Global Power Tools and Hand Tools Market Synopsis

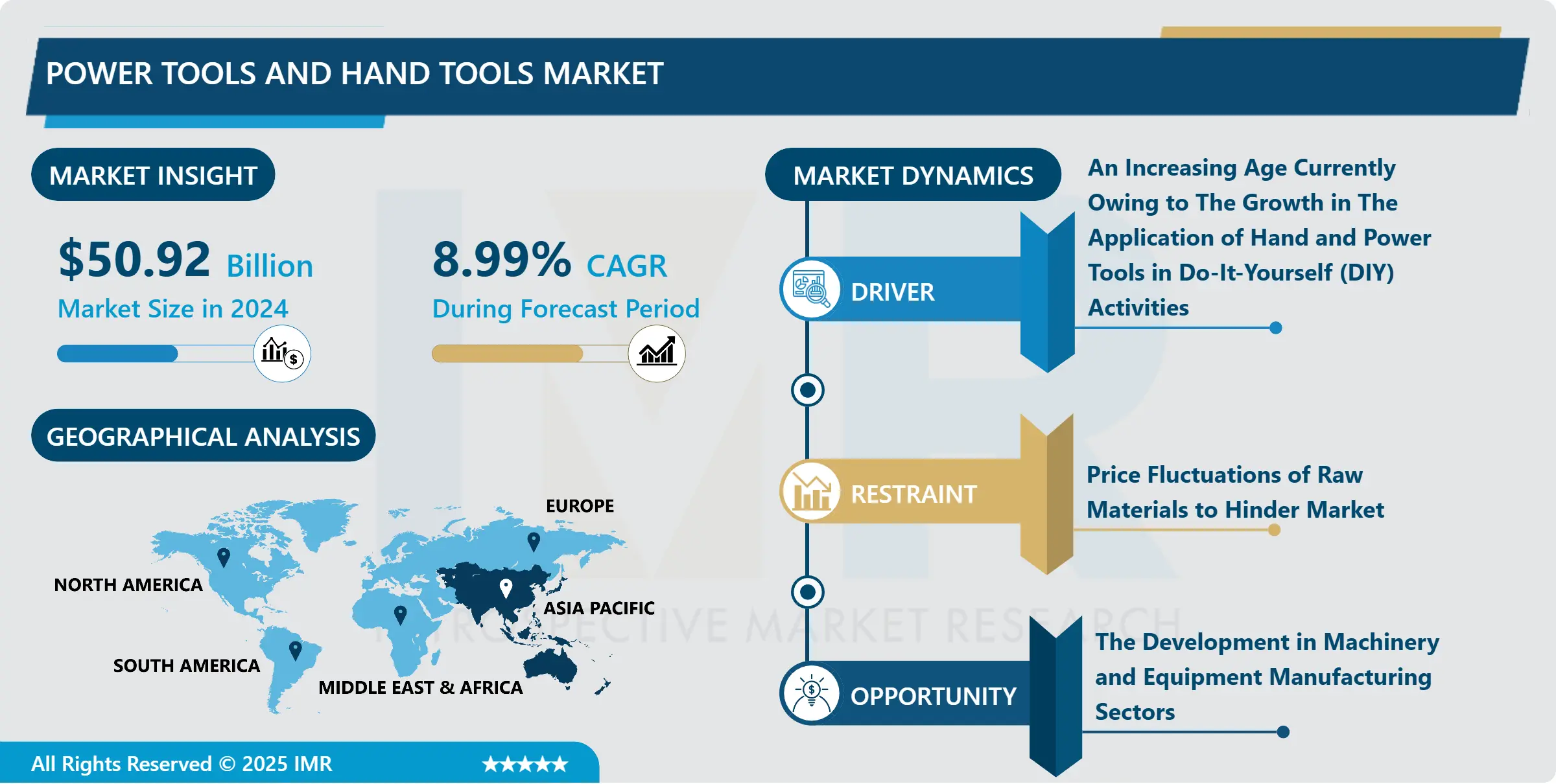

Global Power Tools and Hand Tools Market Size Was Valued at USD 50.92 Billion in 2024 and is Projected to Reach USD 101.39 Billion by 2032, Growing at a CAGR of 8.99% From 2025-2032.

Power tools and hand tools are a common part of our everyday lives and are present in around every industry. These tools are utilized to easily perform tasks that otherwise would be difficult or impossible. Nevertheless, these simple tools can be harmful and have the potential for causing serious injuries when utilized or maintained improperly.

