Oil & Gas

8.2.6.2 Water & Wastewater

8.2.6.3 Food & Beverages

8.2.6.4 Chemicals & Petrochemicals

8.2.6.5 Pulp & Paper

8.2.6.6 And Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Progressive Cavity Pump (PCP) Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Pumping Capacity (GPM)

8.3.4.1 0 To 500

8.3.4.2 500 To 1000

8.3.4.3 Above 1000

8.3.5 Historic and Forecasted Market Size by Power Rating (HP)

8.3.5.1 Up To 50

8.3.5.2 51 To 100

8.3.5.3 Above 100

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Oil & Gas

8.3.6.2 Water & Wastewater

8.3.6.3 Food & Beverages

8.3.6.4 Chemicals & Petrochemicals

8.3.6.5 Pulp & Paper

8.3.6.6 And Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Progressive Cavity Pump (PCP) Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Pumping Capacity (GPM)

8.4.4.1 0 To 500

8.4.4.2 500 To 1000

8.4.4.3 Above 1000

8.4.5 Historic and Forecasted Market Size by Power Rating (HP)

8.4.5.1 Up To 50

8.4.5.2 51 To 100

8.4.5.3 Above 100

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Oil & Gas

8.4.6.2 Water & Wastewater

8.4.6.3 Food & Beverages

8.4.6.4 Chemicals & Petrochemicals

8.4.6.5 Pulp & Paper

8.4.6.6 And Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Progressive Cavity Pump (PCP) Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Pumping Capacity (GPM)

8.5.4.1 0 To 500

8.5.4.2 500 To 1000

8.5.4.3 Above 1000

8.5.5 Historic and Forecasted Market Size by Power Rating (HP)

8.5.5.1 Up To 50

8.5.5.2 51 To 100

8.5.5.3 Above 100

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Oil & Gas

8.5.6.2 Water & Wastewater

8.5.6.3 Food & Beverages

8.5.6.4 Chemicals & Petrochemicals

8.5.6.5 Pulp & Paper

8.5.6.6 And Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Progressive Cavity Pump (PCP) Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Pumping Capacity (GPM)

8.6.4.1 0 To 500

8.6.4.2 500 To 1000

8.6.4.3 Above 1000

8.6.5 Historic and Forecasted Market Size by Power Rating (HP)

8.6.5.1 Up To 50

8.6.5.2 51 To 100

8.6.5.3 Above 100

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Oil & Gas

8.6.6.2 Water & Wastewater

8.6.6.3 Food & Beverages

8.6.6.4 Chemicals & Petrochemicals

8.6.6.5 Pulp & Paper

8.6.6.6 And Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Progressive Cavity Pump (PCP) Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Pumping Capacity (GPM)

8.7.4.1 0 To 500

8.7.4.2 500 To 1000

8.7.4.3 Above 1000

8.7.5 Historic and Forecasted Market Size by Power Rating (HP)

8.7.5.1 Up To 50

8.7.5.2 51 To 100

8.7.5.3 Above 100

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Oil & Gas

8.7.6.2 Water & Wastewater

8.7.6.3 Food & Beverages

8.7.6.4 Chemicals & Petrochemicals

8.7.6.5 Pulp & Paper

8.7.6.6 And Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Progressive Cavity Pump (PCP) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.41 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.7% |

Market Size in 2032: |

USD 3.64 Bn |

|

Segments Covered: |

By Pumping Capacity (GPM) |

|

|

|

By Power Rating (HP) |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||