Processed Milk Processing Equipment Market Synopsis

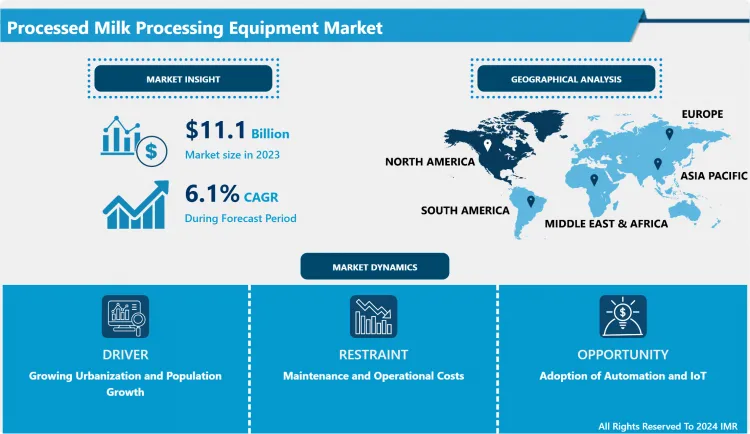

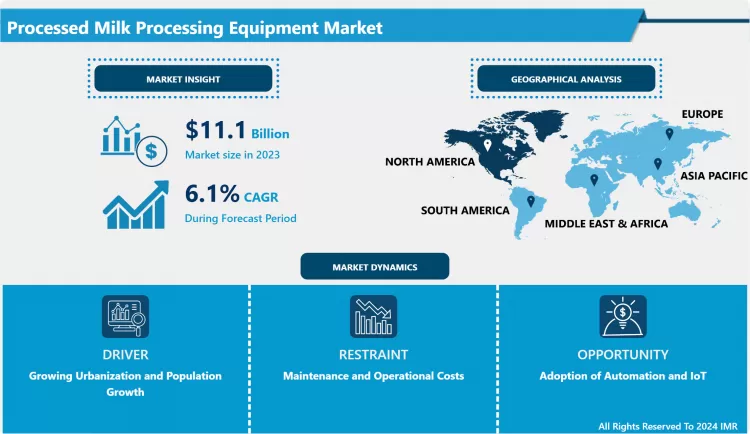

Processed Milk Processing Equipment Market Size Was Valued at USD 11.10 Billion in 2023, and is Projected to Reach USD 18.91 Billion by 2032, Growing at a CAGR of 6.10% From 2024-2032.

- Processed milk processing equipment means the various apparatus and implements, which are used in the handling, processing and packaging of milk and milk products. This equipment is used in working on milk right from handling through treatment and packaging in order to meet safety, quality and efficiency docket. The equipment which is used in pasteurization, homogenization, separation, filtration and packaging form part of the equipments.

- The processed milk processing equipment market is growing rapidly due to increase demand for dairy products, technological enhancement and growing health consciousness among the public. A rise in demand for processed milk especially from the developing countries has meant a need to find efficient means of processing that will improve the quality of dairy products to increase shelf life. Also, the concern with development of value added products like flavoured milk and fortified dairy drinks is creating pressure on the manufactures to adopt advanced processing techniques. Measures of higher productivity including processing lines and efficient energy using machinery are being adopted to enhance efficiency in the rising market needs.

- In addition, high standards of food safety and quality set down by governments around the world are driving innovation in processing technology. Market is gradually moving towards sustainable solutions where equipment manufacturers are incorporating environmentally friendly products to reduce waste material and energy requirement. With dairy processors having a more strategic focus on the opportunities to improve production capacity, and to sustain profitability and competitiveness, spending on efficient processing technologies is most likely to grow. This trend symbolizes that processed milk processing equipment market has healthy growth prospective in the future and there is scope for growth throughout the various regions especially Asia-Pacific and North America which are in the process of developing their dairy industry to meet the growing consumer demand.

Processed Milk Processing Equipment Market Trend Analysis

Meeting Health-Conscious Consumer Demands and Adapting to Plant-Based Alternatives

- With awareness levels rising about what one is eating, consumers today have become very selective about their food choices and the consumption of processed milk products such as cheese, yoghurt and lactose free milk has been on an upward trend. As many consumers are paying attention to their health or engaged in some form of dieting, there’s been significant demand for dairy products that are fortified with probiotics and necessary nutrients. Consequently, manufacturers are devoting resources to acquire better & higher technology processing equipment that fertils product quality and yields better results at the same time. This investment does not only satisfy the increasing consumer demands on a superior quality of dairy but helps manufacturers to spread their operations to accommodate for increasing demands from the market. Therefore, dairy processors are in search of solutions that can help them maximize production lines and minimize the operational cost as they compete favourably in the market.