Special attention toward hand and power tool safety is necessary to overcome or eliminate these hazards. Power tools comprise varieties of tools, which are added with some additional power to perform particular tasks. The electric motor is the most common kind of power tool. Some examples of the power tools are grinders, drills, saws, sanders, oscillating and rotary tools, woodworking power tools, concrete power tools, compressors, and accessories. Hand tools are functioned by hand only and not by any electric machine. Some of the hand tools are hammers, garden forks, hook cutters, plumbing tools, rakes, secateurs, spanners, pliers, wrenches, clamps, screwdrivers, and chisels. Hand tools are generally less harmful than power tools. Hand and power tools are generally used in almost every industry including manufacturing, gardening, healthcare among others.

Global Power Tools and Hand Tools Market Trend Analysis

Global Power Tools and Hand Tools Market Growth Drivers- An Increasing Age Currently Owing to The Growth in The Application of Hand and Power Tools in Do-It-Yourself (DIY) Activities.

- The hand and power tools market is at an increasing age currently owing to the growth in the application of hand and power tools in do-it-yourself (DIY) activities. Furthermore, key factors turning the world hand tools market include rise demand from the automotive maintenance and repair sector along with developments in the production technology of hand and power tools. The growing spending income of consumers will positively impact the power and hand tools market in the future. Also, increasing the use of hand and power tools in industrial applications is another factor driving the overall market.

- Furthermore, cordless power tools gaining importance among the industries which include a wide range of battery-powered tools, such as hammer drills, impact wrenches, and circular saws, as well as nailers and staplers. The demand for more mobile, flexible, and compact tools is turning the market for cordless tools. Lithium-ion batteries are replacing conventional nickel-cadmium (Ni-Cd) and nickel-metal hydride (Ni-MH) power tools. Advancement in battery technology is contributing to the growing promotions of cordless power tools with high-density batteries that can last longer once charged. Lithium-ion batteries supply higher energy density and longer operational life to power tools. These batteries are lightweight and do not exhibit self-discharge. Hence, lithium-ion batteries have become the most popular option for powering cordless power tools. Moreover, with consumers' attraction toward cordless tools, tool producers are focusing on cordless power tools and launching innovative products in the market. This leads to the growth of the power tools and hand tools market over the forecast period.

Global Power Tools and Hand Tools Market Opportunuites- The Development in Machinery and Equipment Manufacturing Sectors

- The development in machinery and equipment manufacturing sectors over the world provides profitable growth opportunities for the power tools and hand tools market players over the forecast period. In addition to the sales growth for existing power tools and battery switches, new products are also trending in the industry. Companies have been executing research and development (R&D) efforts to boost tool strength and life span. For instance, one of the biggest power tool manufacturers, Dewalt, of the Stanley Company, recently introduced the latest invention referred to as the Flexvolt. This is a battery that automatically changes its voltage with each tool it is used with; the first of its kind in the world to do so.

Global Power Tools and Hand Tools Market Segment Analysis:

Global Power Tools and Hand Tools Market Segmented on the basis of type, application, and end-users.

By Type, power tools segment is expected to dominate the market during the forecast period

The power tools segment is expected to dominate the power tools and hand tools market during the forecast period. Growing demand for power tools will outpace those for hand tools. Among power tools, cordless electric tools will provide lucrative growth opportunities. Ongoing development in lithium-ion battery density and the raised acceptance of technological inventions such as brushless motors that improve usable lifespan per charge will boost sales. Cordless electric power tools experience more product invention than other types of tools, which attract users to enhance to better performing versions or to switch from plug-in to cordless versions. However, product developments for hand tools are generally limited to ergonomic developments or incremental performance increases.

By Application, Industrial segment held the largest share in 2024

The industrial application segment is anticipated to dominate the power tools and hand tools market throughout the projected period. The power tools and hand tools market will experience faster gains through the forecast period in response to a recovery in industrial employment levels. Industrial generally use higher-value power tools more intensively than do consumers, and they are often preferring to pay more for higher quality tools since the initial investment will pay off over the long run by good performance and longer tool life. Furthermore, as industrial tend to use tools daily, they must replace tools frequently (although some basic hand tools can be used for more than a decade). In addition, consumers are typically less frequent users of tools and are more probably to buy tools based on price. Also, consumers rarely need the power related with more expensive hydraulic or pneumatic power tools, but instead buy electric tools.

Global Power Tools and Hand Tools Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- China, have contributed substantially to the production and export of power tools and hand tools worldwide. Their competitive pricing, diverse product range, and technological advancements have allowed China to assert its dominance in this sector within the Asia Pacific region.

- While other countries in the region Japan, South Korea, and India also play vital roles and have their strengths in this market, China's scale of production, manufacturing infrastructure, and export capabilities often give it an edge in dominance within the Asia Pacific region.