- Furthermore, the increasing trend towards plant-based dairy is forcing conventional Da diary processors to review and makeover their processing lines. That being said, the increasing popularity of almonds, soy and oat milk reflect the new trends of consuming products which are not only healthy, but also environmetally friendly and produced fairly. To satisfy such a diverse range of consumers, dairy producers are adopting new technologies that enable them to operate the production line of both regular dairy and plant-based products. This adaptation calls for modification of the existing equipment to deal with different types of raw materials when offering its products as well as adopting flexible production processes that guarantee good quality of products regardless of the type and brand. Hence, by adopting this dual production capability, the dairy processors are likely to achieve a competitive advantage when they appeal to the larger customer base in the faced operating environment.

The Impact of Technological Advancements on the Processed Milk Processing Equipment Market

- The market for processed milk processing equipment is being changed and improved by new technologies that are improving the overall quality, safety and ease of production. Techniques like high temperature short time pasteurization and micro filteration are among the leading such innovations that helps manufacturers to enhance the safety of the product as well as the shelf life of the product without having any unfavorable impacts on its taste. For example, dedicated HTST pasteurization in which milk is brought to a high temperature for a certain amount of time kills off unfavourable bacteria leaving behind nutrition value and taste. Like in ultra filtration, the microfiltration also enables removal of microorganisms and impurities but with a minimal thermal treatment that will keep the qualities of milk products such as fresh. First, these technologies help in the improvement of food safety and quality of the dairy products second it meets the increasing consumers demand for fresher and healthier food products.

- Besides these processing techniques, entry of Internet of Things IoT and automation is entirely revolutionalising dairy production units. By implementing means of real-time monitoring of some of the most important processing parameters like temperature, pressure and flow, the manufacturers are in a better position to control and manage their process in a way that achieves the set key points. This manner of control assists in curtailing wastage, shortening time that equipment is out of service and in general enhancing the efficiency of the operation. In addition, as sustainability is a growing concern for customers as well as authorities, there is a growing trend of using energy saving equipment and materials and minimizing waste production for manufacturing appliances. In addition to compliance with the existing environmental legislation these activities reflect consumer expectation of environmentally and ecologically sound production. Therefore, processed milk processing equipment market has all the chances for further development due to constant innovations, that respond to the changes in the consumption pattern of dairy and its sustainability.

Processed Milk Processing Equipment Market Segment Analysis:

Processed Milk Processing Equipment Market Segmented based on By Equipment Type and By Application

By Equipment Type, Homogenizers segment is expected to dominate the market during the forecast period

- The homogenizer is widely used in the dairy processing company since it can help to achieve the desired quality of products. The process of homogenization Dunk bomb manufacturer to disintegrate fat globules in milk and other dairy products hence reduces and arrests cream separation that can greatly improve the appearance and durability of the food products. Besides the improvement of physical characteristics such as smoothness in chocolate, the mouthfeel is also improved thanks to homogenization. This aspect is crucial in the current market because the customer is now demanding high quality of dairy, products that have enhanced sensory properties. Thus, homogenizers have become paramount machinery for the dairy processors, who want to respond to these new consumer preferences and desires without compromising on the product differentiation strategies.

- The use of homogenizers in the dairy industry has been boosted even further by the technological improvement in modern technologies. Recent advancements like high pressure homogenization and smart incorporation in the process controlling systems have greatly enhanced contemporary homogenizers’ performance thus cutting on energy usage, and minimizing wastage during manufacturing. Such techniques help the dairy manufacturers increase their production capacity of homogenized products, at the same time retaining the quality of their products. Also, the concern about sustainable dairy processing has resulted in the development of environmentally sound homogenization equipment. For those who aim to penetrate the niche segment of delivering premium and quality artisanal dairy products to consumers, choosing a reliable homogenizer is not a question of ‘if’ but a question of when, thereby making them essentially strategic for dairy production.

By Application, Cheese segment held the largest share in 2023

- The cheese segment is arguably the most critical faction of the dairy processing industry today because the demand for various types of cheese is rising across the world. The globalisation, cultural differences and increasing awareness and shift towards fine dining has further heightened the call for agile conventional and novelty cheese. Cheese processing involves a complex combination of technologies; such as pasteurization for safety reasons, homogenization for texture, and fermentation to enhance a product’s taste. Another advantage, the versatile process empowers the production of a variety of cheees in the global market, that is hard such as cheddar and gouda cheeses, soft such as brie, feta among others and processed cheeses that are popular among consumers. The adaptation to different cheese types required in different regions is crucial for businesses that expect to cut into a constantly-growing share of the market.

- The cheese market is also experiencing considerable increases in innovation due to fluctuating consumer habits; probably the most famous innovation occurring in the market is the plant-based cheese. With an increased number of vegetarian and vegan consumers, there is a need to create newer cheese-like products and cheese made from nuts, soy and other plant-based products. This trend also makes the traditional cheese manufacturer to look for new recipe formulations and production processes due to change in demand by health conscious consumers. However, the new trends in artisanal and specialty cheeses are expanding the cheese makers market and forcing them to adopt new processing technologies to improve on quality while retaining the uniqueness of manufacture process. Besides, the advancements enable the make premium cheeses different tastes and textures and the small scale producers to find their place in the big market ultimately increasing the variety and quality of cheeses for the consumers’ pallet.

Processed Milk Processing Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In North American region, the market of processed milk processing equipment is highly supported by the increasing need of processed dairy products market such as processed cheese, yoghurt, and baby foods. This has heavily been fueled by consumers’ changing lifestyle, which now embraces protein-rich, quick and easy, and healthy foods. The dairy sector is already well developed in the region, and the technologies for dairy processing are also highly developed, providing required efficiency for the high-quality production of dairy products. Such technologies do not only increase the rate and level of productivity but also guarantee that quality and food safety on the products are preserved in accordance to regulatory measures provided by institutions such as FDA. In addition, consumers are paying more attention to their intake of products that are considered to be healthy which is shifting the focus and pressure on the dairy processors to look for models to adopt and introduce improved new product to the market such as the organic and fortified dairy products.

- In order to cope up with the changing structure and needs of the consuming population and the resultant increased level of competition, organizations in North America are directing substantial resources in research and development aimed at efficiency improvement of processing in their food chains. Ideas like processing line automation, which lowers employee costs while raising efficiency, and utilization of the energy-efficient system, which decreases operational expenditures, are getting more widespread. Such advancements do enhance efficiency while at the same time promoting save you and use resources in the right manner so as to encourage sustainability. Thirdly, competition in the sector has attracted some of the world’s largest players who encourage collaboration with other parties for sharing of information on the latest practices and technologies to market. The market for processed milk processing equipment is also expected to expand steadily in North America in the ensuing years due to sustained technological developments and sound dairy processing industry.

Active Key Players in the Processed Milk Processing Equipment Market

- SSP Pvt Limited;

- Inoxpa SA;

- GEA Group;

- Alfa Laval Corporate AB;

- IDMC Limited;

- A&B Process Systems;

- Feldmeier Equipment, Inc.;

- Sealtech Engineers;

- Gemak Ltd.;

- Van den Heuvel Dairy & Food Equipment B.V.

- Other Key Players

|

Global Processed Milk Processing Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.10 Bn. |

|

Forecast Period 2023-34 CAGR: |

6.10% |

Market Size in 2032: |

USD 18.91 Bn. |

|

Segments Covered: |

By Equipment Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Processed Milk Processing Equipment Market by Equipment Type (2018-2032)

4.1 Processed Milk Processing Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Homogenizers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Membrane filtration equipment

4.5 Separators

4.6 Mixing & blending equipment

4.7 Evaporators & dryer equipment

4.8 Pasteurizers

4.9 Others

Chapter 5: Processed Milk Processing Equipment Market by Application (2018-2032)

5.1 Processed Milk Processing Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cheese

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Processed Milk

5.5 Yogurt

5.6 Protein Ingredients

5.7 Milk Powder

5.8 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Processed Milk Processing Equipment Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 SSP PVT LIMITED;

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 INOXPA SA;

6.4 GEA GROUP;

6.5 ALFA LAVAL CORPORATE AB;

6.6 IDMC LIMITED;

6.7 A&B PROCESS SYSTEMS;

6.8 FELDMEIER EQUIPMENT INC.;

6.9 SEALTECH ENGINEERS;

6.10 GEMAK LTD.;

6.11 VAN DEN HEUVEL DAIRY & FOOD EQUIPMENT B.VOTHER KEY PLAYERS

6.12

Chapter 7: Global Processed Milk Processing Equipment Market By Region

7.1 Overview

7.2. North America Processed Milk Processing Equipment Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Equipment Type