Global Power Tools and Hand Tools Market Top Key Players:

- Actuant Corporation(USA)

- AIMCO Corporation (USA)

- Ancor (USA)

- Stanley Engineered Fastening (USA)

- Allied Trade Group (ATG) Stores (USA)

- Alltrade Tools LLC(USA)

- AMES Companies (USA)

- Ancor (USA)

- Milwaukee (USA)

- Apex Tool Group LLC(USA)

- Garden Weasel (USA)

- Wera(Canada)

- Atlas Copco AB (Europe)

- Bosch (Robert) GmbH (Germany)

- Stihl (Germany)

- Knipex (Germany)

- Einhell (Germany)

- Festool AG(Japan)

- Makita Corporation(Japan)

- Hilti AG(Japan)

- Chervon Holdings Limited (Japan)

- Chervon (China)

- Ergon (China)

- Stafil (China)

- Metafix (China)

- Other Active Players

Key Industry Developments in the Global Power Tools and Hand Tools Market:

- In February 2024, Robert Bosch GmbH introduced the AdvancedDrill and AdvancedImpact 18V-80 QuickSnap cordless tools, part of their '18V Power for All System'. These cordless tools, equipped with Syneon Technology, enable powerful screwing and drilling in tight spaces, saving space and money while reducing environmental impact. The 18V lithium-ion battery and charger ensure efficient drilling and screwing.

- In February 2024, Makita U.S.A., Inc. introduced the 5" Paddle Switch Angle Grinder with AC/DC Switch (9558HP), offering 7.5 AMPs and 10,000 RPM in a compact 4.5 lb grinder, making it an ideal choice for professionals in metal fabrication, electrical, mechanical, and plumbing trades.

|

Global Power Tools and Hand Tools Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 50.92 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.99% |

Market Size in 2032: |

USD 101.39 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Power Tools and Hand Tools Market by Type (2018-2032)

4.1 Power Tools and Hand Tools Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Power Tools

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hand Tools

Chapter 5: Power Tools and Hand Tools Market by Application (2018-2032)

5.1 Power Tools and Hand Tools Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Industrial

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Residential

Chapter 6: Power Tools and Hand Tools Market by Distribution Channel (2018-2032)

6.1 Power Tools and Hand Tools Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online Sales

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline Sales

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Power Tools and Hand Tools Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AMWAY CORP (US)

7.4 NESTLÉ (SWITZERLAND)

7.5 HERBALIFE NUTRITION LTD. (US)

7.6 ADM (US)

7.7 GLAXOSMITHKLINE PLC (UK)

7.8 ARKOPHARMA (FRANCE)

7.9 DSM (NETHERLANDS)

7.10 GLANBIA PLC (US)

7.11 BASF (GERMANY)

7.12 ASSOCIATED BRITISH FOODS PLC (UK)

7.13 BIONOVA (INDIA)

7.14 RENOWN PHARMACEUTICALS PVT LTD (INDIA)

7.15 BIOLIFE TECHNOLOGIES (INDIA)

Chapter 8: Global Power Tools and Hand Tools Market By Region

8.1 Overview

8.2. North America Power Tools and Hand Tools Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Power Tools

8.2.4.2 Hand Tools

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Industrial

8.2.5.2 Residential

8.2.6 Historic and Forecasted Market Size by Distribution Channel

8.2.6.1 Online Sales

8.2.6.2 Offline Sales

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Power Tools and Hand Tools Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Power Tools

8.3.4.2 Hand Tools

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Industrial

8.3.5.2 Residential

8.3.6 Historic and Forecasted Market Size by Distribution Channel

8.3.6.1 Online Sales

8.3.6.2 Offline Sales

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Power Tools and Hand Tools Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Power Tools

8.4.4.2 Hand Tools

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Industrial

8.4.5.2 Residential

8.4.6 Historic and Forecasted Market Size by Distribution Channel

8.4.6.1 Online Sales

8.4.6.2 Offline Sales

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Power Tools and Hand Tools Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Power Tools

8.5.4.2 Hand Tools

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Industrial

8.5.5.2 Residential

8.5.6 Historic and Forecasted Market Size by Distribution Channel

8.5.6.1 Online Sales

8.5.6.2 Offline Sales

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Power Tools and Hand Tools Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Power Tools

8.6.4.2 Hand Tools

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Industrial

8.6.5.2 Residential

8.6.6 Historic and Forecasted Market Size by Distribution Channel

8.6.6.1 Online Sales

8.6.6.2 Offline Sales

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Power Tools and Hand Tools Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Power Tools

8.7.4.2 Hand Tools

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Industrial

8.7.5.2 Residential

8.7.6 Historic and Forecasted Market Size by Distribution Channel

8.7.6.1 Online Sales

8.7.6.2 Offline Sales

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Power Tools and Hand Tools Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 50.92 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.99% |

Market Size in 2032: |

USD 101.39 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||