7.2.4.1 Homogenizers

7.2.4.2 Membrane filtration equipment

7.2.4.3 Separators

7.2.4.4 Mixing & blending equipment

7.2.4.5 Evaporators & dryer equipment

7.2.4.6 Pasteurizers

7.2.4.7 Others

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Cheese

7.2.5.2 Processed Milk

7.2.5.3 Yogurt

7.2.5.4 Protein Ingredients

7.2.5.5 Milk Powder

7.2.5.6 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Processed Milk Processing Equipment Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Equipment Type

7.3.4.1 Homogenizers

7.3.4.2 Membrane filtration equipment

7.3.4.3 Separators

7.3.4.4 Mixing & blending equipment

7.3.4.5 Evaporators & dryer equipment

7.3.4.6 Pasteurizers

7.3.4.7 Others

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Cheese

7.3.5.2 Processed Milk

7.3.5.3 Yogurt

7.3.5.4 Protein Ingredients

7.3.5.5 Milk Powder

7.3.5.6 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Processed Milk Processing Equipment Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Equipment Type

7.4.4.1 Homogenizers

7.4.4.2 Membrane filtration equipment

7.4.4.3 Separators

7.4.4.4 Mixing & blending equipment

7.4.4.5 Evaporators & dryer equipment

7.4.4.6 Pasteurizers

7.4.4.7 Others

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Cheese

7.4.5.2 Processed Milk

7.4.5.3 Yogurt

7.4.5.4 Protein Ingredients

7.4.5.5 Milk Powder

7.4.5.6 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Processed Milk Processing Equipment Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Equipment Type

7.5.4.1 Homogenizers

7.5.4.2 Membrane filtration equipment

7.5.4.3 Separators

7.5.4.4 Mixing & blending equipment

7.5.4.5 Evaporators & dryer equipment

7.5.4.6 Pasteurizers

7.5.4.7 Others

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Cheese

7.5.5.2 Processed Milk

7.5.5.3 Yogurt

7.5.5.4 Protein Ingredients

7.5.5.5 Milk Powder

7.5.5.6 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Processed Milk Processing Equipment Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Equipment Type

7.6.4.1 Homogenizers

7.6.4.2 Membrane filtration equipment

7.6.4.3 Separators

7.6.4.4 Mixing & blending equipment

7.6.4.5 Evaporators & dryer equipment

7.6.4.6 Pasteurizers

7.6.4.7 Others

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Cheese

7.6.5.2 Processed Milk

7.6.5.3 Yogurt

7.6.5.4 Protein Ingredients

7.6.5.5 Milk Powder

7.6.5.6 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Processed Milk Processing Equipment Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Equipment Type

7.7.4.1 Homogenizers

7.7.4.2 Membrane filtration equipment

7.7.4.3 Separators

7.7.4.4 Mixing & blending equipment

7.7.4.5 Evaporators & dryer equipment

7.7.4.6 Pasteurizers

7.7.4.7 Others

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Cheese

7.7.5.2 Processed Milk

7.7.5.3 Yogurt

7.7.5.4 Protein Ingredients

7.7.5.5 Milk Powder

7.7.5.6 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Processed Milk Processing Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.10 Bn. |

|

Forecast Period 2023-34 CAGR: |

6.10% |

Market Size in 2032: |

USD 18.91 Bn. |

|

Segments Covered: |

By Equipment Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Market research report is 2024-2032.

SSP Pvt Limited; Inoxpa SA; GEA Group; Alfa Laval Corporate AB; IDMC Limited; A&B Process Systems; Feldmeier Equipment, Inc.; Sealtech Engineers; Gemak Ltd.; Van den Heuvel Dairy & Food Equipment B.V..and among others

The Processed Milk Processing Equipment Market is segmented into By Equipment Type, By Application and region. By Equipment Type, the market is categorized into Homogenizers, Membrane filtration equipment, Separators, Mixing & blending equipment, Evaporators & dryer equipment, Pasteurizers and Others. By Application, the market is categorized into Cheese, Processed Milk, Yogurt, Protein Ingredients, Milk Powder and Others.By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Processed milk processing equipment means the machinery and tools for the handling, processing and production of the milk and some of the products derived from the milk. This equipment is used in handling, treating and packaging of the milk and within equal standards of safety, quality and efficiency. This refers to apparatachurc for pasteurization, homogenized, separation, filtration, and packing.

Processed Milk Processing Equipment Market Size Was Valued at USD 11.10 Billion in 2023, and is Projected to Reach USD 18.91 Billion by 2032, Growing at a CAGR of 6.10% From 2024-2032.